Atletico Madrid’s 2016/17 accounts cover a season when they finished third in La Liga and reached the semi-finals of the Champions League under coach Diego Simeone. Some thoughts on their finances in the following thread #Atleti #AúpaAtleti #AtleticoMadrid

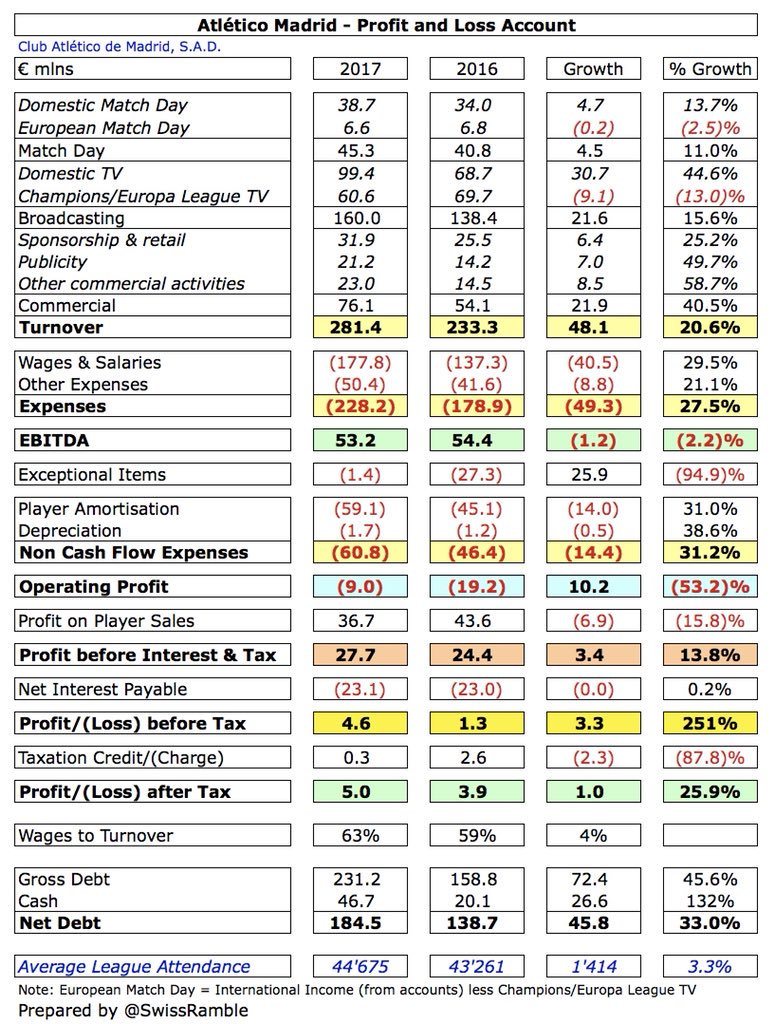

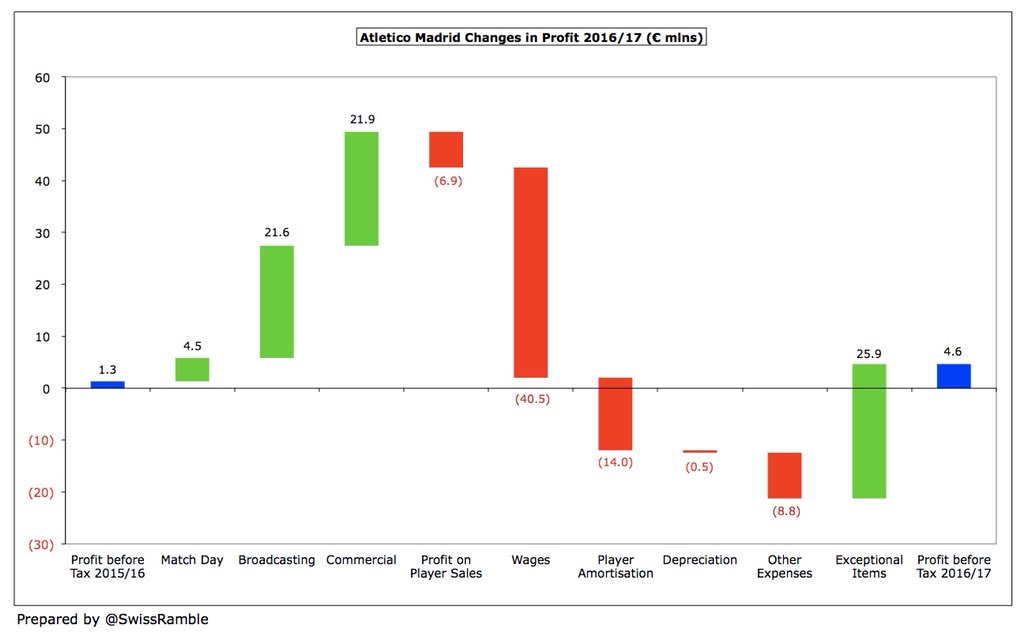

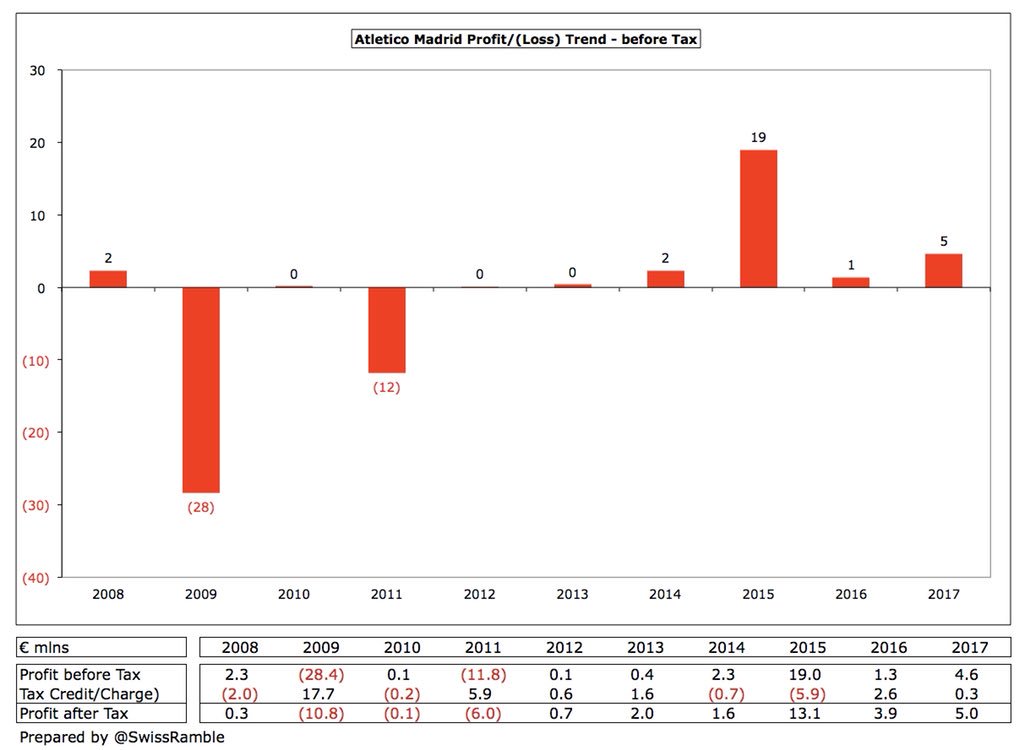

#Atleti profit before tax improved from €1m to €5m (profit after tax up from €4m to €5m), as revenue rose €48m (21%) to a record high of €281m, though profit on player sales fell €7m to €37m. No repeat of the 15/16 €27m extraordinary charge linked to stadium development.

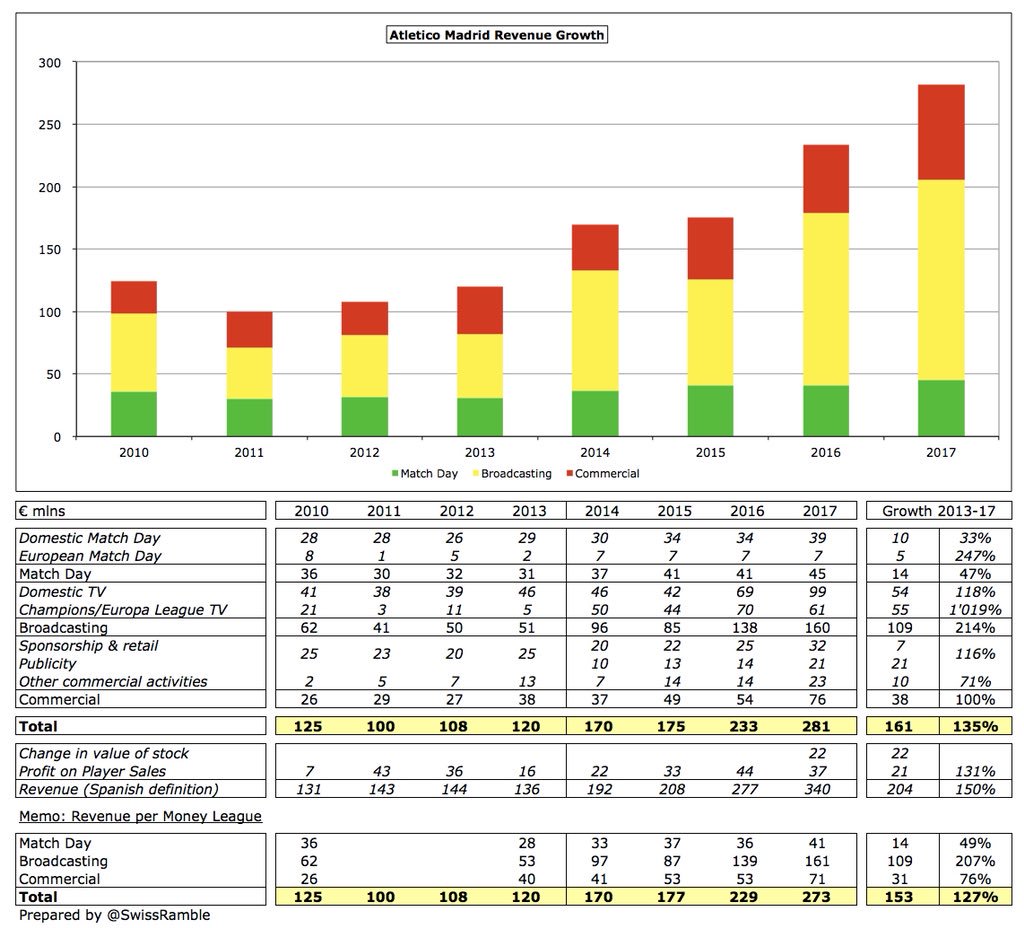

The main driver of the #Atleti revenue increase was the La Liga TV deal, up €31m to €99m, though Champions League TV money was €9m lower at €61m. Commercial rose €22m (41%) to €76m, while match day was €4m (11%) higher at €45m.

