How to get URL link on X (Twitter) App

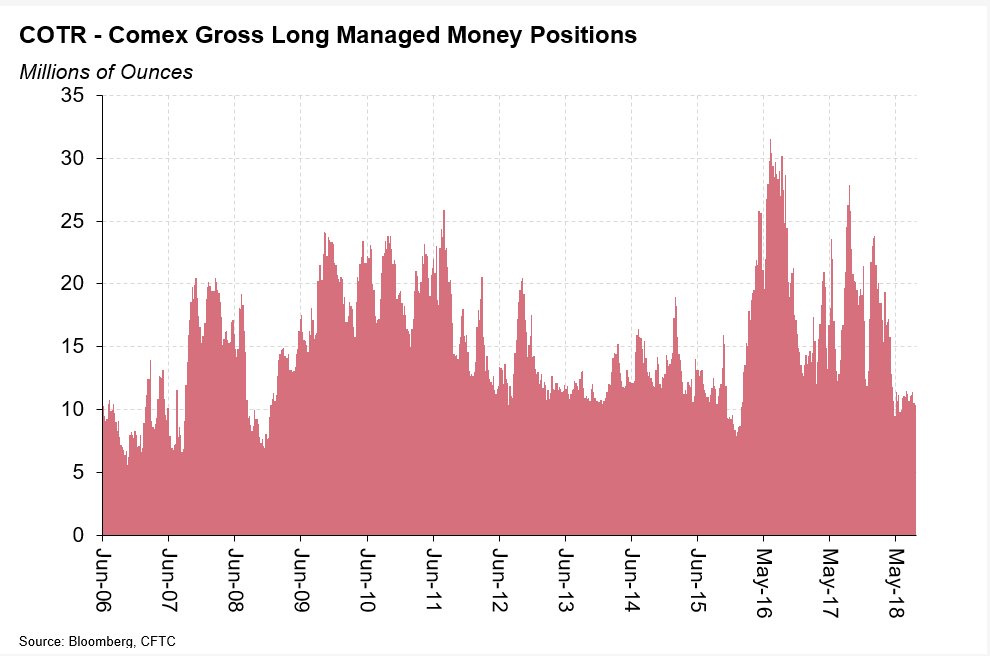

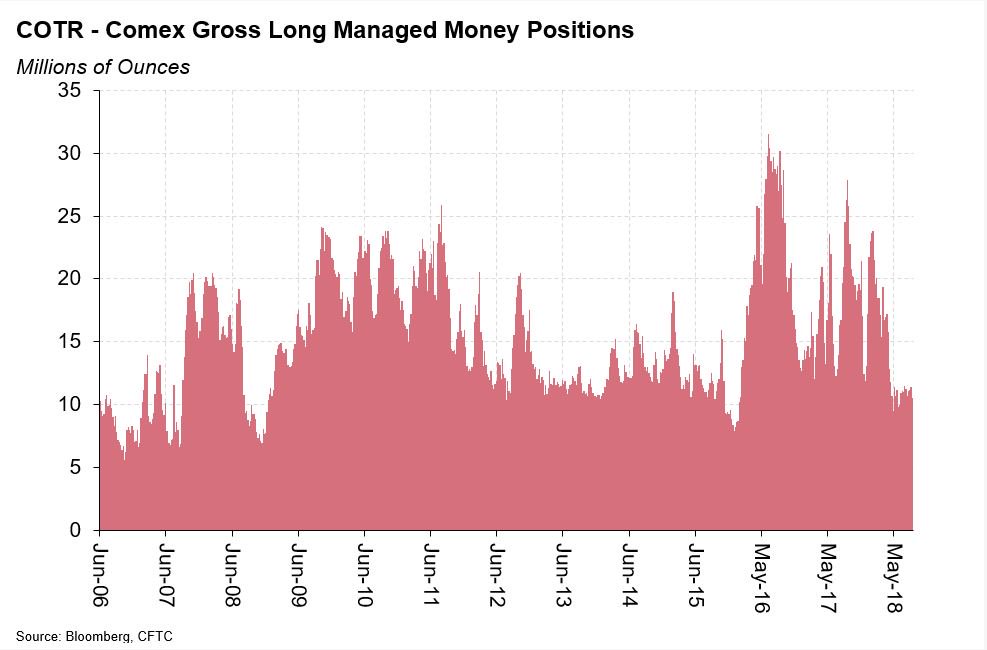

Gold: Gross #gold longs were down 0.16moz to 10.4moz, continuing to bounce roughly around the base level seen over the past six or seven years

