I realize I should spend some time on explaining why I think blockchain is a "rent-dissipating Aumann Machine", seeing that I made that up on the spot. This is going to get hardcore wonky for the #cryptoeconomics geeks. Looking at @VladZamfir, @VitalikButerin and maybe 2-3 others

External Tweet loading...

If nothing shows, it may have been deleted

by @ecoinomia view original on Twitter

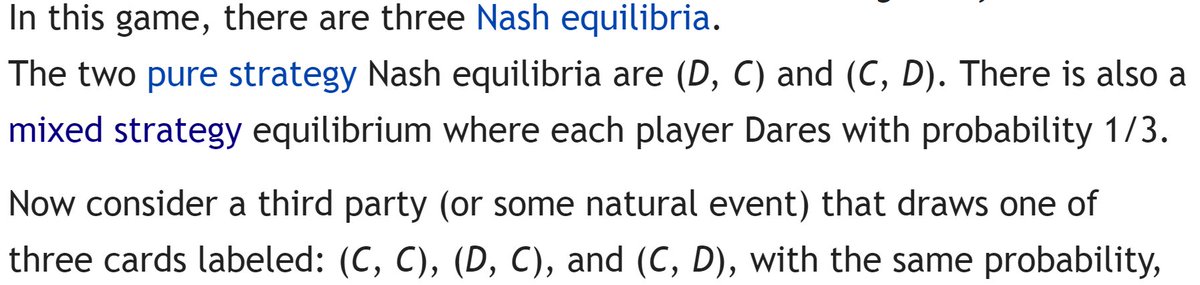

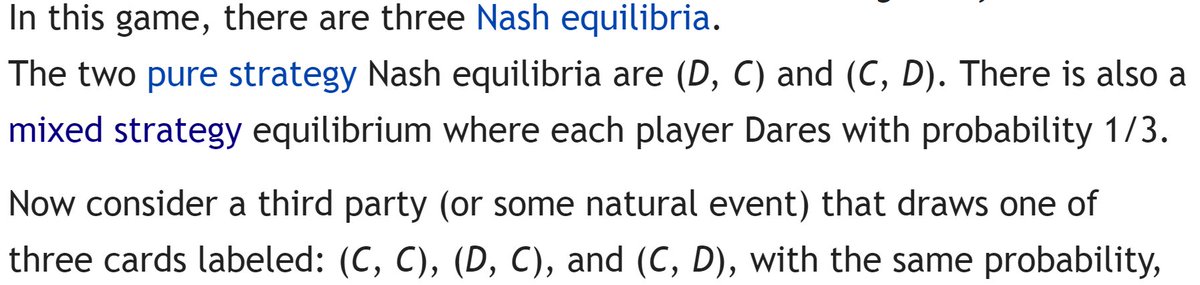

Robert Aumann's major contribution to game theory is the formulation of the "correlated equilibrium", a generalization of the Nash equilibrium, especially mixed Nash. He got the Nobel for it but it's still not well known, partly bc it's, well, weird.

Aumann's insight was that there's a way to improve on the payoffs for mixed Nashs if we find a way to let the players "correlate" (or "coordinate") their actions. Money quote: "Now consider a third party (or some natural event)"...

This third party we know as the "trusted intermediary", and the natural event is known as "sunspots" or, in the cryptoverse, the "oracle". A big obstacle to the adoption of Aumann's idea was that it was very fuzzy on what such a correlating device could be.

Let's pick an example. In a two-strategy space, "I go first" vs "I go second" a mixed strategy could lead to disaster if both decide to go first. A coordinating device proposing that both players alternate could be beneficial. Such a device is also known as a traffic light.

Two big problems with tasking a third party to create the coordinated strategy portfolio: 1. We have to trust that third party that the portfolio is well-assembled 2. Anytime someone creates value for others they're also tempted to extract some or all of that value for themselves

So of course there is a common incentive to replace this not-so-trust-worthy third party with an observable, competent and impartial device that reflects their interests: an "Aumann Machine".

Lots of more nifty things about correlated equilibria (which I believe should be called Aumann equilibria), esp about equilibrium path and learning, but I hope I made the connection to blockchain consensus clear.

• • •

Missing some Tweet in this thread? You can try to

force a refresh