Nottingham Forest recently published financial results for 2016/17, when they finished 21st in the Championship, narrowly avoiding relegation. After the season concluded, the club was purchased from Fawaz Al Hasawi by NF Football Investments Ltd. Some thoughts follow #NFFC

NF Football Investments Ltd is owned by Evangelos Marinakis (80%) & Sokratis Kominakis (20%). Marinakis is a Greek shipowner, who also owns perennial Greek champions Olympiacos. The takeover was concluded on 18th May 2017, i.e. at the very end of the 16/17 reporting period #NFFC

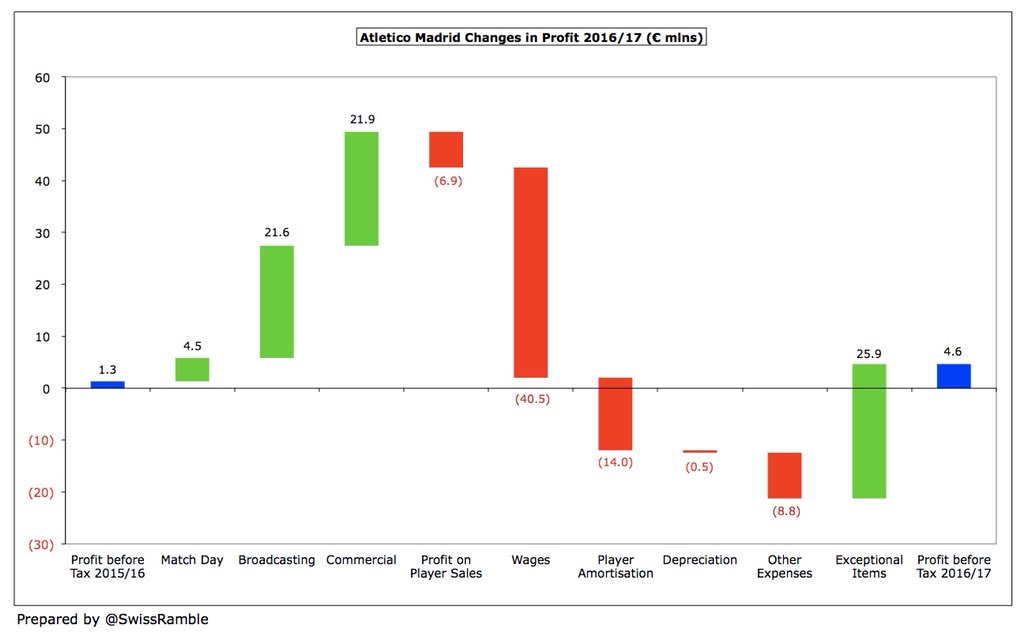

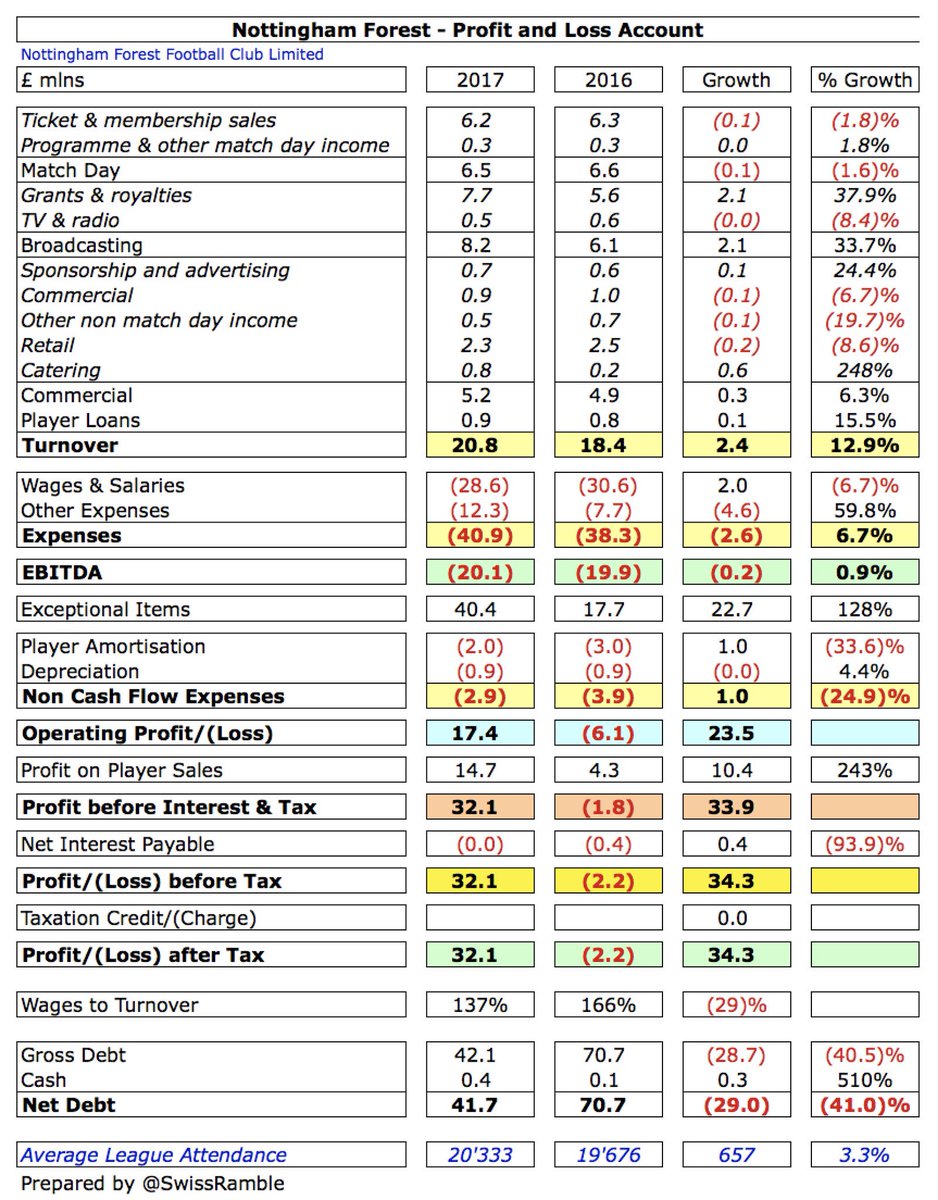

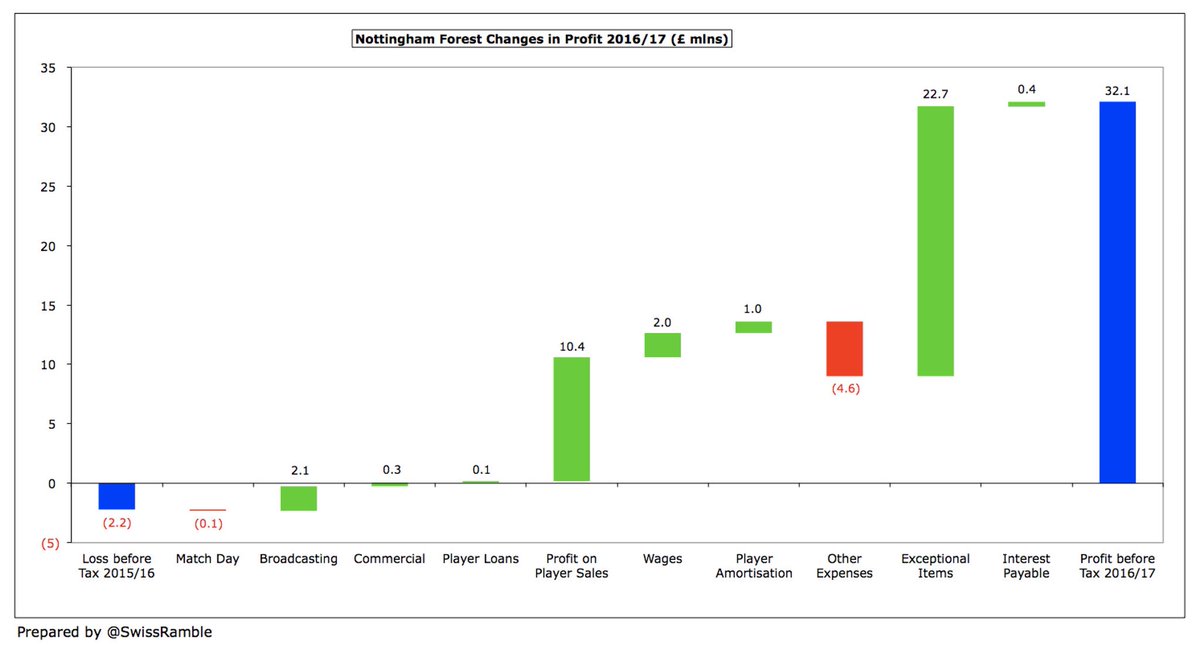

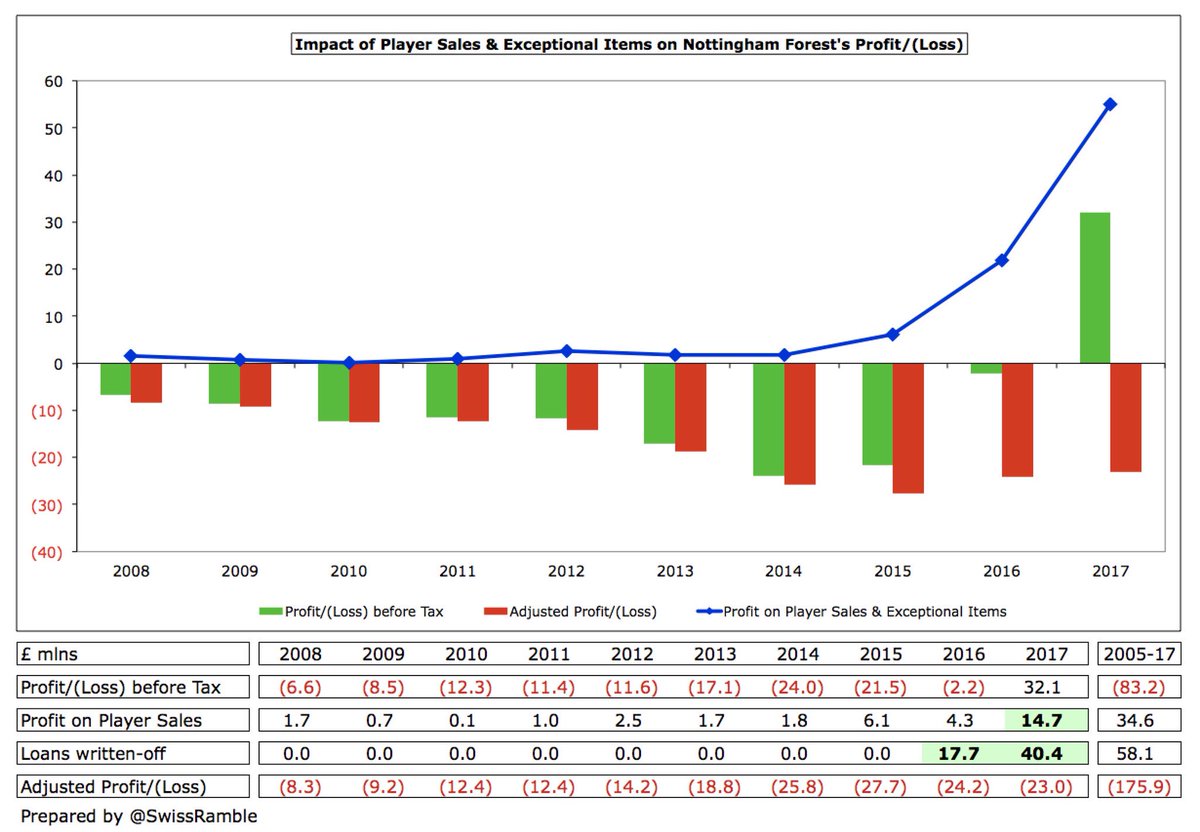

#NFFC reported a £32.1m profit against a £2.2m loss the previous season (a £34.3m improvement), largely due to loan write-offs increasing by £22.7m from £17.7m to £40.4m and profit on player sales rising £10.4m to £14.7m, mainly the sale of Oliver Burke to RB Leipzig.

