Ten years after Sheikh Mansour acquired the club, Manchester City’s 2017/18 financial results covered a season when they won the Premier League in some style, won the League Cup and reached the Champions League quarter-finals. Some thoughts in the following thread #MCFC

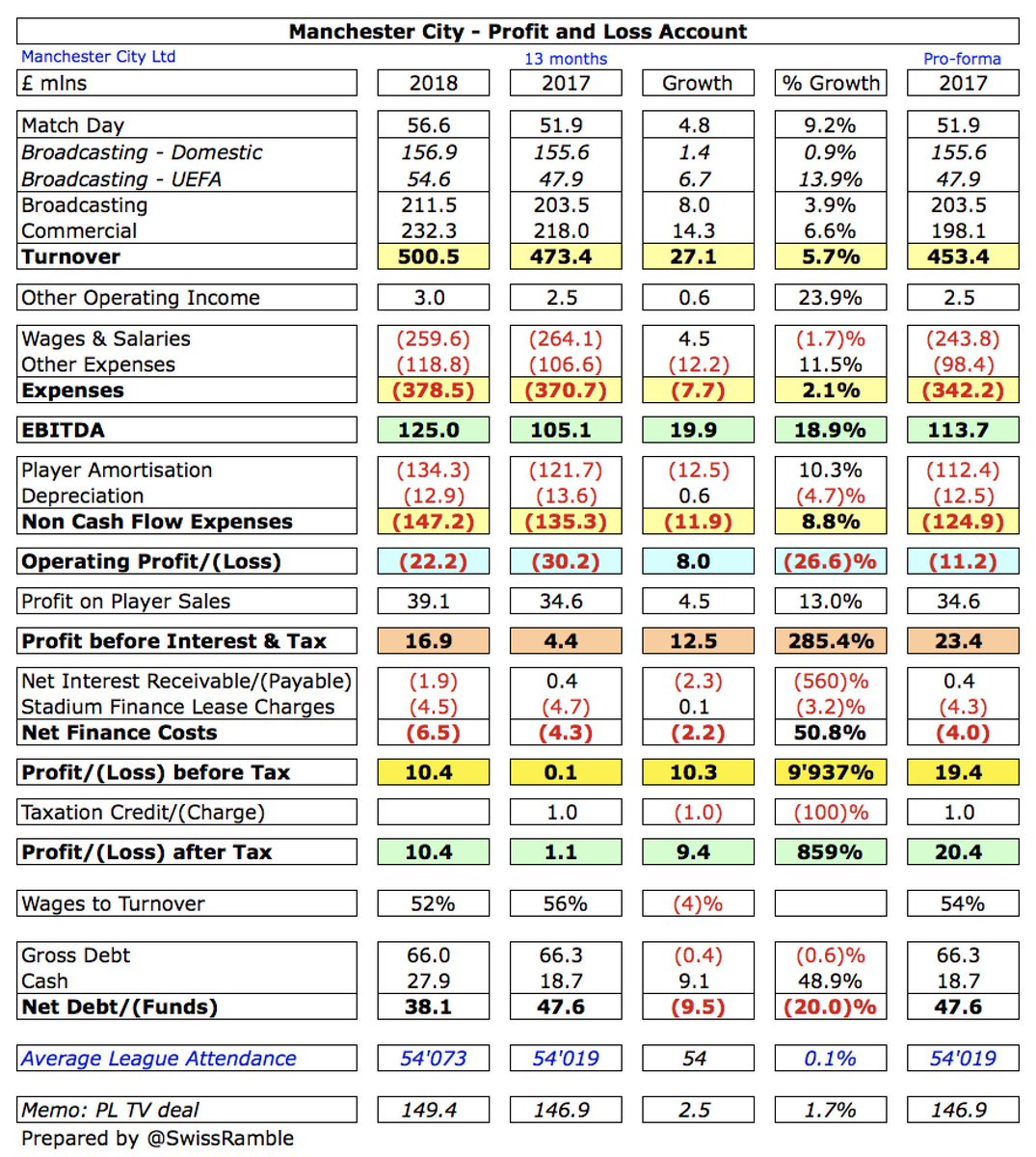

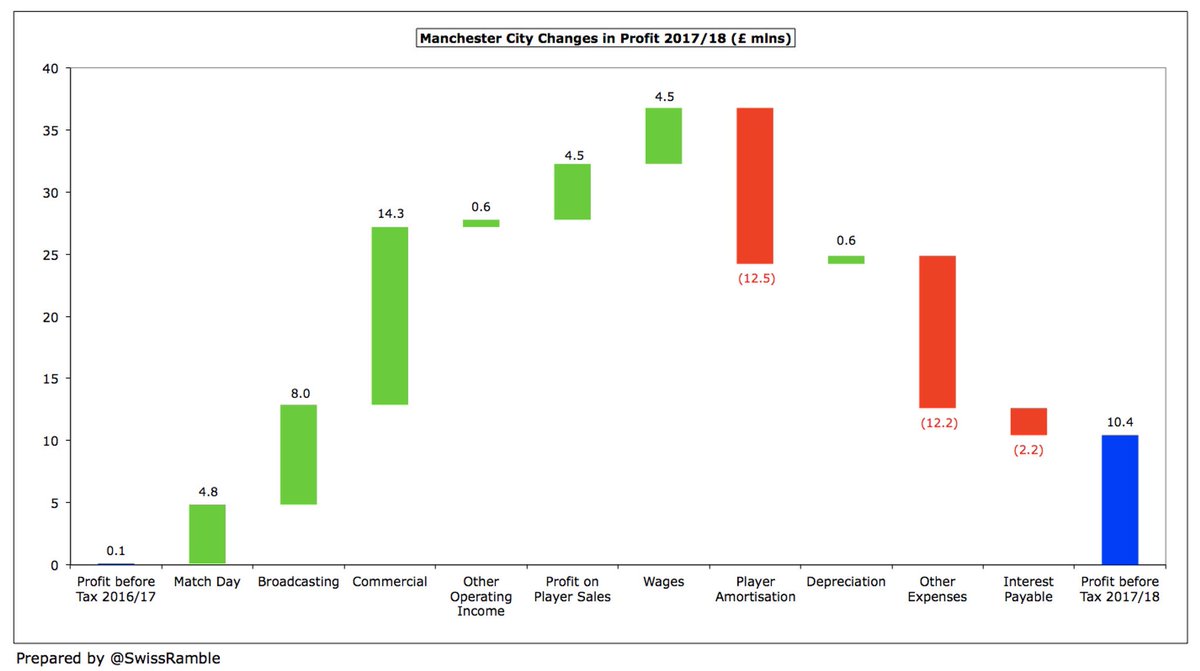

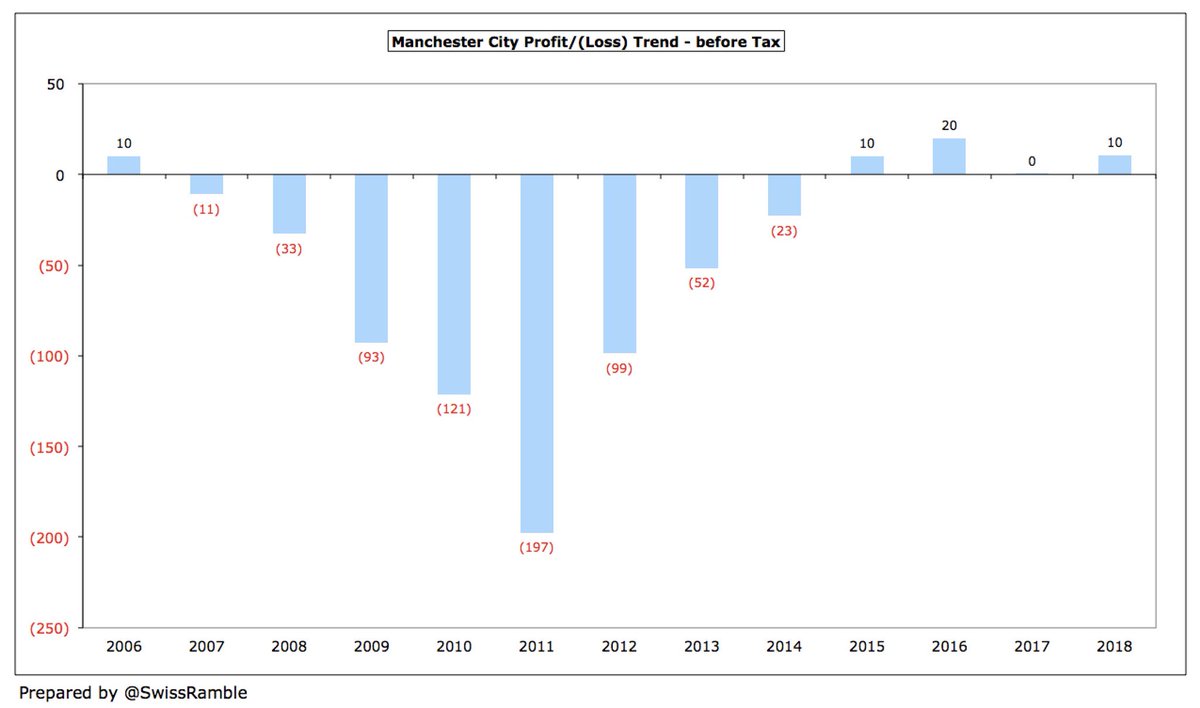

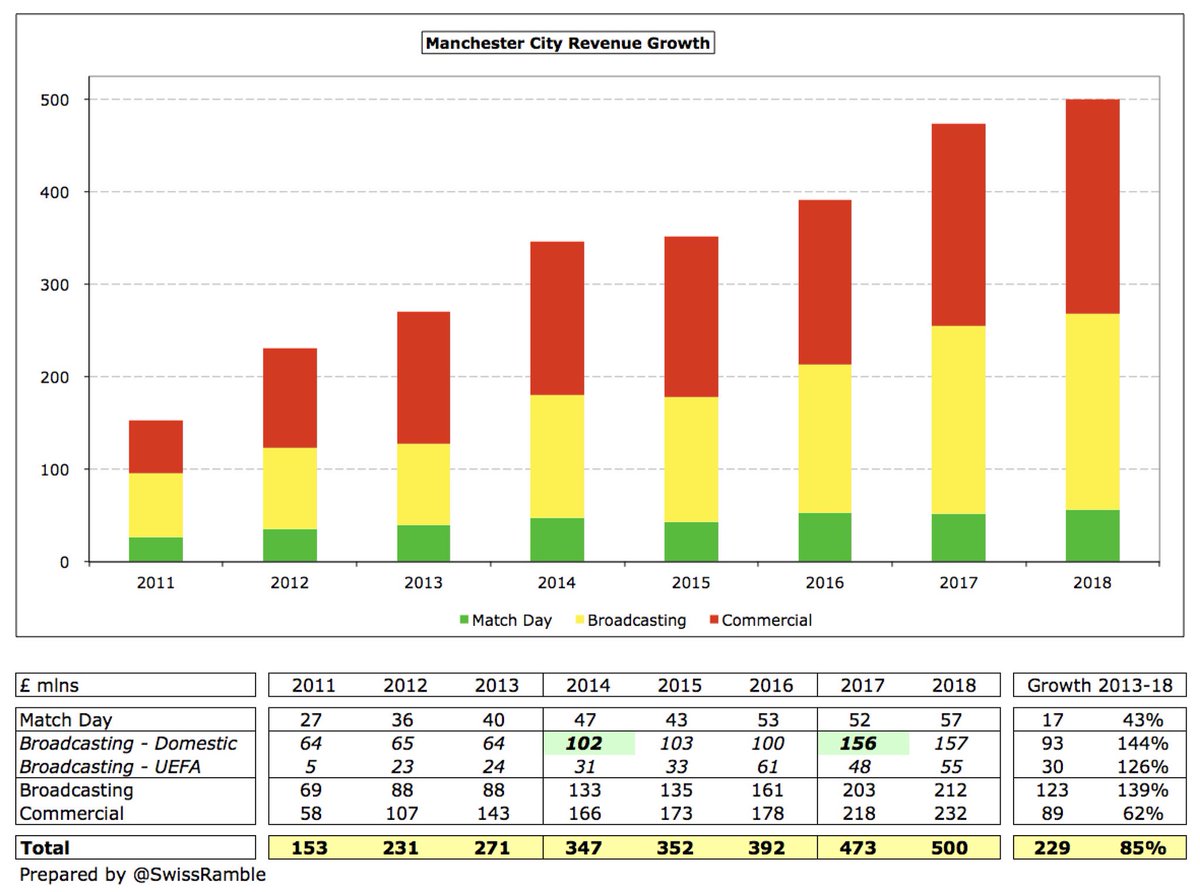

#MCFC profit before tax up from £0.1m (£1.1m after tax) to £10.4m, as previous season was adversely impacted by change in year-end resulting in an extra month’s costs with minimal revenue uplift. Revenue rose £27m (6%) to £500.5m, only second English club above £0.5 bln.

