1/ A friendly reminder of what really matters with #Tesla. It isn't today's stock action or yesterday's executive departure. That's all noise. Before proceeding, disclosures: short via puts, not investment advice, do your own research, etc. etc. etc.

2/ At the highest level, gross profit - operating expenses - interest = pretax profit. It is really that simple. To assess a company, look at those three things. For $TSLA, gross profit can be divided into auto and everything else.

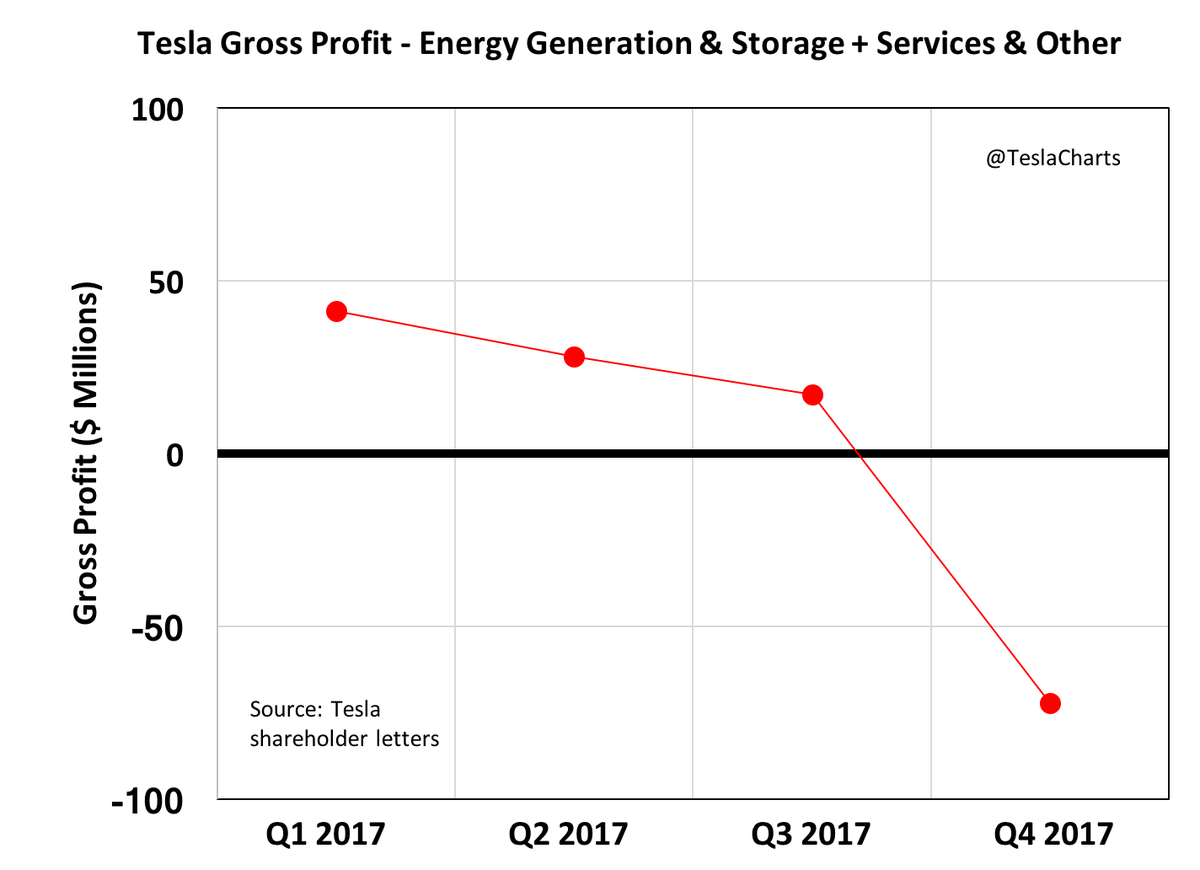

3/ Gross profit for everything else ex-auto at Tesla isn't pretty. Batteries, solar, services and other. Not good. Roughly a $70MM loss in Q4. Essentially: Auto gross profit must carry things.

