Prize money for UEFA club competitions significantly increases in 2018/19, including a new coefficient ranking payment that better rewards historically successful clubs rather than those with larger national TV rights deals. Some thoughts follow on Champions League distribution.

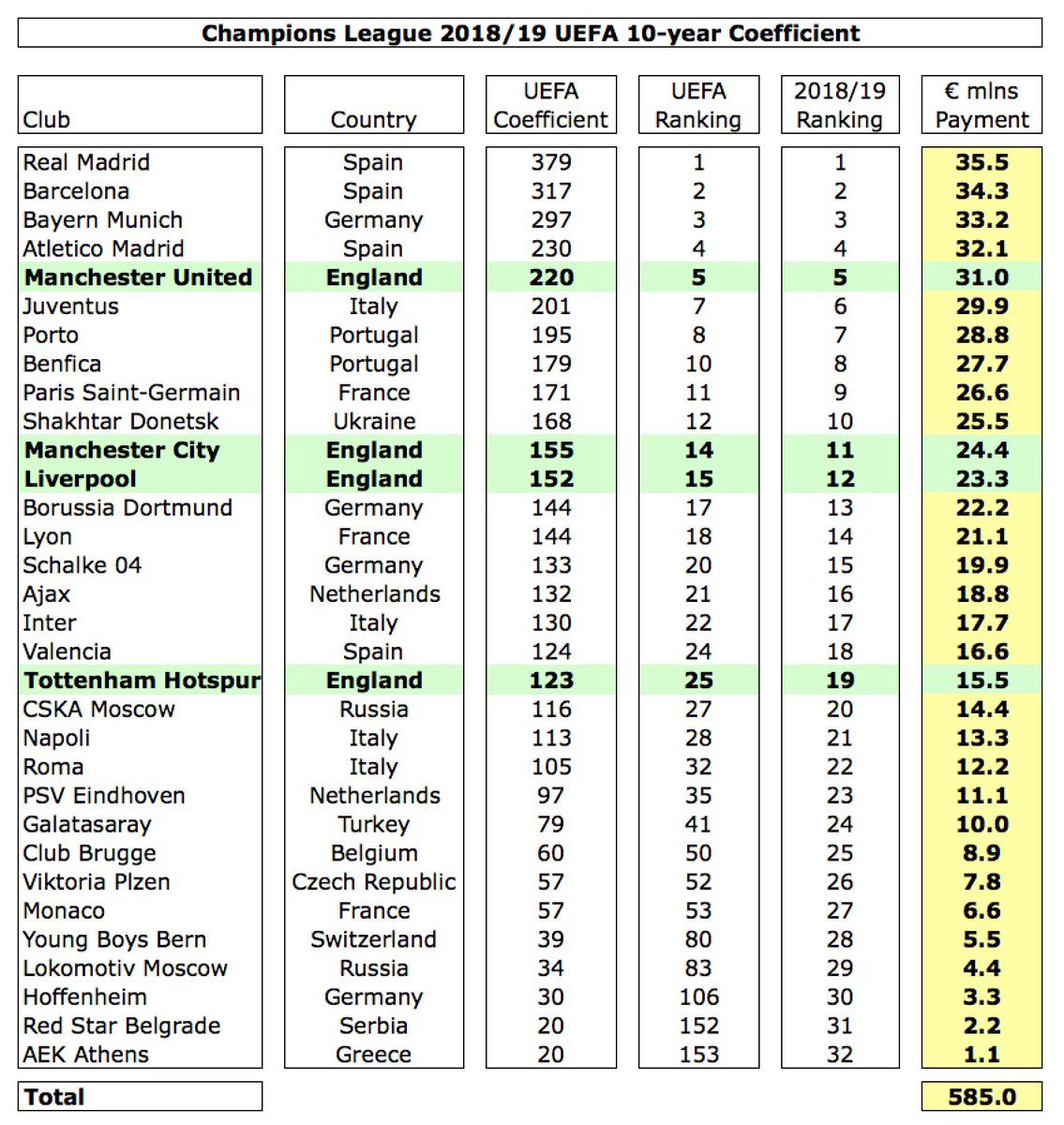

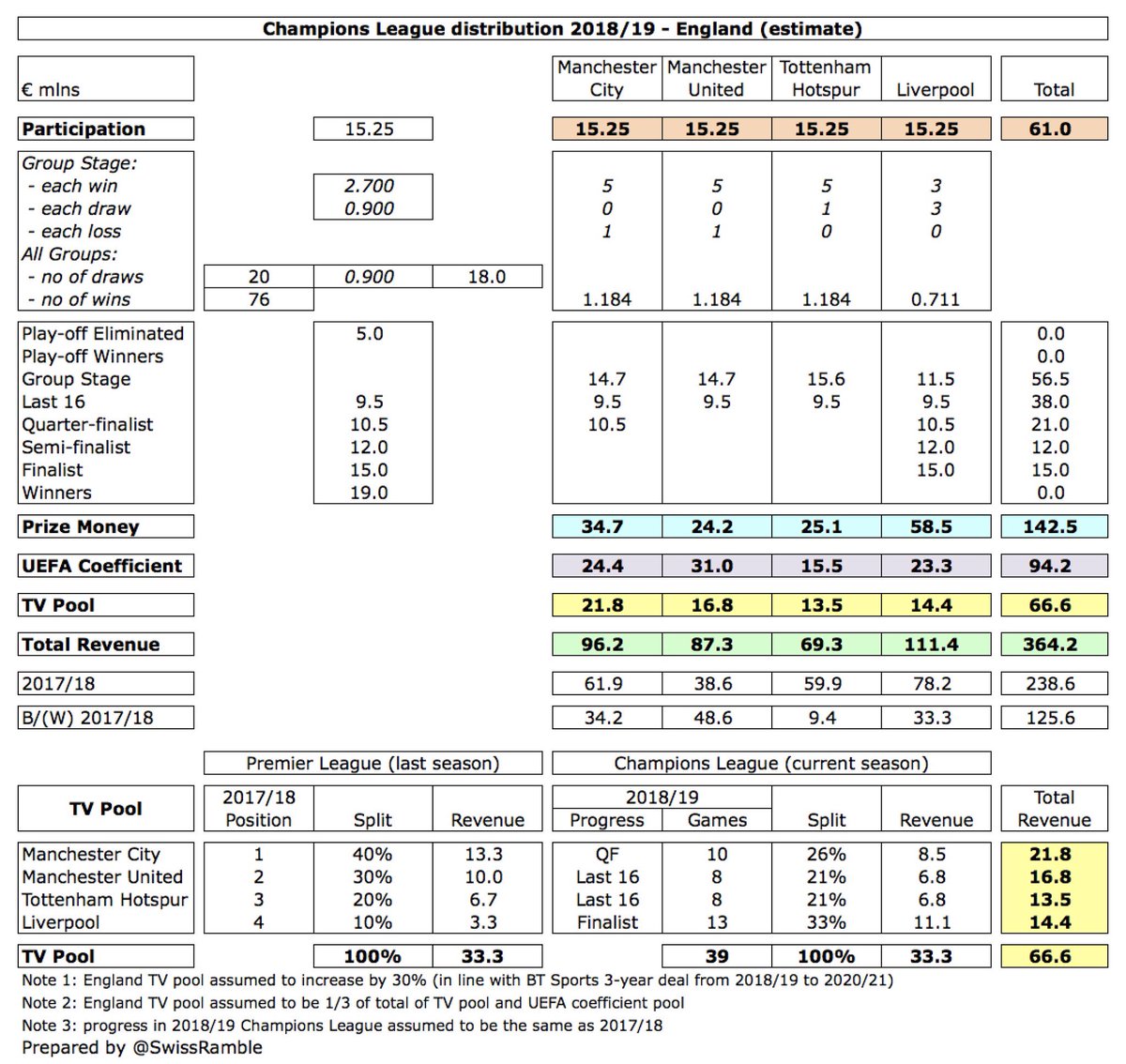

The amount distributed to clubs in UEFA Champions League (group stage onwards) will rise €681m (54%) from €1.269 bln to €1.950 bln in 2018/19. This is split: participation €488m (25%), performance €585m (30%), TV pool €292m (15%) and coefficient rankings €585m (30%).

In 2018/19 each of the 32 clubs qualifying for Champions League group stage gets €15.25m plus €2.7m for a win and €900k for a draw. Additional prize money for each further stage reached: last 16 €9.5m, quarter-final €10.5m, semi-final €12m, final €15m and winners €19m.

