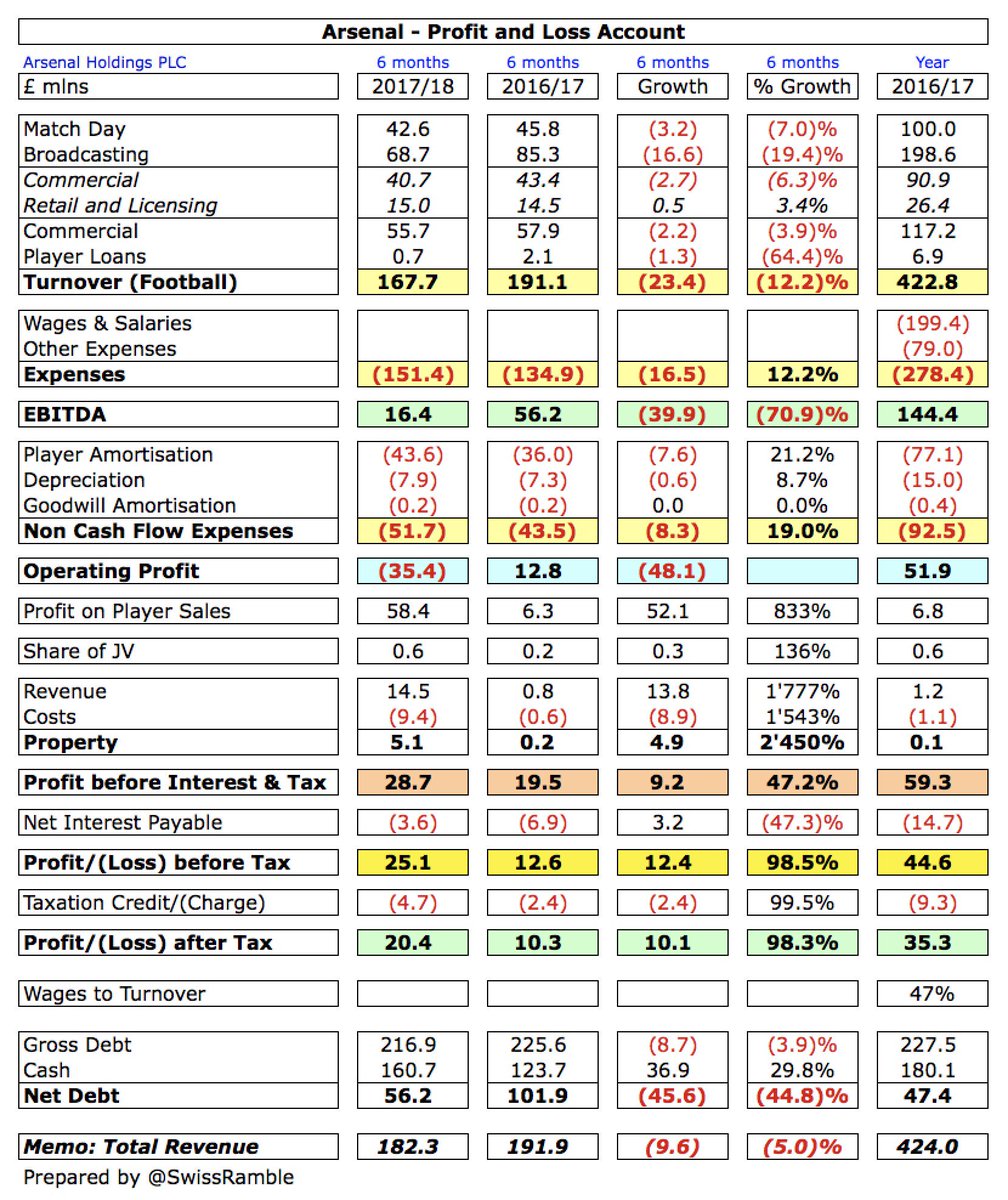

Arsenal this week announced their financial results for the first half of the 2017/18 season, reflecting the impact of competing in the Europa League instead of the Champions League plus continuing investment in the playing squad. Some thoughts in the following thread #AFC

