#RealMadrid 2017/18 accounts cover a season when they finished third in La Liga, but won the Champions League for a third consecutive year, the fourth time in 5 years, plus the Club World Cup and European and Spanish Super Cups. Some thoughts in the following thread.

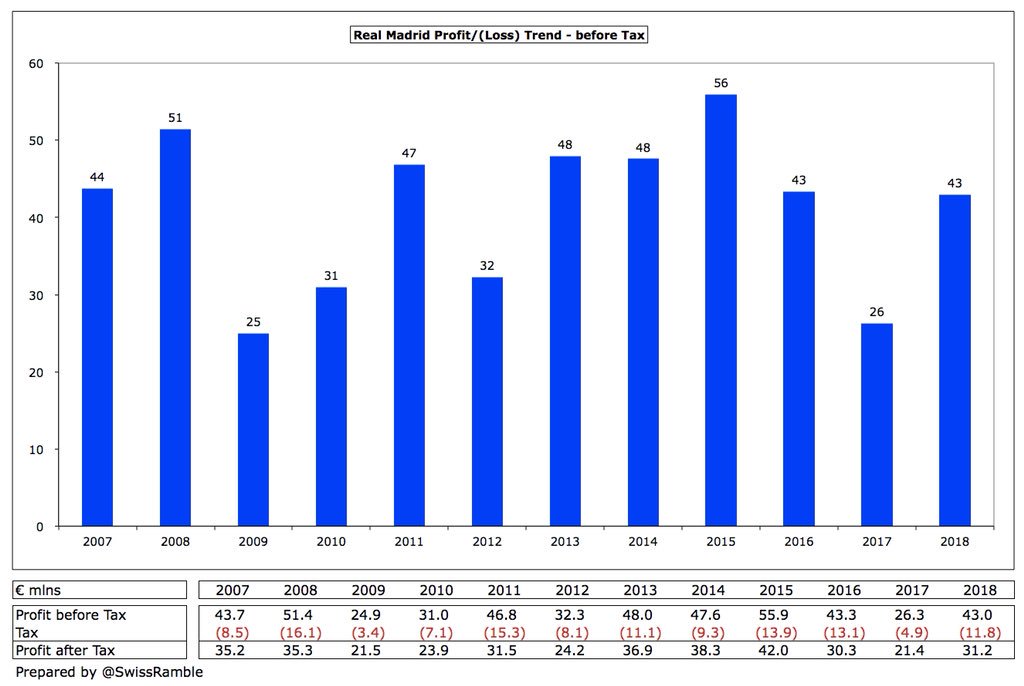

#RealMadrid profit before tax increased by €17m from €26m to €43m (profit after tax up €10m from €21m to €31m). Revenue (Madrid’s definition) rose 11% (€76m), their largest rise since 2000, to a record high of €751m, while profit on player sales was 4% (€2m) up at €54m.

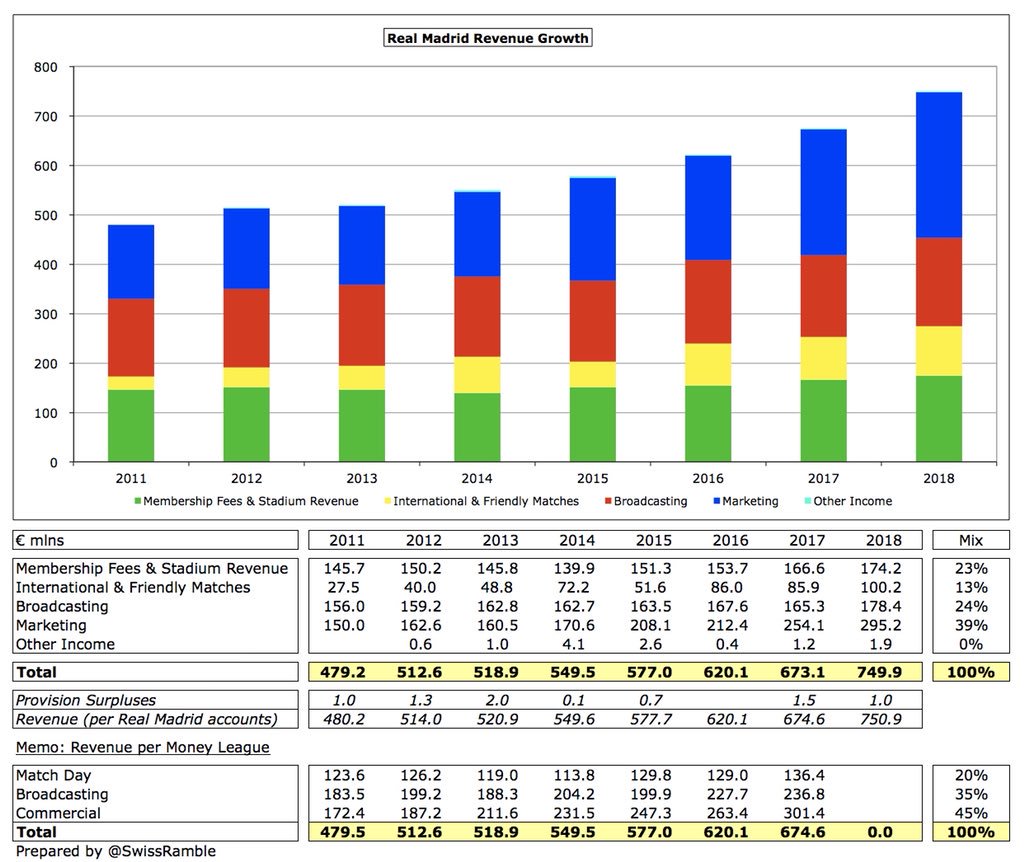

All #RealMadrid revenue streams increased with the largest growth in marketing €41m (16%) to €295m, followed by international & friendly matches €13m (17%) to €100m, broadcasting €13m (8%) to €178m and membership fees & stadium revenue €8m (5%) to €174m.

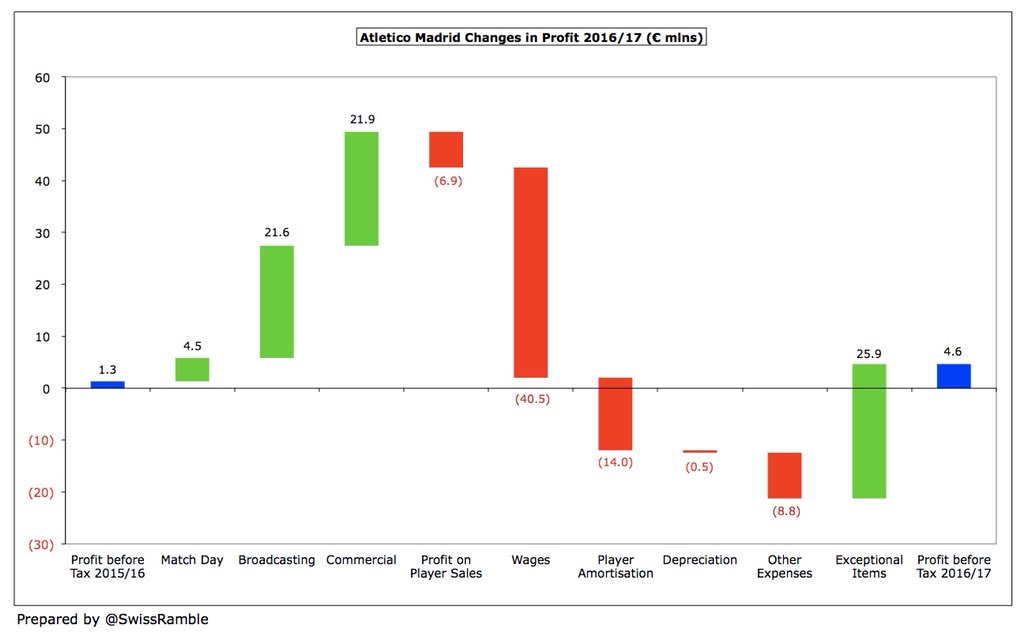

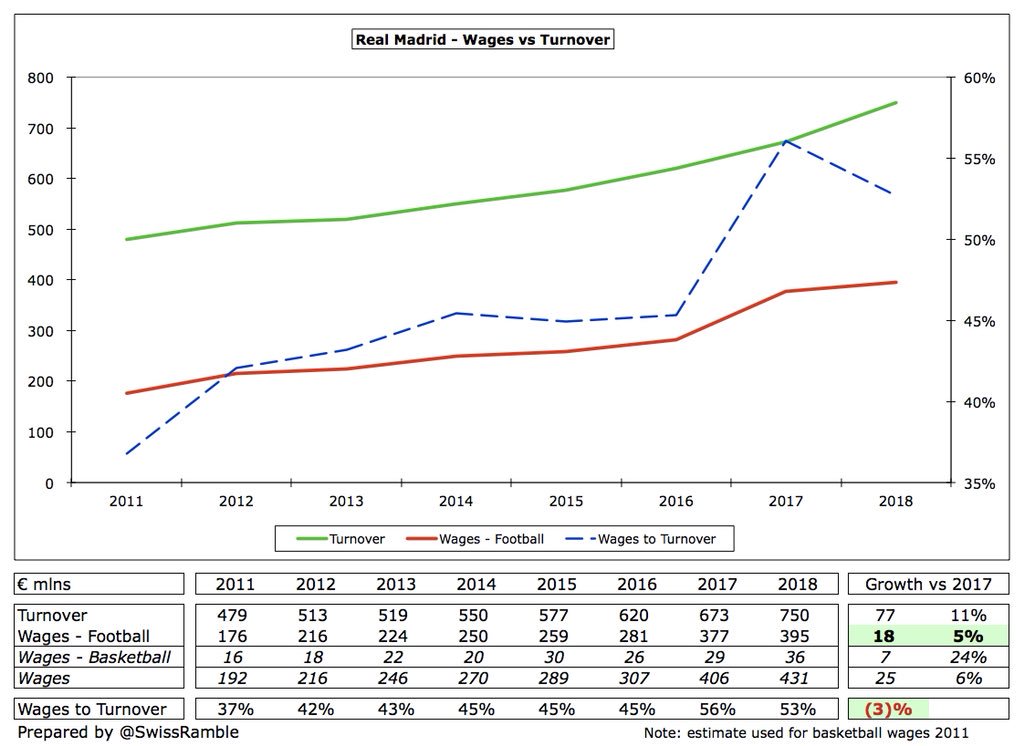

However, #RealMadrid paid the price of success with wages up €25m (6%) to €431m, split football €395m & basketball €36m, and other expenses €45m (25%) higher, partly due to €10m new TV deal payments. Offset by €8m (3%) reductions in player amortisation and depreciation.

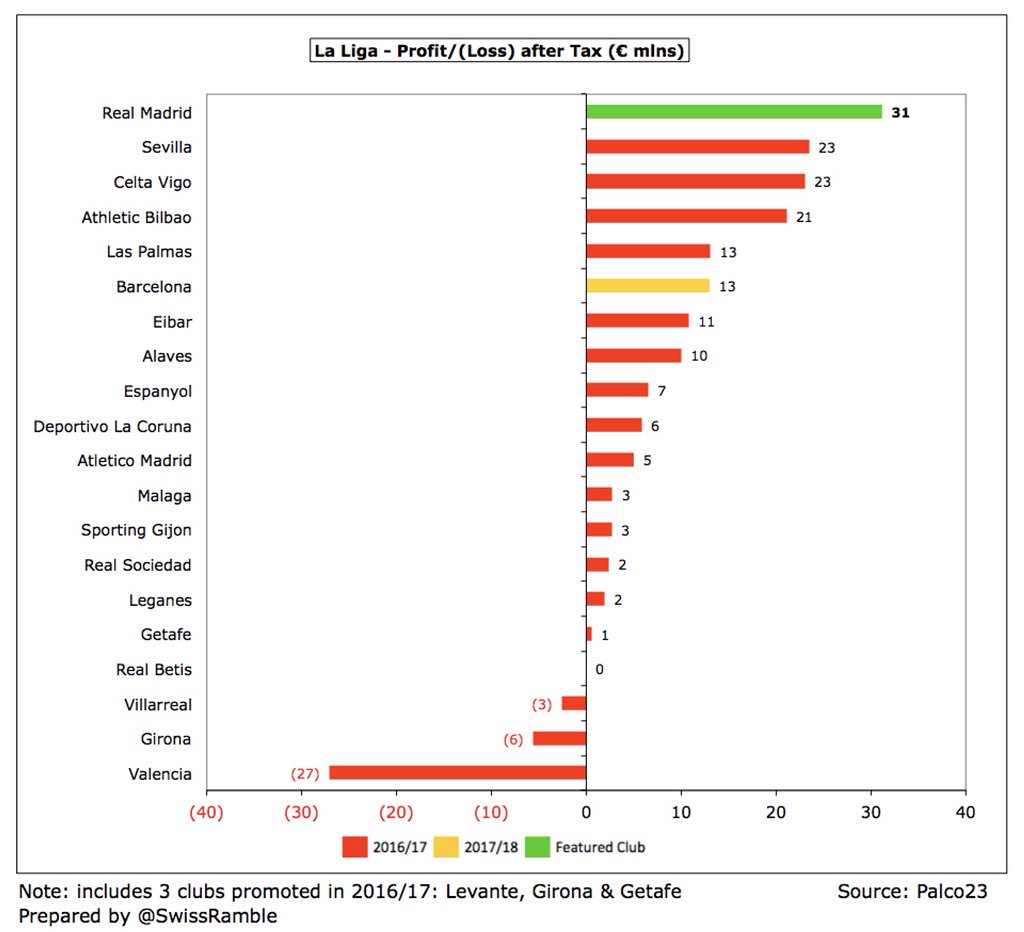

Most clubs in La Liga are profitable, but #RealMadrid 2017/18 €31m profit after tax would have been higher than all other clubs’ reported 2016/17 figures with Sevilla €23m and Celta Vigo €23m leading the way. In comparison, Barcelona’s 2017/18 profit was only €13m.