Gold: Gross #gold longs were down 0.16moz to 10.4moz, continuing to bounce roughly around the base level seen over the past six or seven years

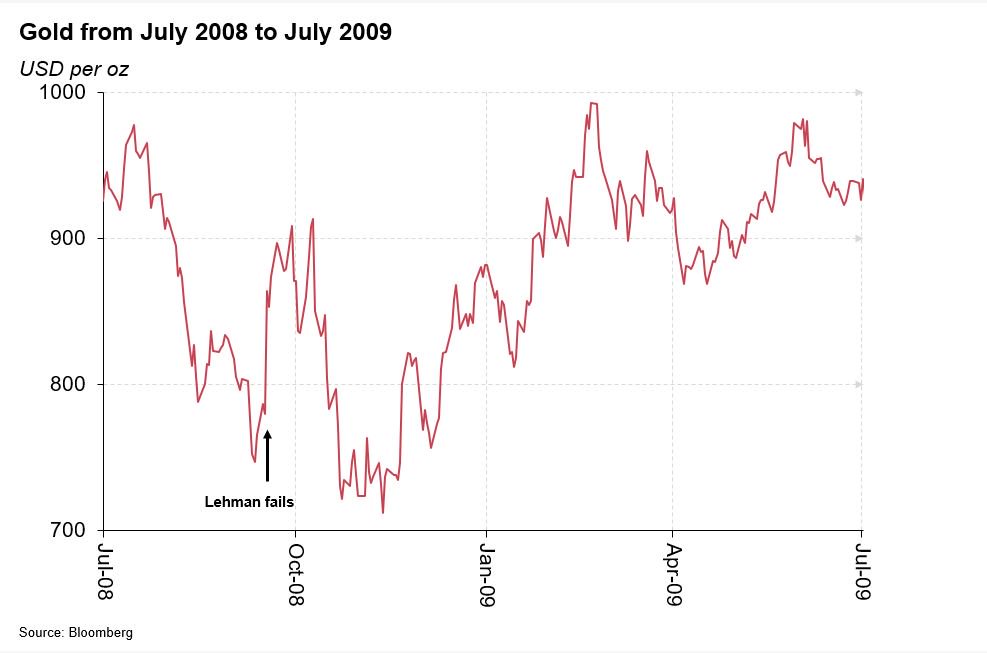

Gold: How did #gold fare through the crisis? This chart, from July 2008 to July 2009, shows no sign of gold moving rapidly higher? In fact, gold fell in the fourth quarter of 2008 as the dollar strengthened and gold was used as a source of liquidity (and sold.)

Gold: How did #gold fare through the crisis? This chart, from July 2008 to July 2009, shows no sign of gold moving rapidly higher? In fact, gold fell in the fourth quarter of 2008 as the dollar strengthened and gold was used as a source of liquidity (and sold.)

