Manchester United are the second Premier League club after #MCFC to publish 2017/18 financial results, covering a season when they were runners-up in the league and FA Cup, but were eliminated by Sevilla in the Champions League last 16. Some thoughts in the following thread #MUFC

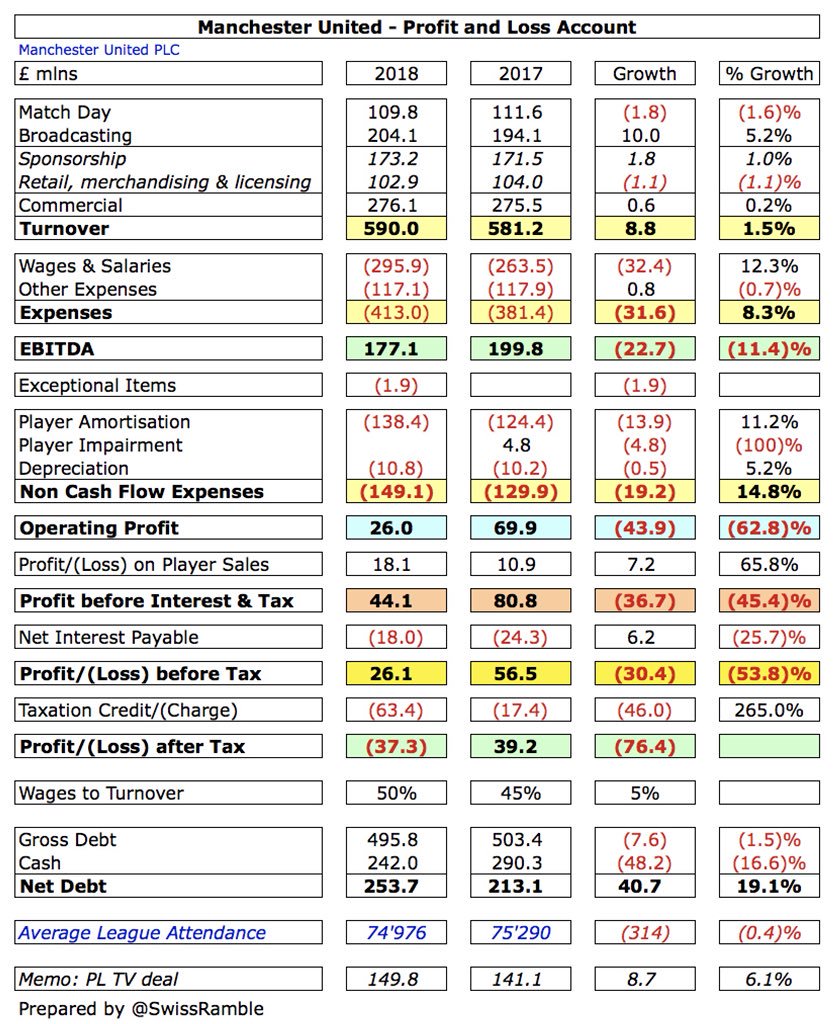

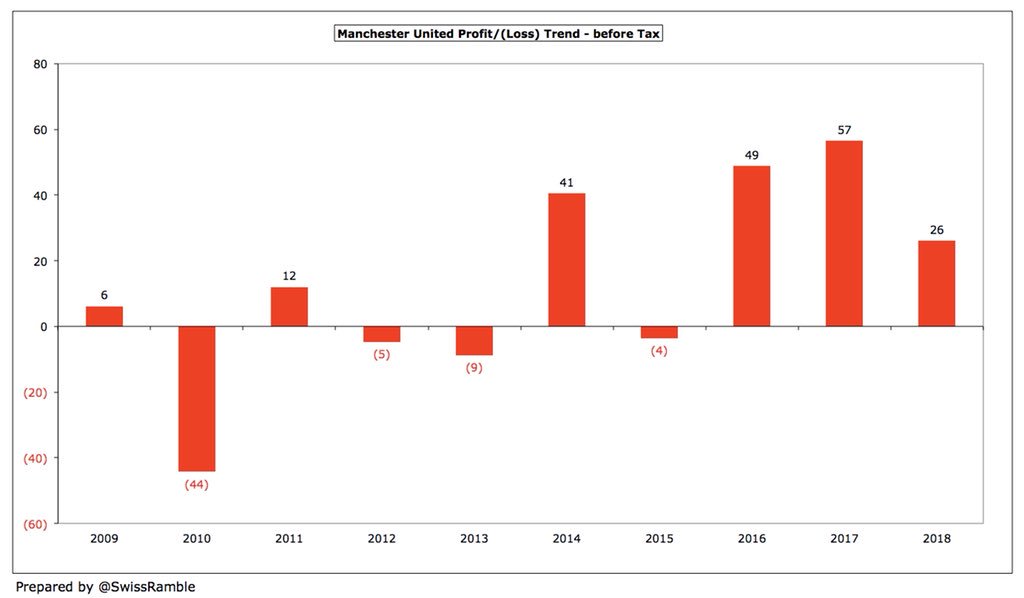

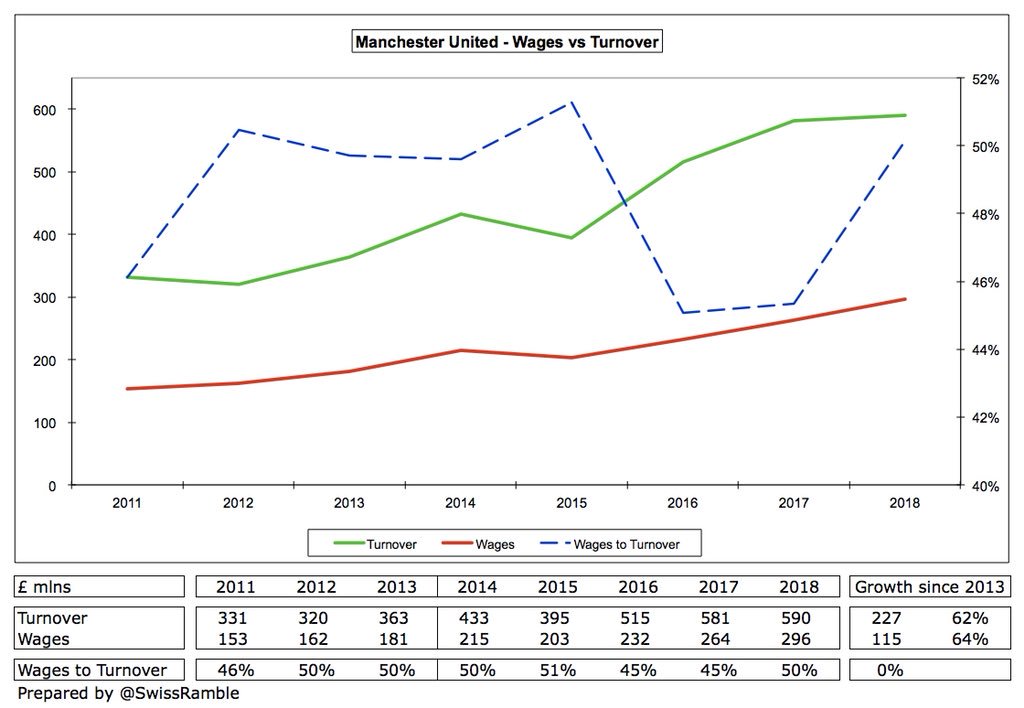

#MUFC profit before tax down from £57m to £26m, mainly due to higher player costs, as wage bill shot up £32m and player amortisation rose £14m, while revenue only up £9m. Tax bill increased from £17m to £63m as a change in US corporate tax rate led to a £49m non-cash write-off.

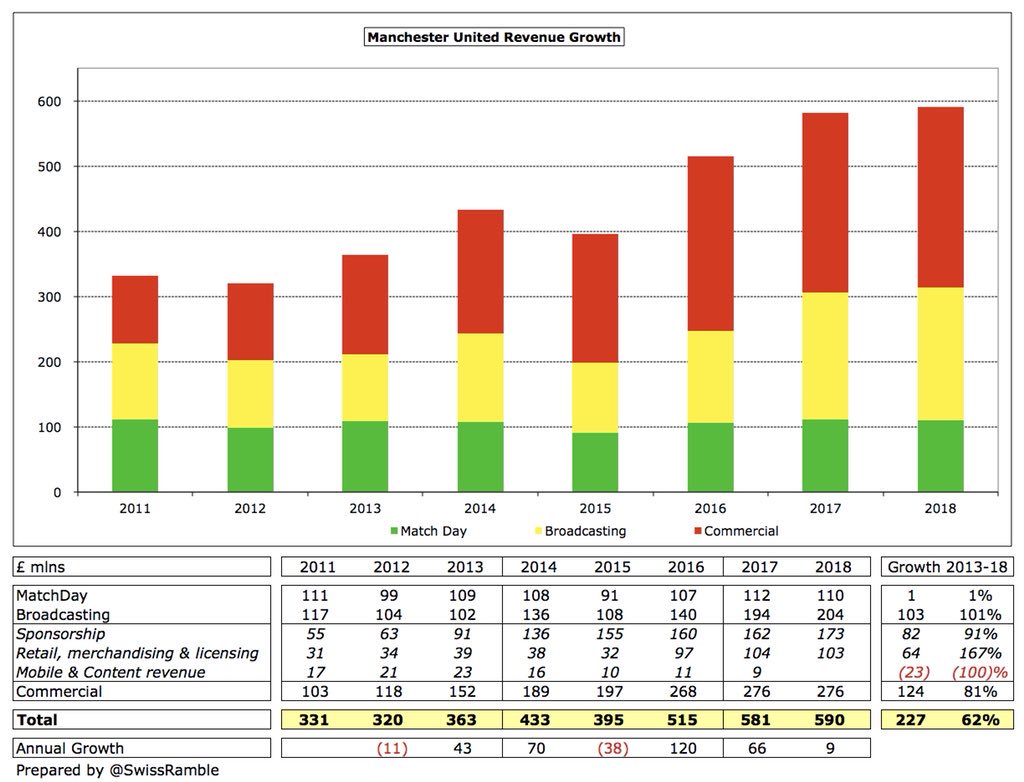

#MUFC revenue only grew £9m (2%). Only meaningful increase was broadcasting, up £10m (5%) to £204m. Commercial income was basically flat at £276m, while match day dropped £2m (2%) to £110m. Profit on player sales rose £7m to £18m.