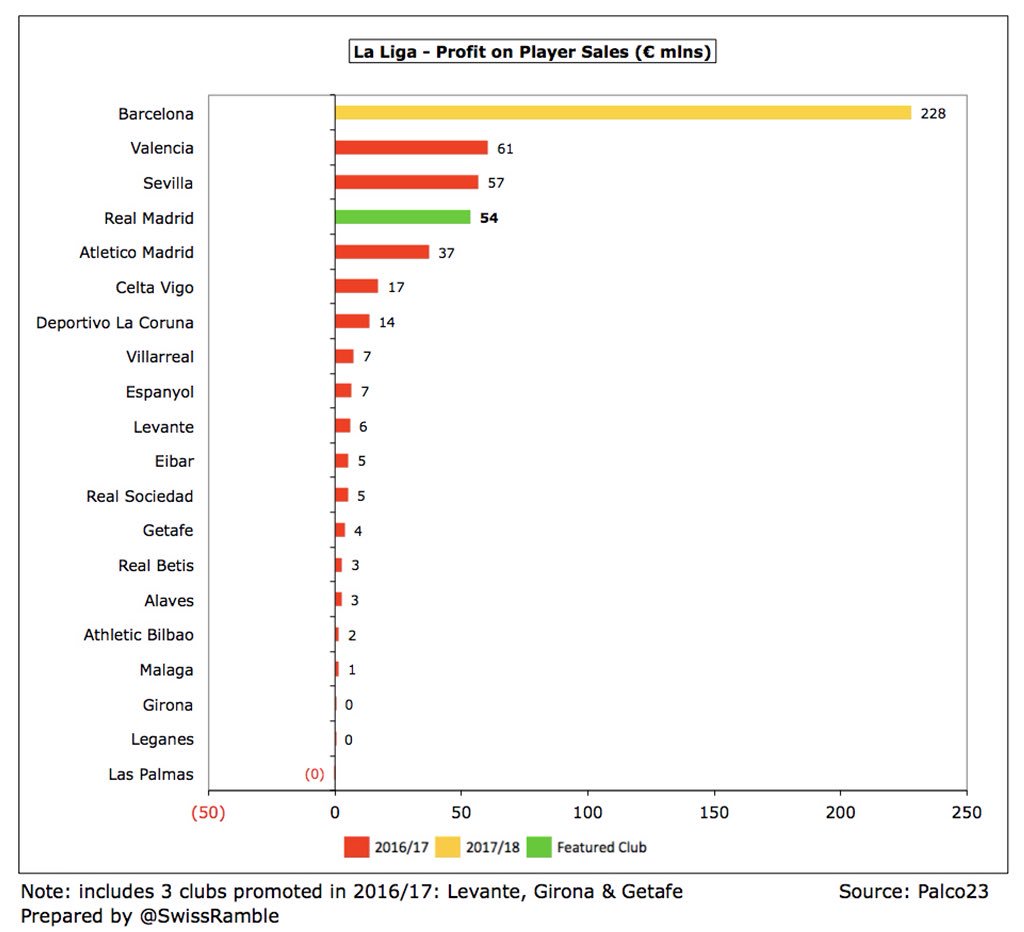

#RealMadrid benefited from €54m profit on player sales, largely due to the moves of Alvaro Morata to Chelsea and Danilo to Manchester City. However, this almost paled into insignificance compared to Barcelona’s colossal €228m profits following Neymar’s sale to PSG.

#RealMadrid are highly profitable, largely due to their great ability to generate revenue. In fact, the club has made €216m profit in the last five years alone, averaging €43m a season. The budgeted profit for 2018/19 is €43m, even after including a €45m stadium provision.

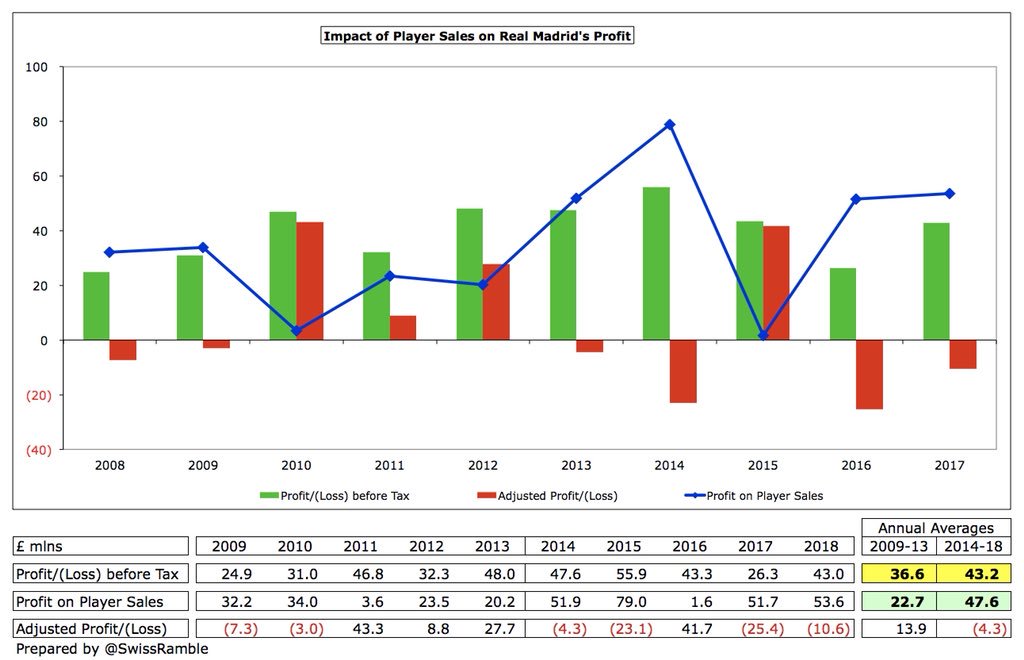

Even though #RealMadrid profits have been remarkably consistent, it is evident that they have become increasingly reliant on player sales with average profits here more than doubling in last 5 years from €23m to €48m. 2018/19 budget includes €102m (mainly Ronaldo to Juventus).

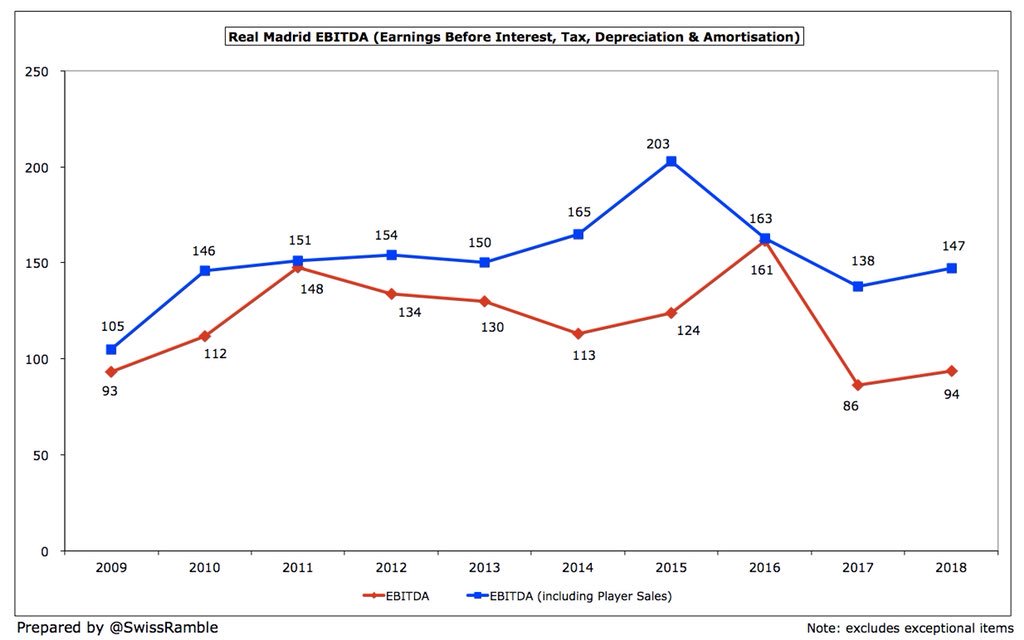

#RealMadrid EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), considered cash operating profit, rose from €86m to €94m, though much less than 2016 peak of €161m. Including player sales, this increased from €138m to €147m.

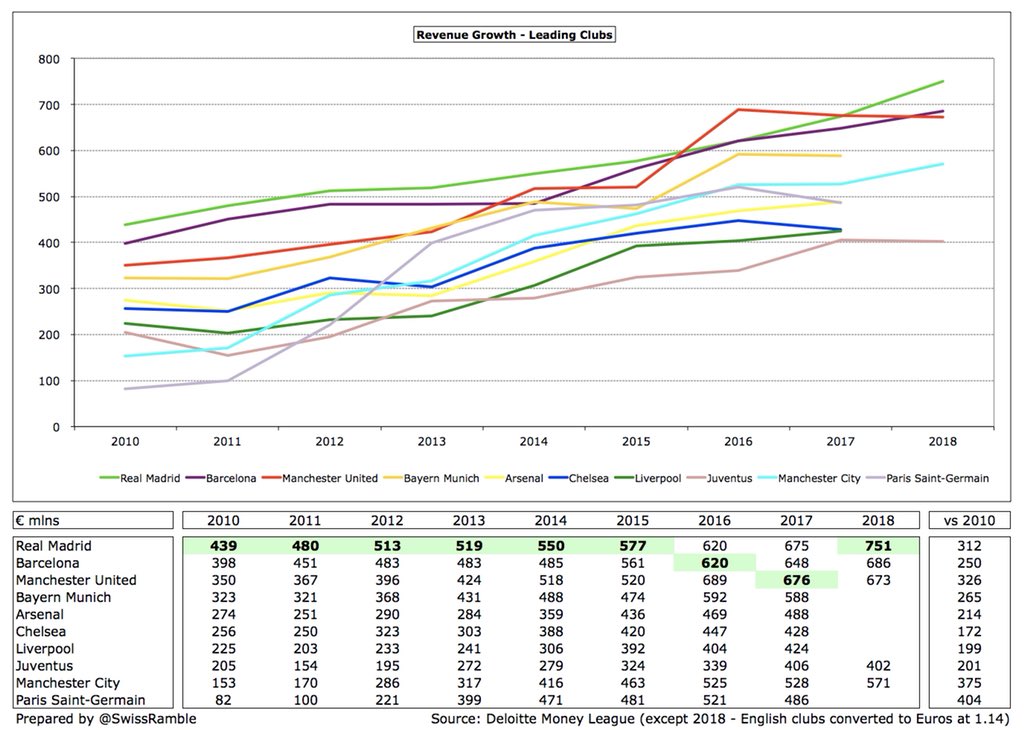

#RealMadrid revenue continues to rise, around €200m in the last four years alone. Since 2000 revenue has grown at an annual average rate of 11%. It’s a reasonably balanced mix: commercial 45%, broadcasting 35% & match day 20% (2016/17). Estimated 2018/19 revenue is €752m.

