Okay. I'm live-tweeting again. In a very welcome recommendation, JEP recommends that FOR THIS 2017 valuation, USS revert to the Sept proposed 10 year delay in de-risking and increase Test 1 permitted outperformance of low risk self-sufficiency portfolio from £10 bn to £13 bn. 1/

The increase in permitted outperformance (aka 'reliance on the covenant' or 'gap to self-sufficiency') would simply involve an assumption of growth in the payroll by CPI rather than prudent downward adjustment below CPI. 2/

Actually, I see that the move from £10 bn to £13 bn was a joint suggestion of @Aon & @FirstActuarial (i.e., @UniversitiesUK & @ucu actuaries, but who provided *independent* advice to JEP). JEP recommends increase in gap but doesn't specify a figure. 3/

The above recommendations re delaying de-risking and increasing reliance on covenant would involve employers agreeing to accept a higher level of investment risk. They are along lines of what I recommended in this blog: 4/

medium.com/@mikeotsuka/uu…

medium.com/@mikeotsuka/uu…

Panel quantifies delaying de-risking by 10 yrs & increasing reliance on covenant to £13 bn as reducing required contributions by 1.9%. The reduction isn't very great, because the increase in reliance to £13 bn is fairly modest. 5/

Both @Sam_Marsh101 & I (as well as @ucu) had recommend increased reliance to higher £19 bn, since #USS had proposed this in Feb 2017 consultation as most consistent w/ their own assumption re growth in the payroll. 6/

More consequentially, insofar as decrease in required contributions is concerned, JEP recommends changes in assumption regarding investment returns on deficit recovery contributions, to bring them back in line w/ the less pessimistic assumptions of the 2014 valuation. 7/

What JEP recommends would bring deficit recovery contributions (DRCs) back down from the high 6% rate of November valuation to the 2.1% rate of September valuation plus 2014 valuation. A significant decrease in required contributions! 8/

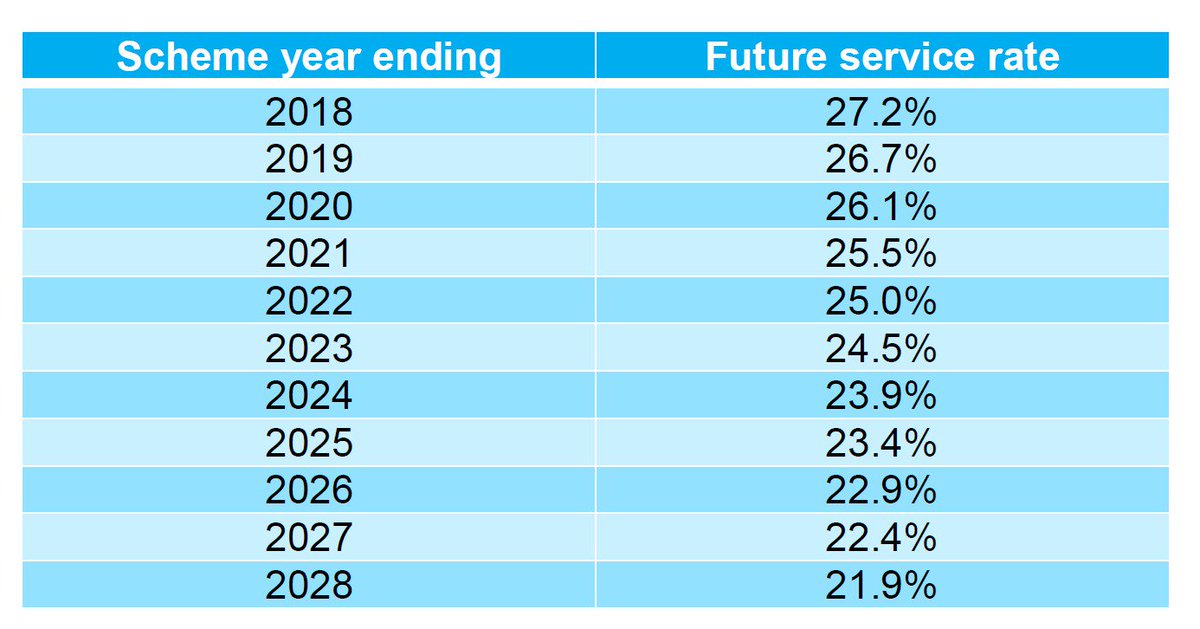

JEP also recommends smoothing future service contributions over no fewer than 2 valuation cycles (6 years)! “This approach would keep the FSC rate constant for the period, rather than it rising and then falling and would be intergenerationally fairer.” 9/