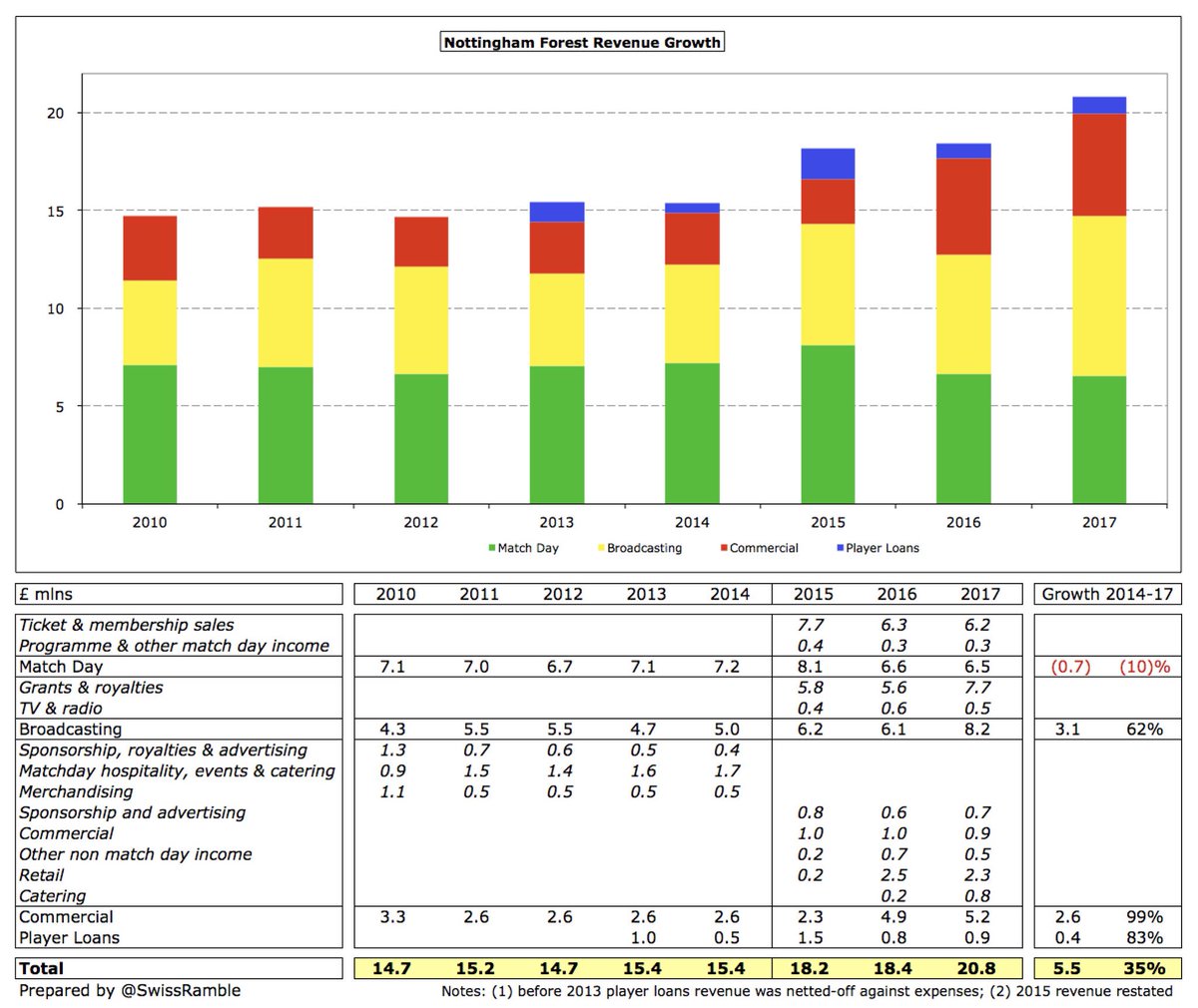

#NFFC revenue was up £2.4m (13%) from £18.4m to £20.8m, mainly due to broadcasting (£2.1m), thanks to higher Premier League solidarity payments, and commercial (£0.3m), after bringing catering back in-house. Match day fell very slightly (2%).

