🇦🇷 Economist. Trader. Entrepreneur. Advisory. Columbia MBA. Bitcoin '13. Sharing views on crypto and global markets.

2 subscribed

2 subscribed

2 subscribed

2 subscribed

How to get URL link on Twitter App

2 subscribed

2 subscribed

Chart aside, what one trades is the elections: Bolsonaro (right-wing populist wildcard, similar to Trump, initially despised by markets, now seen positively as much better than the alternative) vs. Haddad (left-wing candidate, Lula's party). en.wikipedia.org/wiki/Brazilian…

Chart aside, what one trades is the elections: Bolsonaro (right-wing populist wildcard, similar to Trump, initially despised by markets, now seen positively as much better than the alternative) vs. Haddad (left-wing candidate, Lula's party). en.wikipedia.org/wiki/Brazilian…

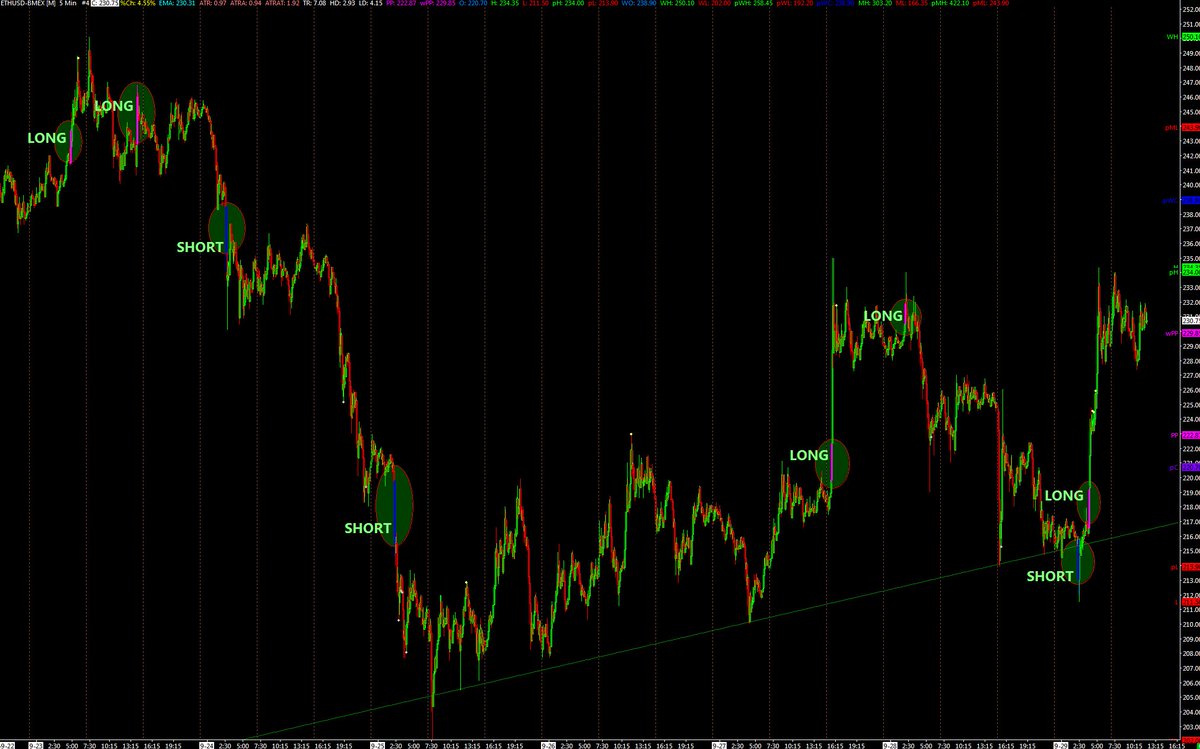

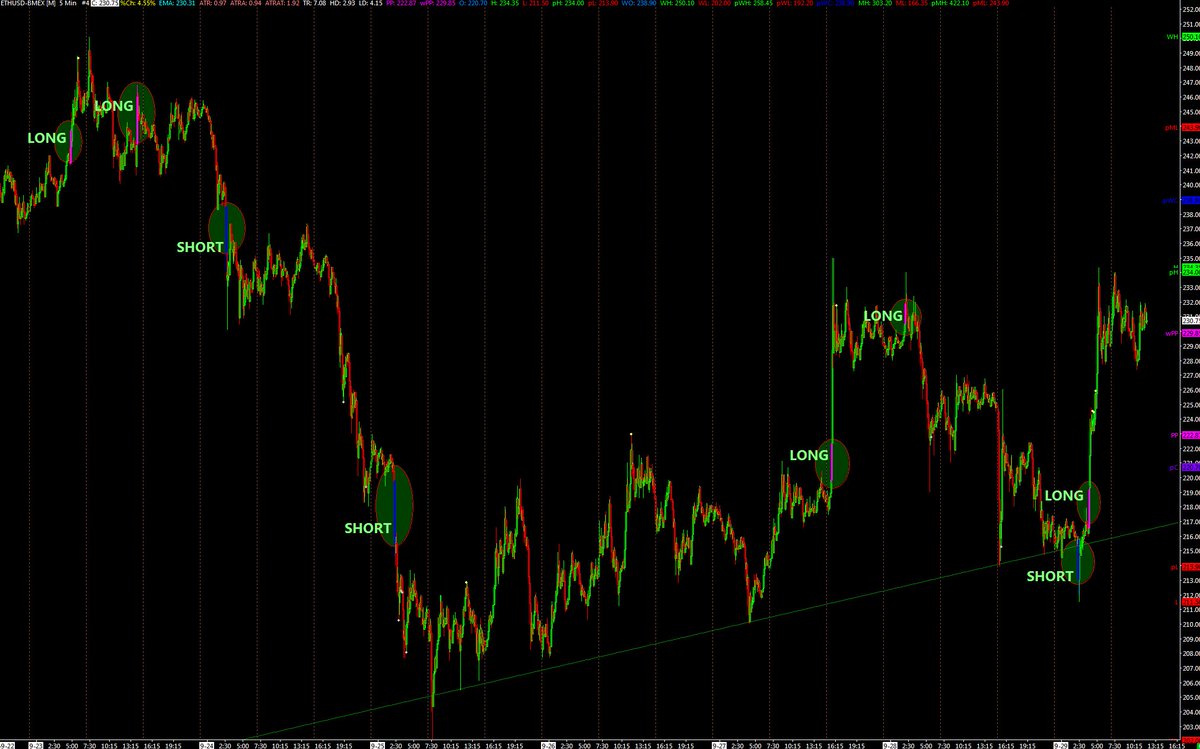

Understanding this is useful for investors as well who want to enter positions only with the trend. It's also helpful to any trader who is fearful of buying a top. Buying a top or selling a bottom sometimes represents good decision making.

Understanding this is useful for investors as well who want to enter positions only with the trend. It's also helpful to any trader who is fearful of buying a top. Buying a top or selling a bottom sometimes represents good decision making.

Sounds familiar?

Sounds familiar?

https://twitter.com/APompliano/status/1041495429995810816Facts:

https://twitter.com/charliebilello/status/1042448012180631552Revenue numbers of these multi billion dollar cannabis companies make me think of the number of ethereum daily users.

https://twitter.com/businessinsider/status/1037294282741309441Some news are noise or FUD. Goldman ditching plans to open a trading desk is neither. It indicates lack of interest from Goldman's clients, which can be extrapolated to others' in the institutional space. It also reduces odds of a US based ETN, which requires a trading desk.

Assuming once again this represents mostly one large directional market participant (which is feasible), this represents a double edged sword, as such market participant could also be sitting on cash to defend the area and dump on the market.

Assuming once again this represents mostly one large directional market participant (which is feasible), this represents a double edged sword, as such market participant could also be sitting on cash to defend the area and dump on the market.