.@UniversitiesUK has just published the consultation document on the JEP report that they've sent to employers. (Link.) Some 'live-tweeting' of my reactions as I read this document in real time. 1/

https://twitter.com/USSEmployers/status/1044262774812086272

I see that the pdf is protected in a manner that makes it impossible to cut and paste. Gratuitous and annoying. I'm now wasting time creating a cut-and-paste-able version. 2/

My efforts have been defeated. So I'm going to need to waste more time making and cropping screenshots. 3/

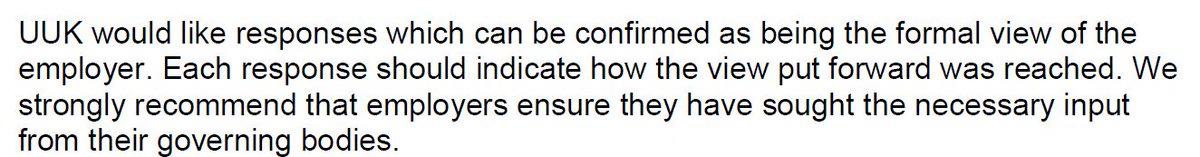

Remember the botched September consultation, in which various Oxbridge College bursars agreed a common line rejecting the level of risk that USS had proposed? Recall also that many of these bursars (or their masters or equivalent) submitted consultation responses w/o... 4/

...governing body approval? @UniversitiesUK also remembers this: 5/

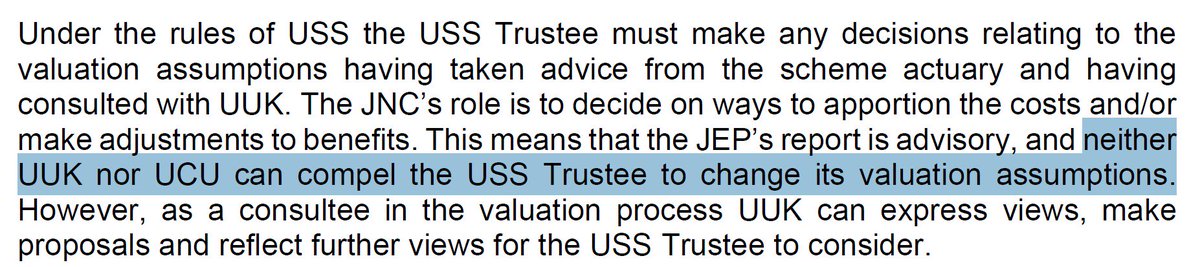

UUK's claim, here, that it cannot compel the USS trustee to adopt JEP's valuation assumptions ignores the fact that they have full power of appointment of 4 of the 12 trustees, whom they can remove and replace at any time. 6/

One UUK-appointed trustee is the VC of Bath, Dame Glynis Breakwell. Her university's response to the September consultation called for less risk than the trustee proposed in September! Especially since she has resigned in disgrace for her lack of judgement regarding her... 7/

absurdly bloated Bath VC salary and expenses, it would seem reasonable to replace her as trustee now with someone with greater credibility and more sensible judgement regarding the acceptable level of risk for a DB pension scheme. 8/

