👆Tagging @Sam_Marsh101 @Flibitygibity @carlomorelliUCU @DaveGuppy @RedActuary @Derek_Benstead @kevinwesbroom @ucu @UniversitiesUK @USSbriefs @OpenUPP2018 @JosephineCumbo @henryhtapper @AlistairJarvis

I now see that there is one important respect in which SAUL's DB is less good than #USS: for DB accrual from 2016, there is a 2.5% CPI cap on pensions in payment, w/ increases above the cap at the discretion of the trustees. This is much less generous than USS's CPI cap. 1/

2.5% cap does NOT apply to the revaluation of career average accrual before retirement. More generous USS cap still applies there. So SAUL's CPI revaluation remains much more generous than the March ACAS #USS proposal, w/ its 2.5% cap BEFORE as well as after retirement. 2/2

PS: I believe, however, that an increase in SAUL contributions to the current level for USS (i.e., 8% rather than 6% for members & 18% rather than 16% for employers) would be more than sufficient to pay for a restoration of USS’s more generous CPI cap for pensions in payment. 1/

If that's right, then, 𝗮𝗹𝗹 𝘁𝗵𝗶𝗻𝗴𝘀 𝗰𝗼𝗻𝘀𝗶𝗱𝗲𝗿𝗲𝗱, 𝗶𝗻𝗰𝗹𝘂𝗱𝗶𝗻𝗴 𝗰𝗼𝗻𝘁𝗿𝗶𝗯𝘂𝘁𝗶𝗼𝗻𝘀, 𝗦𝗔𝗨𝗟’𝘀 𝗗𝗕 𝗿𝗲𝗺𝗮𝗶𝗻𝘀 𝗮𝘁 𝗹𝗲𝗮𝘀𝘁 𝗮𝘀 𝗴𝗼𝗼𝗱 𝗮𝘀 𝗨𝗦𝗦’𝘀. 2/2

