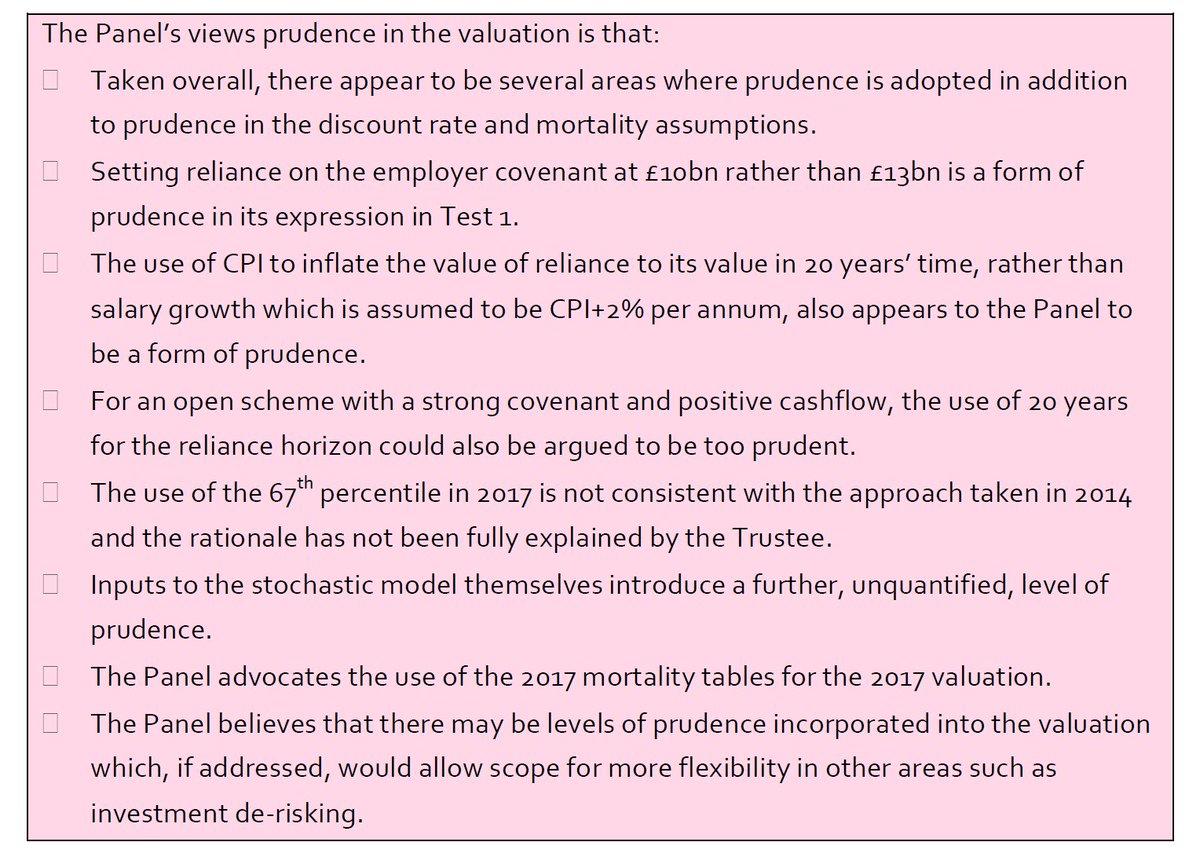

It has been over a month since @Sam_Marsh101 submitted his Addendum to the JEP and #USS. If he's right, the current valuation contains a significant, hidden layer of prudence ABOVE AND BEYOND the following that JEP lists here: 1/

I say more about the significance of Sam's Addendum in this blog post, where I also explain why #USS and @GuyCoughlan owe us an answer to Sam's findings. 2/

medium.com/@mikeotsuka/us…

medium.com/@mikeotsuka/us…

I believe that, so far, this is the only response @Sam_Marsh101 has received: 3/

https://twitter.com/Sam_Marsh101/status/1034727303153102848

In claiming that "the trustee's valuation methodology does not require the projection of assets based on current contribution rates" so they have not "sought to confirm these figures", #USS impales itself on the 2nd horn of the dilemma I sketch in my blog post above. 4/