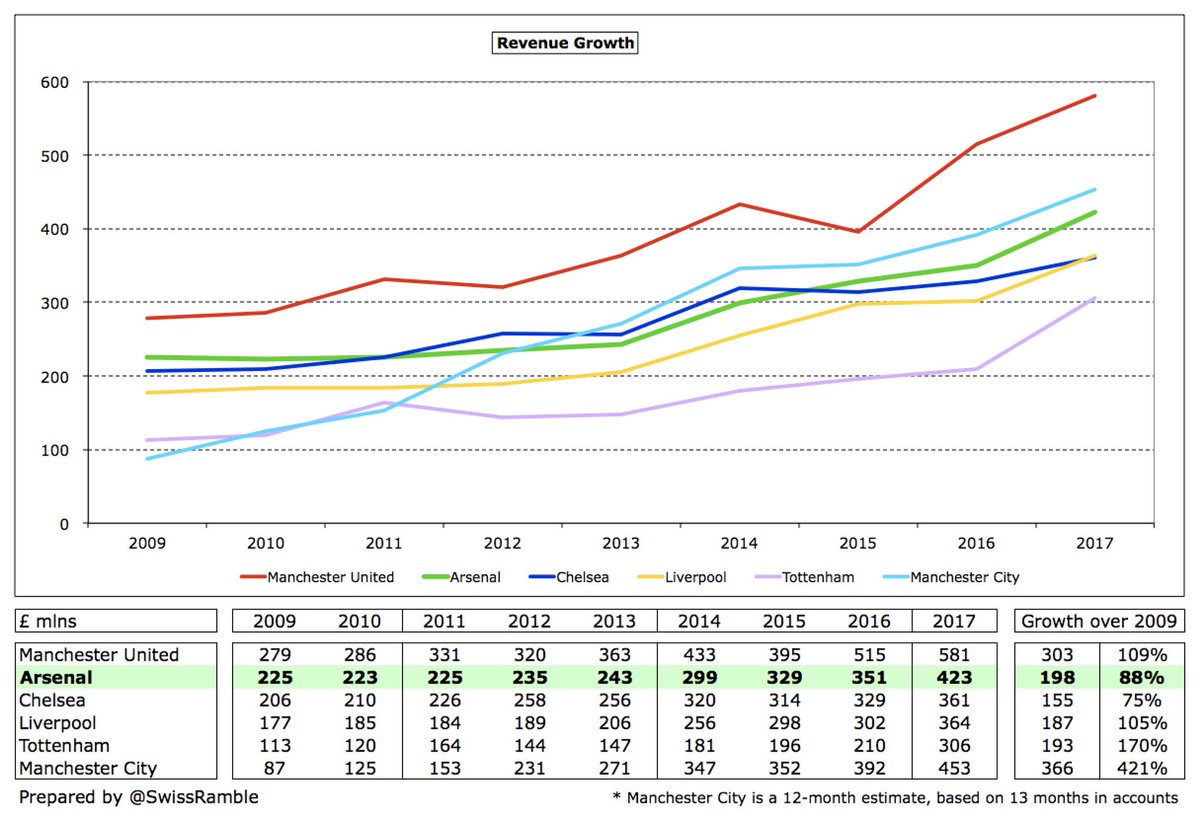

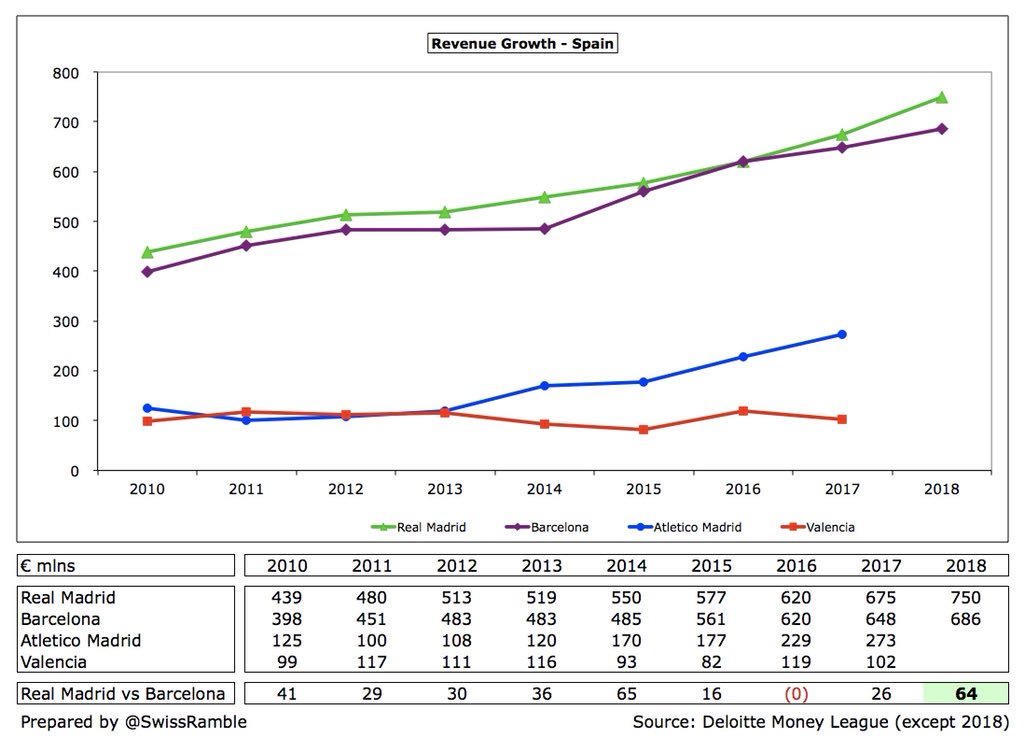

After a blip in 2015/16, #RealMadrid revenue is once again higher than Barcelona by €64m in 2017/18: €750m vs €686m (€914m less €228m player sales). They earn around three times as much as Atletico Madrid, the next closest challenger, with the gap being an enormous €477m.

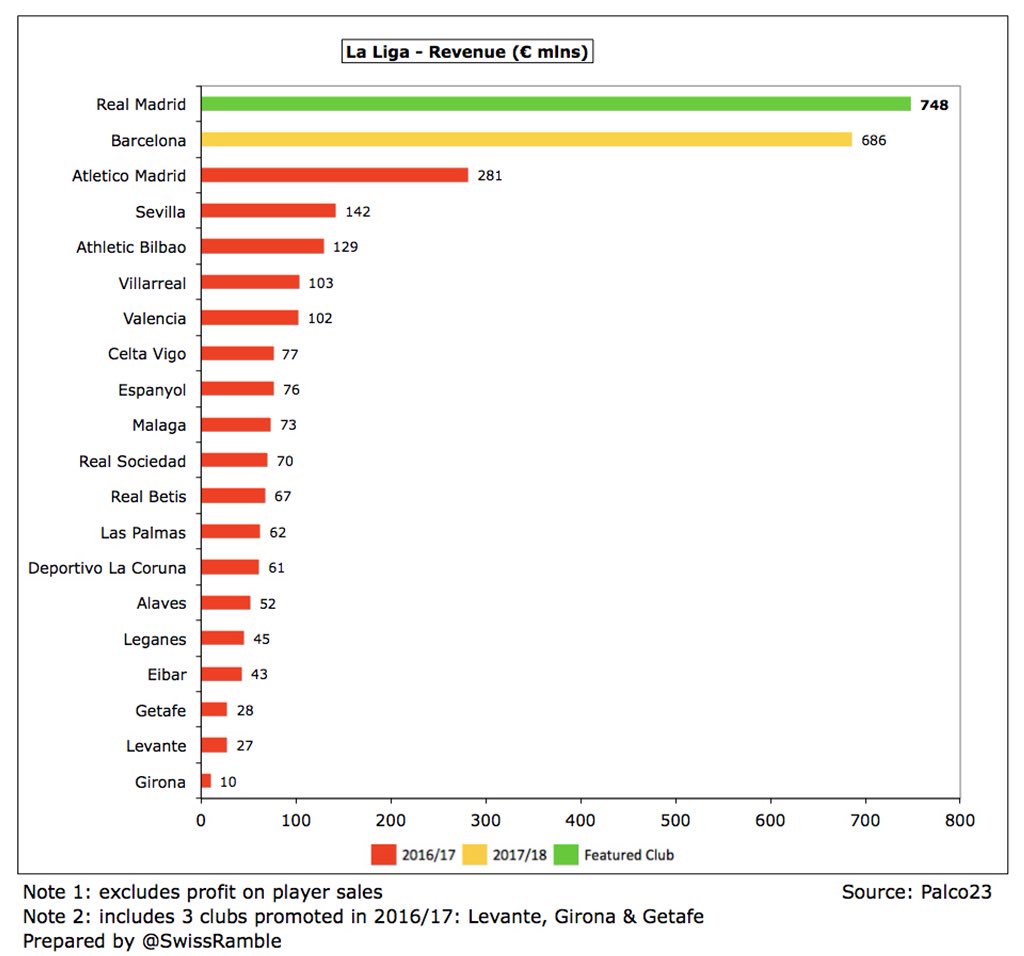

To highlight the contrast in LaLiga, 13 clubs had revenue below €100m in 2016/17. In fact, #RealMadrid €748m revenue (on this basis) is more than the bottom 13 clubs’ combined.

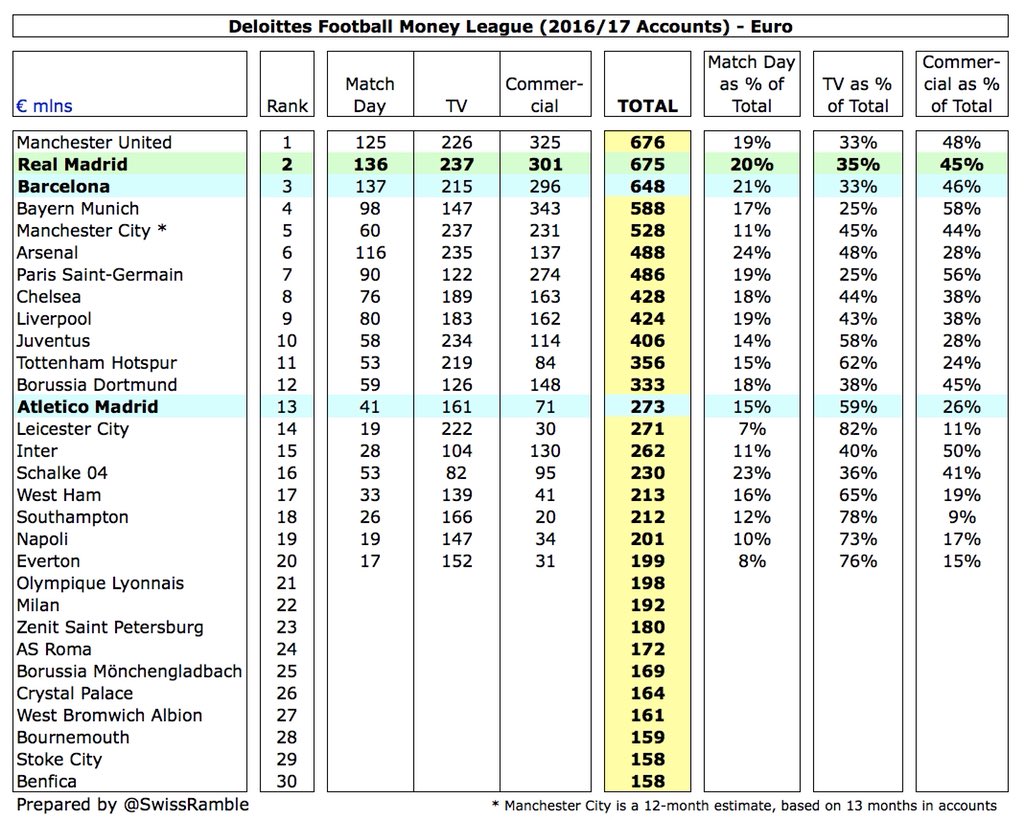

After 11 years in first place in the Deloitte Money League, #RealMadrid were knocked off the top spot in the 2015/16 Money League by Manchester United. In 2016/17 they jumped back above rivals Barcelona and were only €1m behind United, partly due to the weakening Pound.

However, #RealMadrid will once again officially have the highest revenue in world football when the 2017/18 Money League is published, as their €751m is much higher than Manchester United’s estimated €673m (£590m converted at 1.14).