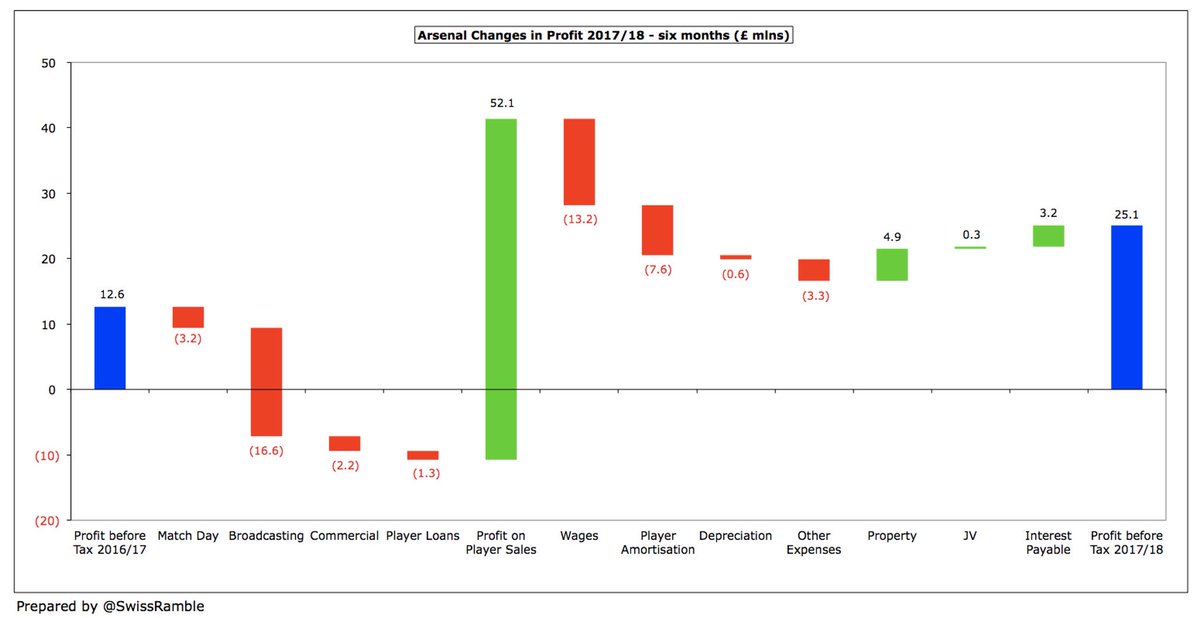

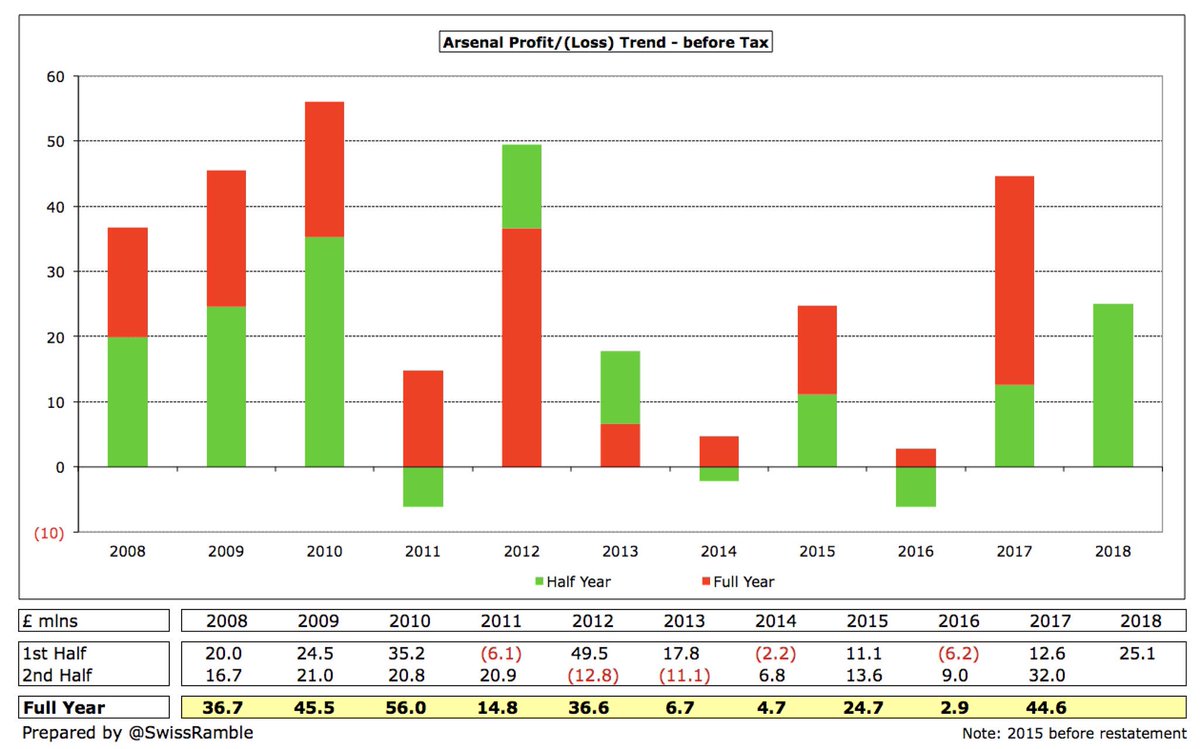

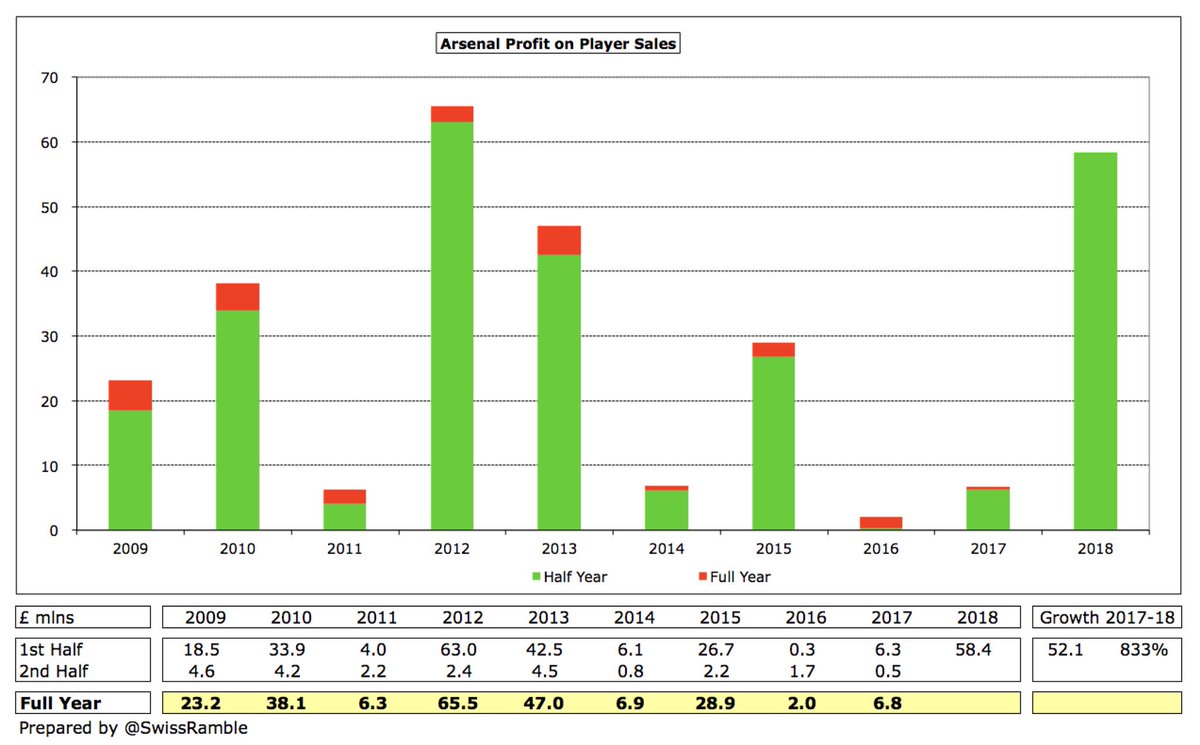

#AFC profit before tax almost doubled from £13m to £25m, though a substantial 71% reduction in (cash) operating profit from £56m to £16m was compensated by a surge in profits from player sales from £6m to £58m (Oxlade-Chamberlain, Szczesny, Gabriel and Gibbs in the summer).

