Graham Doddsville Winter 2018

Cooperman bashing Ackman ($ADT)

Sequoia on $GOOG, $CACC

Vulcan Value on $ORCL

Oasis on activism in Japan/China

Pitches: Staples 2025 bond, $FLT, $FDC

www8.gsb.columbia.edu/valueinvesting…

Cooperman bashing Ackman ($ADT)

Sequoia on $GOOG, $CACC

Vulcan Value on $ORCL

Oasis on activism in Japan/China

Pitches: Staples 2025 bond, $FLT, $FDC

www8.gsb.columbia.edu/valueinvesting…

Cooperman: don't talk about your shorts (we'll let the last sentence slide)

Cooperman: clear ex-ante expectations. Analysts won't take a loss by themselves

Cooperman: leave $ADT alone

Sequoia: don't stick your head into the sand. This is not the 70's and See's Candies better figure out their instagram strategy

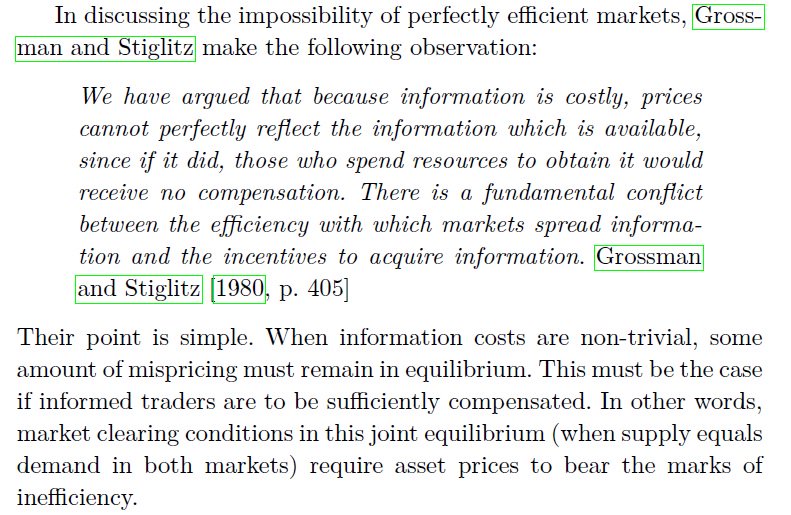

Sequoia: before you even think about your information #edge make sure you're not the sucker buying based on a hot tip

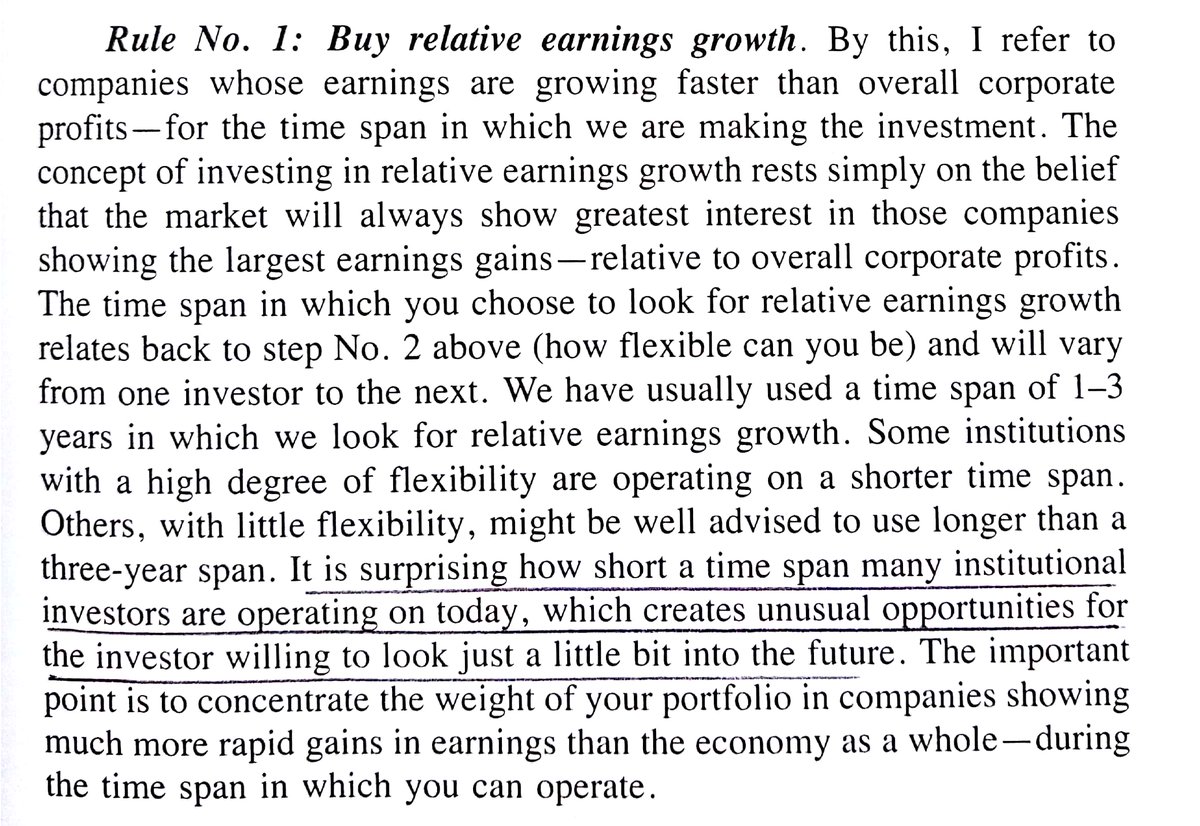

Sequoia: the case for growth investing. Pleasant long-term surprises

Vulcan Value: pick quality (stability) over valuation

• • •

Missing some Tweet in this thread? You can try to

force a refresh