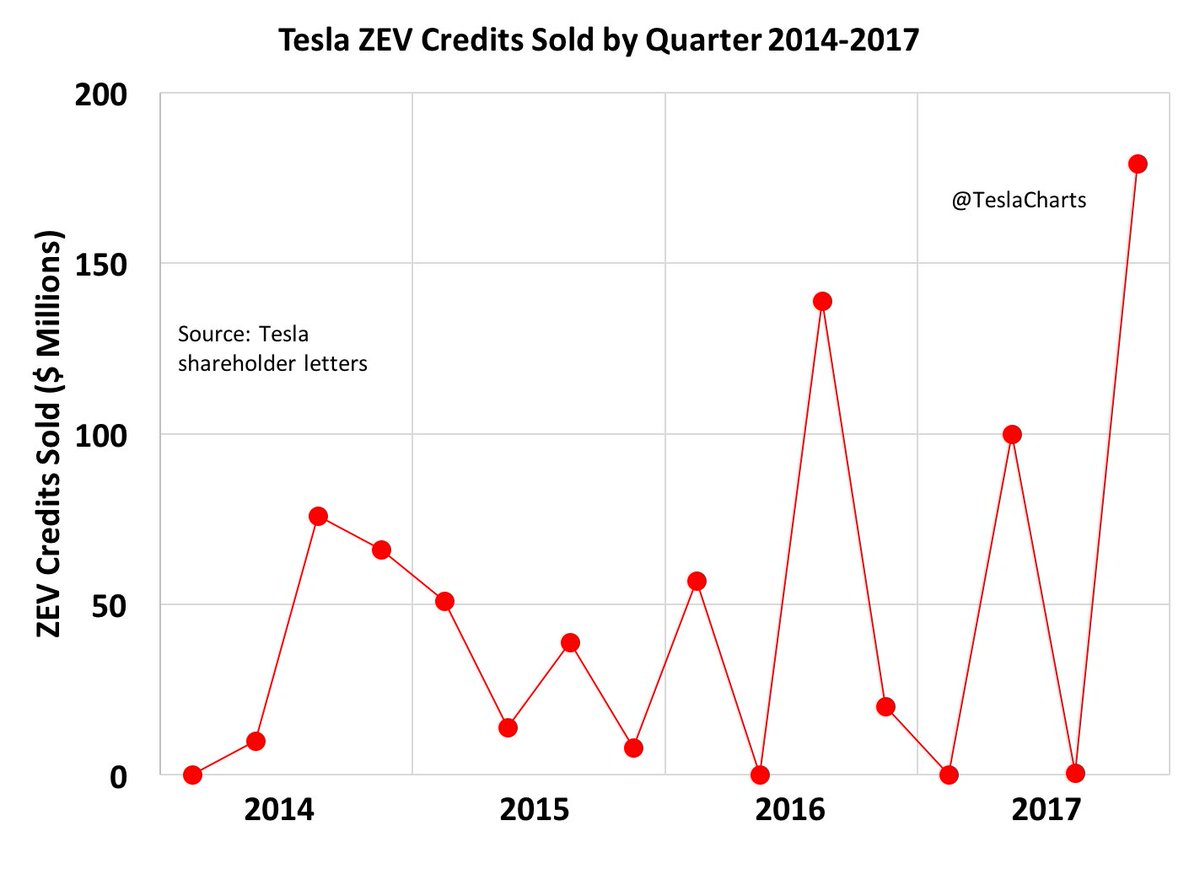

4/ Auto gross profit is complicated by how Tesla recognizes ZEV credits. It is very lumpy. But in Q4 2017, they sold the most ever, implying there's not much left for a quarter or two