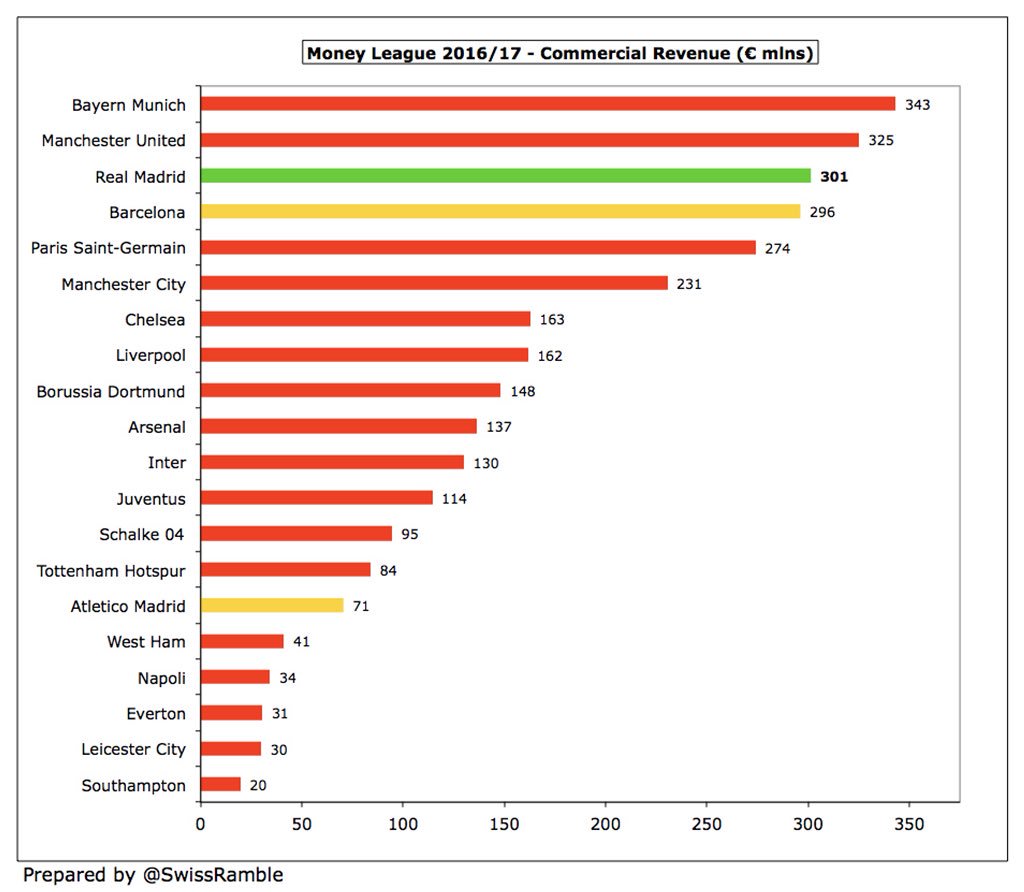

#RealMadrid had the third highest commercial income in the Money League with €301m, only behind Bayern €343m and #MUFC €325m. They have an excellent shirt sponsorship with Emirates (€70m a year) and kit deal with Adidas (€70m a year plus guaranteed merchandising of €30m).

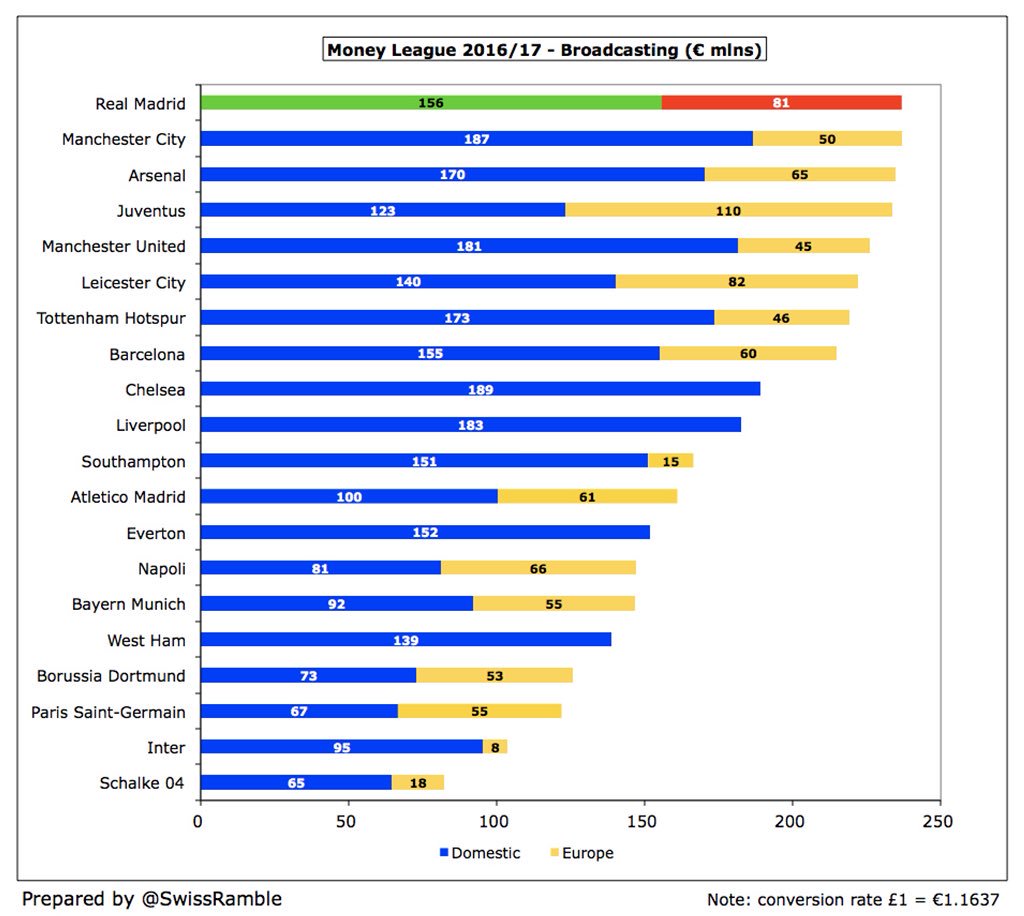

#RealMadrid had the highest broadcasting revenue in 2016/17 with a total of €237m, the same as Manchester City, though the split is quite different (Madrid: domestic €156m, Europe €81m; City: domestic €187m, Europe €50m).

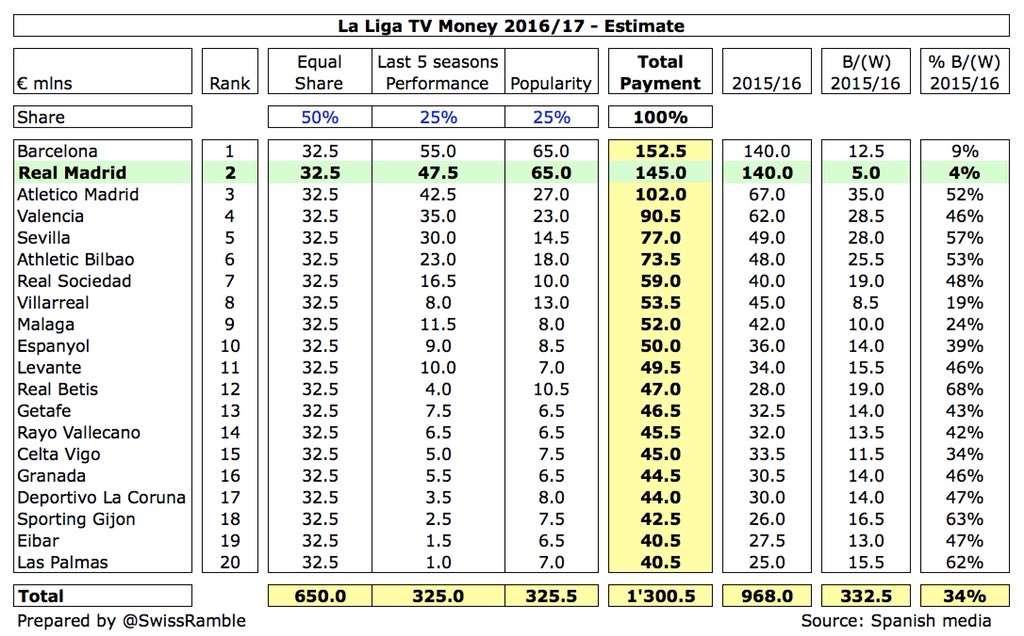

After move to collective Spanish TV deal in 16/17, based on 50% equal share, 25% performance & 25% popularity, #RealMadrid & Barcelona still get the most, but other clubs’ share grew more. New 3-year deal from 19/20 will further increase revenue: domestic 15%, international 30%.

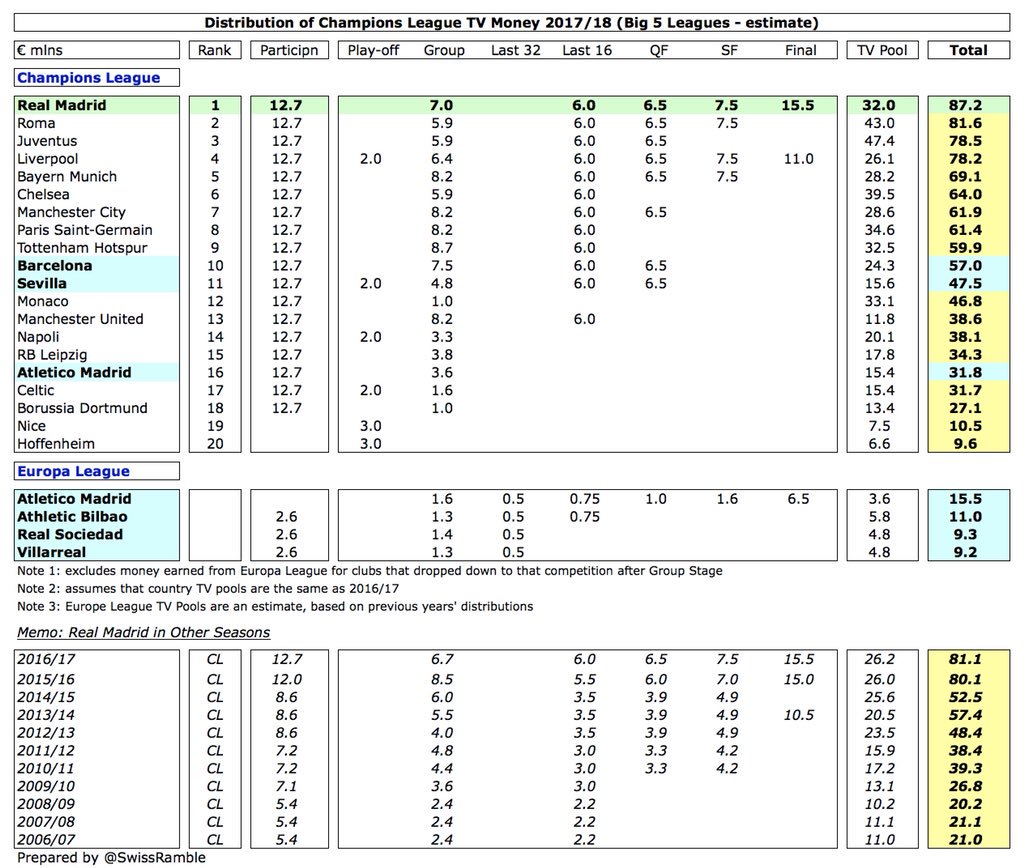

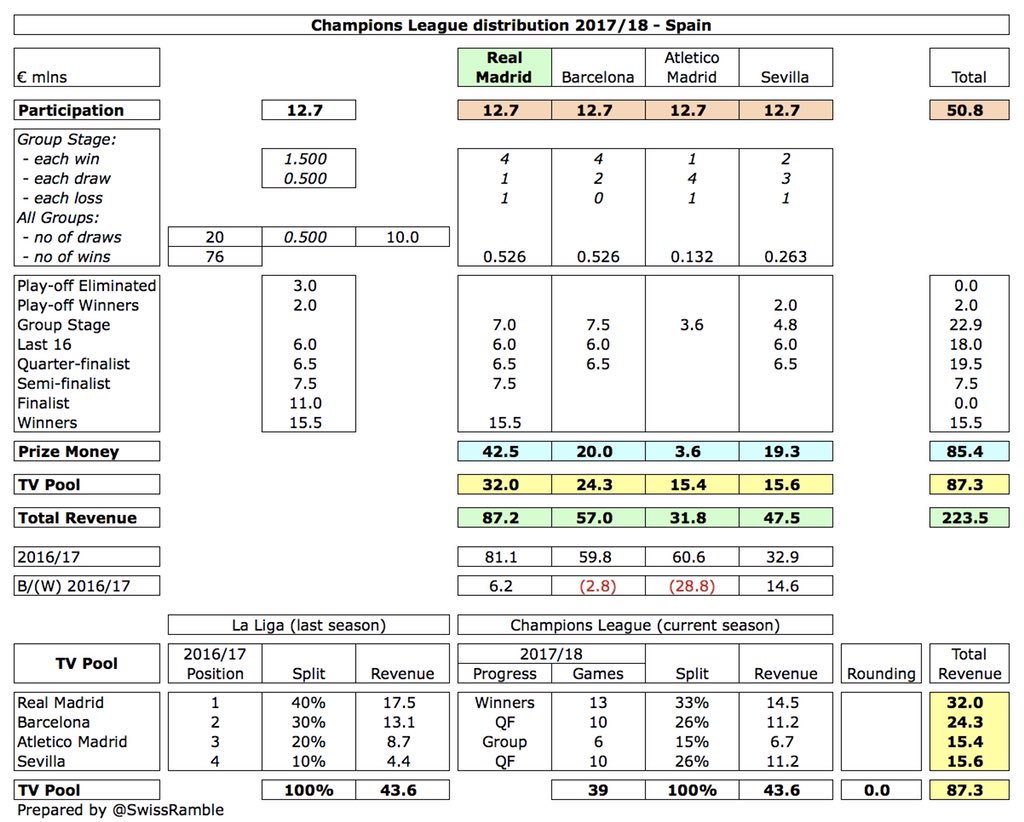

Assuming that the Spanish TV pool was unchanged in 2017/18, #RealMadrid earned €87m for winning the Champions League, €6m more than the previous season. Based on similar estimates, other Spanish clubs: Barcelona €57m, Sevilla €48m and Atleti €47m (including Europa League).

