Outstanding talk by @nic__carter at @hodlhodl's #hb2018.

Some highlights... Quoted text are from Nic's talk, the rest is my commentary.

"Container ships, not parcels."

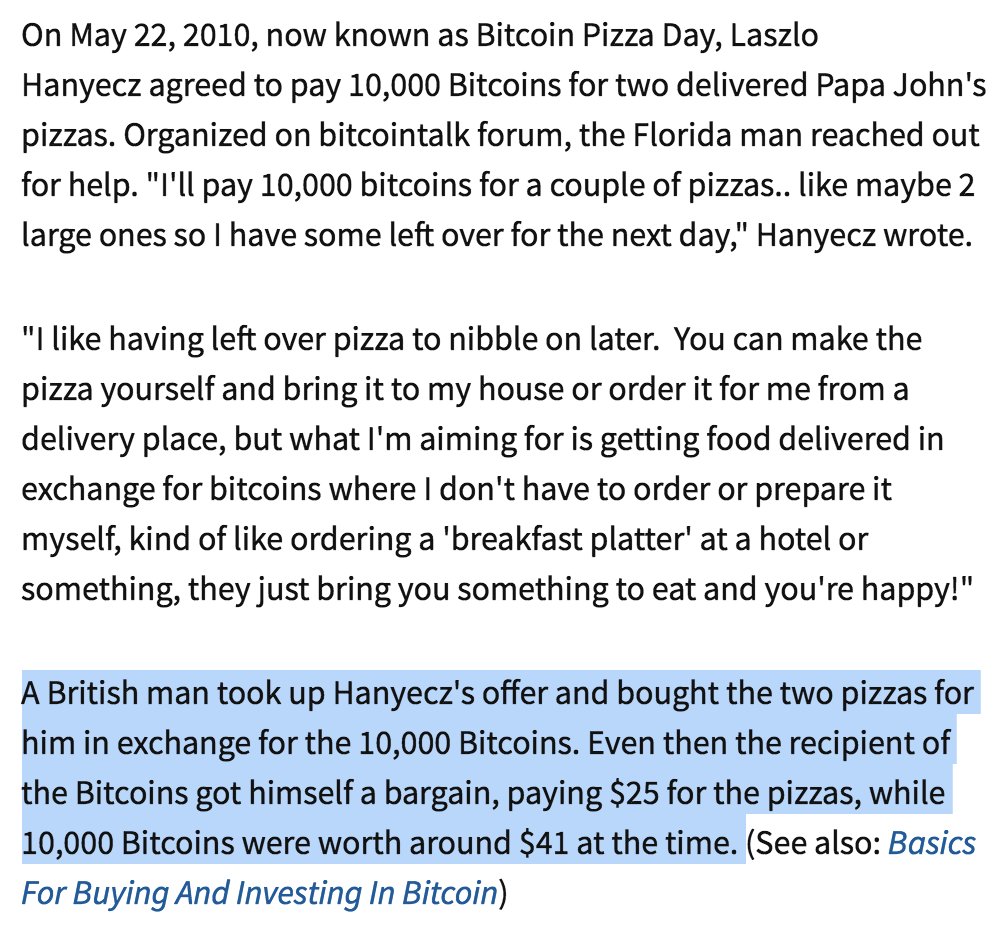

"Bitcoin - $3k avg transaction"

Credit cards (2012 figures):

Visa - $91

Mastercard - $92

Amex - $150

Some highlights... Quoted text are from Nic's talk, the rest is my commentary.

"Container ships, not parcels."

"Bitcoin - $3k avg transaction"

Credit cards (2012 figures):

