A Professor in LSE's Dept of Philosophy, Logic & Scientific Method. Photo not completely up to date. But neither is yours, unless it's a live webcam image.

How to get URL link on X (Twitter) App

https://twitter.com/UCL_UCU/status/1047552495650852865In my subsequent exchange with @UCL_UCU that begins with the embedded tweet, I demonstrate that it is just as clear that they refer accrual rate to JNC as that they refer cost-sharing to JNC. 2/2

https://twitter.com/MikeOtsuka/status/1047553004373774336

https://twitter.com/UCL_UCU/status/1047493116595503105If employers call for a cut to DB accrual from 1/75 to 1/80 in order to keep employer contributions down to 19.3% on a 65%/35% employer/member cost-sharing basis, would that also be consistent, in you view, with acceptance of the JEP recommendations in full? 2/2

I say more about the significance of Sam's Addendum in this blog post, where I also explain why #USS and @GuyCoughlan owe us an answer to Sam's findings. 2/

I say more about the significance of Sam's Addendum in this blog post, where I also explain why #USS and @GuyCoughlan owe us an answer to Sam's findings. 2/

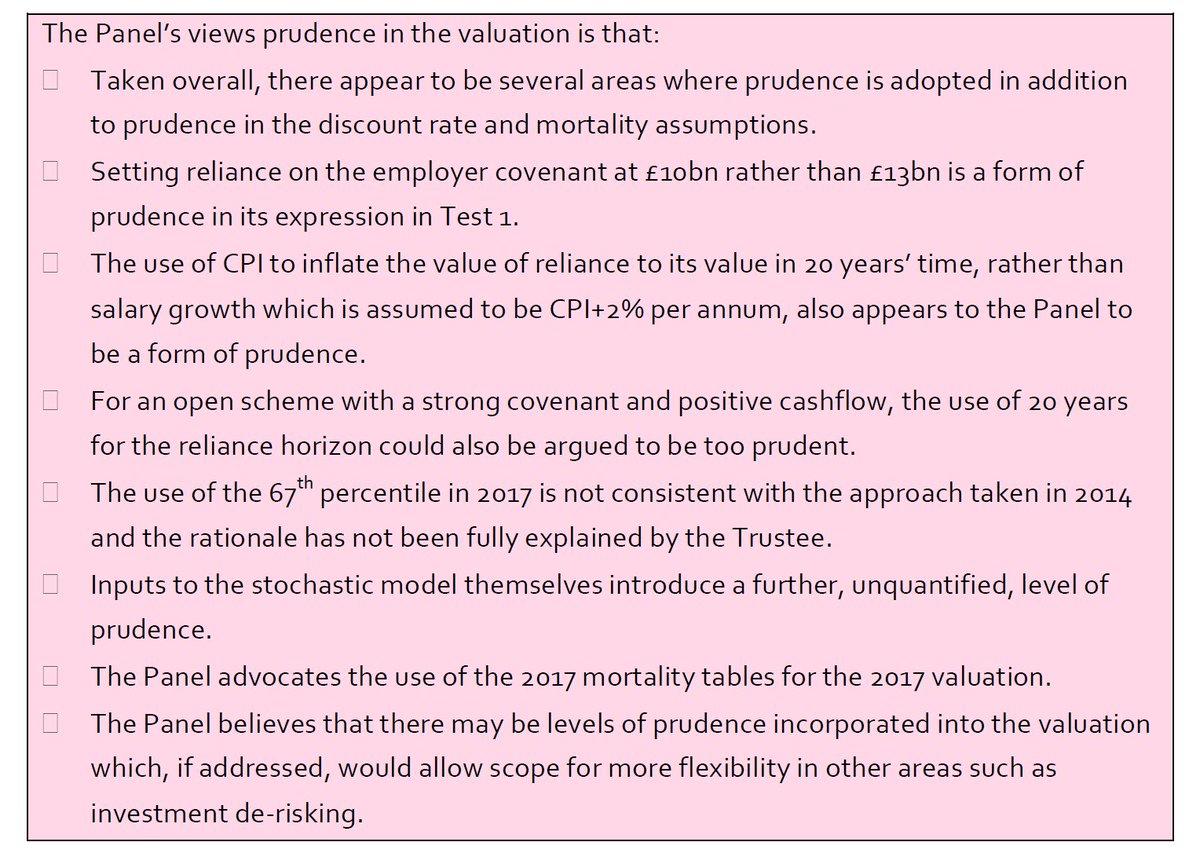

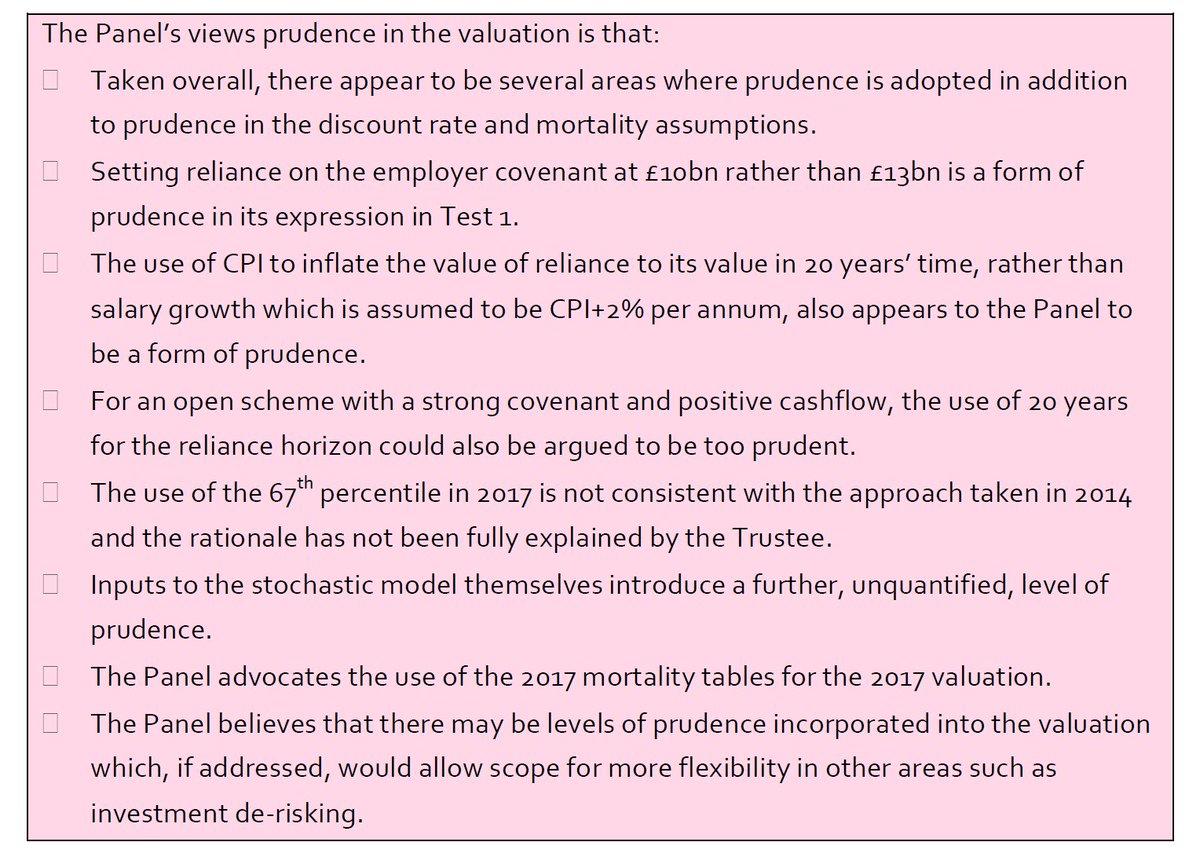

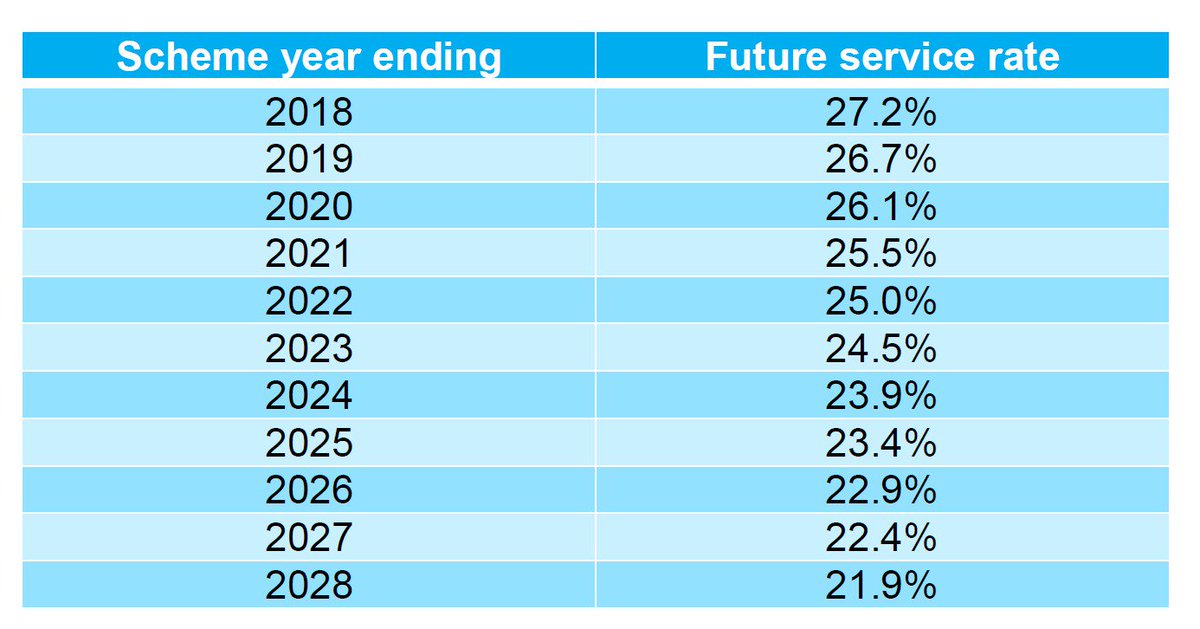

#USS's failure to smooth the cost of future service contributions constitutes a significant hidden layer of prudence. See this blog post: 2/

#USS's failure to smooth the cost of future service contributions constitutes a significant hidden layer of prudence. See this blog post: 2/

https://twitter.com/MikeOtsuka/status/1044866886075322368

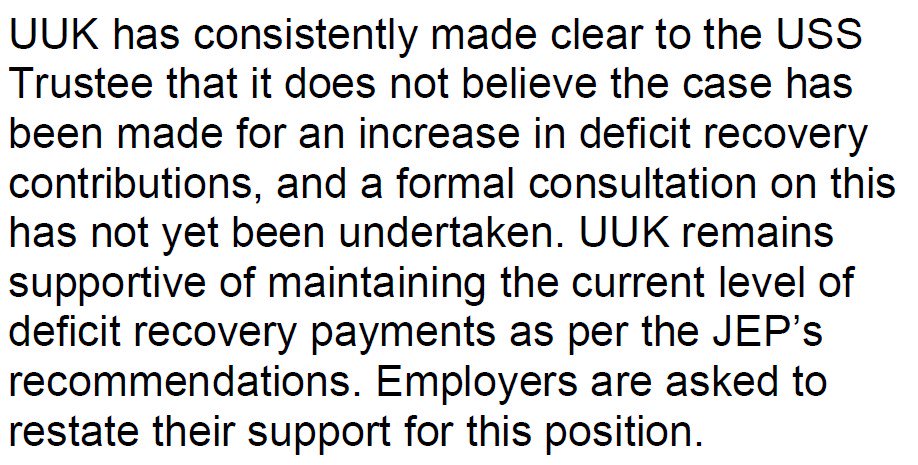

It is also the JEP recommendation that @AlistairJarvis's @UniversitiesUK supports most strongly👇. 2/

It is also the JEP recommendation that @AlistairJarvis's @UniversitiesUK supports most strongly👇. 2/

https://twitter.com/USSEmployers/status/1044262774812086272I see that the pdf is protected in a manner that makes it impossible to cut and paste. Gratuitous and annoying. I'm now wasting time creating a cut-and-paste-able version. 2/

https://twitter.com/MikeOtsuka/status/1042155582160089091See also this reader-friendly version of @JeanFind's comments in the thread (tagging JNC negotiators @Sam_Marsh101 @carlomorelliUCU @Flibitygibity):

https://twitter.com/JeanFind/status/1042331019532271617

https://twitter.com/Will_McDowall/status/1041694181331218432Provost: "With the stock market performing more strongly in the months since the original valuation, the deficit is reduced and the cost of retaining a predominantly defined benefit scheme in the future is feasible". 2/