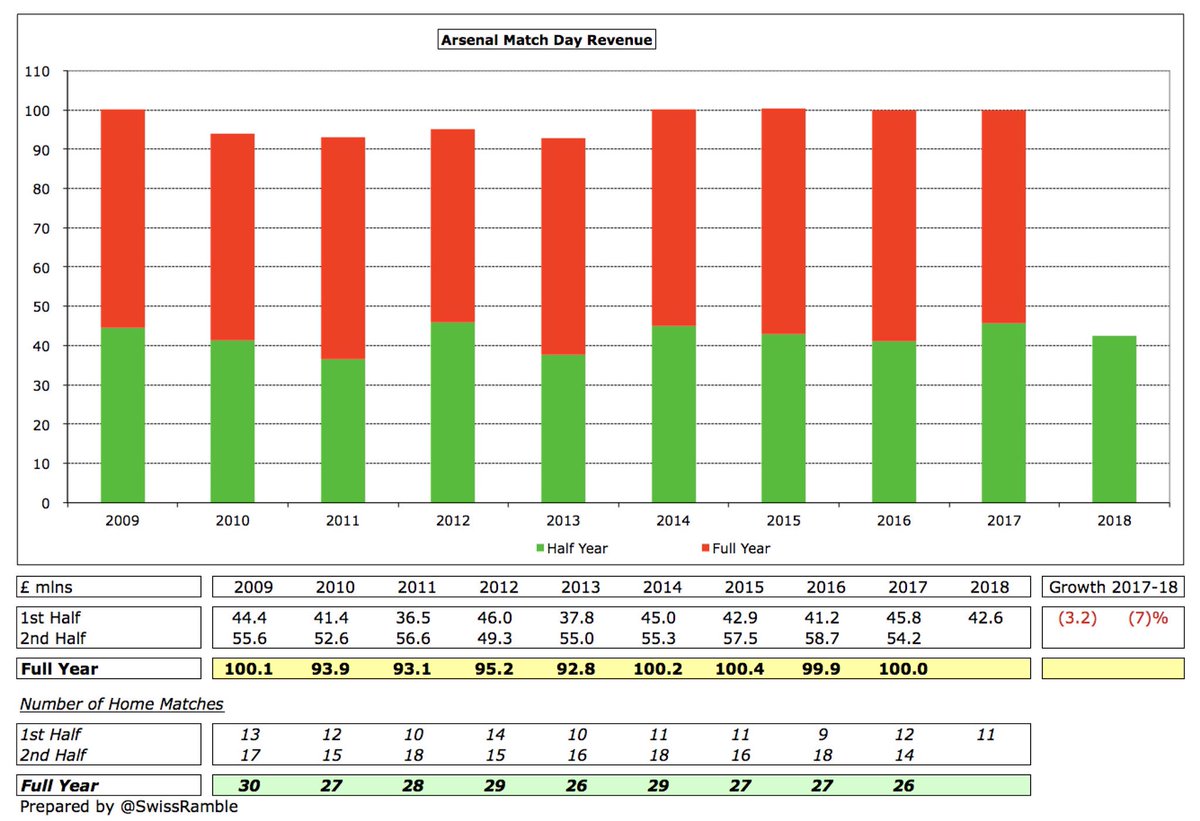

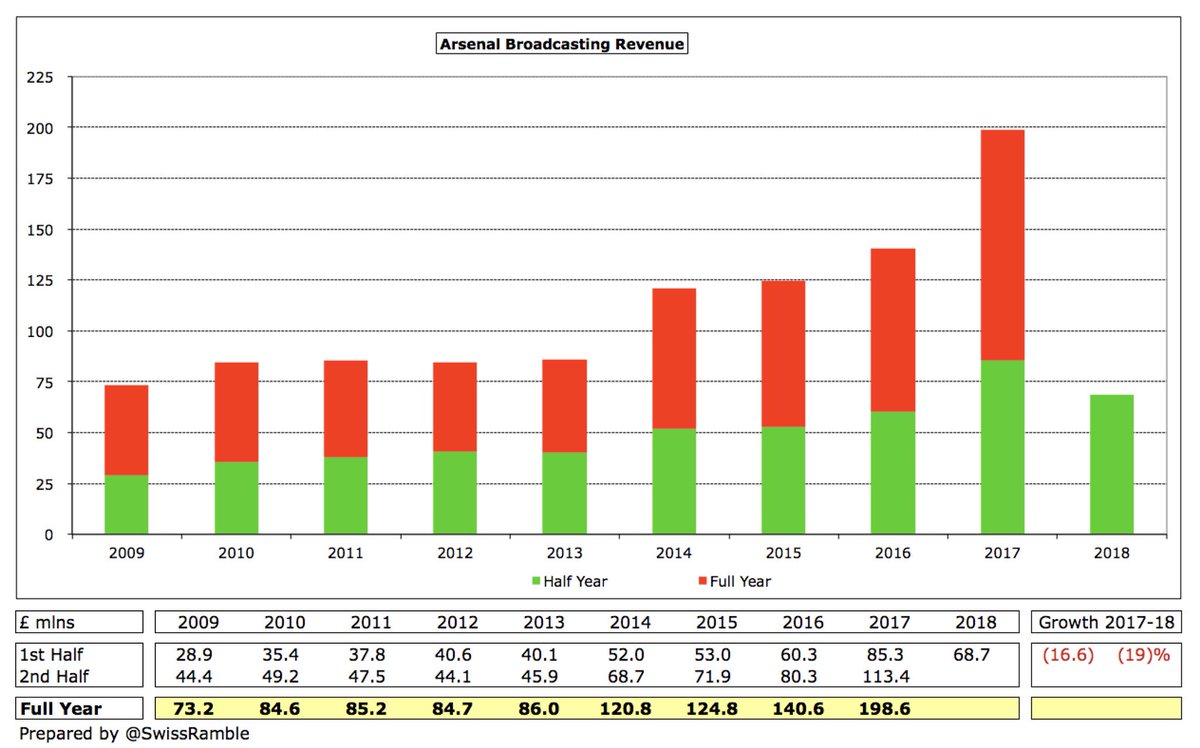

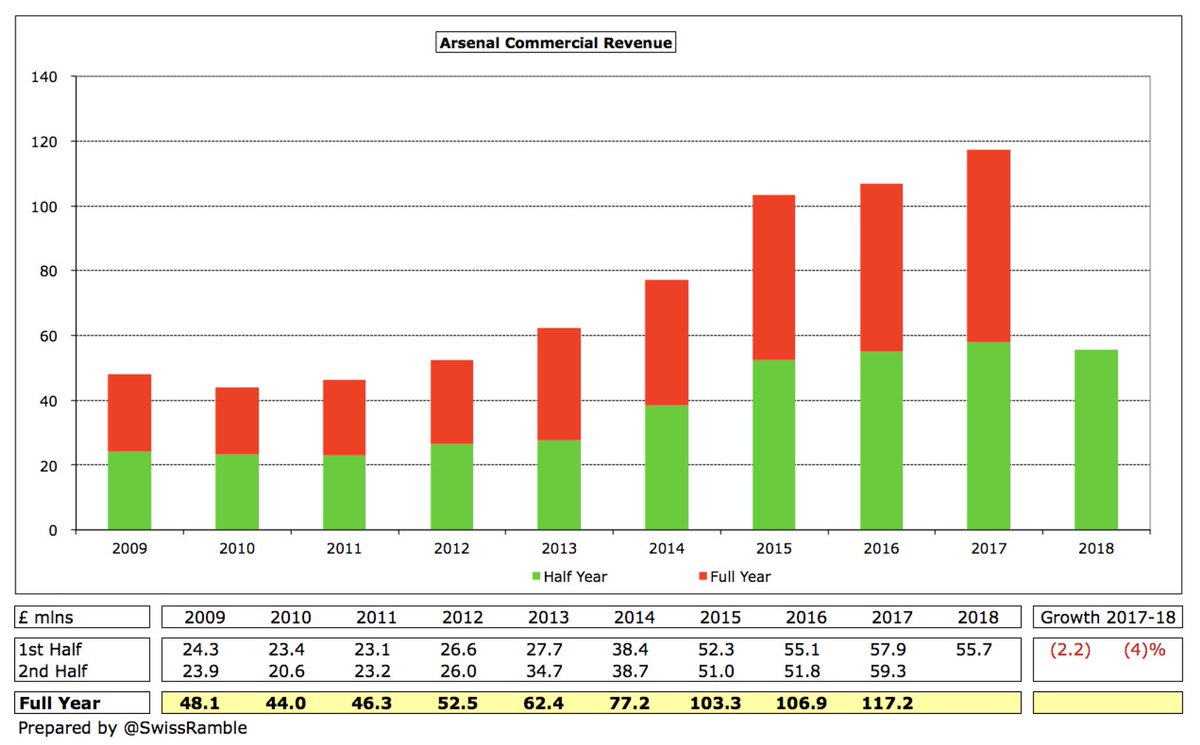

#AFC H1 revenue decreased 12% (£23m) from £191m to £168m, mainly due to dropping into the Europa League. All revenue streams were impacted: broadcasting fell 19% (£16m) from £85m to £69m; match day down 7% (£3m) from £46m to £43m; commercial down 4% (£2m) from £58m to £56m.

AlthougH #AFC revenue fell, expenses increased, most notably wages, which were £13m higher despite no bonuses for Champions League qualification. Player amortisation rose 21% (£8m) to £44m, largely due to acquisition of Lacazette. Other expenses were £3m higher.

On the other hand, #AFC property profit was up £5m (revenue to £15m), thanks to the sale of one of the two remaining development sites on Holloway Road; while net interest payable was £3m lower at £4m, mainly due to a positive change in the market value of the interest rate swap.

