Bitcoin tax questions I ask myself:

1/ I bought Bitcoin for $1k in April. Now it’s $10k. Did I just make $9,000?

I think you're forgetting something. There's only two things certain in life: death and...

1/ I bought Bitcoin for $1k in April. Now it’s $10k. Did I just make $9,000?

I think you're forgetting something. There's only two things certain in life: death and...

2/ Taxes...what?! Cryptocurrency is beyond the government's control, man!

Government won’t shut down Bitcoin, but US citizens still owe tax on worldwide income. Tax evasion, in extreme cases, leads to imprisonment.

Government won’t shut down Bitcoin, but US citizens still owe tax on worldwide income. Tax evasion, in extreme cases, leads to imprisonment.

3/ OoF! How much tax do I have to pay on Bitcoin profits?

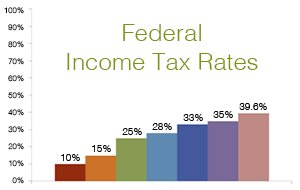

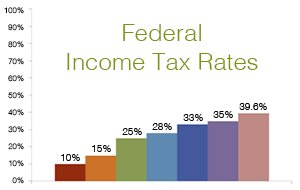

The top income bracket in the US pays 39.6% short-term capital gains which is $3,564 for you. But if you #hodl for over a year, long-term capital gains is only 15%.

The top income bracket in the US pays 39.6% short-term capital gains which is $3,564 for you. But if you #hodl for over a year, long-term capital gains is only 15%.

4/ I def won’t cash out right away! If I dabble in Bitcoin-Altcoin trading for the next year I pay only 15%, right?

Clever, but no. Each crypto-for-crypto trade is a barter of intangible assets according to the IRS and triggers a tax event. forbes.com/sites/robertwo…

Clever, but no. Each crypto-for-crypto trade is a barter of intangible assets according to the IRS and triggers a tax event. forbes.com/sites/robertwo…

5/ If I use my bitcoin to buy coffee and pizza do I avoid being taxed?

Anytime you exchange your bitcoin for an item is a taxable event. When you buy a $10 burrito with Bitcoin you trigger a short-term capital gains tax of $5.40.

Anytime you exchange your bitcoin for an item is a taxable event. When you buy a $10 burrito with Bitcoin you trigger a short-term capital gains tax of $5.40.

6/ $15.40 Burrito?!@#% Will the government go after $5.40?

“The IRS [could] collect several billion dollars in back taxes, penalties, and interest,” according to @GreenTraderTax. In 2015 only 802 people reported their bitcoin profits. venturebeat.com/2017/03/20/onl…

“The IRS [could] collect several billion dollars in back taxes, penalties, and interest,” according to @GreenTraderTax. In 2015 only 802 people reported their bitcoin profits. venturebeat.com/2017/03/20/onl…

7/ Who's gonna calculate tax on every Bitcoin burrito?

You. You have to track purchases/investments with Bitcoin to determine how much tax to pay at year end. Tips given/received via @Tipprbot, @YoursOrg and giving bitcoin to a friend triggers a tax event, too.

You. You have to track purchases/investments with Bitcoin to determine how much tax to pay at year end. Tips given/received via @Tipprbot, @YoursOrg and giving bitcoin to a friend triggers a tax event, too.

8/ I have to log everything I buy or sell with cryptocurrencies?

Services like @BitcoinTax or @Coin_Tracking semi-automate transaction import, but not all crypto apps make it easy. (Referral codes: cointracking.info/?ref=K188874, bitcoin.tax/r/Z3tAutAz)

Services like @BitcoinTax or @Coin_Tracking semi-automate transaction import, but not all crypto apps make it easy. (Referral codes: cointracking.info/?ref=K188874, bitcoin.tax/r/Z3tAutAz)

9/ Businesses never told me about capital gains tax AND tracking a ridiculous number of transactions. Criminal!

Bitcoin accounting is even more tedious for business. The burrito shop calculates capital gains they owe for each burrito, taco and nacho sold.

Bitcoin accounting is even more tedious for business. The burrito shop calculates capital gains they owe for each burrito, taco and nacho sold.

10/ There should be someone who makes Bitcoin accounting easier.

Indeed! Opportunistic entrepreneurs can "Sell shovels to gold miners" as they say. It's called Second Order Effects. Here's a video to inspire your Bitcoin Enterprise

Indeed! Opportunistic entrepreneurs can "Sell shovels to gold miners" as they say. It's called Second Order Effects. Here's a video to inspire your Bitcoin Enterprise

11/ Good idea! Are there any companies who help businesses accept Bitcoin?

@Bitpay, @Coinbase, @CoinGatecom and others do already. Here’s a table comparing the Bitcoin payment processors: kyleschutter.me/crypto-for-bus…

@Bitpay, @Coinbase, @CoinGatecom and others do already. Here’s a table comparing the Bitcoin payment processors: kyleschutter.me/crypto-for-bus…

12/ Is there any way to avoid taxes on my Bitcoin?