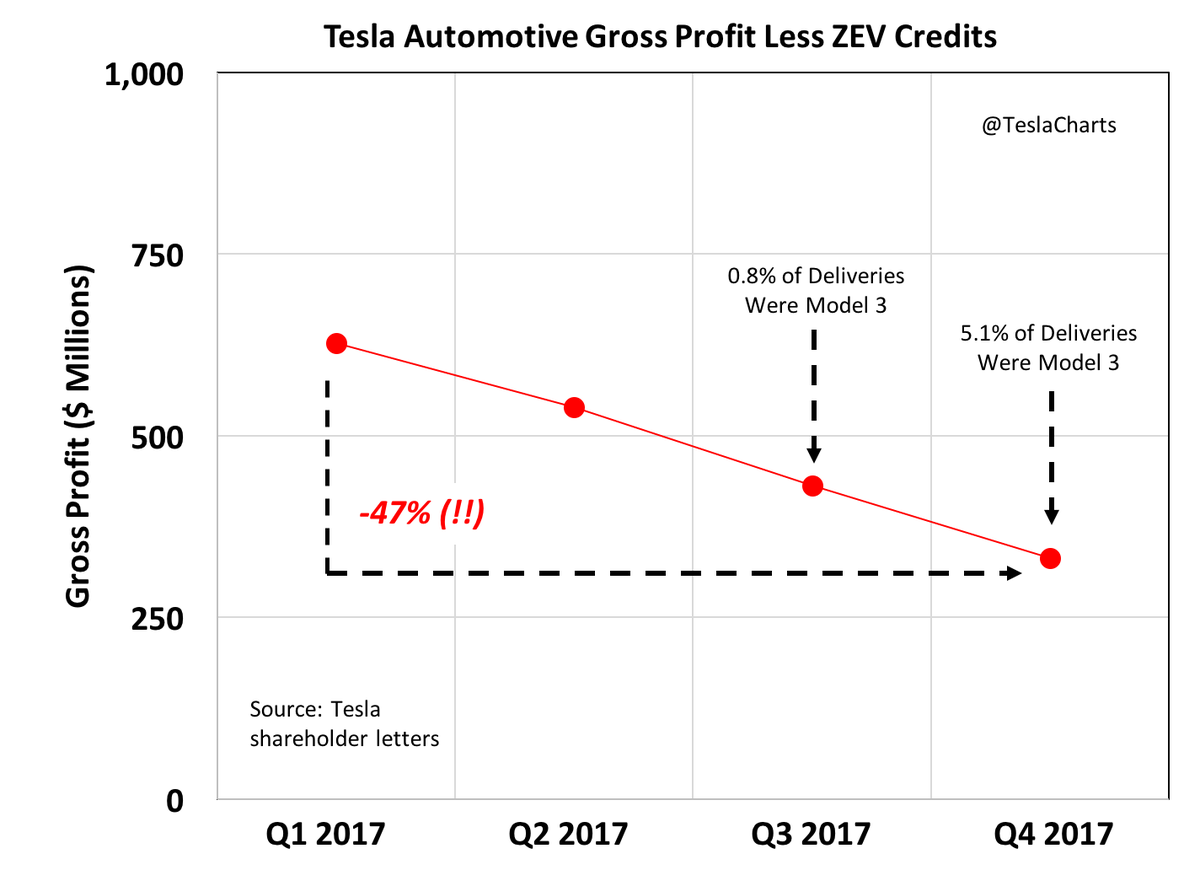

5/ If you remove ZEV credits (and there should be very few if any in Q1 2018), the gross profit from the auto business has been declining throughout 2017. In Q4 it was down to about $330MM. And the Model 3 doesn't explain much of this.