Main reason for the increase in #RealMadrid Champions League revenue was the TV pool, as half is distributed based on the finishing position in the previous season’s La Liga (first in 2016/17 compared to second in 2015/16). Note: Spanish TV deal (and pool) is relatively small.

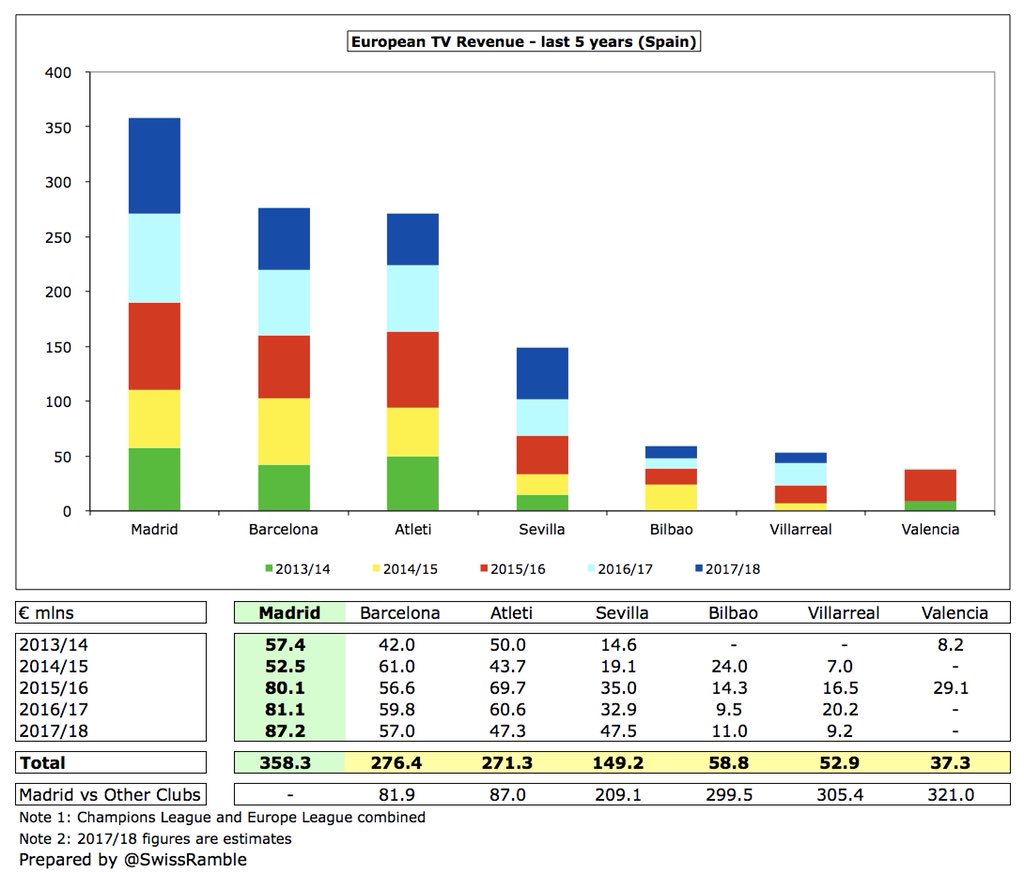

Thanks to their fantastic record in the Champions League, #RealMadrid have earned a hefty €358m from European competition in the last 5 years, which is €82m and €87m more than Barcelona and Atletico Madrid respectively. In Europe, this is only surpassed by Juventus.

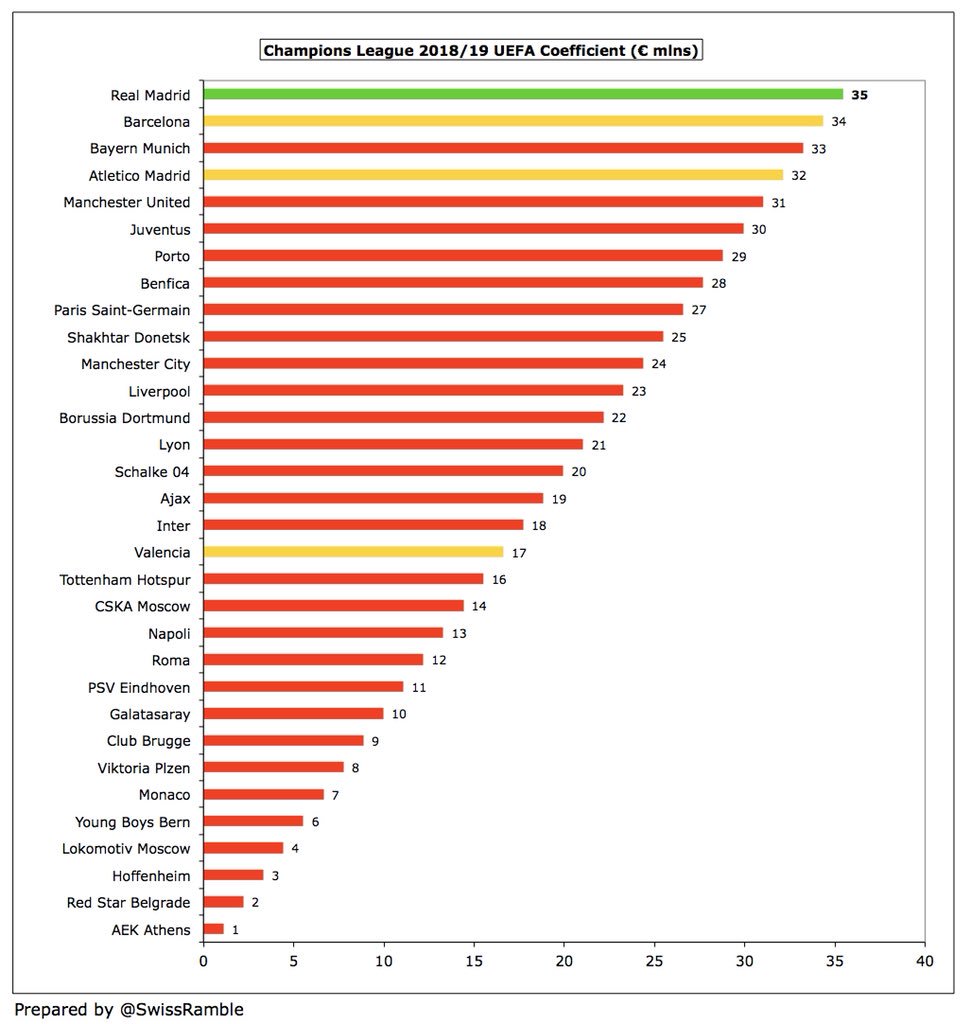

Champions League revenue will rise by 54% in 2018/19. There is also a new UEFA coefficient payment (based on performances over 10 years), which will benefit #RealMadrid at the expense of clubs from countries with large TV pools (England and Italy), guaranteeing them €35m.

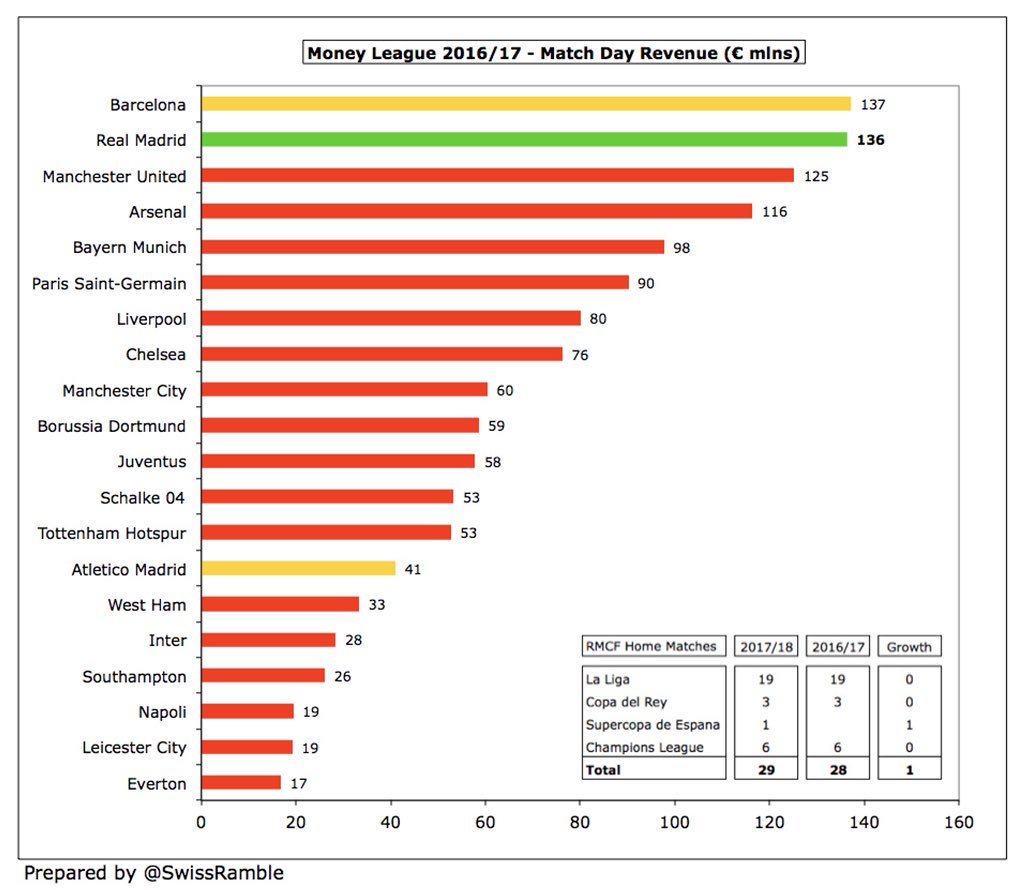

#RealMadrid match day revenue of €136m, including €50m of membership fees, was the second highest in the world in 2016/17, only beaten by Barcelona €137m, but ahead of Manchester United €125m and Arsenal €116m.

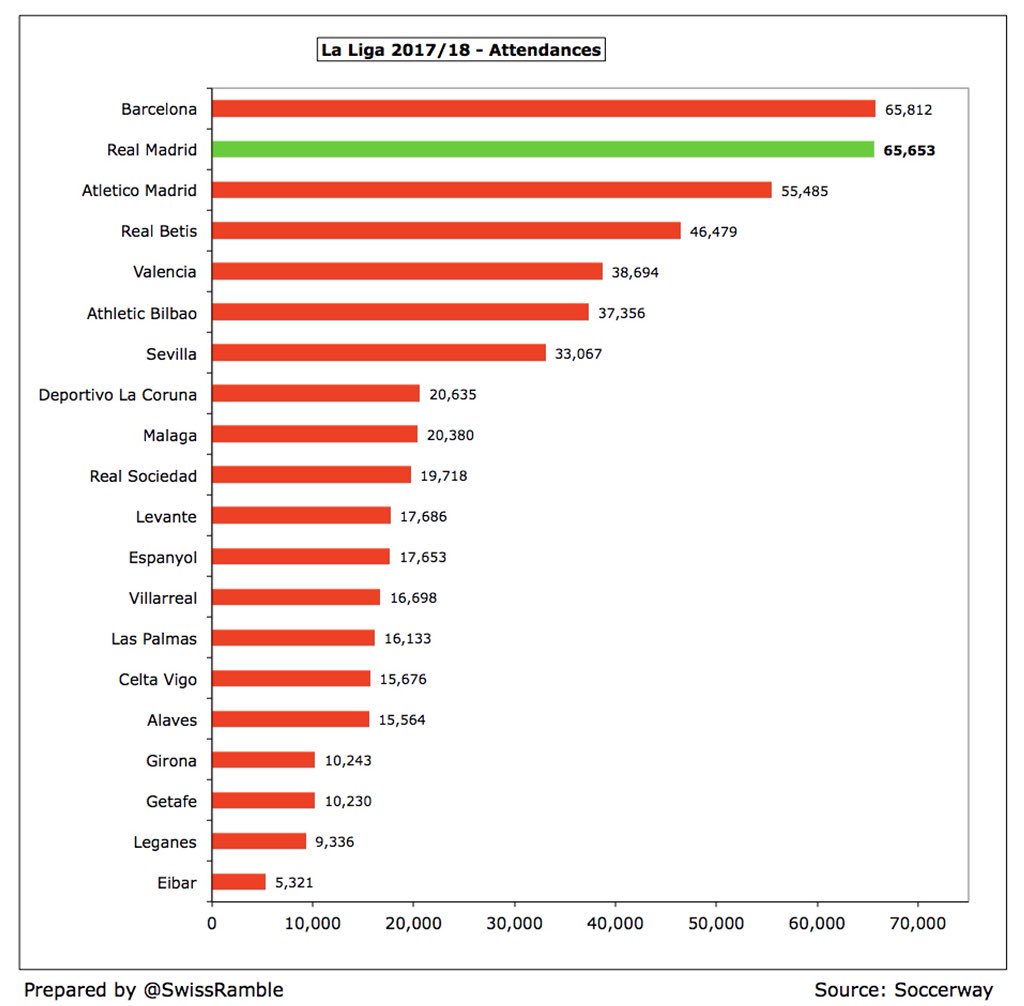

Similarly, #RealMadrid average attendance in 2017/18 of 65,653 was the second highest in Spain, just behind Barcelona 65,812. Atletico Madrid rose to 55,475 following their move from the Vicente Calderon to the Wanda Metropolitano.