#MUFC wage bill climbed £32m (12%) to a Premier League high of £296m, while player amortisation increased £14m (11%) to £138m. Other expenses were slightly down at £117m, but net finance costs were £6m (26%) lower at £18m (due to unrealised foreign exchange gains).

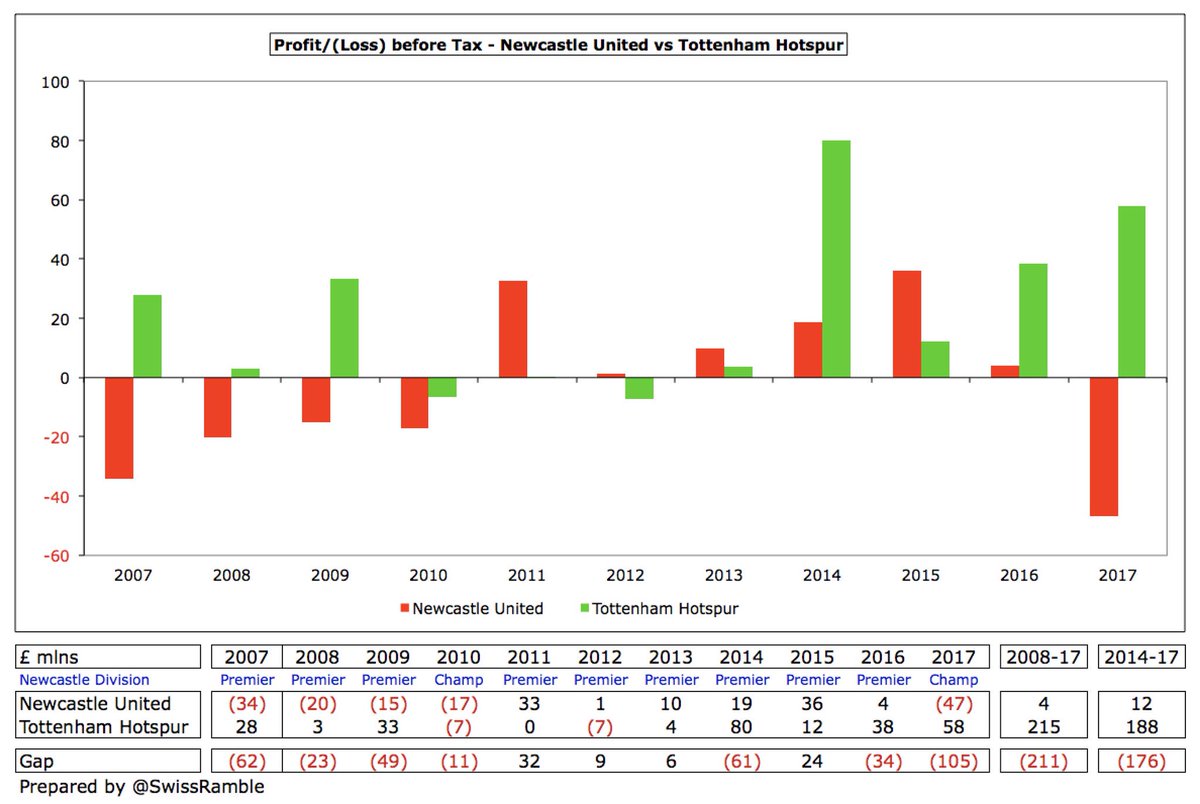

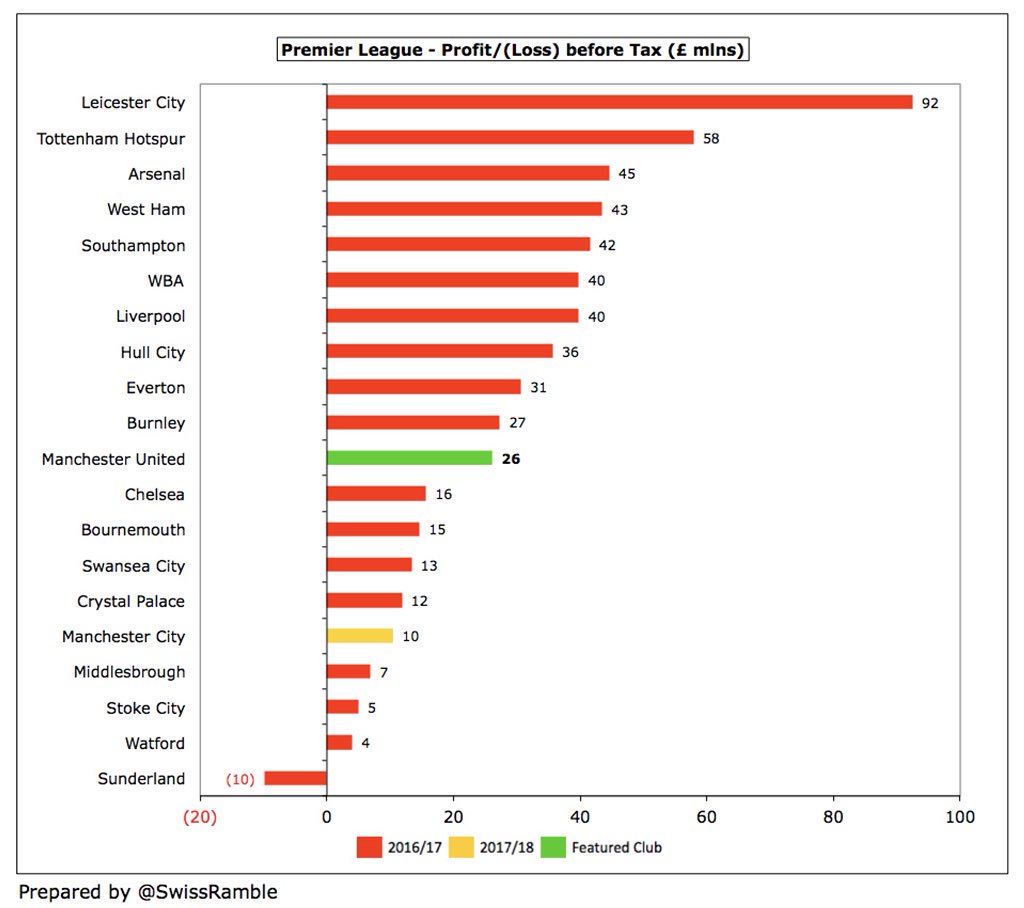

Despite the fall in profit, #MUFC £26m would still have been around mid-table in 2016/17. Worth noting that thanks to TV money and wage controls, the Premier League is now very profitable with only one club reporting a loss, while many had huge profits (#LCFC £92m, #THFC £58m).