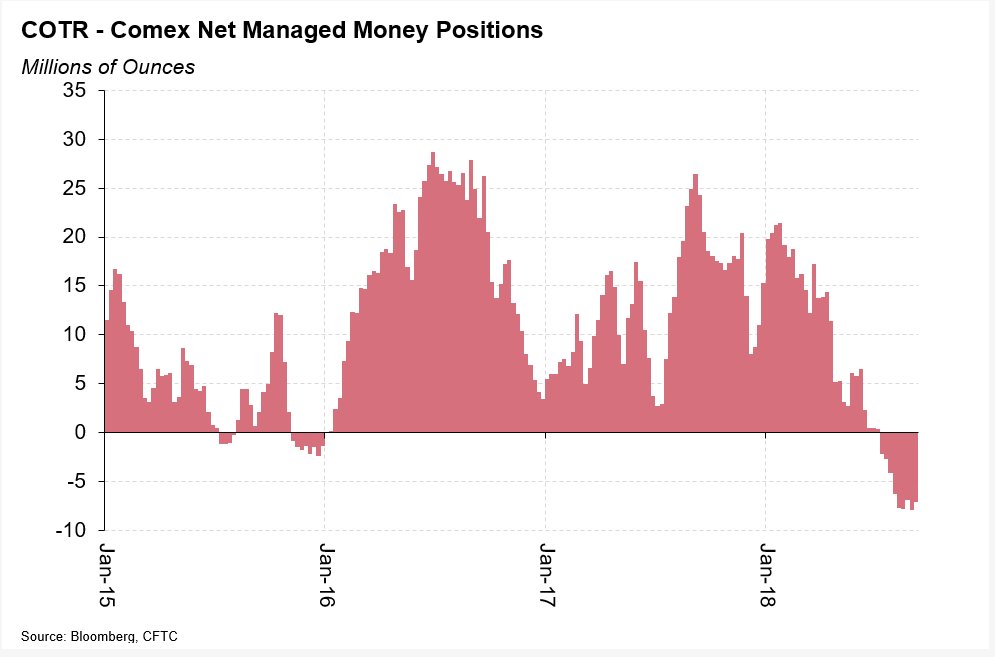

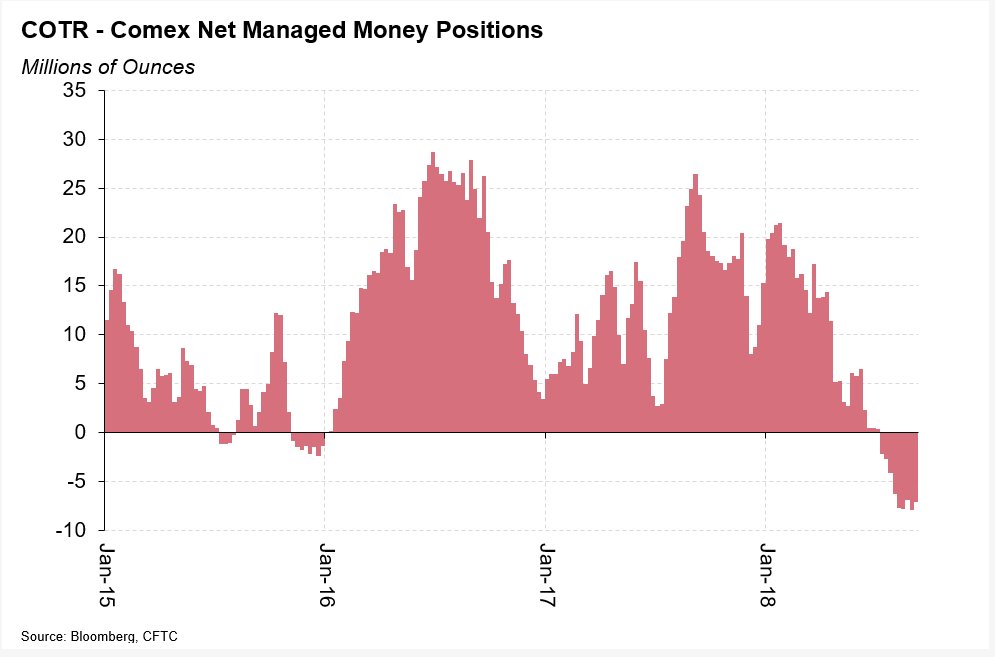

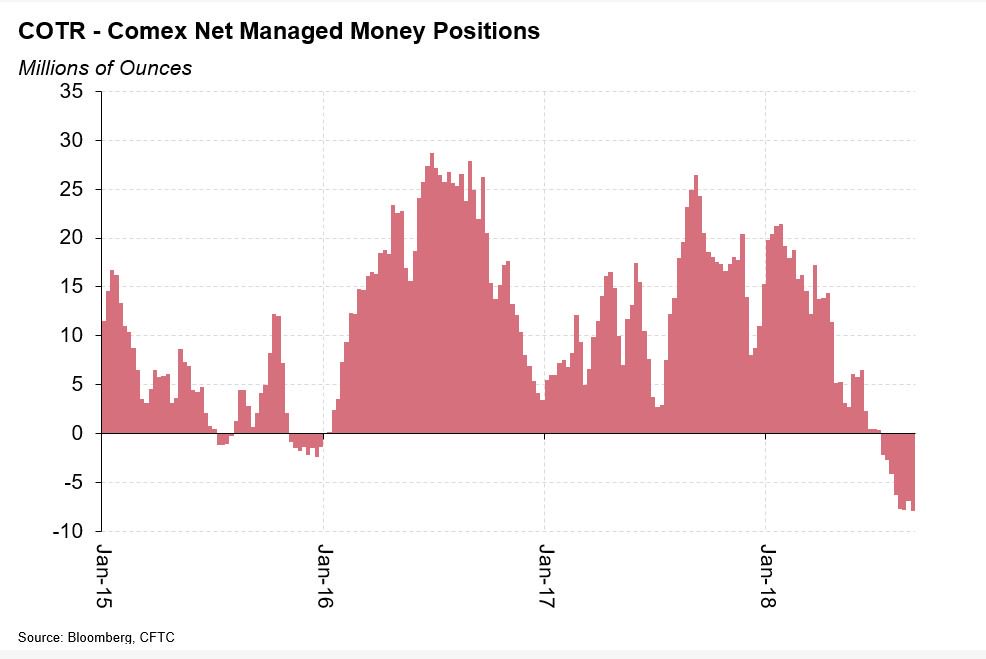

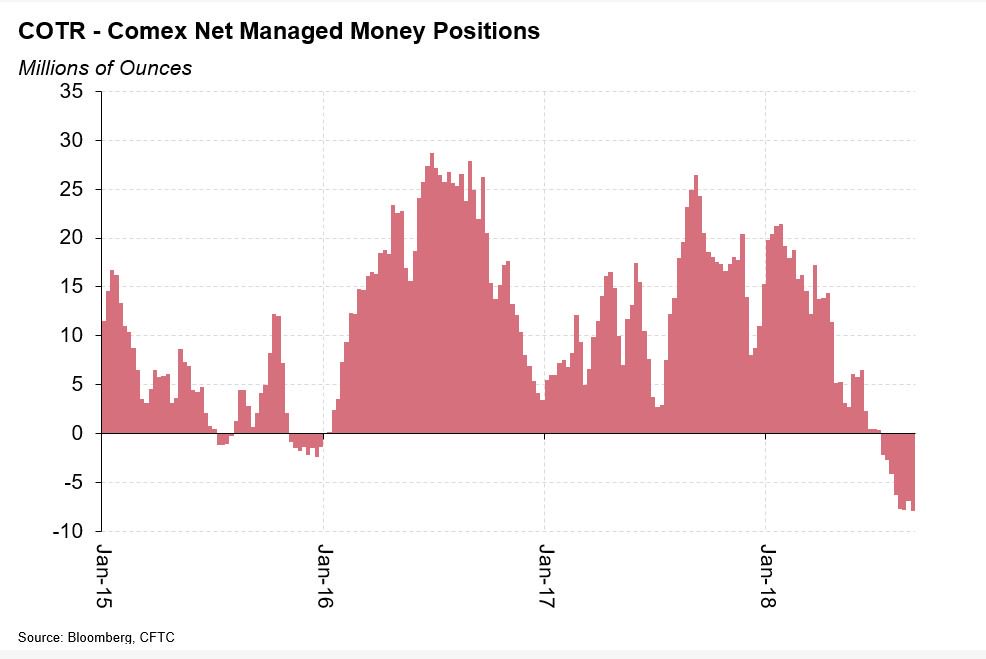