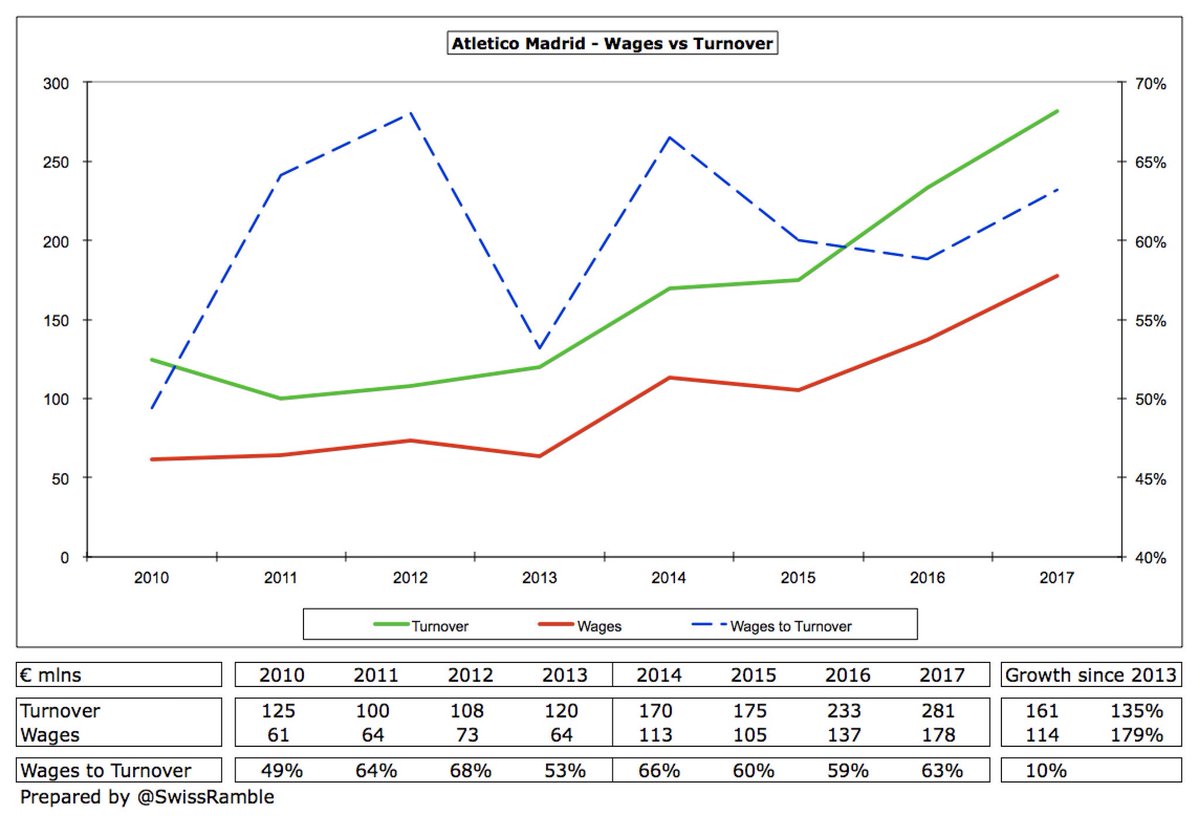

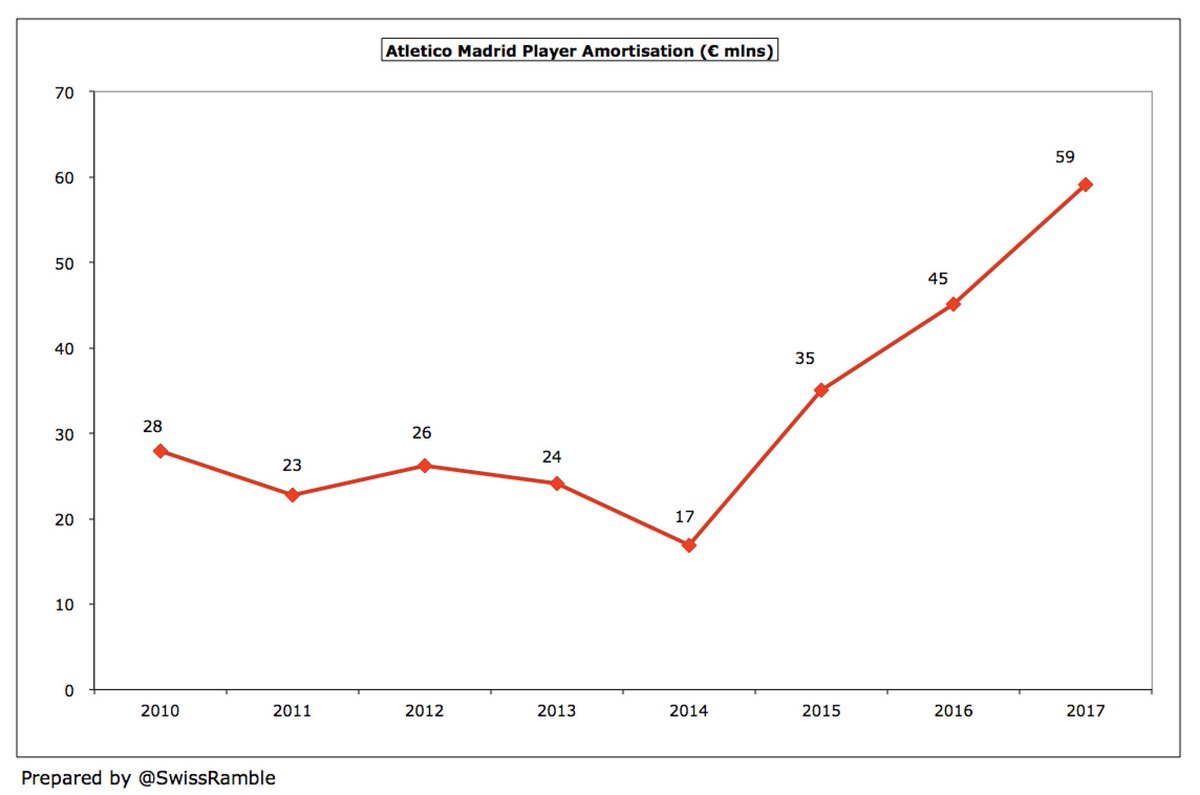

On the other hand, #Atleti wage bill surged €41m (30%) to €178m, while player amortisation also rose €14m (31%) to €59m. Other expenses increased €9m (21%) to €50m, while net interest payable remained a hefty €23m.

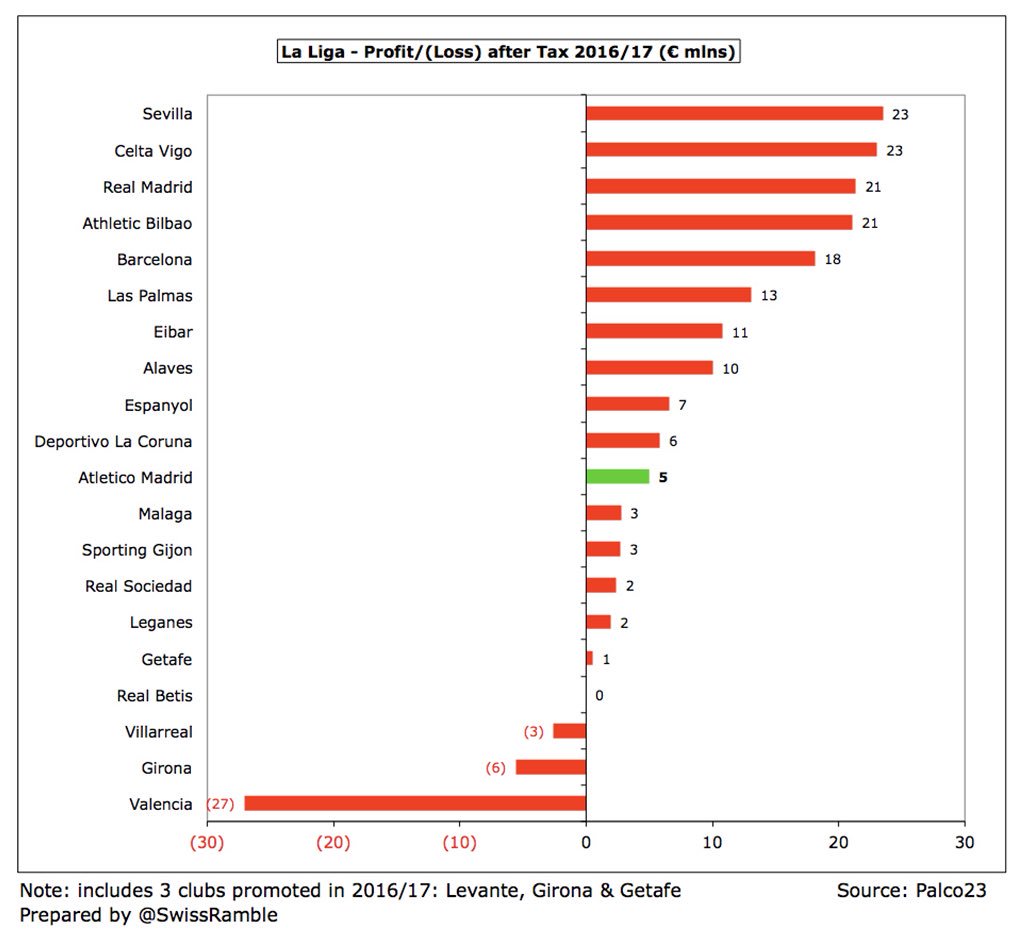

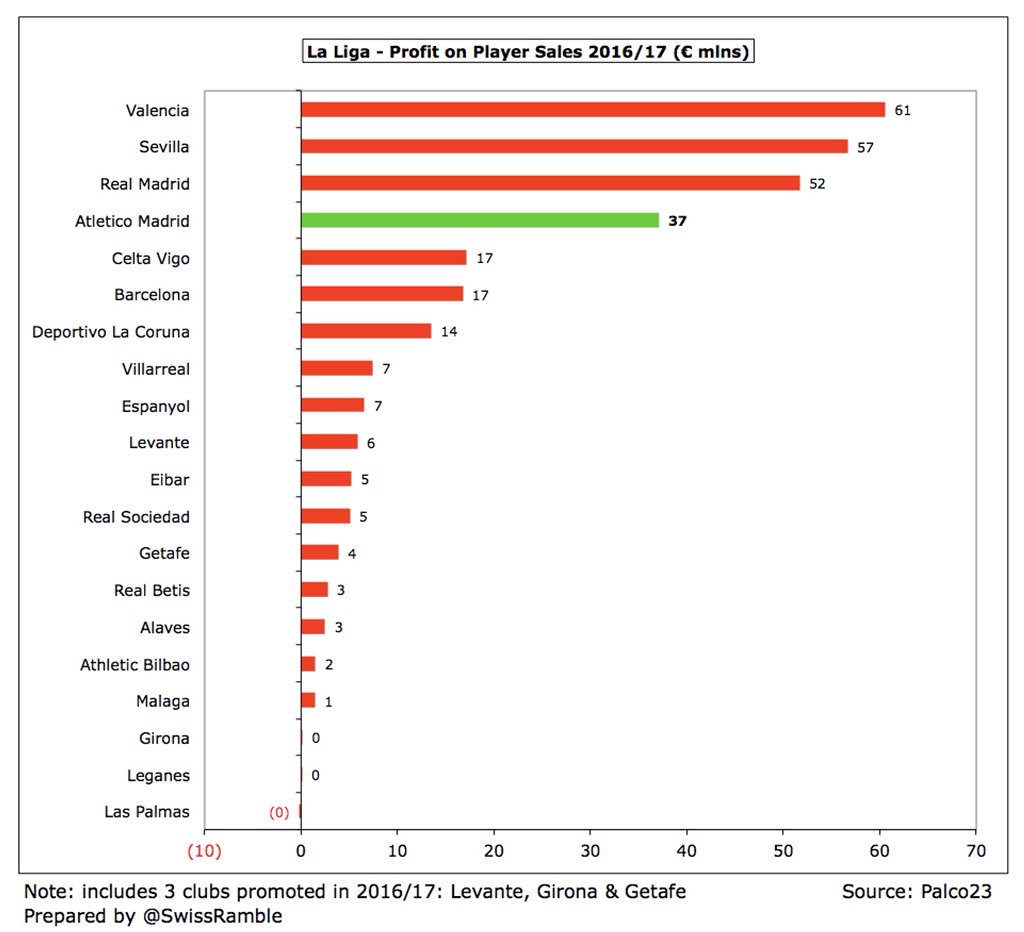

Most clubs in La Liga are profitable, so #Atleti €5m profit after tax was only mid-table in 2016/17 with Sevilla €23m, Celta Vigo €23m and Real Madrid €21m leading the way. The largest loss was reported by Valencia €27m.

#Atleti figures benefited from €37m profit on player sales, largely due to the moves of Borja Baston to Swansea City, Miranda to Inter and Leo Baptistao to Espanyol. This was only surpassed by Valencia €61m, Sevilla €57m and Real Madrid €52m.

#Atleti profits have been improving with the last loss coming six years ago in 2011. Since then, they have reported aggregate profits of €28m with €25m from the last 3 seasons alone (2015 €19m, 2016 €1m & 2017 €5m). This is in stark contrast to the €28m loss in 2009.

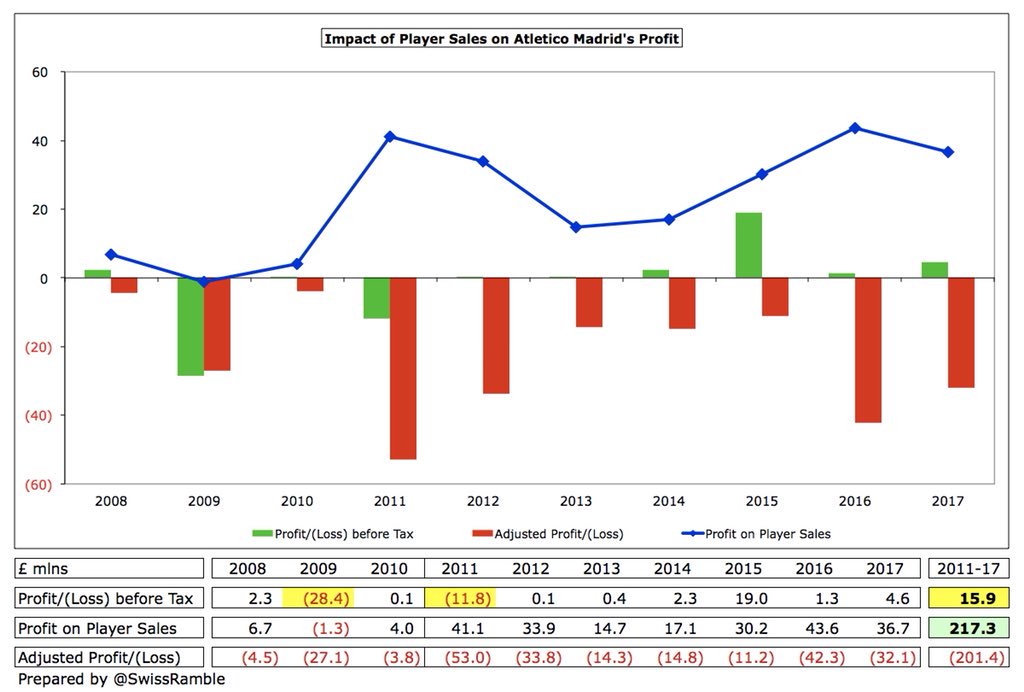

However, #Atleti are still reliant on player sales to make a profit, earning a thumping great €217m from this activity in last 7 years. If these sales were excluded, total loss would have been €201m. Next year helped by sales of Yannick Carrasco, Theo Hernandez & Oliver Torres.

