As talk intensifies of a potential move of Arsenal’s chief executive, Ivan Gazidis, to Milan, I thought it would be interesting to look at how the club’s financials have developed since he arrived in January 2009. Some thoughts in the following thread #AFC #Milan #ACMilan

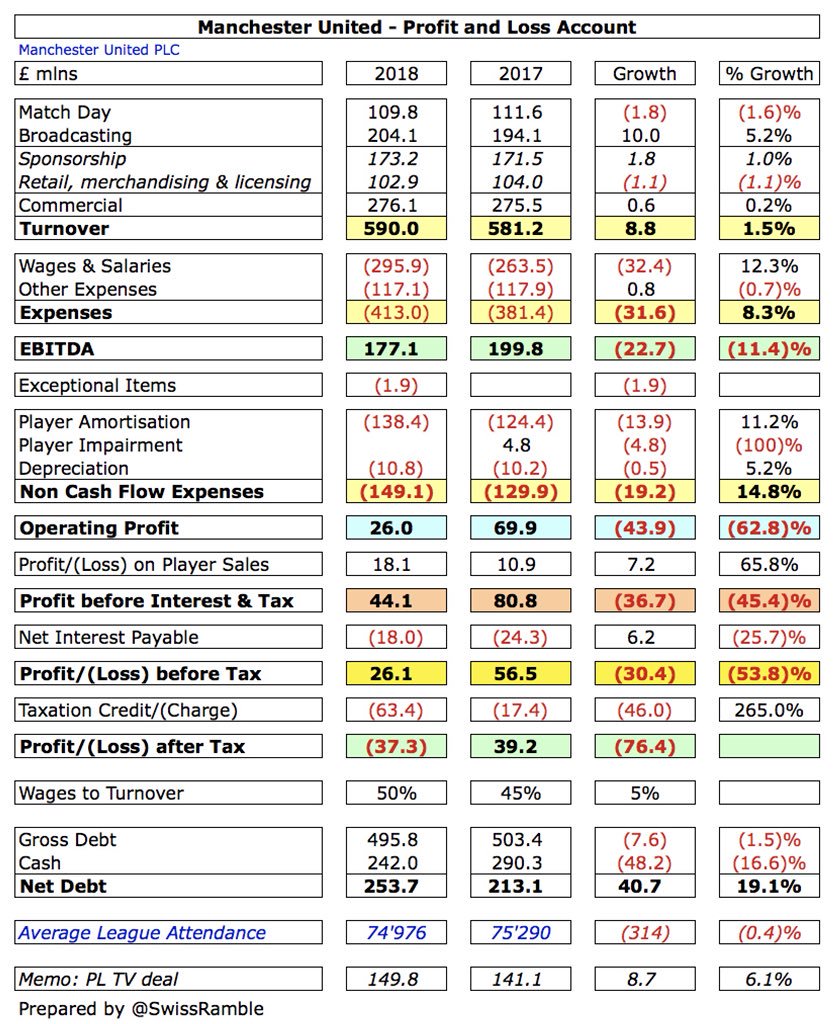