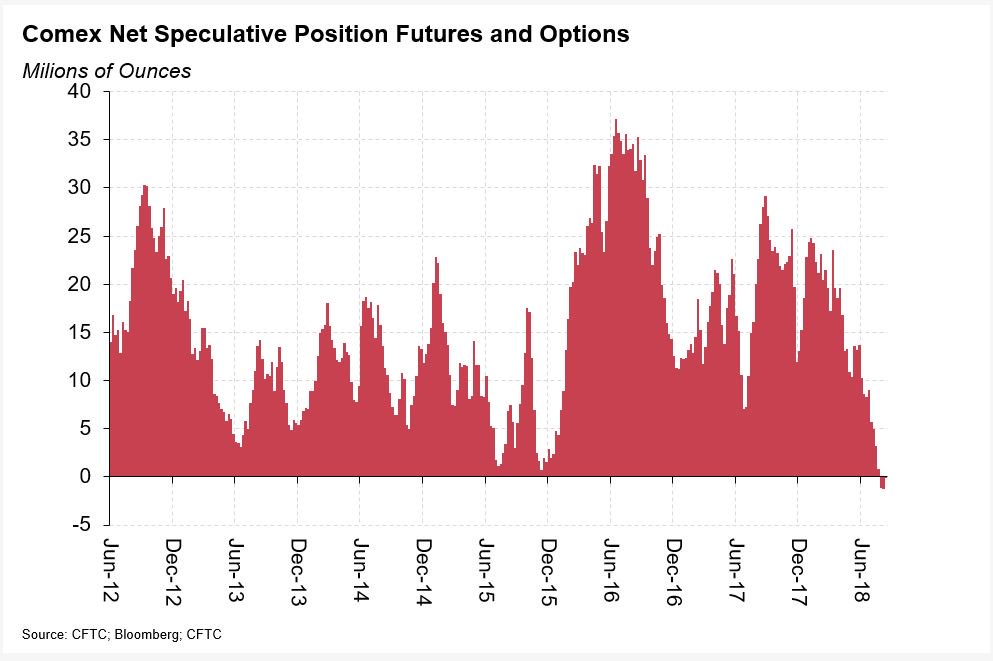

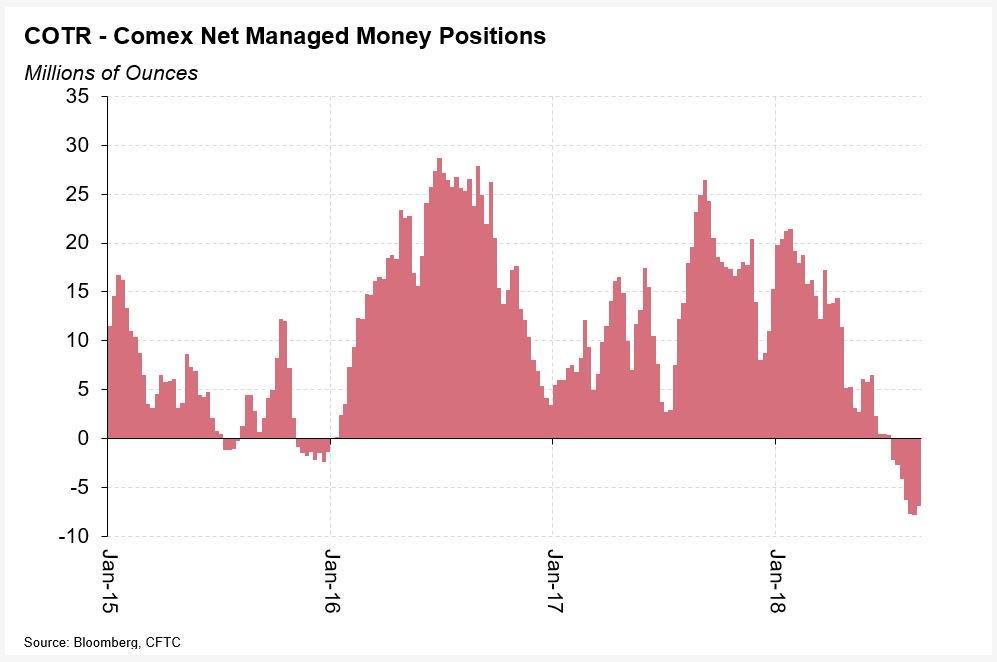

Gold: There was little change to the already-elevated gross Managed Money short #gold position, which increased by only 100Koz; gross longs fell by 900koz to 10.5 million ounces, driving the net short position 1moz higher to 7.9Moz

