🚨💣😱.@Cambridge_Uni's response to a 2016 consultation re strength of the #USS covenant has recently been released via FOI. Cambridge disputes PWC's finding of a strong covenant over 30 as opposed to merely 20 years! The following statement in their response is a bombshell: 1/

"We would be concerned if the increase in visibility of a strong covenant was used to support a less prudent approach to the 2017 valuation than that adopted in 2014, either in terms of the assumptions adopted or the time horizon for de-risking." 2/

We are all aware that tPR's challenge, in their Sept 2017 letter, to the PWC/#USS assessment of the strength of the covenant, wreaked havoc on our DB pension and helped explain the shift to the more conservative November valuation. 3/

This is of a piece with various other pieces of information that have come to light, regarding Cambridge's efforts to undermine #USS's DB pension scheme. See here: 4/

medium.com/@mikeotsuka/ox…

medium.com/@mikeotsuka/ox…

To add insult to injury, the author of the response, Sue Curryer, who is Head of Pensions Administration at Cambridge, notes that "The response has not been considered by the governing body in advance of submission". 9/

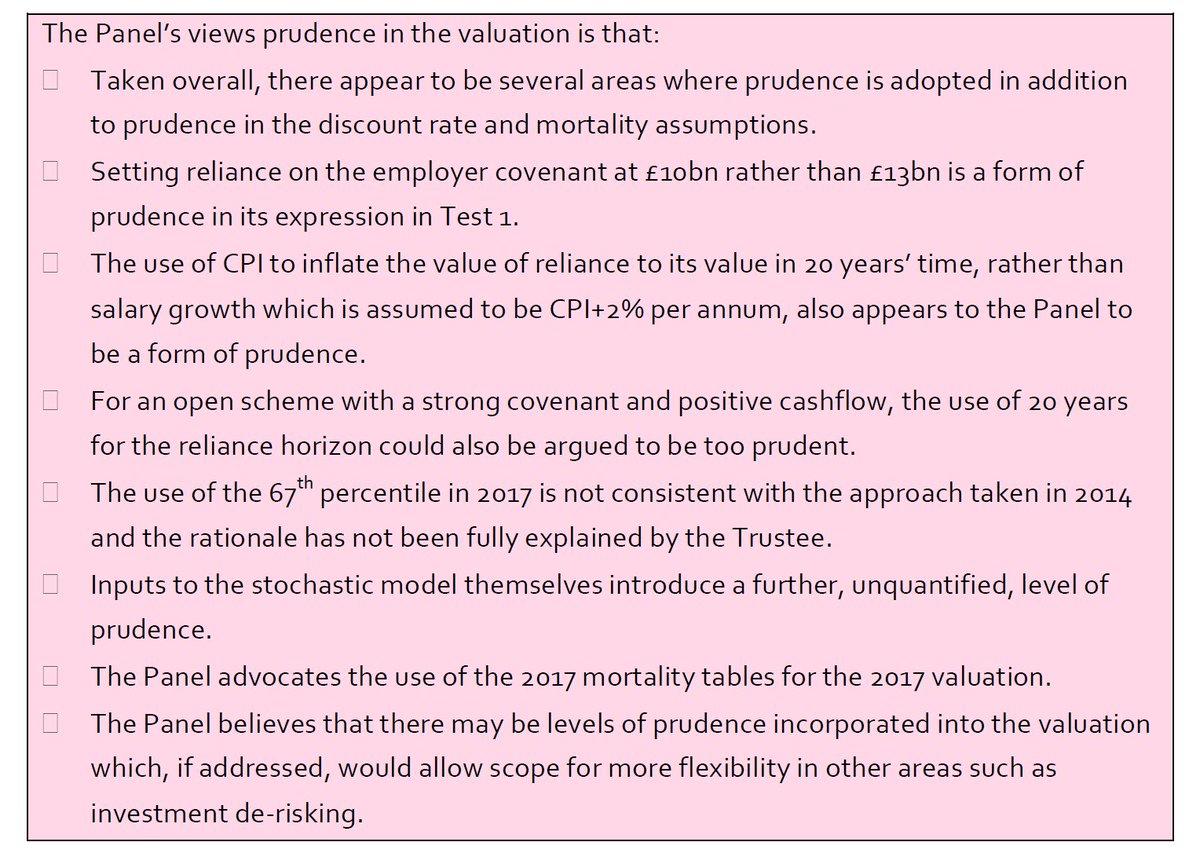

It is also telling that Cambridge's expresses opposition to a relaxation of the excessively prudent assumptions of the 2014 valuation and the linear de-risking over 20 years, starting now, of that valuation. 10/

They express such opposition in spite of the fact that, in their 2014 consultation response, Cambridge was fairly sceptical of the 2014 valuation, noting back then that it appeared to be 'overly prudent'. 11/

Perhaps the following helps explain Cambridge's shift in position between 2014 and 2017: 12/12

https://twitter.com/MikeOtsuka/status/1045246357768998912

👆@CambridgeUCU @OxfordUCU @clem1768 @ucu @Sam_Marsh101 @Flibitygibity @carlomorelliUCU @HershMarion @Dennis_Leech @DaveGuppy @USSbriefs @OpenUPP2018 @JosephineCumbo @henryhtapper

Cambridge's assessment of the strength of the covenant (which was drafted by Jonathan Seed) is at odds with that of the Joint Expert Panel.

It would be good to learn of any discussion or correspondence between Cambridge PWG members (including their outside actuary) & the Pensions Regulator. To what extent did Cambridge try to persuade tPR to adopt their more pessimistic assessment of the strength of the covenant? 1/

tPR's Sept 2017 assessment of the covenant as "tending to strong" rather than (as PWC had assessed it) "strong" is harshly criticised in the JEP report. It was also rejected by all parties: USS, UUK, UCU, and their actuaries. 2/

Not only was tPR's assessment regarded as unfounded. It also played a key role in undermining the prospects of a negotiated settlement between UUK and UCU. 3/

Although @Cambridge_Uni has recently been fairly forthcoming in responding to FOI requests (for which they should receive due credit), they have refused the following request by @ProfBillCooke (see link) for: 4/

whatdotheyknow.com/request/492339…

whatdotheyknow.com/request/492339…

"...all details you hold on meetings and correspondence between your staff

and representatives of The Pensions Regulator in the last three years..."

It was rejected on grounds that compliance, combined w Prof Cooke's other FOI request, would be too costly (time-consuming).

5/

and representatives of The Pensions Regulator in the last three years..."

It was rejected on grounds that compliance, combined w Prof Cooke's other FOI request, would be too costly (time-consuming).

5/

It would be good to submit a narrower request limited to discussion or correspondence with tPR by Cambridge's VC, their CFO (Anthony Odgers), their actuary (Jonathan Seed) in his capacity as Cambridge adviser or rep, plus (other) members of their Pensions Working Group. 6/

I hope members of Cambridge's governing body (i.e., the thousands of academics and other university members of Regent House) call for an investigation of the various responses to #USS consultations Cambridge officials have been submitting... 7/

governance.cam.ac.uk/governance/key…

governance.cam.ac.uk/governance/key…

...without your authorisation and not in your name. I believe that these responses to various #USS consultations will be shown to be radically at odds with the will of the university's governing body. 8/

Members of Regent House: please don't let officials submit yet another unauthorised response to the current (linked) employer consultation on the JEP report, which is once again radically at odds with your will. 9/9

ussemployers.org.uk/news/universit…

ussemployers.org.uk/news/universit…

• • •

Missing some Tweet in this thread? You can try to

force a refresh