2018/19 Champions League payments will significantly increase over 2017/18, especially in the early stages, eg 80% for group performance, compared to “only” 23% for the winners. The maximum amount a club could earn (excluding TV pool & coefficient) is up from €57.2m to €82.5m.

The minimum a club will earn from Champions League (excluding TV pool) has increased, due to addition of UEFA coefficient ranking, with Real Madrid guaranteed €51m (participation €15.25m + coefficient €35.5m). English clubs: #MUFC €46m, #MCFC €40m, #LFC €39m & #THFC €31m.

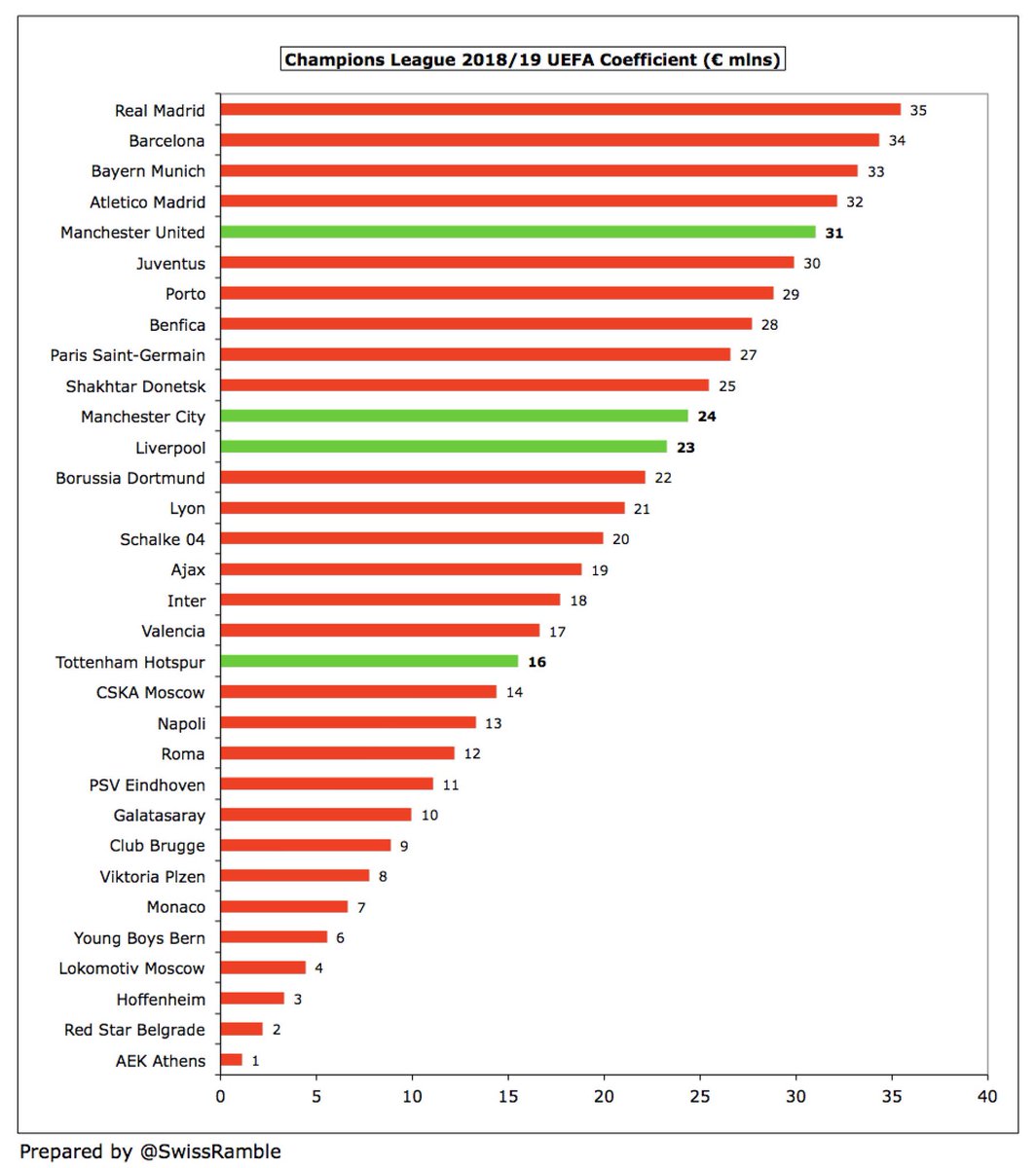

UEFA coefficient is based on performances over 10 years, including bonus points for winning UEFA tournaments. The €585m is divided into shares with each worth €1.108m, so highest ranked club gets €35.5m and lowest €1.1m. English rankings #MUFC 5, #MCFC 14, #LFC 15 & #THFC 25.

