A long-suffering Newcastle United fan asked how their financial performance compared with Tottenham Hotspur since Mike Ashley bought the club in July 2007, so here’s a few thoughts in the following thread #NUFC #THFC

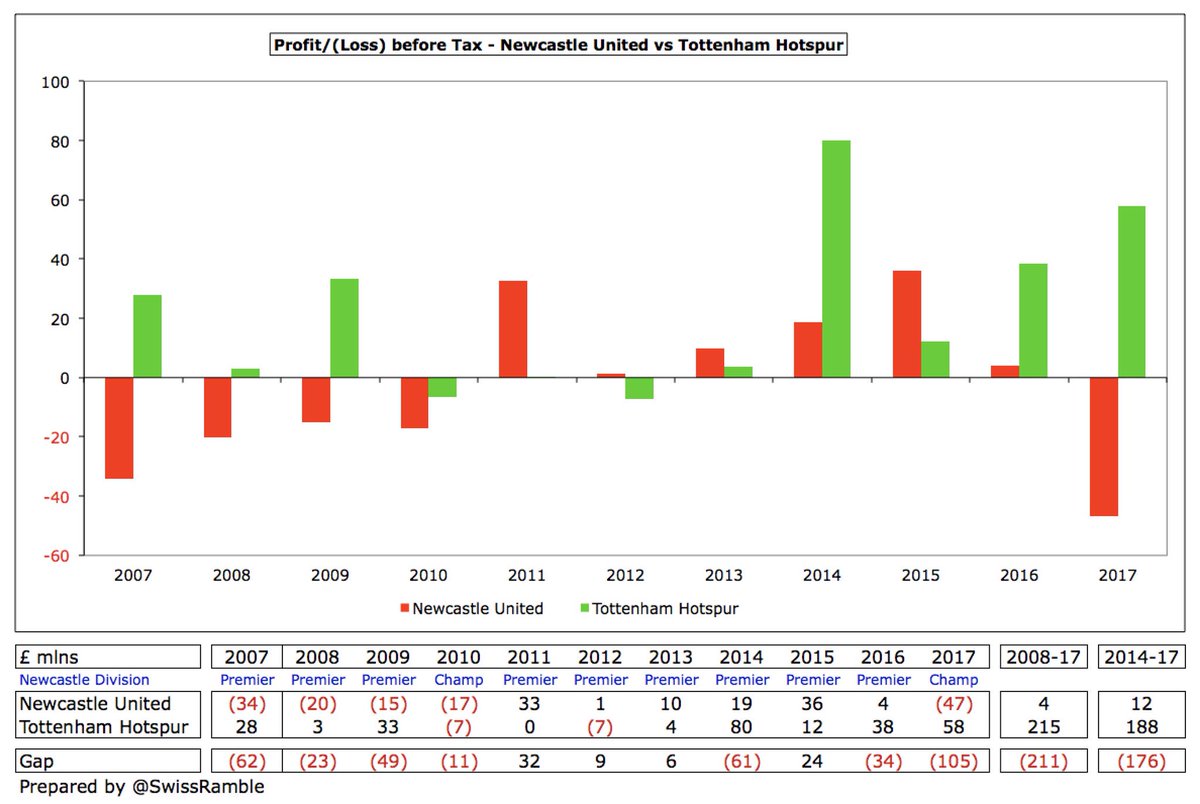

Both #NUFC and #THFC have focused on profit. #NUFC have essentially broken even during Ashley’s tenure with £4m aggregate profit, while #THFC have reported an impressive £215m. Worth noting that £188m of that came in last 4 seasons, when #NUFC had a £47m loss in Championship.