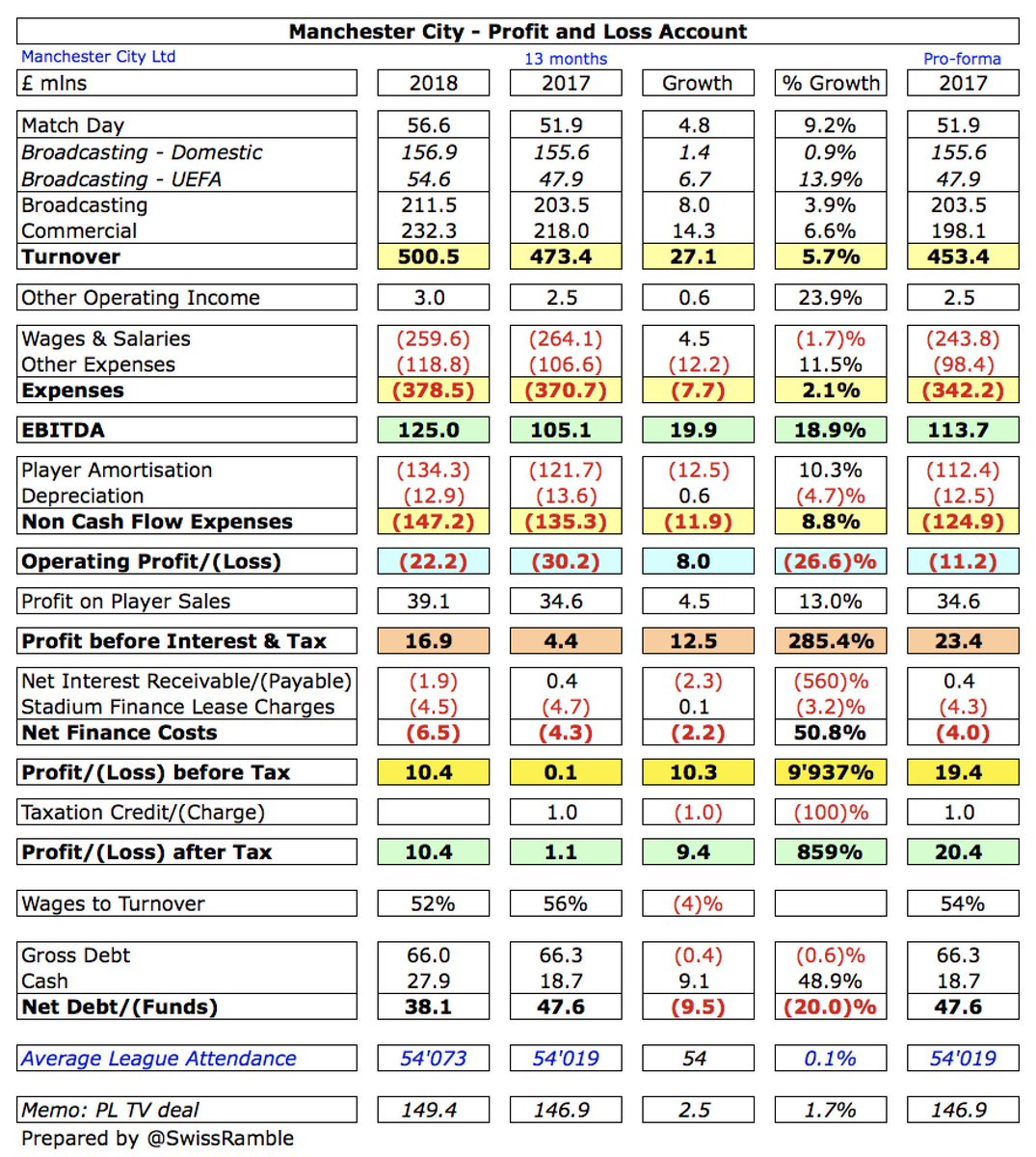

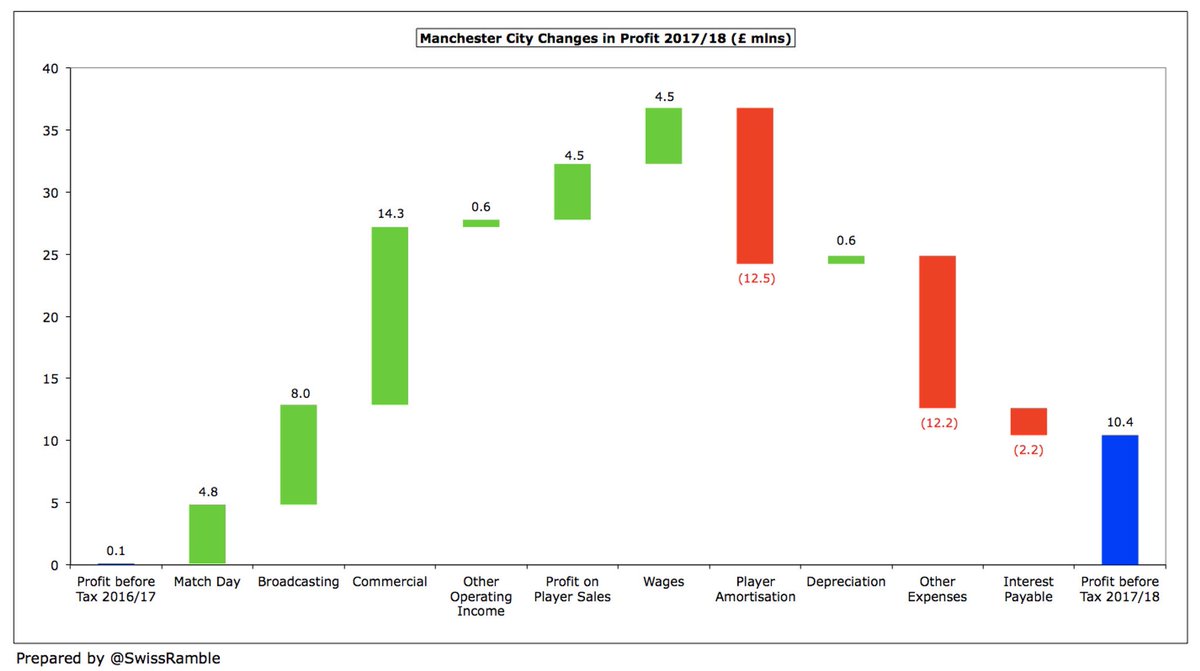

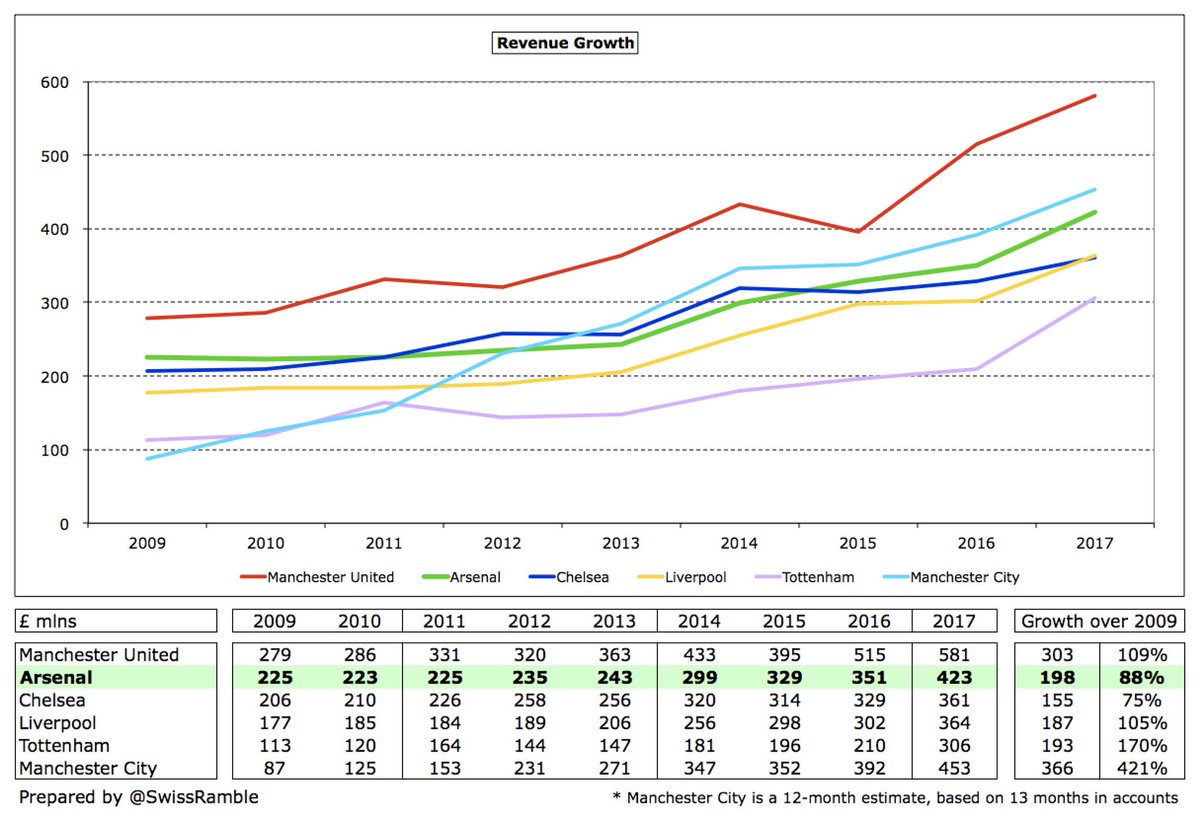

#AFC revenue has grown by an impressive £198m under Gazidis, only outpaced by #MCFC £366m & #MUFC £303m in absolute terms. However, this was the 2nd smallest % growth of Big 6. Furthermore, 2017/18 revenue is likely to