This is along lines of what @FirstActuarial recommended in their submission to the September consultation. FA noted that, on #USS assumptions, the cost of future service would fall over the next 10 years as the gilt yield reverted faster than market forecasts. (See FA chart.) 10/

#USS's view is that cost of future service should be set to assumed 2018 high point for this entire valuation, with potential for downward adjustment only at future valuations. JEP recommends setting this cost *now* as average of at least next 6 yrs (2018-2024). 11/

JEP also recommends use of most recently released mortality tables, in line w/ practice at 2014 valuation (& with regulator guidelines), which would further reduce deficit & cost of future service modestly. 12/

UPSHOT of above recommendations: "The Panel believes that there are a number of different paths that the Trustee could adopt to reduce the contribution rate to below 30%" while maintaining DB status quo (plus DC status quo minus 1% match). 13/

29% would, under cost-sharing, amount to a modest 2% rise in employer contributions and 1% rise in member contributions. That wouldn't quite be No Detriment. But it would be a huge improvement over #USS's current 2017 valuation. 14/

Here's a summary of the above changes the panel recommends. Panel also says that implementing all of them would bring contributions down to 29.18%. 15/

👆Some speculation on the above. I think all of the above 4 changes to USS's 2017 valuation will be acceptable to @UniversitiesUK (as well, more obviously, as to @UCU, though the union had pressed for changes beyond these). 16/

Re the contribution increases that would be the upshot of this: since employers already agreed an increase to 19.3% at March ACAS, I don't think they would allow a further modest increase to c. 20% to be a deal-breaker, if the increase is split 65% employer/35% member. 17/

It also stands to reason that, given the fact that @UniversitiesUK & @ucu each appointed half of the JEP members & agreed a chair, the recommendations are likely to have been made w/ an eye to what would be acceptable to both of these parties. 18/

The greater obstacle to these 4 recommendations are #USS, their actuary, & tPR. #USS's initial response is, by my lights (and I know others have interpreted it otherwise), reasonably encouraging. People have fixated on the following in the #USS statement: 19/

"Unless and until an alternative has been agreed, consulted upon, and implemented, cost sharing remains the default process for addressing the regulatory and legal obligations of the 2017 valuation." 20/

uss.co.uk/how-uss-is-run…

uss.co.uk/how-uss-is-run…

But that's the position #USS would need to take even if they were receptive to these four changes. I note that, in their response, #USS does NOT specify that an alternative must involve changes to benefits. That is a welcome omission. 21/

#USS also correctly notes that JEP's "proposed solutions ... would require employers to take on higher levels of risk – and to pay higher contributions – than has been expressed to us to date, through the valuation process." 22/

What the proposed solutions would require of members is an increase in contributions of a bit more than 1% plus the abandonment of the 1% DC match. JEP's recommendations are more favourable for members than for employers. 23/

As I say above, I think the biggest obstacle to these proposals are #USS, their actuary, & tPR. #USS will, I think, try to resist & water down these recommendations, & the upshot of any watering down will be contribution increases unwelcome to both members or employers. 24/

Employers & members would need to be strongly supportive of these 4 proposals, & to unite to push #USS hard to adopt them, for there to be much prospect that #USS would accept them, *especially* if #USS & their actuary would need to do so against the likely resistance of tPR. 25/

So I hope employers & members find it possible to unite behind these JEP proposals strongly & quickly. Given the 50-50% @UniversitiesUK/@ucu composition of the panel, the report is surprisingly favourable towards views that @ucu & @FirstActuarial have been pushing for years. 26/

I'm sure I'll have more to say later. But I'll leave things at this for now. END (for now).