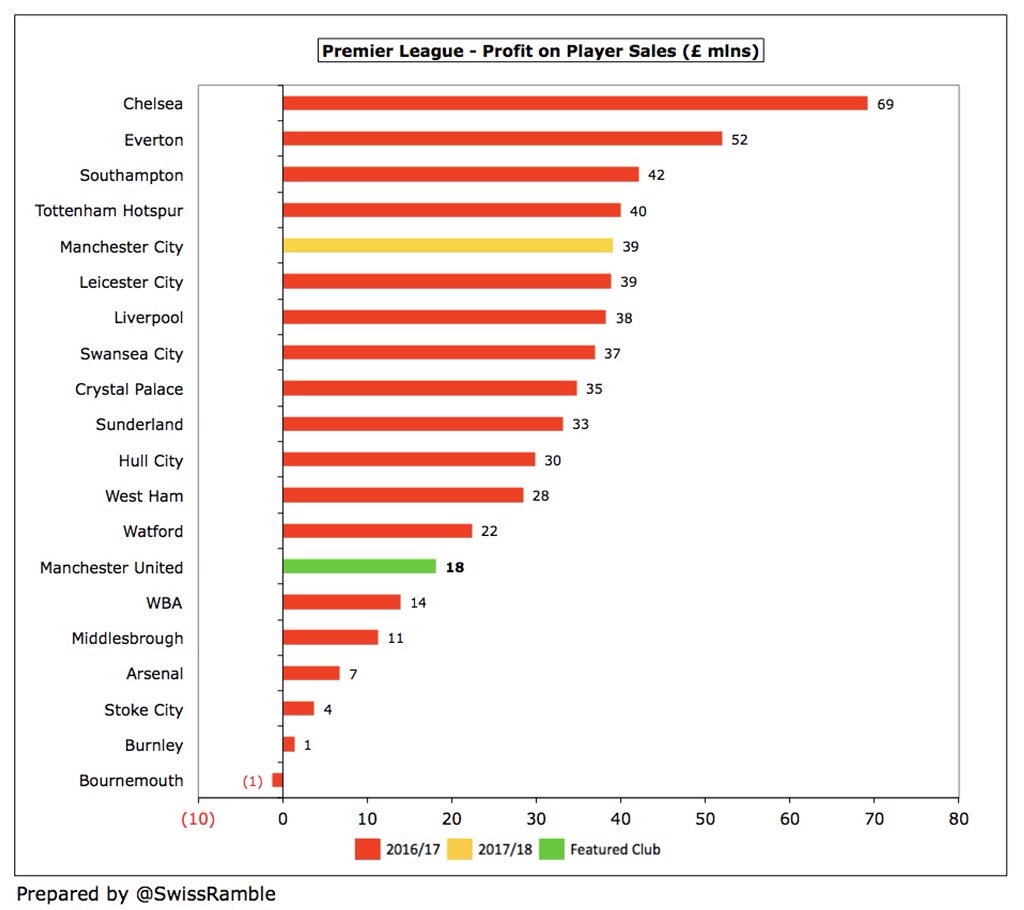

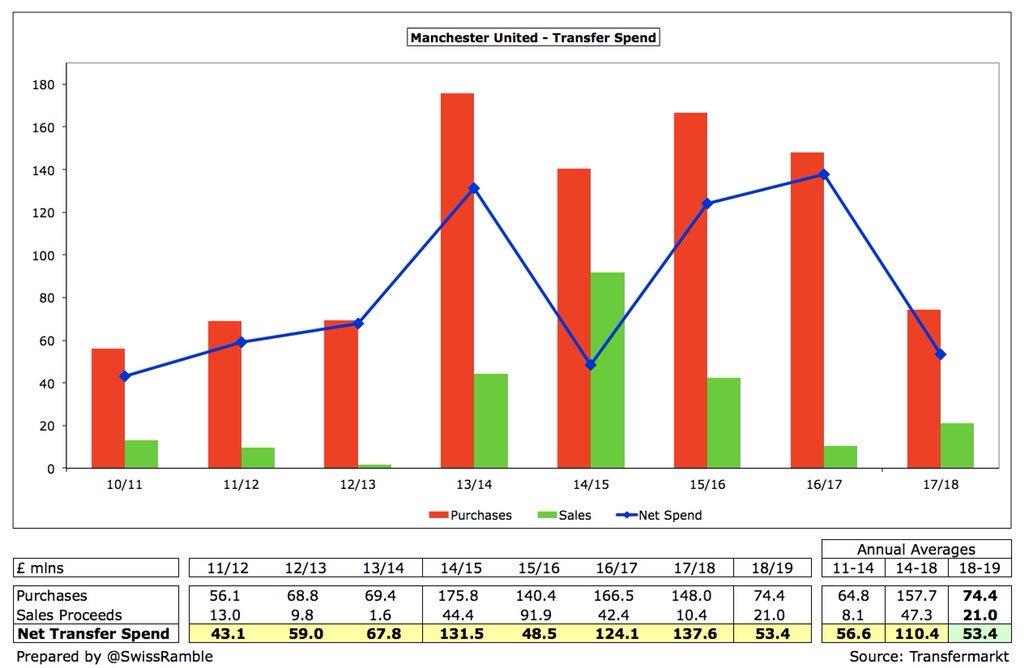

The #MUFC strategy has not been overly reliant on player sales and 2017/18 was no exception with only £18m earned from this activity, mainly Januzaj to Real Sociedad and sell-on fees. For perspective, this would have been one of the lowest in the 2016/17 Premier League.

#MUFC have reported profits for three years in a row, averaging £44m in that period. In fact, £57m in 2017 and £49m in 2016 are among the highest profits in the entire history of the Premier League (5th and 7th respectively). Loss in 2015 was due to lack of European football.

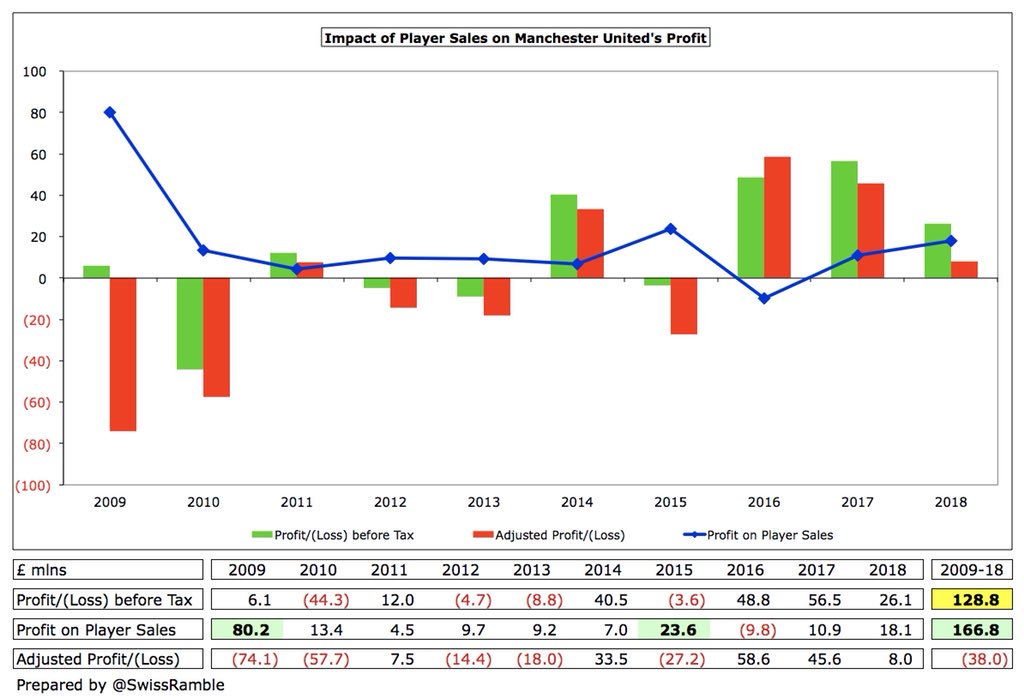

#MUFC results have hardly ever been boosted by player sales with 2009 being the last year where this made a meaningful contribution (Ronaldo’s £80m sale to Real Madrid). Since then, only one year has been above £20m, namely 2015, and that was just £24m.