be £40-50m lower, due to not qualifying for Champions League.

Analysing #AFC £198m revenue growth under Gazidis, most (£125m) is from TV, due to central Premier League deals. As Warren Buffett said, “a rising tide lifts all boats”. Commercial up £69m, but this was a slam dunk after long-term sponsorships linked to stadium funding expired.

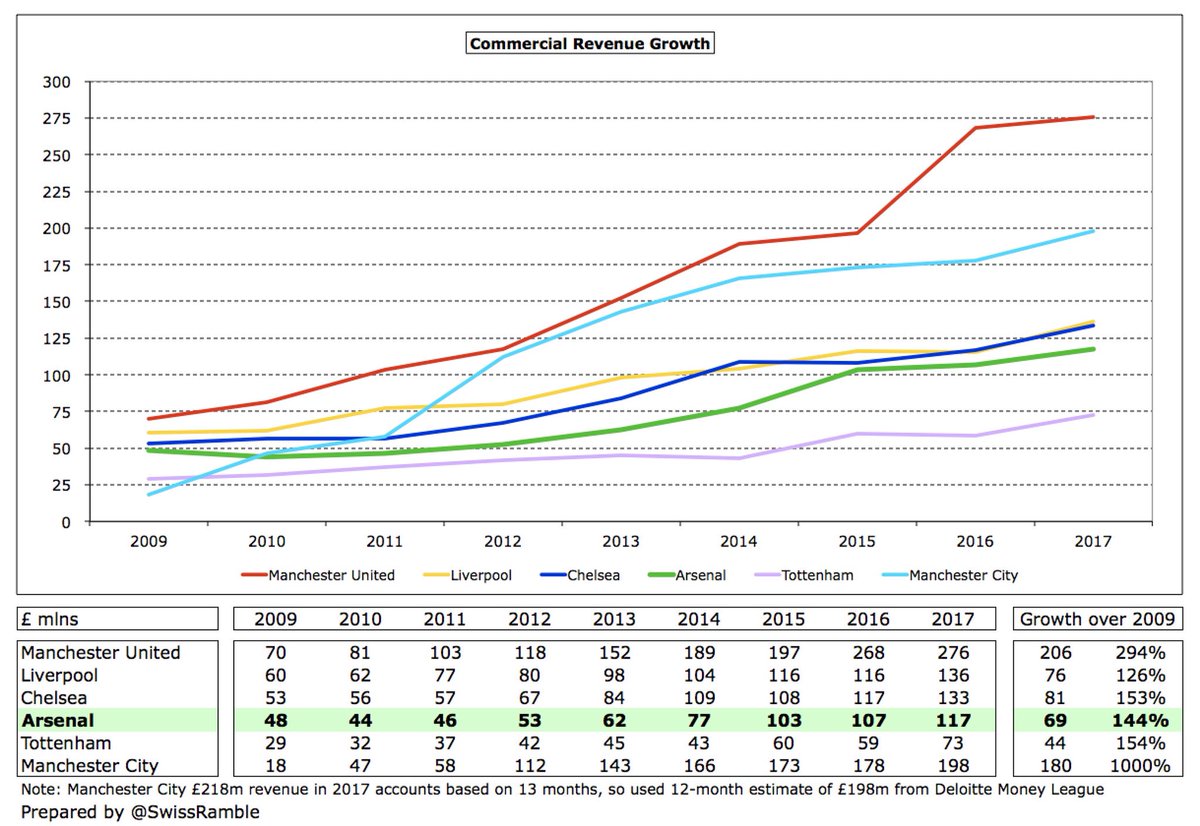

#AFC commercial revenue, where you would expect Gazidis to have most influence, has grown by £69m, the second lowest of the Big 6 over this period, only ahead of #THFC £44m. #AFC growth was around a third of #MUFC £209m and also behind #MCFC £180m, #CFC £81m and #LFC £76m.