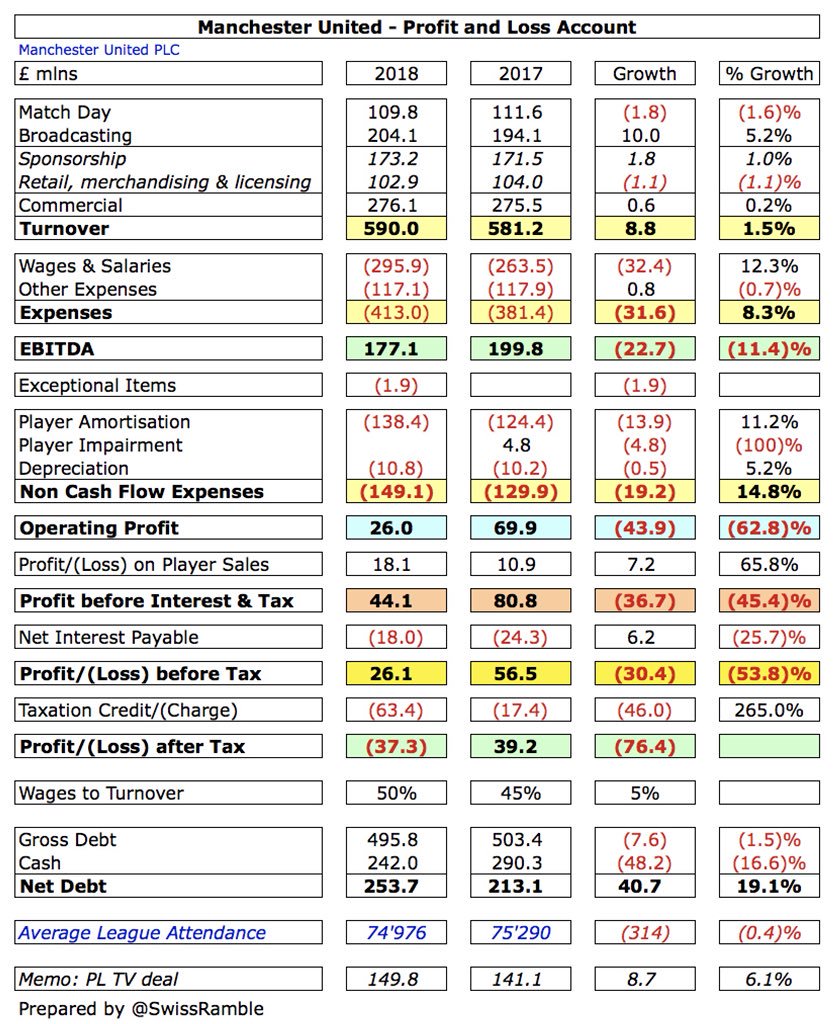

For context #AFC H1 £25m profit before tax is £14m below #MUFC £39m, though individual elements are very different. #MUFC revenue is £137m higher (mainly commercial £90m), which they use to spend £76m more on expenses. #AFC partially closed the gap with £40m more player sales.

#AFC pre-tax profit of £25m for the first six months of 2017/18 is the highest since the £49m reported in 2011/12 and has only been surpassed twice in the last 11 years. In that period the club has had three losses, which were converted into full year profits in the second half.

However, this was heavily influenced by #AFC profits on player sales of £58m, again the highest since £63m in 2011/12. Moreover, second half will be boosted by around £48m for sales of Walcott, Giroud and Coquelin in January window (Alexis Sanchez was swapped with Mkhitaryan).