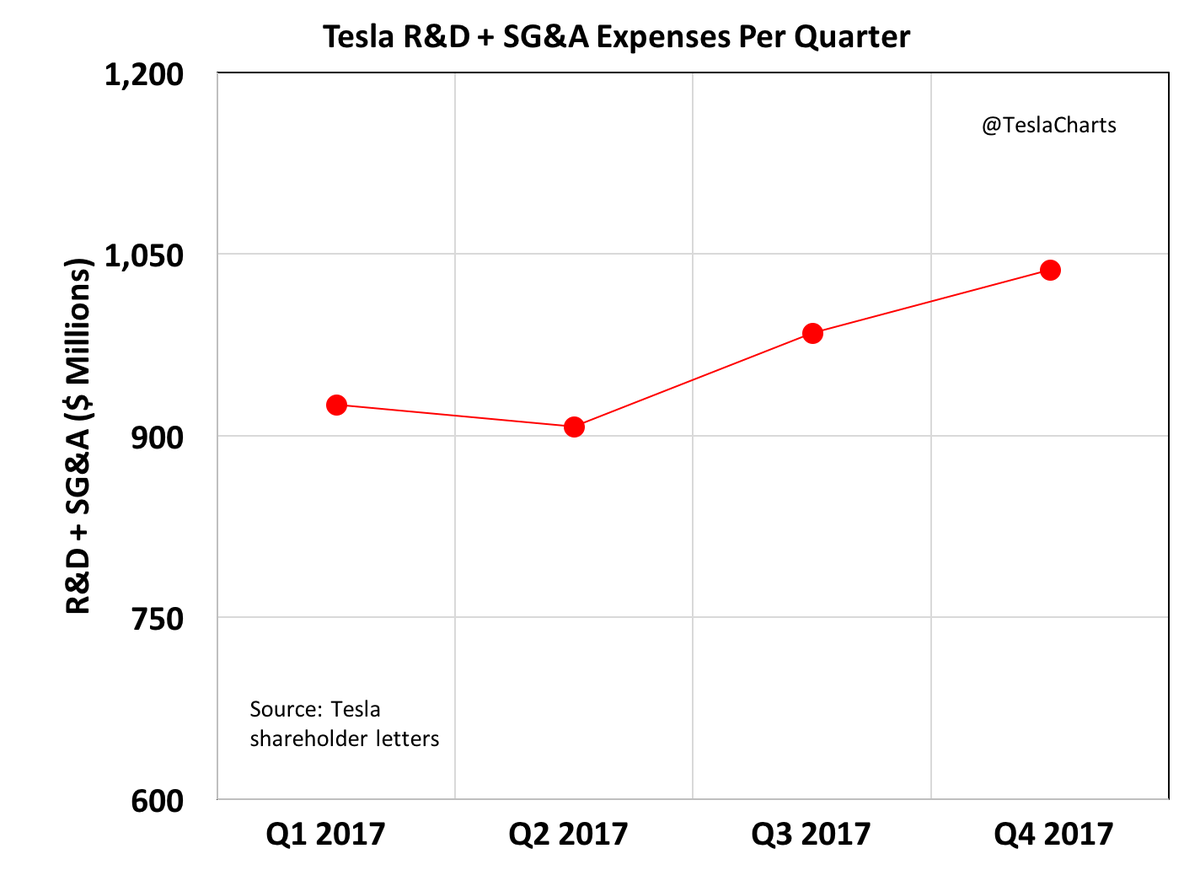

6/ This $330MM in gross profit (ex-ZEV) needs to carry losses from all other businesses and the operating expenses and interest. Let's look at operating expenses. Sequentially growing to over a $1B per quarter!