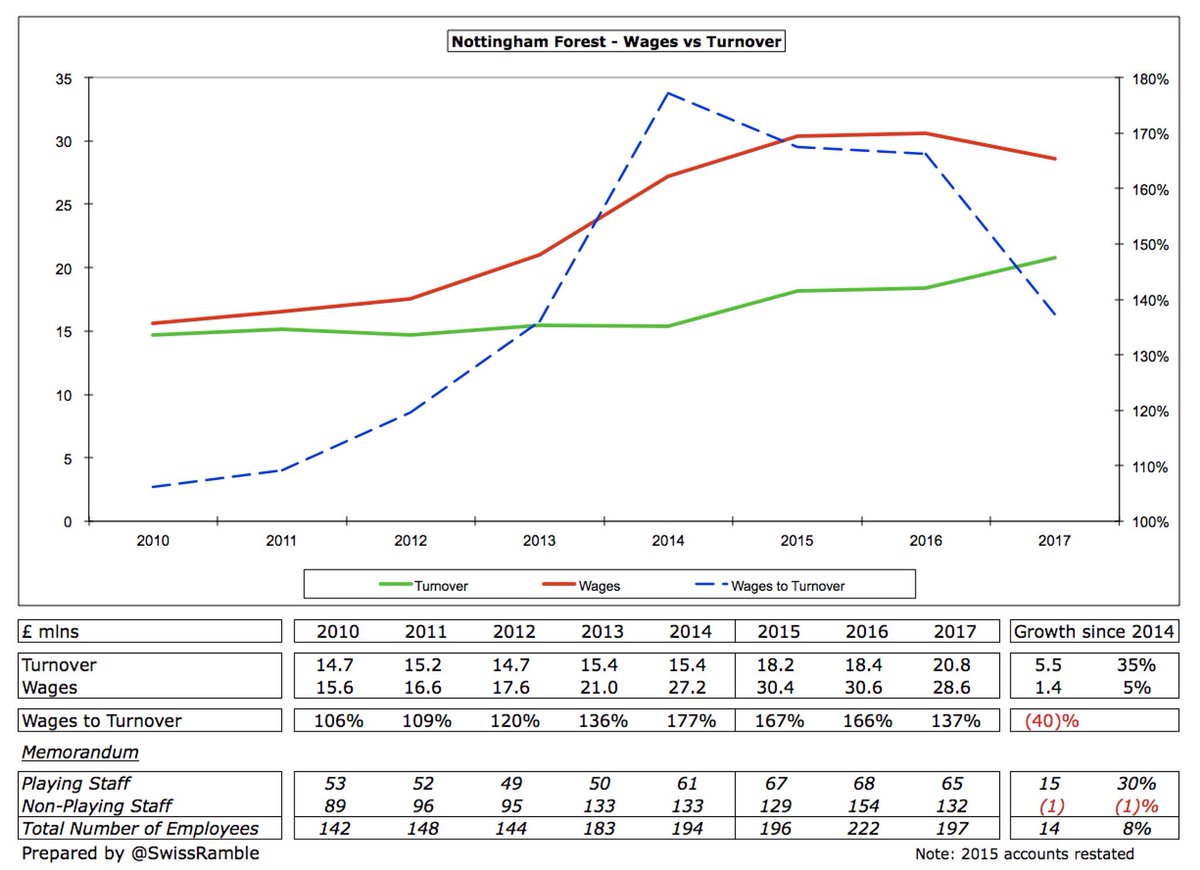

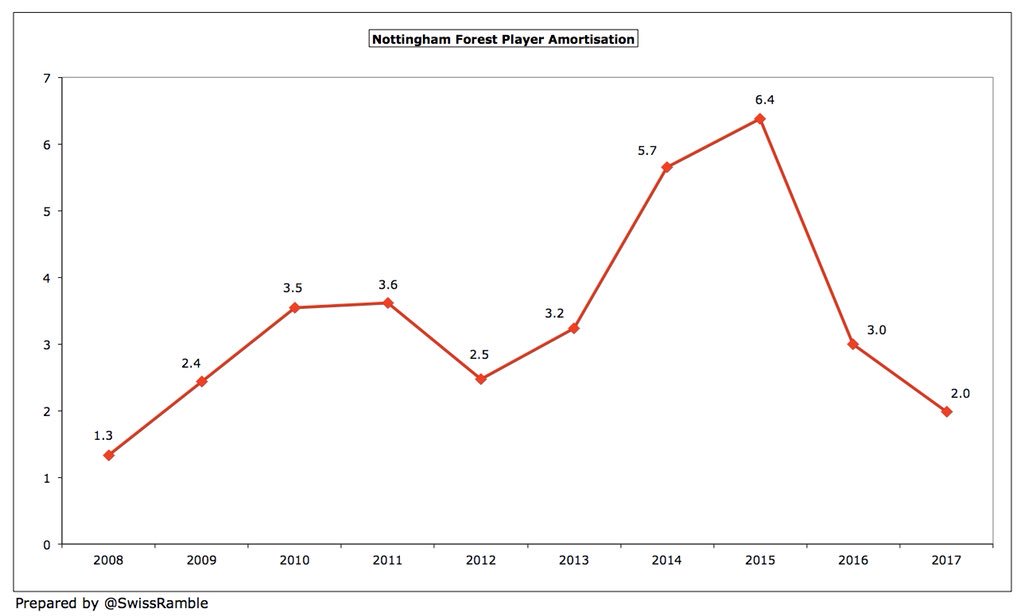

#NFFC reduced wages by £2m (7%) to £28.6m and player amortisation by £1m (34%) to £2m. Interest payable was also cut by £0.4m to virtually zero. In contrast, other expenses climbed £4.6m (60%) to £12.3m.

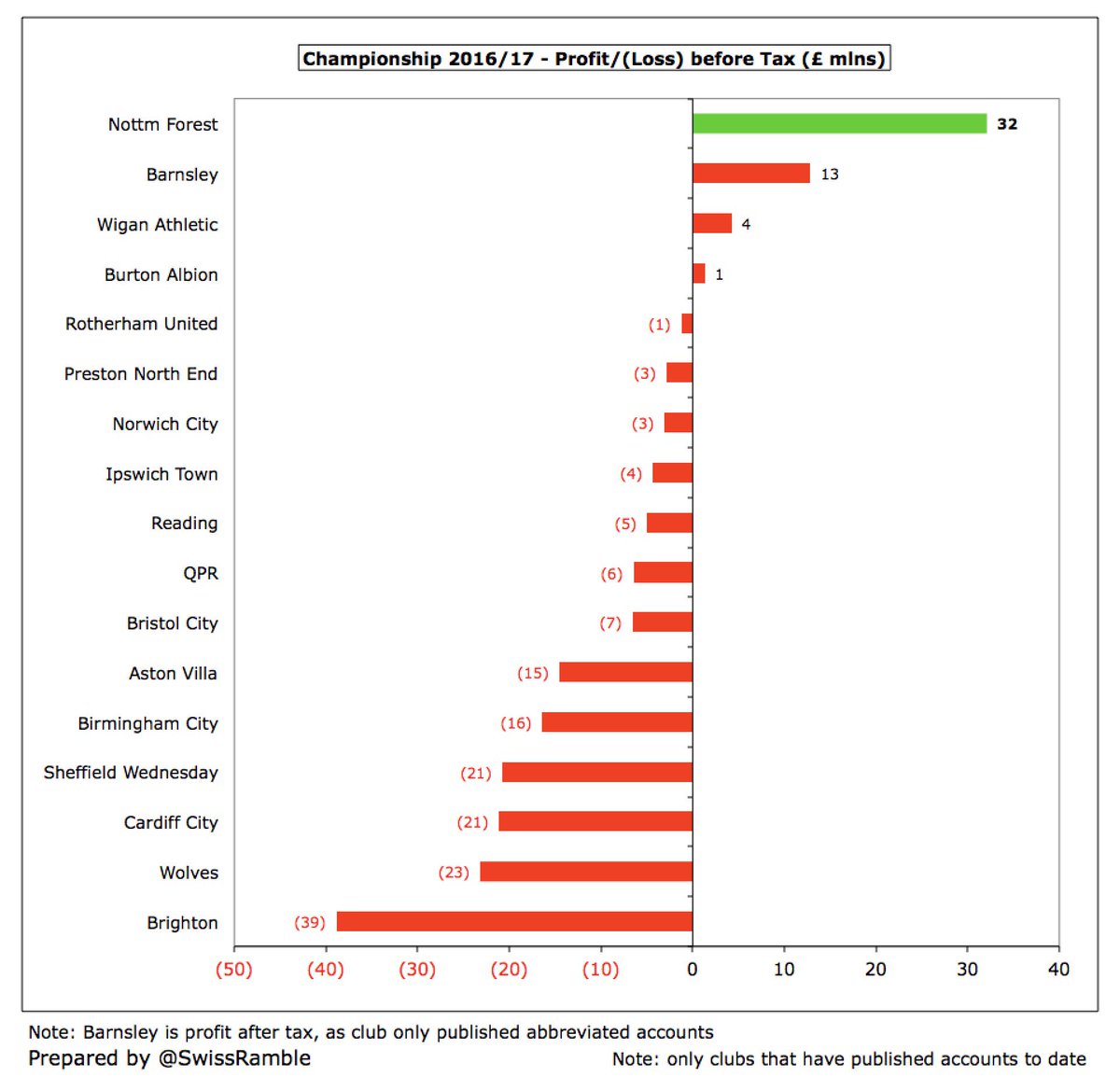

Thanks to £40m loan write-off, #NFFC reported highest profit in the Championship of 17 clubs that have reported to date. In general, almost all clubs in this division lose money as they gamble on promotion. Exceptions are normally due to once-off items (player sales, write-offs).

