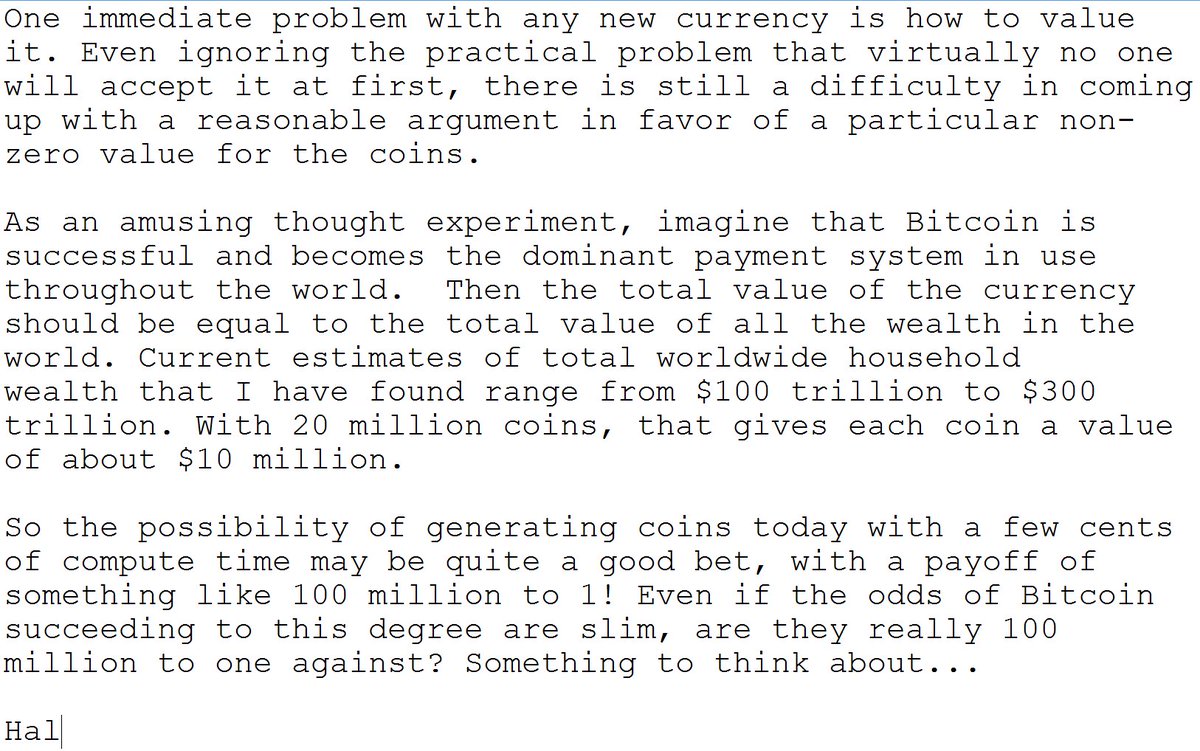

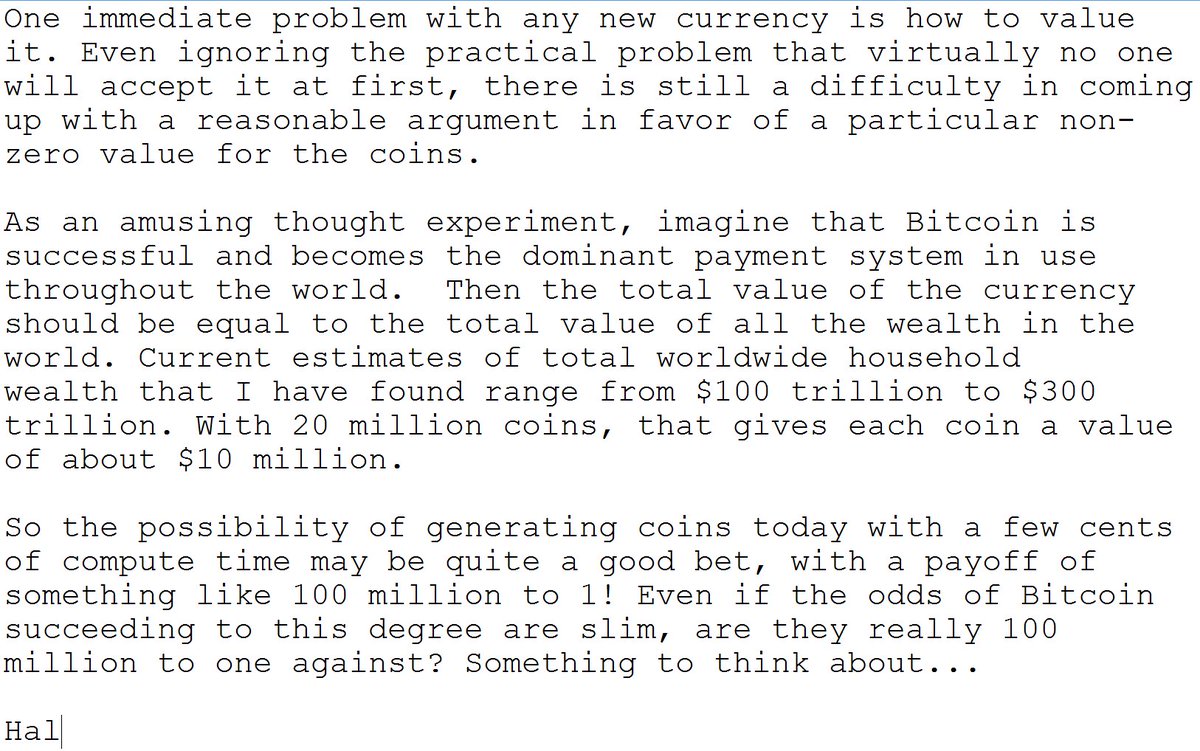

Here's #HalFinney's back-of-the-envelope calculation from January 2009. Let's update that and turn it into a collective decision problem.

I'm starting with a bunch of simplifying assumptions:

1. The "ultimate payoff of world domination" is fixed at $10m per coin.

2. All-or-nothing scenario: world domination or bust. (I actually disagree with that.)

3. No interest rate or NPV accounting.

1. The "ultimate payoff of world domination" is fixed at $10m per coin.

2. All-or-nothing scenario: world domination or bust. (I actually disagree with that.)

3. No interest rate or NPV accounting.

• • •

Missing some Tweet in this thread? You can try to

force a refresh