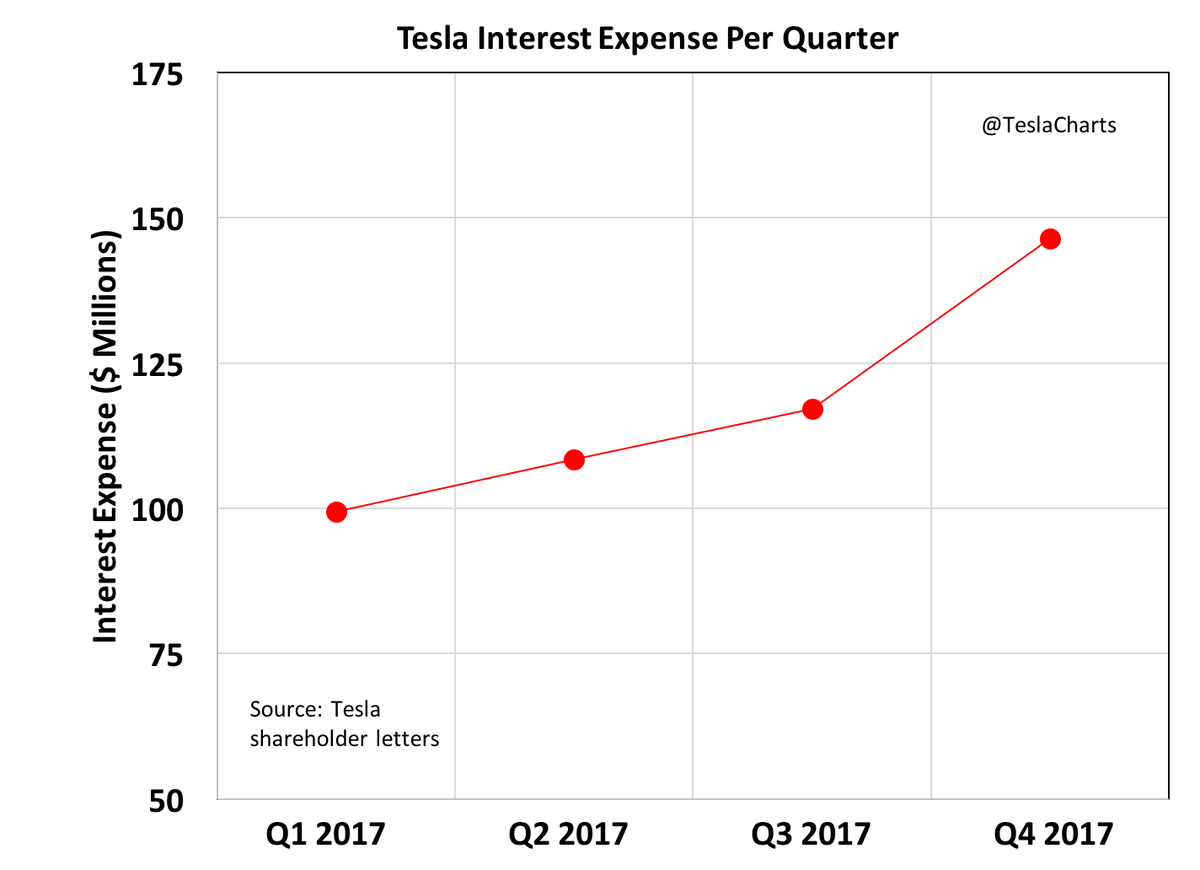

7/ Interest expense is growing with increasing debt load. Approaching $150MM per quarter in Q4 2017. So $330MM - $70MM - $1B - $150MM = -$890MM per quarter before things get better or worse. Note: Some of these losses are applicable to non-shareholders. Don't ask.

8/ Will Model 3 make things better? Management has guided the Model 3 gross margins will be negative in Q1. As a rule, Tesla always hits its negative guidance. They will almost assuredly recognize negative gross profit on all Model 3s sold in the quarter.

9/ I can find no evidence that demand for Model S/X is growing in Q1, either sequentially or year on year. There's much evidence for the opposite. This can change with a strong March, but things aren't looking great. If Tesla was more transparent we wouldn't have to guess.

10/ So baseline loss of ~$900 per quarter, less Model 3 losses, less declining Model S+X demand, plus increasing interest expenses. Losing a billion per quarter seems quite possible in the near term.

