Tweeted about Bayesian Belief Propagation in Heterogeneous Networks before it was cool.

How to get URL link on X (Twitter) App

"Business process" is about optimizing the enterprise as a production function. "Business model" is about optimizing the enterprise as a market participant. Germany as a tech economy is really good at the former, and has created a specialized labor market around it.

"Business process" is about optimizing the enterprise as a production function. "Business model" is about optimizing the enterprise as a market participant. Germany as a tech economy is really good at the former, and has created a specialized labor market around it.

https://twitter.com/kerooke/status/1031293508743716864Which shouldn't come as a surprise to anyone knowledgeable in enterprise systems. These processes are notoriously difficult to implement in an enterprise-centric systems landscape. Settlement takes days, establishing provenance can take weeks.

https://twitter.com/IBMBlockchain/status/10193711718364528651. The "stable" in stable coin refers to price stability, i.e. the extent to which price changes signal changes in the competitive environment of the priced commodity rather than changes in the underlying currency. The "marvel of the price system" relies on price stability.

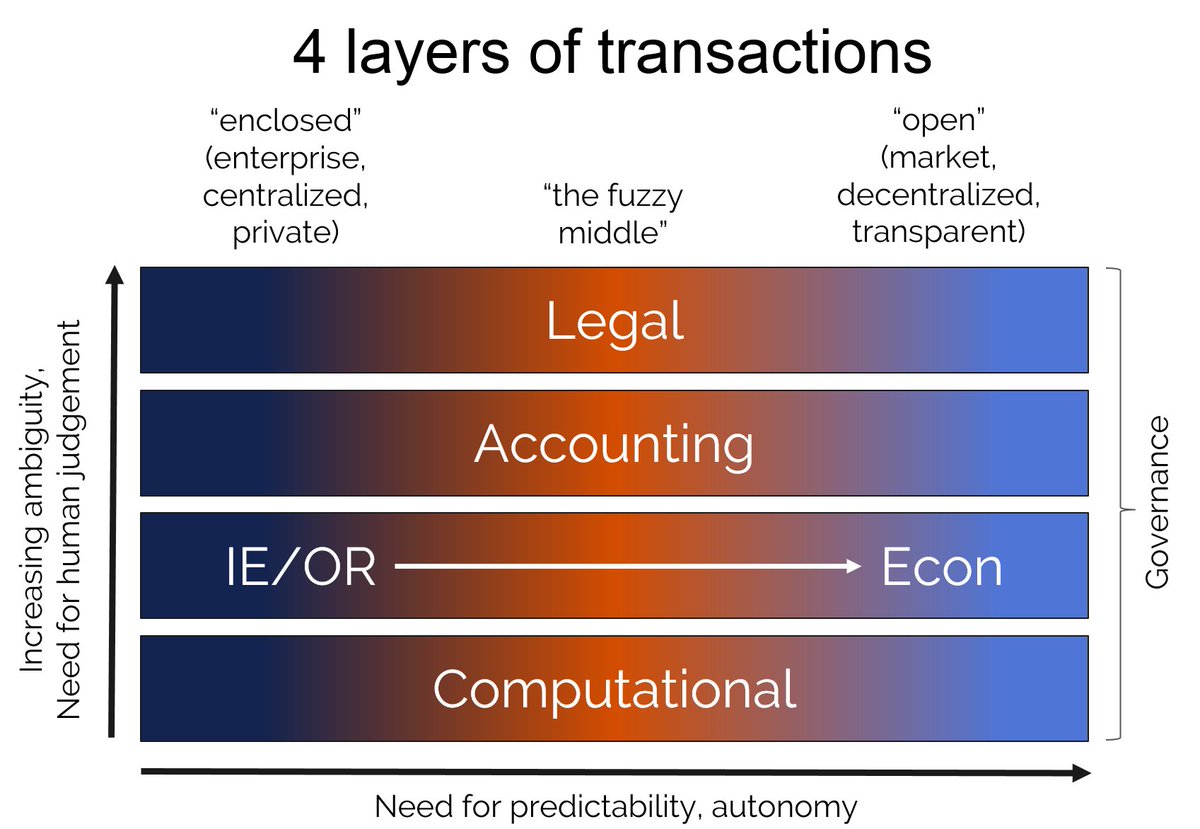

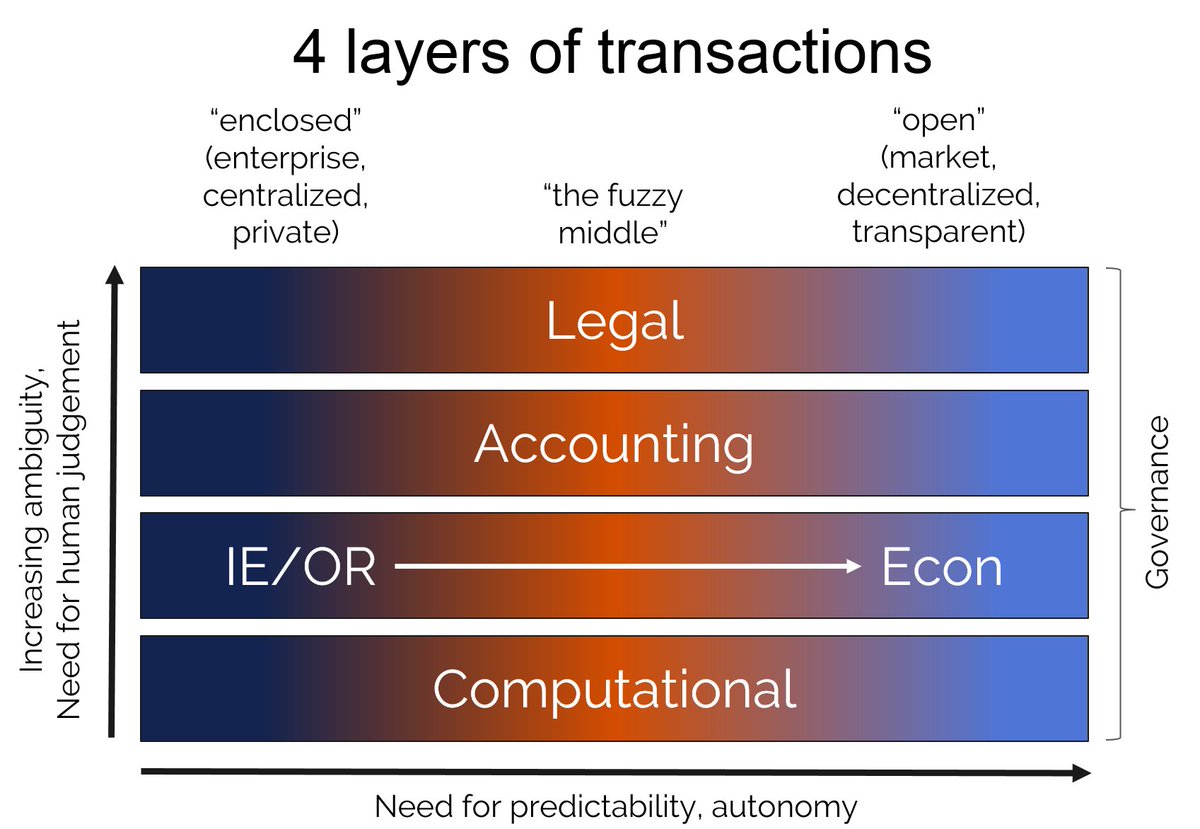

Let's start with the most layer-neutral expression of a transaction as an exchange of objects of value (a.k.a. assets) as the building block of economic interaction. Each of the four layers has subtly reinterpreted this definition to suit their own objectives.

Let's start with the most layer-neutral expression of a transaction as an exchange of objects of value (a.k.a. assets) as the building block of economic interaction. Each of the four layers has subtly reinterpreted this definition to suit their own objectives.

Blockchains have this popular appeal as shared, transparent databases that use a participatory consensus-finding process to resolve conflicts. As such, land registries and similar registries (e.g. for music, trademarks, patents, vehicle...) sound like attractive use cases.

External Tweet loading...

If nothing shows, it may have been deleted

by @kate_sills view original on Twitter

To get this out of the way: enterprise blockchains aren't Satoshi blockchains. Typically in enterprise: no tokens, no PoW, throughput and restrictive data access are still paramount. (Some people call these things DLT. I don't.)