All #MCFC revenue streams up: commercial income rose £14m (7%) to £232m; broadcasting increased £8m (4%) to £212m; and match day was £5m (9%) higher at £57m. Profit on player sales was up £4m to £39m.

#MCFC wage bill was £4m lower at £260m, though real growth was £16m (6%) based on 12 months. However, player amortisation increased £12m (10%) to £134m, while other expenses rose £12m (11%) to £119m and net finance costs were up £2m to £6m.

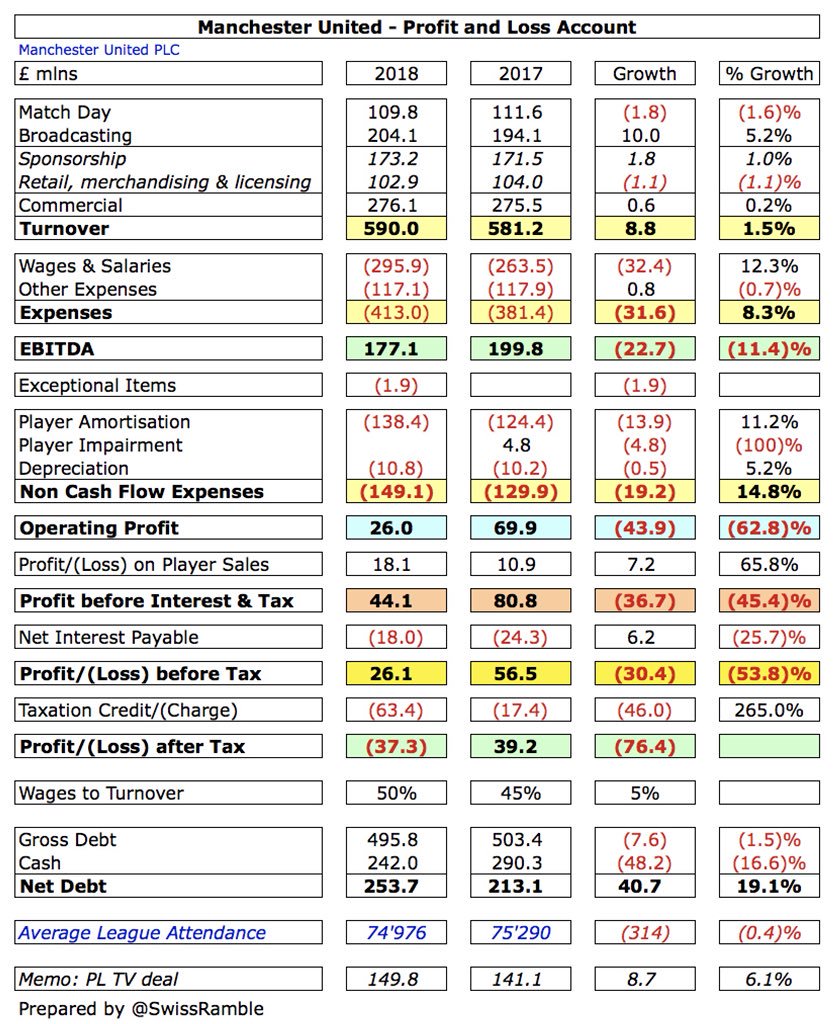

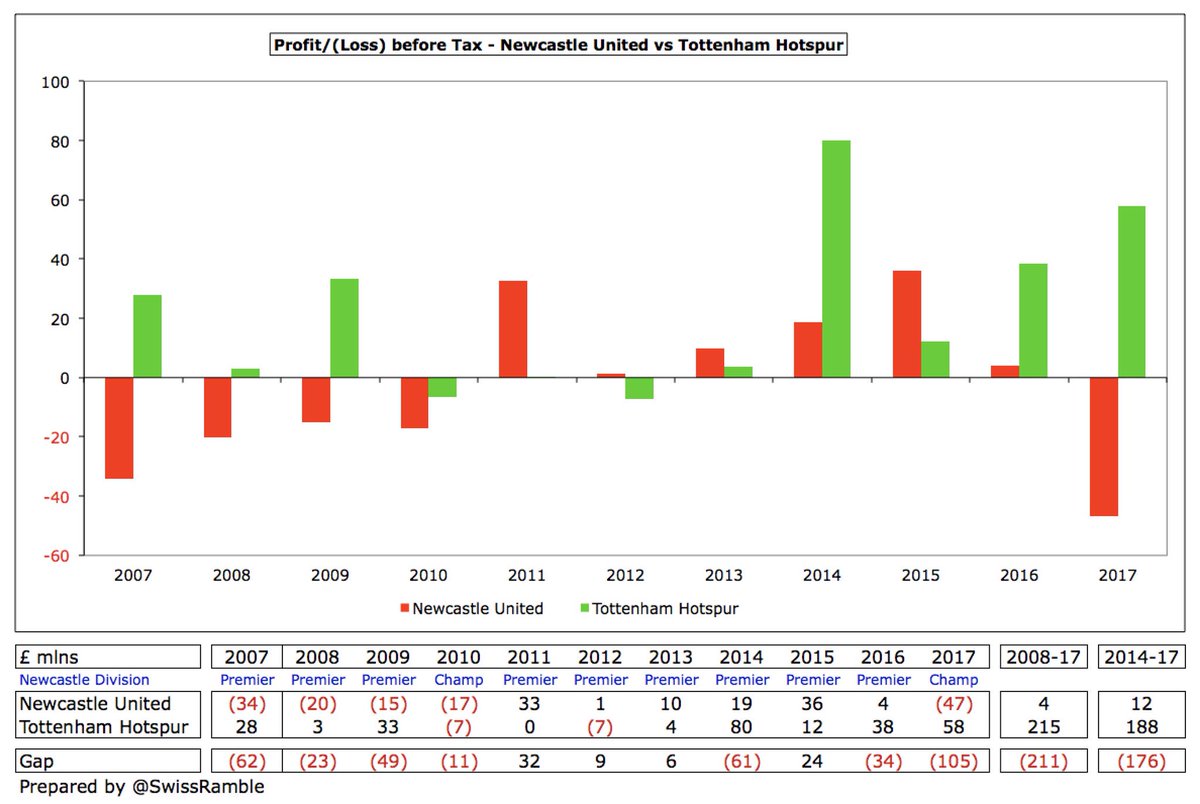

Despite rise in #MCFC profit to £10m, this would still have been one of the smallest in 16/17. Thanks to TV money & wage controls, the Premier League has become very profitable with only one club reporting a loss, while many had huge profits: #LCFC £92m, #THFC £58m & #MUFC £57m.