Visa - $91

Mastercard - $92

Amex - $150

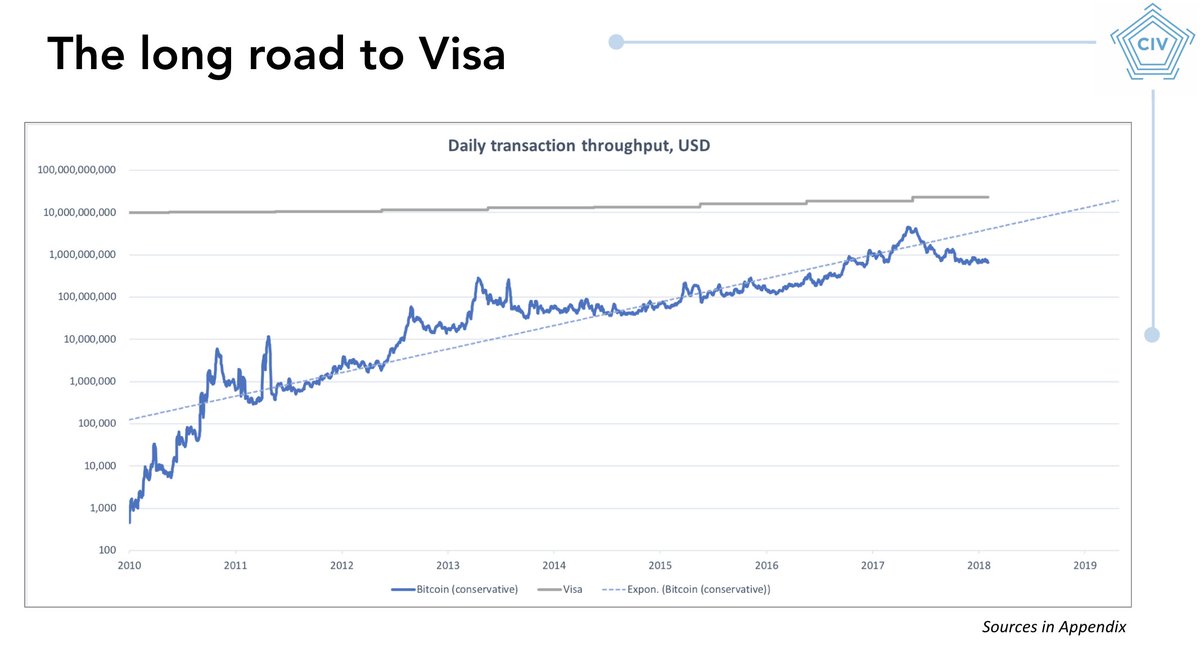

"We are within an order of magnitude away from Visanet throughput."

@blockchain's estimates are shown here, which I agree are conservative. I would guess we are within 3 years away for exceeding Visanet volume throughput.

@blockchain's estimates are shown here, which I agree are conservative. I would guess we are within 3 years away for exceeding Visanet volume throughput.

"Bitcoin volumes in context"

"Bitcoin just recently surpassed Gold OTC settlement markets"

