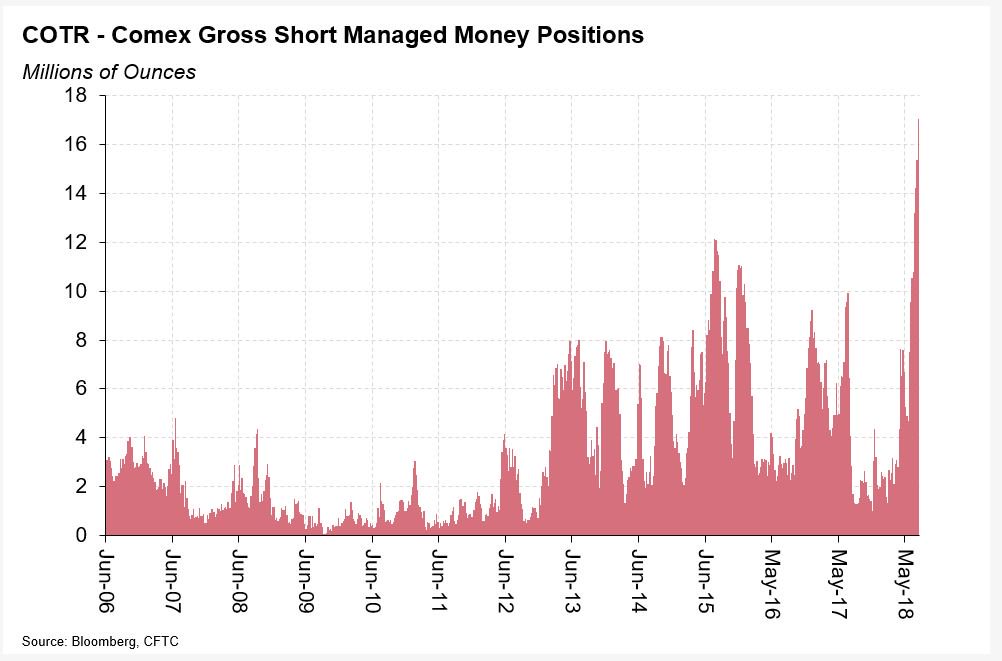

Gold: I've had a busy morning reconciling data from the CFTC website with that which I download from Bloomberg to ensure that that I’m using the right information in our charts and research. (1/3)