This new revenue distribution method clearly benefits traditional big clubs like Real Madrid and Barcelona at the expense of clubs from countries with large TV pools (i.e. England and Italy). Lack of qualification has hurt #CFC and #AFC, who are ranked 6th and 9th respectively.

However, the overall increase in Champions League prize money (from booming TV and commercial deals) will mean that English clubs will still earn more in 2018/19 than 2017/18, assuming similar performance.

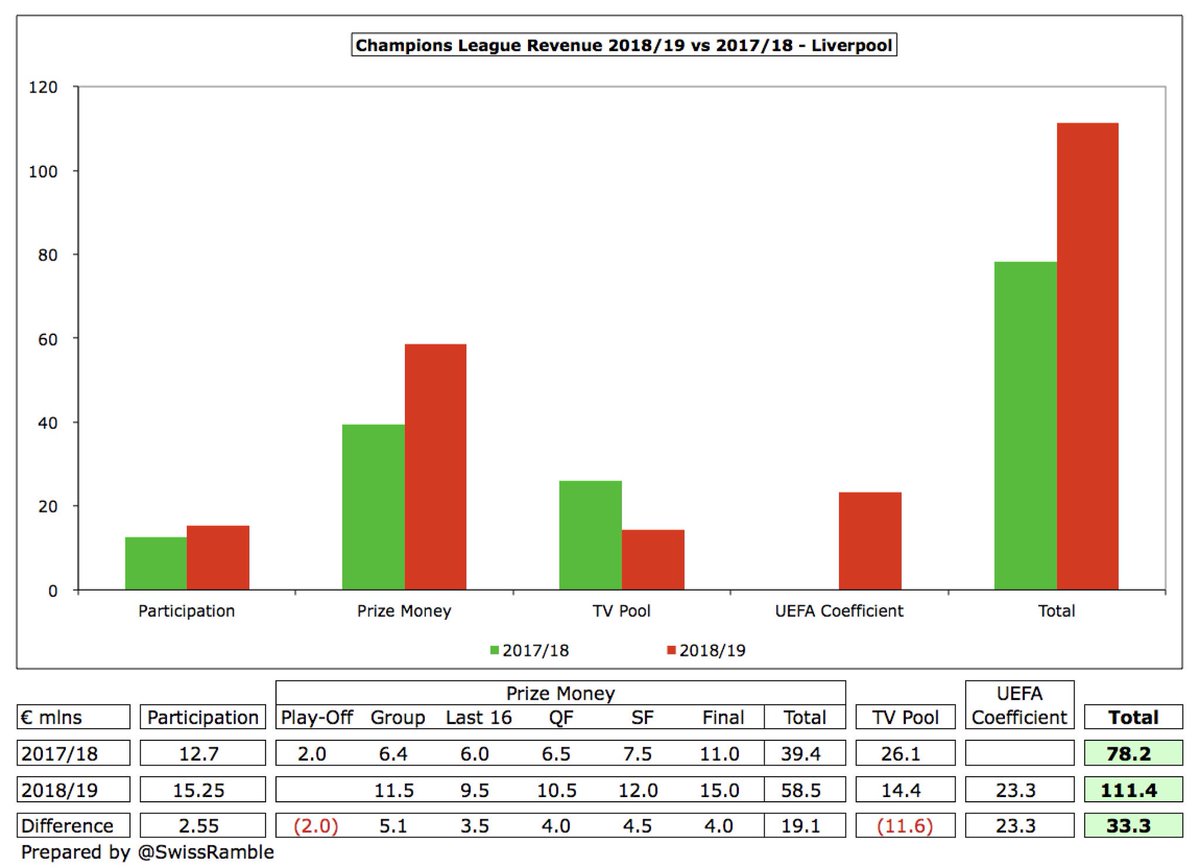

As a reminder, estimated English clubs earnings for 2017/18 based on old distribution are: #LFC €78m, #CFC €64m, #MCFC €62m & #THFC €60m. TV pool: (a) half based on position in previous season’s Premier League; (b) half based on current season’s Champions League performance.