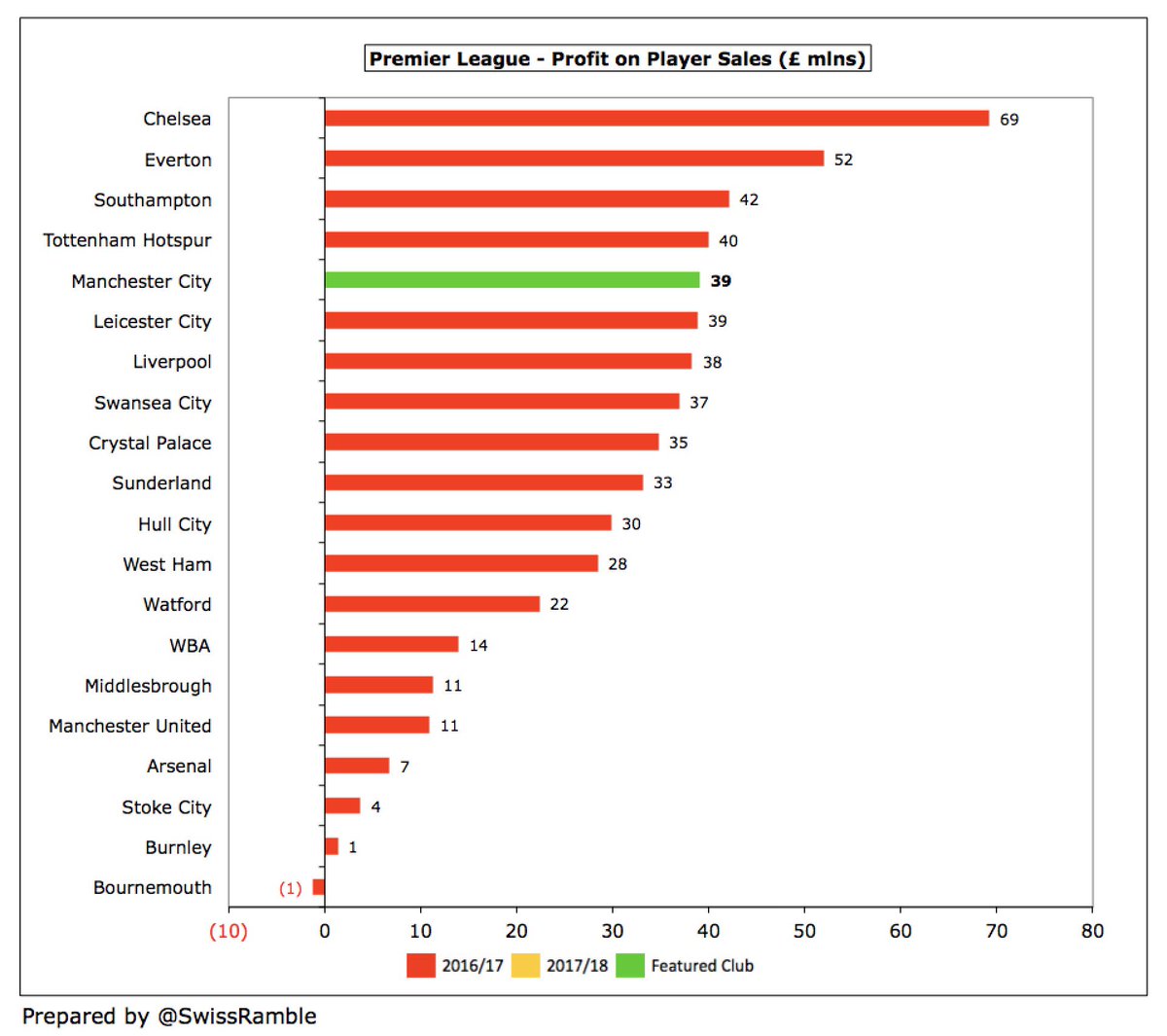

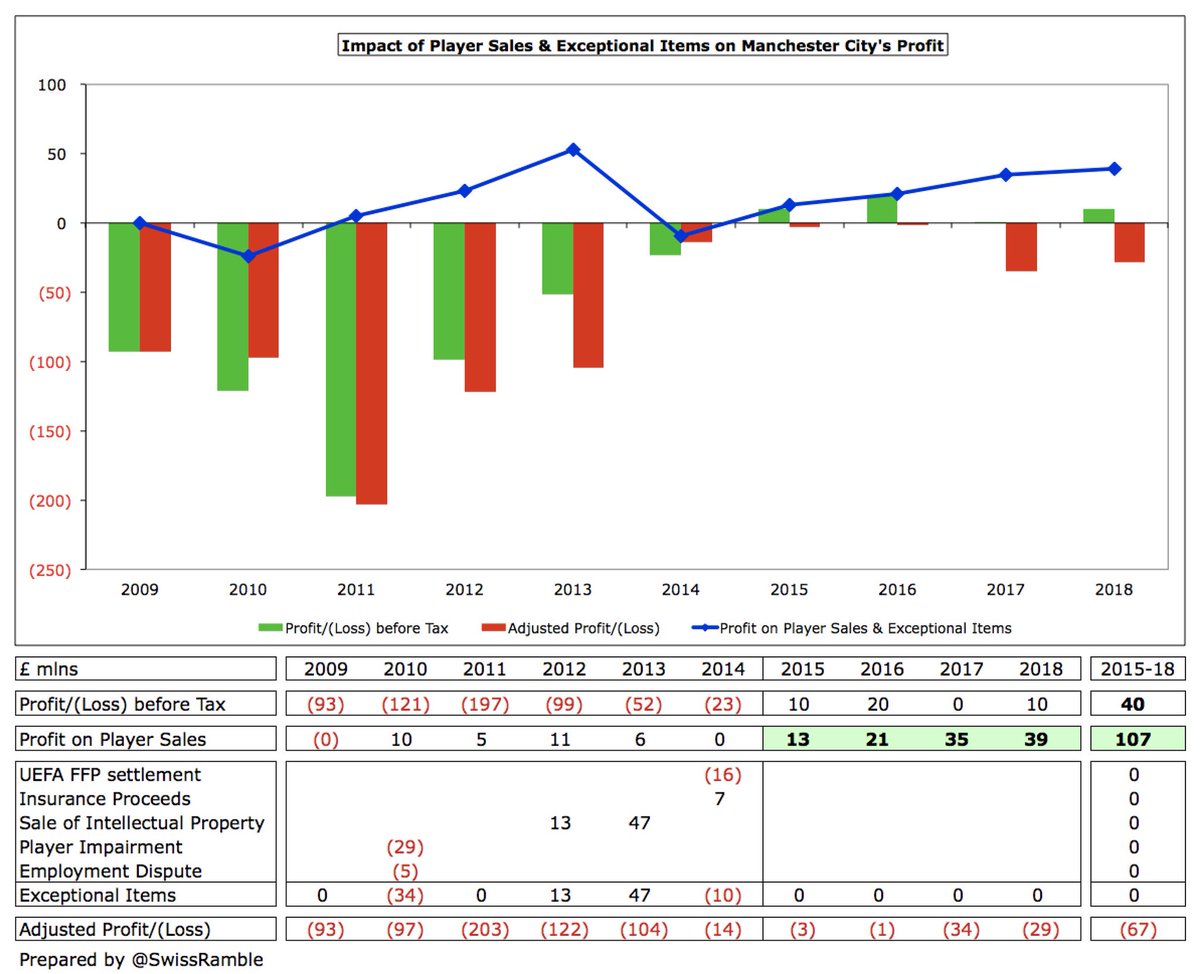

Up to now, the #MCFC strategy has not been overly reliant on player sales, but the £39m they made from this activity in 2017/18 would have been the fifth highest in the 2016/17 Premier League. Largely due to Iheanacho to Leicester, Bony to Swansea and Mooy to Huddersfield.

This is the fourth consecutive profitable year for #MCFC, something that chairman Khaldoon Al Mubarak said “may well have been rejected as fanciful by some commentators” in the years when they made heavy losses due to significant spending in order to build a competitive squad.

#MCFC results are no longer enhanced by any “fancy footwork”, such as the £47m sale of intellectual property in 2013. Player sales have had an increasing impact on the club’s profits (£107m in last 4 years), but to date 2018/19 sales are much lower (Gunn, Denayer, Hart).

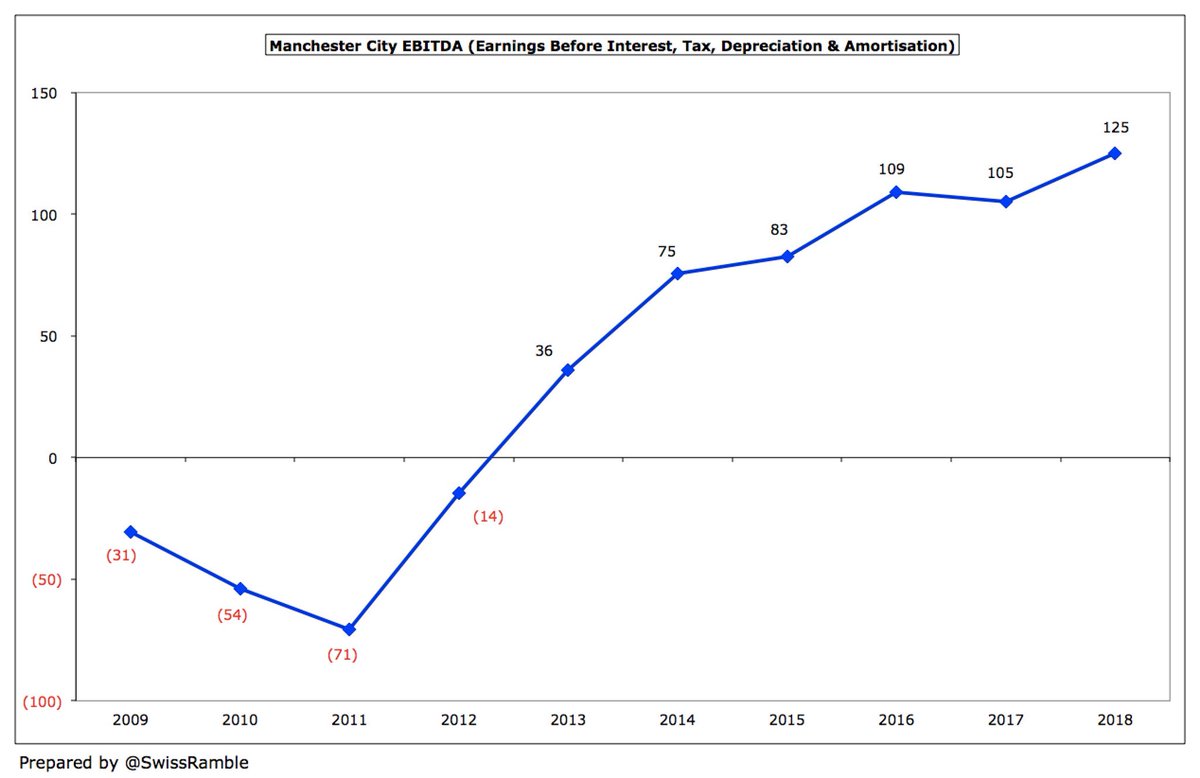

That said, #MCFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which can be considered as a proxy for cash operating profit, further increased by £20m to a record £125m, nearly £200m better than the low of (71)m in 2010/11.

#MCFC EBITDA of £125m is excellent, underlining the club’s financial progress, but it is still much lower than #MUFC £200m (in 2016/17), who are a veritable cash machine.

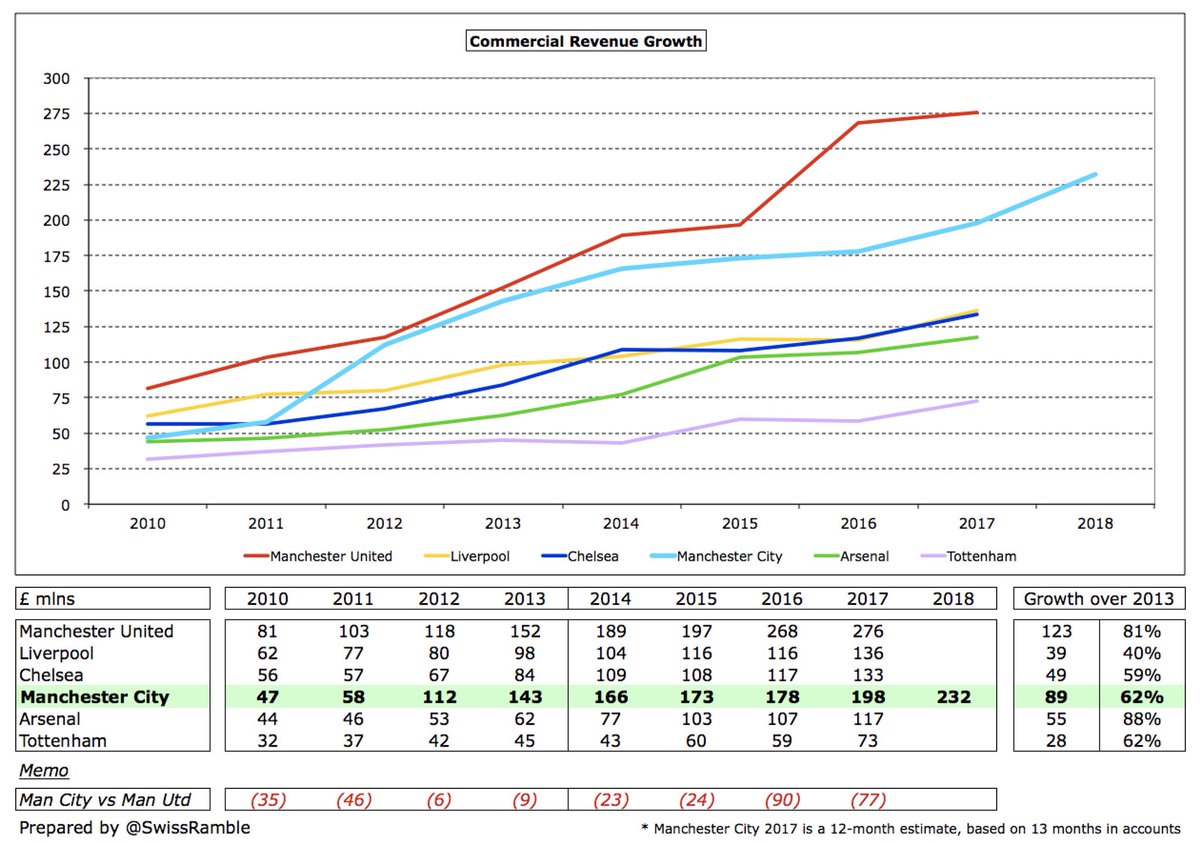

Although #MCFC revenue “only” increased by 6% in 2017/18, this is not unusual in the second year of a Premier League TV deal. Since 2013 revenue has grown by an incredible £229m (85%) from £272m to £500m, mainly TV £123m, but commercial also rose £89m, while match day up £17m.