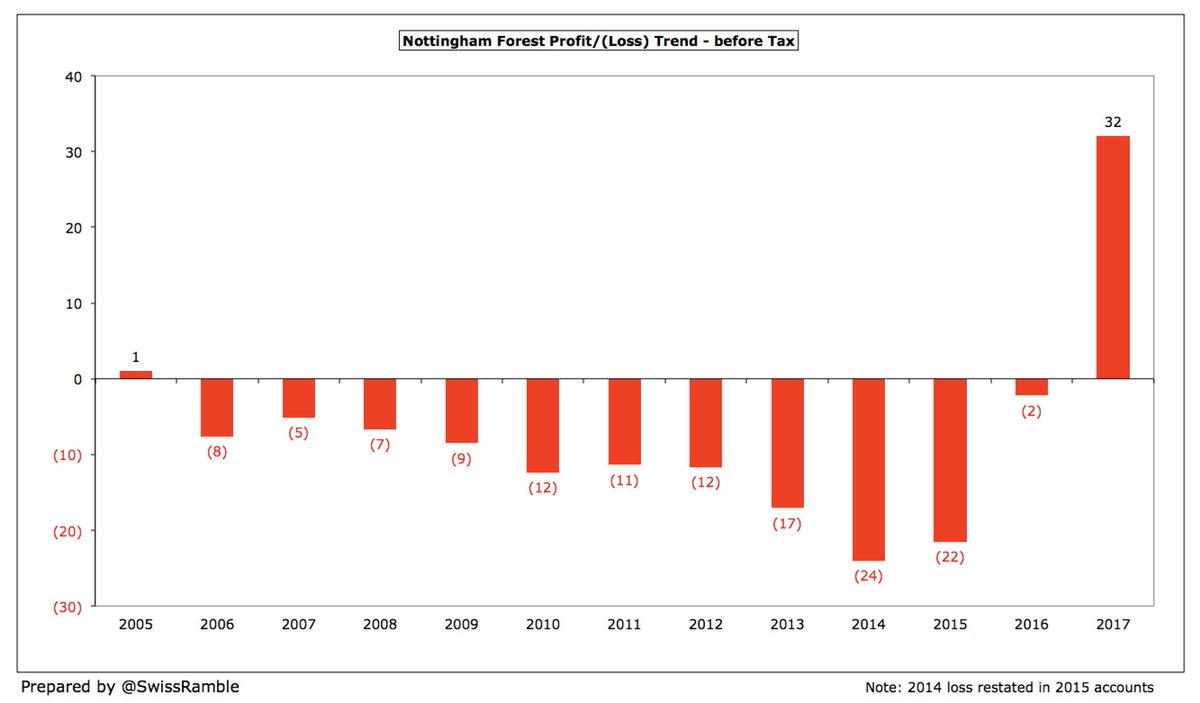

Before 2016/17, the last time #NFFC made a profit was way back in 2005 – and that was only £1m. The club then suffered 11 consecutive years of losses, amounting to an extraordinary £128m, though the 2015/16 loss was reduced to only £2m.

However, main drivers for improvement in #NFFC bottom line in last 2 seasons are once-offs: (a) £58m of loan write-offs: £18m in 15/16, £40m in 16/17; (b) profits from player sales: £15m in 16/17. Excluding these items, Forest’s losses would again have been at £23-24m level.

In the past #NFFC made very little money from player sales, but this has changed in last 3 seasons: 14/15 £6m (Darlow & Lascelles); 15/16 £4m (Antonio); and 16/17 £15m (Burke & Lansbury). This season will similarly benefit from £15m sale of Britt Assombalanga to Middlesbrough.