PS: This is a highly professional & accurate report. It was also clearly written w aim of making recommendations that USS, their actuary, & tPR might actually accept this autumn (even if very reluctantly & as the result of a concerted effort on the part of employer and union). 1/

I've been immersed in the details of USS & pensions valuation more generally long enough that obvious mistakes leap out. There are a few minor infelicities & inconsistencies. But nothing of consequence. Probably down to the tight time schedule. 2/

There are, of course, controversial claims, with which people will disagree. But I wasn't able to find anything of consequence that people will be able to point to as an embarrassing error. 3/

It at least equals the high level of expertise & professionalism evident in USS's own technical documents plus the documents by Aon and First Actuarial. 4/

By contrast, much of the work of those commentators on USS who aren't pensions experts are invariably misinformed or confused in significant respects. 5/

The report has extra credibility & objectivity, since it is the work of an expert panel, half chosen by the union & half by the employer, who volunteered generously of their time rather than being paid either by @UniversitiesUK or @UCU to put one party's view across. 6/

The result is reinforced by the fact that "Aon and First Actuarial concur on the results presented in this report". 7/

If we're able to get USS, their actuary, & tPR on board with JEP’s four recommendations, & there is the suggested cost-splitting +1.1% member, +2.1% employer, to retain the status quo minus the 1% match for the duration of this valuation... 8/

...that would be far better than what UCU proposed in December 2017 & January 2018. It will be very difficult, in the best of circumstances, to persuade USS, their actuary, & tPR to accept JEP’s four recommendations. 9/

We stand a chance of achieving this only if UUK and UCU can come to agree on this quickly, jointly get behind the JEP recommendations, and start pushing for this, in unity, ASAP. 10/

It would be a hugely regrettable if things descend into a quarrel between union & employer over a +0%/+3.2% split versus a +1.1%/+2.1% member/employer split over a modest rise in contributions that it would be possible to achieve only in the best of circumstances. 11/

For the sake of scheme members, I hope nobody tries to delay coming to agreement on the recommendations & suggestions of this report in order to fight over the minor respects in which they would constitute a detrimental change from the status quo for scheme members. 12/12

PS: Strong words against the regulator's bizarre but destructive claim that the covenant of the pre-92 sector is not strong:

Another interesting fact from the JEP report: as of 31 March 2018, the deficit under 2017 valuation assumptions was £4 bn (as opposed to £7.5 bn as of 31 March 2017).