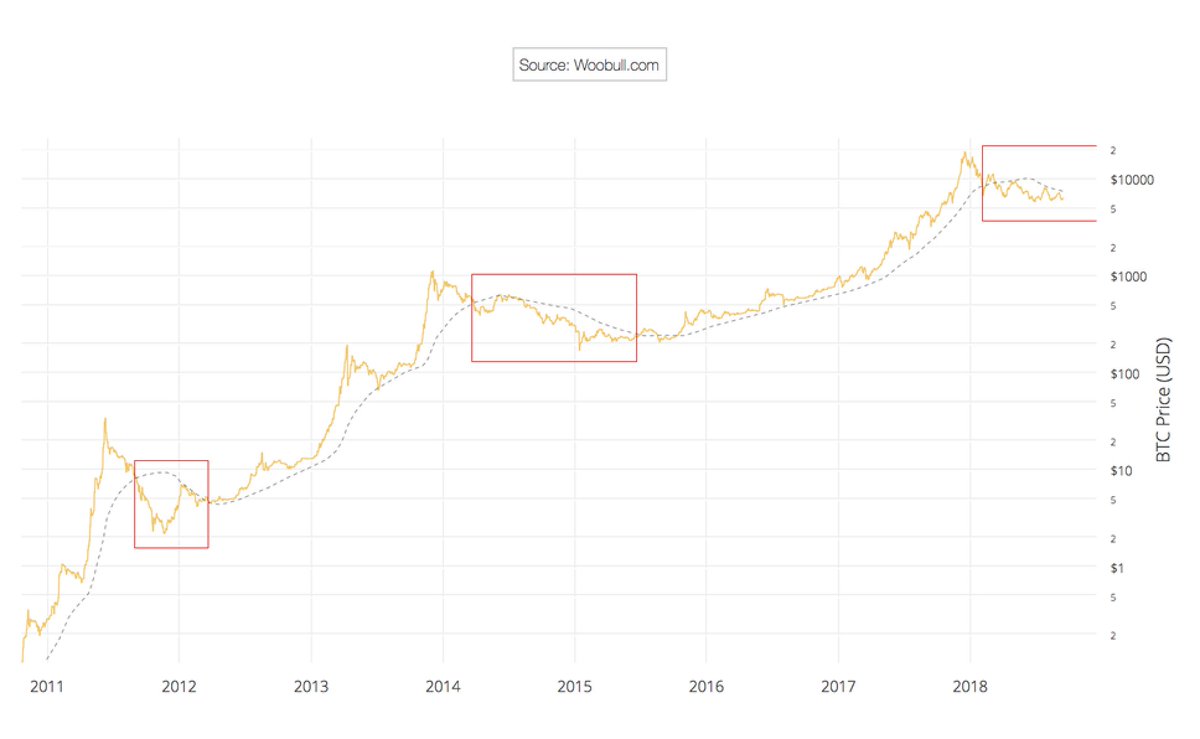

One of these lines is not like the others :). Bitcoin is still in its earlier stage of the adoption S-curve. Best estimates is 1%-3% of world population.

"Bitcoin just recently surpassed Gold OTC settlement markets"

One of these lines is not like the others :). Bitcoin is still in its earlier stage of the adoption S-curve. Best estimates is 1%-3% of world population.

"Market cap is an extremely inferior metric, does it make sense to count permanently lost coins in market-cap?"

This chart shows the breakdown in coins from when they last moved. Here you can see visibly the coins that aren't moving, between 2m-4m coins.

This chart shows the breakdown in coins from when they last moved. Here you can see visibly the coins that aren't moving, between 2m-4m coins.

"Inflows of capital into Bitcoin"

"Thermocap"

Capital flows do not come in via exchanges. This is because sells match buys, money in = money out. Thus the true inflows into Bitcoin is the aggregate of mining resources spent. @nic__carter's chart is exactly this capital input.

"Thermocap"

Capital flows do not come in via exchanges. This is because sells match buys, money in = money out. Thus the true inflows into Bitcoin is the aggregate of mining resources spent. @nic__carter's chart is exactly this capital input.

"Realized Cap: Aggregating UXTOs at the price they last moved"

Summing the value of coins by the value at which they last moved has an effect of de-emphasising older, and more probably lost coins from Bitcoin's Network Value. I really like this metric.

Summing the value of coins by the value at which they last moved has an effect of de-emphasising older, and more probably lost coins from Bitcoin's Network Value. I really like this metric.

"Bitcoin Realised Cap $88b vs Market cap $115b"

"The criticism of Realised Cap is that there are some long term holders who do intend to sell their coins, they are not lost"

"It's a rough metric"

... but a great better than Market Cap IMO.

"The criticism of Realised Cap is that there are some long term holders who do intend to sell their coins, they are not lost"

"It's a rough metric"

... but a great better than Market Cap IMO.

Contributions to Realised Cap by age. @nic__carter skipped this slide, but I'll comment.

Only a third of Realised Cap is from HODLs 4 years or less.

The significance of older coins, even with Realised Cap is high, Market Cap serves to exaggerate the importance of these coins.

Only a third of Realised Cap is from HODLs 4 years or less.

The significance of older coins, even with Realised Cap is high, Market Cap serves to exaggerate the importance of these coins.

"case studies with Realised Cap"

Interesting to see in both cases, BCH and BCP (forks of BTC with claimable coins) that the market seems to be pricing in the unclaimed coins.

This would be an alternative argument validating Market Cap. Having both is useful to investors.

Interesting to see in both cases, BCH and BCP (forks of BTC with claimable coins) that the market seems to be pricing in the unclaimed coins.

This would be an alternative argument validating Market Cap. Having both is useful to investors.

"Throughput is mainly to and from exchanges"

"Some people say Bitcoin is only for speculation"

"I say Bitcoin is an efficient clearing house of value"

Exchanges account for 40% of all transactions on the Bitcoin Network, and holding 18% of the network value.

"Some people say Bitcoin is only for speculation"

"I say Bitcoin is an efficient clearing house of value"

Exchanges account for 40% of all transactions on the Bitcoin Network, and holding 18% of the network value.

"Stewardship of the network"

"Exchanges who did not implement Segwit are acting irressponsibly"

"Bitcoin activism in respect to these intermediaries is tremendously important"

"Exchanges who did not implement Segwit are acting irressponsibly"

"Bitcoin activism in respect to these intermediaries is tremendously important"

Full talk here:

Slides:

docdroid.net/FbgH1WS/bitcoi…

Big thanks to @nic__carter for his enlightening charts and analysis.

Slides:

docdroid.net/FbgH1WS/bitcoi…

Big thanks to @nic__carter for his enlightening charts and analysis.

• • •

Missing some Tweet in this thread? You can try to

force a refresh