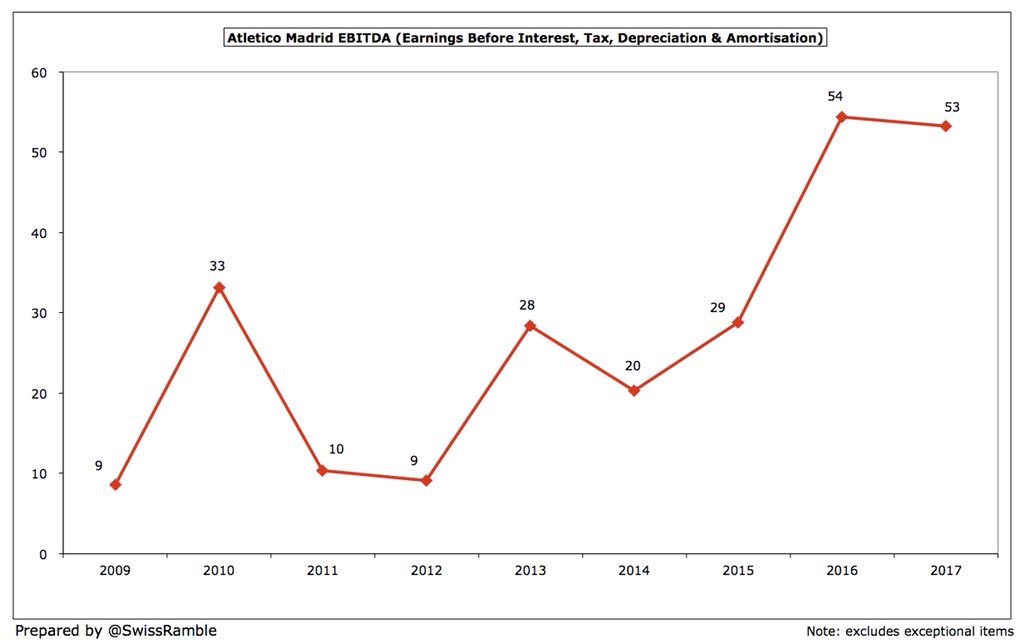

That said, #Atleti EBITDA (Earnings Before Interest, Depreciation and Amortisation), which strips out player sales and non-cash items to give underlying profitability, has improved from €9m in 2012 to €53m in 2017, though it did dip slightly last year.

#Atleti revenue grew by an impressive €161m (135%) in just 4 years from €120m in 2013 to €281m in 2017, largely from TV €109m (split evenly between domestic TV deal and Champions League). Board expects €347m in 2017/18. Revenue mix: TV 57%, commercial 27% and match day 16%.

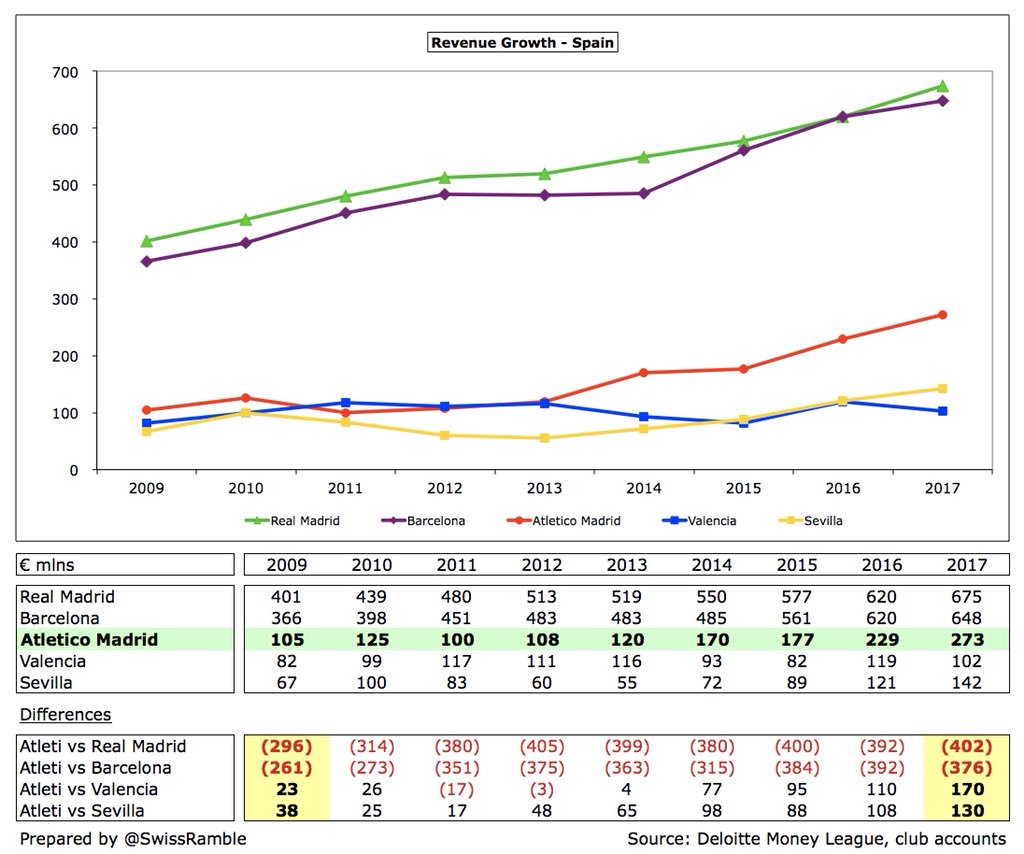

However, the revenue gap to Real Madrid €675m and Barcelona €648m continues to grow and is now around €400m. In turn, #Atleti are outpacing Sevilla and Valencia, generating between €130m and €170m more than these rivals.

n fact, the two Spanish giants (Real Madrid and Barcelona) still earn more than twice as much as #Atleti, which is an immense advantage. No wonder chief executive Miguel Angel Gil said it would be impossible for #Atleti to keep competing without substantial revenue growth.

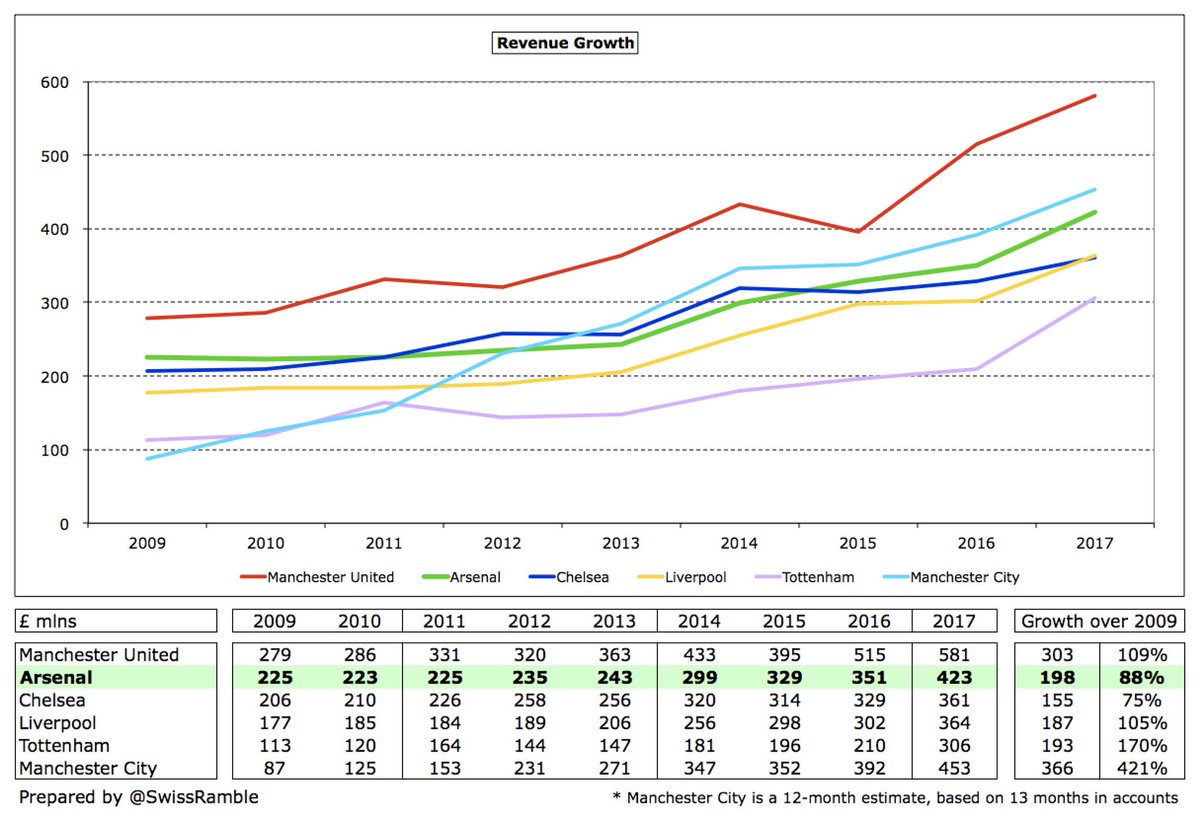

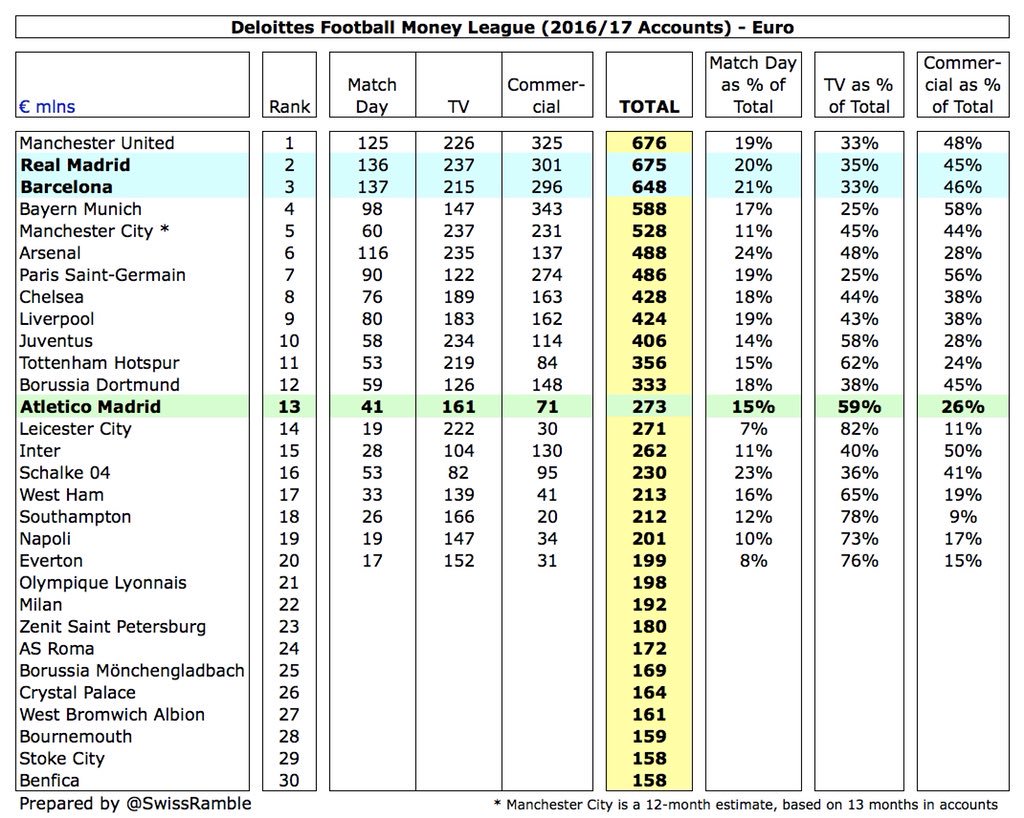

#Atleti retained 13th place in the Deloitte Money League, though their €273m was €60m below 12th placed Borussia Dortmund €333m. Their challenge is emphasised by the fact that Real Madrid and Barcelona fill the 2nd and 3rd spots, just behind Manchester United.

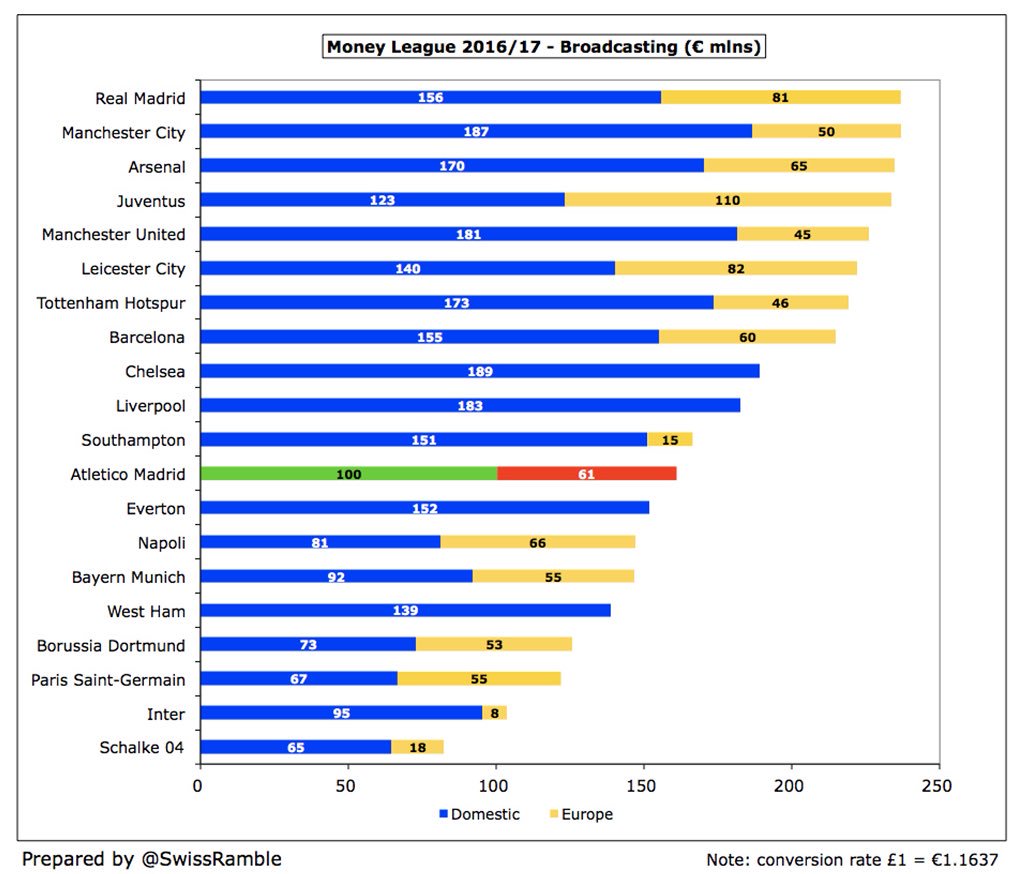

#Atleti had the 12th highest broadcasting income in the Money League with €161m, split between €100m domestic and €61m Champions League. That’s not bad, but to place it into context it was lower than Southampton €166m, due to the blockbuster Premier League TV deal.