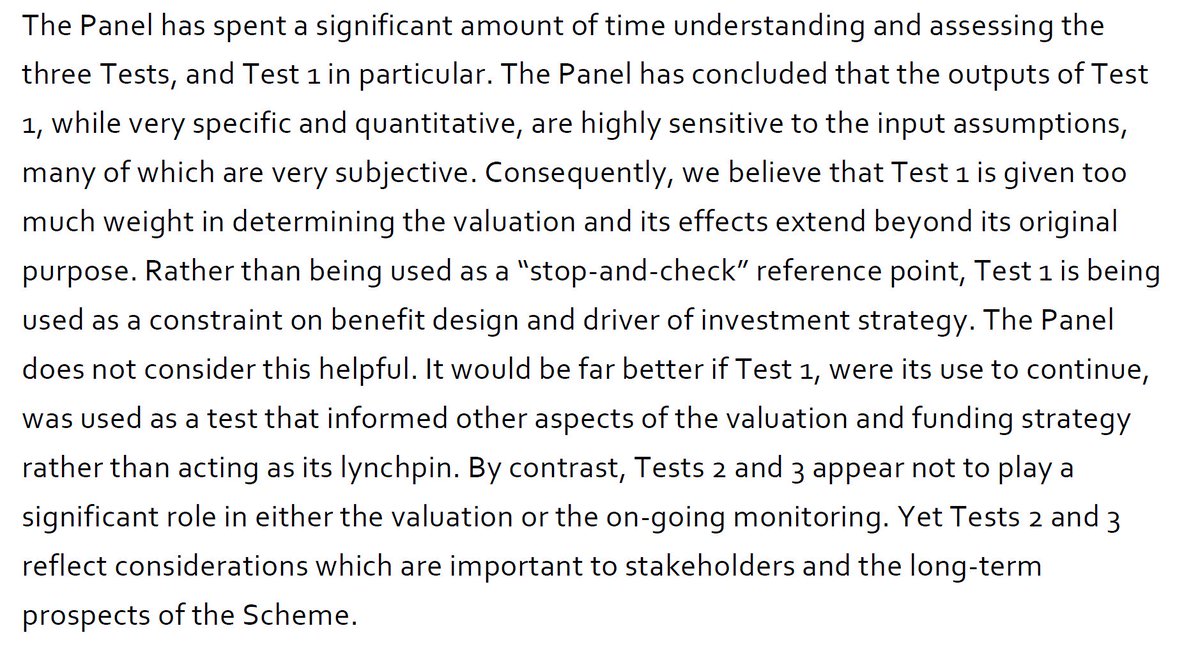

In other words, #USS is failing to apply Test 1 in a manner that makes sense of its underlying rationale: namely, that the level of the assets at yr 20 be high enough that purchase of a self-sufficiency portfolio by yr 40 is affordable via +7% contributions from year 20-40. 5/

This would be yet another serious flaw with #USS's application of Test 1, above and beyond the flaws JEP describes here: 6/

Stakeholders @UniversitiesUK & @ucu should obtain a response from #USS in time to inform the employer's consultation on the JEP report before it closes on 30 Oct, as this bears directly on the question of whether the increased level of risk appetite JEP proposes is prudent. 7/

If @Sam_Marsh101 is right, then Sept de-risking satisfies Test 1, w/o the need to increase contributions above the current 26%, in order to fund the current level of DB & DC provision. 8/

And therefore JEP's proposed increase in contributions by 3.2% (+2.1% employer, +1.1% member) involves an extra layer of prudence beyond what is needed, on a proper application of #USS's own Test 1. 9/

That fact would give employers the confidence to embrace the level of investment risk in the JEP proposals and also serve to undermine any attempt by #USS to resist the JEP proposals as insufficiently prudent. 10/10

👆@UniversitiesUK @AlistairJarvis @ucu @colette147 @JoanneSegars @SallyBridgeland @Sam_Marsh101 @Flibitygibity @carlomorelliUCU @HershMarion @Dennis_Leech @DaveGuppy @RedActuary @Derek_Benstead @kevinwesbroom @GuyCoughlan @USSbriefs @OpenUPP2018 @JosephineCumbo @henryhtapper

• • •

Missing some Tweet in this thread? You can try to

force a refresh