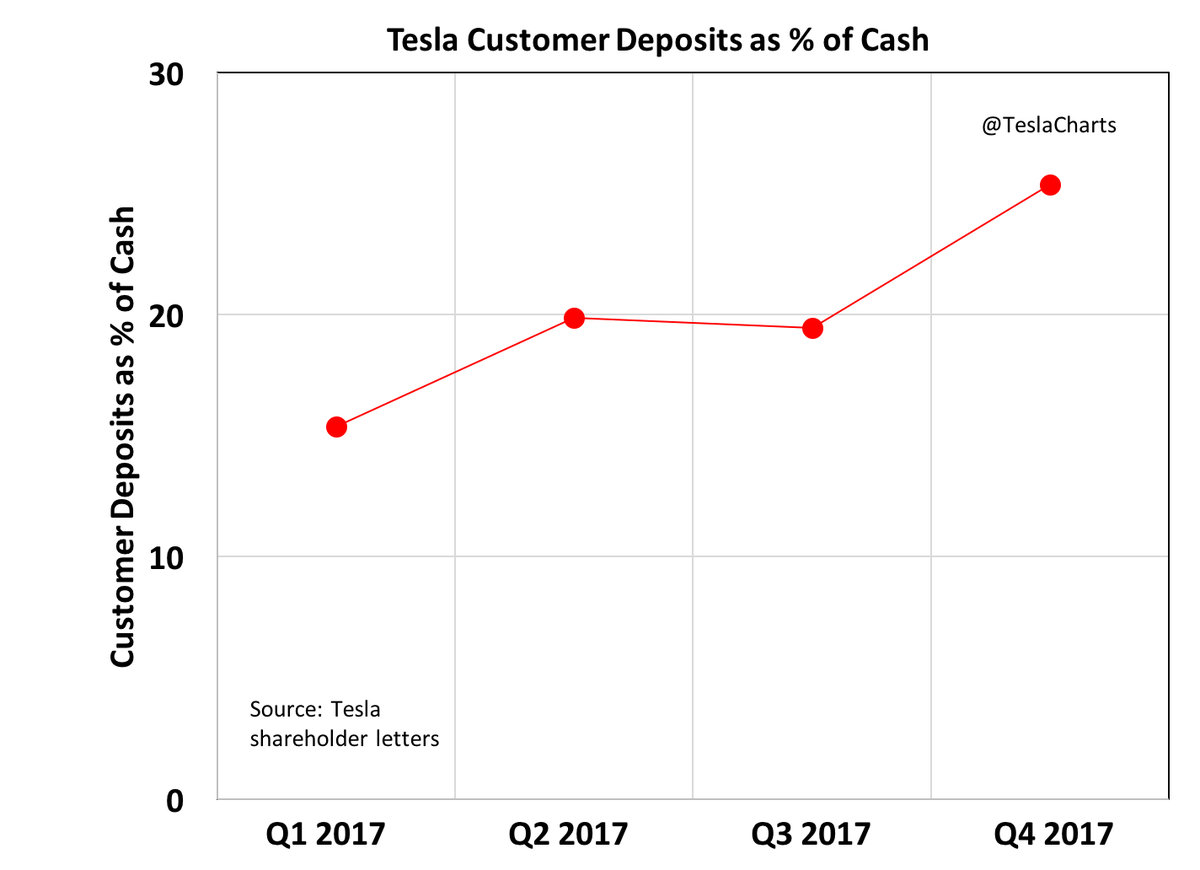

11/ But what about their cash position? Roughly 25% of their cash is in the form of refundable customer deposits not held in escrow. Mostly for the Model 3, presumably. Not that you'd know by reading their disclosures.