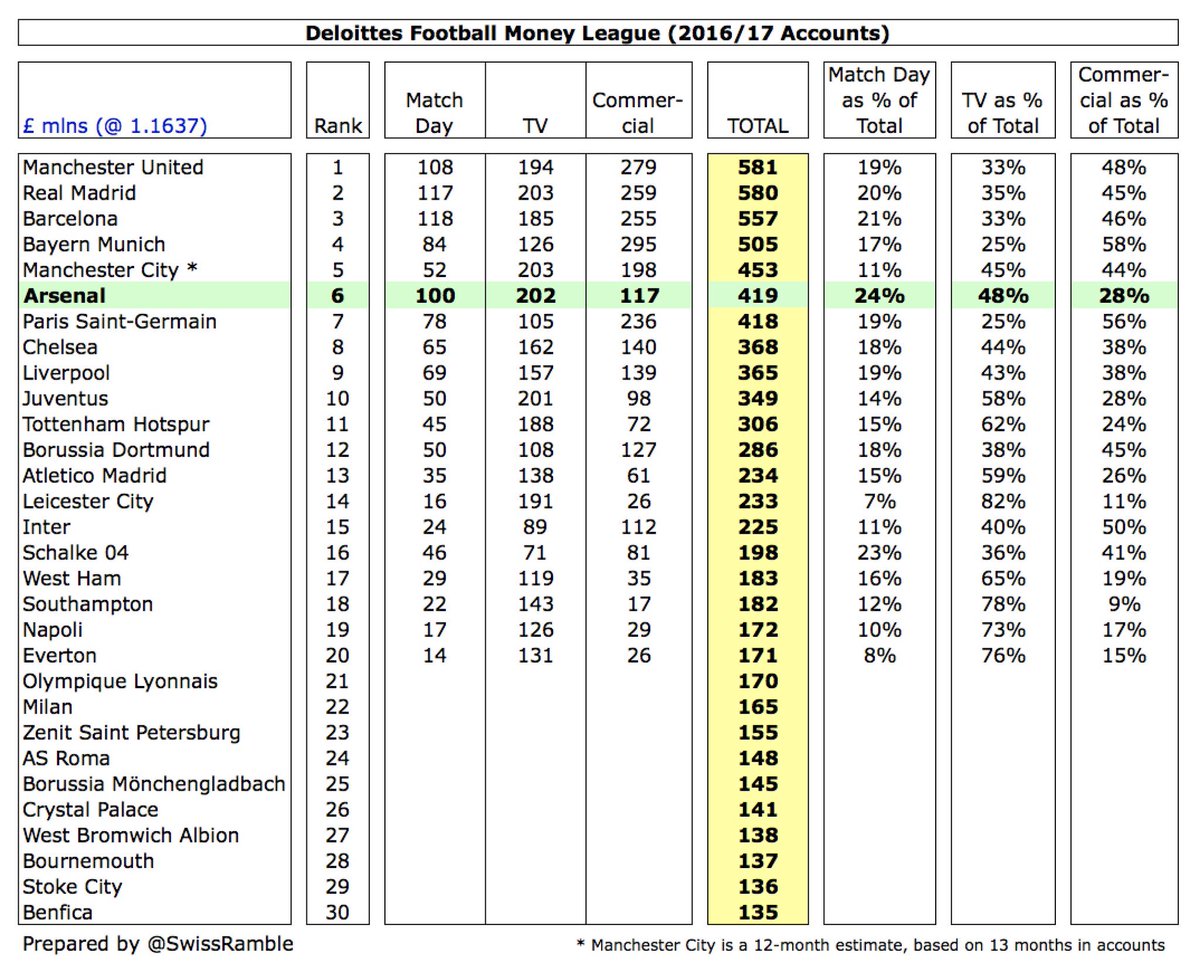

#AFC moved up one place to sixth in the Deloitte Money League (based on 2016/17 revenue), overtaking PSG, thanks to the new Premier League TV deal. However, they are likely to be lower in the 2017/18 report, due to not qualifying for the lucrative Champions League.

#AFC match day revenue fell 7% (£3m) from £46m to £43m, as there was one less home game compared to the previous season, exacerbated by reduced ticket prices put in place for the Europa League. Revenue reduction will be mitigated by playing more games in 2017/18 (minimum 28).