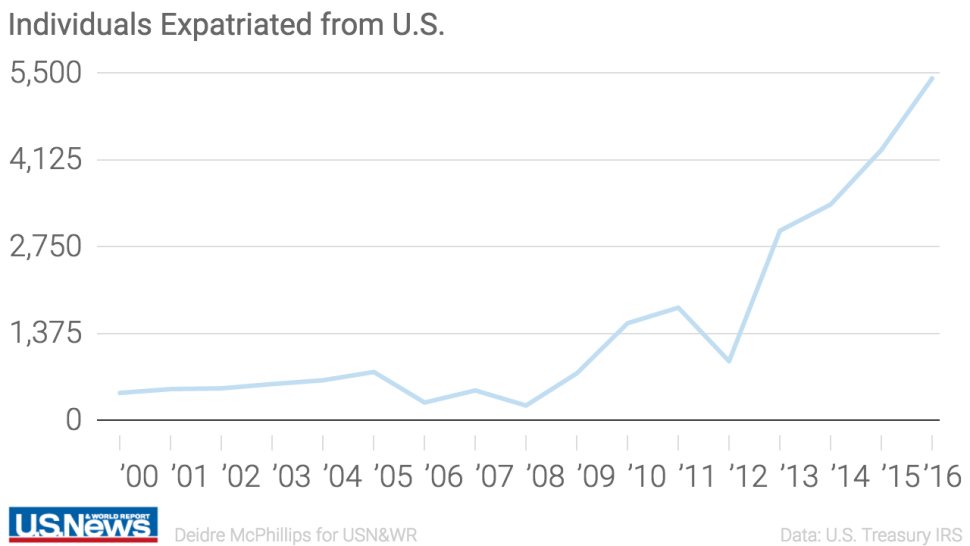

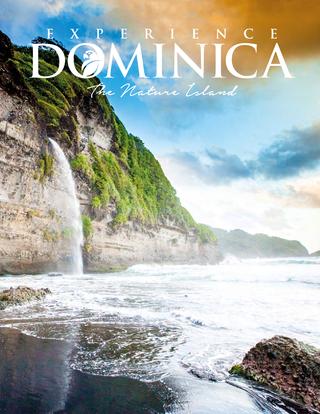

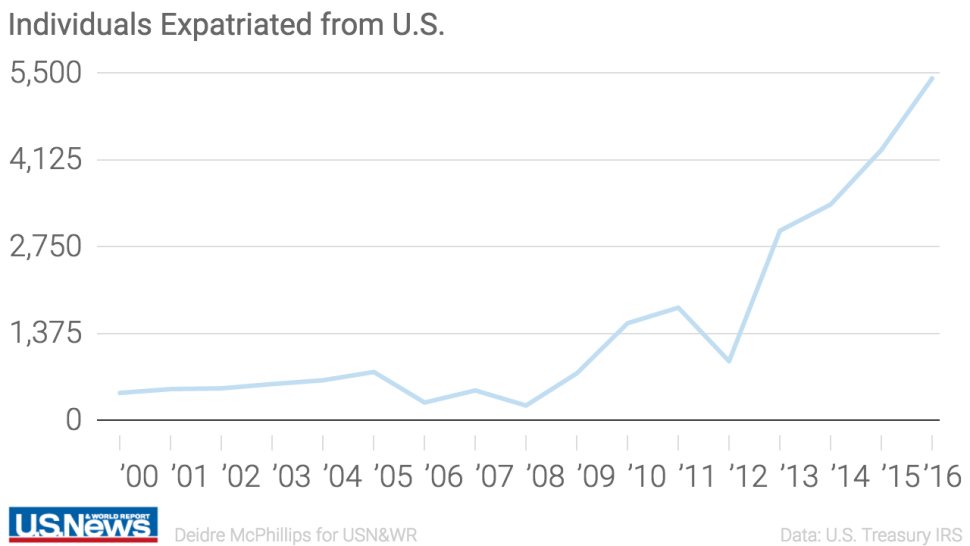

You could give up US citizenship, buy $200k in real estate in Dominica to become a citizen there. Eduardo Saverin (FB co-founder) gave up citizenship to avoid taxes. Expatriation is at an all time high. @Deedrah

You could give up US citizenship, buy $200k in real estate in Dominica to become a citizen there. Eduardo Saverin (FB co-founder) gave up citizenship to avoid taxes. Expatriation is at an all time high. @Deedrah

13/ Expatriation to avoid tax is too extreme. Is there no way to beat the system? We developed an amazing cryptocurrency to finally beat the government!!! and then to give half away to Uncle Sam? It just seems…wrong.

You could donate to a non-profit.

You could donate to a non-profit.

14/ People do that?