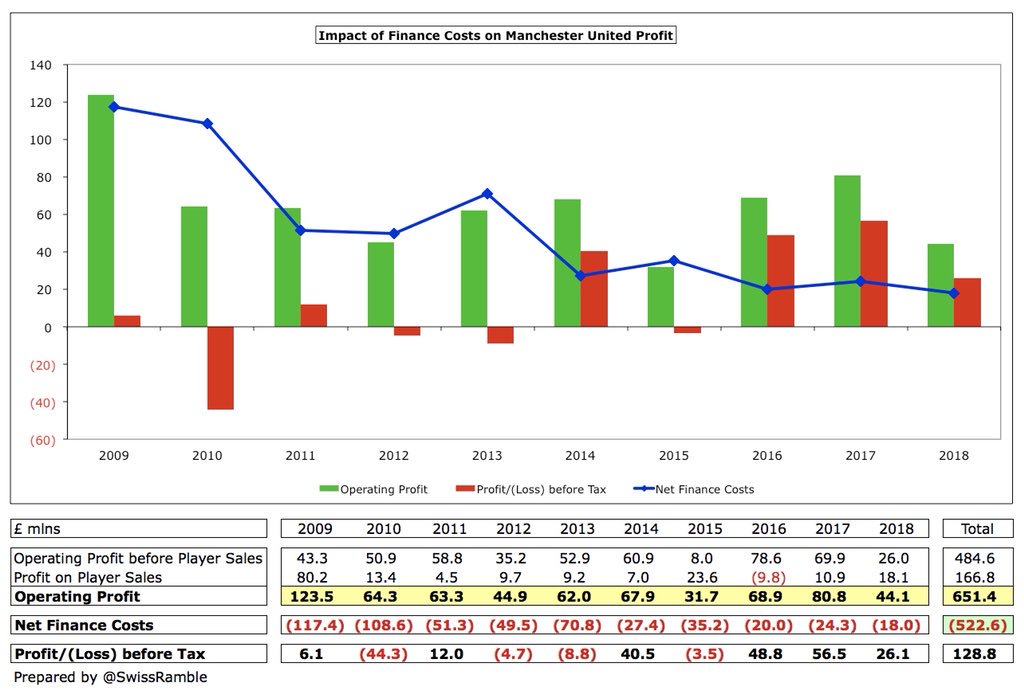

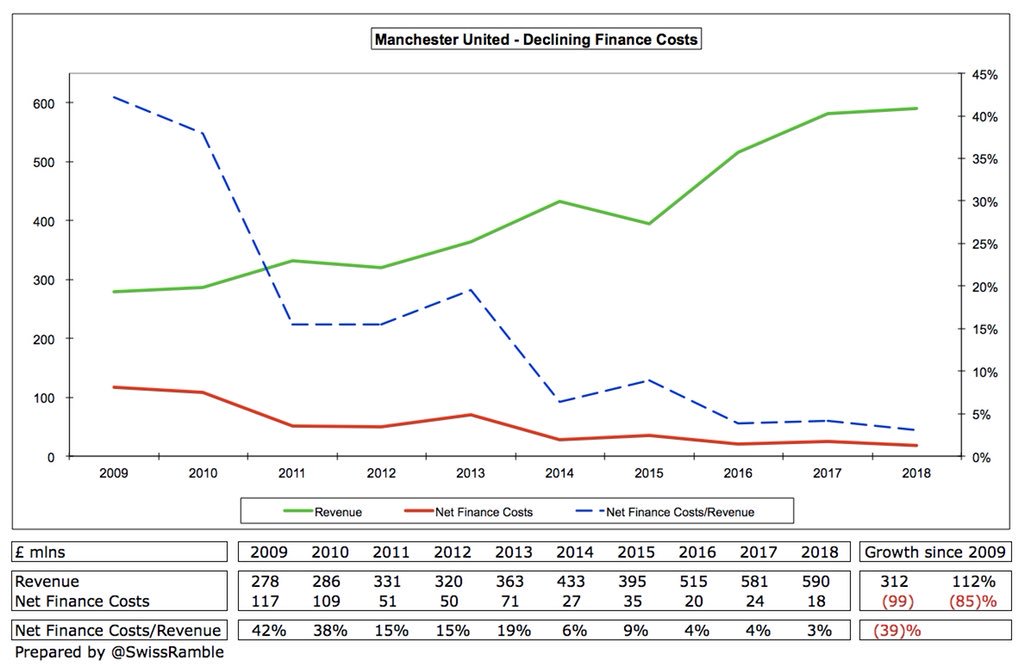

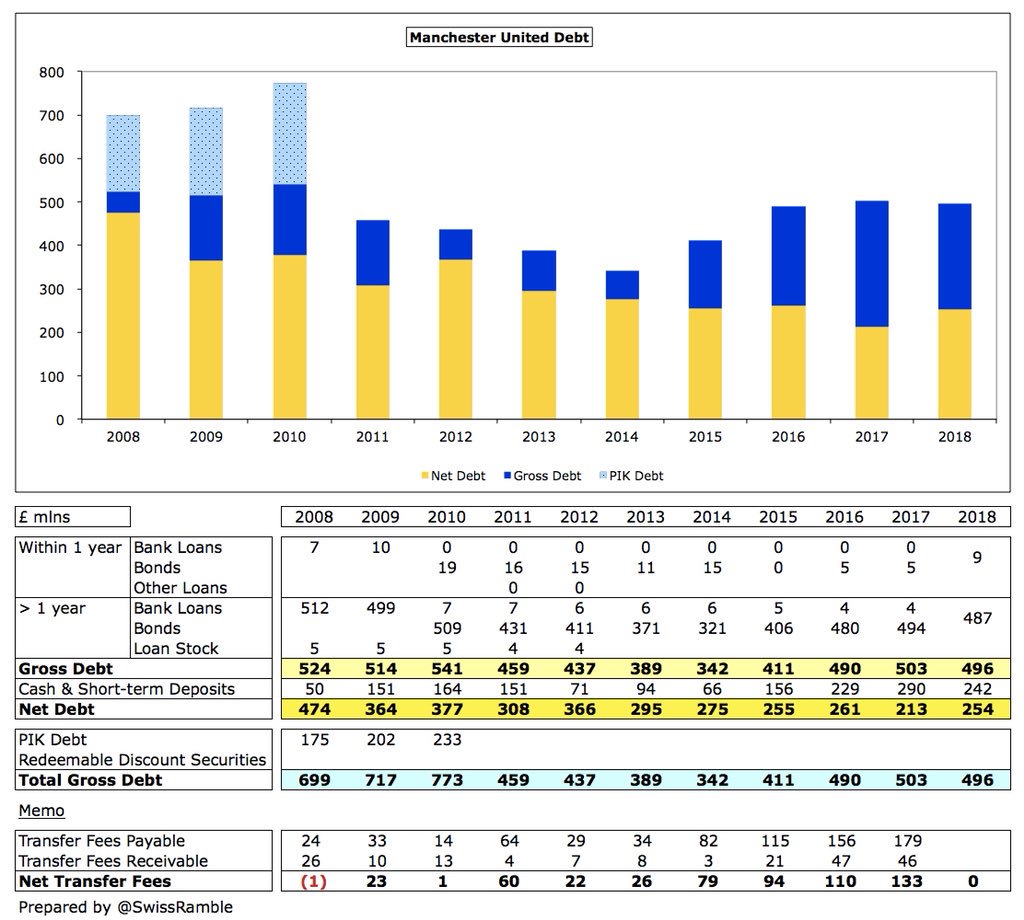

Of course, #MUFC profits would have been substantially higher if they did not have to bear the cost of the Glazers’ leveraged buy-out. In fact, in the last 10 years they made operating profits of £651m, which have been largely offset by net financing costs of £523m.

The good news is that the cost of #MUFC debt has reduced following a series of refinancings from a horrific £117m in 2009 to “only” £18m in 2018. Coupled with explosive revenue growth, this means that financing costs have been cut from 42% of revenue in 2009 to just 3%.

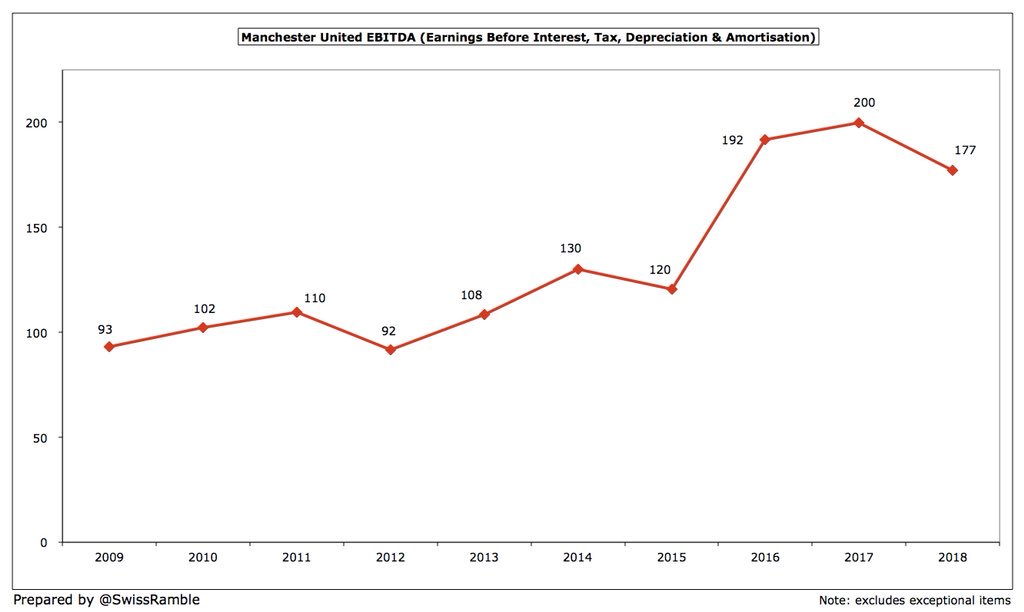

#MUFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which can be considered as a proxy for cash operating profit, fell by £23m from last season’s record £200m to £177m, though this is still around double the £92m in 2012. Forecast is £175-190m for 2018/19.