Gold: There was little change to the already-elevated gross Managed Money short #gold position, which increased by only 100Koz; gross longs fell by 900koz to 10.5 million ounces, driving the net short position 1moz higher to 7.9Moz

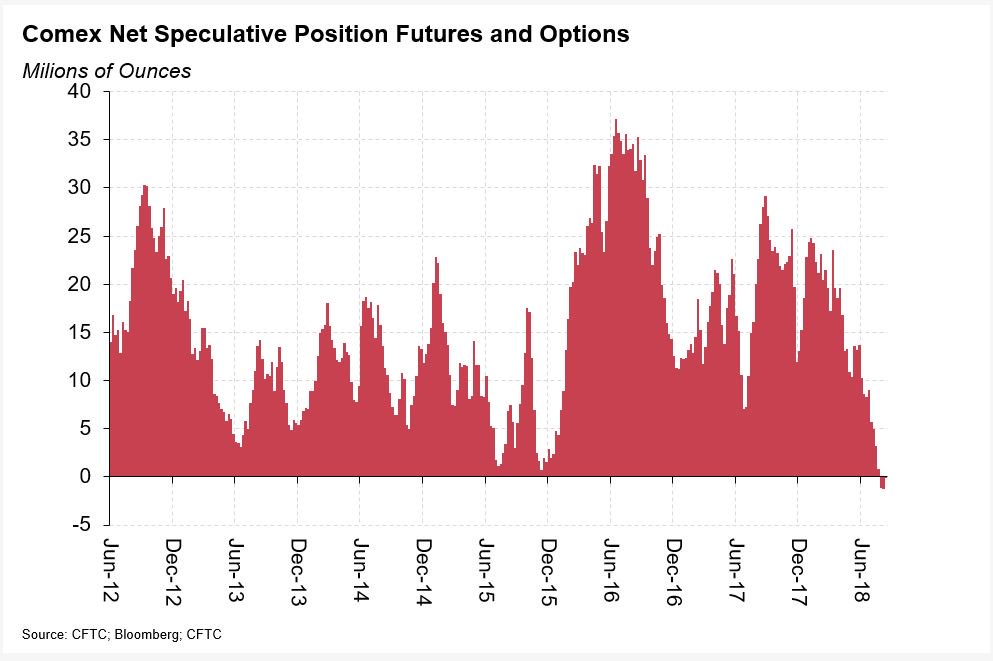

Gold: The Managed Money category also remains net short #gold, although as in the case of the legacy report net speculative position, the net Managed Money short decreased slightly last week. 2/6

Gold: The Managed Money category also remains net short #gold, although as in the case of the legacy report net speculative position, the net Managed Money short decreased slightly last week. 2/6