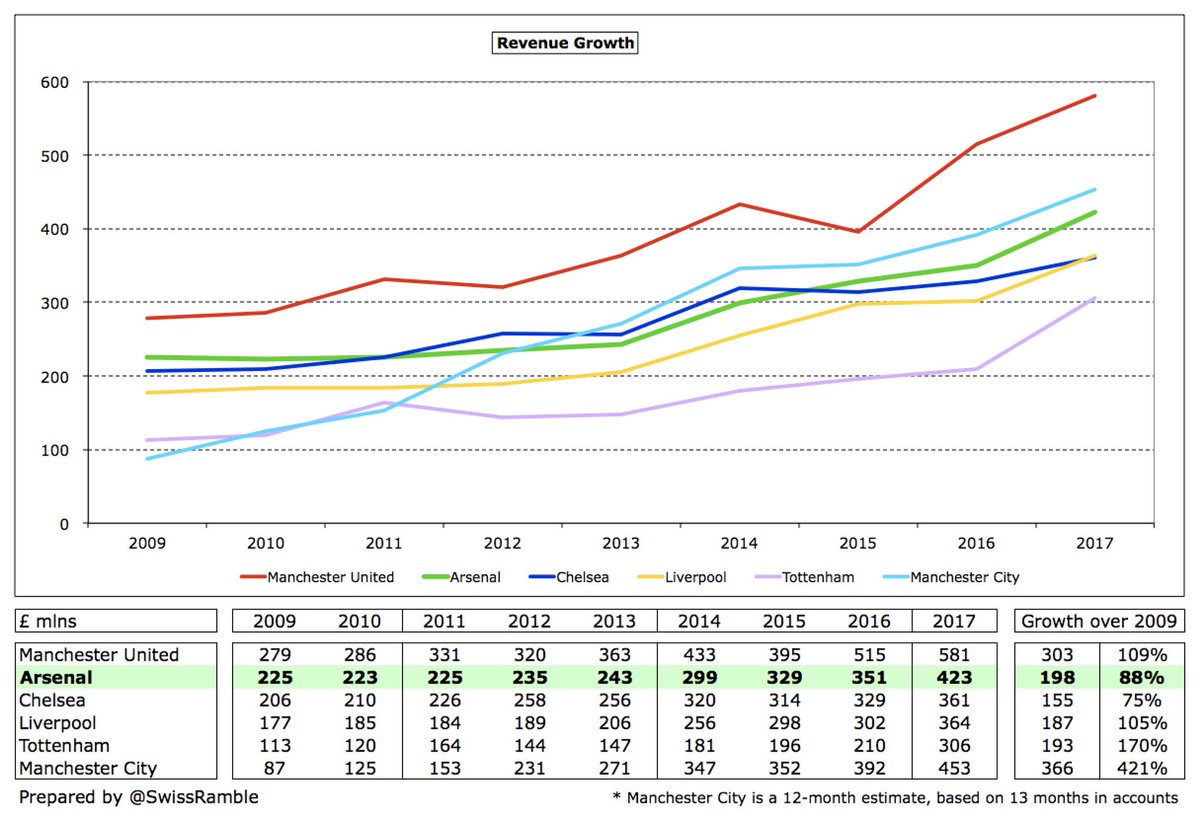

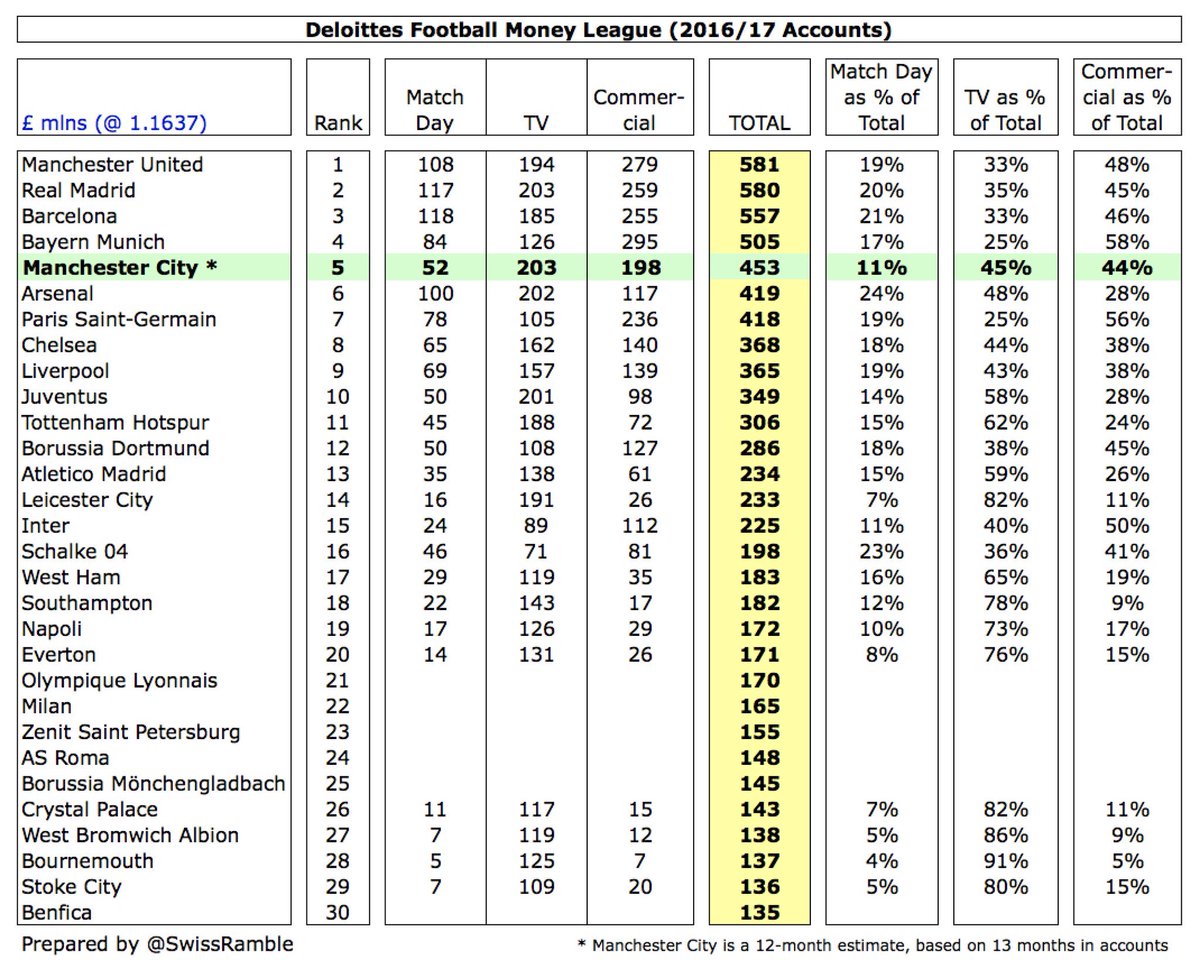

#MCFC revenue of £500m is the second highest in England, though it still trails #MUFC by a fair amount, as they reported £581m in 2016/17. On the other hand, there is a healthy gap to the nearest clubs: #AFC £423m, #LFC £364m, #CFC £361m and #THFC £306m.

Based on 2016/17 figures, #MCFC were in fifth place in the Deloitte Money League, as their £453m revenue was only surpassed by Manchester United £581m, Real Madrid £580m, Barcelona £557m and Bayern Munich £505m. Note that City revenue is a 12-month estimate.

#MCFC TV money from the Premier League increased £3m to £149m, boosted by finishing 1st versus 3rd the previous season (merit payment), though hit by being shown live fewer times (facility fee). Just below #MUFC £150m, who were shown live 28 times (compared to 26 for City).