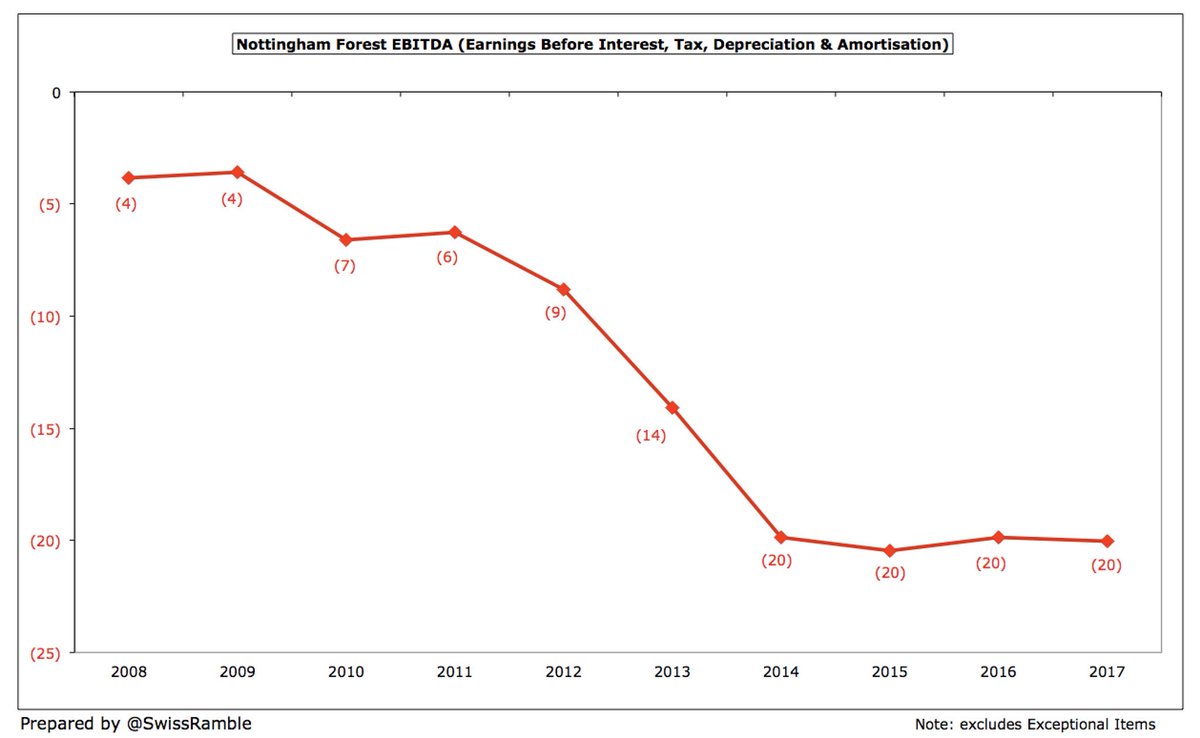

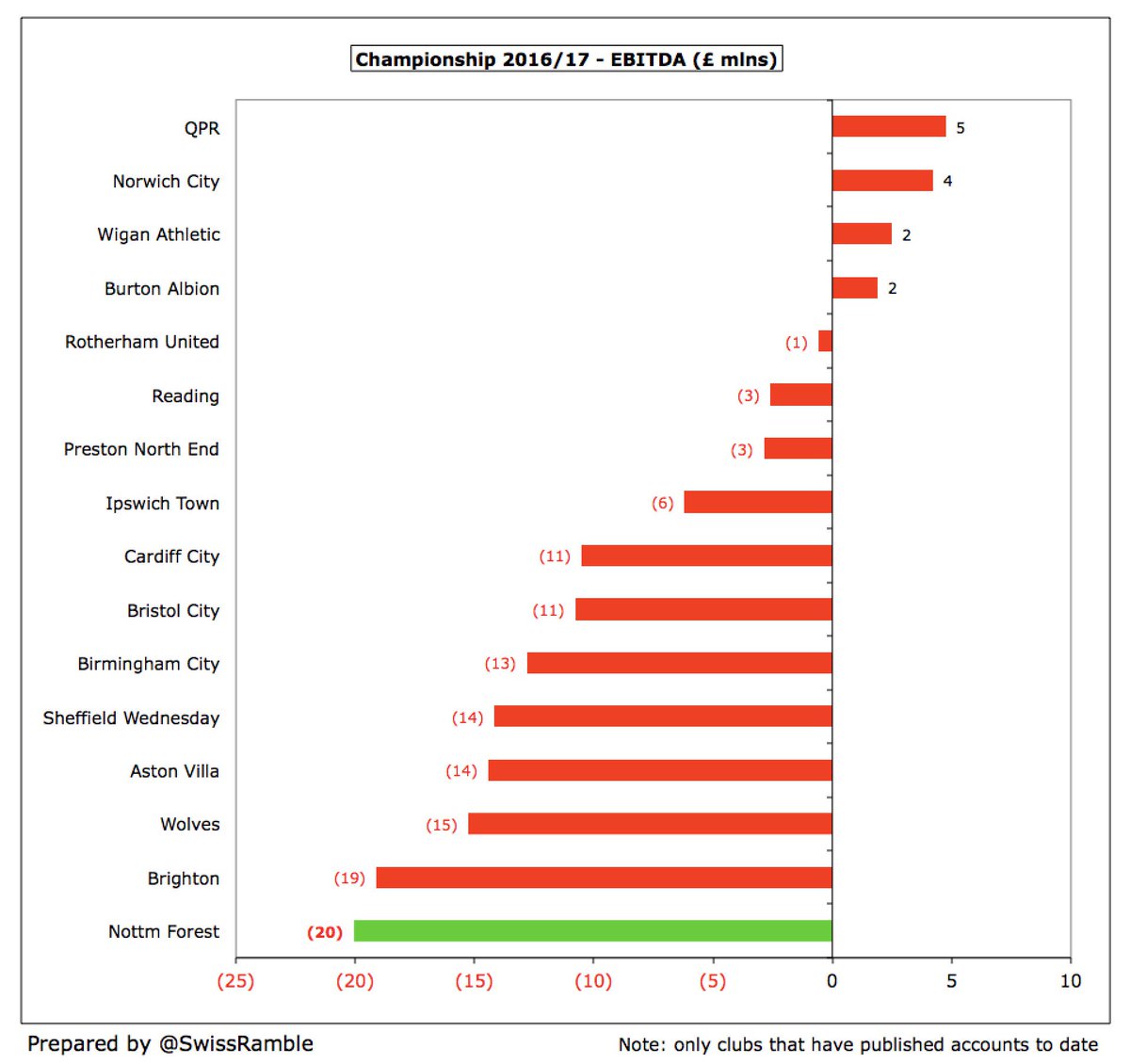

#NFFC underlying profitability remains poor, as shown by their EBITDA (Earnings Before Interest, Depreciation and Amortisation), which strips out once-off profits from player sales and non-cash items. This has been consistently negative at minus £20m for the last 4 years.

To be fair, very few Championship clubs manage to generate positive EBITDA, but #NFFC’s £(20)m in 2016/17 is the worst in the division, lower than Brighton £(19)m, Wolves £(15)m and Aston Villa £(14)m.

#NFFC revenue has grown by £5.4m (35%) from £15.4m to £20.8m in the 3 years since 2014/15, though £3.1m of that is from bringing back in-house retail operations and catering. Another £3.1m is from broadcasting, due to increase in solidarity payment from the Premier League.