If we assume same progress as 17/18, we can estimate amounts earned under new system in 18/19. I have increased England TV pool by 30% (per new BT Sports deal), then taken a third (per split of TV pool & coefficient). Note: this number is not certain, but used for illustration.

#MCFC would earn €96m in 2018/19 compared to €62m in 2017/18 for reaching the quarter-finals, including €24m from the new UEFA coefficient (ranking 14th, but 11th best of teams that have qualified for this season’s Champions League).

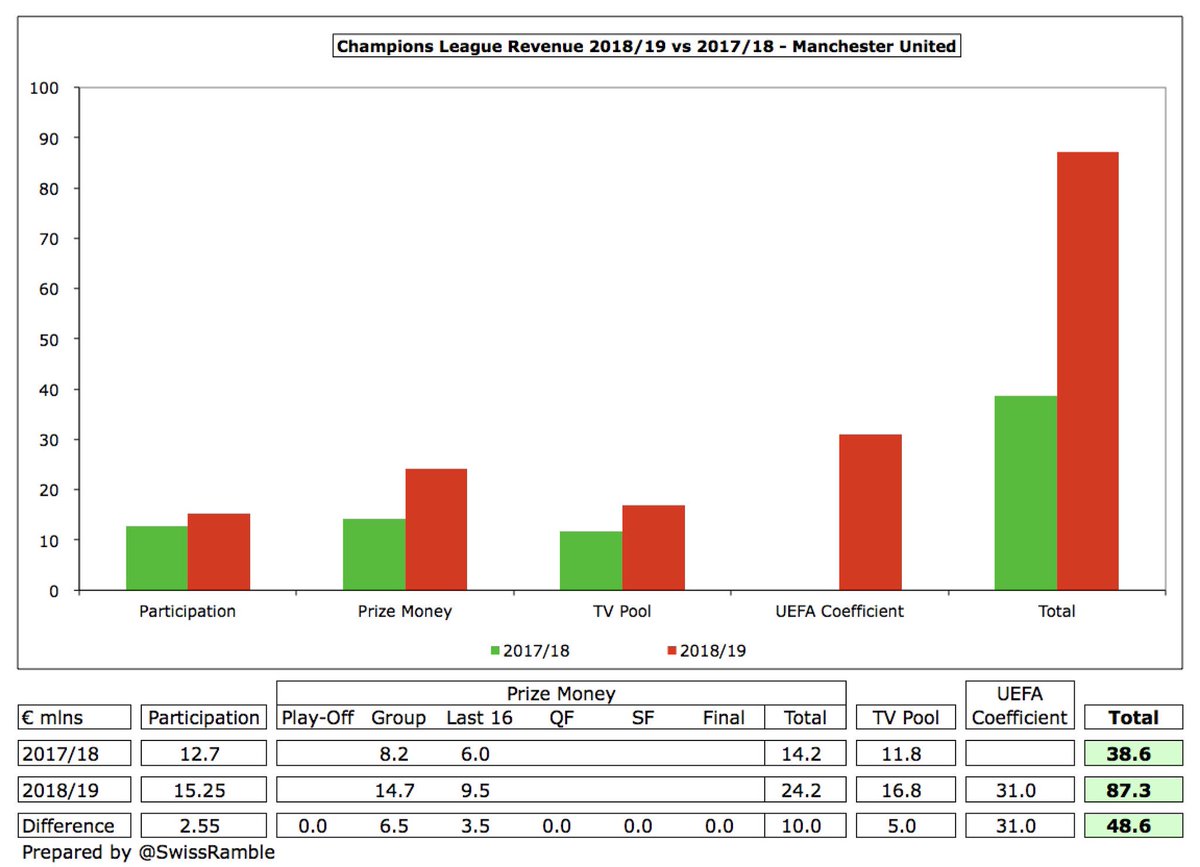

#MUFC earnings would increase from €39m to €87m for reaching last 16, but this is a little misleading, as they only received half of TV pool in 2017/18, because they qualified by winning Europa League. However, they do benefit from their history, as they are ranked 5th by UEFA.