In fairness to Gazidis, Emirates extended their #AFC deal (shirt sponsorship & naming rights) from 18/19 for £40m a year (up £10m) – the same as #CFC & #LFC, but below #MUFC £58m (current exchange rates) & #MCFC £45m. Also added “visit Rwanda” as sleeve sponsor for £10m a year.

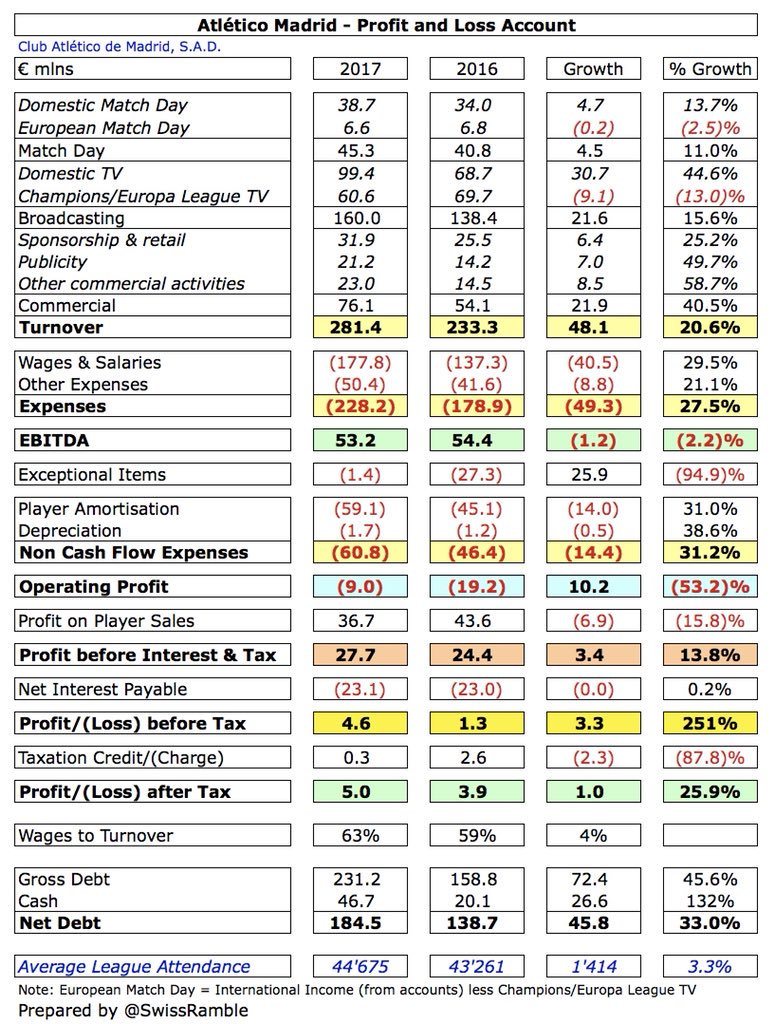

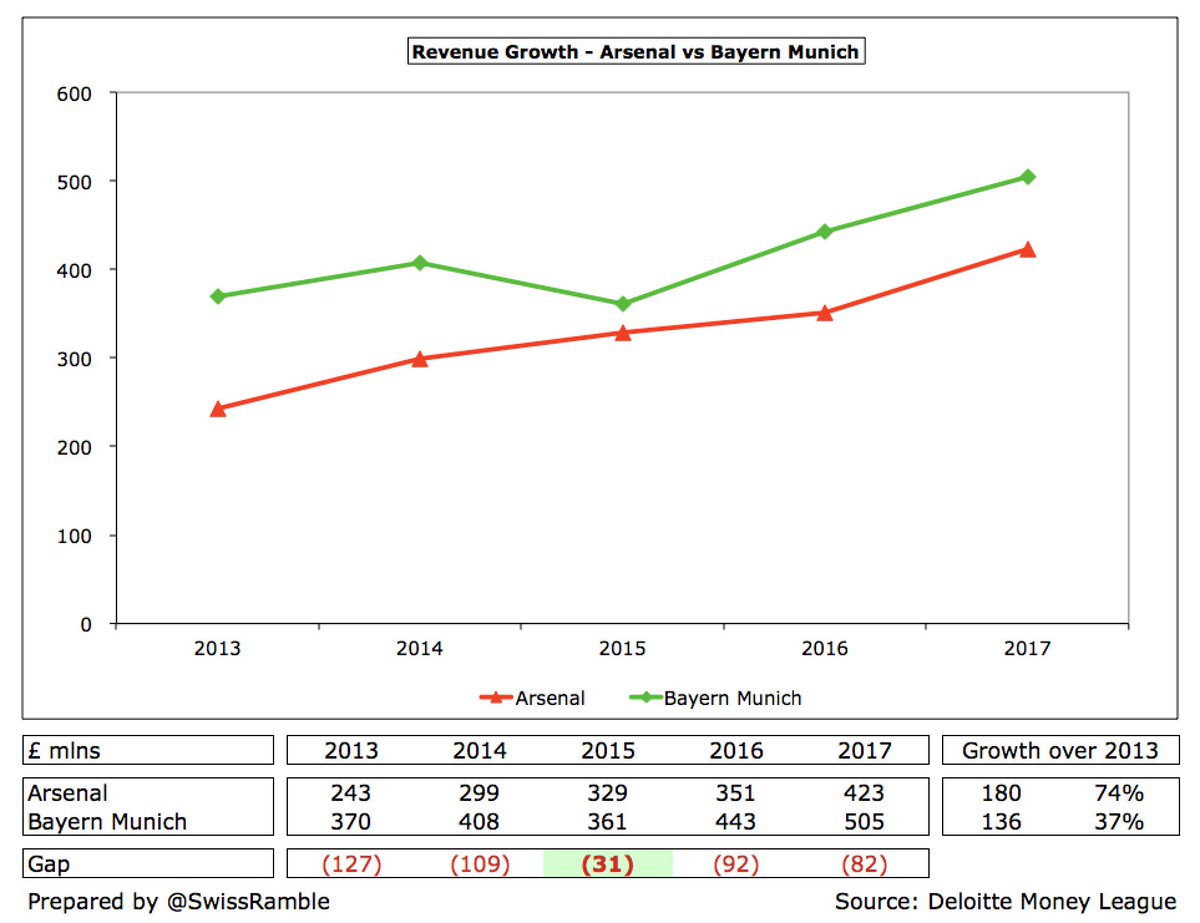

In 2013 Gazidis said #AFC “should be able to compete at a level like a club such as Bayern Munich”. Since then, revenue gap fell from £127m to £82m in 2017, but this is still a large shortfall. With the anticipated £40-50m revenue reduction in 18/19, gap will be same as it was.

In 2011 Gazidis said that “we deliberately kept some powder dry” re #AFC spending plans, which has proved to be a poor strategy, as transfer fees have continued to significantly rise, while the weaker Pound has further reduced the club’s spending power.

Furthermore, #AFC ability to outspend others has diminished. In 2012 they had almost as much cash (£154m) as the rest of the Premier League combined (£181m), but in 2017 other clubs have seen their cash boosted by new PL TV deals, so they now have £819m compared to #AFC £180m.

Indeed, after many years of rising cash, this has actually fallen at #AFC in last 2 years: £2m in 2016 & £46m in 2017. This is arguably no bad thing, as it is partly due to higher player purchases, but it does mean that Arsenal now have less cash than #MUFC £290m & #THFC £200m.

