Consultation on #USS contribution increases opens today. Their website is now live (link). Some differences, on which I comment below, between what's on the website & what's in the hard copy consultation document that we've received in the post. 1/

ussconsultation2018.co.uk/members

ussconsultation2018.co.uk/members

Here's a link to a pdf of the hard copy consultation document we received in the post. 2/

ussconsultation2018.co.uk/uploads/docume…

ussconsultation2018.co.uk/uploads/docume…

In this tweet, I noted my surprise over the following in that document: 3/

https://twitter.com/MikeOtsuka/status/1033022070454714369

The above claim that "feedback could result in changes to benefits" is not repeated in any of the online material. I infer that this surprising claim was misleading and that's why #USS does not repeat it. 5/

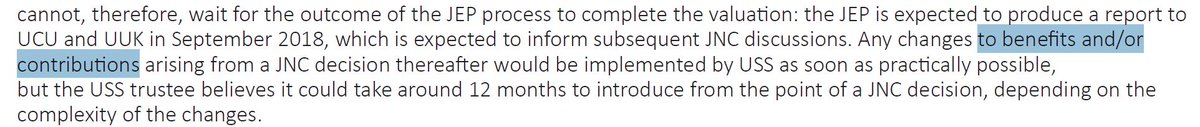

There is another change of wording on the website, having to do with the role the Joint Expert Panel (JEP) might play. In a previous tweet, I drew attention to the following passage in the hard copy document: 6/

https://twitter.com/MikeOtsuka/status/1033049644014686214

I see that in the linked Q&A on the JEP, #USS has removed "and/or contributions". The role of JEP is instead described as follows: 8/

ussconsultation2018.co.uk/members/queries

ussconsultation2018.co.uk/members/queries

"Based on the JEP’s findings, the JNC may propose changes to benefits which, subject to due diligence by the trustee, would then be subject to a further consultation by employers with affected employees and their representatives." 9/

The "...and/or contributions..." phrase is, however, retained in the following section of the consultation website: 10/

ussconsultation2018.co.uk/members/abouts

ussconsultation2018.co.uk/members/abouts

Significantly, however, "benefits and/or contributions" has been removed from #USS's most detailed description of the role of the JEP in their new online material. 11/

This is how #USS described the role of JEP in the hard copy consultation document they posted to scheme members last week. Note highlighted phrase. 12/

There is a subtle but potentially change of wording to the analogous passage describing the role of JEP in the new online material. The phrase "changes to benefits and/or contributions" has been replaced by the more ambiguous phrase "scheme changes". 13/

A change to contributions rather than benefits might constitute a "scheme change". But note that #USS no longer mentions the possibility that the trustee might consider a JEP/JNC recommendation consisting of only a change in contributions, unaccompanied by benefit changes. 14/

#USS appears, therefore, to be signalling the following: Even if, upon assessment of the valuation, JEP concludes that no detrimental changes to the status quo are required, either in the form of a cut to benefits or an increase of the current 26% contribution level,.... 15/

...they will not accept a proposal involving no detrimental changes to the status quo. Rather, any proposal must include either a cut to benefits or an increase in contributions, relative to the status quo. 16/

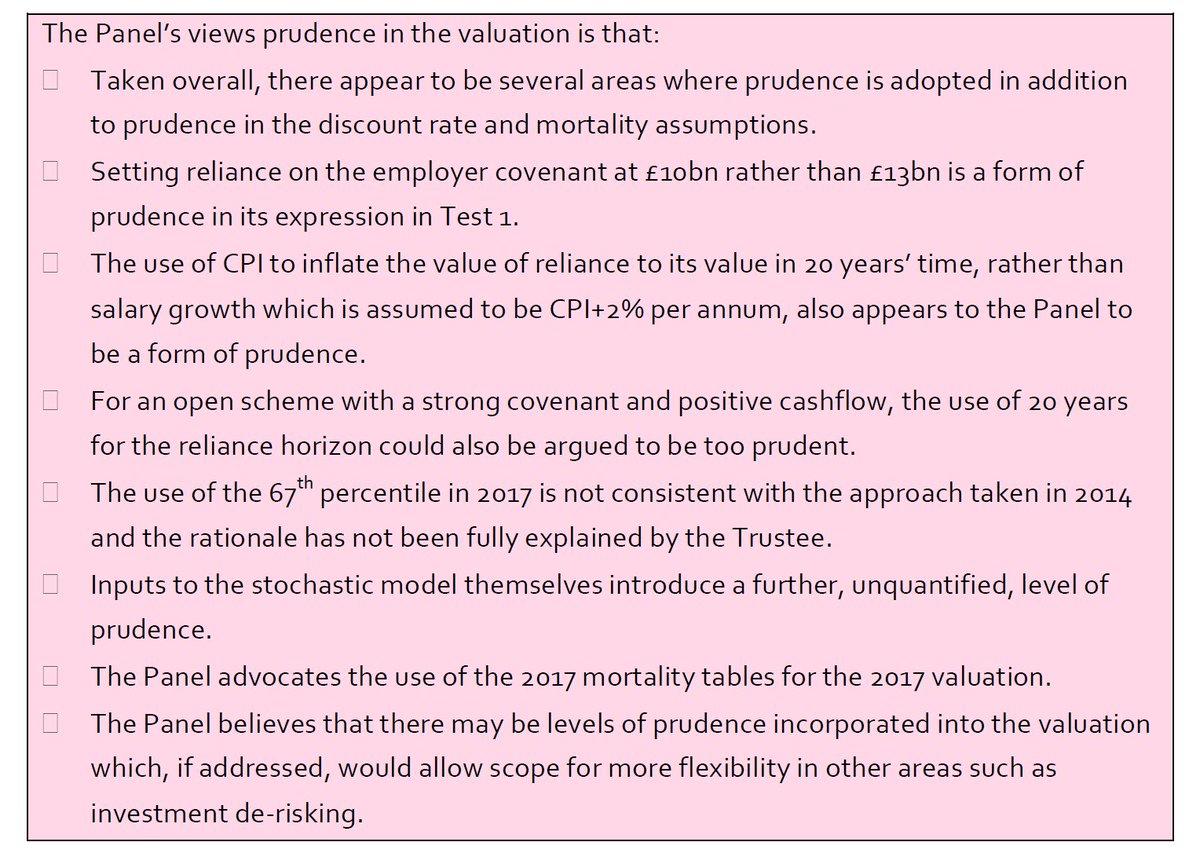

This strikes me as a pre-judging of the results of the JEP review. It is, for example, to rule out, in advance, that @Sam_Marsh101's findings demonstrate that a proper application of Test 1 is consistent with no detrimental changes (see link). 17/17

https://twitter.com/MikeOtsuka/status/1036125211987521536

PS: A new linked #USS post on "The valuation and the JEP", dated 4 Sept, says "and/or contributions": "[In December] The JNC may decide on any future changes to benefits and/or contributions...."

uss.co.uk/how-uss-is-run…

uss.co.uk/how-uss-is-run…

• • •

Missing some Tweet in this thread? You can try to

force a refresh