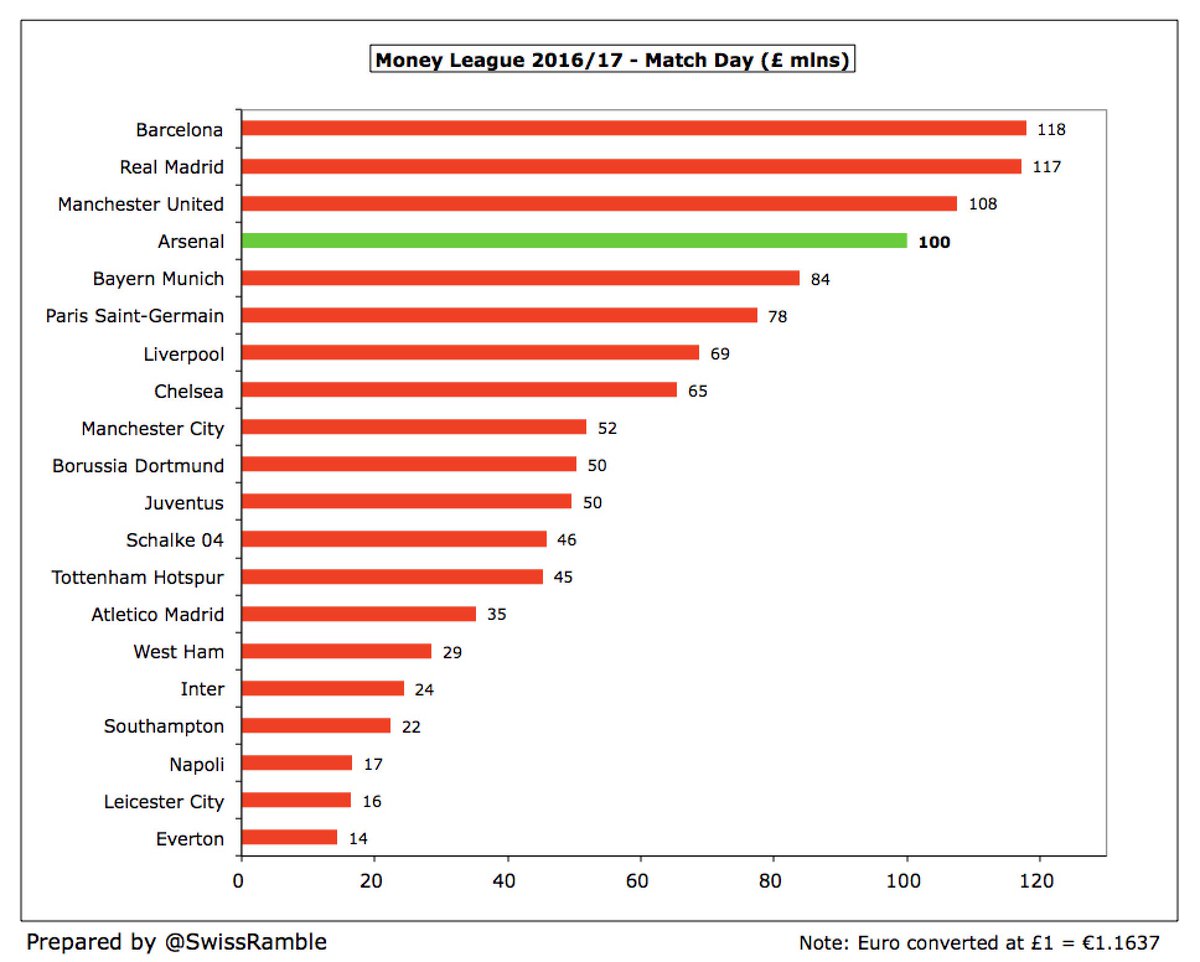

In 2016/17 #AFC full year match day revenue of £100m was only beaten by Barcelona, Real Madrid and Manchester United. Looking to add 780 seats to Club Level, bringing stadium capacity to just around 60,600 (will be completed summer 2019).

#AFC broadcasting revenue fell 19% (£16m) from £85m to £69m, mainly due to lower distributions from the Europa League, though partially offset by a weaker GBP exchange rate and two more Premier League games broadcast live (worth £1.1m per game).

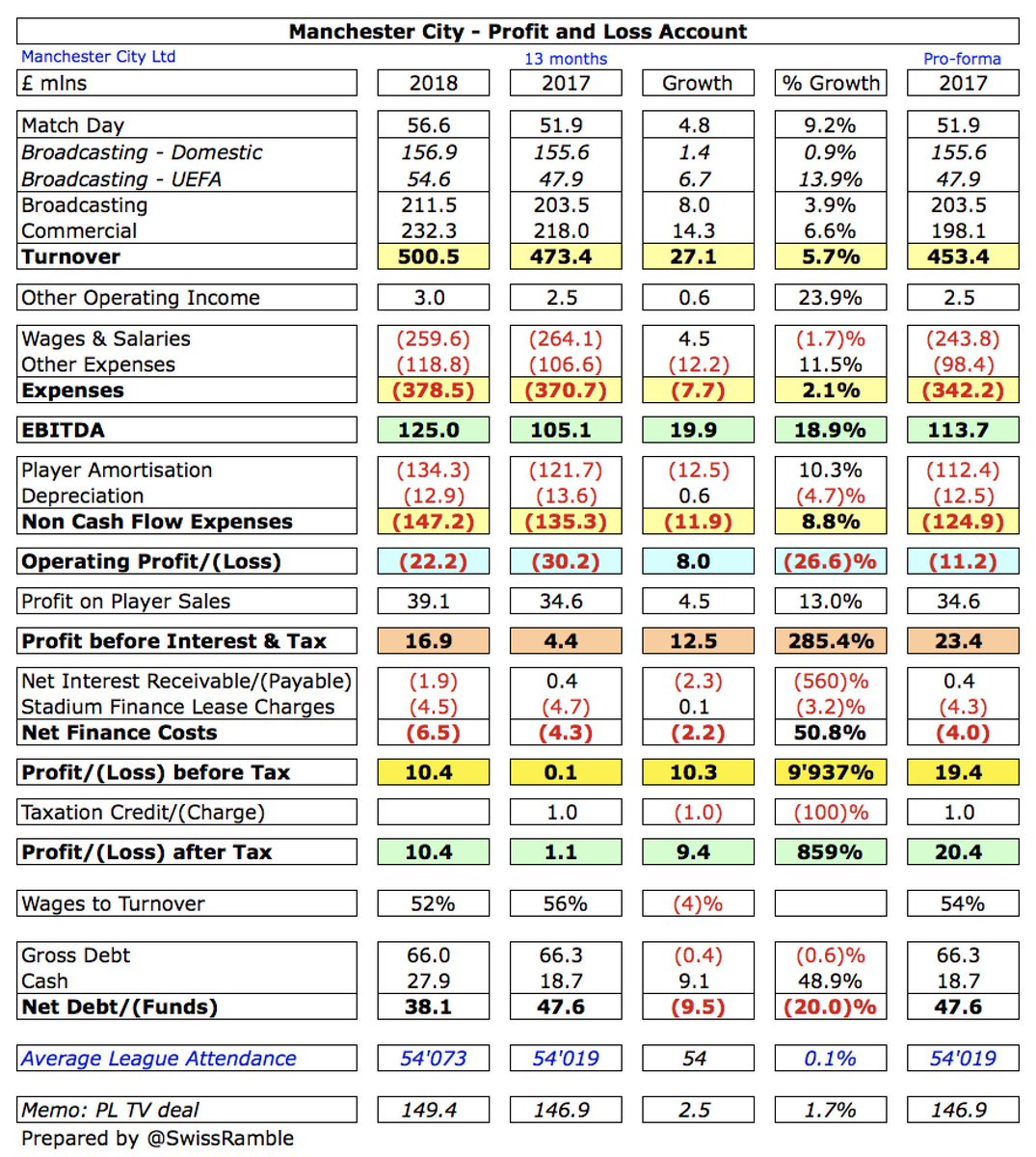

#AFC actually had the third highest broadcasting income in the world in 2016/17, only behind #MCFC & Real Madrid, though this included £55m from the Champions League. This year’s Europa League income will be lower, though #MUFC earned a healthy £38m from their victory last season