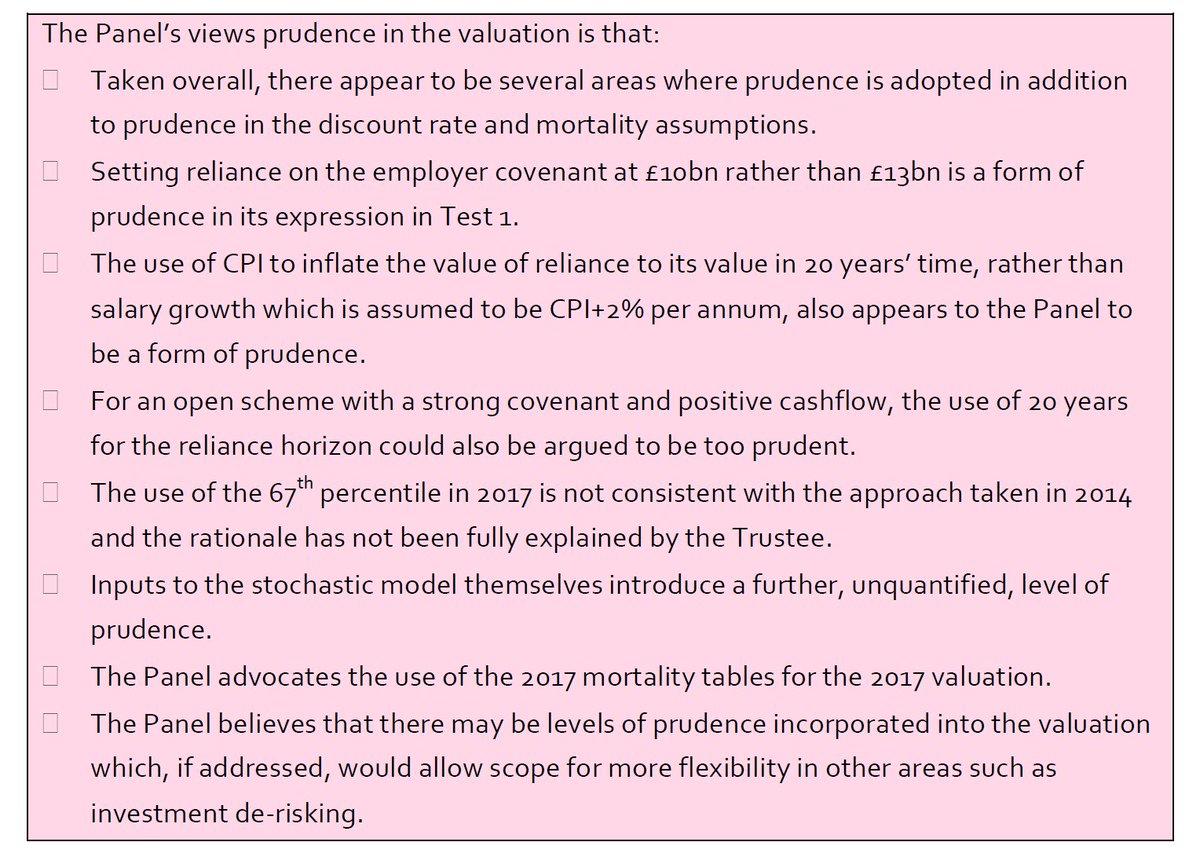

The highlighted is important. £13 bn was USS's upper limit in September, given the responses of employers to an earlier consultation in February. See this blog post of mine from July, in which I say more about the importance of February. 9/

medium.com/@mikeotsuka/uu…

medium.com/@mikeotsuka/uu…

On the p. 10 summary of JEP's recommendation re employer risk appetite, UUK does not offer any recommendation of its own. This led me to conclude that they were now taking a more neutral, rather than steering, role in this consultation, in contrast to Sept leading questions. 10/

But their p. 10 summary of the next recommendation, re lowering of deficit recovery contributions (DRCs) quickly disabuses me of the notion that UUK is now being more hands off. There is this surprisingly overt steer from above on behalf of lowering DRC from 6% back to 2.1%. 11/

When it comes to JEP's next recommendation--that the cost of future service be smoothed over 6 years--UUK once again takes a hands off approach. 12/

But it returns to providing a steer, when it comes to the last recommendation to update the valuation with the most recent mortality figures. 13/

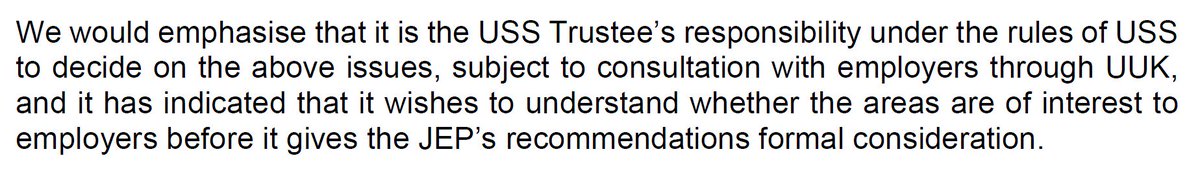

The following is an interesting piece of news to me: USS has indicated to UUK that employers must express an interest (presumably via this consultation) in a given JEP recommendation before they will engage with it. 14/

👆It is suggested that this has to do w/ the lack of formal standing of JEP in USS's governance structure. 15/