The #RealMadrid assembly recently approved the €575m redevelopment of the Santiago Bernabéu stadium with estimated completion date of 2023. A €400m naming rights deal with IPIC fell through, so this will significantly increase club’s debt (annual cost around €25m).

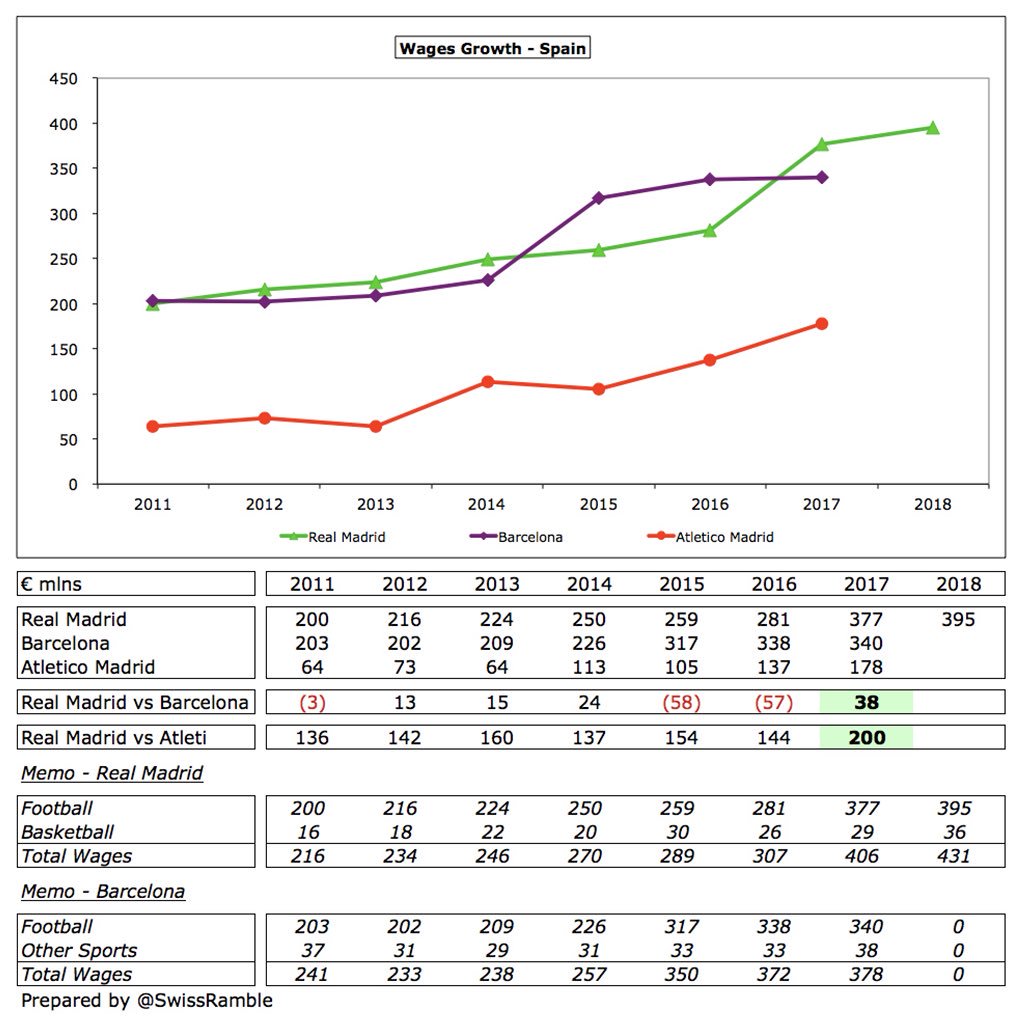

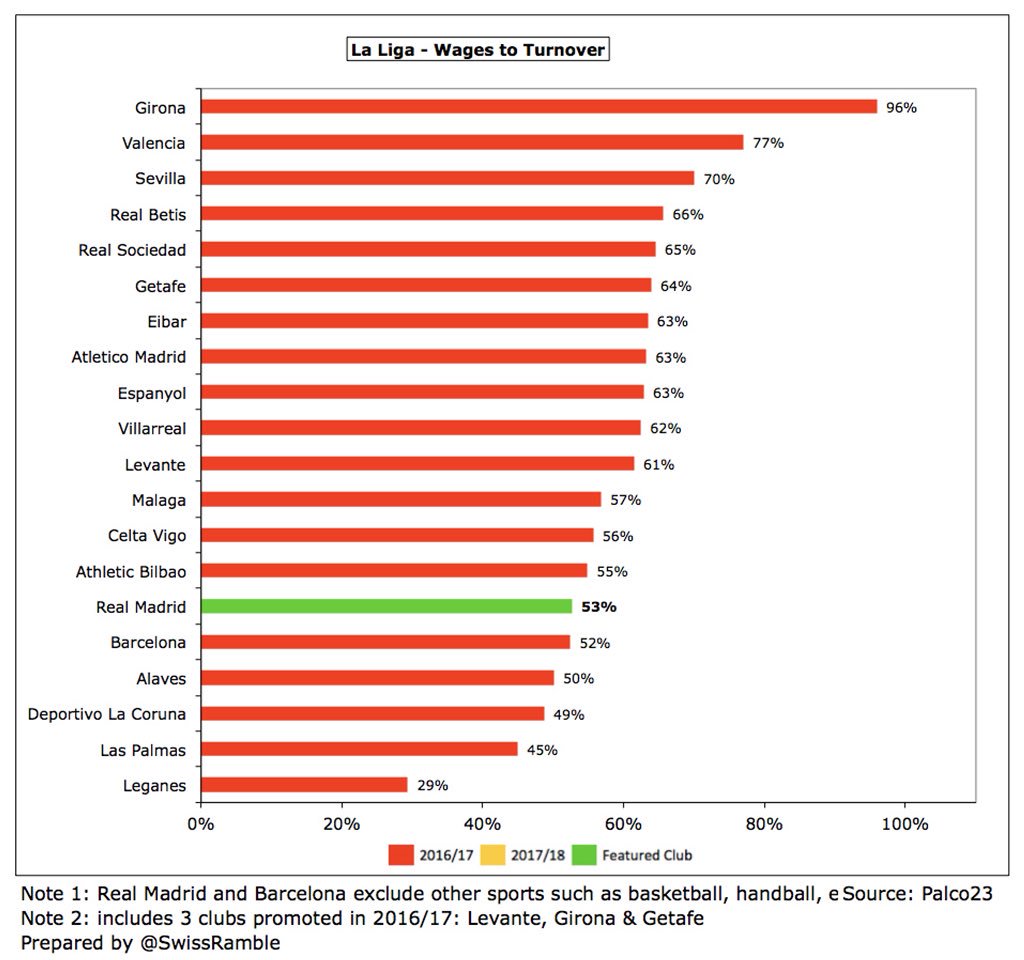

#RealMadrid football wage bill rose 5% (€18m) from €377m to €395m in 2017/18 with the wages to turnover ratio falling from 56% to 53%, well within the ECA maximum level of 70%, Football wages have increased by €136m (52%) in the last three years.

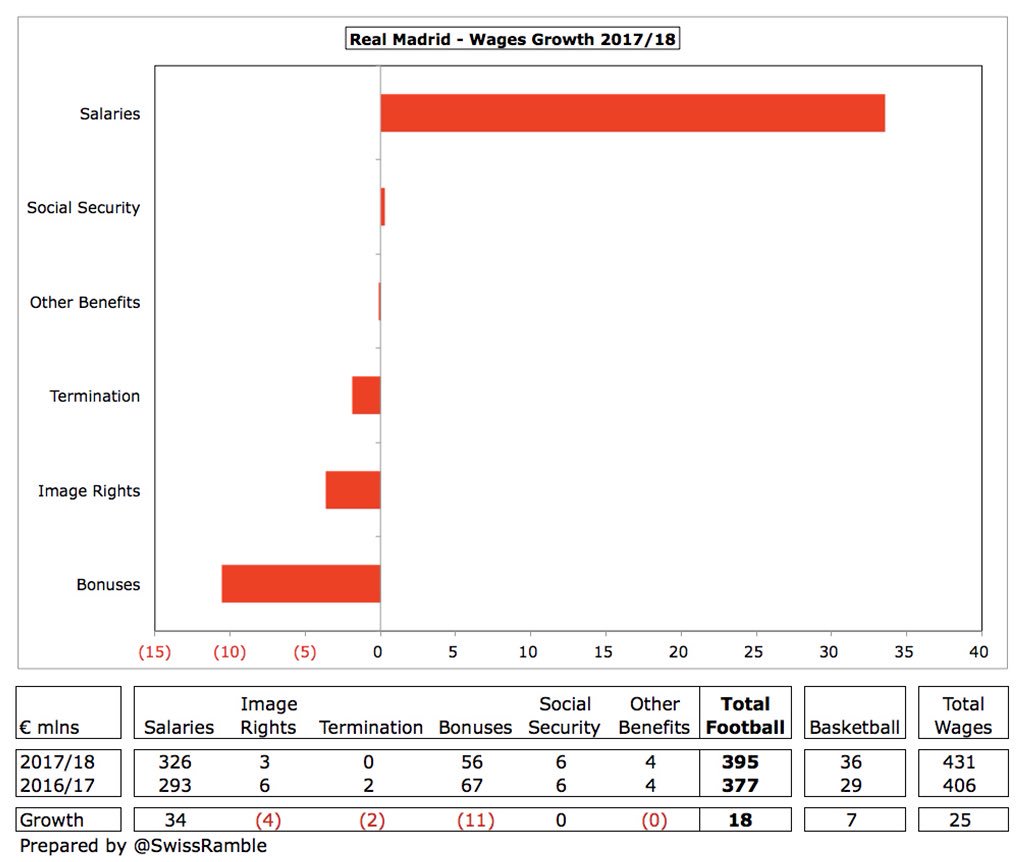

The main driver of #RealMadrid wages growth was a €34m increase in basic salaries to €325m, offset by €11m reductions in bonus payments to €56m and €4m in image rights. Note that the total wage bill of €431m includes €36m for basketball (up €7m).