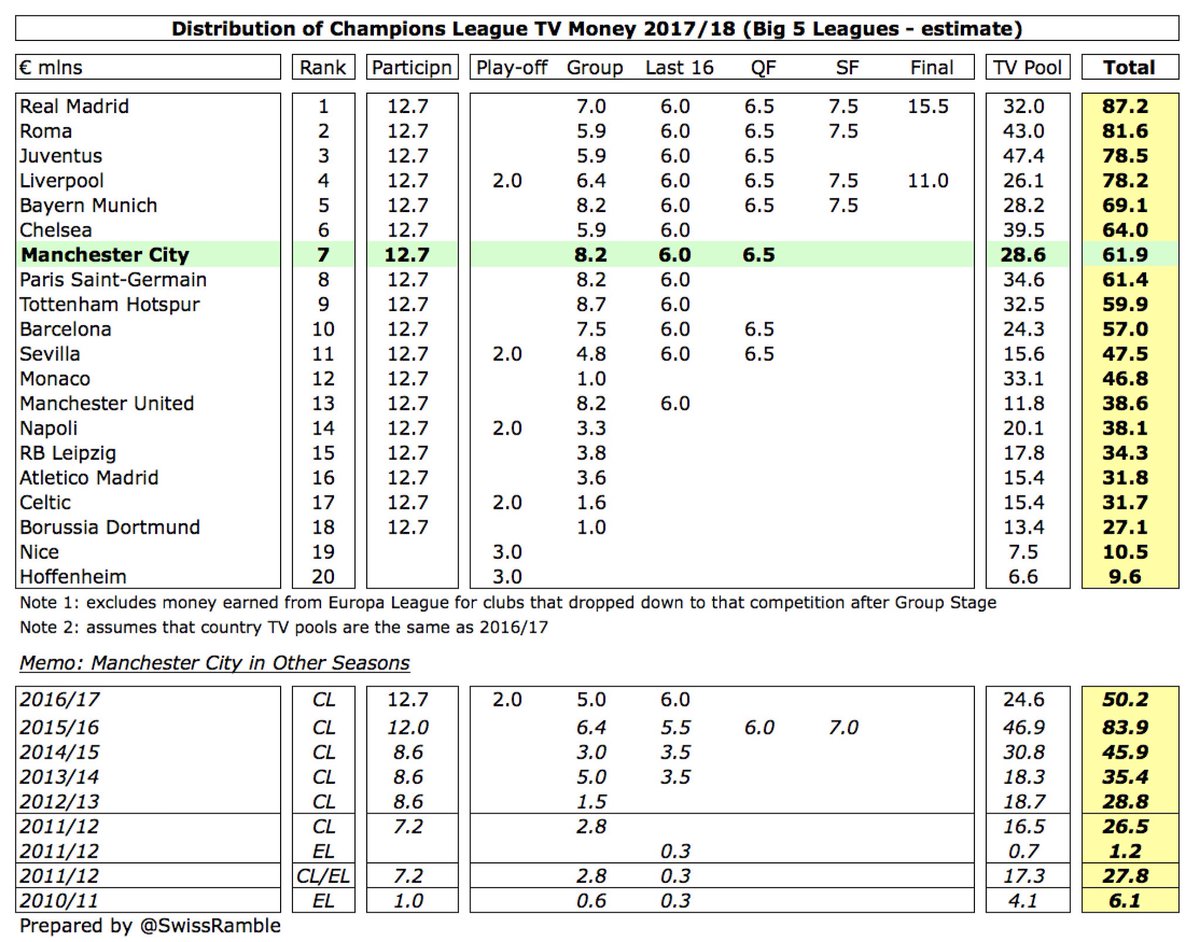

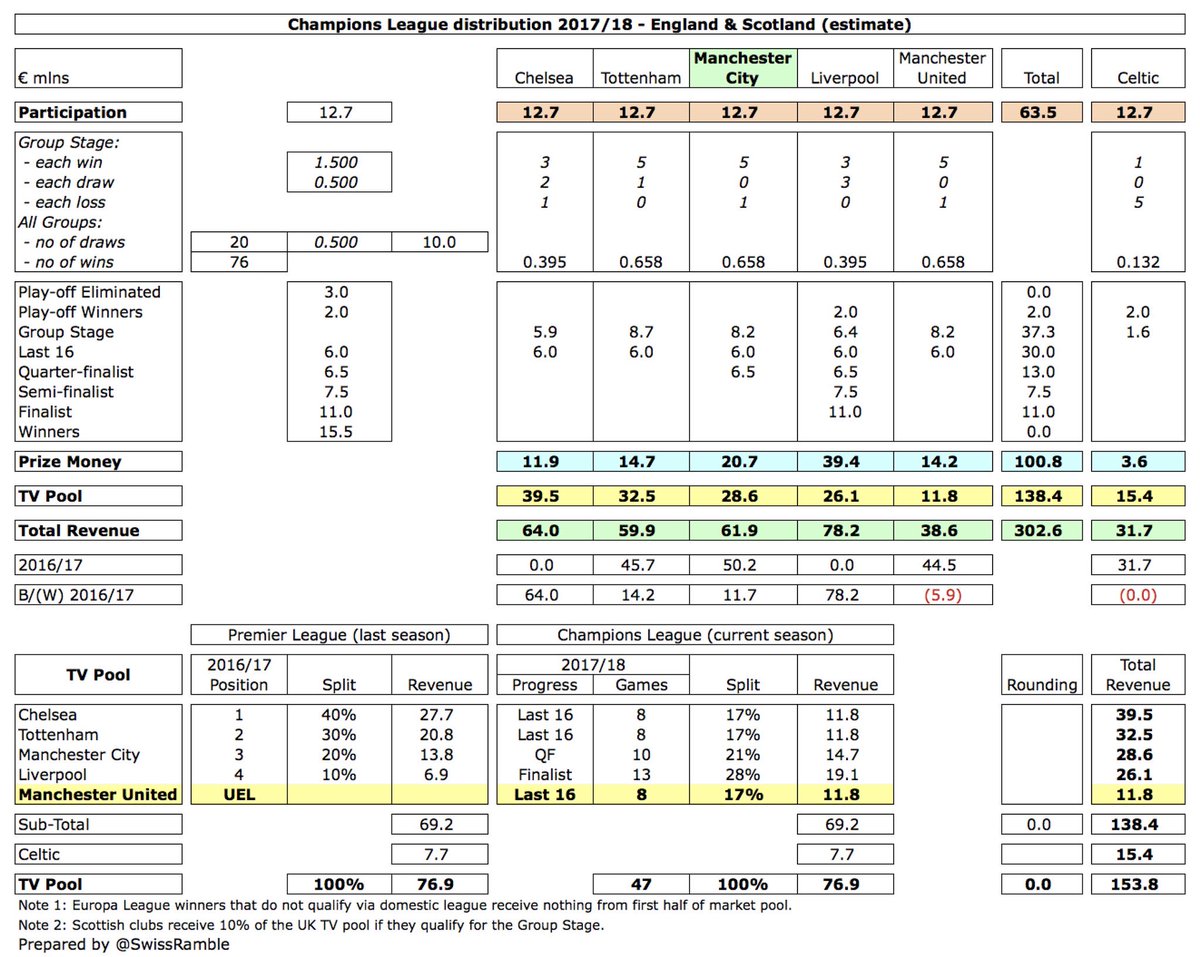

Assuming that England TV pool was unchanged in 2017/18, #MCFC earned €62m from the Champions League for reaching the quarter-final, €12m more than the previous season when they got to the last 16. Winners Real Madrid received €87m.

Despite the increase, #MCFC Champions League revenue €62m was still lower than Liverpool €78m, as the Reds reached the final, and Chelsea €64m, as they got more from the TV pool after winning the Premier League in 2016/17.

Nevertheless, #MCFC have earned a lot more revenue (€277m) from European competition than any other English club in the last 5 years: Chelsea €216m, Arsenal €214m, Manchester United €170m, Liverpool €150m, Tottenham €138m and Leicester City €82m.

#MCFC commercial income was up 7% (£14m) to £232m, only below #MUFC £276m, including new partners Gatorade, Tinder & Marathonbet. City have grown by an impressive £89m (62%) since 2013, but have been outpaced by #MUFC £123m (81%), even though they have had one less year.

However, to place this into context, #MCFC £232m commercial income is at least £100m more than the other English clubs (2016/17 figures): #LFC £136m, #CFC £133m, #AFC £117m, #THFC £73m and #WHUFC £35m. Benefited from the Amazon Prime documentary.

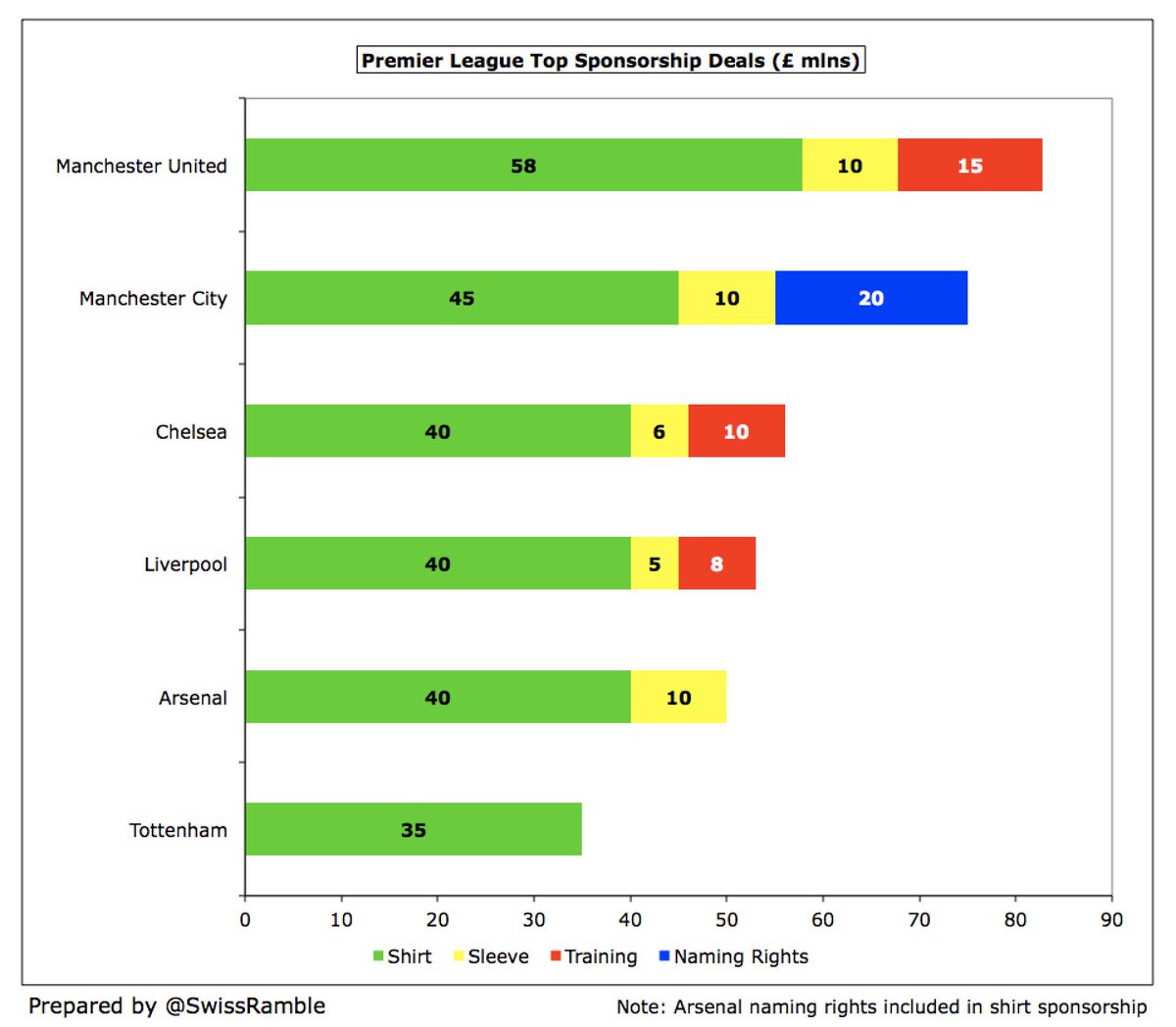

#MCFC Etihad shirt sponsorship worth £45m a season, while naming rights for stadium and campus estimated at £15-20m. City Football Group will reportedly have a £50m kit deal with Puma from 2019/20, a big increase on current Nike £20m. Nexen Tire sleeve sponsor is £10m.

The importance of commercial business to #MCFC is clear, as 46% of their 2017/18 revenue came from this revenue stream. The only comparable club is #MUFC 47%, while #LFC and #CFC are only at 37% and other clubs are significantly lower.

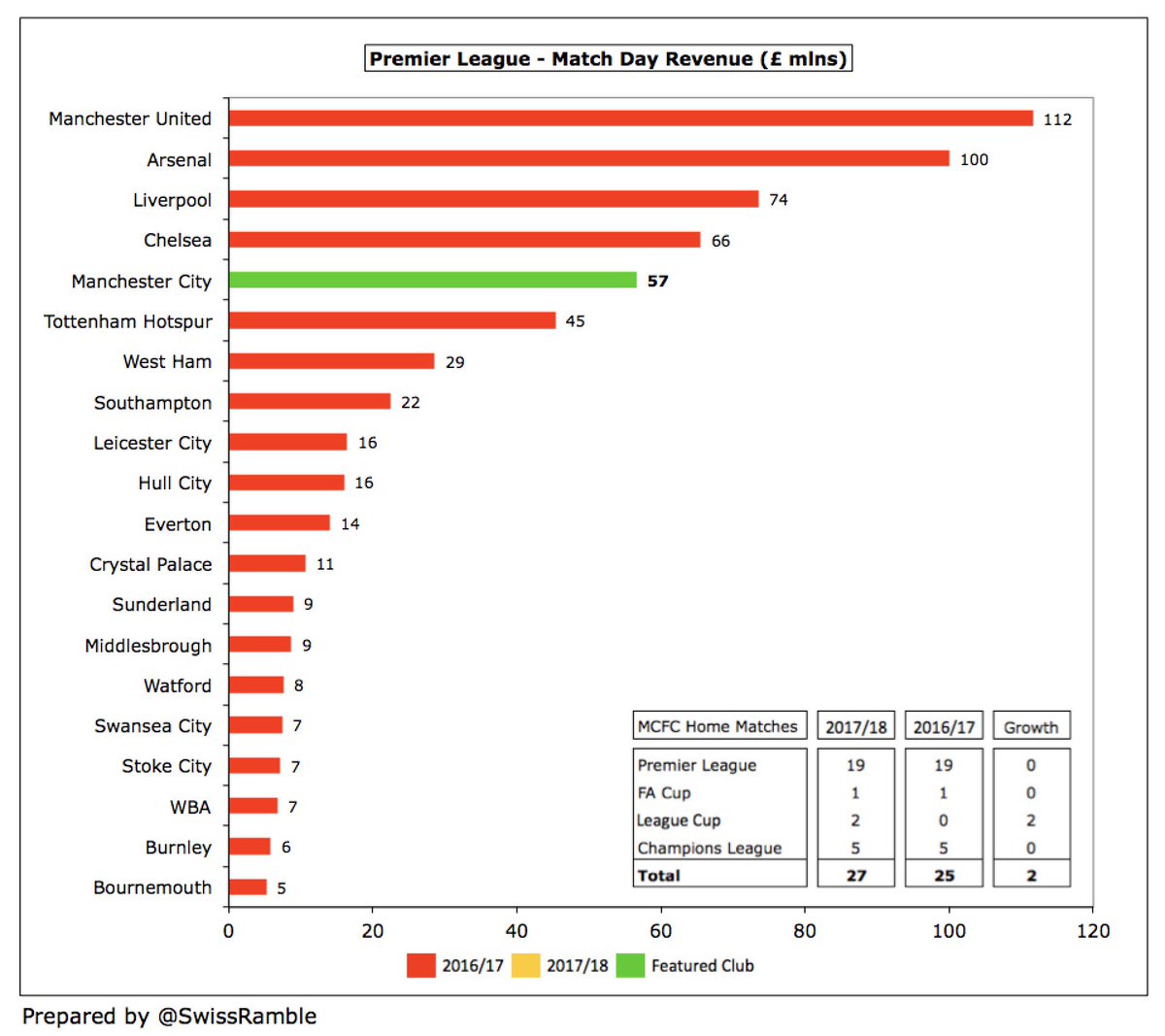

#MCFC match day income rose £5m (9%) from £52m to £57m, as they staged 2 more home games and had a Champions League quarter-final as opposed to a play-off. However, this was still only 5th highest in the Premier League, around half of #MUFC £112m.