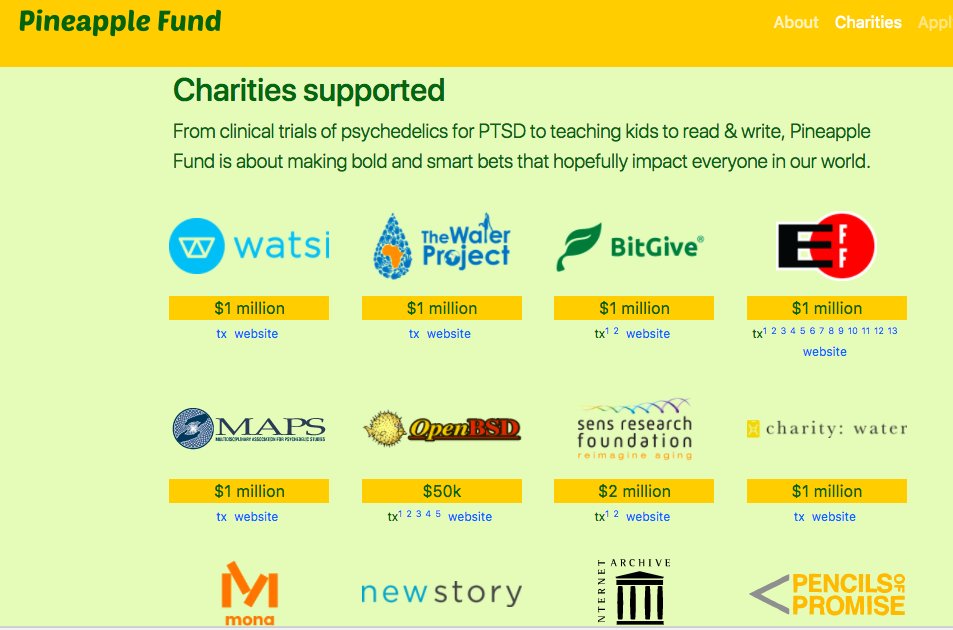

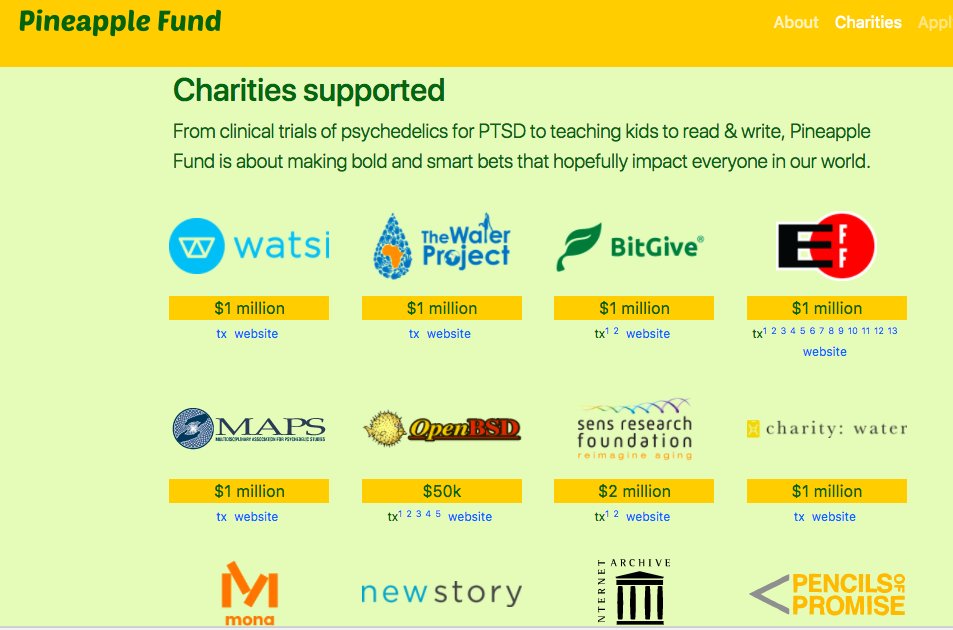

Someone donated $86m in Bitcoin to start PineappleFund.org, tax free. Bitcoin has made a lot of people rich. Maybe now is a good time for us to give back. @conniegallippi at @BitGiveOrg helps non-profits accept Bitcoin

Someone donated $86m in Bitcoin to start PineappleFund.org, tax free. Bitcoin has made a lot of people rich. Maybe now is a good time for us to give back. @conniegallippi at @BitGiveOrg helps non-profits accept Bitcoin

15/ I didn’t make THAT much. How do I avoid tax on Bitcoin?

1st Calculate: bitcoin.tax or cointracking.info

2nd Minimize:

Hold

Move to low tax state (eg Texas)

Give to family/charity

Match losses

Invest in IRA, 401k, HSA forbes.com/sites/davidmar… @MarottaOnMoney

1st Calculate: bitcoin.tax or cointracking.info

2nd Minimize:

Hold

Move to low tax state (eg Texas)

Give to family/charity

Match losses

Invest in IRA, 401k, HSA forbes.com/sites/davidmar… @MarottaOnMoney

16/ Is there a Bitcoin tax podcast?

@laurashin just created a great podcast at unchainedpodcast.co/the-tax-rules-… The title, Tax Rules that have Crypto Users Aghast, seems appropriate.

@laurashin just created a great podcast at unchainedpodcast.co/the-tax-rules-… The title, Tax Rules that have Crypto Users Aghast, seems appropriate.

• • •

Missing some Tweet in this thread? You can try to

force a refresh