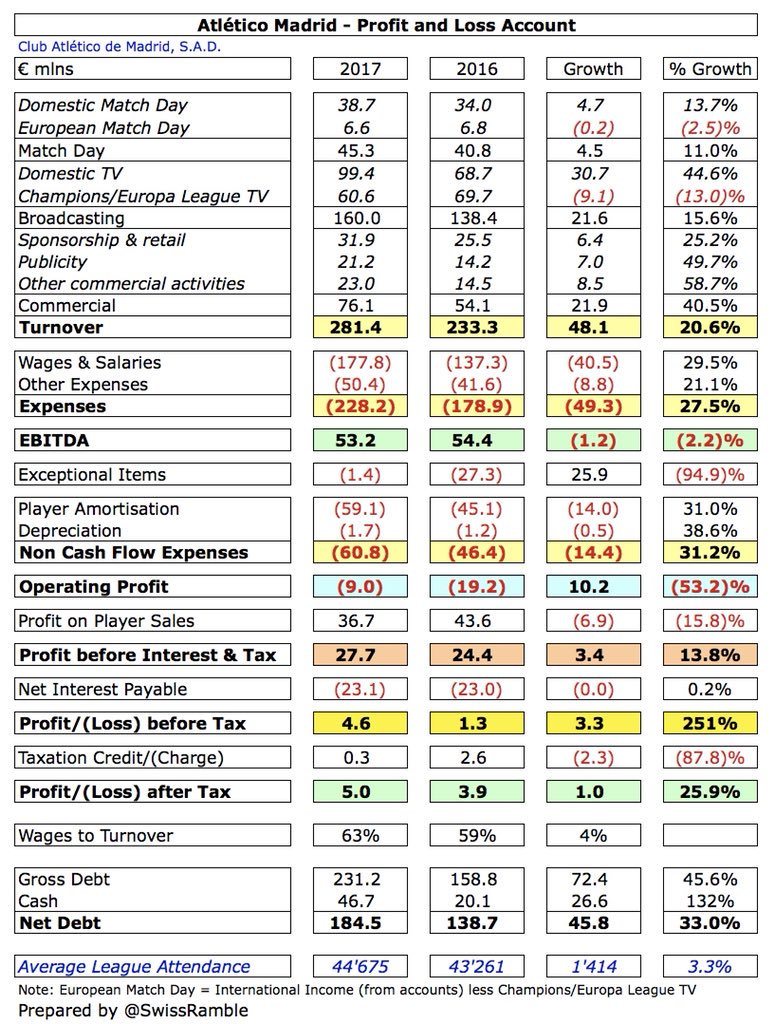

As well as the direct impact that dropping out of the Champions League has on #AFC revenue, it also means that rivals benefit. For example, #THFC have already earned €62m for reaching the last 16, which will increase if they progress any further in the competition.

Despite Sir Chips Keswick noting “a number of new commercial partnerships”, #AFC total commercial income actually fell 4% (£2m) from £58m to £56m, comprising £41m commercial and £15m retail & licensing, largely due to contractual clauses linked to Champions League participation.

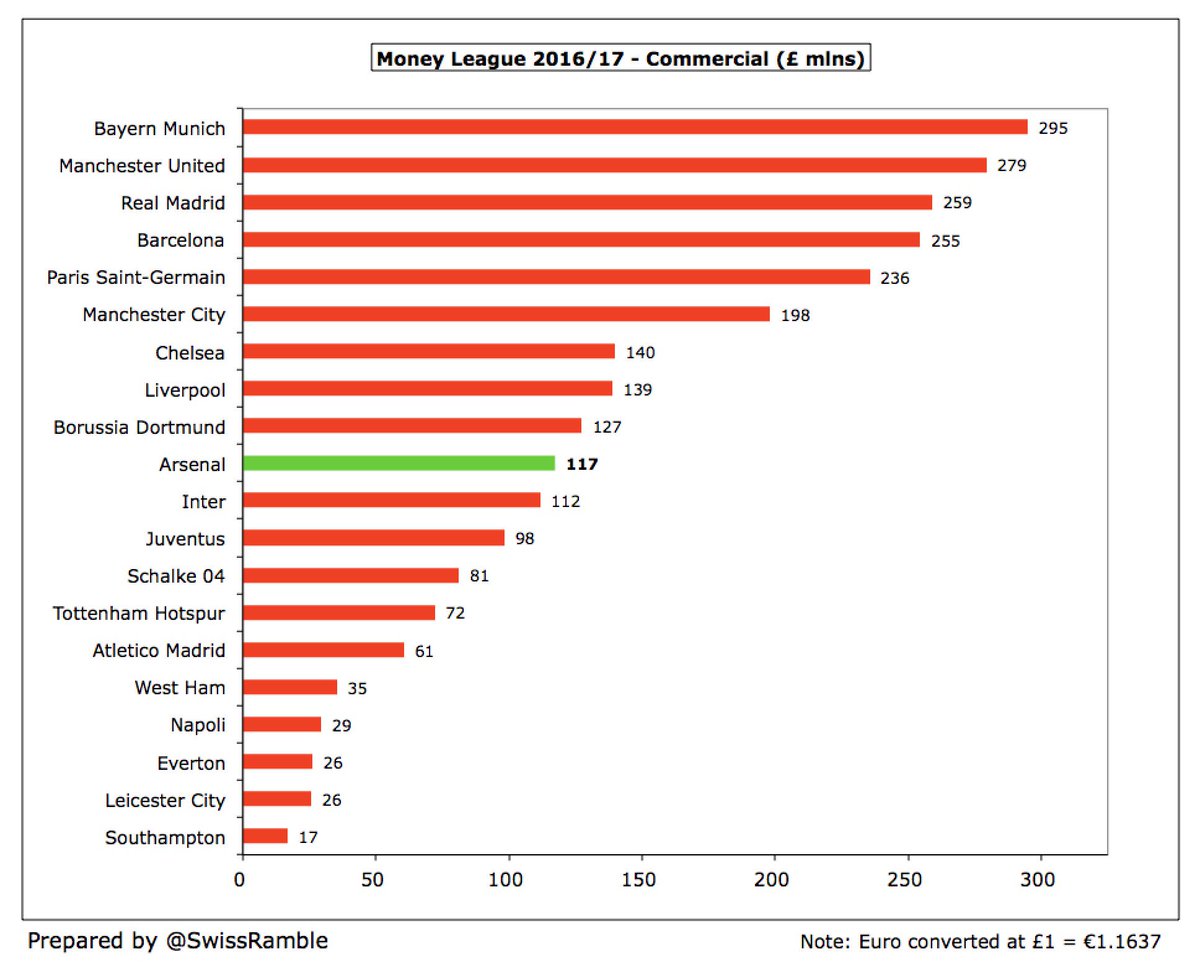

#AFC commercial income has long been the club’s financial Achilles heel. In 2016/17 Arsenal’s £117m was miles behind Bayern £295m, #MUFC £279m, Real Madrid £259m & Barcelona £255m. That’s maybe not too surprising, but they’re also below the likes of #CFC, #LFC & Dortmund.