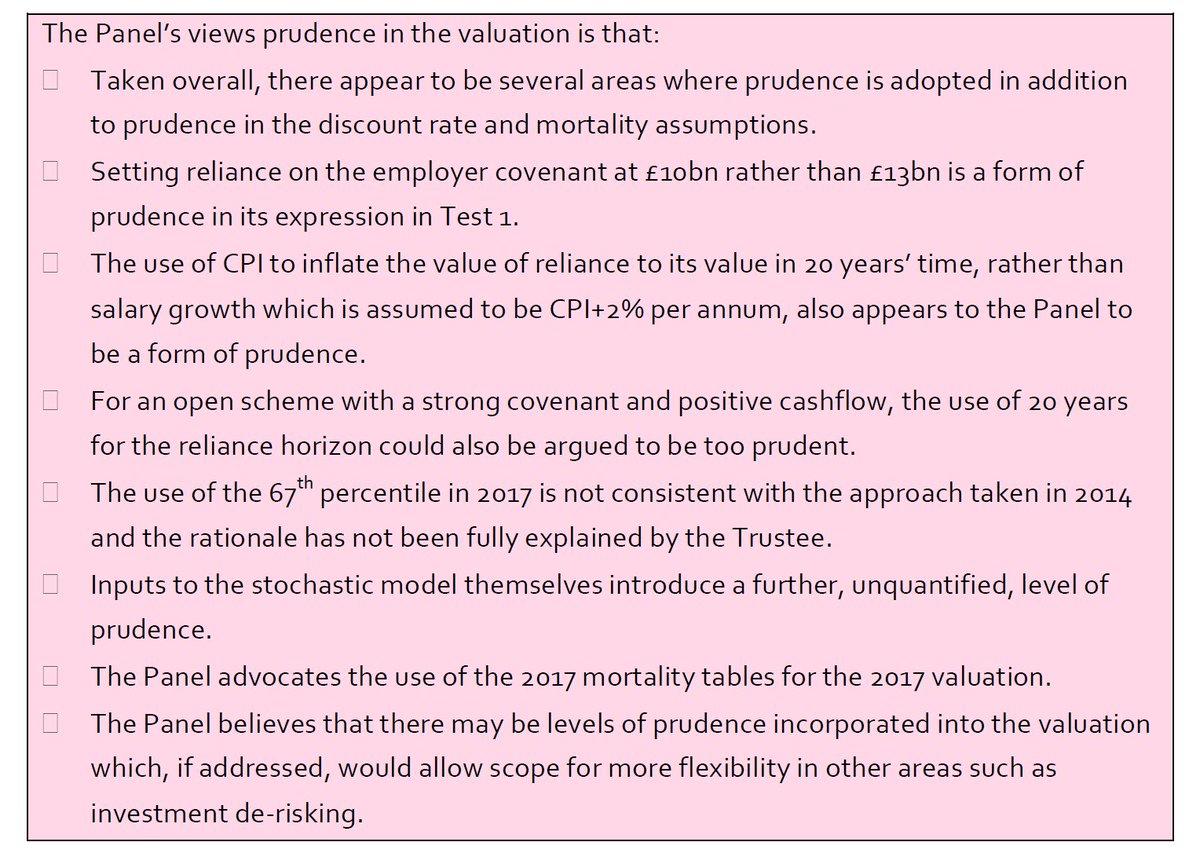

JEP report also says that there is a lot of unacknowledged prudence built into the valuation, beyond the acknowledged prudent adjustment of the discount rate and the longevity assumption.

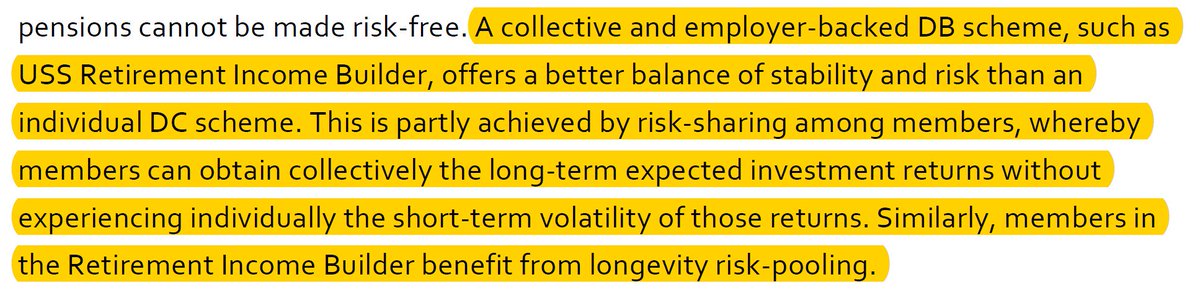

A succinct & elegant statement of the advantages of collective DB over individual DC. Employers will need to be reminded of this passage by their jointly chosen expert panel if they ever try to reintroduce IDC:

𝗔 𝗱𝗶𝗳𝗳𝗶𝗰𝘂𝗹𝘁𝘆 𝗳𝗼𝗿 𝗝𝗘𝗣 𝗽𝗿𝗼𝗽𝗼𝘀𝗮𝗹: 𝗧𝗲𝘀𝘁 𝟭'𝘀 𝗿𝗲𝗹𝗶𝗮𝗻𝗰𝗲 𝗴𝗮𝗽 𝗿𝗲𝗾𝘂𝗶𝗿𝗲𝘀 𝗳𝘂𝗿𝘁𝗵𝗲𝗿 𝗶𝗻𝗰𝗿𝗲𝗮𝘀𝗲 𝘁𝗼 𝗺𝗮𝗸𝗲 𝗿𝗼𝗼𝗺 𝗳𝗼𝗿 𝗔𝗡𝗬 𝗶𝗻𝗰𝗿𝗲𝗮𝘀𝗲 𝗶𝗻 𝗿𝗲𝗴𝘂𝗹𝗮𝗿 𝗲𝗺𝗽𝗹𝗼𝘆𝗲𝗿 𝗰𝗼𝗻𝘁𝗿𝗶𝗯𝘂𝘁𝗶𝗼𝗻𝘀: See below. 1/

𝗣𝗿𝗼𝗯𝗹𝗲𝗺: any increase in employer contributions which is not temporary (e.g., for this 3 yr valuation cycle only) will be self-defeating, given Test 1's 'iterative' character. 2/

𝗘𝘅𝗽𝗹𝗮𝗻𝗮𝘁𝗶𝗼𝗻: The Test 1 gap by which #USS's actual portfolio can outperform an expensive, low-risk bond-weighted portfolio is determined by the amount of extra cash that could be raised by an increase in employer contributions to the maximum affordable 25% level. 3/