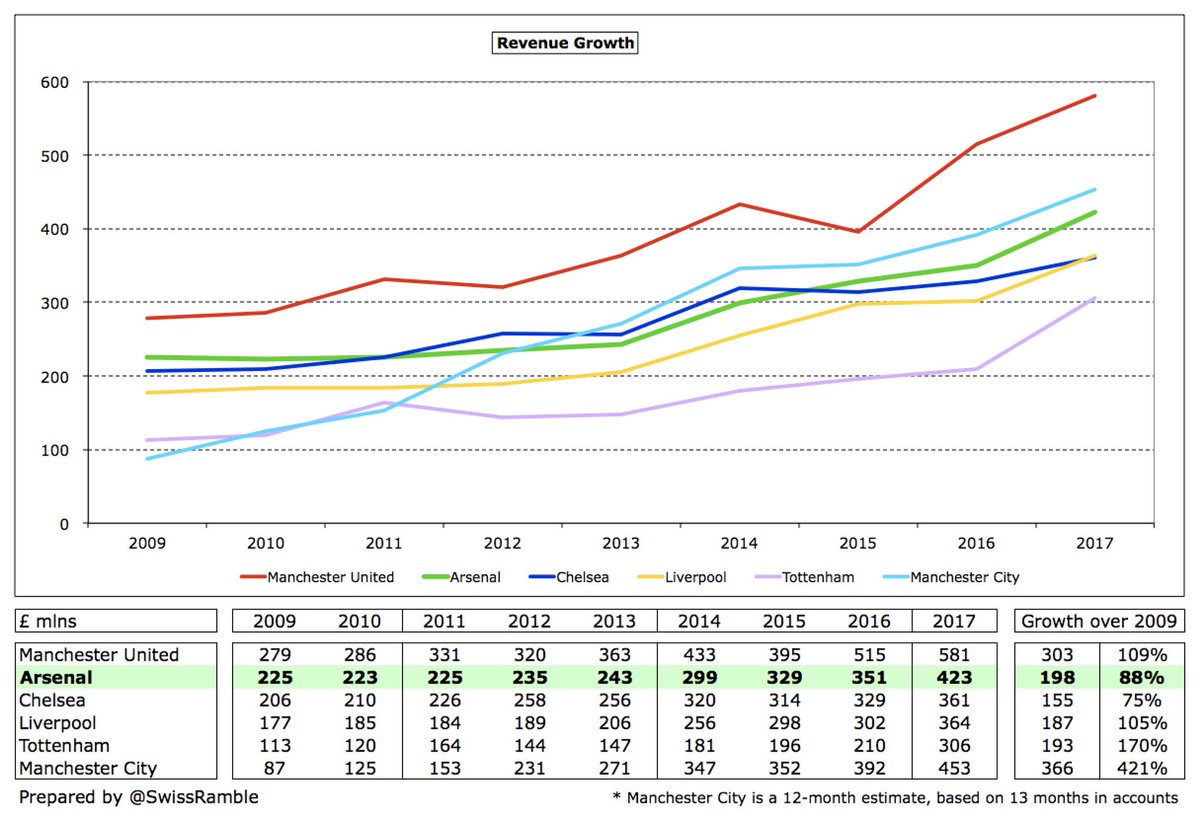

#NUFC revenue has fallen by £1m since Ashley’s arrival from £87m to £86m, deflated by the lower money in the Championship. In the same period, #THFC revenue has tripled, rising £203m from £103m to £306m. In fairness, #NUFC 2018 revenue will be much higher (£175-180m estimate).

In Ashley’s first season #NUFC earned £1m more from broadcasting (£41m) than #THFC £40m, but in 2017 #THFC were £141m higher, largely due to #NUFC relegation to the Championship. That said, difference was still £38m in #THFC favour in 2016 when both clubs were in the top flight.

In the last 11 seasons #NUFC received a hefty £627m from central Premier League distributions, but this is £231m less than the £858m #THFC received. The two relegations to the Championship during Ashley’s reign have really hit revenue. accounting for £142m of the difference.

In the 11 seasons before Ashley arrived #NUFC qualified 8 times for Europe, including twice for the Champions League group stage, but have only qualified for the Europa League once since, so they have only earned a paltry €5m. In the same period #THFC have earned €179m.