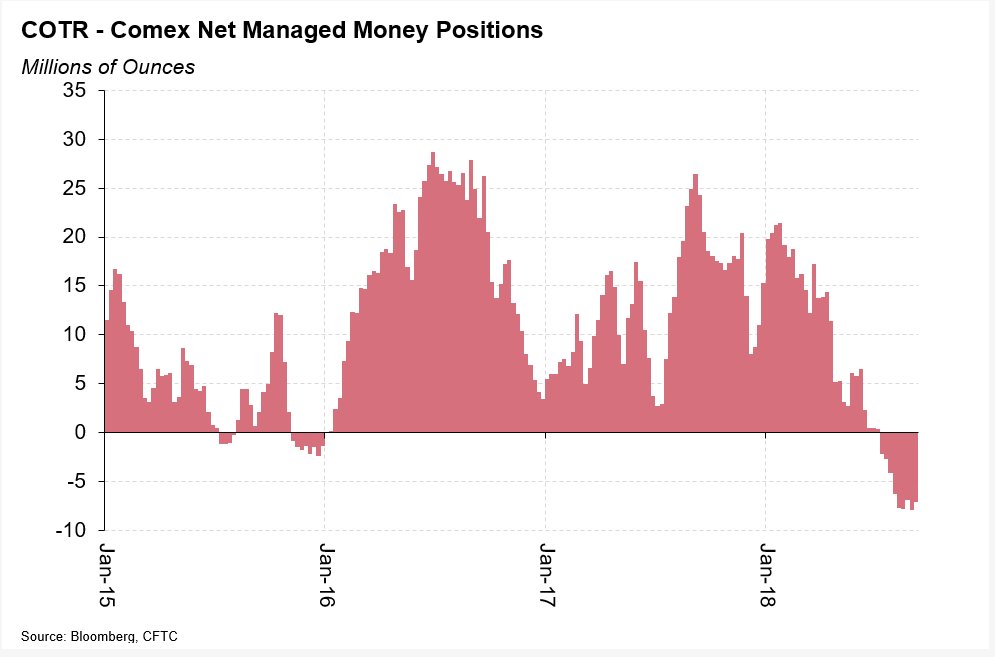

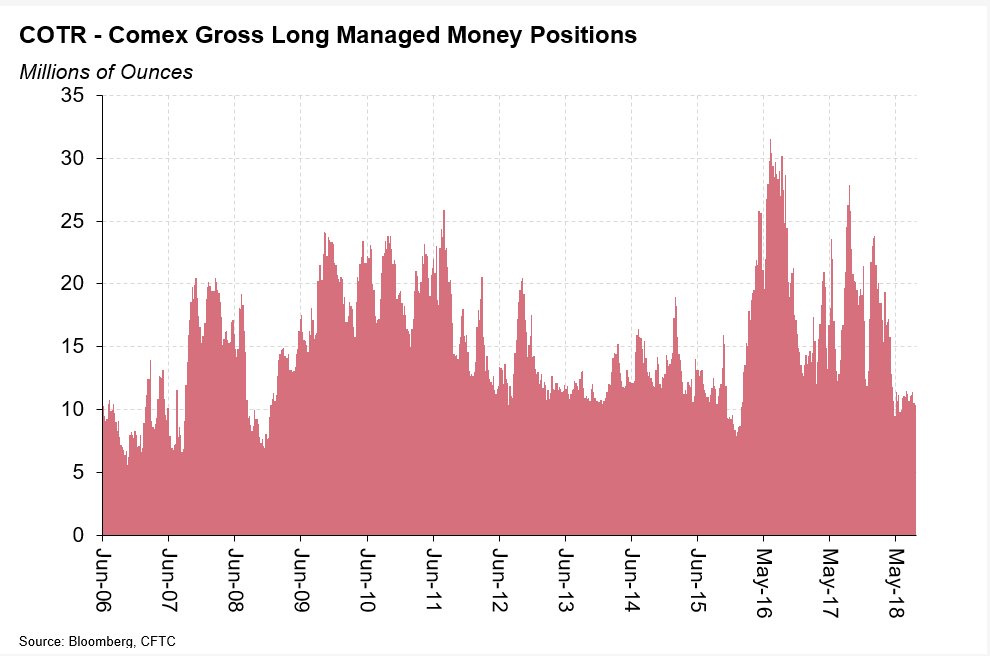

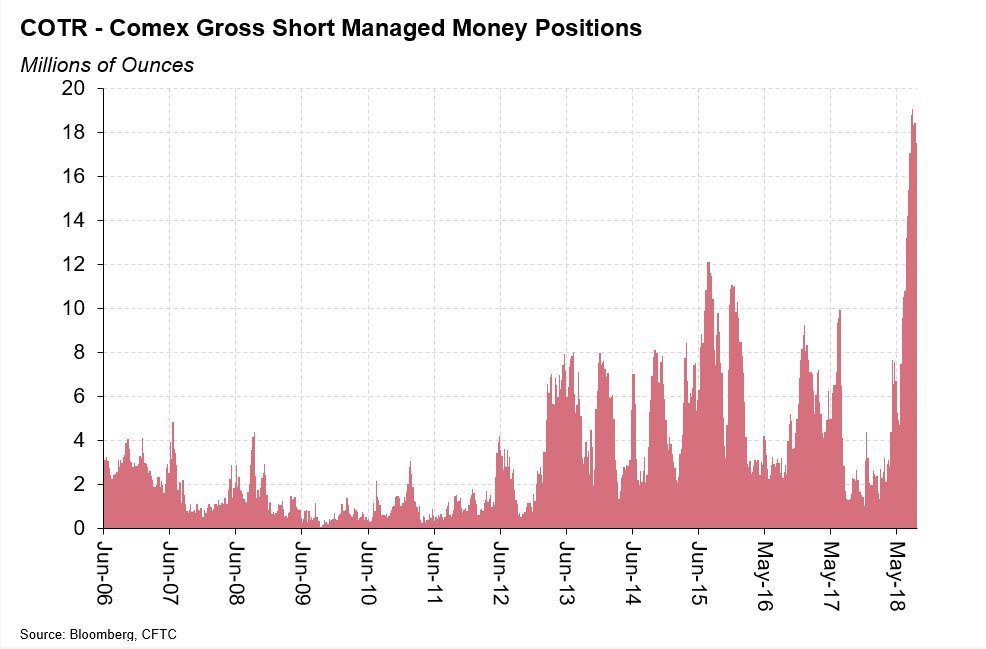

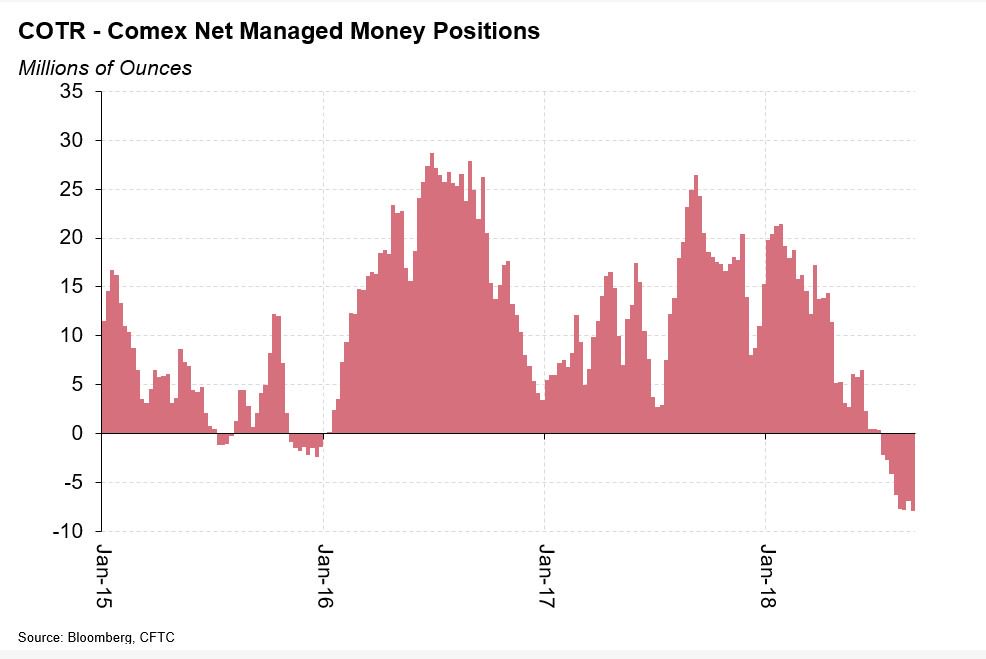

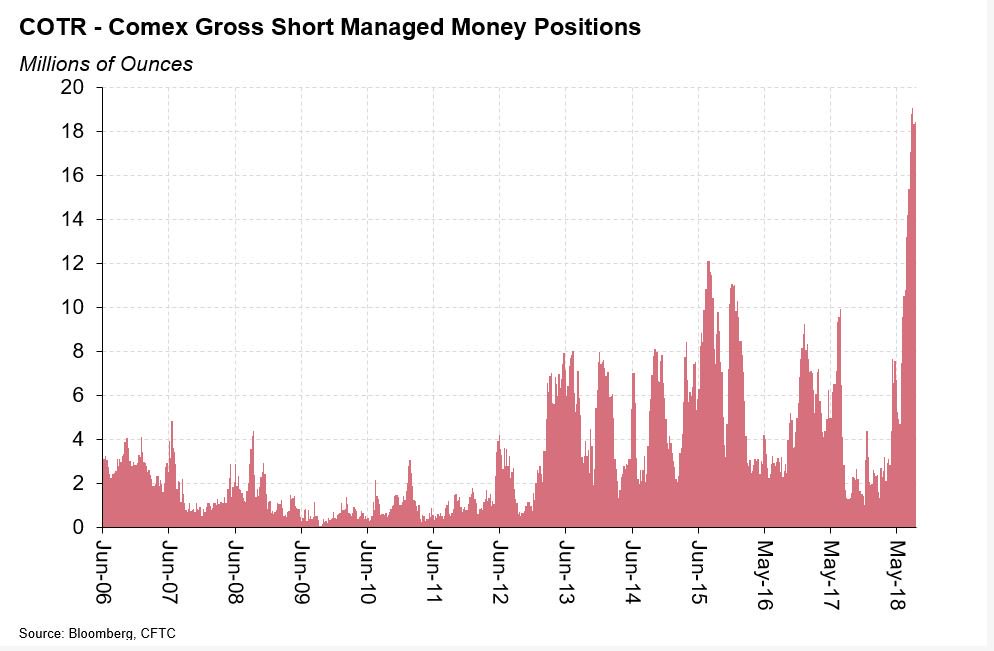