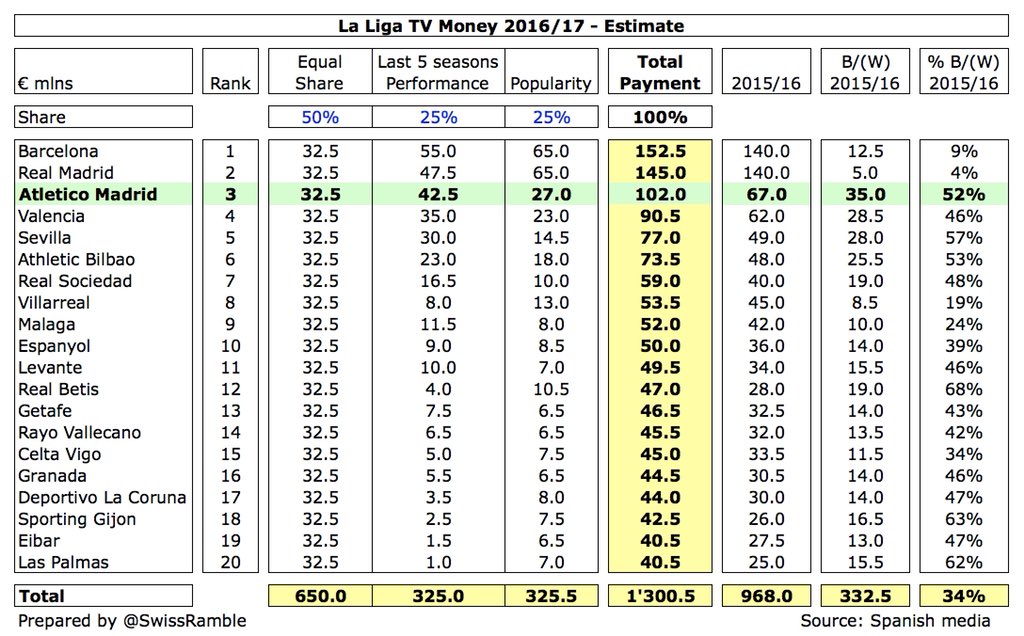

#Atleti benefited from move to collective TV deal in Spain, based on 50% equal share, 25% performance & 25% popularity. Real Madrid & Barcelona still get the most, but other clubs’ share grew more. New 3-year deal from 19/20 will further increase: domestic 15%, international 30%.

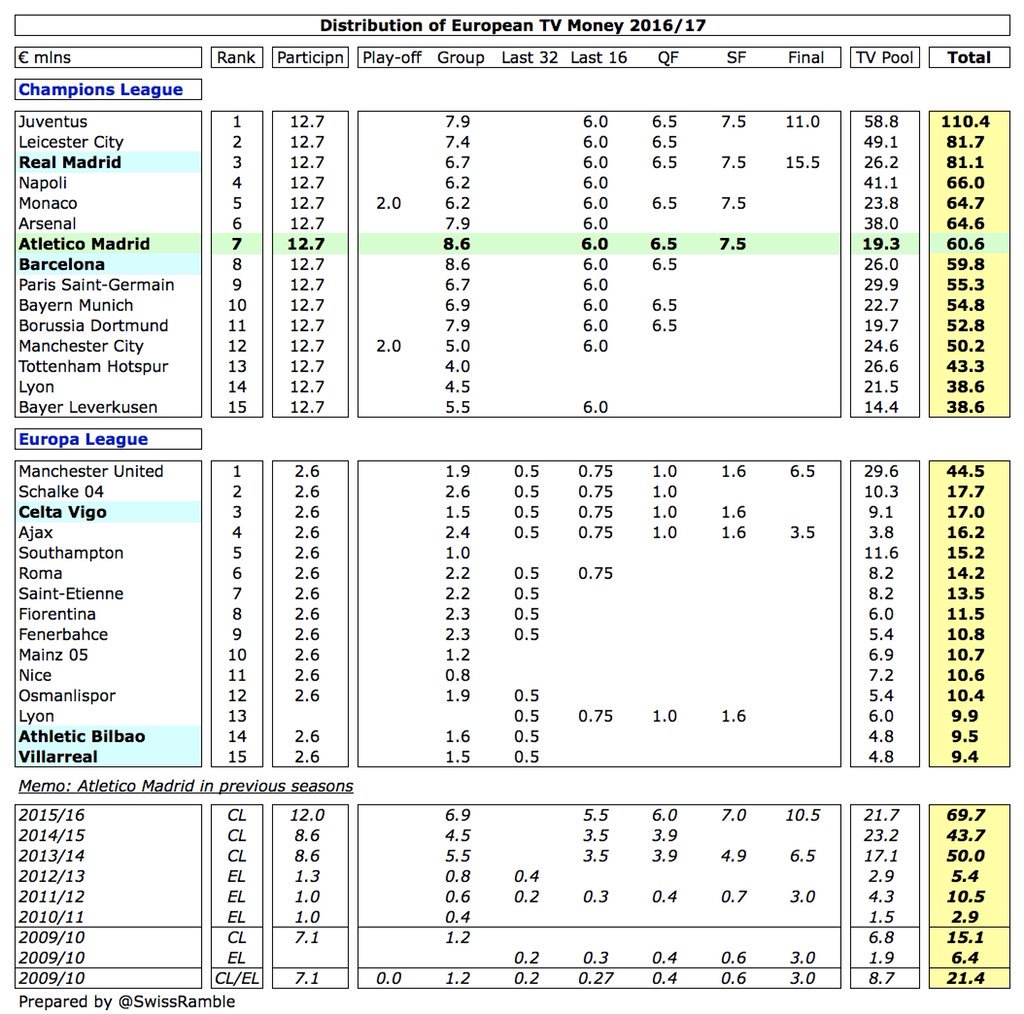

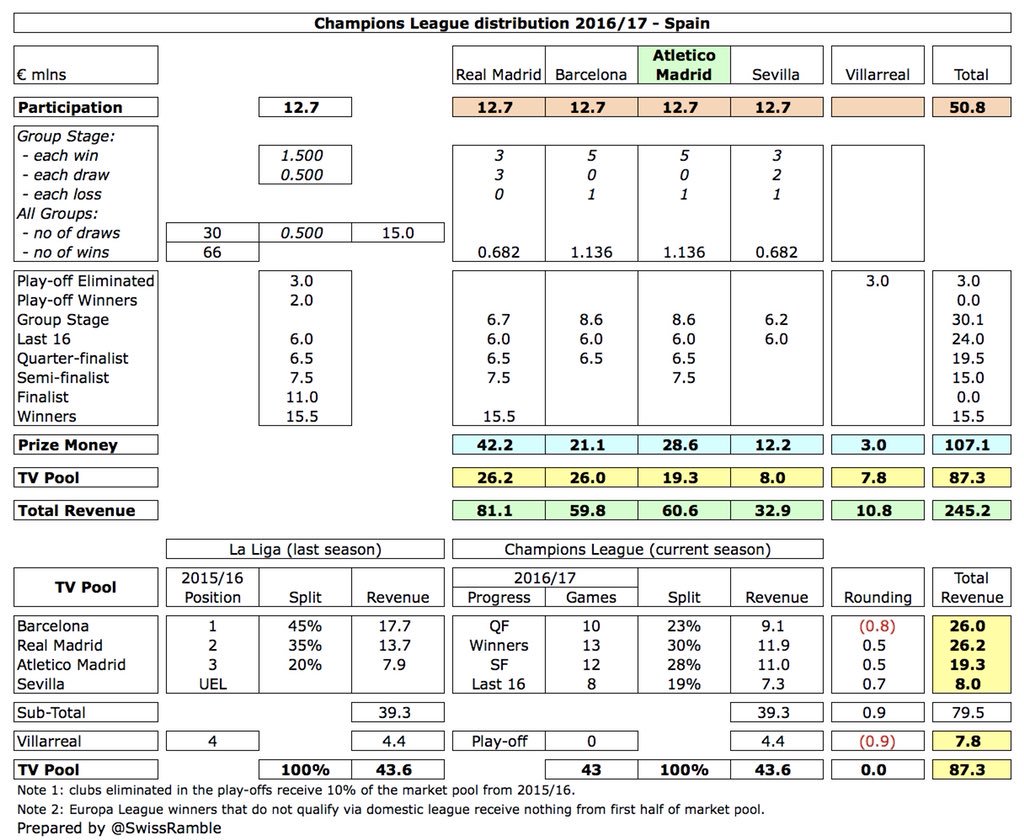

#Atleti earned €61m for reaching the Champions League semi-final, €9m less than the previous season, when they were runners-up. This compared to Real Madrid’s €81m for winning the tournament and Barcelona’s €60m for exiting at the quarter-final stage.

#Atleti Champions League revenue was lower than 2 clubs who were eliminated earlier than them in the last 16 (Napoli €66m and Arsenal €65m), due to higher TV deals in Italy and England, as reflected in #Atleti’s smaller share of the TV pool.

For #Atleti the TV pool share was also impacted by finishing 3rd in La Liga the previous season, which meant they only received 20% of the first half (compared to Barcelona 45% and Real Madrid 35%). The other half was based on progress in that season’s Champions League.

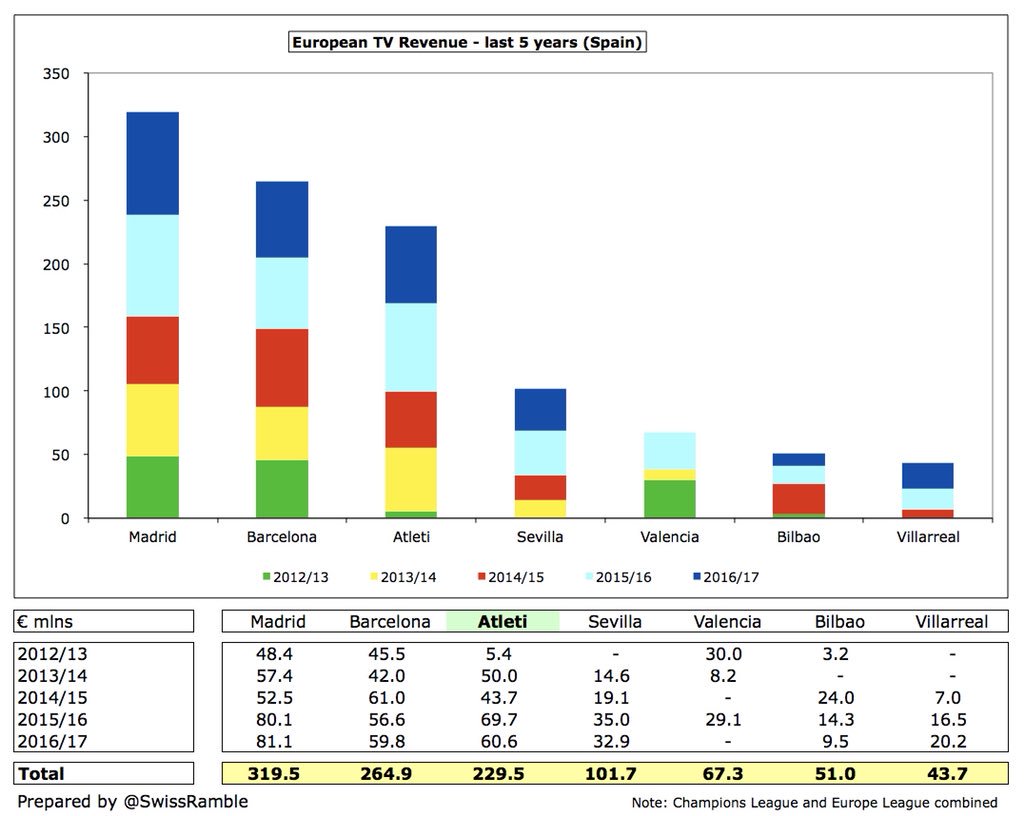

Nevertheless, it is clear that #Atleti’s recent success in Europe, including twice reaching Champions League final & winning the Europa League 3 times, has had a major impact on club’s finances, earning them €230m in last 5 years, though behind Real Madrid €320m & Barca €265m.