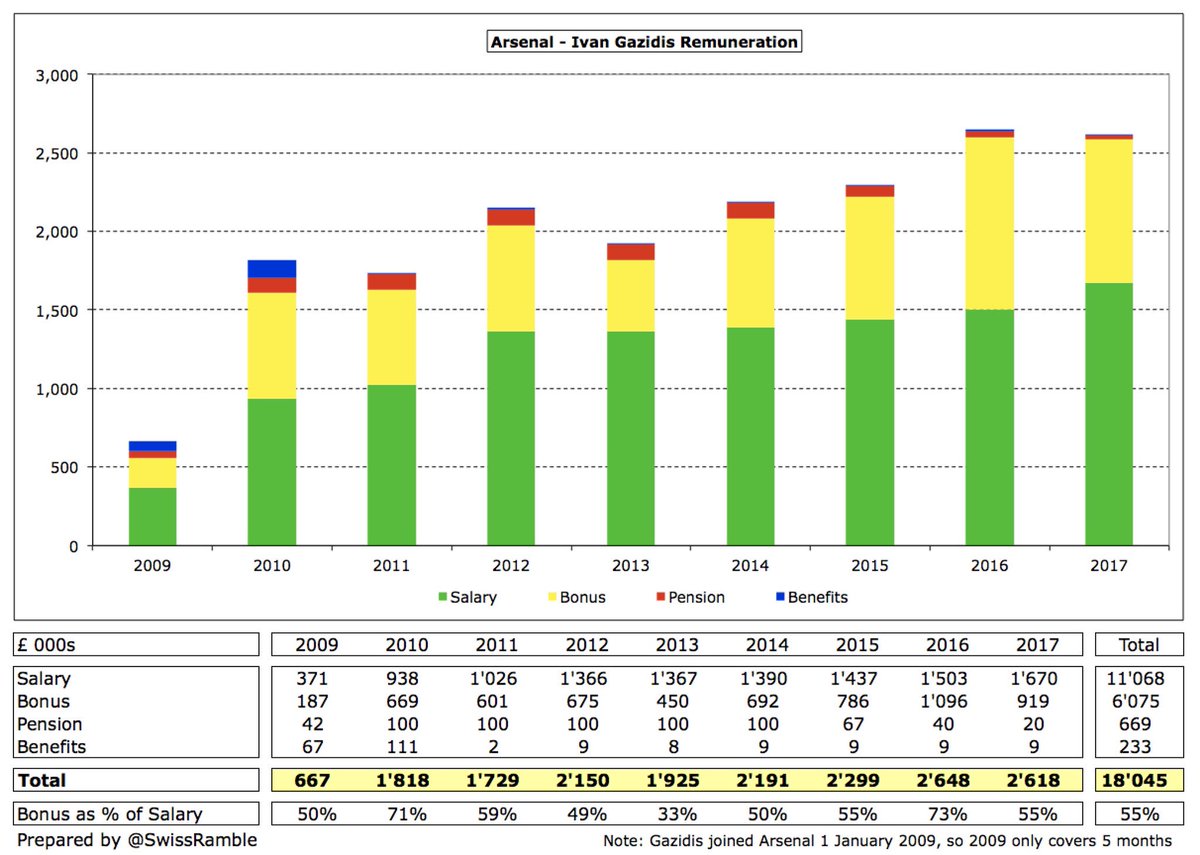

Up to the end of the 2016/17 season Gazidis had received £18m remuneration from #AFC. Assuming a similar level in 2017/18 as the previous season, this means that he has trousered over £21m to date. His latest £2.6m remuneration represents a 31% increase over his first full year.

Despite a slight decrease in 2016/17 Gazidis’ #AFC remuneration of £2.6m is only below Daniel Levy’s extraordinary £6m at #THFC (though this apparently includes a backdated pay rise and bonuses), but just above Ed Woodward at #MUFC. Almost three times his #LFC equivalent £0.9m.

From a financial perspective Ivan Gazidis has not been a bad chief executive at #AFC, just not especially good. Whether his track record merits Milan’s eager pursuit is debatable. If he does leave Arsenal, the club should be able to find a replacement at least as capable.

• • •

Missing some Tweet in this thread? You can try to

force a refresh