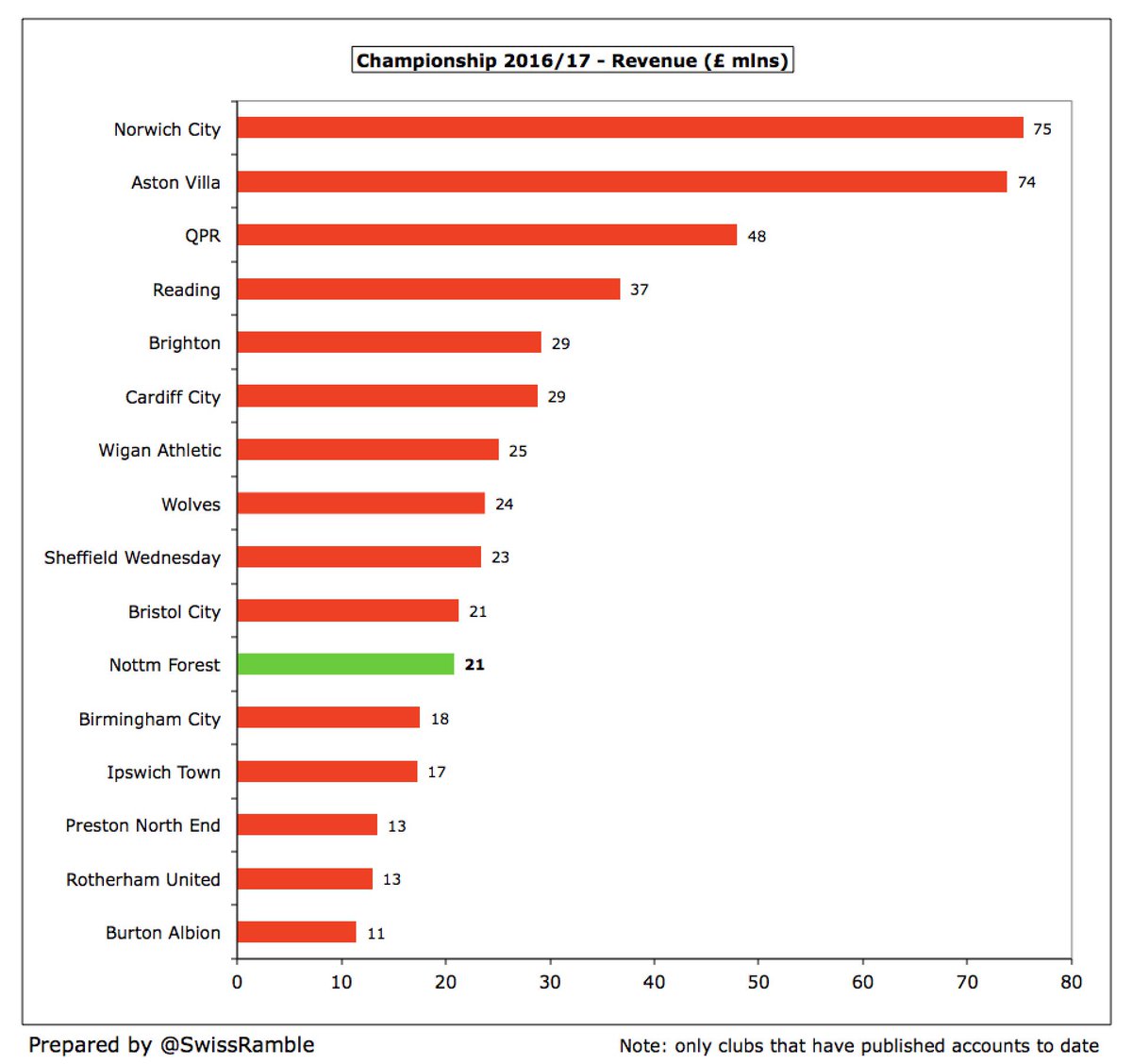

#NFFC £21m revenue was still miles below leading Championship clubs in 2016/17, e.g. Norwich £75m, Aston Villa £74m. The clubs not benefiting from parachute payments higher than Forest (to date) are Brighton £29m, Wolves £24m, Sheffield Wednesday £23m and Bristol City £21m.

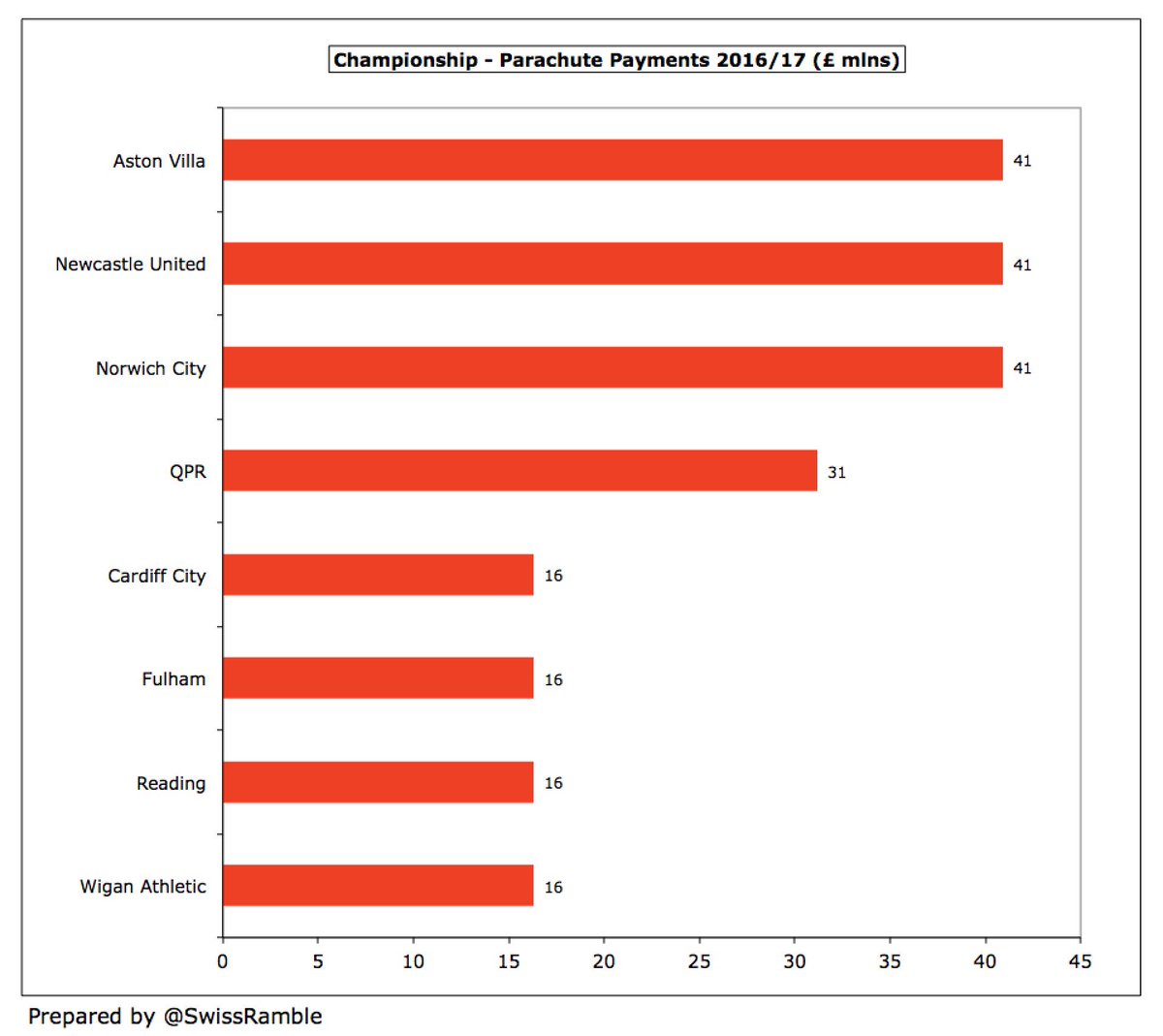

Revenue is greatly influenced by those Premier League parachute payments, e.g. £41m to Villa, Newcastle & Norwich. This has increased from £26m in 15/16 thanks to new PL TV deal, making the task more difficult than ever for clubs like #NFFC, especially if they don’t spend much.