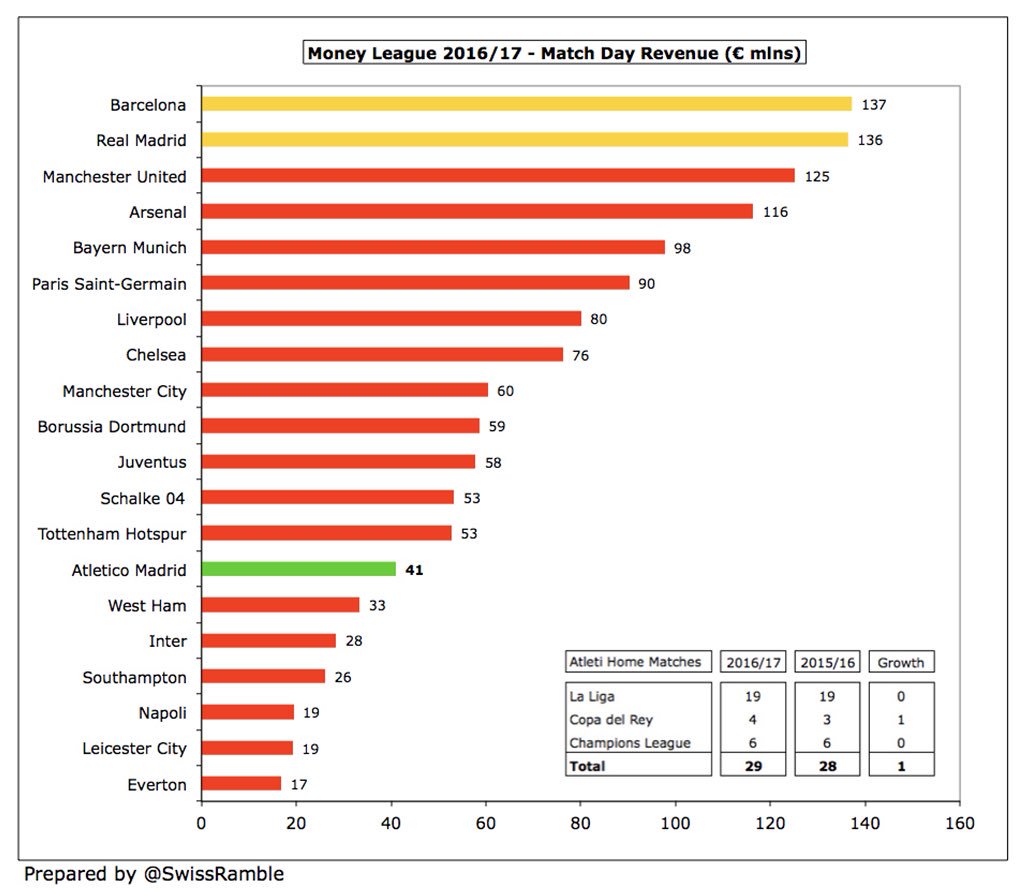

Although #Atleti match day income rose to €41m (Deloitte definition), it was still only 14th highest in the Money League, way behind Barcelona €137m & Real Madrid €136m. Note that my match day estimate is higher at €45m following reclassification of some international income.

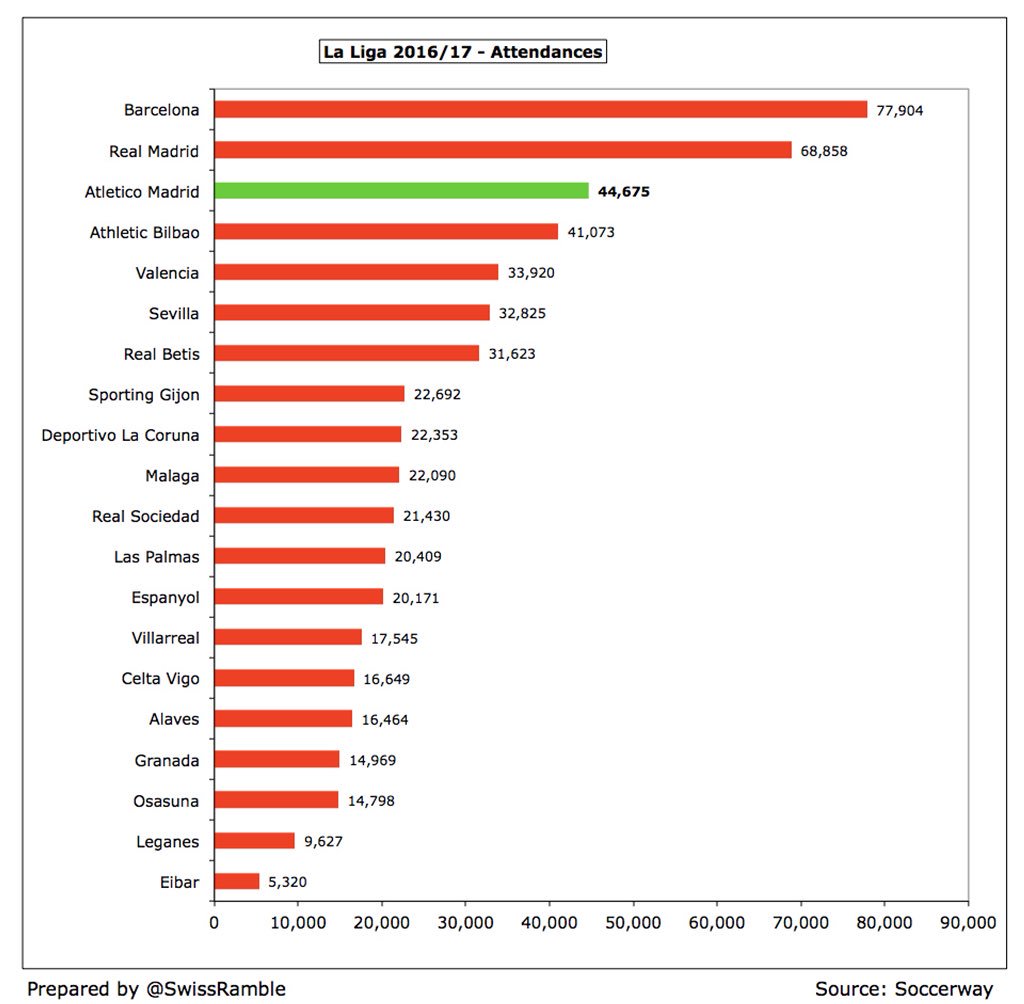

Similarly #Atleti average attendance in 2016/17 of 44,675 was the third highest in Spain, behind Barcelona 77,904 and Real Madrid 68,858.

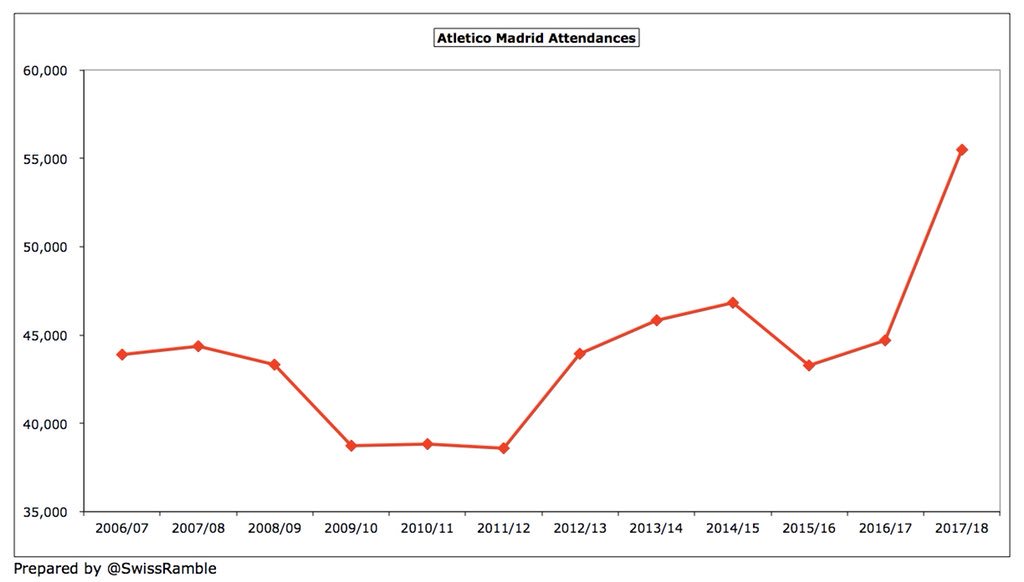

Following the move from the Vicente Calderon to the newly renovated, 68,000 capacity Wanda Metropolitano, #Atleti attendance rose to 55,475 in 2017/18. The stadium has cost over €300m, though it is hoped to recoup €175m from the sale of Calderon property rights.

As Gil said, the stadium move is “an exciting challenge, but also a big risk, as it will create a big short-term debt for the club.” However, if it goes to plan, higher revenue will pay off net investment in 6 years. Club already has €50m naming rights for 5 years from Wanda.

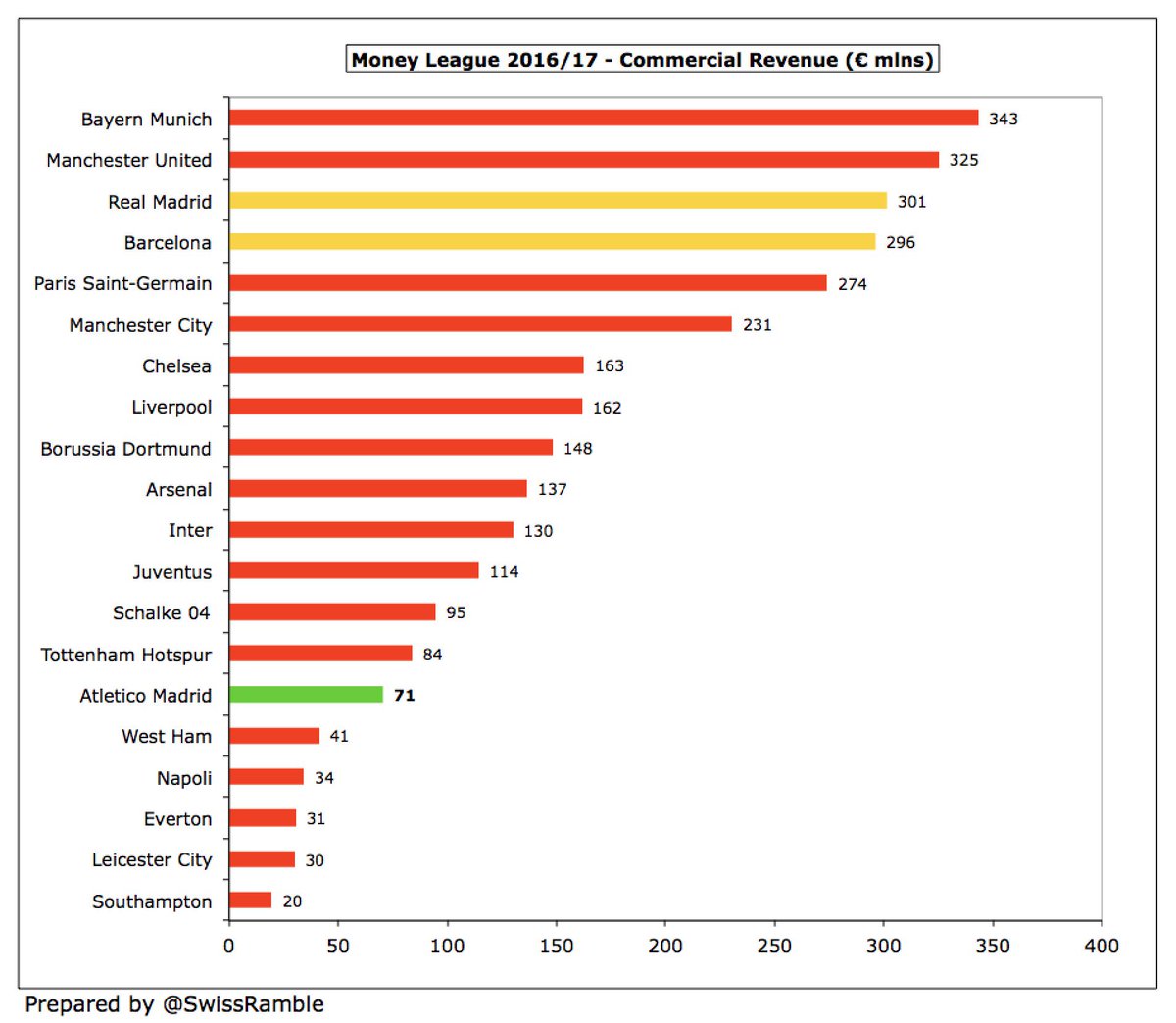

#Atleti commercial income rose €22m (41%) from €54m to €76m, comprising sponsorship & retail €32m, publicity €21m & other €23m. However, as Gil said, they “still have a long way to go” with club only 15th highest in Money League, far below Real Madrid & Barca (both €300m).

#Atleti extended Plus500 shirt sponsorship by 3 seasons to 2020/21 (reportedly worth around $10m a year), while their kit deal has been with Nike since 2001. Recently announced Hyundai as new sleeve sponsor from 2018/19 season. Wanda relationship is helping to open doors in Asia.

#Atleti wage bill shot up €41m (30%) from €137m to €178m in 2016/17, though the wages to turnover ratio only increased from 59% to 63%. This means that wages have nearly tripled from €64m in 2013, though revenue has also risen from €120m to €281m in the same period.