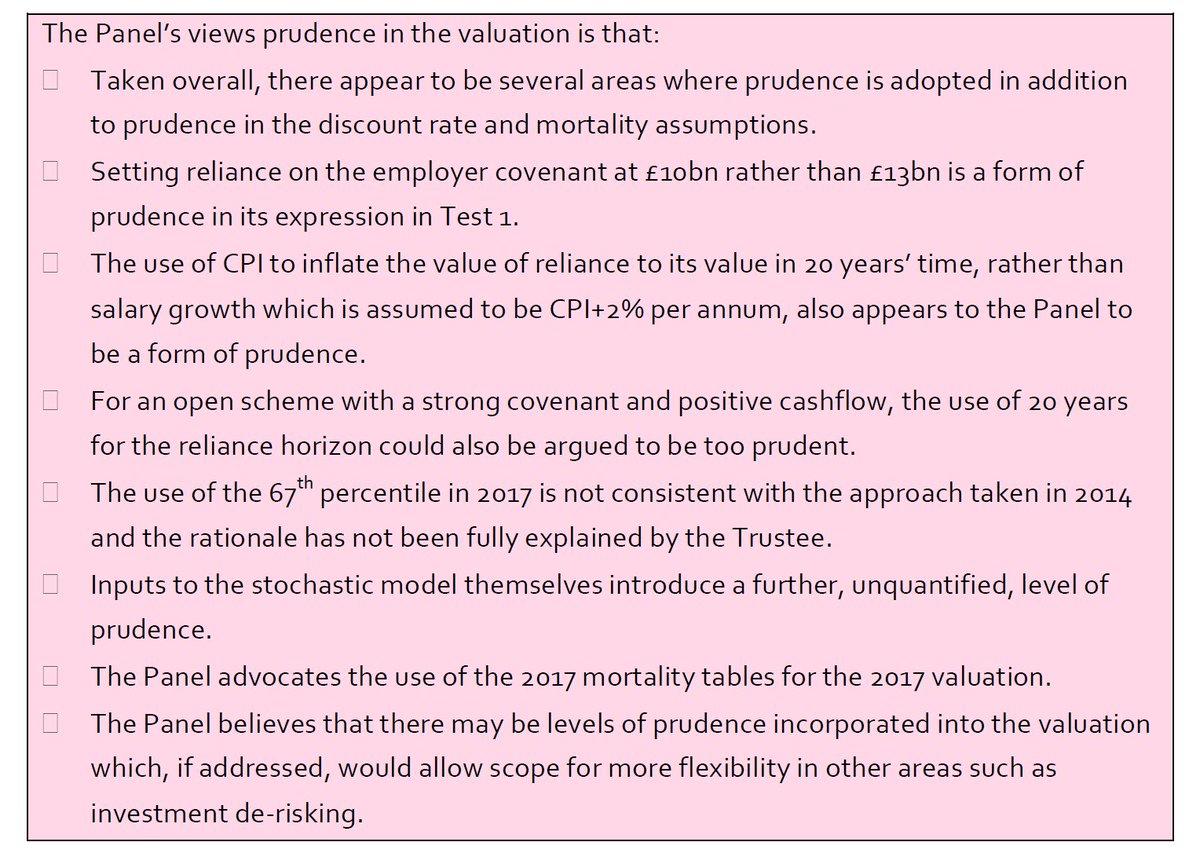

𝗦𝗔𝗨𝗟'𝘀 𝘀𝘂𝗰𝗰𝗲𝘀𝘀: 𝘁𝗵𝗲𝘆 𝗮𝗰𝗵𝗶𝗲𝘃𝗲𝗱 𝗵𝗶𝗴𝗵 𝗿𝗲𝘁𝘂𝗿𝗻𝘀 𝗼𝗻 𝗮 𝗽𝗼𝗿𝘁𝗳𝗼𝗹𝗶𝗼 𝘁𝗵𝗮𝘁 𝘄𝗮𝘀 𝗮𝗹𝗿𝗲𝗮𝗱𝘆 𝟰𝟴% 𝗱𝗲-𝗿𝗶𝘀𝗸𝗲𝗱 𝗶𝗻𝘁𝗼 𝗯𝗼𝗻𝗱𝘀 & 𝗼𝘁𝗵𝗲𝗿 𝗹𝗶𝗮𝗯𝗶𝗹𝗶𝘁𝘆-𝗱𝗿𝗶𝘃𝗲𝗻 𝗶𝗻𝘃𝗲𝘀𝘁𝗺𝗲𝗻𝘁. See below. 1/

SAUL's success provides a challenge to @ucu's view that the main problem w/ #USS's approach is their insistence on de-risking out of growth assets and into bonds. Here is SAUL's portfolio as of 31 March 2017: /2

👆LDI = liability-driven investment (gilts & cash). CDF = cashflow driven financing. Here corporate bonds & property are included, to try to match liabilities less expensively than via gilts. This image provides a more fine-grained representation of the portfolio. 3/

I believe that SAUL's current portfolio is already more de-risked than #USS's. It appears to be somewhere in between #USS's current portfolio and the one into which #USS plans to de-risk over the next 20 years. 4/

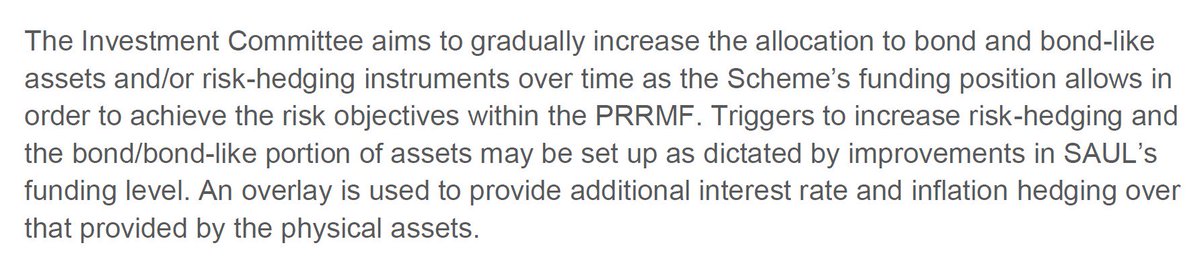

SAUL also plans to engage in *further* de-risking of their portfolio. But, unlike #USS, not in a rigid Test 1-driven fashion, even if this worsens poor scheme funding. Rather, only when funding level has improved. 5/

It appears that SAUL can afford to fund DB out of a de-risked portfolio w/o high contributions because the scheme is now in good financial health (i.e., surplus = assets greater than liabilities). 6/

Moreover, as I note in my blog, SAUL appears to be in such good health, relative to #USS, because they have invested their assets much more successfully than #USS has. 7/

In 2016-17, e.g., SAUL managed both to grow their assets at a much higher rate than USS did *and* to hedge interest rates and inflation in a manner that matched increases in the value of the liabilities much better than USS did. 8/

It would be very useful if JEP, perhaps w/ assistance of @UniversitiesUK & @ucu actuaries @kevinwesbroom @RedActuary & @Derek_Benstead, could shed light on how SAUL is able to provide a DB pension in much more cost-effective manner than #USS. 9/

In addition to facing the very same hostile DB regulatory environment as #USS, SAUL has, of course, operated within the same challenging investment climate as #USS. SAUL shows that it is possible to do things much better than #USS has managed in these circumstances. 10/

#USS: I hope, in the light of SAUL's example, that you will show a bit more humility, openness to self-scrutiny & willingness to entertain the possibility that you may have got things wrong & to open your accounts (e.g., your cash-flow figures) more fully to public scrutiny. 11/

I realise, #USS, that, in comparison with SAUL, you are a giant of an operation that bestrides the pensions world. But we all know how SAUL's son-in-law David fared in his encounter with Goliath. 12/12

A new blog post that incorporates tweets above about SAUL's approach to investment and de-risking:

medium.com/@mikeotsuka/sa…

medium.com/@mikeotsuka/sa…

• • •

Missing some Tweet in this thread? You can try to

force a refresh