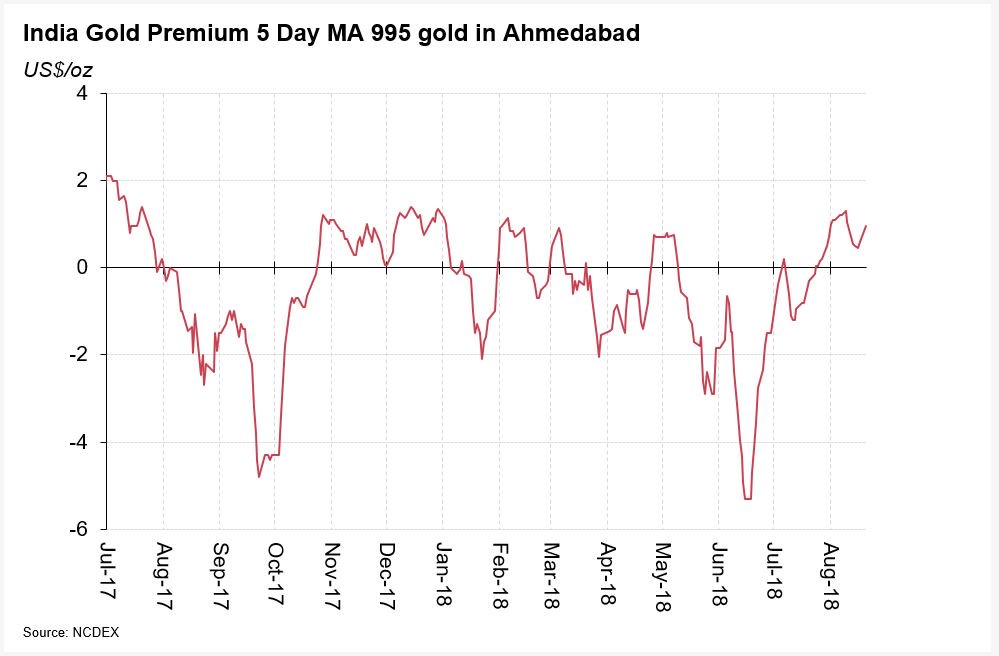

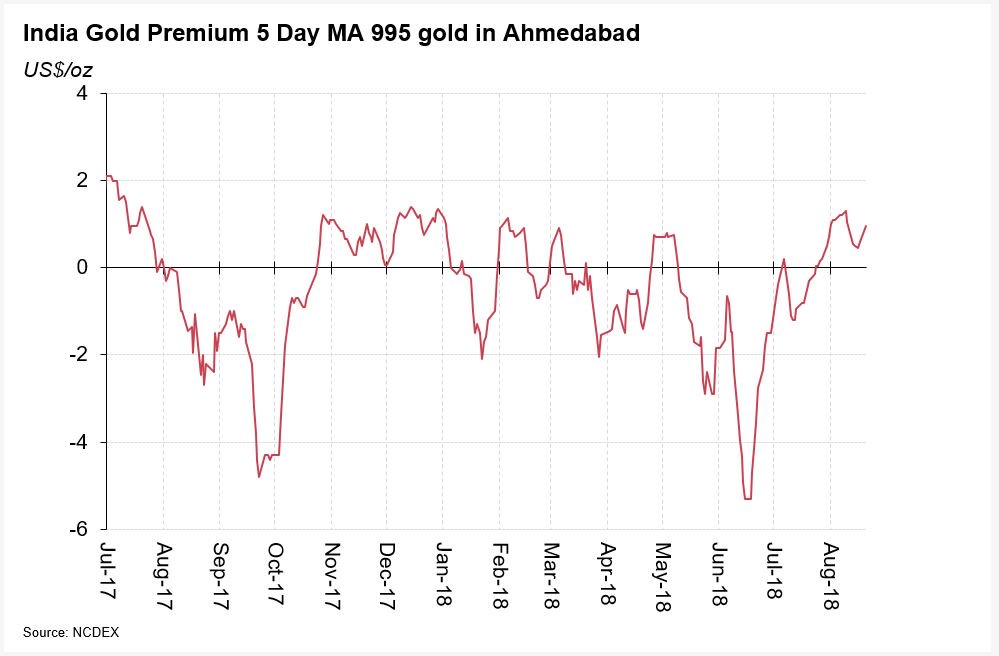

Gold: Mukesh notes that there will be an impact from the recent devastating Kerala floods and that the Onam festival will see less #gold demand than normal. But almost all the contacts believe the impact of the flooding will be temporary and should be limited to Q3-18. 2/6

Gold: Mukesh notes that there will be an impact from the recent devastating Kerala floods and that the Onam festival will see less #gold demand than normal. But almost all the contacts believe the impact of the flooding will be temporary and should be limited to Q3-18. 2/6