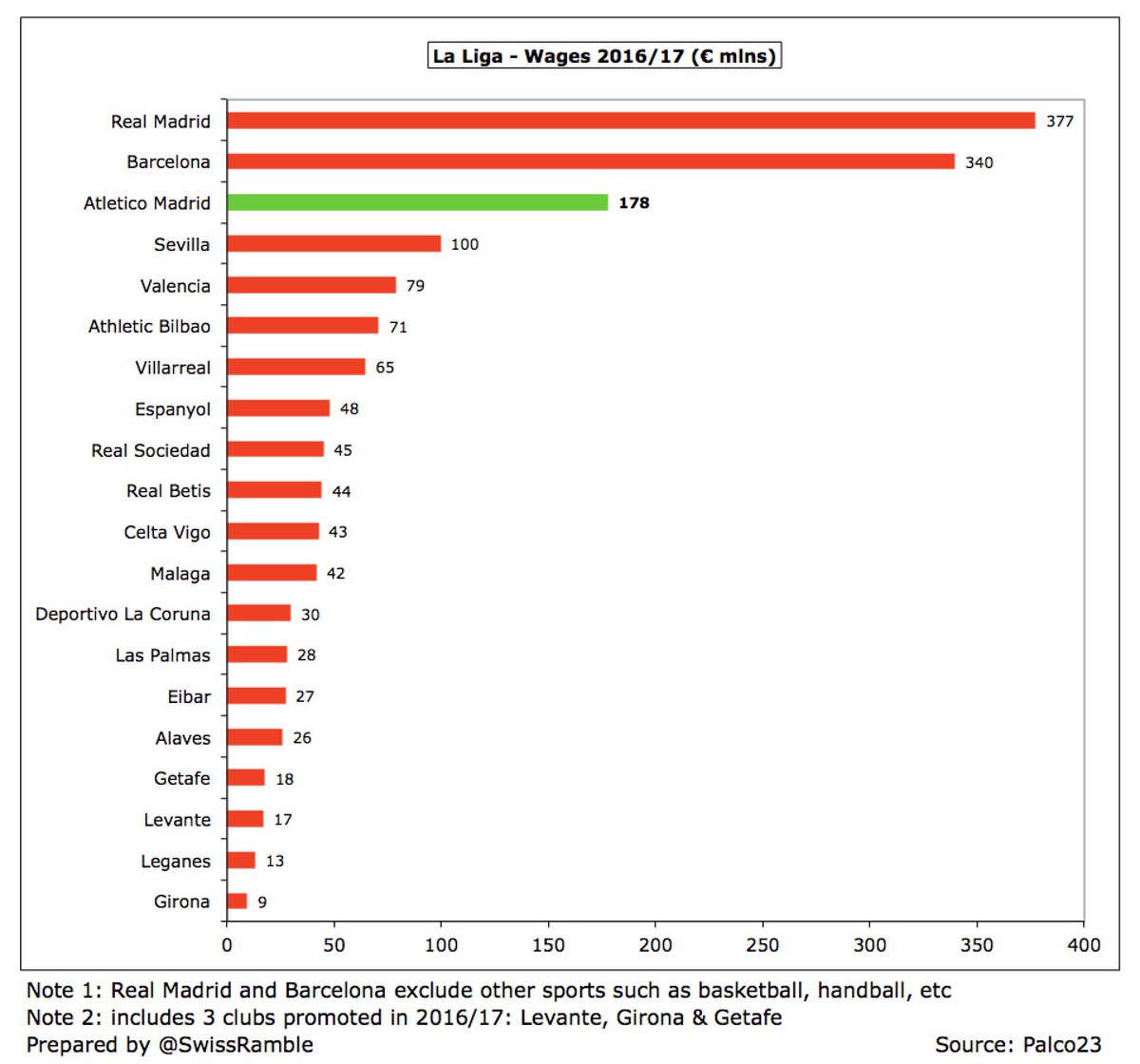

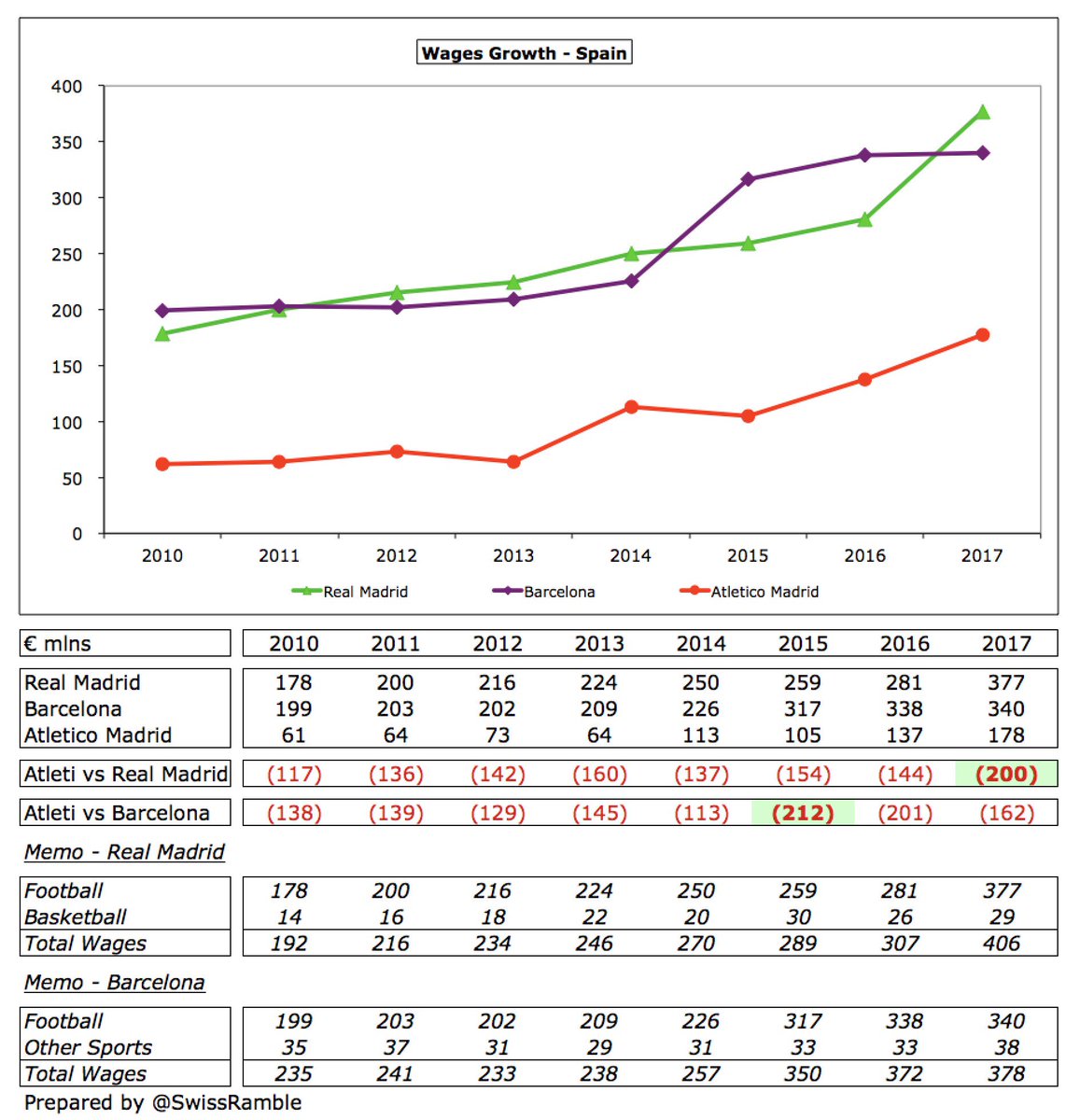

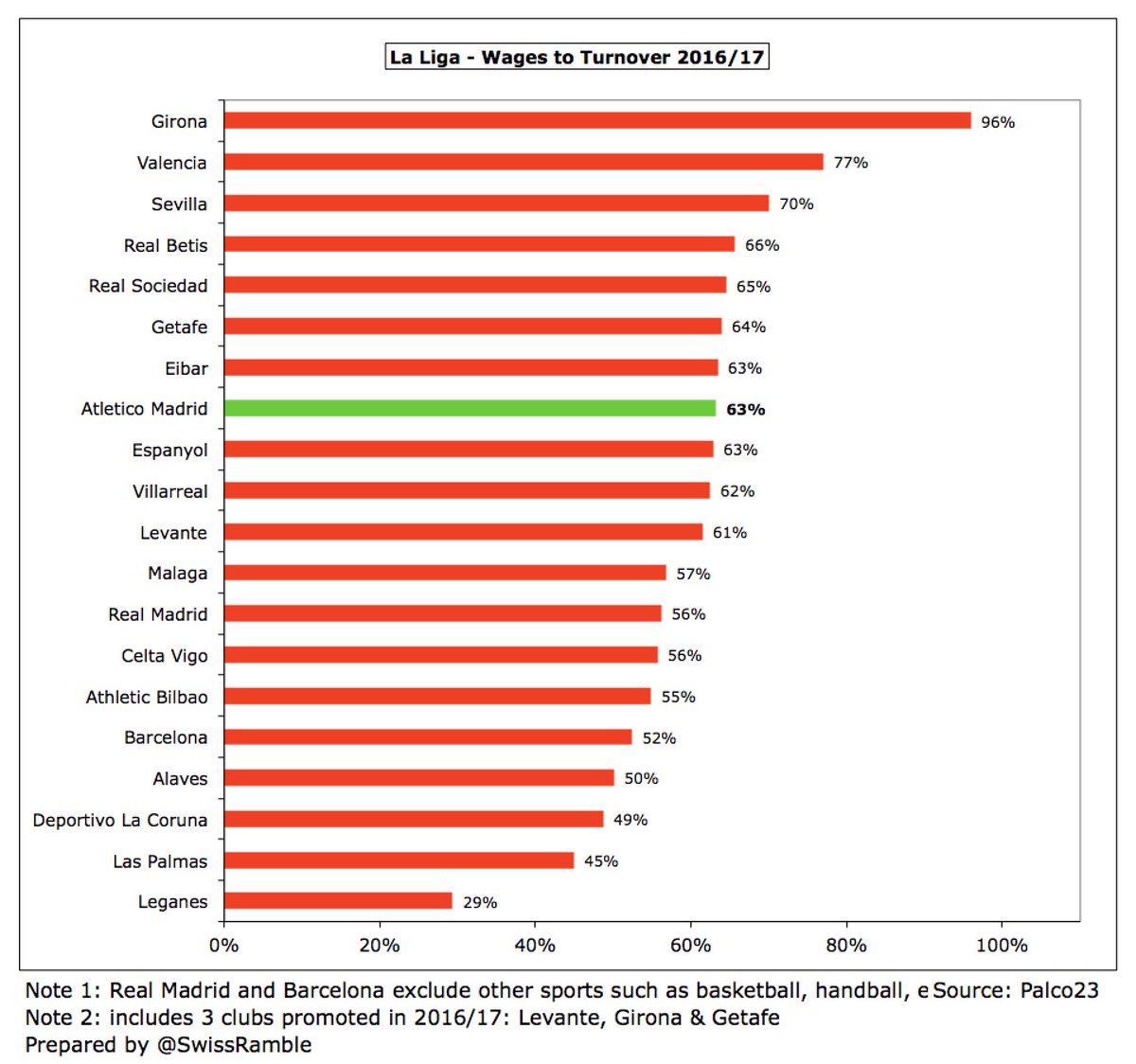

Once again, this leaves #Atleti as the “Inbetweeners” of La Liga, as their €178m wage bill is around half of Real Madrid €377m and Barcelona €340m, but a long way ahead of the closest challengers: Sevilla €100m, Valencia €79m and Athletic Bilbao €71m.

In fact, the gap between #Atleti and Real Madrid’s wage bills has never been higher: it was up to €200m in 2017. Although the difference with Barcelona has reduced, it is still a massive €162m. Worth noting this is based on pure football wages, as I have excluded other sports.

#Atleti wages to turnover ratio of 63% may be their highest since the 66% reported in 2014, but it is comfortably below UEFA’s recommended 70% threshold. That said, the ratios at Barcelona 52% and Real Madrid 56% are much better, thanks to their enormous revenue.

#Atleti’s other staff cost, player amortisation, has risen considerably over the last few seasons, reflecting their growing investment in the playing squad. It has increased from €17m in 2014 to €59m in 2017.

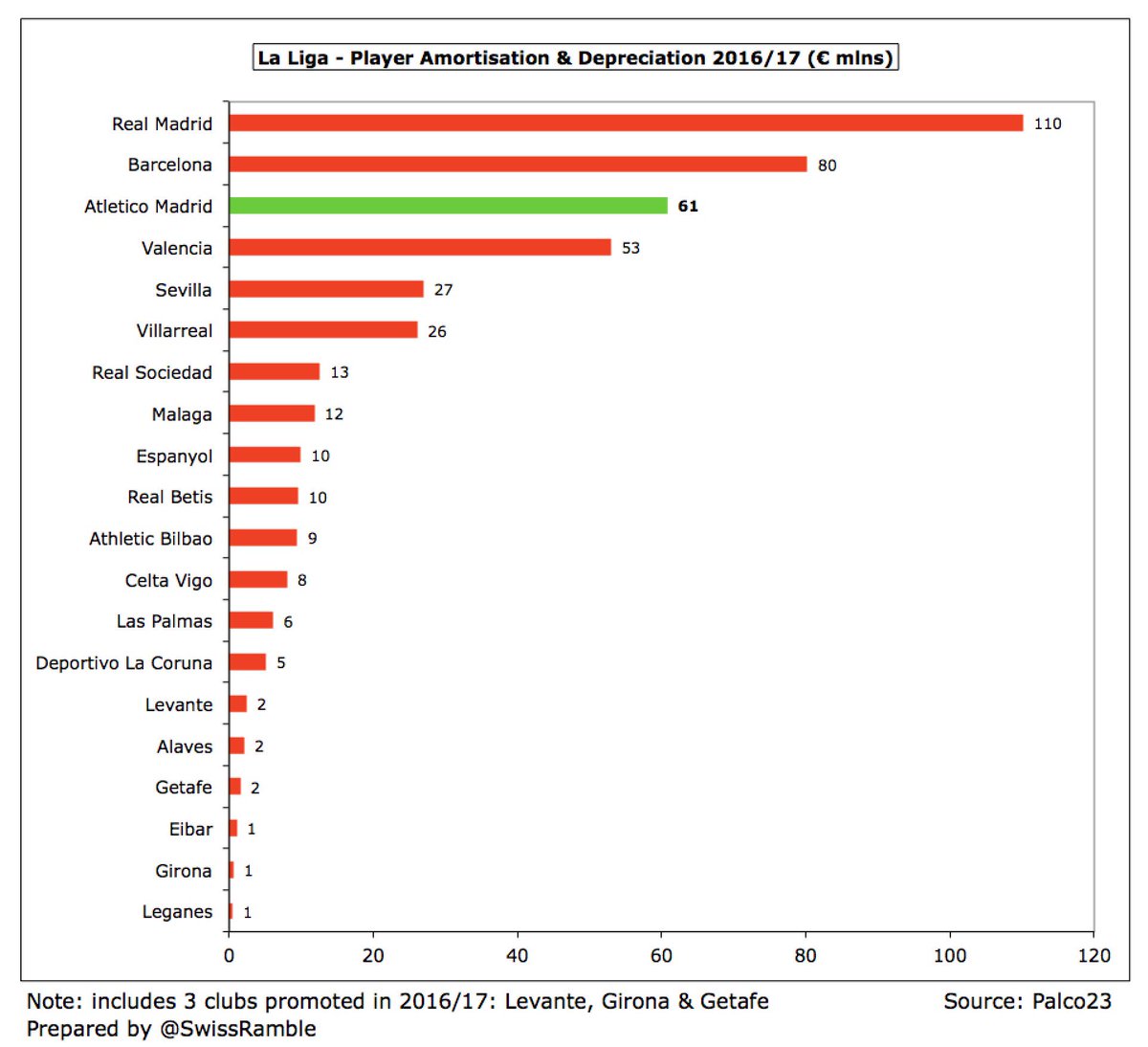

To place this into context, #Atleti total amortisation (including €2m depreciation) of €61m is still a fair way below the Big Two (Real Madrid €110m and Barcelona €80m), while Valencia somehow have an annual €53m charge.