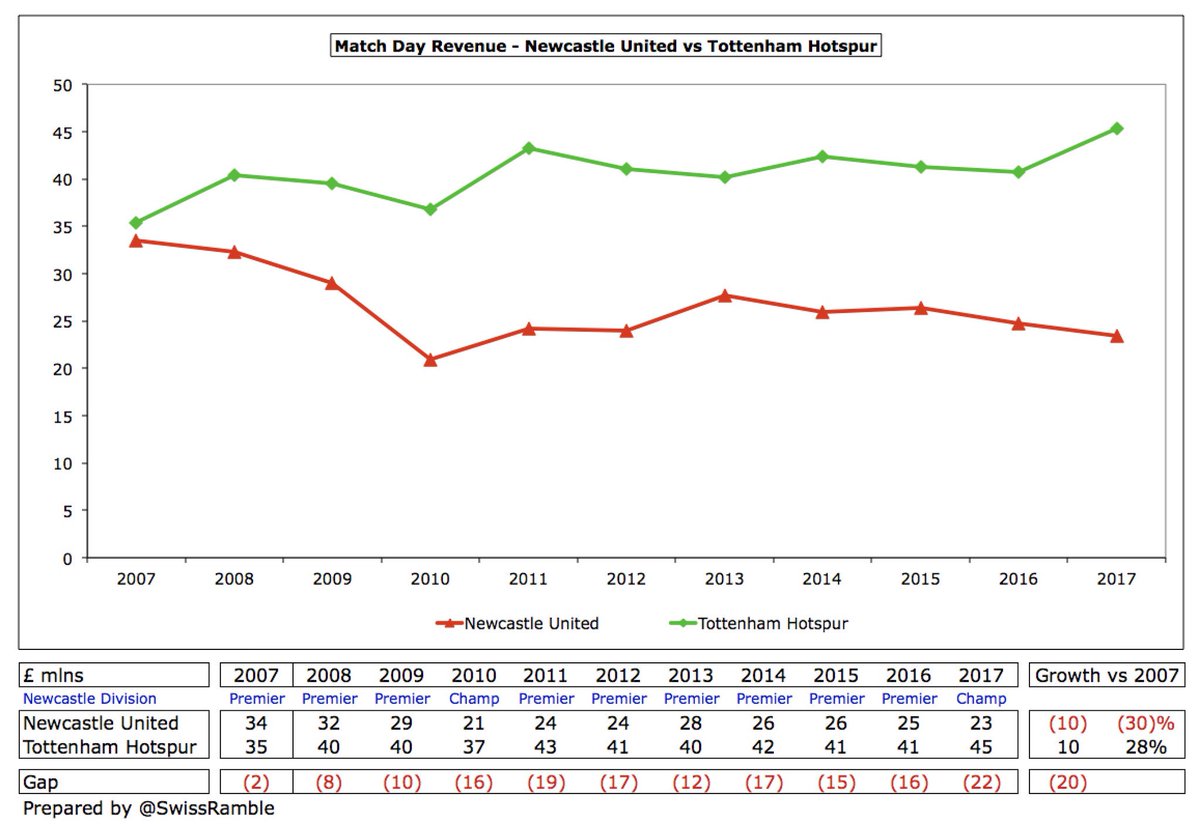

#NUFC match day income has dropped £10m from £34m to £23m in the Ashley era (partly due to 10% ticket price reduction in Championship). Over the same period #THFC income has grown by £10m from £35m to £45m, partly due to lucrative Champions League matches.

#NUFC attendance held up very well in the Championship with crowds of over 51,000, nearly 20,000 more than the closest challenger #AVFC 32,000. #THFC attendances have been restricted by White Hart Lane’s capacity, as seen by the 68,000 in their temporary Wembley home in 17/18.

#NUFC commercial income almost halved from £28m pre-Ashley to £15m in 2017. Partly due to outsourcing catering in 2009, though other revenue streams are basically flat, put off by the Sports Direct brand. In same period #THFC have more than doubled commercials from £34m to £73m.

#NUFC enjoyed the 5th highest wage bill in England before Ashley’s arrival in 2007, but since then this has risen by just £20m (34%) from £60m to £80m in 2017 (excluding one-offs). In contrast #THFC have almost tripled wages from £44m to £127m (up from £100m in previous 3 years).

Based on the clubs’ cash flow statements #NUFC have outspent #THFC on a net basis: £129m to £98m. However, this is due to Spurs’ player sales (e.g. Gareth Bale to Real Madrid for £90m). On a gross basis #THFC have spent £210m more than #NUFC: £541m vs. £331m.

However, cash flow can be a bit misleading, as most transfers involve stage payments, so using Transfermarkt the figures are a little different, showing that on a net basis #THFC have spent twice as much on players as #NUFC: £138m vs. £63m.

One criticism leveled at Ashley is that he has not invested in #NUFC infrastructure (stadium & training ground), which is borne out by the feeble capital expenditure – only £10m in 10 years. #THFC are the complete opposite, splashing out almost half a billion in the same period.

Ashley is fond of mentioning the £144m loan he has put into #NUFC, which is true, though omits the £77m of debt that he inherited. Including 2017 £8m bank overdraft the net increase is £76m. #THFC debt has surged from £31m to £185m, very largely due to loans for new stadium.

In fairness to Ashley his loan is interest-free, leading to a £5m reduction in #NUFC annual interest payments, while #THFC is up to £6m in 2017 and will further increase as more loans are taken out to fund the new stadium build.

Most fans are more interested in how the teams fare on the pitch and this is where Newcastle have suffered. Only 1 place separated the clubs in Ashley’s first season (#THFC 11th vs. #NUFC 12th). While Spurs are now regularly in top 4, #NUFC have only once been better than 10th.

So there it is “in black and white”: #THFC have done well financially and improved on the pitch, while #NUFC have thrown away the advantages they had when Ashley arrived in 2007. No regular qualification for Europe plus 2 relegations to the Championship have really hurt the club.

• • •

Missing some Tweet in this thread? You can try to

force a refresh