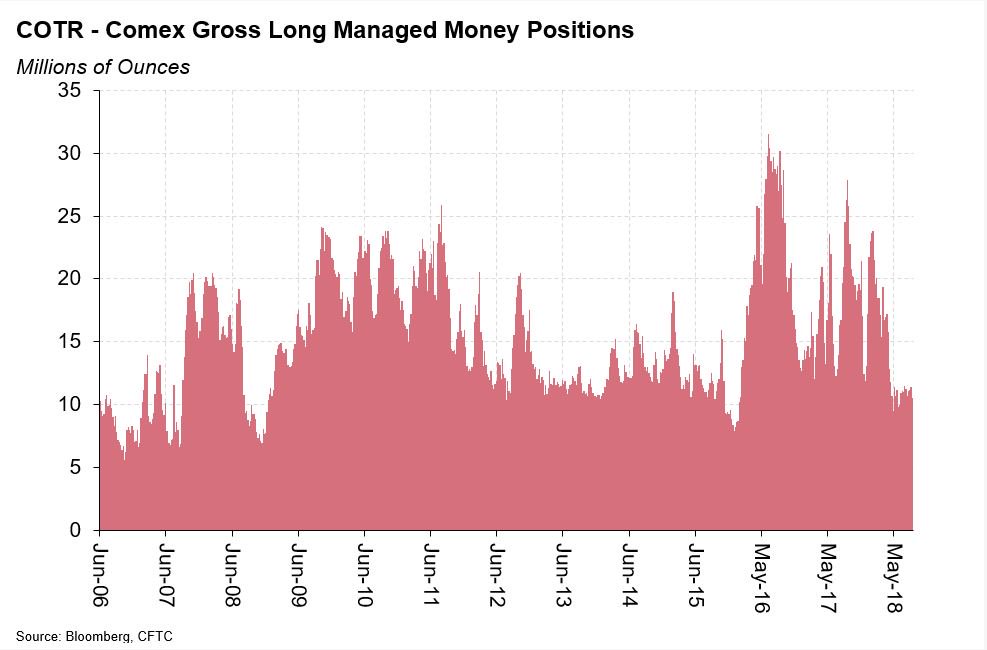

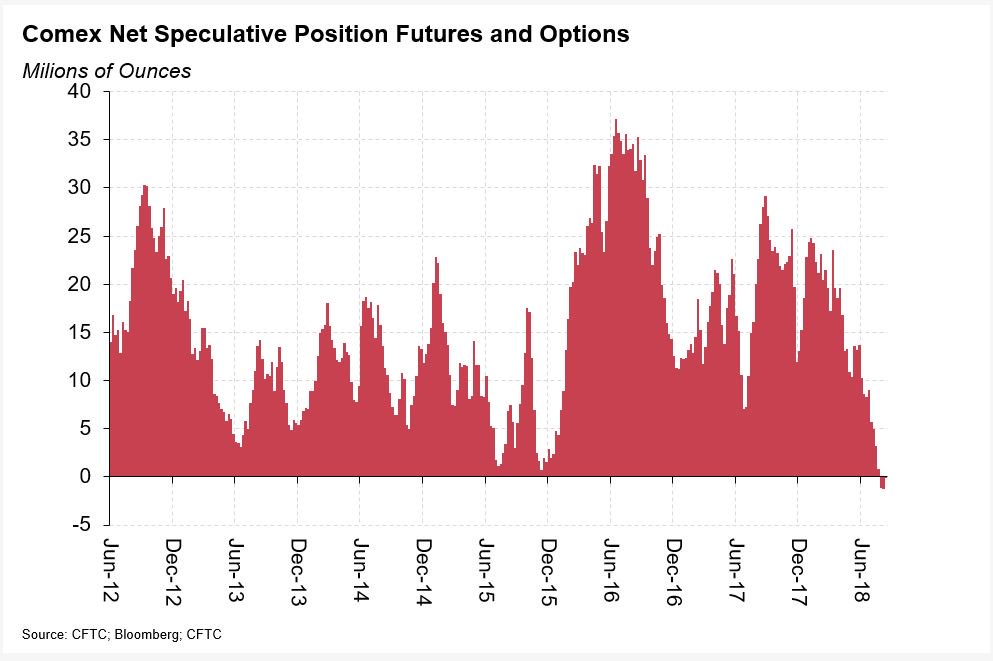

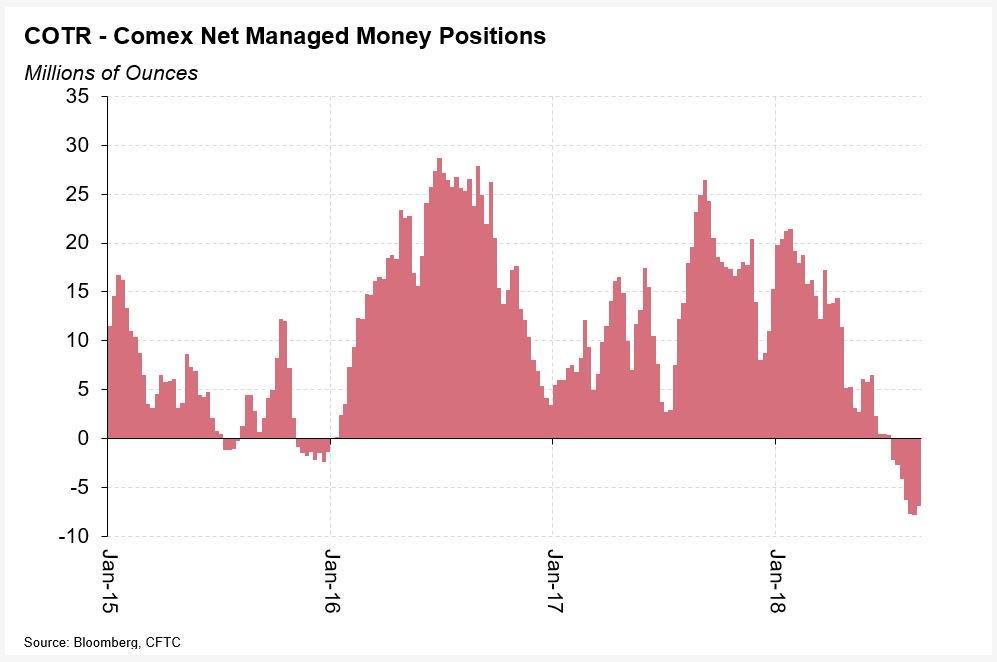

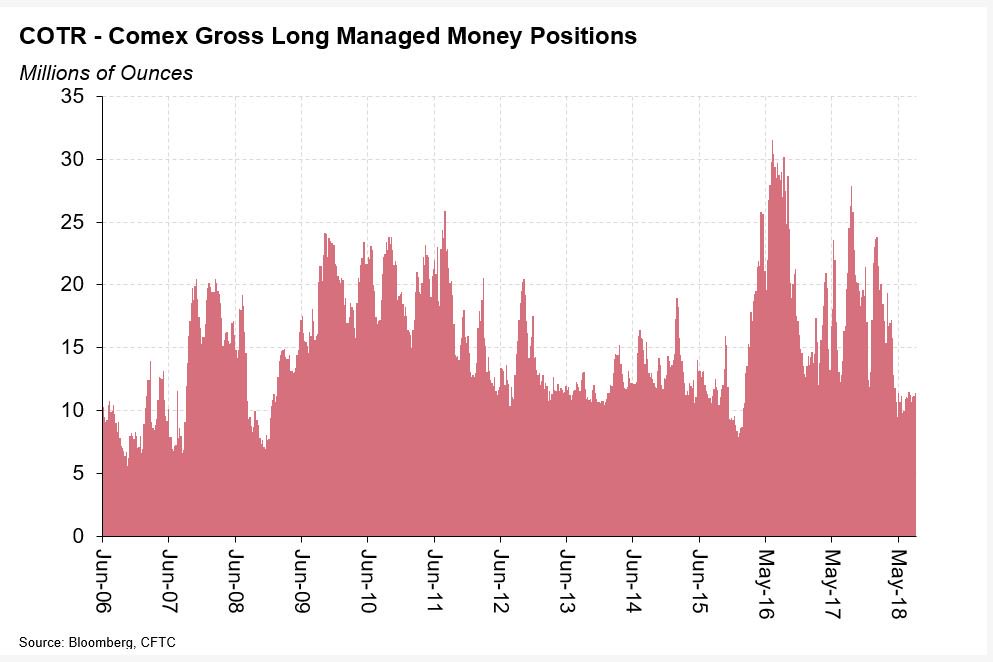

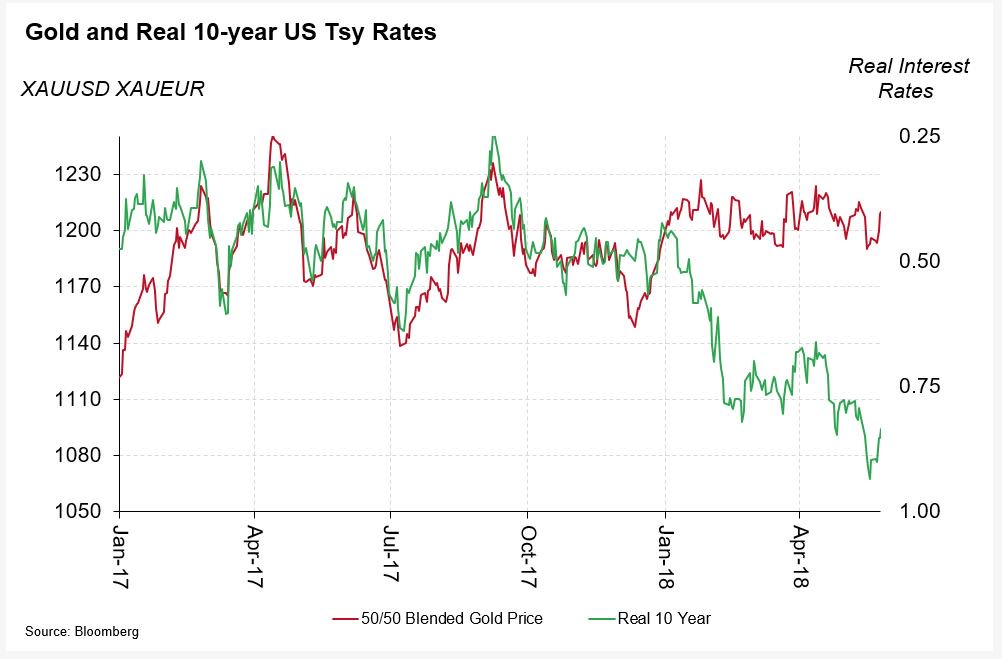