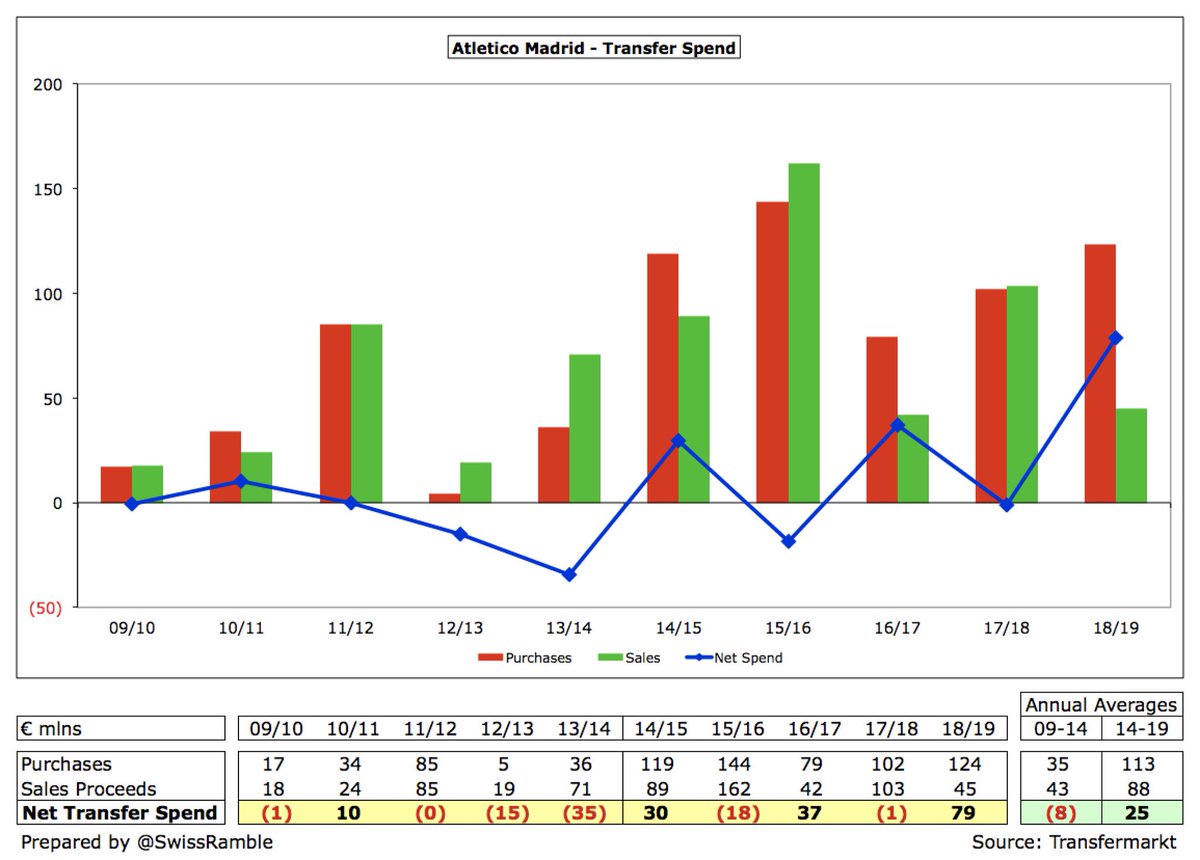

#Atleti average net transfer spend has significantly grown from £(8)m in 5 years 2009-14 to £25m in 5 years between 2014-19. Even though average player sales have doubled in this period from €43m to €88m, purchases have more than tripled from €35m to €113m.

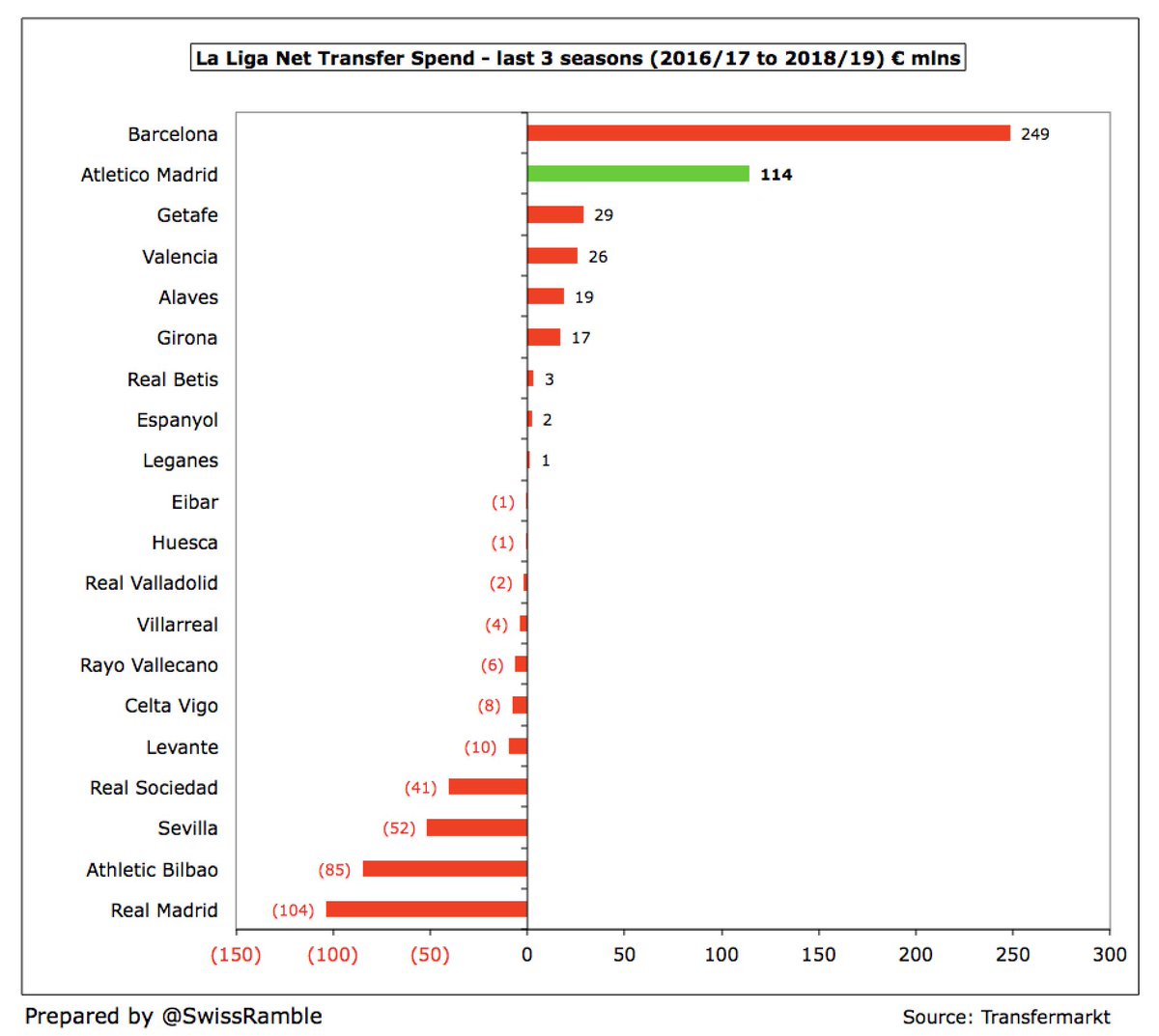

In fact, #Atleti’s €114m net sales over last 3 seasons is only behind Barcelona’s €249m, including buying Lemar, Diego Costa, Vitolo, Gameiro, Gaitan & Rodri. Perhaps surprisingly Real Madrid have net sales, partly due to transfers of Ronaldo to Juventus & Morata to Chelsea.

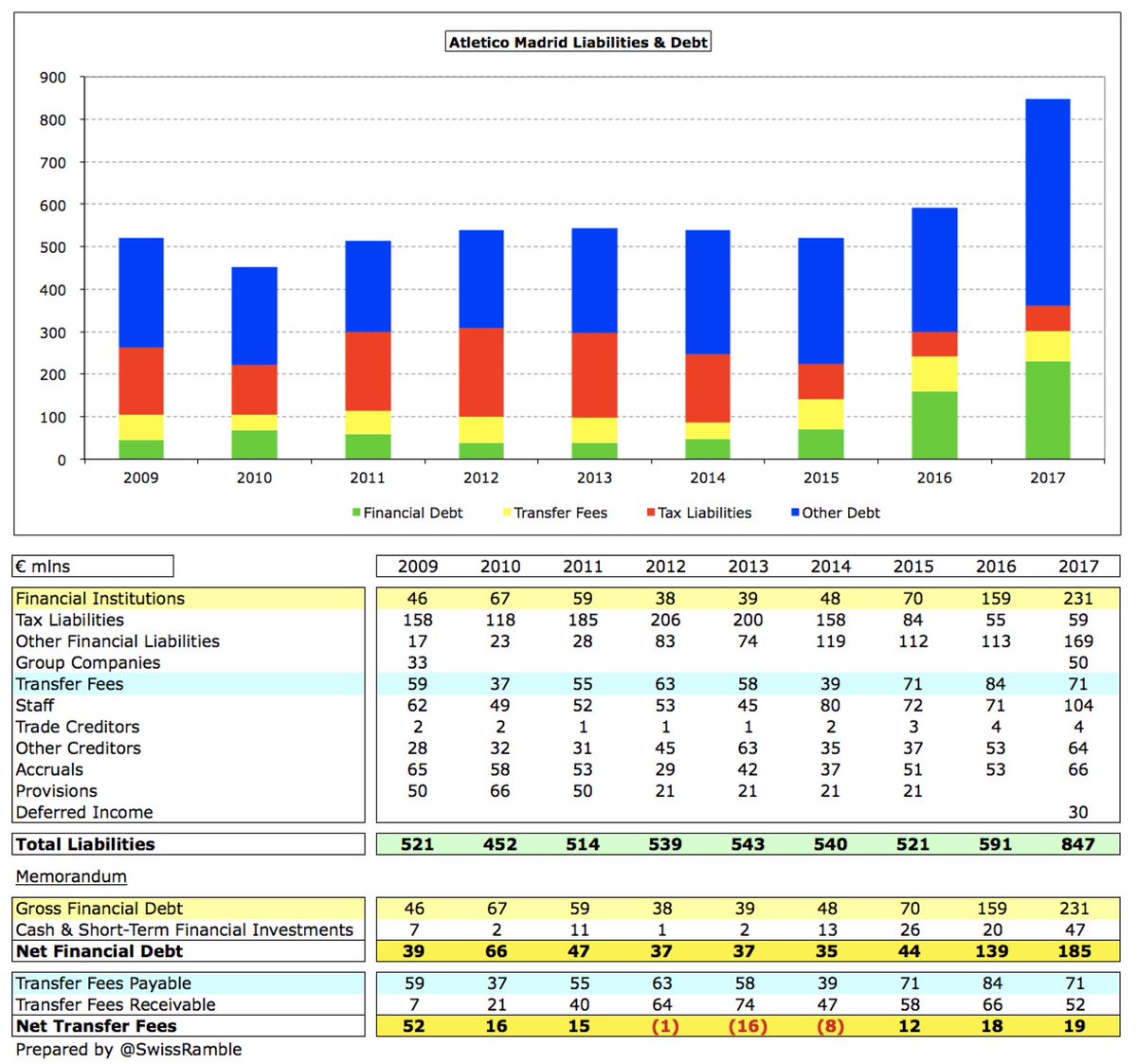

#Atleti have suffered from huge debt for many years and total liabilities have risen from €591m to €847m in 2017, largely due the new stadium. The good news is that debt to tax authorities has been cut from €206m in 2012 to “only” €59m, but amounts owed to staff up to €104m.

#Atleti debt to financial institutions has risen from €159m to €231m, but transfer fees owed are down from €84m to €71m (net €19m considering €52m owed by other clubs). There is €50m from group companies, presumably the money advanced by Wanda for naming rights.