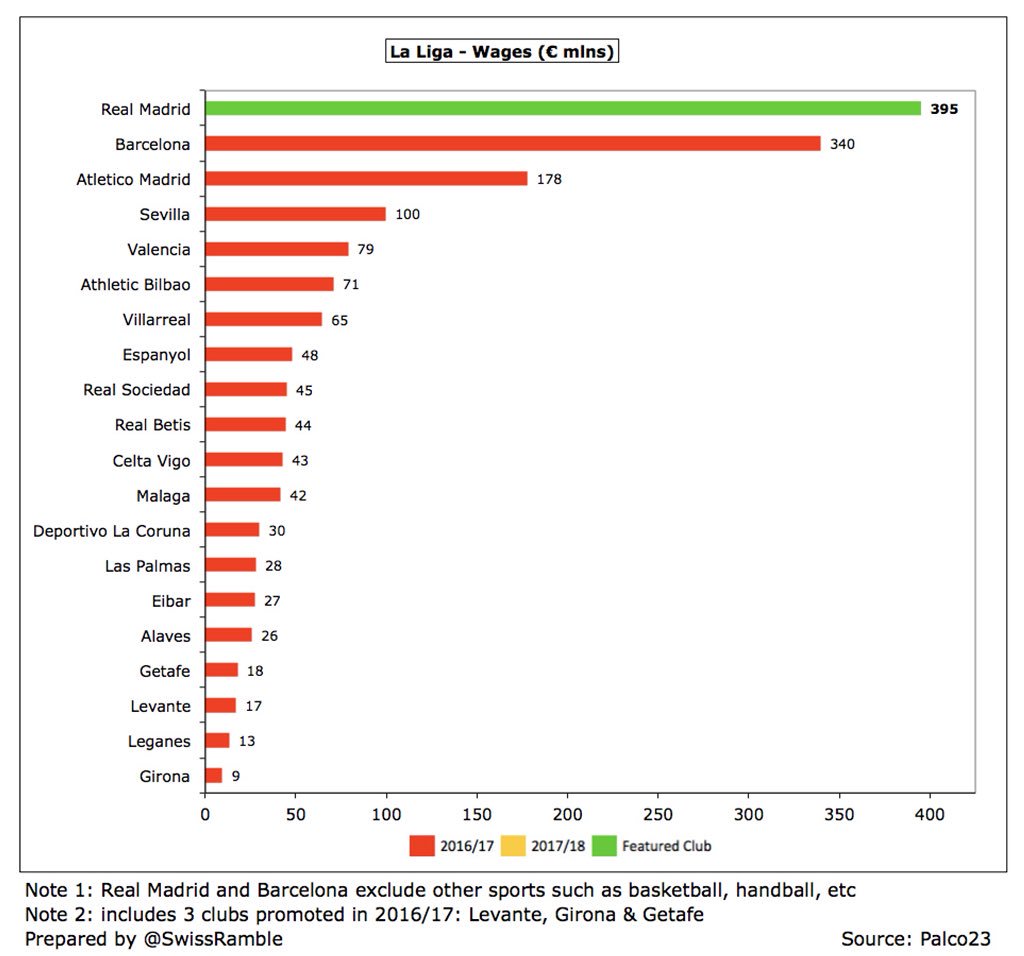

#RealMadrid wage bill of €395m is €55m higher than Barcelona’s €340m, though the Catalan club’s number will surely increase once it publishes detailed 2017/18 accounts. The “big two” pay around twice as much as Atleti €178m, followed by Sevilla €100m and Valencia €79m.

In fact, the gap between #RealMadrid €395m wage bill and others has never been higher. The shortfall against Barcelona 2015 & 2016 has reversed, while difference with Atletico Madrid was a massive €200m in 2016/17. As a comparison, top English wages: #MUFC €340m, #MCFC €300m.

Despite the continued increase in wages, #RealMadrid 53% wages to turnover ratio is still highly respectable, thanks to their enormous revenue, and is around the same level as Barcelona 52%. That said, this is much higher than the 42-45% the club achieved between 2012 and 2016.

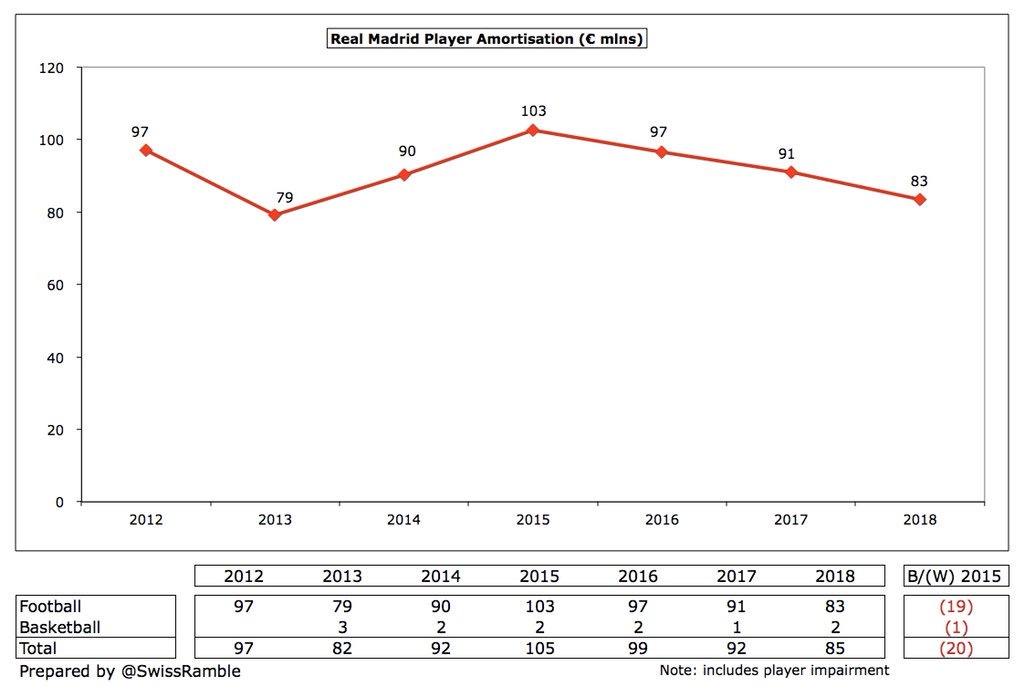

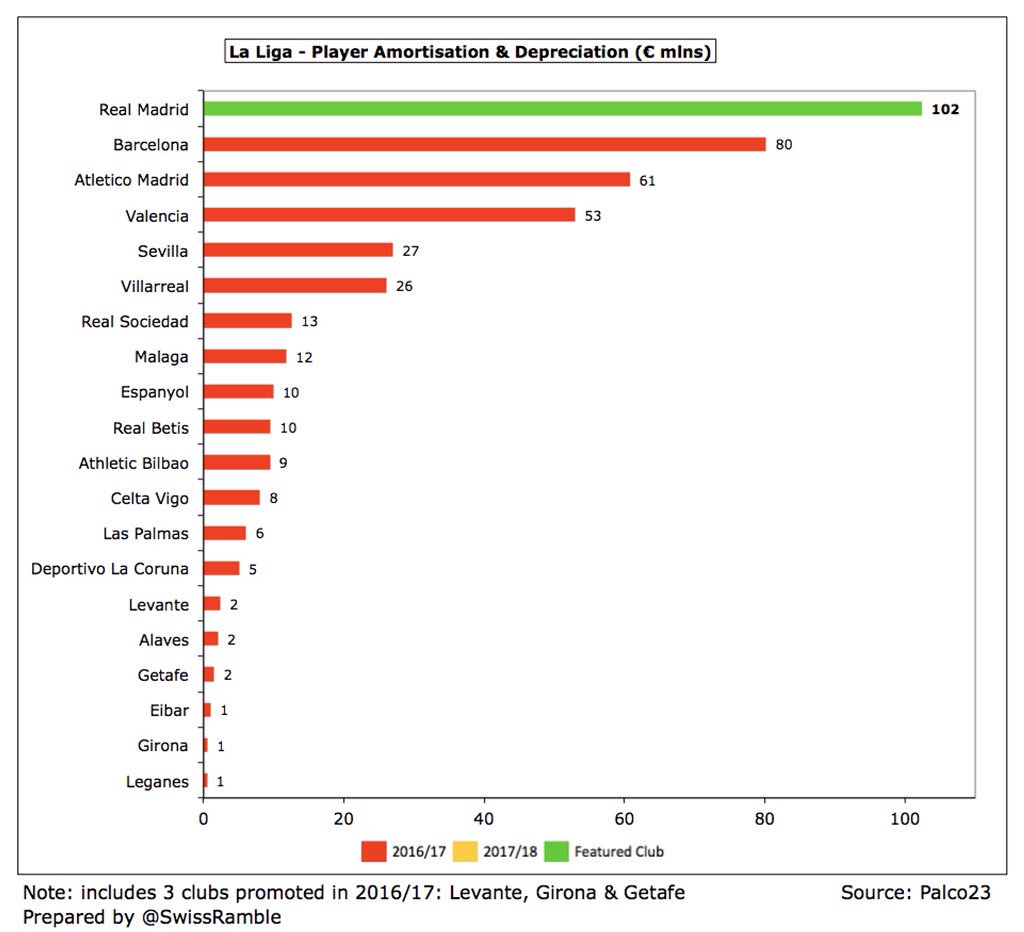

The other #RealMadrid staff cost, player amortisation, has actually fallen by 19% over last 3 seasons from €103m in 2015 to €83m in 2018, partly as a result of extending player contracts. For some context, player amortisation at big spending #MUFC and #MCFC is around €155m.

#RealMadrid total amortisation of €102m (including €15m depreciation) is the highest in Spain, above Barcelona €80m and Atletico Madrid €61m, which reflects to an extent their traditional strategy of buying “Galacticos”.

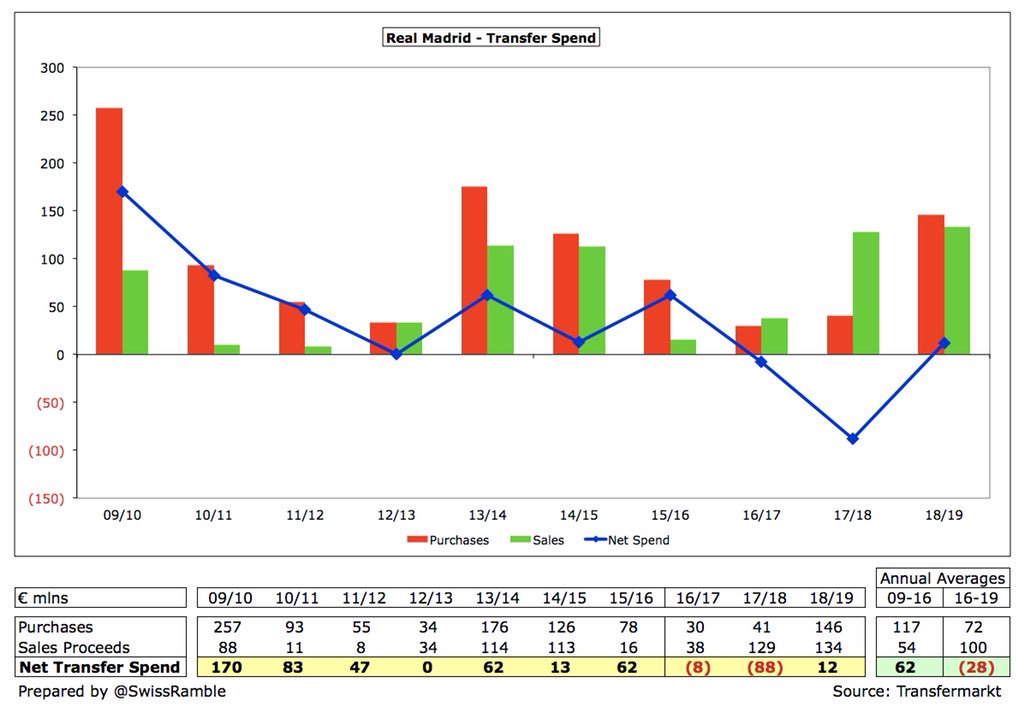

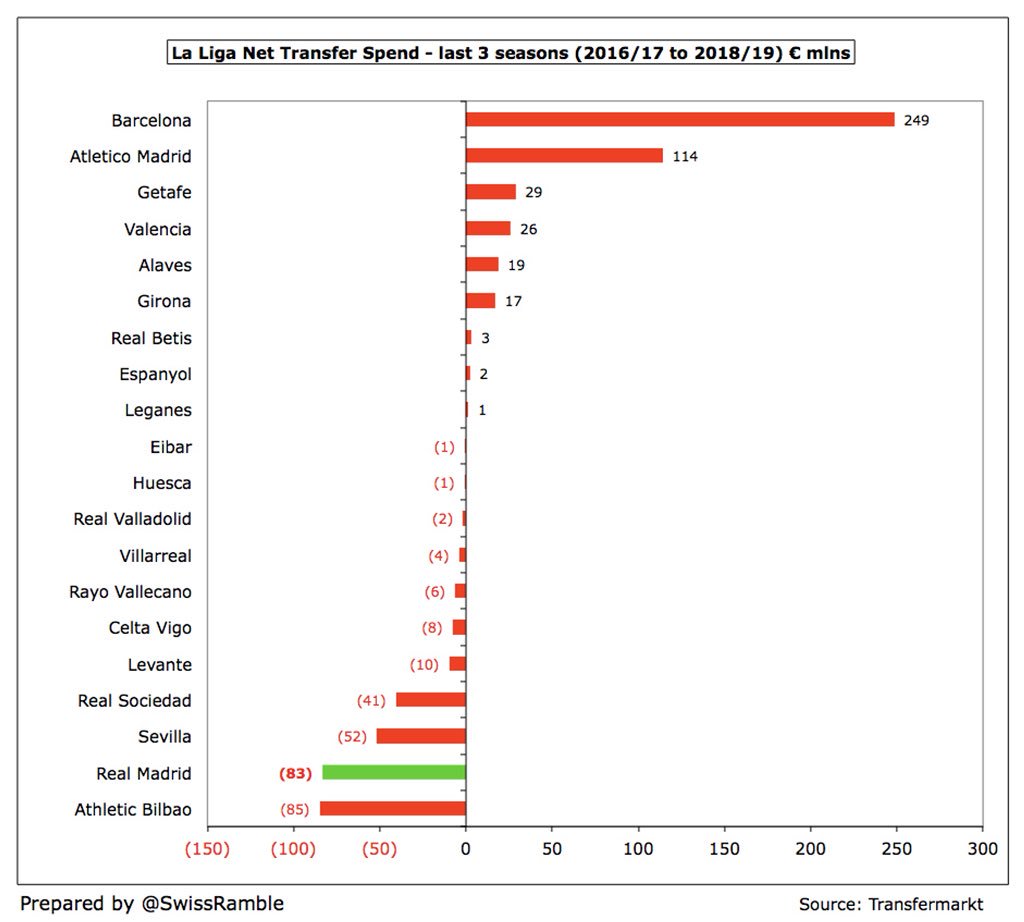

Perhaps surprisingly, #RealMadrid have made a profit from transfers in the last 3 seasons (annual average £28m), partly due to a transfer ban after club found guilty of breaching rules on signing youth players. This compares to £62m average net spend for preceding 7 years.