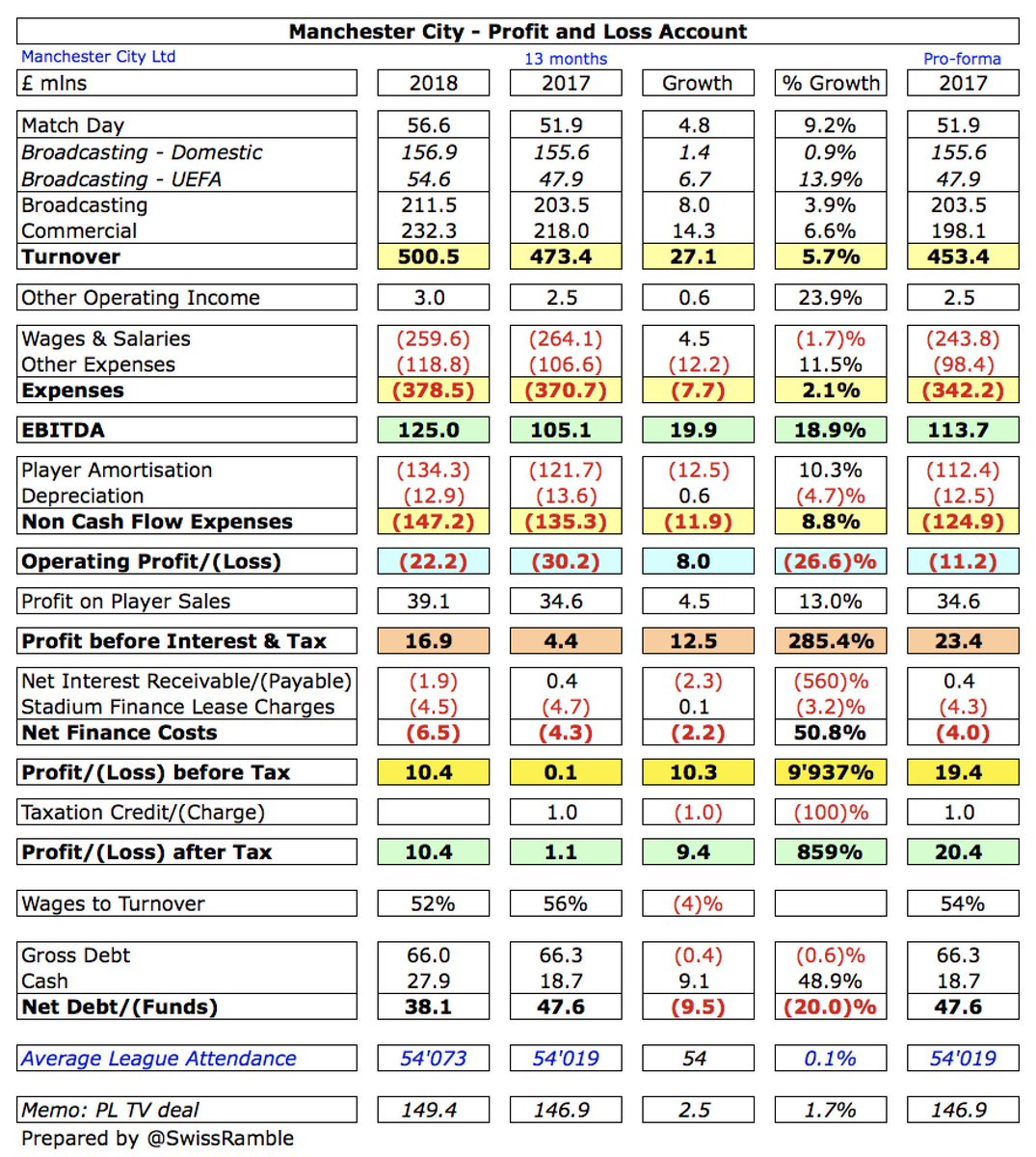

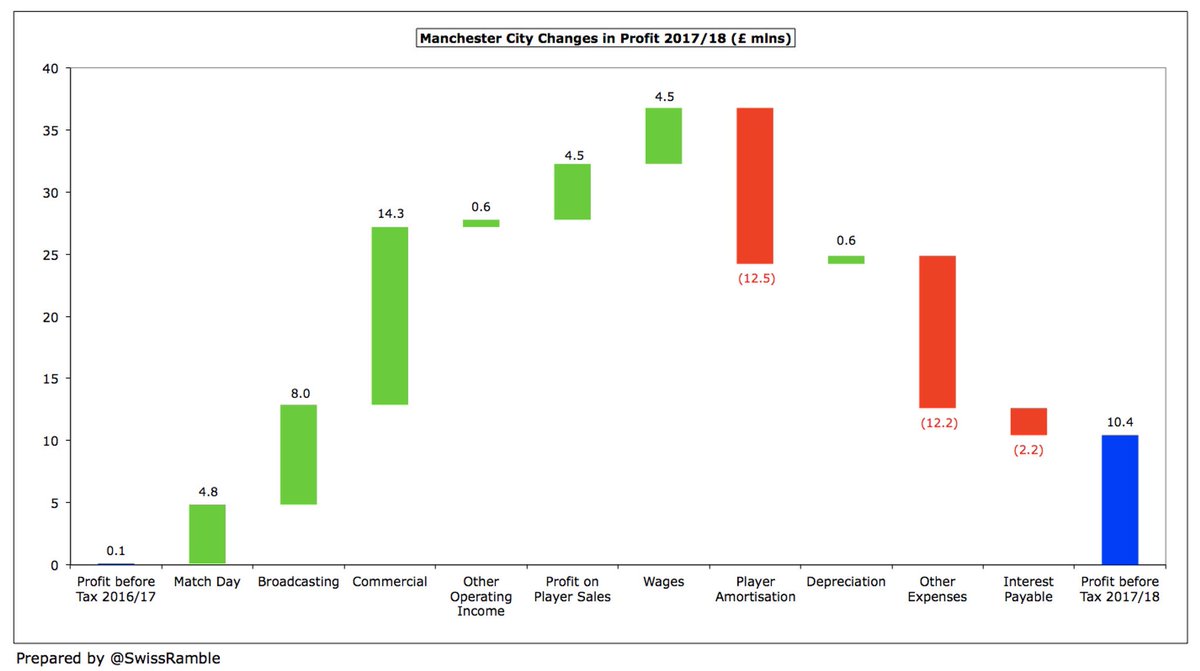

However, #MUFC EBITDA of £177m is still excellent, underlining their incredible ability to generate cash. To place this into context, #MCFC are £52m lower with £125m, while #AFC are likely to fall from £138m due to lack of Champions League in 2017/18. Only 4 PL clubs above £100m.

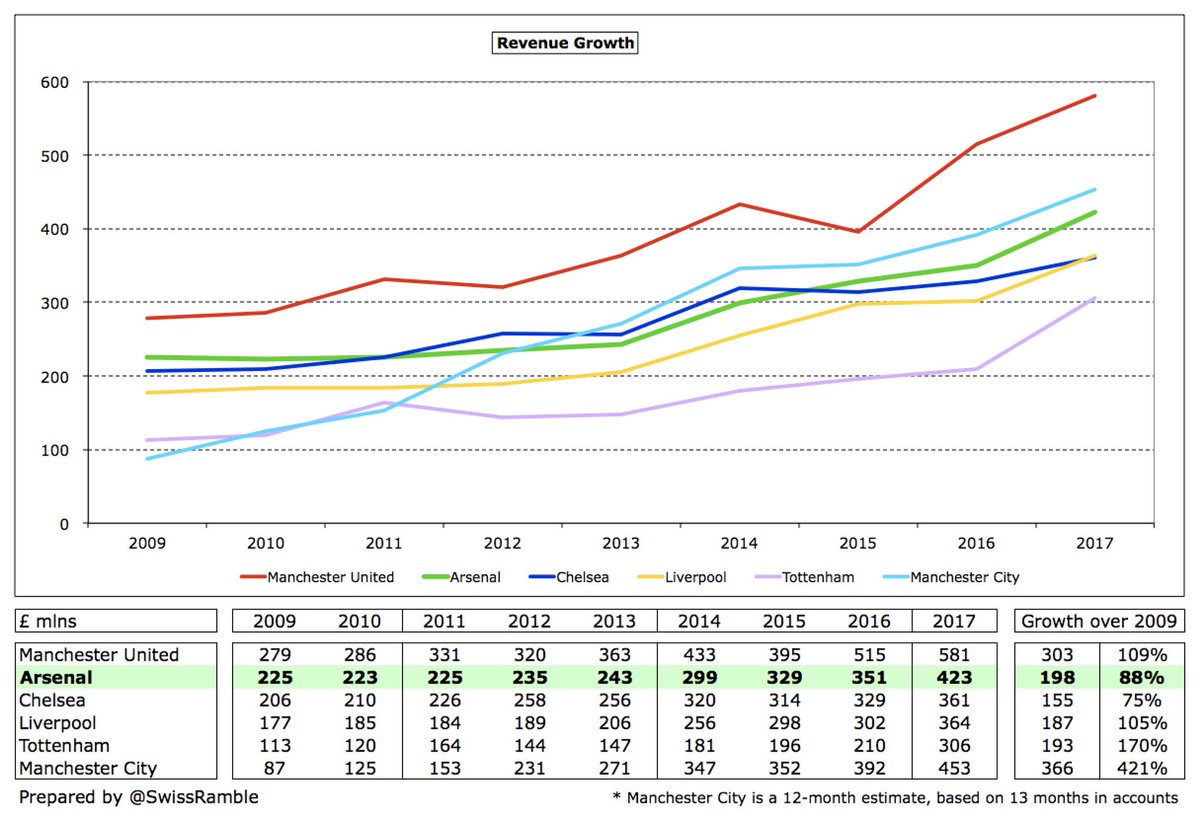

Although #MCFC revenue “only” increased by 2% in 2017/18, this is not unusual in the second year of the Premier League TV deal. Since 2013 revenue has grown by an incredible £227m (62%) from £363m to £590m, due to commercial £124m and TV £103m. Forecast is £615-630m for 2019.

#MUFC revenue of £590m is the highest in England, £90m more than the closest challenger #MCFC £500m. There is then a fairly sizeable gap to the next clubs (#AFC £423m, #LFC £364m, #CFC £361m & #THFC £306m), though some of these will increase when 2017/18 results published.

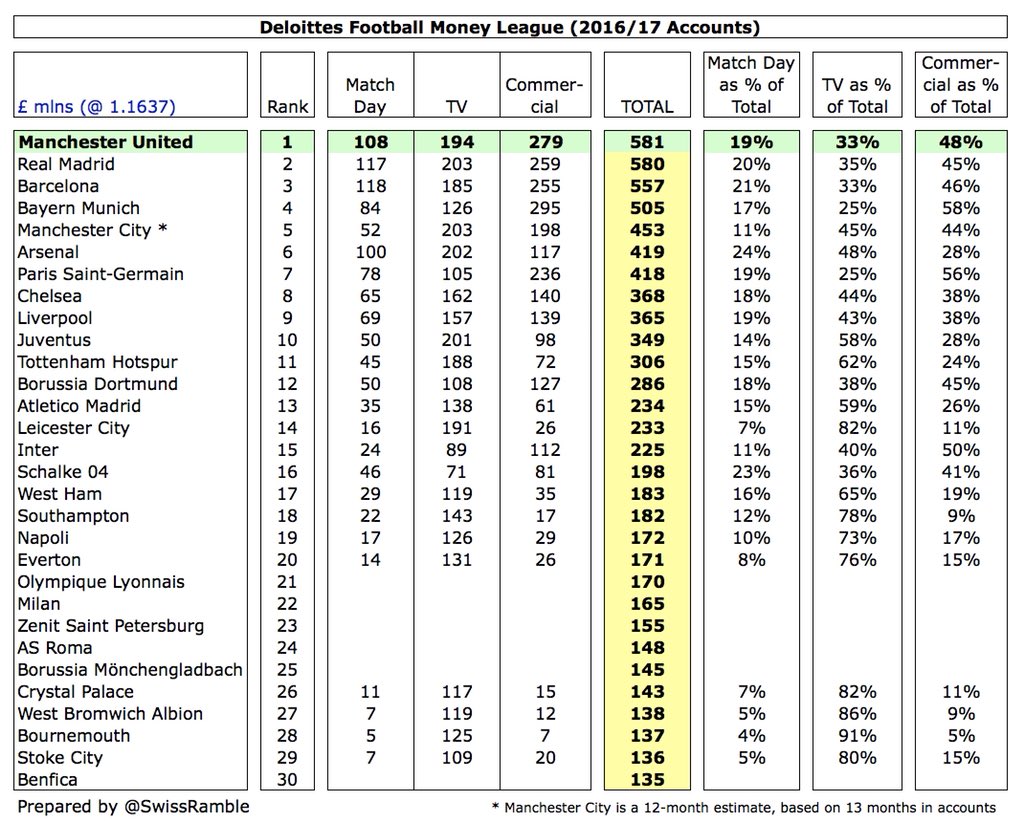

Based on 2016/17 figures, #MUFC had the highest revenue in the Deloitte Money League for the second year in a row, with their £581m revenue just above Real Madrid £580m, followed by Barcelona £557m and Bayern Munich £505m, though will be overtaken by Madrid in 2017/18 (€751m)

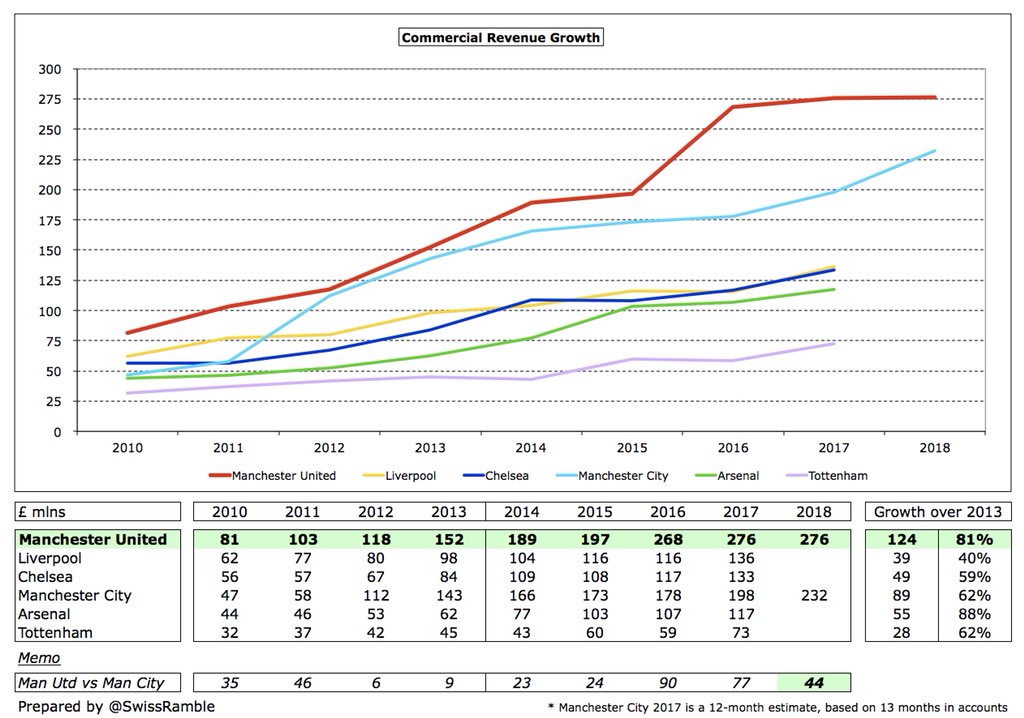

Somewhat disappointingly, #MUFC commercial income was basically flat at £276m, despite 7 new sponsorship deals including their first sleeve sponsor. That said, this revenue stream has grown by an impressive £124m (81%) since 2013.