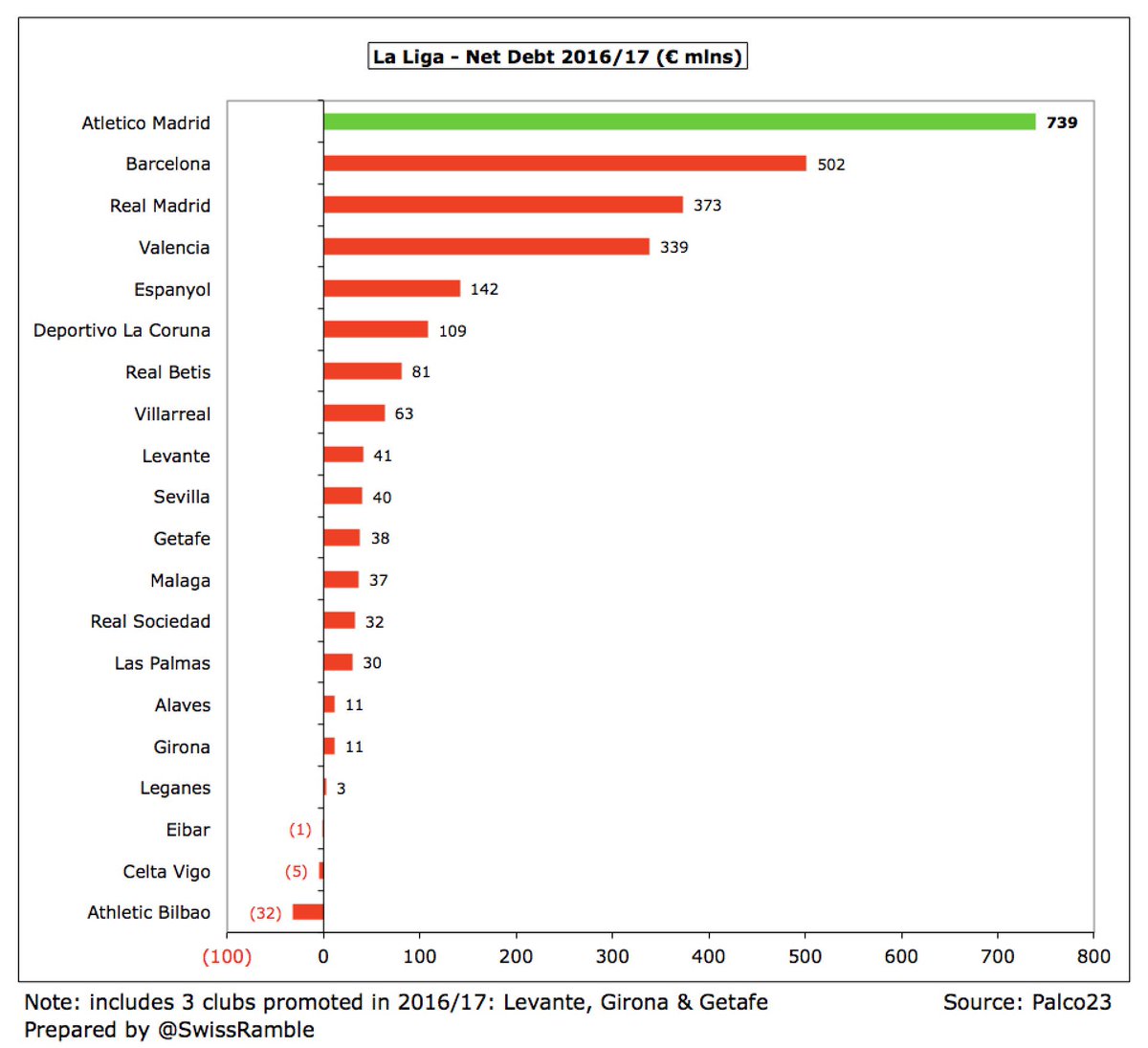

On a net basis #Atleti €739m have by some distance the highest debt in Liga, much more than Barcelona €502m, Real Madrid €373m, Valencia €339m and Espanyol €142m.

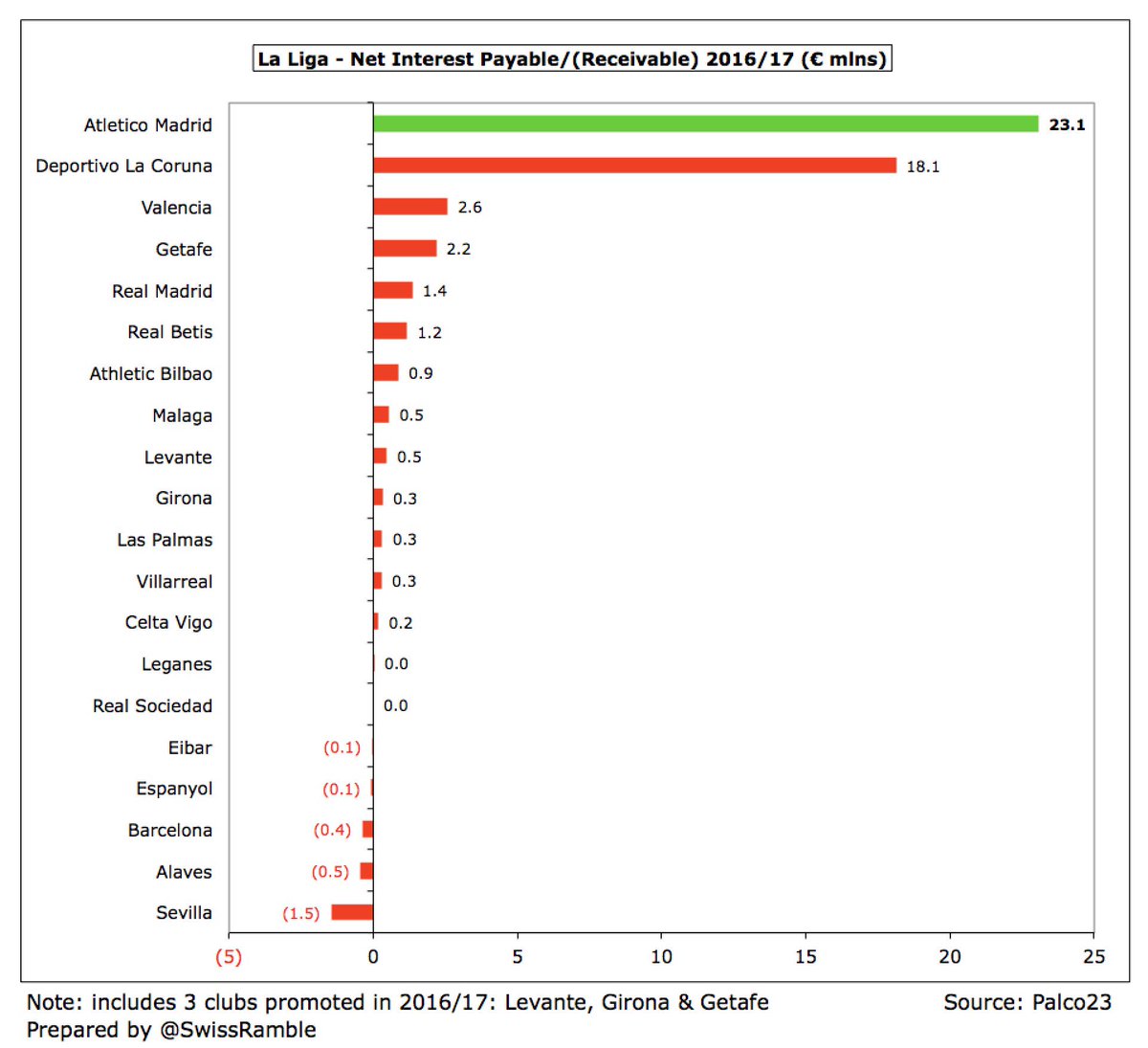

As a result of high debt, #Atleti have paid a lot of interest. In 2016/17 their net interest payable was €23m with only Deportivo La Coruna €18m anywhere near this amount. Next highest was Valencia €3m. In last 7 years #Atleti have had reported total net interest of €146m.

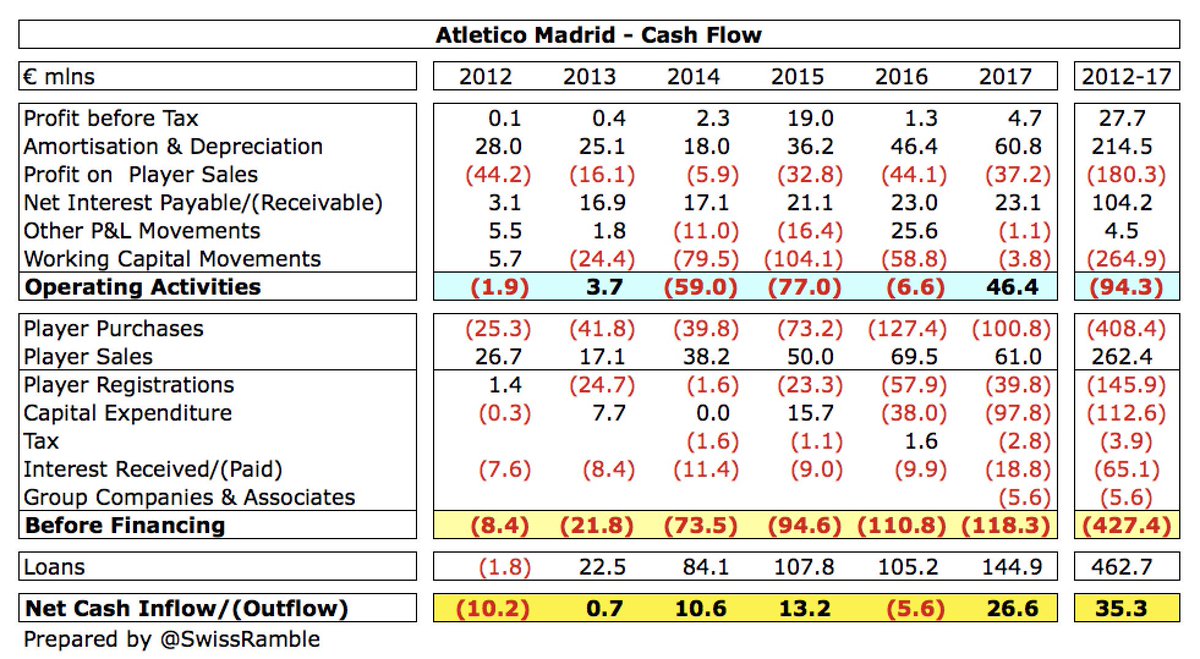

Despite reporting profits over the last few years, #Atleti only generated meaningful cash from operating activities in 2017, as they had to repay creditors (tax authorities). This has required taking on more debt to fund player purchases, stadium investment and interest payments.

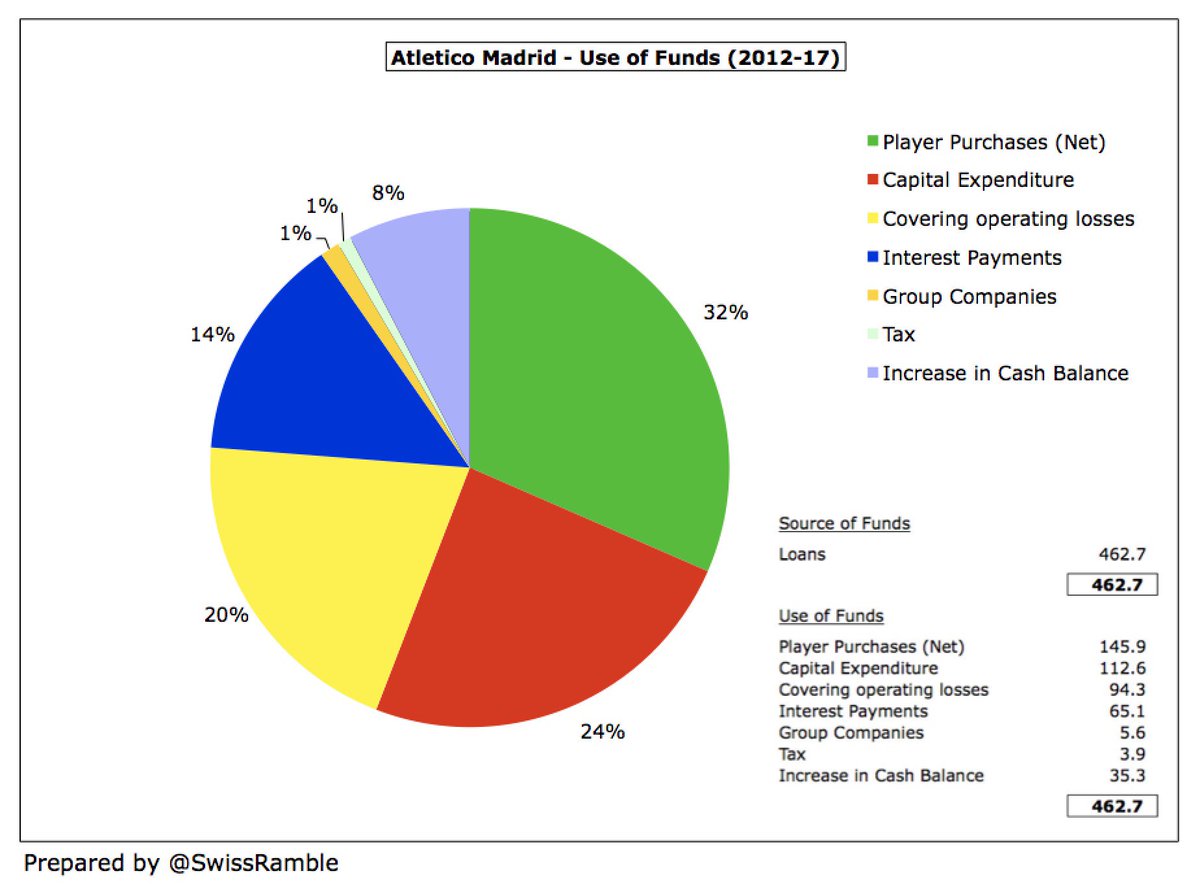

In last 6 years #Atleti have been funded by an additional €463m of loans. This has been spent on (net) player purchases €146m, infrastructure €113m and interest payments €66m, while covering €94m operating losses. In the same period, cash balance is up €35m.

Interestingly, Wanda sold their 17% shareholding to Idan Ofer’s Quantum Pacific Group in February, increasing his stake to 32% (the initial 15% followed a €50m capital increase in November 2017). Majority shareholders remain Miguel Angel Gil 46% & chairman Enrique Cerezo 15%.

Although #Atleti’s recovery is somewhat tarnished by their well-known tax issues, there is much to applaud about their efforts to compete with Real Madrid and Barcelona. Despite considerable financial disadvantages, Diego Simeone has managed to deliver much success on the pitch.

• • •

Missing some Tweet in this thread? You can try to

force a refresh