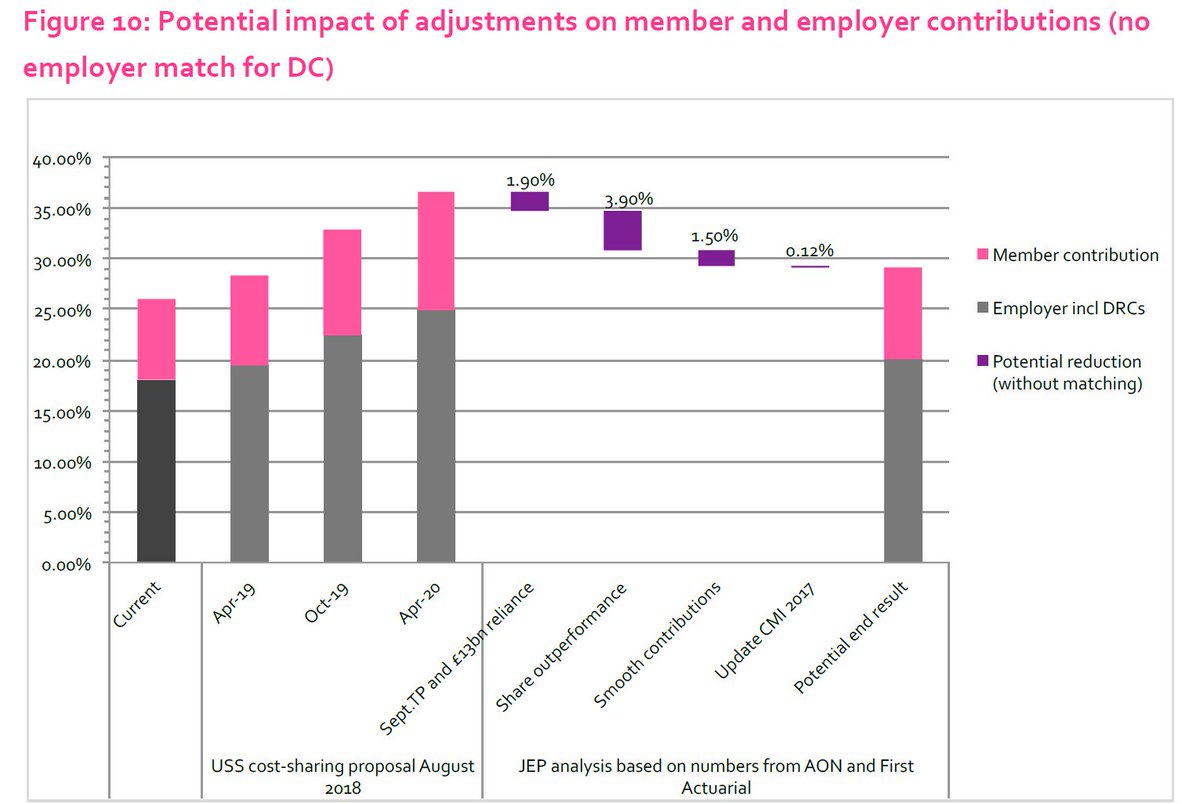

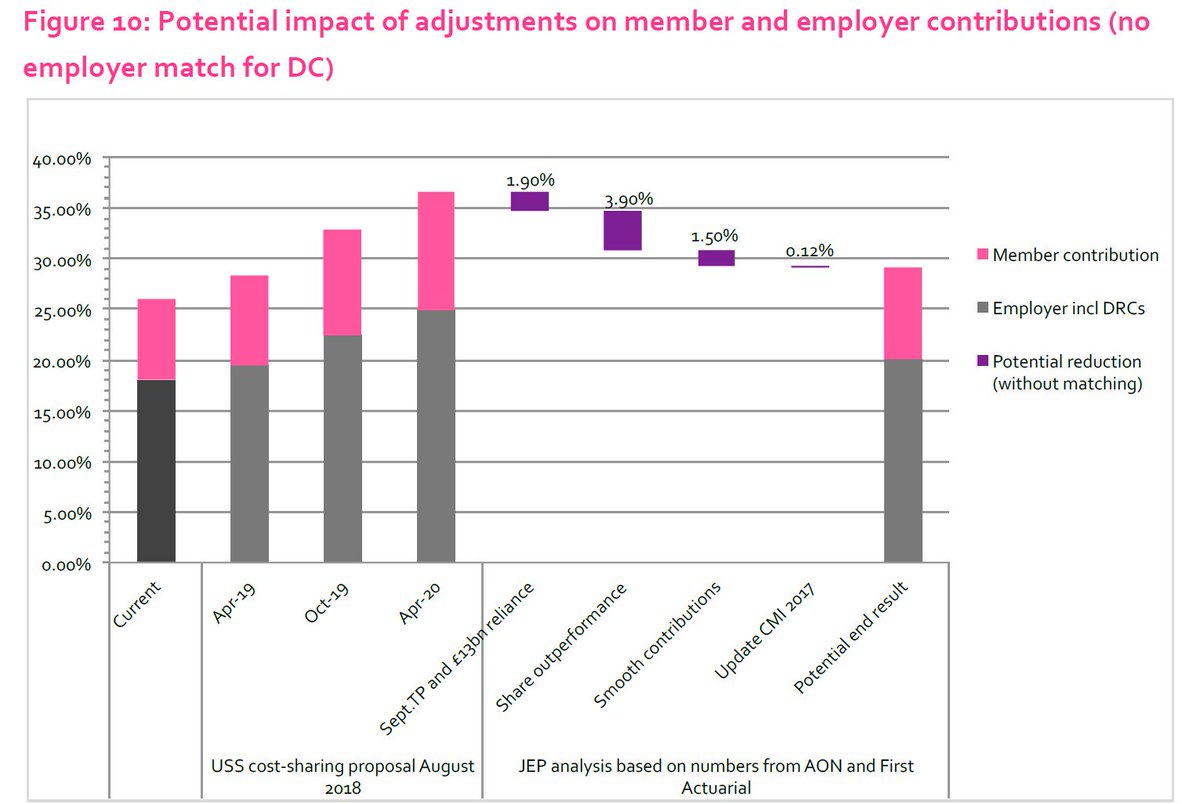

Some have questioned my claim that the 65%-35% employer-member split of the 3.2% contribution increase graphed above in the righthand column of Figure 10 of the report is among the JEP's proposals. 1/

Some have questioned my claim that the 65%-35% employer-member split of the 3.2% contribution increase graphed above in the righthand column of Figure 10 of the report is among the JEP's proposals. 1/