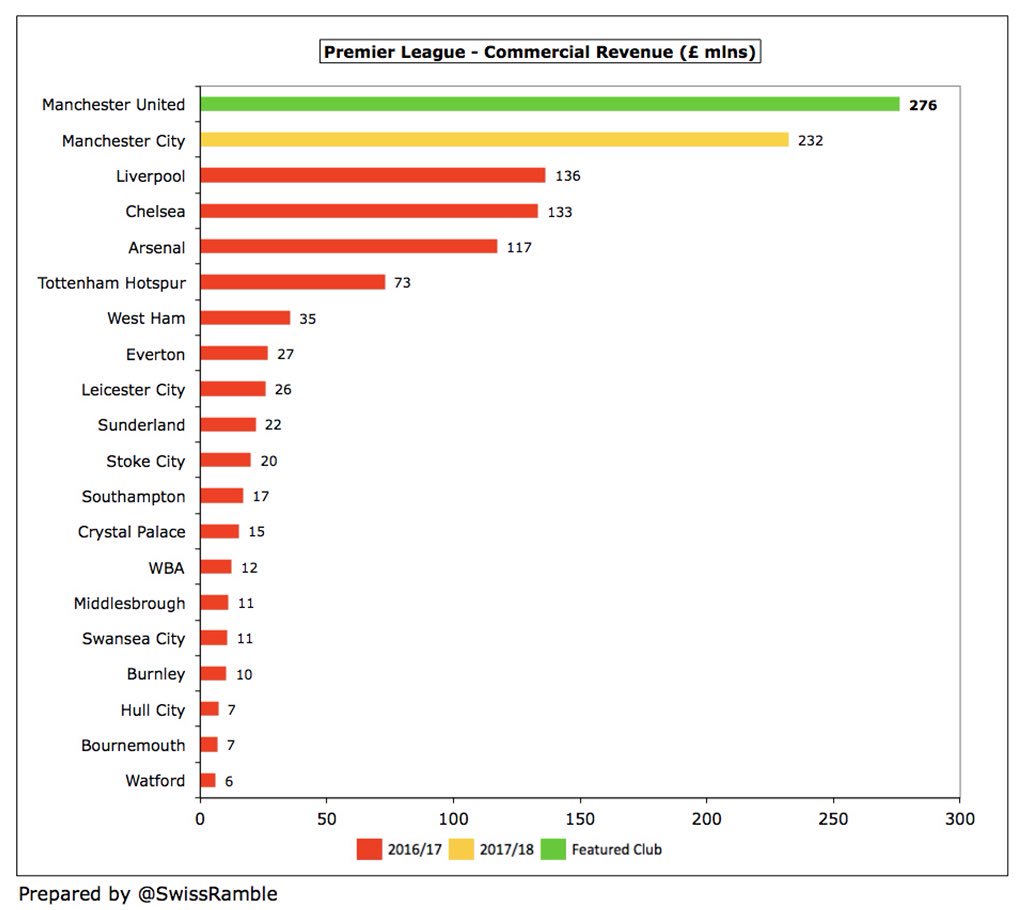

However, to place this into context, #MUFC £276m commercial income is still £44m higher than #MCFC £232m. It is also at least £140m more than their next closest challengers (2016/17 figures): #LFC £136m, #CFC £133m, #AFC £117m, #THFC £73m and #WHUFC £35m.

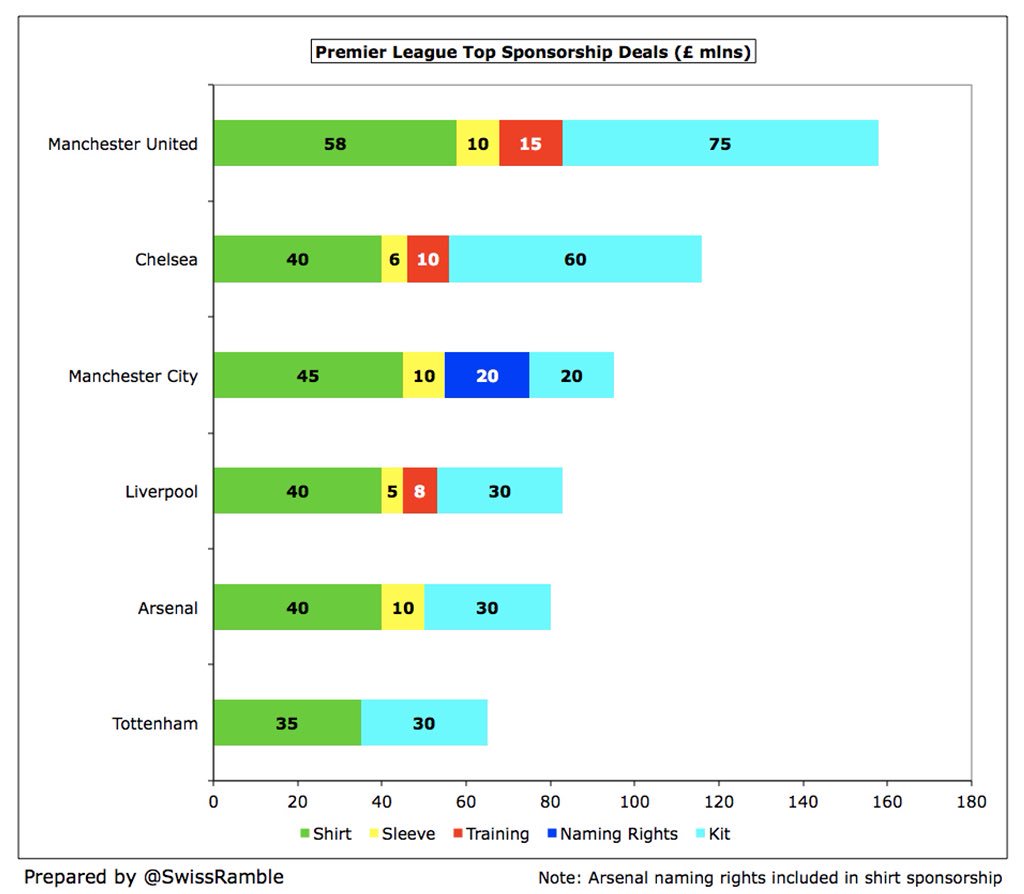

#MUFC Chevrolet shirt sponsorship worth £58m a season ($75m at current exchange rates), while Adidas kit deal is an amazing £75m (though cut by 30% if fail to reach Champions League for 2 or more seasons). Aon pay £15m for training kit/facilities, Kohler £10m for sleeve sponsor.

The importance of commercial business to #MUFC is clear, as 47% of their 2017/18 revenue came from this revenue stream. The only comparable club is #MCFC 46%, while #LFC and #CFC are only at 37% and other clubs are significantly lower.

#MUFC TV money from the Premier League increased £9m to £150m, boosted by finishing 2nd versus 6th the previous season (meaning a higher merit payment). They actually received more than champions #MCFC £149m, as they were shown live 28 times (compared to 26 for City).

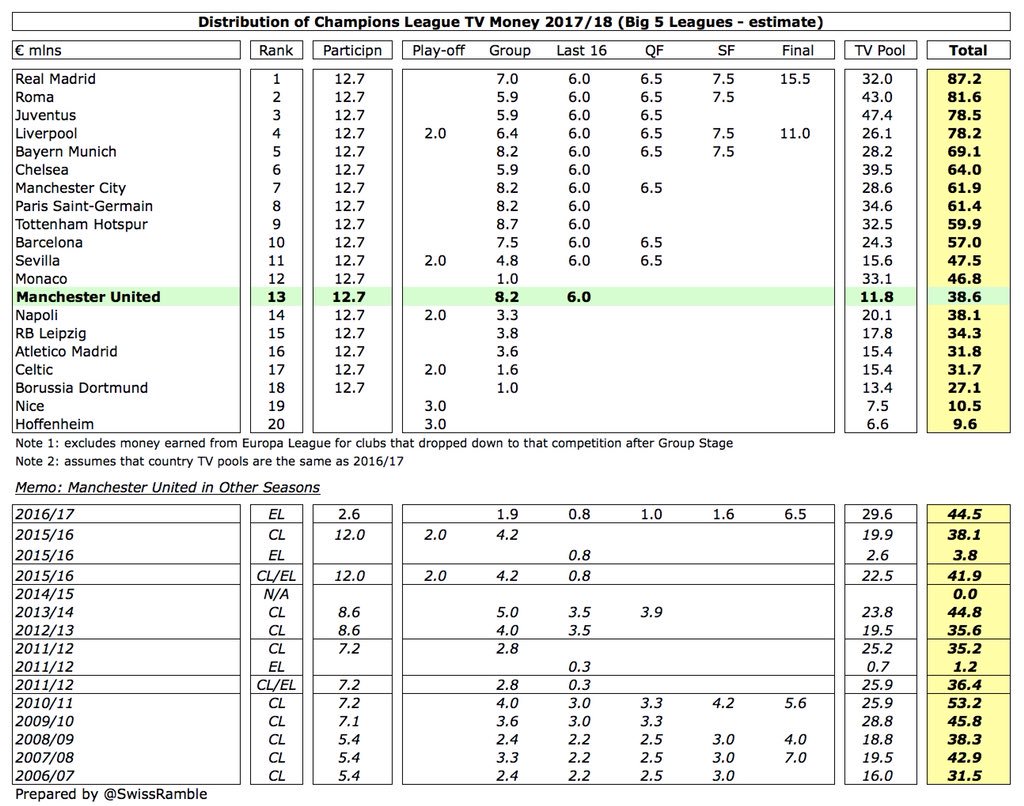

Assuming that English TV pool was unchanged in 2017/18, #MUFC earned €39m from Europe for reaching the Champions League last 16, €6m less than the previous season when they won the Europa League by beating Ajax in the final. Champions League winners Real Madrid received €87m.