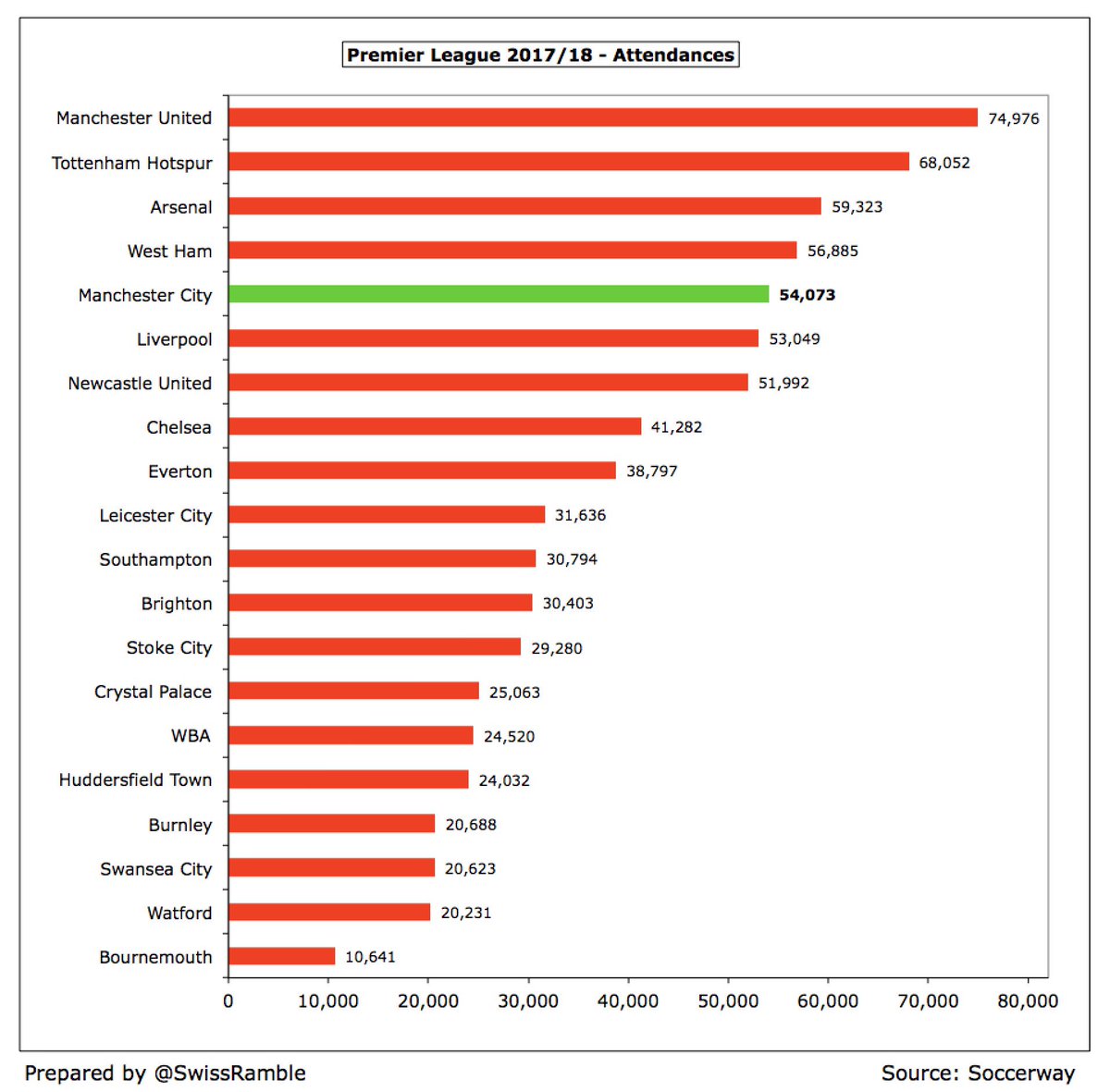

#MCFC average attendance was a record 54,073, though again the 5th highest in the Premier League, around 21,000 below their Manchester neighbours. Season ticket prices have increased by an average of 3% in 2018/19, though cheaper tickets and under-18s have been frozen.

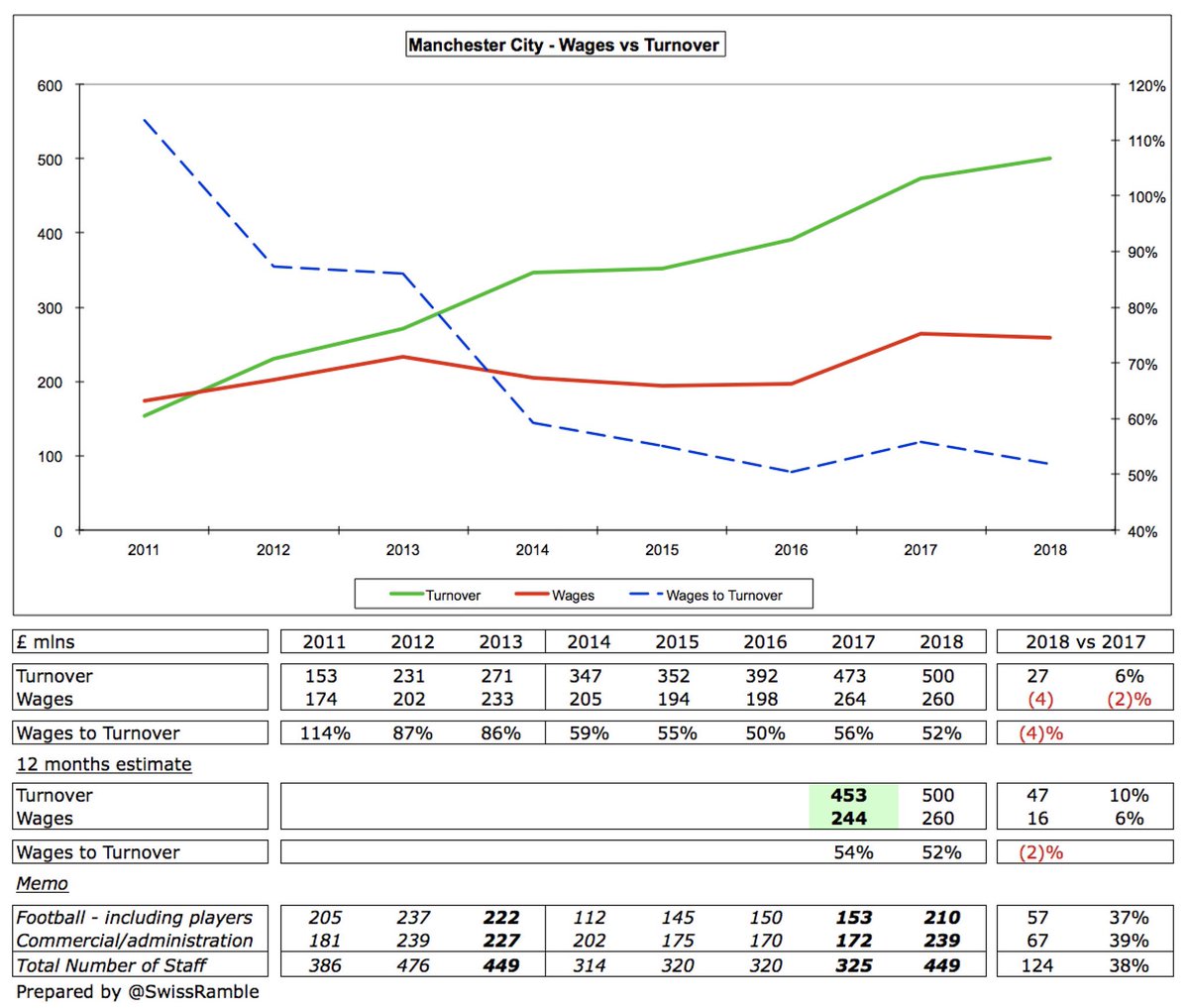

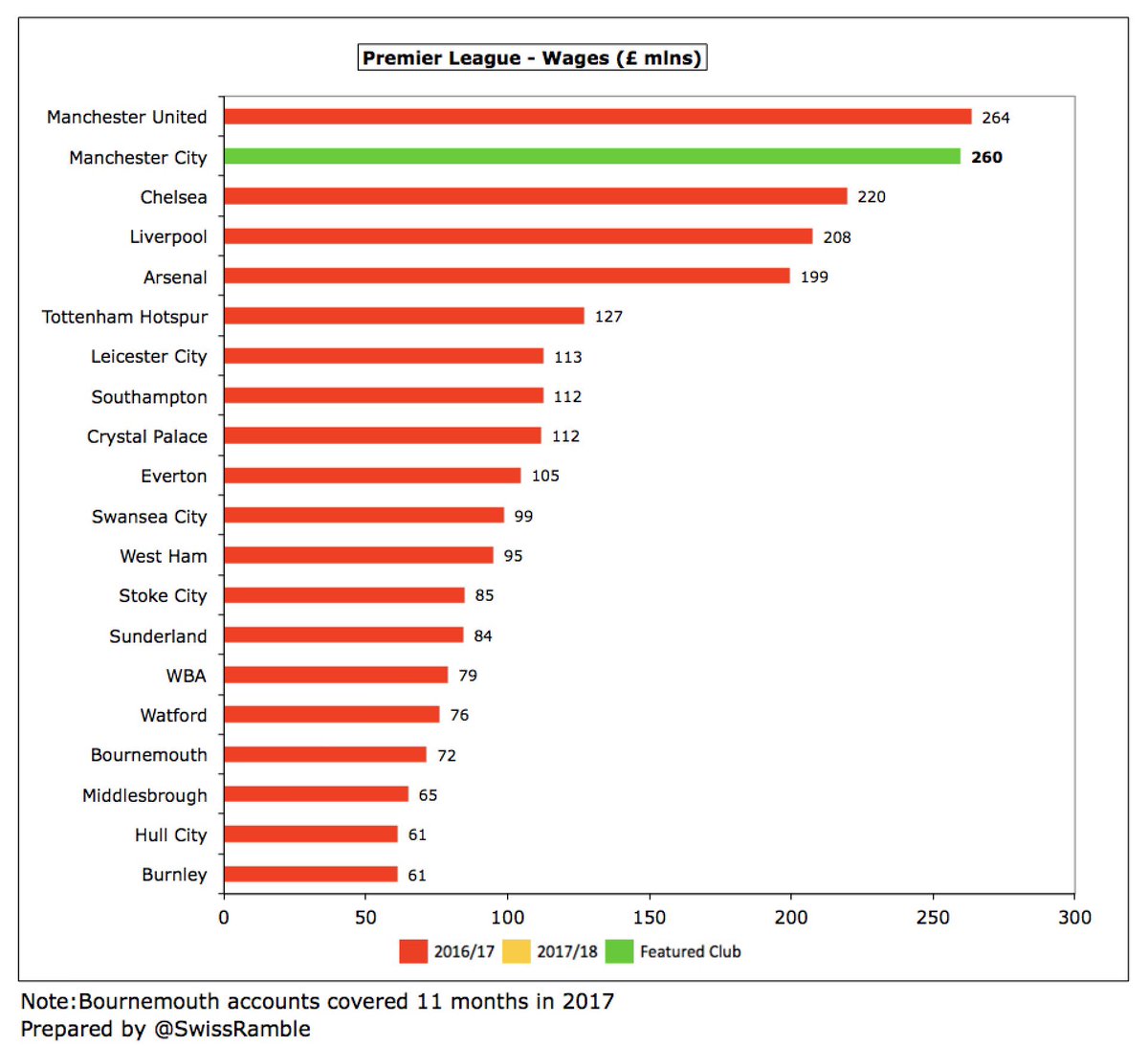

#MCFC reported wages fell £4m (2%) from £264m to £260m, but as 16/17 accounts covered 13 months, the real growth was £16m (6%) from £244m, due to trophy bonuses and higher headcount, up 124 from 335 to 449, maybe due to some staff coming back from other CFG entities.