Here (see paragraphs leading up) UUK is blaming tPR's September intervention for at least some of the employer skittishness regarding the level of risk USS proposed in September. 16/

Here, though in somewhat muted terms, UUK indicates that it shares some of JEP's fundamental reservations regarding Test 1. 17/

On the last page of their document, UUK takes a somewhat more positive stance regarding smoothing the cost of contributions for future service over 6 years. 18/

My bottom line impression: This strikes me as an accurate, balanced, clear, and realistic consultation document. 19/

I suspect that others will, however, insist that this or that passage reveals the document to be the work of the devil. They will also complain that the document fails to acknowledge past UUK perfidy and malfeasance, both real and imagined. 20/20

Further thoughts re how UUK is positioning itself w/r/to JEP's recommendations. The following strikes me as a good and useful statement of the remit of the JEP, regarding benefit and contribution levels. The inclusion of the italicised from the terms of reference is helpful. 1/

Predictably, UUK expresses an interest in keeping contributions down. It states that it has a strong desire to pre-empt the October Rule 76 second increase. It also reminds that 19.3% March ACAS employer contribution level was the previously expressed maximum. 2/

👆UUK speaks of financial risk to sector of higher employer contributions. This is along lines of an interesting passage elsewhere, where UUK says that "de-risking" the pension fund exposes employers to the different risk of unaffordably & unsustainably high DB contributions. 3/

The combination of the two passages quoted above suggests to me that UUK would like to propose a reduction to 1/80 DB accrual as broadly "comparable" to the current 1/75 provision, while also keeping contributions at an "affordable" 19.3%. 4/

In addition to being bad on the merits, a push for a reduction of DB benefits from 1/75 to 1/80 might plausibly be regarded as contrary to the spirit, if not the letter, of JEP's report. 5/

Moving to 1/80 would involve a rejection of JEP's prominently modelled solution involving retention of the 1/75 DB status quo via a 1.1% increase in member and a 2.1% increase in employer contributions, assuming application of 35%/65% cost-sharing. 6/

It would be good for UCU to be able to apply pressure on UUK to embrace JEP's modelled solution, rather than watering down DB accrual. 7/

But UCU will undermine their ability to do so, if they insist, as some in the union are advocating, on a rejection of the modelled 35:65 cost-share, and splitting 0%-3.2% rather than 1.1%-2.1% member-employer. 8/

See also this blog: 10/10

medium.com/@mikeotsuka/uc…

medium.com/@mikeotsuka/uc…

👆The 'highlighted' refers to what's highlighted in this screenshot👇, which I didn't manage to attach to the above tweet.

Tagging @AlistairJarvis into the above thread, w/ special emphasis the above tweet which I embed here👇. 1/

https://twitter.com/MikeOtsuka/status/1044273946055626753

Given the importance of this issue, I reproduce the relevant portion of this linked document. 2/

Link: uss.co.uk/~/media/docume…

Link: uss.co.uk/~/media/docume…

In full conformity with #USS's articles of association, it's time for @UniversitiesUK & @ucu to take back control of their pension scheme, in order to allow for FULL implementation of the JEP recommendations. 3/

UCU & UUK should enter into agreement to remove their trustees who try to block implementation of the JEP recommendations and replace them w/ trustees who will better serve the interests of scheme members & employers, by implementing JEP recommendations in full. 4/

The UUK & UCU trustees should also take steps to rectify the absurd imbalance of the perspectives of the independent trustees. See this tweet and the ones below it: 5/

https://twitter.com/MikeOtsuka/status/1040510445000552448

Since UUK & UCU together have a controlling majority of the governing body of #USS, @UniversitiesUK's "Not me, guv" proclamation here 👇doesn't cut it. Must do better, on behalf of scheme members. 6/6

https://twitter.com/MikeOtsuka/status/1044273946055626753

UPDATE: Dame Glynis is no longer a trustee! Former UUK JNC member Will Spinks is her replacement, but it's not clear we should welcome his appointment, insofar as implementation of JEP is concerned. See this tweet from @Sam_Marsh101 & my replies below:

https://twitter.com/Sam_Marsh101/status/1044500862087901184

• • •

Missing some Tweet in this thread? You can try to

force a refresh