https://twitter.com/carlomorelliUCU/status/1041424747056300032This is not in conformity w current UCU policy. “HE6 Demand to UCU negotiators: restore USS status quo and re-evaluation” calls for “a UCU and UUK agreement on the status quo for contributions and benefits”. 2/

https://twitter.com/MikeOtsuka/status/1035446795185389568

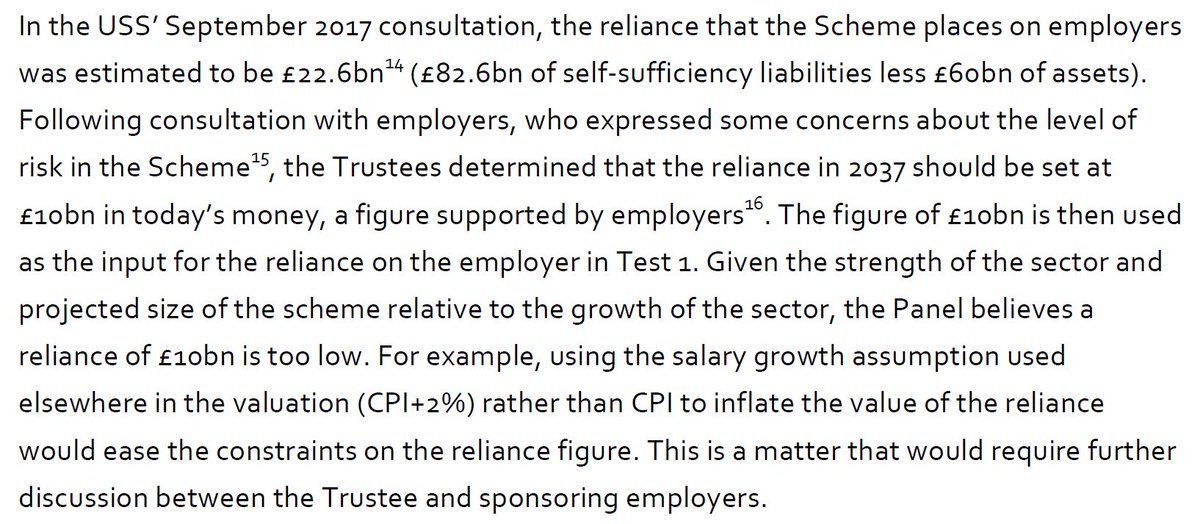

https://twitter.com/Sam_Marsh101/status/1034727303153102848But to determine whether Test 1 is currently satisfied, #USS needs to project assets that would be in the fund in 20 years' time, assuming 67% probable investment returns of prudent discount rate are realised. 2/