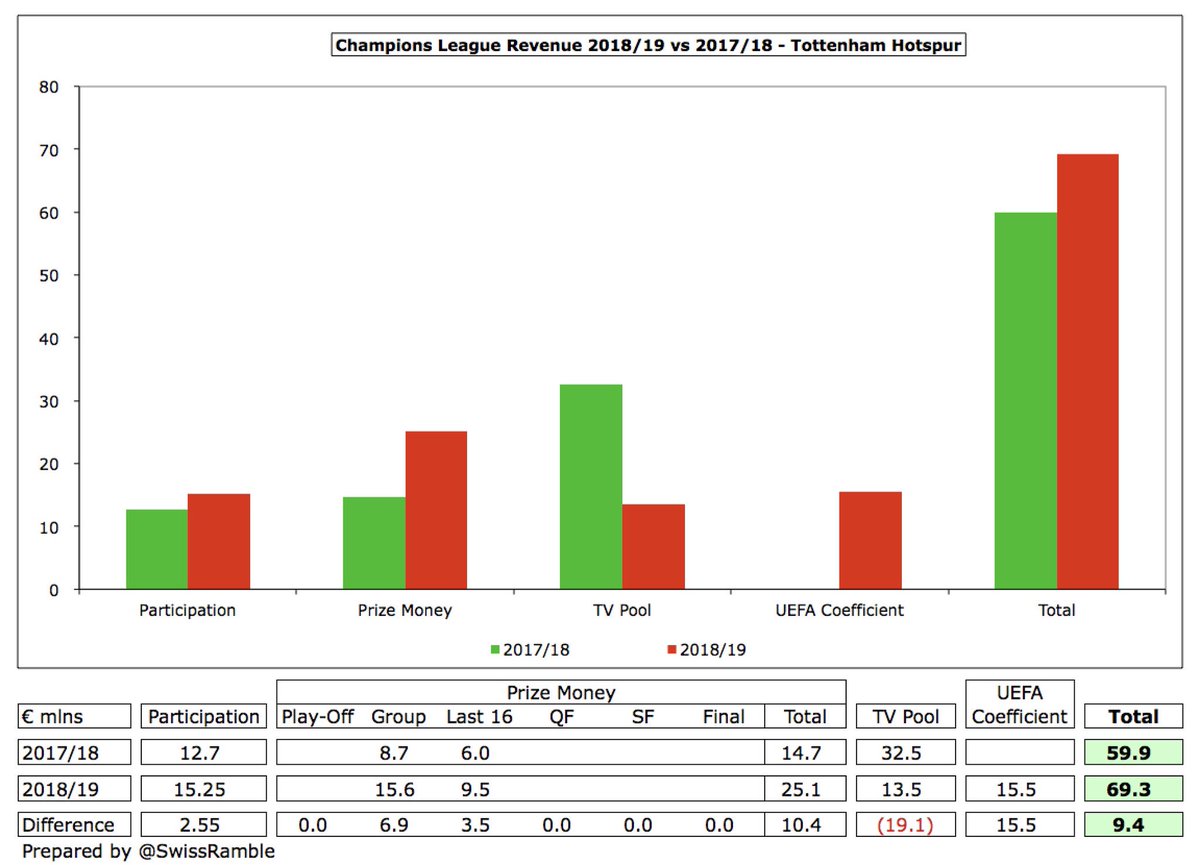

#THFC earnings would increase from €60m to €69m for reaching last 16, boosted by an excellent performance in group stage, but adversely impacted by a relatively low UEFA coefficient (ranking 25th, but 19th best of teams that have qualified for this season’s Champions League).

#LFC revenue would have risen from €78m to an incredible €111m for reaching the final, mainly due to the hefty increases in prize money, but also thanks to a relatively high UEFA coefficient (ranking 15th, but 12th best of teams qualified for this season’s Champions League).

It should be emphasised that these are only estimates, particularly the assumption around the English TV pool, while revenue will also clearly depend on progress in this season’s competition, but hopefully the examples do make clear the differences in the new distribution system.

• • •

Missing some Tweet in this thread? You can try to

force a refresh