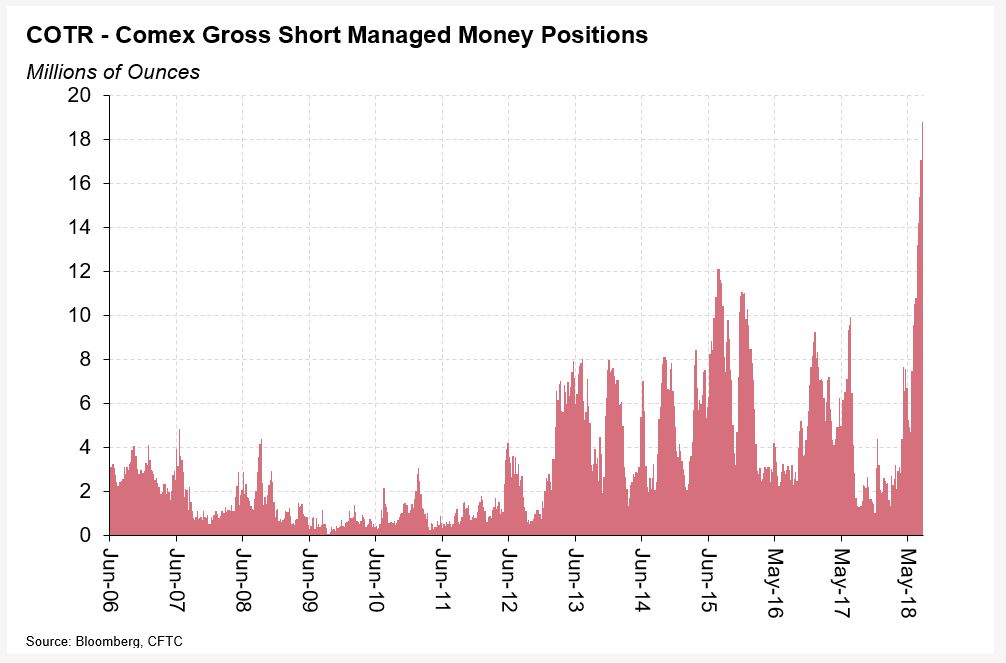

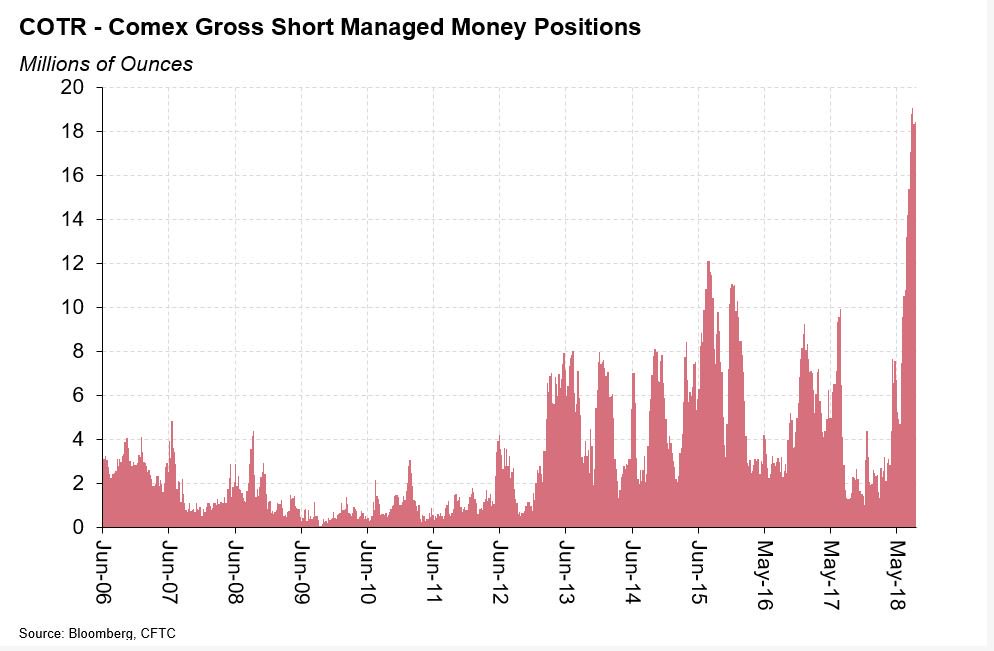

Gold: Why did I use the ‘Coiled Spring’ analogy? Because of build-up of Managed Money short #gold positions held on the Comex Futures market. Gross Managed Money short positions increased by a further 1.7 million ounces last week and now stand at a new record 18.8moz. 2/7

Gold: Why did I use the ‘Coiled Spring’ analogy? Because of build-up of Managed Money short #gold positions held on the Comex Futures market. Gross Managed Money short positions increased by a further 1.7 million ounces last week and now stand at a new record 18.8moz. 2/7