A blog in which I argue for the importance of acceptance in full by union and employer of the proposals of the Joint Expert Panel on #USS. Further remarks below on the graphed 65%-35% employer member split of contribution increases. 1/

Link: medium.com/@mikeotsuka/uc…

Link: medium.com/@mikeotsuka/uc…

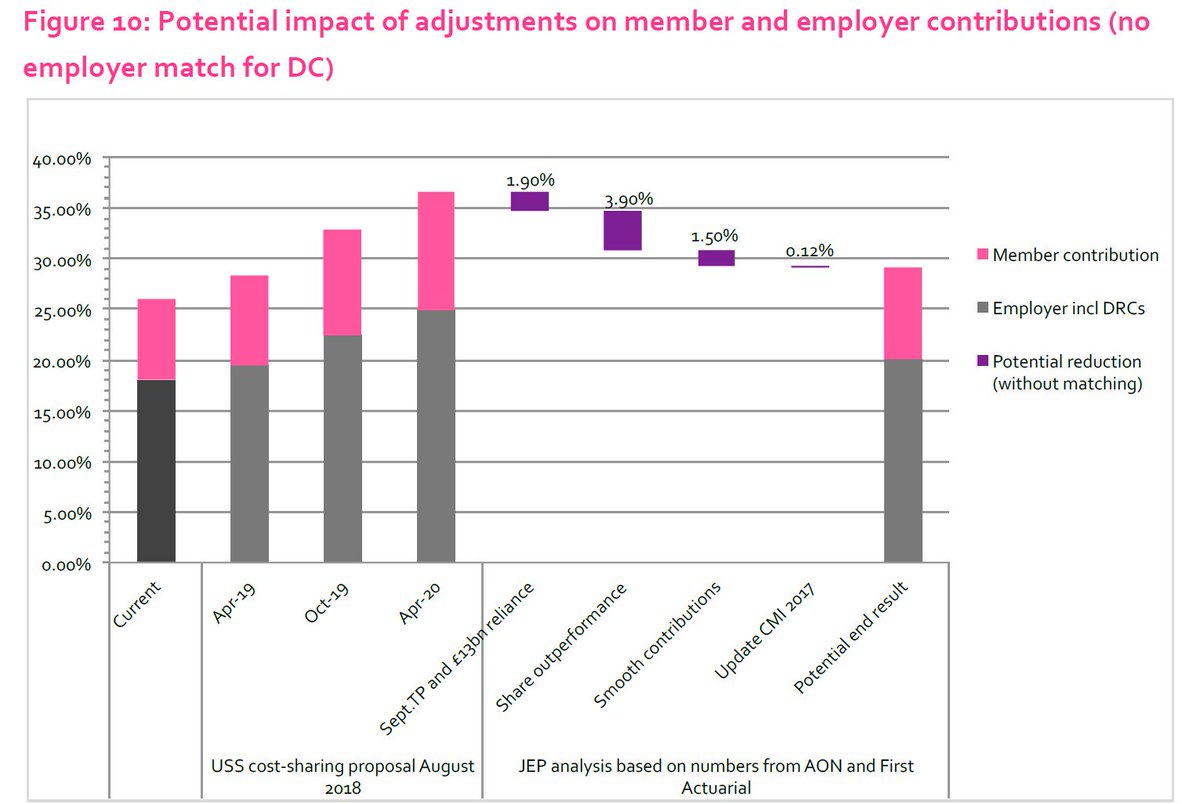

Some have questioned my claim that the 65%-35% employer-member split of the 3.2% contribution increase graphed above in the righthand column of Figure 10 of the report is among the JEP's proposals. 1/

Whether or not JEP ‘proposes’ this, they are offering a clear steer in the direction of a 65%-35% split. The JEP chair also says the following in the introduction: 2/

“On the basis of our analysis we have made a number of recommendations, the overall effect of which would be to reduce the valuation estimates of the future service cost and deficit to the point where the increase is small enough to allow the Joint Negotiating Committee..." 3/

"...to be able to reach an agreement so that the issues currently facing the Scheme can be resolved, recognising that compromise may be needed on all sides.” 4/

Some are urging @ucu to insist that contribution increases should fully be absorbed by employers. This would be to adopt an uncompromising position, in which members give away nothing. 5/

Moreover, this version of No Detriment is not @ucu policy. The union's current policy (HE6) goes further, in calling for no increase whatsoever in contributions, for employers as well as members. 6/

Adopting No Detriment would also be contrary to the April ballot of members, in which 64% voted to set up the Joint Expert Panel and even many who opposed made clear that this was not because they supported No Detriment, but rather because they supported 'revise & resubmit.' 7/

Given this clash with the April ballot, those who are pushing @ucu to adopt No Detriment should provide members with an answer to the following question: Would you be willing to put No Detriment to an electronic ballot of members now? 8/

More specifically, would you be willing to put the following question to members?: 9/

“Would you accept a settlement in which status quo benefits are preserved (except for the 1% DC match), at the cost of a 1.1% increase in member contributions accompanied by a 2.1% increase in employer contributions?..." 10/

"...Or would you reject any settlement in which employers do not absorb all 3.2% of the contribution increase?" 11/

👆Ask: Is your No Detriment stance something you're willing to put to a vote of the membership as a whole now? If not, why not? 12/12

The union's position will be settled in a special sector conference in Manchester on Wed 7 November. (See link for details.) Branches send delegates & motions that pass become binding @ucu policy. 1/

ucu.org.uk/hesc_nov2018

ucu.org.uk/hesc_nov2018

I anticipate that some branches will table motions that bind UCU negotiators to refuse to accept any member contribution increases. Any such motion should be amended so that it renders such binding conditional on member ratification of this policy by above-worded e-ballot. 2/

I anticipate that those who table these motions will resist such amendment, because they know they would lose a vote of the membership as a whole. Members should instruct their branch delegates to insist that members as a whole decide. 3/3

.@ucu spokesperson gets it exactly right: 1/

https://twitter.com/JosephineCumbo/status/1042017348302135296

Union negotiators must also be given space to "engage fully and constructively with the JEP’s proposals". Therefore, conference motions that bind negotiators to no detriment should be rejected. 2/2

A new short blog. What it says on the tin. Why No Detriment is now self-defeating:

medium.com/@mikeotsuka/wh…

medium.com/@mikeotsuka/wh…

• • •

Missing some Tweet in this thread? You can try to

force a refresh