Now that @AlistairJarvis's @UniversitiesUK has opened the linked consultation, it's important for @ucu & #USS members to make the case to our employers to STRONGLY & PUBLICLY support all 4 JEP recommendations. Links below to arguments in support. 1/

ussemployers.org.uk/news/universit…

ussemployers.org.uk/news/universit…

Embedded thread w/ arguments in support of JEP recommendation #2, re lowering of deficit recovery contributions. 2/

https://twitter.com/MikeOtsuka/status/1044866886075322368

Embedded thread w/ arguments in support of JEP recommendation #3, re smoothing of cost of future service, which draws on @Sam_Marsh101's cashflow data analysis. 3/

https://twitter.com/MikeOtsuka/status/1044992237342543872

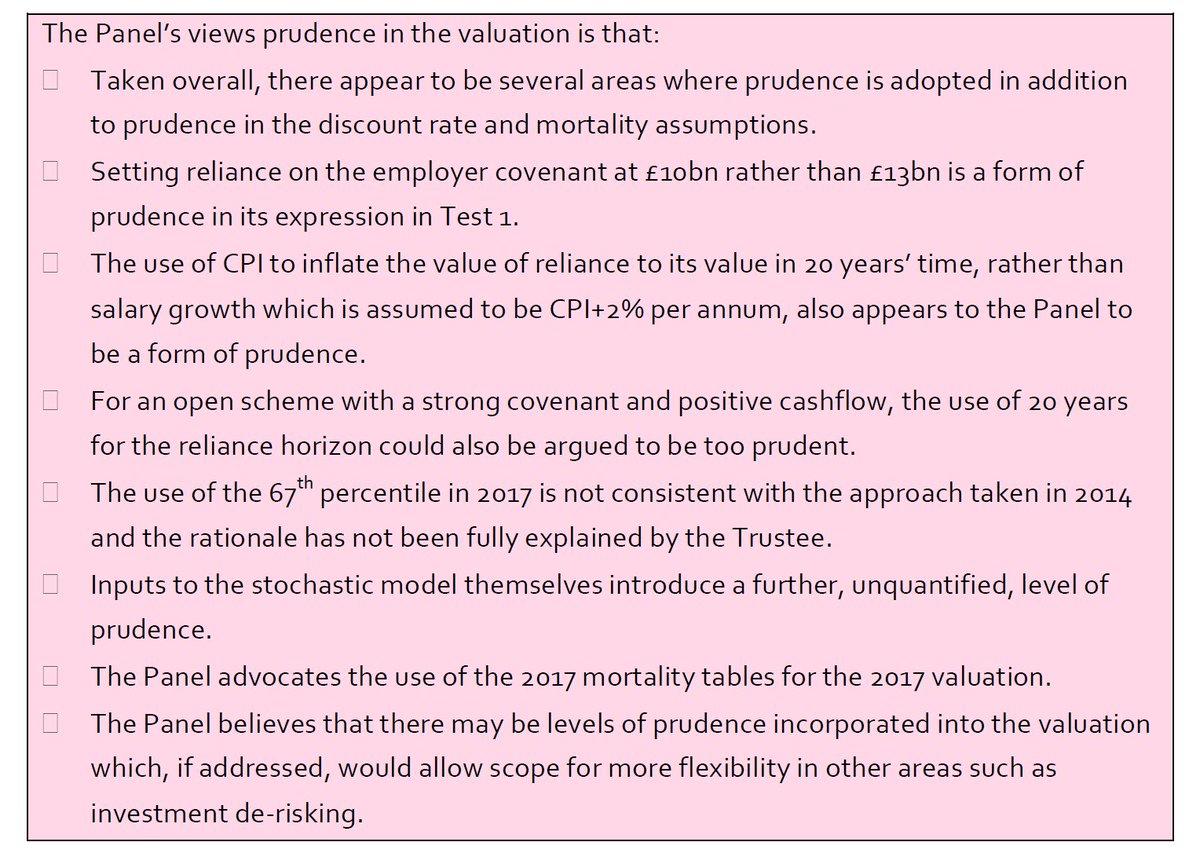

JEP RECOMMENDATION #4--update to the most recent mortality data--is a no brainer. As UUK says, "it would be reasonable to regard this as not exposing employers to additional risk & simply a refinement for new data." But this reduces contributions by only 0.12%. 4/

JEP RECOMMENDATION #1 has two parts: (a) Reversion to September '17 delay of onset by 10 years of 'de-risking' shift to bonds. (b) Increase extent to which scheme assets can outperform a gilts+0.75 self-sufficiency portfolio. 5/