#AFC recently renewed Emirates deal for £40m a year (up from £30m) from 2019 to 2024. Compares to #MUFC £54m, #CFC £40m, #MCFC £35m, #THFC £35m & #LFC £30m. However, includes naming rights & training kit, plus #AFC first in update cycle. Will allow sleeve sponsor (worth £5-10m).

This is important, due to Premier League Short-Term Cost Controls, which restrict annual wage bill increases to £7m – except if funded by more revenue from sources other than PL TV deal, thus increasing pressure to grow commercial income (or increase profits from player sales).

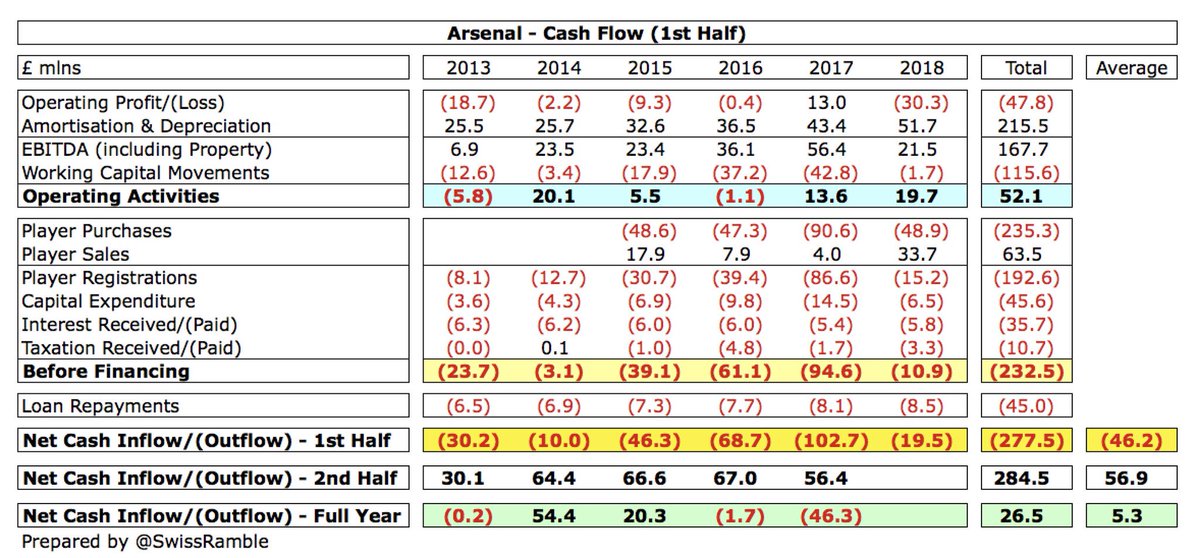

#AFC net cash outflow of £19m in H1, but nothing to worry about, as always a reduction in cash in first six months, offset by increases in H2. In fact, this was £84m lower than previous season, as net player spend was £71m lower, while infrastructure investment was cut by £8m.

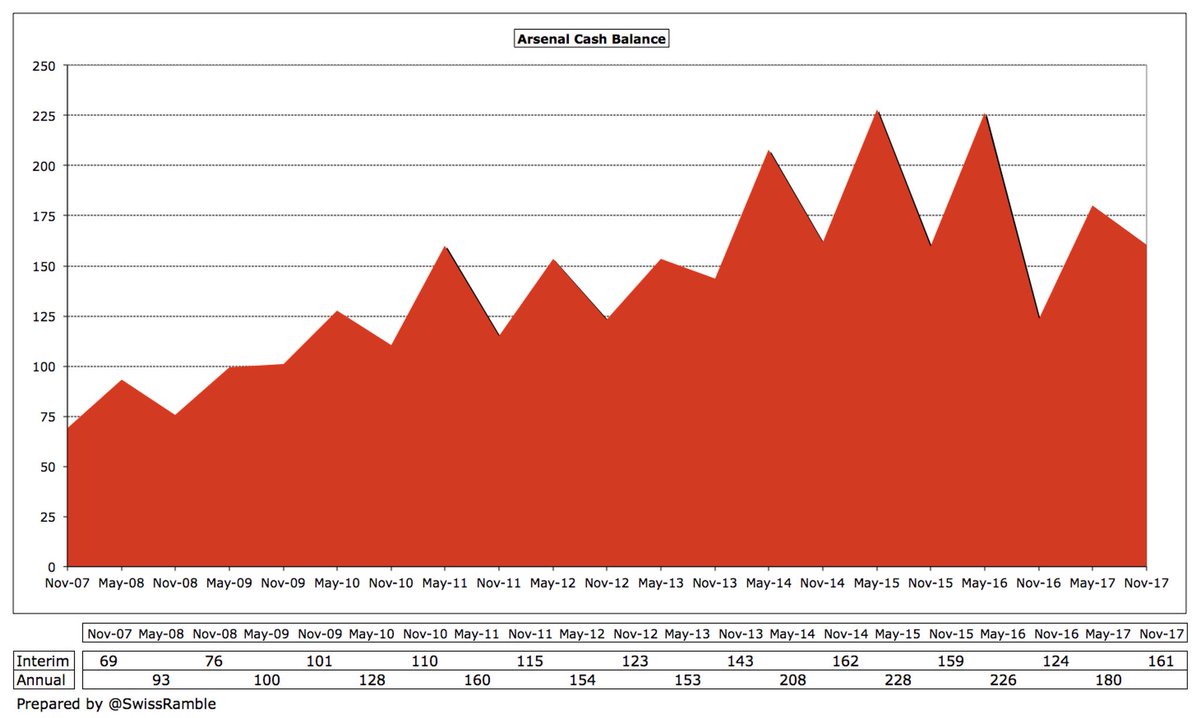

#AFC has no short-term debt, while cash balance of £161m (including £23m debt service reserve) was described as “robust”. Although this was £19m lower than six months ago, it was up £37m from the previous H1 position. Figure likely to be even higher at year-end.

Even though club has broken its transfer record twice this season (first Lacazette, then Aubameyang), #AFC approach is likely to continue to be prudent. According to the chairman, “our strategy remains self-financing” and “we need to spend effectively.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh