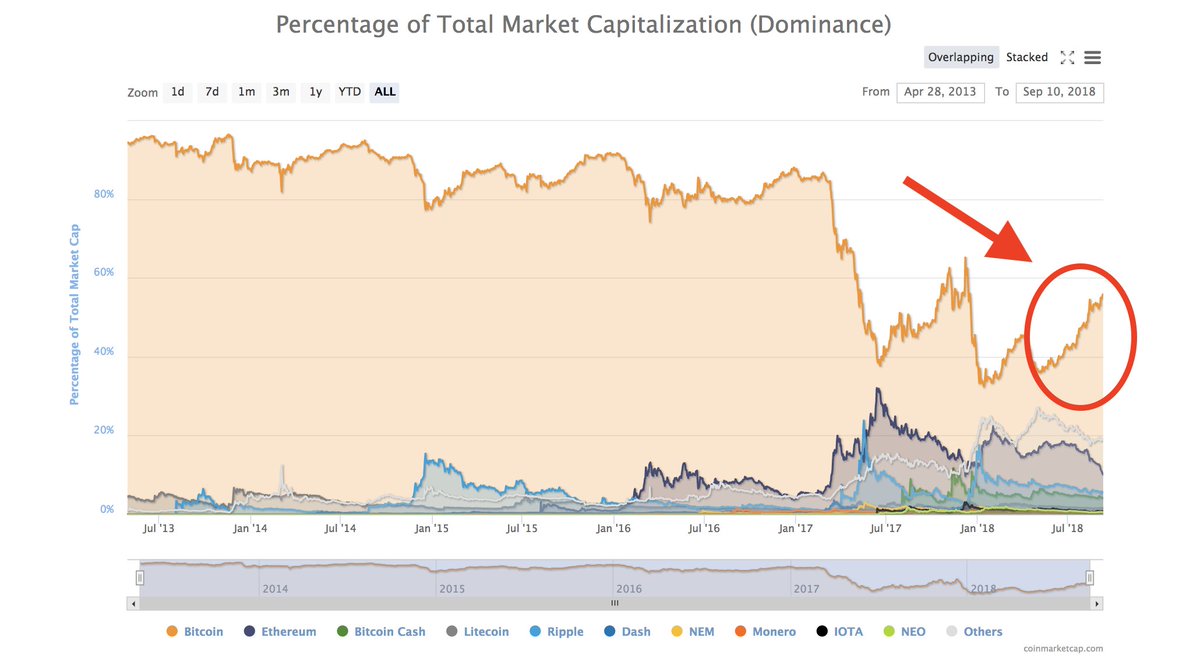

1/ @alexhevans recently dug into the numbers behind forks of #Bitcoin, #Ethereum, #Monero & #Zcash.

Main conclusion: Value can’t be forked away as easily as people like to think. placeholder.vc/blog/2018/9/17…

Main conclusion: Value can’t be forked away as easily as people like to think. placeholder.vc/blog/2018/9/17…

2/ Secondary conclusion: Despite parent #cryptonetworks retaining users, devs & value, the child forks trade at (puzzling) relative valuation premiums.

3/ To follow are graphs and conclusions from @alexhevans that are relevant to specific actors or ratios (if you're not a fan of long form writing 😉)

4/ User behavior after a fork: “the creation of a child chain does not appear to correlate with a decline in daily active users or transaction volume on the parent chain.”

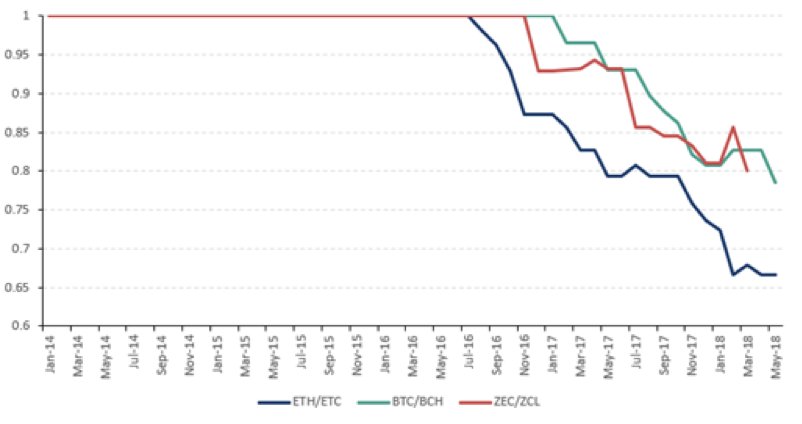

5/ “The loyalty of core developers to the original chain is striking, as the number of top 30 contributors from the original codebase that become exclusive contributors to the child is almost zero” (Graph = Sorensen Dice Coefficient)

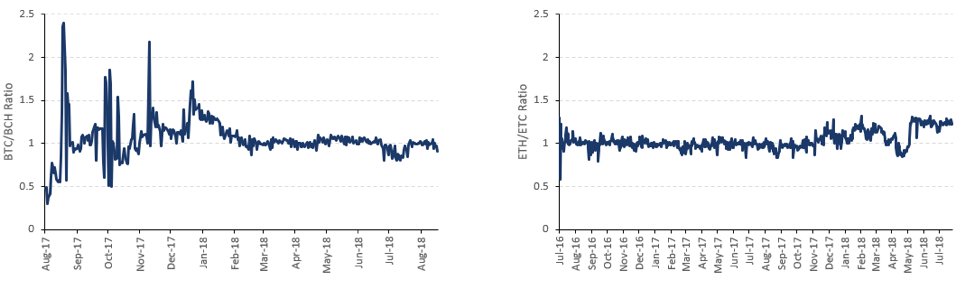

6/ Unsurprisingly, most miners are loyal to profit only, “exhibiting highly efficient economic behavior in exploiting opportunities across networks.” (Graph = relative profitability between parent & child chain)

7/ "It is often casually argued that network rents can be 'forked away,' with value flowing to a less rent-seeking fork. While we lack sufficient evidence to confidently reject this hypothesis, early evidence points against it." -@alexhevans

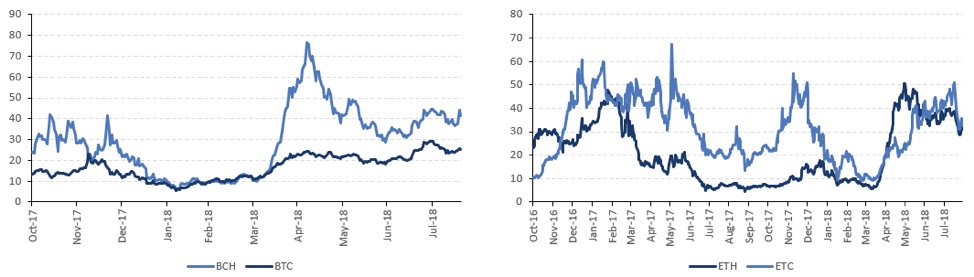

8/ Comparing NVT Ratios for #Bitcoin / #BitcoinCash & #Ethereum / $ETC reveals child chains often trade at a premium to the parent.

9/ Shoutout to @Kalichkin and his team @CryptolabCap for informal work we did together on relative valuation ratios of different #cryptonetworks a few months ago (but that never saw the light of day).

10/ Similar result for Network Value to Metcalfe’s law Ratio (NVM Ratio), as both $BCH and $ETC trade at premiums to $BTC and $ETH.

11/ Explanations for child chains being valued “more richly” than the parent:

1) More illiquid coins than parent

2) Insurance premium to parent meltdown

3) Assisted by "mental value anchoring" to parent

1) More illiquid coins than parent

2) Insurance premium to parent meltdown

3) Assisted by "mental value anchoring" to parent

• • •

Missing some Tweet in this thread? You can try to

force a refresh