Therefore, any non-temporary increase now in regular employer contributions to sustain DB decreases the Test 1 gap. This aspect of Test 1 is mentioned here in the JEP report: 4/

#USS's modelling in the Sept consultation document of a 4% increase in regular employer contributions from 18% to 22% indicates that such an increase would be completely self-defeating: 5/

The decrease in the gap to self-sufficiency would force a de-risking of the portfolio into bonds w/ lower expected returns. The resulting increase in expense of DB promises would cancel out the benefit of the extra employer contributions. 6/

It appears that even a 2% or 3% increase in regular employer contributions would be self-defeating for the same reason. To get around this problem, either (i) any increase in employer contributions will need to be a temporary fix that lasts a short time (e.g., 3 years), or 7/

(ii) Test 1 will need to be modified in a fairly radical fashion, or else replaced w/ something else.

#USS would be much more resistant to (ii) than (i). Trying to push for (ii) would be contrary to the otherwise pragmatic, realistic nature of the JEP recommendations. 8/

#USS would be much more resistant to (ii) than (i). Trying to push for (ii) would be contrary to the otherwise pragmatic, realistic nature of the JEP recommendations. 8/

Barring #USS agreement this autumn to a radical transformation or scrapping of Test 1, any increase in employer contributions would need to be accompanied by an explicit sunset clause, according to which they go back down to 18% after 3 (or maybe could push for 6) years. 9/

Realistically, any proposal calling for a non-temporary increase in employer contributions will need to await JEP Phase 2, at which point they will make the case for more tranformative & sustainable changes to #USS's approach to the valuation. 10/10

PS: Link in main thread to this clarifying exchange w @etymologic, the upshot of which is that #USS cannot be treating the Rule 76 cost-sharing increases on which we're now being consulted as permanent increases in regular employer contributions either:

https://twitter.com/etymologic/status/1040488340162846720

#USS members & employers, @ucu & @UniversitiesUK, & @colette147 & @AlistairJarvis owe a HUGE THANKS to @JoanneSegars & the six JEP members for volunteering so much of their time to producing such a magnificent report. 1/

It's clear that these are 7 people who care deeply about the future of DB pensions & who are trying to ensure that those of the 200,000 active members of #USS aren't destroyed by a regulator who fails to appreciate the unique strength & longevity of the #USS covenant. 2/

There are now only 500,000 active members left in OPEN private occupational DB pension schemes in this country. 3/

https://twitter.com/JosephineCumbo/status/1037629065161834497

Two-fifths of them are members of #USS. Another one-fifth are members of the Railway Pension Scheme, whose former chief accountant contributed the following much-admired submission to the JEP: 4/

medium.com/ussbriefs/not-…

medium.com/ussbriefs/not-…

Joint Expert Panel chair @JoanneSegars is chair of the funded (not PAYG) Local Government Pension Scheme. She also has a background w/ TUC as well as Pensions & Lifetime Savings Association. 5/

By contrast, there is not one person with a background in, and commitment to, the provision of public sector pensions, either funded or PAYG, among the 5 independent #USS trustees. See here for the backgrounds of the 5 #USS independents: 6/

threadreaderapp.com/thread/9744369…

threadreaderapp.com/thread/9744369…

Just as Segars is at the 'middle' of the 7 JEP members, there should also be one or two to provide further counterbalance to those steeped in City finance & DC. E.g., Con Keating, @BrinleyDavies, or Tim Wilkinson. 7/

Even if #USS would like to stick to City of London types, they could appoint a former Governor of the Bank of England such as Mervyn King. See this wonderful critique of existing DB regulations that he co-wrote w/ @ProfJohnKay: 8/

johnkay.com/2018/09/06/uss…

johnkay.com/2018/09/06/uss…

Or they could appoint George Cooper (@FixingEconomics), CIO of Equitile Investments, who wrote this defence of the #USS strikes: 9/

medium.com/ussbriefs/reck…

medium.com/ussbriefs/reck…

#USS is governed on behalf of members by the trustees. Independents are appointed by a majority of the trustees. The majority are appointed by @UniversitiesUK & @ucu. 10/

How is it that this majority has allowed for the appointment of independents so out of sympathy with DB and so out of line with the views of the independent members and chair of the JEP? 11/11

• • •

Missing some Tweet in this thread? You can try to

force a refresh