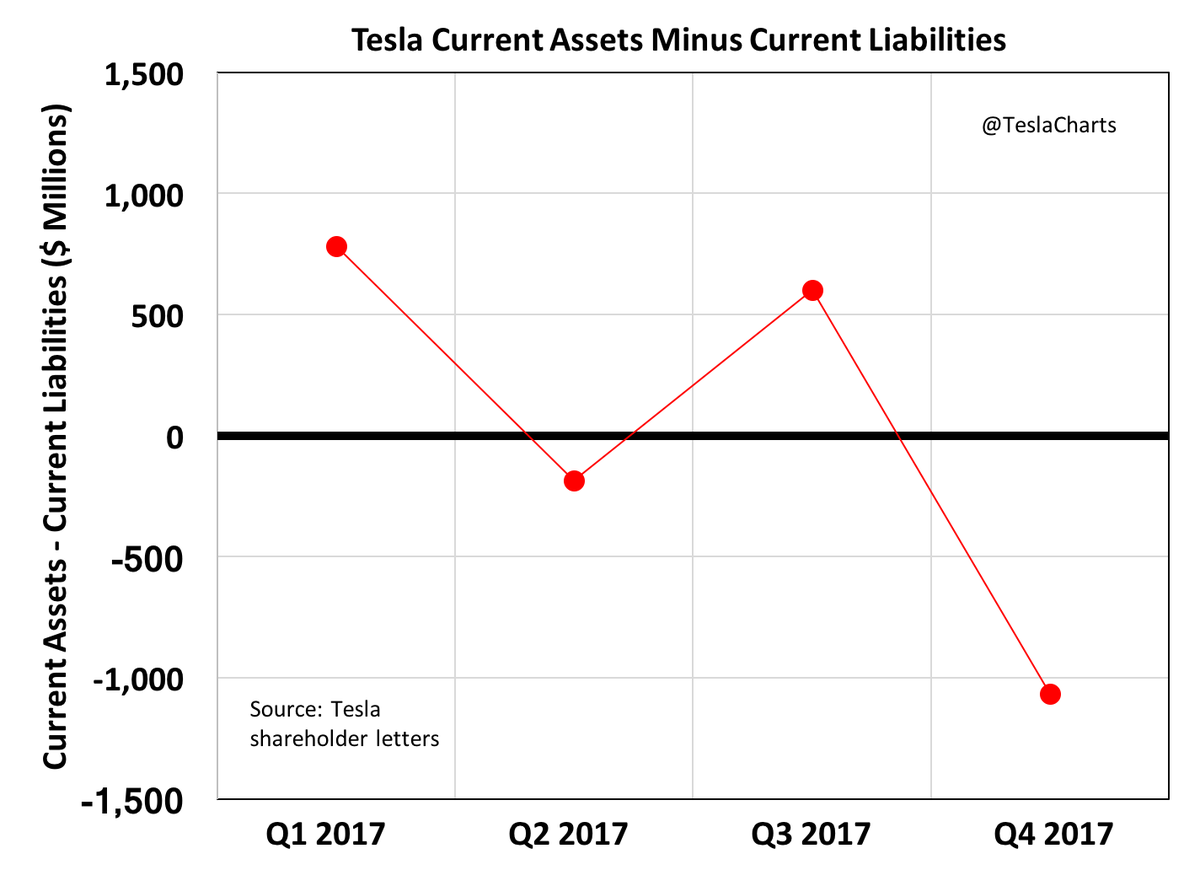

12/ And Q4 saw a massive swing in net working capital. Almost -$1.7B from Q3 to Q4. In other words, inventory draw down, collecting receivables, postponing payables, etc. Sustainable?

13/ Eroding net profit ex auto. Declining Model S+X. Production challenges and negative gross margins on Model 3. Competition arriving at all levels (Leaf, I-Pace, Bolt, Porsche, Audi, etc). And priced for thread-the-needle perfection.

14/ But don't worry, they can raise whenever they want right? Well, why haven't they? Why didn't they at $380? Or $350? They need capital and fast. To me, this is the Tesla news that really matters. Q1 is go time. Trade carefully!

*900mm

• • •

Missing some Tweet in this thread? You can try to

force a refresh