JEP RECOMMENDATION #3: Smooth the cost of future service contributions over at least the next 6 years. As this chart indicates, this would reduce contributions by 1.5%. 1/

#USS's failure to smooth the cost of future service contributions constitutes a significant hidden layer of prudence. See this blog post: 2/

medium.com/@mikeotsuka/us…

medium.com/@mikeotsuka/us…

As these above posts indicate, not only does #USS's failure to account for their forecast decrease in the cost of future serve build an extra layer of prudence into what they're charging employers and members to accrue DB benefits in the future.... 4/

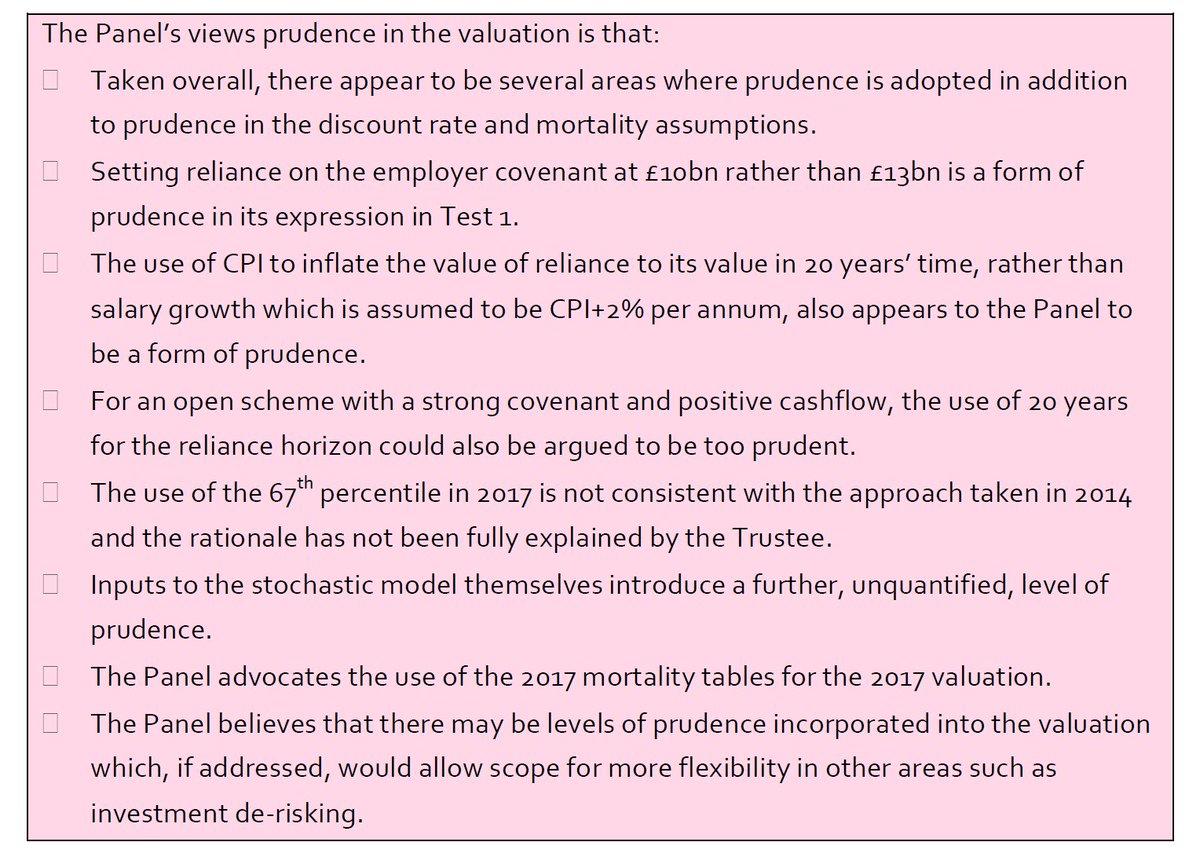

...but it also adds an extra layer of prudence into Test 1, thereby forcing more de-risking of the assets by year 20 than would otherwise be necessary. The above layers of extra prudence are IN ADDITION to all theses that JEP lists here👇. 5/

👆.@Sam_Marsh101 have you received confirmation from #USS that it's the decline in cost of future service which explains why 67% chance asset growth in 2037 at 26% contribution for next 20 years under Nov de-risking just about satisfies Test 1? 1/

If you haven't, pressing #USS to provide an explanation would be good, so that we do not have yet another employer consultation in which they're kept in the dark about the fact and implications of declining cost of future service. 2/

If falling cost of future service provides a hidden extra layer of Test 1 prudence, that would provide a powerful reason for employers to insist on smoothing over the next 6 years. 3/3

• • •

Missing some Tweet in this thread? You can try to

force a refresh