As a consequence, #RealMadrid actually had net sales of €83m over the last 3 seasons, only surpassed by Athletic Bilbao £85m. In contrast, Barcelona and Atletico Madrid had net spend of €249m and €114m respectively in the same period.

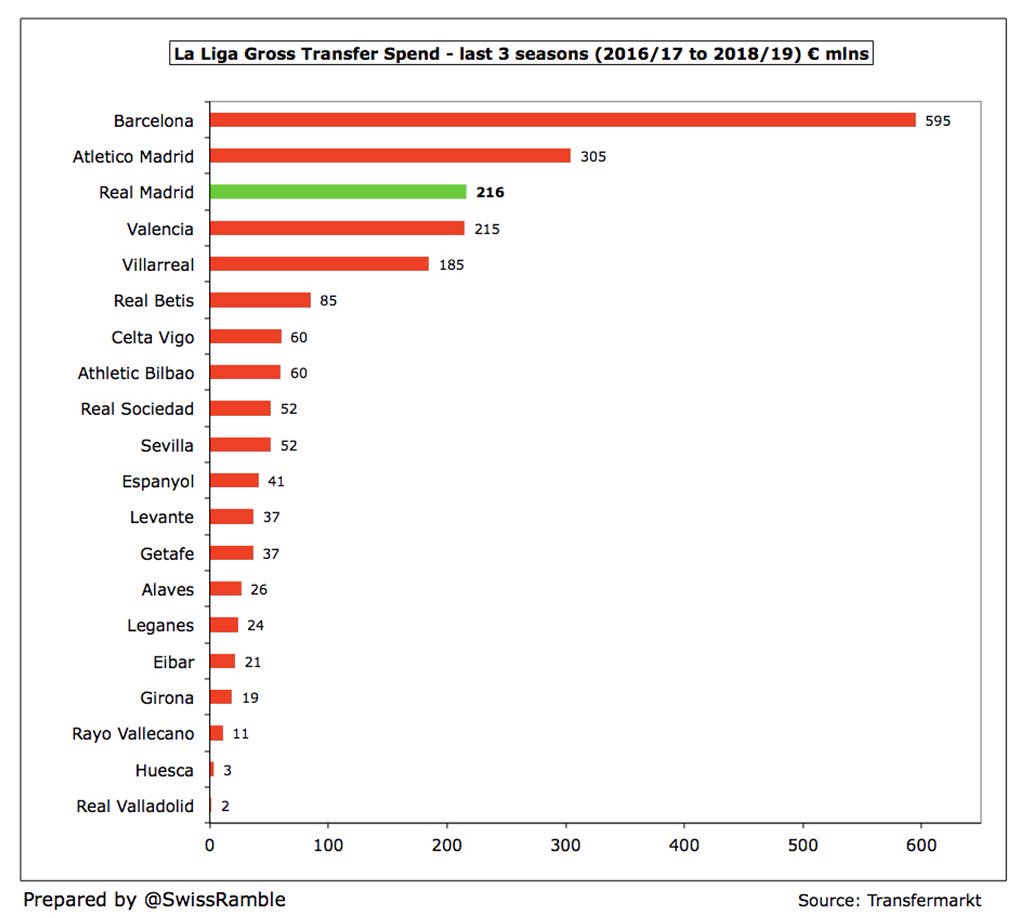

The situation was more predictable for gross spend, as #RealMadrid €216m over the last 3 season was the third highest in La Liga, but even this was a huge €380m below Barcelona €595m, €90m less than Atletico Madrid €305m and only around the same as Valencia €215m.

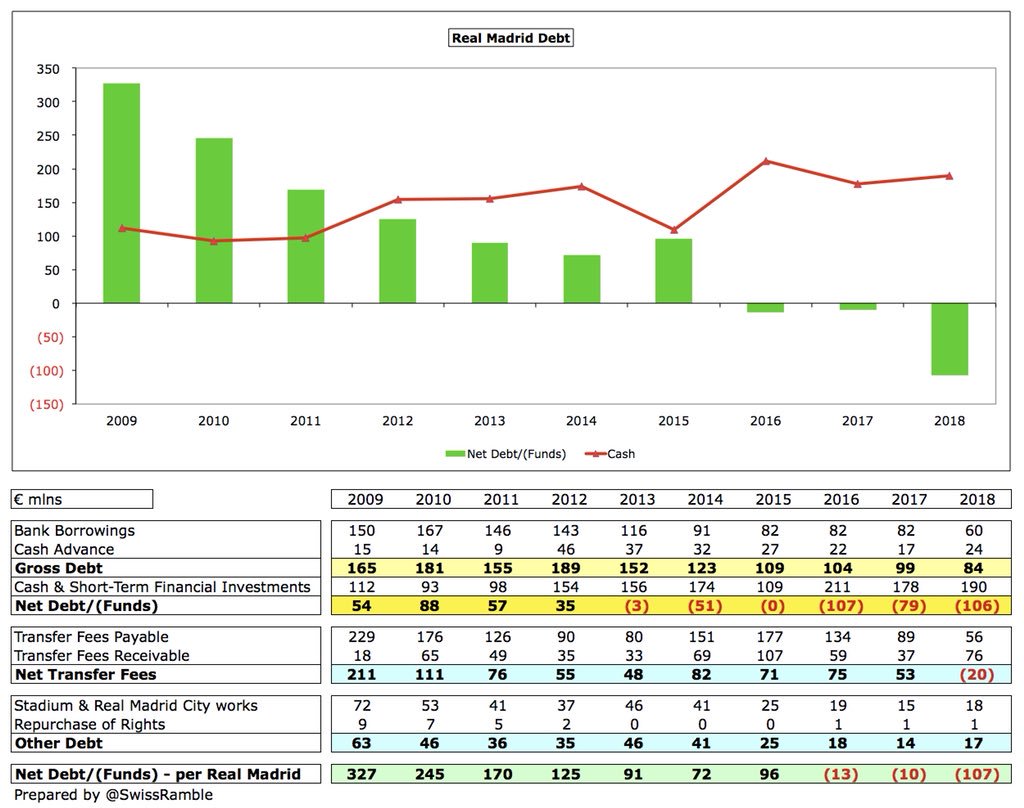

#RealMadrid have made considerable efforts to reduce their debt, so much so that they actually have net funds of €107m, compared to €327m debt in 2009 (as per the club’s own definition, which includes transfer fees & infrastructure liabilities). Bank borrowings are only €60m.

#RealMadrid cash balances are a healthy €190m, partly due to influx of membership fees in June, just before semi-annual wage payment in July. However, outstanding transfer fees have been cut from €177m in 2015 to €56m, while amounts owed by other clubs are up to €76m.

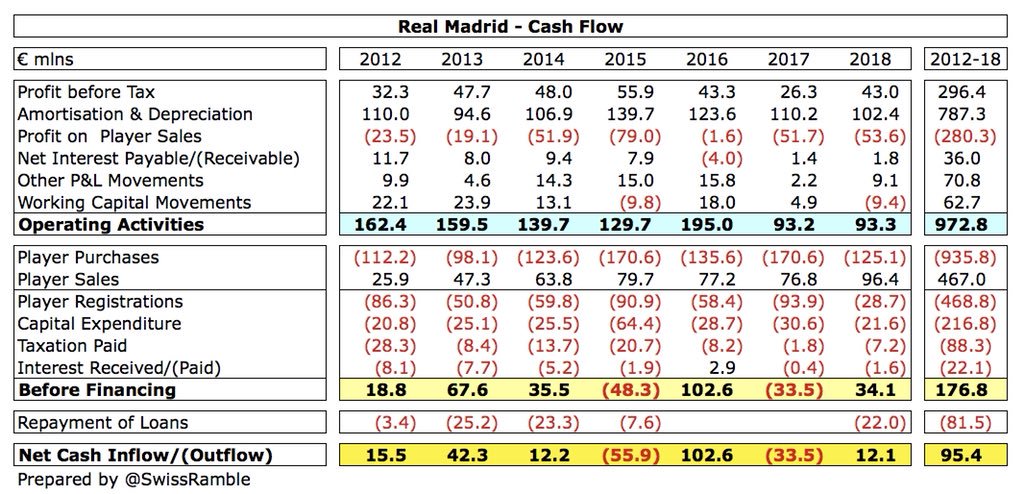

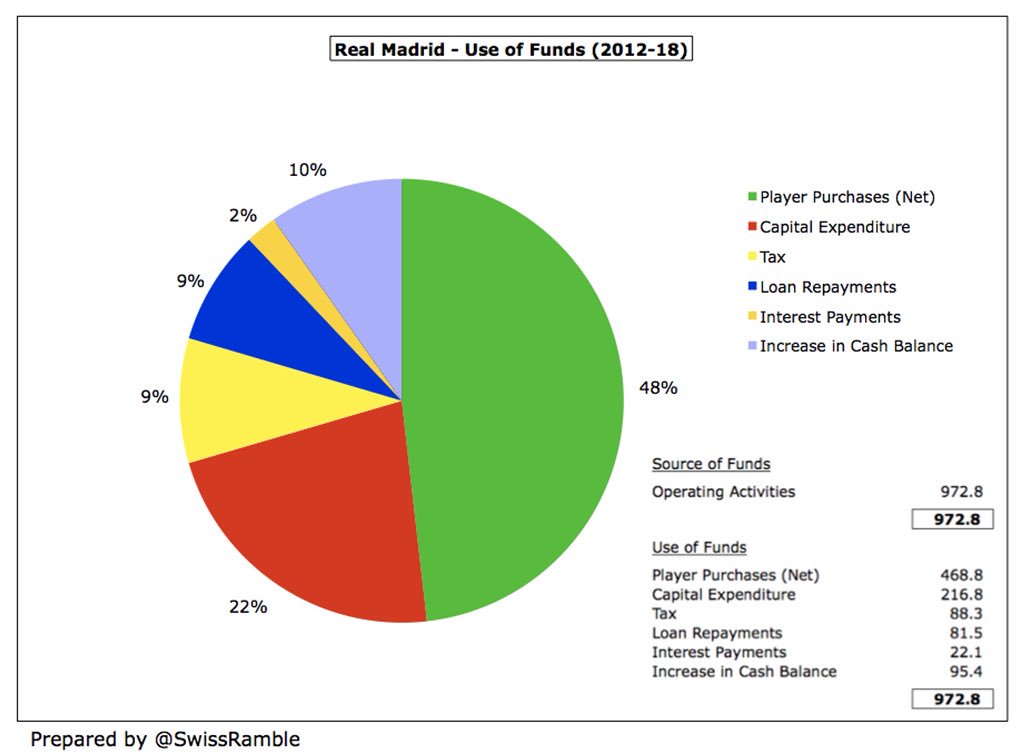

#RealMadrid are a cash machine, generating almost a billion (€973m) from operating activities in last 7 years, though this has fallen from €195m in 2015 to €93m in 2018, mainly due to salaries & bonuses. In 2017/18 cash increased by €12m despite making a €22m loan repayment.

Since 2012 #RealMadrid have used half of their available cash on (net) player purchases, but have also invested €217m into stadium improvements and Real Madrid City. In addition, they spent €104m on loan/interest payments & €88m on tax, while increasing cash balance by €95m.

#RealMadrid have had a clear strategy: success on the pitch leads to higher revenue, which allows them to pay more to players in salaries and bonuses. This has worked well for many years, though the Bernabéu stadium development will represent a major challenge going forward.

• • •

Missing some Tweet in this thread? You can try to

force a refresh