#MUFC Champions League revenue of €39m was much lower than runners-up #LFC €78m and quarter-finalists #MCFC £62m. Also below #CFC €64m and #THFC €62m, even though all 3 clubs fell at last 16, because United only got half the TV pool, having qualified via the Europa League.

#MUFC relatively poor performance in Europe, including not even qualifying 2014/15, means that they have “only” earned €170m in the last 5 years. That’s not too shabby, but it is a hefty €107m less than #MCFC €277m. Also below #CFC €216m and #AFC €214m.

#MUFC match day income fell £2m (2%) from £112m to £110m, as they staged 5 fewer home games (3 in Europe, 2 in domestic cups). However, this was still easily the highest in the top flight: £10m above #AFC £100m, £36m more than #LFC £74m (though this will grow in 17/18).

#MUFC 75,000 average attendance was again the highest in the Premier League, around 7,000 more than #THFC following their use of Wembley. Season ticket prices have been frozen for 7 consecutive years, while £15 tickets for 18 to 25-year-olds have been introduced in 2018-19.

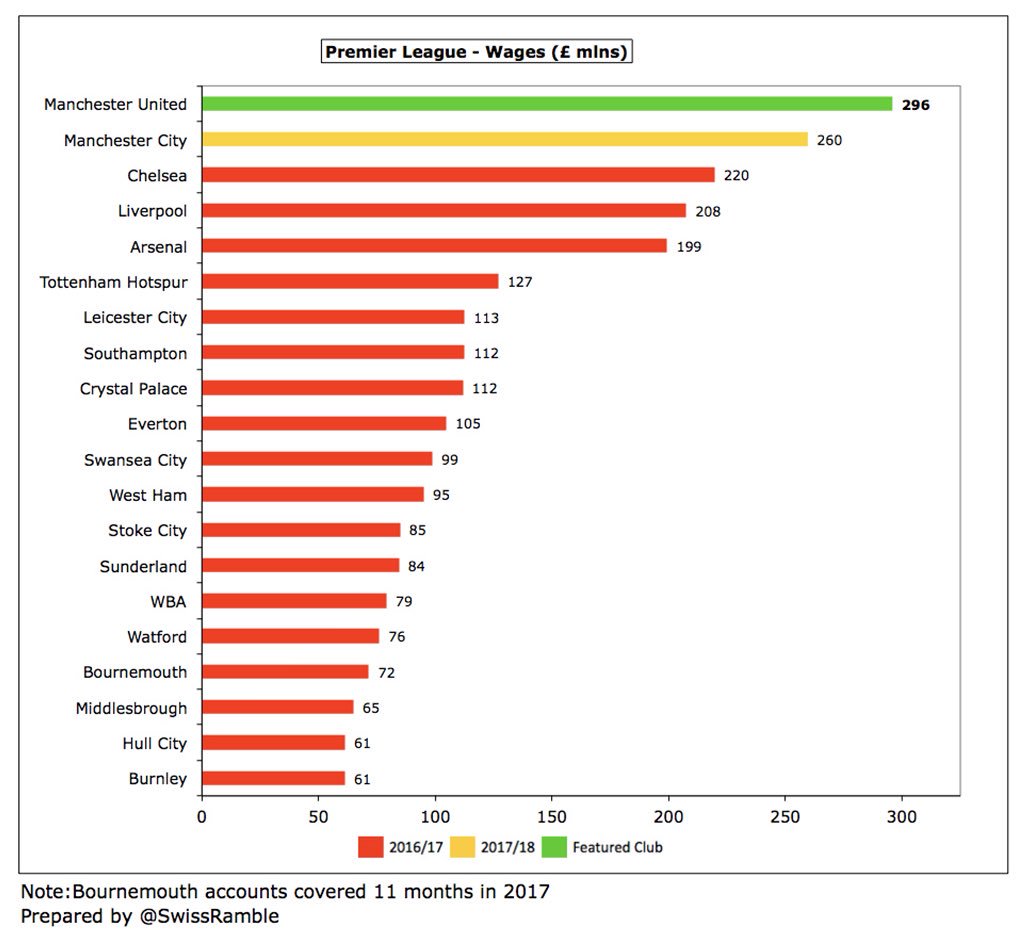

#MUFC wage bill grew £32m (12%) from £264m to £296m, mainly due to player salary uplifts related to Champions League participation plus 5 months of Alexis Sanchez, resulting in an increase in the wages to turnover ratio from 45% to a still very respectable 50%.

Not only is #MUFC wage bill just shy of the £300m barrier, but it is the highest ever reported by a Premier League club. In the last 3 years, it has grown by an incredible £93m (46%). It is now £36m above #MCFC £260m, the highest gap for many years.

Of course, #MUFC £296m wage bill is also miles above the other leading clubs: Chelsea £220m, Liverpool £208m, Arsenal £199m and Tottenham £127m (though in fairness these are all 2016/17 figures).

Despite the increase in #MUFC wages to turnover ratio from 45% to 50%, this is still one of the lowest (best) in Premier League, though not as low as #THFC 41% and # #AFC 47%. This important ratio has been maintained in a tight range between 45% and 51% for the last few years.

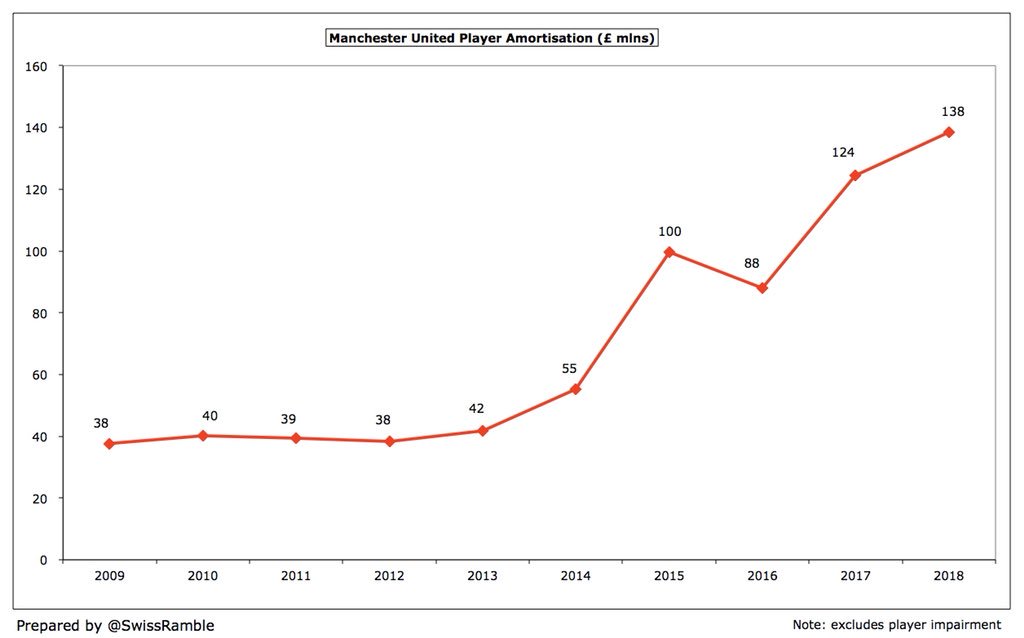

#MUFC player amortisation, the annual charge to expense transfer fees over the length of a player’s contract, continued to rise, up 11% (£14m) from £124m to £138m, reflecting further investment in the squad (Lukaku, Matic, Lindelof & Sanchez in 2017/18).

As a result, #MUFC player amortisation of £138m is again the highest in the Premier League, just above #MCFC £134m. Both Manchester clubs are way ahead of #CFC £88m and #AFC £77m.

#MUFC averaged around £110m net spend for 4 years up to 2017/18 (purchases £158m, sales £47m), but only £53m to date in 2018/19 (mainly Fred and Diogo Dalot), giving some justification to Mourinho’s complaints. In the last 5 seasons net spend is £495m, only behind #MCFC £580m.

#MUFC net debt increased by £41m from £213m to £254m, mainly due to £48m reduction in cash balance from £290m to £242m. In Sterling terms, gross debt was down £7m from £503m to £496m, though the USD debt remains unchanged. Amounts owed on transfers not disclosed (£179m in 2017).

So, even after all the Glazers’ various refinancings, #MUFC still owe the best part of half a billion pounds, more than twice as much as #AFC £227m (the Emirates Stadium loan). Worth noting that #CFC have around £1.2 bln debt in their holding company.