#MCFC £260m wage bill is almost at the same level as #MUFC £264m, though this is expected to rise to £290-295m (based on United’s financials up to Q3). The last time that City’s wage bill was above United’s was 2013.

However, City’s £260m wages are a fair way above the other leading clubs: Chelsea £220m, Liverpool £208m, Arsenal £199m and Tottenham £127m (all 2016/17 figures).

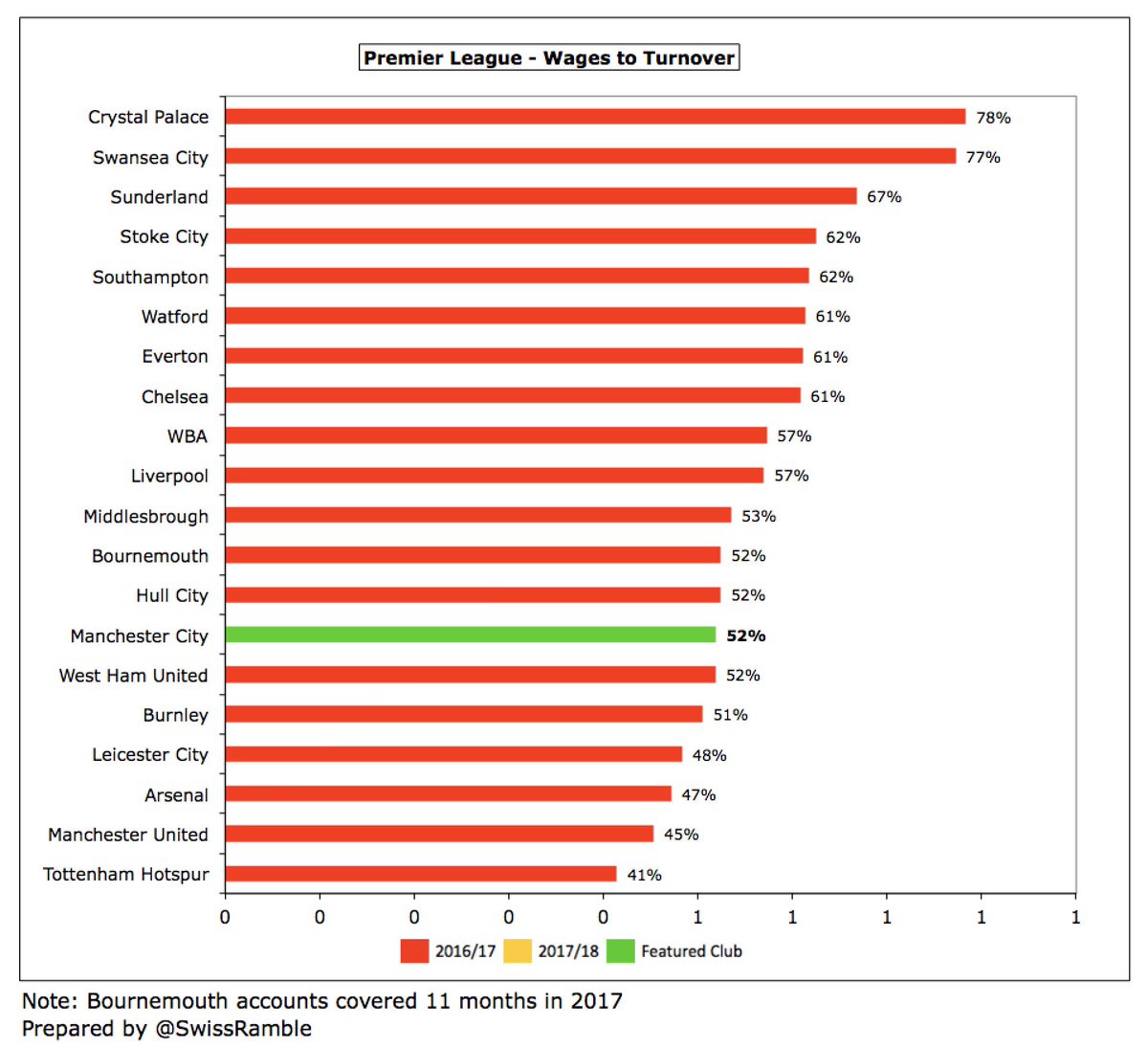

#MCFC wages to turnover ratio reduced from 56% to 52%, which is one of the lowest (best) in Premier League, though not as low as #THFC 41%, #MUFC 45% & #AFC 47%. This important ratio has significantly improved since the 114% reported in 2011, the year of the £197m loss.

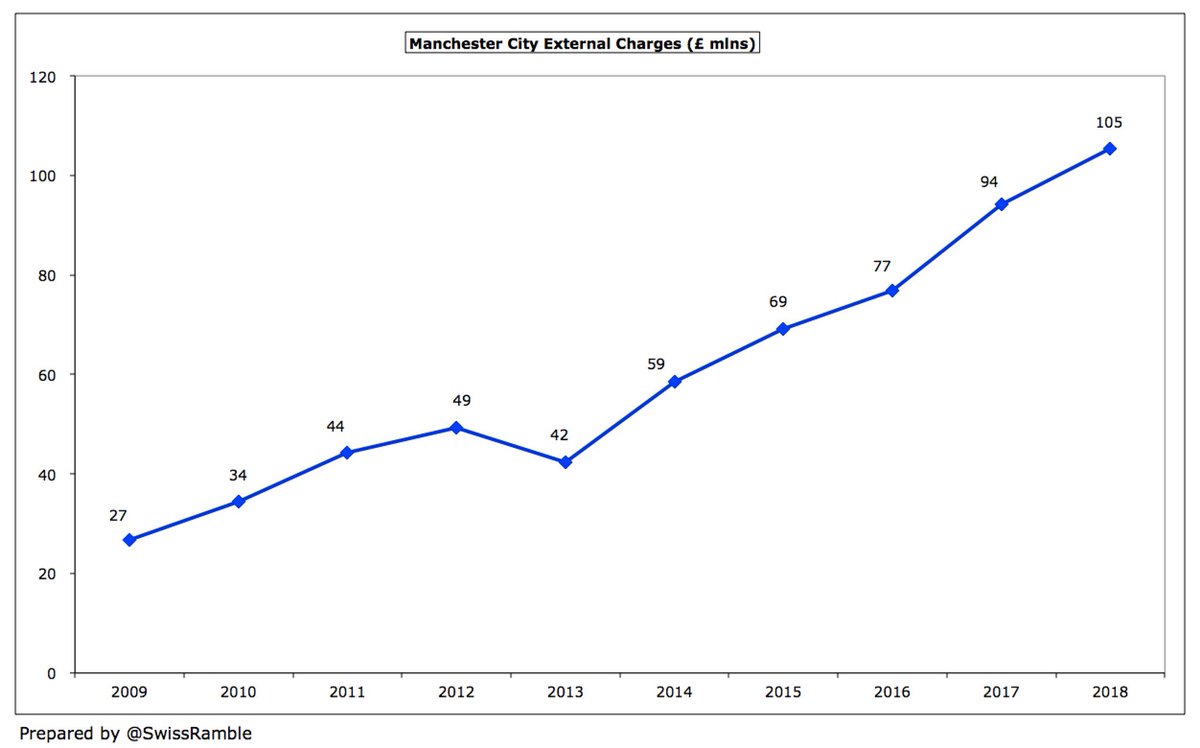

#MCFC have transferred some staff to other group companies, which then charge the club for services provided, which partly explains the large increase in external charges since 2013 from £42m to £105m.

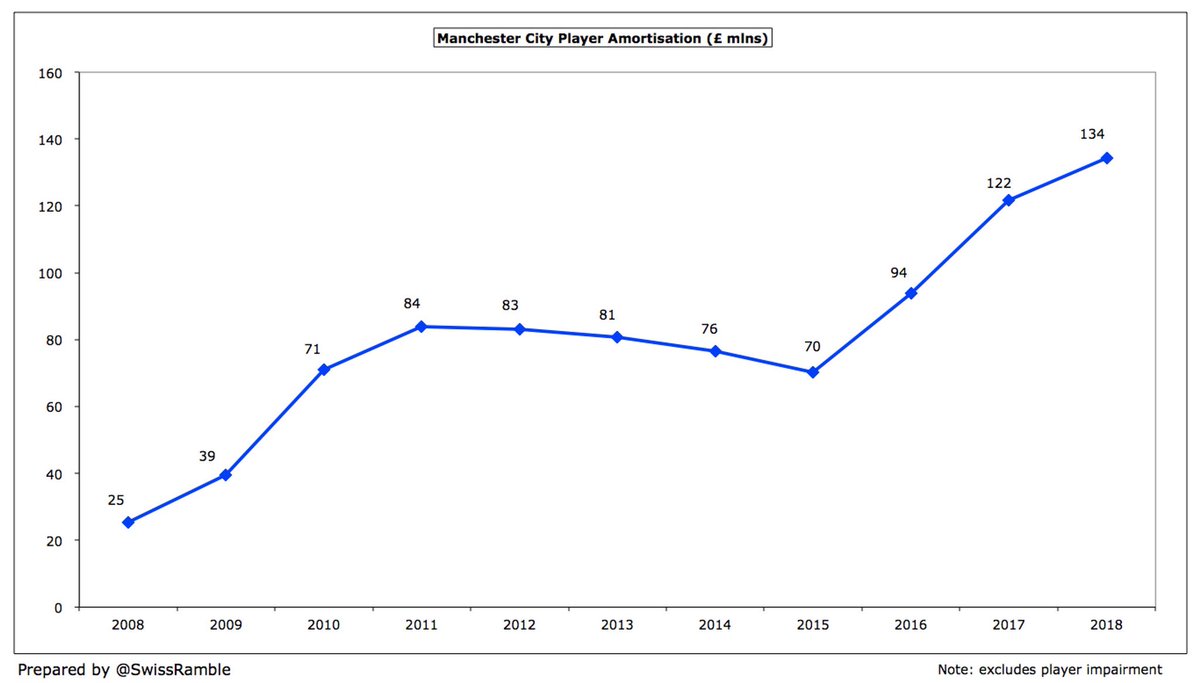

#MCFC player amortisation, the annual charge to expense transfer fees over the length of a player’s contract, continued to rise, up 10% (£12m) from £122m to £134m, reflecting further investment in the squad.

As a result, #MCFC player amortisation of £134m would have been the highest in the Premier League in 2016/17, though it is likely that #MUFC £124m will increase once they publish 2017/18 accounts. Both Manchester clubs are way ahead of #CFC £88m and #AFC £77m.