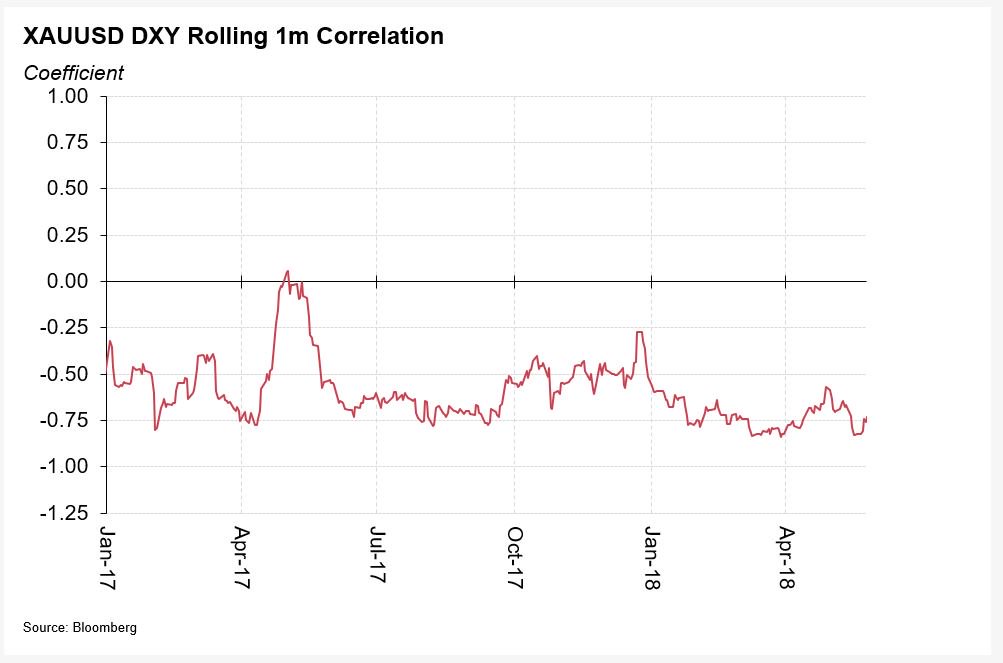

Gold: The reason I did this was that someone, who I respect, told me that my recent charts, shown below were wrong. After a few hours of work, I’m happy to confirm that I have the same data as is available from the CFTC website. (2/3)

Gold: Although this could have been viewed as a waste of time, it does no harm to spend some time checking the integrity of important data and I’m glad it turned out that there was no problem in my spreadsheet #nerd #DataGeek. (3/3)

• • •

Missing some Tweet in this thread? You can try to

force a refresh