External Tweet loading...

If nothing shows, it may have been deleted

by @SarahTaber_bww view original on Twitter

The Walrasian auctioneer is a figure of momentous importance in economics, as it’s he who helps price-taking buyers and sellers grope towards a market-clearing equilibrium in a perfectly competitive market. Except he never existed.

External Tweet loading...

If nothing shows, it may have been deleted

by @ecoinomia view original on Twitter

This isn't the first of course. Microsoft maneuvered itself into the same position ca. 1999, and the verdict back then was MS is irrelevant now that it missed the whole internet thing and is just flailing around, but MS never stopped being a hugely profitable key player.

External Tweet loading...

If nothing shows, it may have been deleted

by @zeynep view original on Twitter

"epsilon", as I posted before, is a very small but nonzero probability of something very big and very profitable happening. Iow, it's like a lottery ticket, except we don't know the chances of a big payday, the payoff value, or even the exact date of the big payday.

"epsilon", as I posted before, is a very small but nonzero probability of something very big and very profitable happening. Iow, it's like a lottery ticket, except we don't know the chances of a big payday, the payoff value, or even the exact date of the big payday.

People who complain about how badly something is run often simply miss how unlikely it was that this thing came together in the first place, and how many things have to fit together to make it work. There's been dozens of attempts to copy the SV model, with modest success.

People who complain about how badly something is run often simply miss how unlikely it was that this thing came together in the first place, and how many things have to fit together to make it work. There's been dozens of attempts to copy the SV model, with modest success.

Sunday was #DataPrivacyDay and private vs public matters *a lot* in law, economics, sociology, cryptosecurity of course, but how much time have you spent recently choosing semi-privacy over real privacy?

Sunday was #DataPrivacyDay and private vs public matters *a lot* in law, economics, sociology, cryptosecurity of course, but how much time have you spent recently choosing semi-privacy over real privacy?