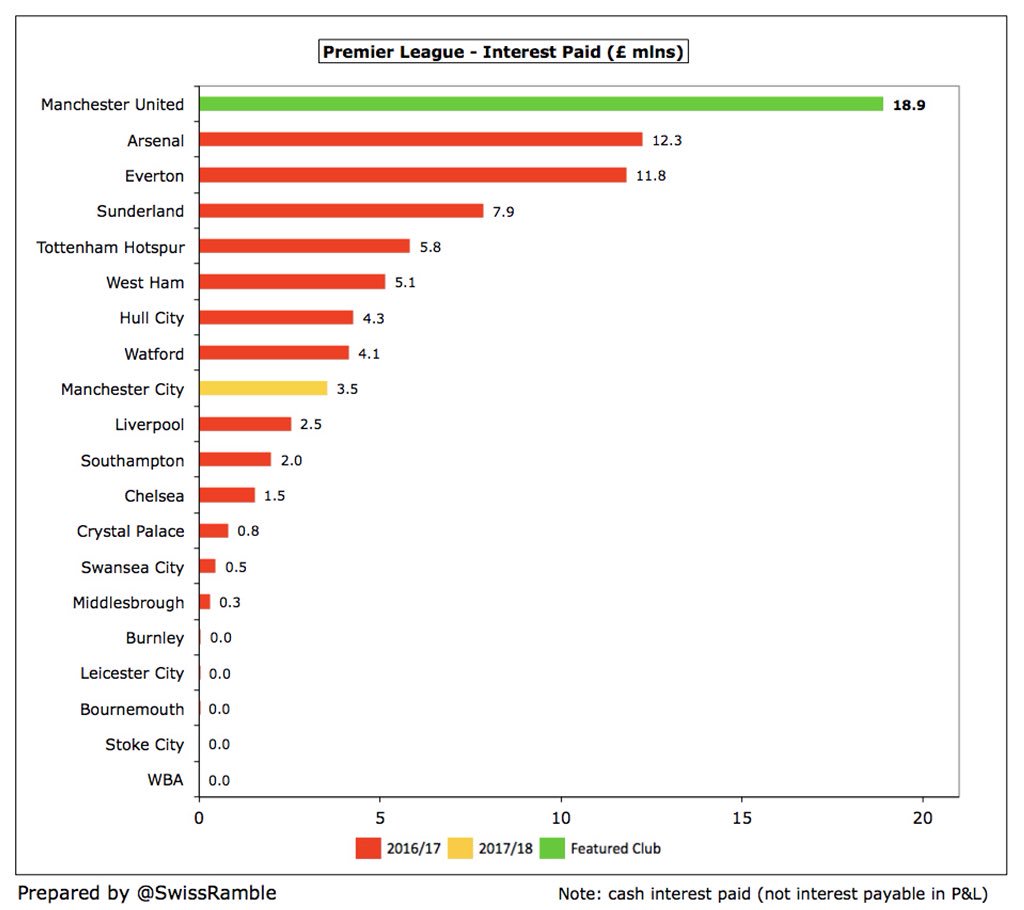

Although it has reduced, #MUFC annual interest payment of £19m is a lot more than any other Premier League club with Arsenal being the only other club with a double-digit interest payment of £12m. To place that into perspective, Manchester City and Liverpool only pay around £3m.

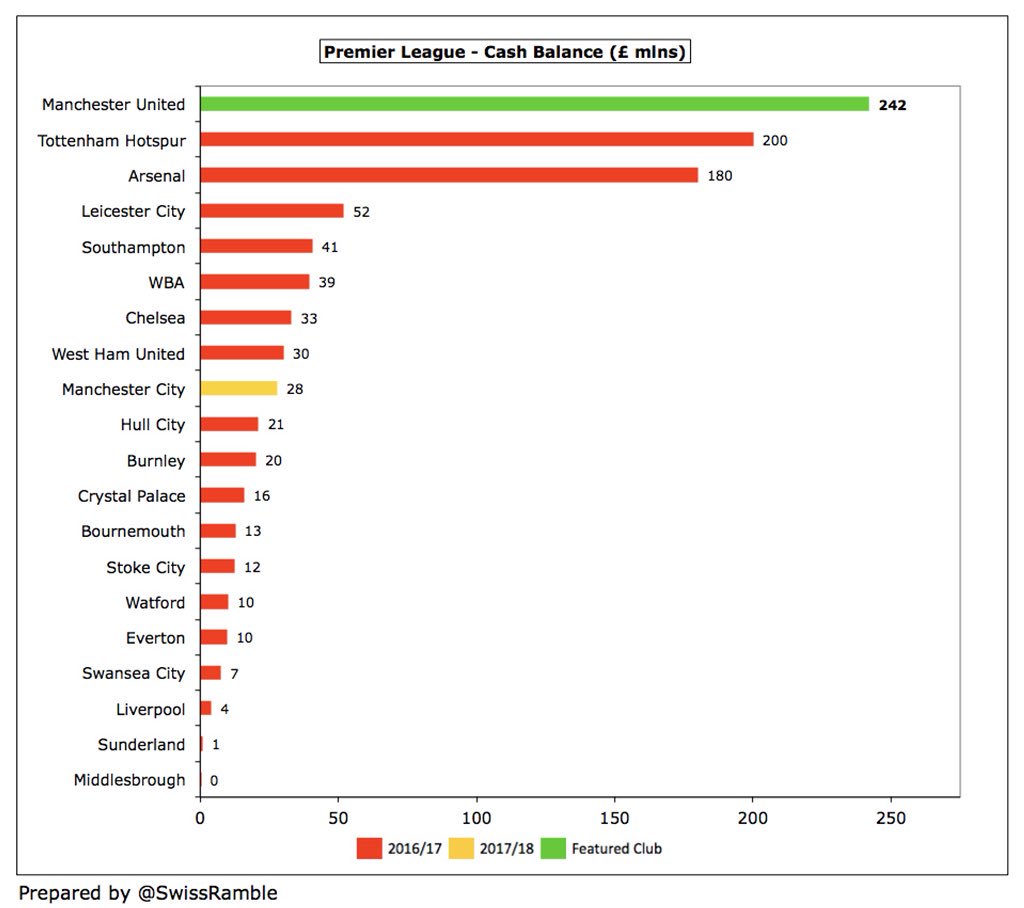

On the other hand, #MUFC also have the highest cash balance of £242m, much more than most Premier League clubs. Tottenham’s £200m is misleading, as this is largely due to advances for their stadium development, leaving only Arsenal £180m as anywhere close.

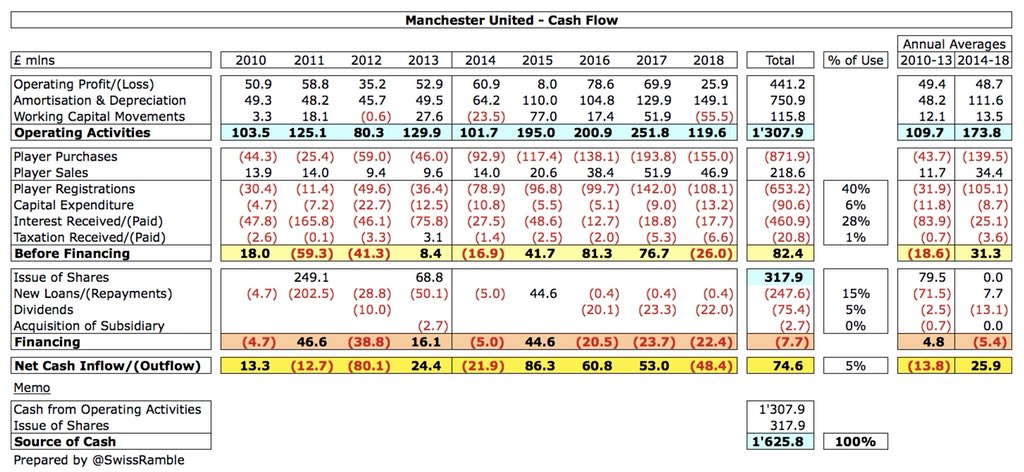

#MUFC cash decreased by £48m, mainly because of a steep fall in cash generated from operating activities, due to timing of cash receipts on commercial contracts. Net £108m spent on players (purchases £155m, sales £47m). Another £22m paid out in dividends.

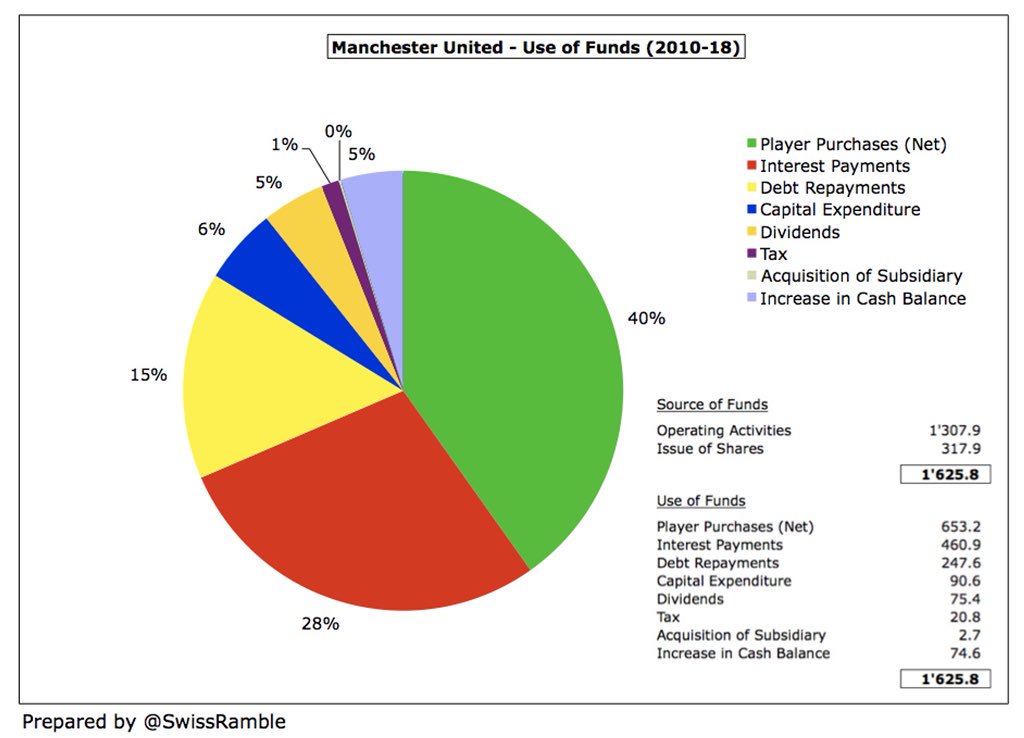

In last 9 years #MUFC have had an incredible £1.6 bln cash: operating activities £1.3 bln plus £318m share issue. £653m has been spent on players and £91m on infrastructure, but £784m used to finance Glazers’ investment: £461m interest, £248m debt repayments & £75m dividends.

Ed Woodward spoke of “continued strong long-term financial performance, which underpins everything we do and allows us to compete for top talent in an increasingly competitive transfer market.” That’s undoubtedly true, but will #MUFC now deliver on the pitch?

• • •

Missing some Tweet in this thread? You can try to

force a refresh