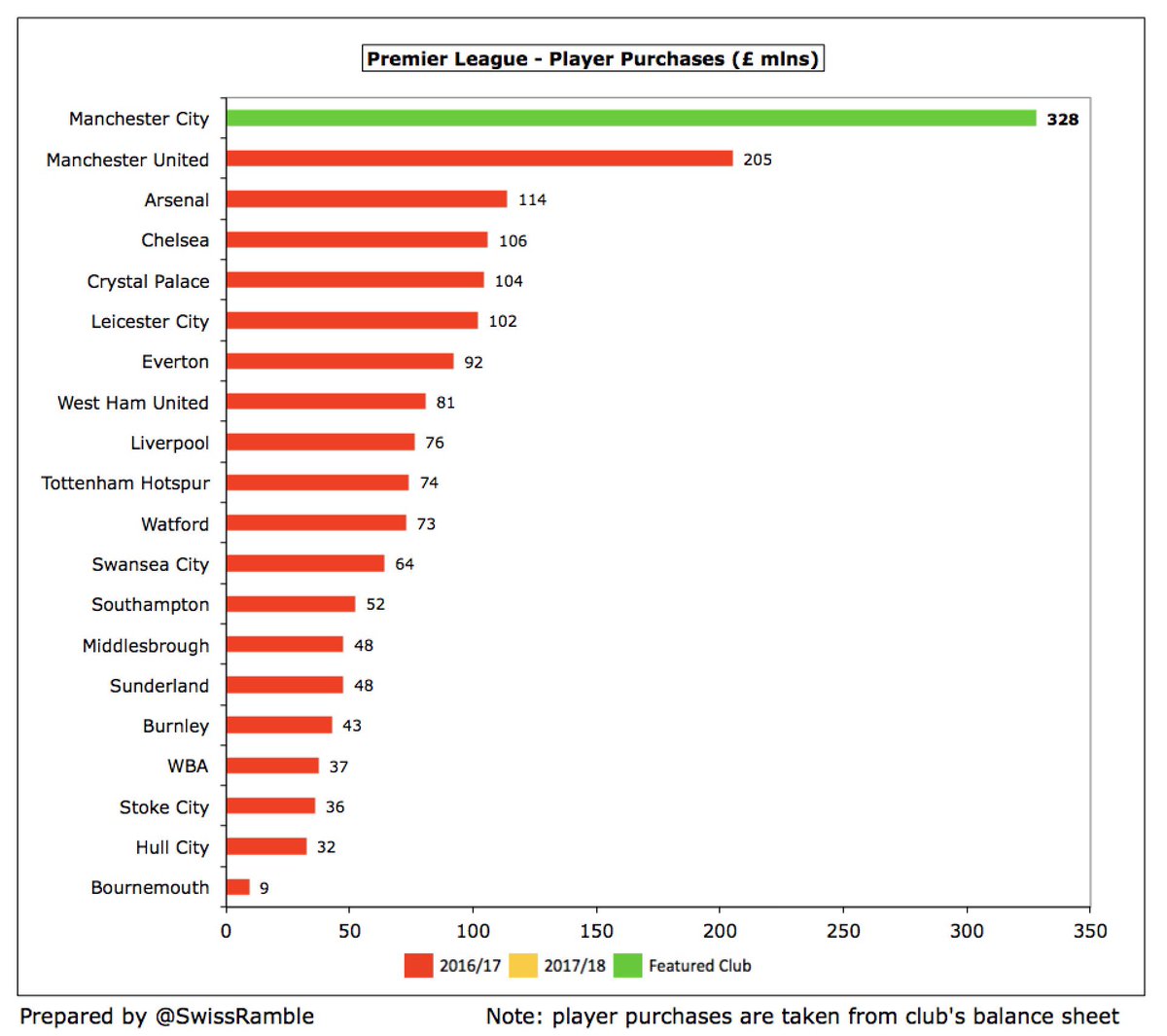

#MCFC had record player purchases of £328m in 17/18, including Laporte, Mendy, Walker, Bernardo Silva, Ederson & Danilo. To place this into context, the highest in 16/17 was #MUFC £205m and #AFC £114m. City’s £532m purchases in last 2 years almost twice previous 2 years £274m.

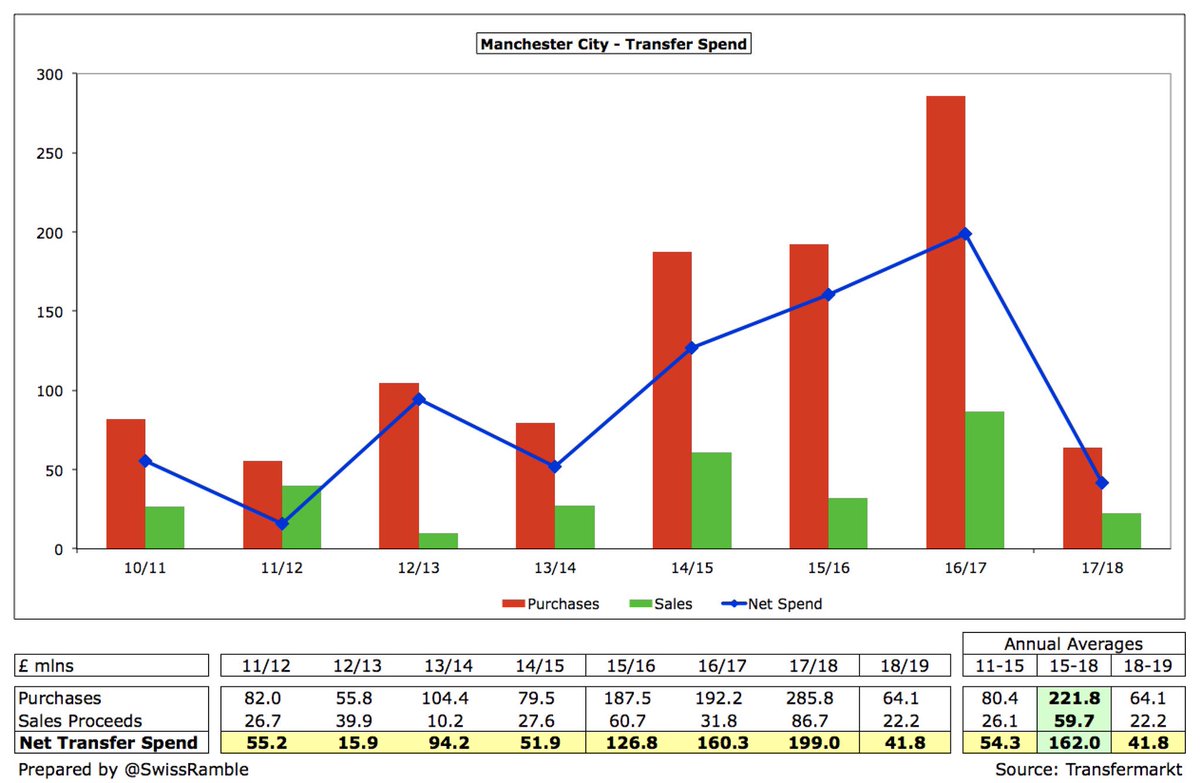

In contrast, #MCFC have relatively low net spend of £42m to date in 2018/19 (mainly Riyad Mahrez). This is in stark contrast to £162m annual average for preceding 3 years (purchases £222m, sales £60m) when City played catch up following UEFA transfer restrictions for FFP breach.

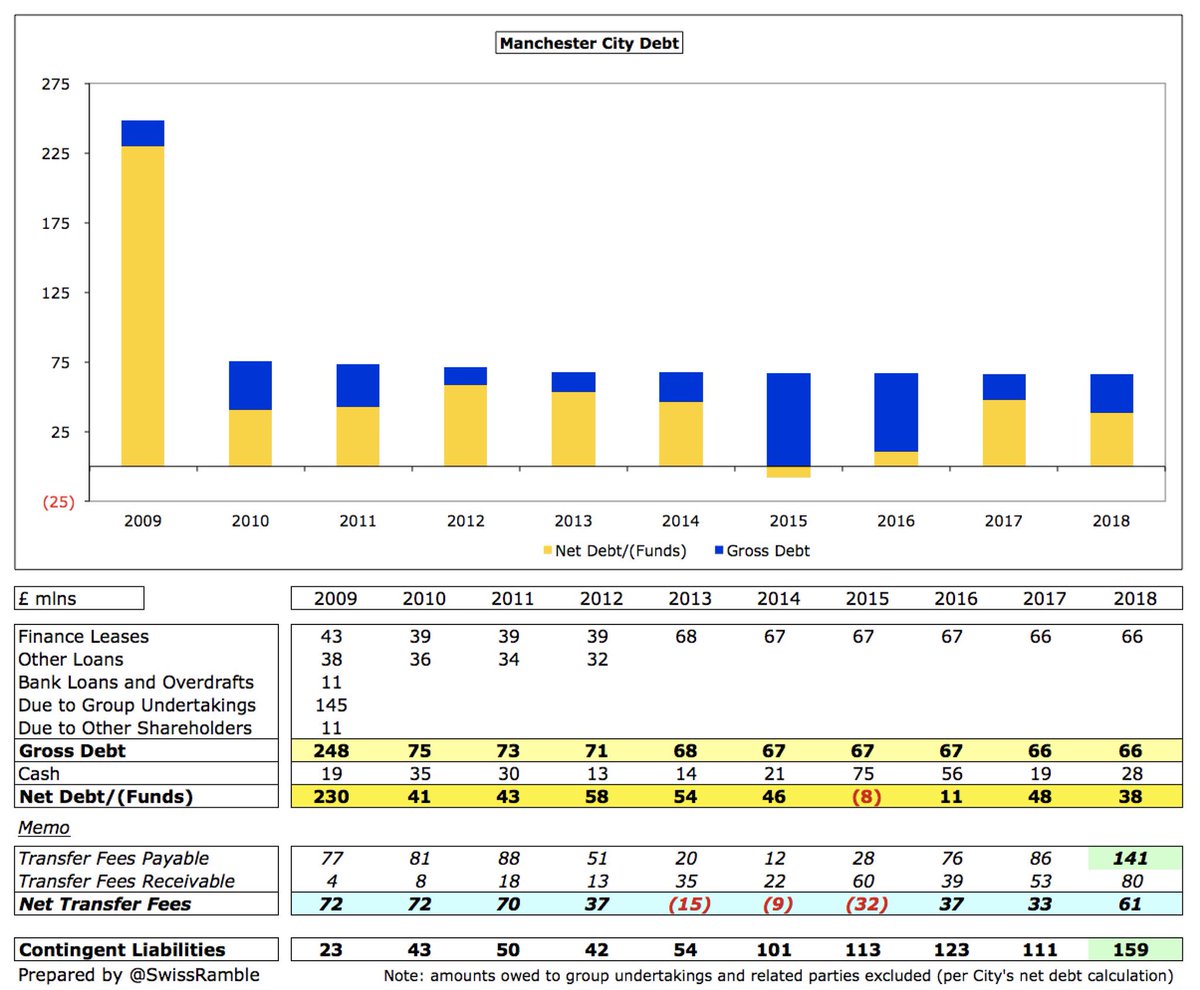

#MCFC have zero financial debt, but reported debt includes £66m leases on the Eitihad stadium. In addition, there is a hefty £141m payable on transfers (though other clubs owe City £80m), while there are huge £159m contingent liabilities (depending on appearances, trophies, etc).

#MCFC £66m gross debt is much smaller than #MUFC £503m (Glazers’ leveraged buy-out) and #AFC £227m (Emirates stadium loan). Worth noting that #CFC have around £1.2 bln debt in their holding company.

Similarly, #MCFC have relatively low annual interest payments of £3.5m, far below #MUFC £19.5m and #AFC £12.3m, as Mansour’s funding via additional share capital provides some competitive advantage.

Although #MCFC have become self-sufficient in the last few years, an additional £58m of share capital was issued in 2017/18, possibly to fund the transfer of Aymeric Laporte. To date, the owners have provided more than £1.3 bln of funding via new shares or loans.

Despite these impressive figures, #MCFC chairman Mubarak stated, “our journey is not complete and we have more targets to fulfil”, which chief executive Ferran Soriano specified as, “consistent domestic success and further development in the Champions League.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh