Raised eyebrows over UCL Provost's email re stock market & #USS deficit. In addition to @Will_McDowall 👇see tweets by @vdiazucl @felicitycallard @UCL_UCU @USSbriefs. Thoughts below. 1/

https://twitter.com/Will_McDowall/status/1041694181331218432

Provost: "With the stock market performing more strongly in the months since the original valuation, the deficit is reduced and the cost of retaining a predominantly defined benefit scheme in the future is feasible". 2/

FACT CHECK: It's true that #USS maintains that the March 2018 deficit is £4 bn, which is £3.5 bn less than the £7.5 bn March 2017 deficit. It's also true that JEP recommendation to lower deficit recovery contributions from 6% to 2.1% appeals to asset outperformance in 2017-18. 3/

But appeal to asset outperformance plays only a small role in JEP's recommendation to lower DRCs from 6% to 2.1%. Moreover, stock market performance doesn't play a very large role in the reduction of the deficit. 4/

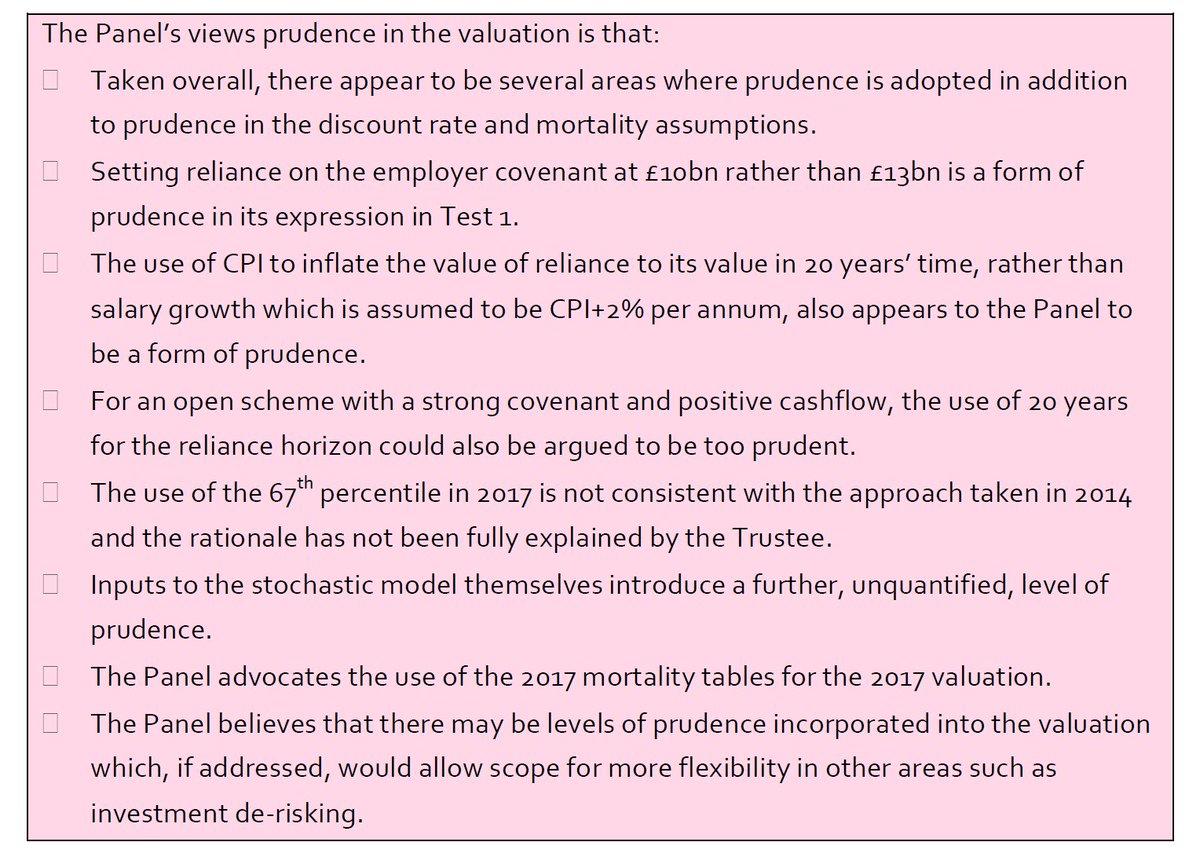

According to annex in JEP report, USS maintains that -£2.1 bn of the -£3.5 bn reduction in deficit arises from "Investment return in excess of assumed". But highlighted 👇indicates that stock market performance shouldn't be singled out as responsible for this outperformance. 5/

Since lowering of DRCs is just one JEP proposal among others & 2017-18 stock market plays only a marginal role in JEP proposal to lower DRCs, I think the Provost's email paints a pretty misleading picture. 6/

Another significant JEP proposal arises from higher employer risk appetite than UUK reported in their botched Sept 2017 consultation. UCL Provost's Finance Director was lead JNC negotiator for UUK back then & must have been instrumental in shaping UUK consultation response. 7/

Provost & his FD should be more up front with their staff. 8/8

• • •

Missing some Tweet in this thread? You can try to

force a refresh