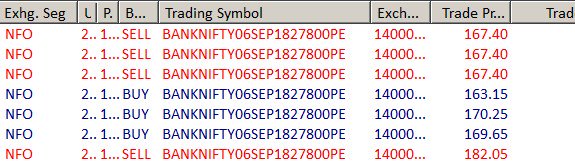

Sold 27800 strike weekly puts at 172, SL 180( 0.25R)

Will add positions if trade moves in my favour. Started with 0.25% of R , R being max risk amount for a trade

SL to 172 #nolosstrade #scalping

waiting for the level of 27815 to be crossed where I will sell more puts and sit tight. Till that not happen, will scalp, scalp,scalp.... 😀

Sl triggered

Again sold at 184, SL now 187 ( initially was 199)

sqedoff 50% at 168, rest Sl to 181

Stop triggered

Sold again at 182, Sl 189. My spidey sense tells me this Sl will hold for long, if this goes then will start shorting the market. Still systems point to a bounce

As I forecasted, this SL holding for the longest time

This is what I am looking at on BNF charts. Any student of technical analysis will understand why I am selling puts with small stops

SL for the running positions to 172

Sl to169

I will not post my scalps everyday, doing this for a friend who requested

I will stop posting here. Now go back to the posts and notice these points

1. My initialSL is pretty small. When I get 1:2 reward, I sqoff half and move rest Sl to entry price

2. No Sl has been trigg at a large loss, it's either at entry price or max very near

3. Min profit is 1R

1. My initialSL is pretty small. When I get 1:2 reward, I sqoff half and move rest Sl to entry price

2. No Sl has been trigg at a large loss, it's either at entry price or max very near

3. Min profit is 1R

Scalping is probably the toughest of all trading endeavors. One has to be absolutely disciplined following a rigid set of rules. the name of the game is to continuously reduce losses and take reasonable profits. If you can do that, scalping can be fun and profitable

The red vertical line is where i started scalping by selling puts, at BNF levels 27770 around. Based on RSI divergence, BNF did go up to 27850. If I was at market, would had reversed and started selling calls at those levels. Selling ATM options would have given max benefit

• • •

Missing some Tweet in this thread? You can try to

force a refresh