For a defence of #1(a) delay of de-risking by 10 years, see this blog: 6/

medium.com/@mikeotsuka/un…

medium.com/@mikeotsuka/un…

That just leaves #1(b), which I'll discuss in the main thread below. #1(b) relates to the notorious Test 1. In order to be able to close the DB scheme by year 40, Test 1 requires that it be possible to purchase a bond-weighted self-sufficiency portfolio by then... 7/

...via supplementation of scheme assets via an increase of 7% — from the current 18% to the maximum affordable 25% of salaries — in employer contributions from years 20 to 40. 8/

The assets must reach a market value by year 20 that is sufficiently high that it is possible to get from there to self-sufficiency via such a 7% increase. 9/

JEP RECOMMENDATION #1(b) is entirely down to how much extra cash we can assume would be generated via +7% contributions in years 20-40. This depends on how much more it is assumed scheme members will be paid then versus now. 10/

#USS's current Test 1 assumption is that the average scheme member will be paid less in real CPI terms than today, taking into account promotions as well as negotiated pay increases. 11/

This, however, conflicts with #USS's own assumption that average pay will increase by CPI + 2% each year (taking account of promotions & average age of scheme members as well negotiated pay increases). 12/

In their Feb 2017 consultation, #USS expressed a willingness to assume CPI + 2%. Upshot = £19 bn would be generated by +7% & hence very little de-risking of assets over the next 20 years would be needed to satisfy Test 1. 13/

Had employers accepted CPI+2% plus assumptions of the Sept valuation, it would have been possible to retain the DB status quo via +1% employer & +0.5% member contributions, which is better than JEP's recommendations. See more details in this blog: 14/

medium.com/@mikeotsuka/uu…

medium.com/@mikeotsuka/uu…

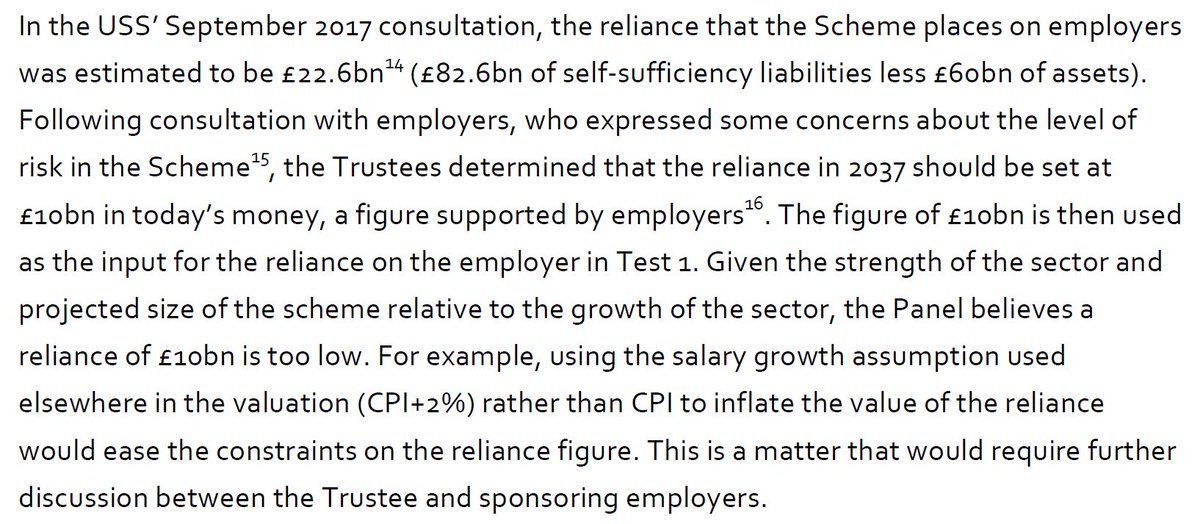

Inexplicably & inexcusably, employers refused CPI+2% (=£19 bn) & instead embraced CPI+0% (=£13 bn). USS ended up saddling employers w/ CPI MINUS about 1% (=£10 bn). 15/

In the end, they recommend something more modest: CPI+0% (£13 bn). Given how much gratuitous trouble Test 1 is causing the scheme (see JEP critique of Test 1 👇), employers have overwhelming reason to unshackle themselves from it by endorsing the least restrictive parameters. 17/

Please see this blog post for an explanation of the extent to which #USS's current version of Test 1 amounts to recklessly prudent overkill. 18/

medium.com/@mikeotsuka/ho…

medium.com/@mikeotsuka/ho…

See also this thread by @Sam_Marsh101: 19/

https://twitter.com/Sam_Marsh101/status/1022404401426849792

In short, adoption of JEP RECOMMENDATION #1(b) relaxation of Test 1 shackles is a no-brainer UNLESS employers would like to continue to try to make the case that DB is too expensive and must close, and everyone should be shifted over to 100% individual DC. 20/20

• • •

Missing some Tweet in this thread? You can try to

force a refresh