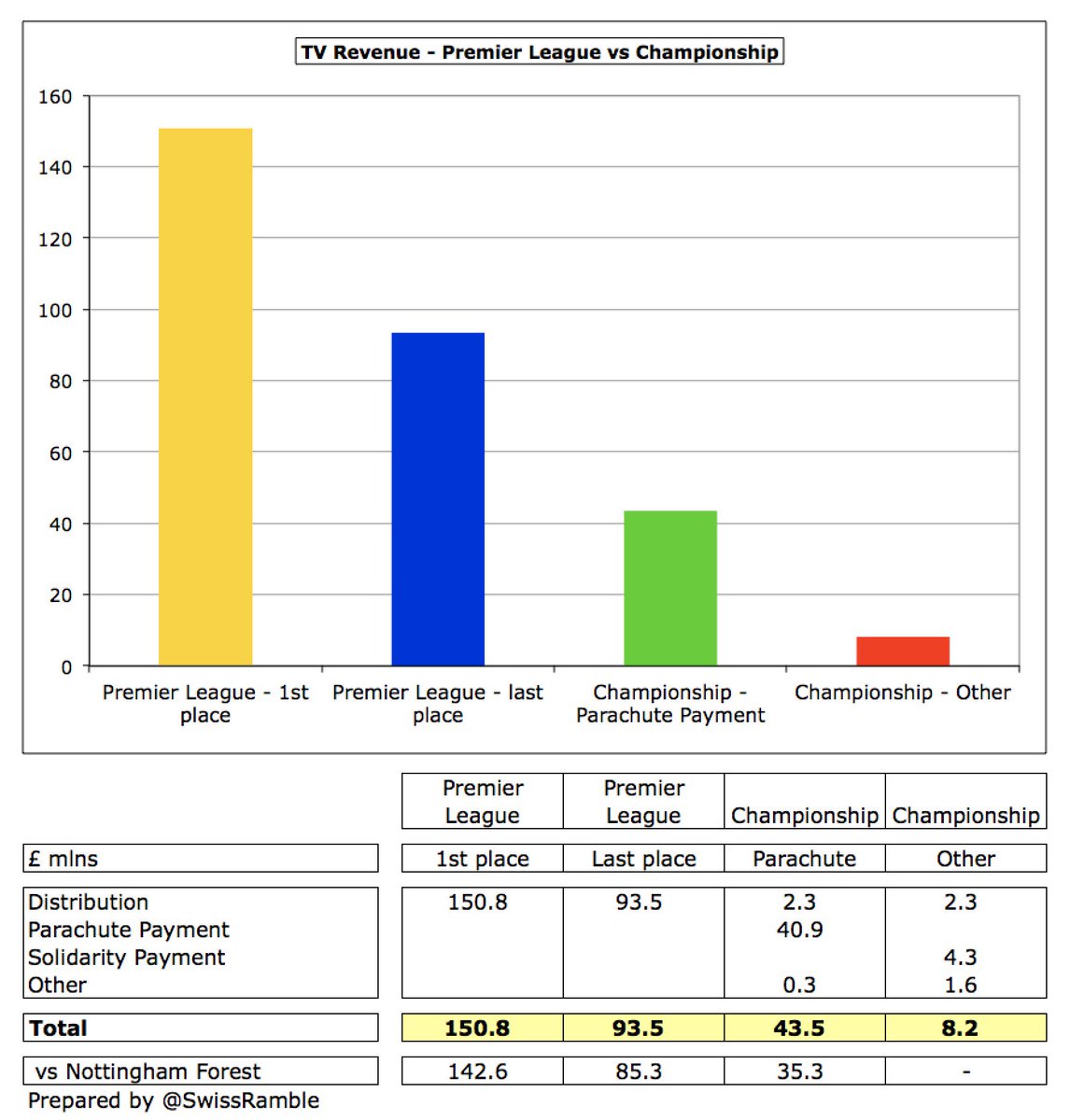

#NFFC TV income rose 34% (£2.1m) from £6.1m to £8.2m, largely due to the increase in PL solidarity payment from £2.3m to £4.3m. The amounts in the top flight (£151m for top club, £93m for bottom club) help explain why some Championship owners spend big.

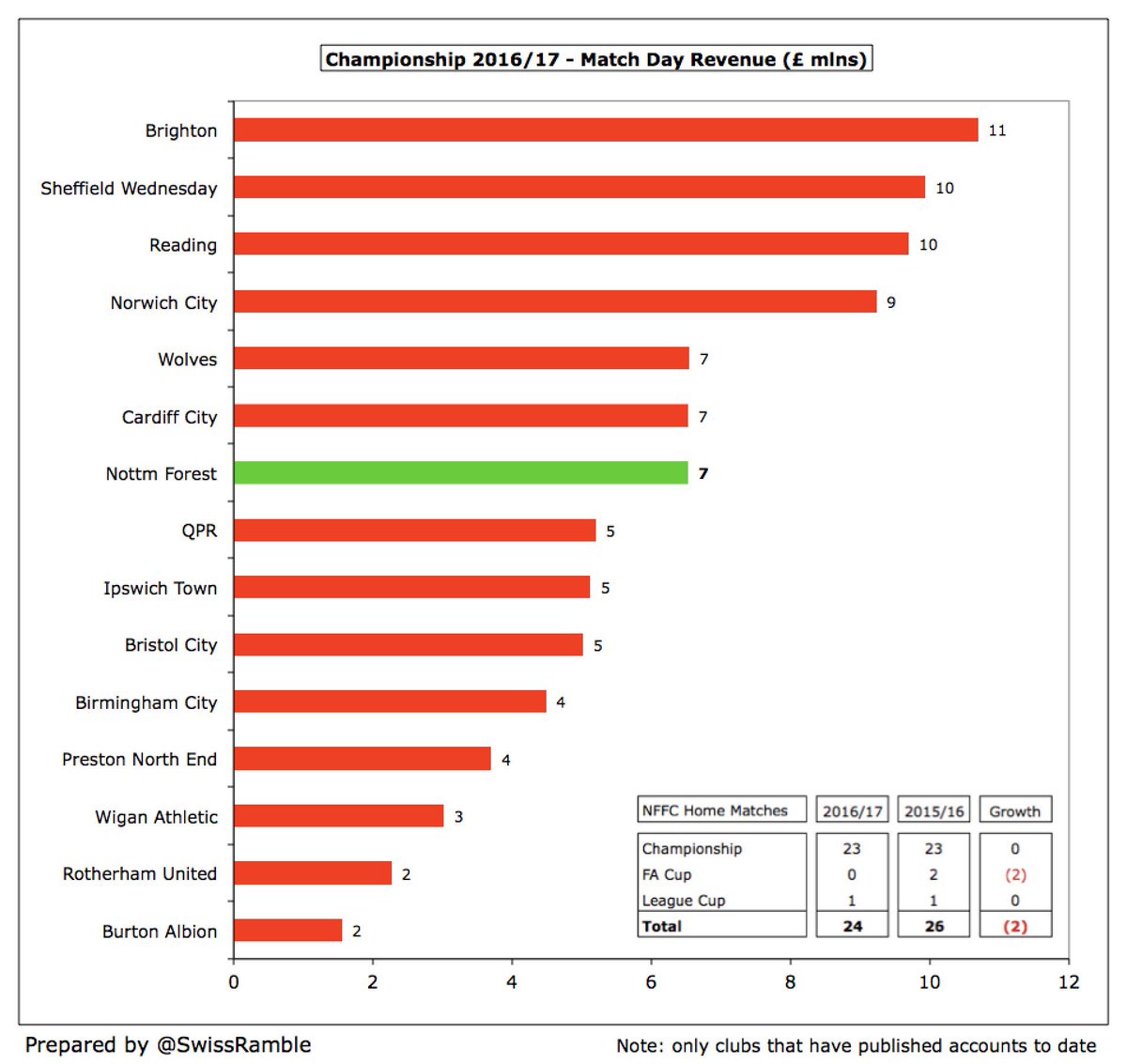

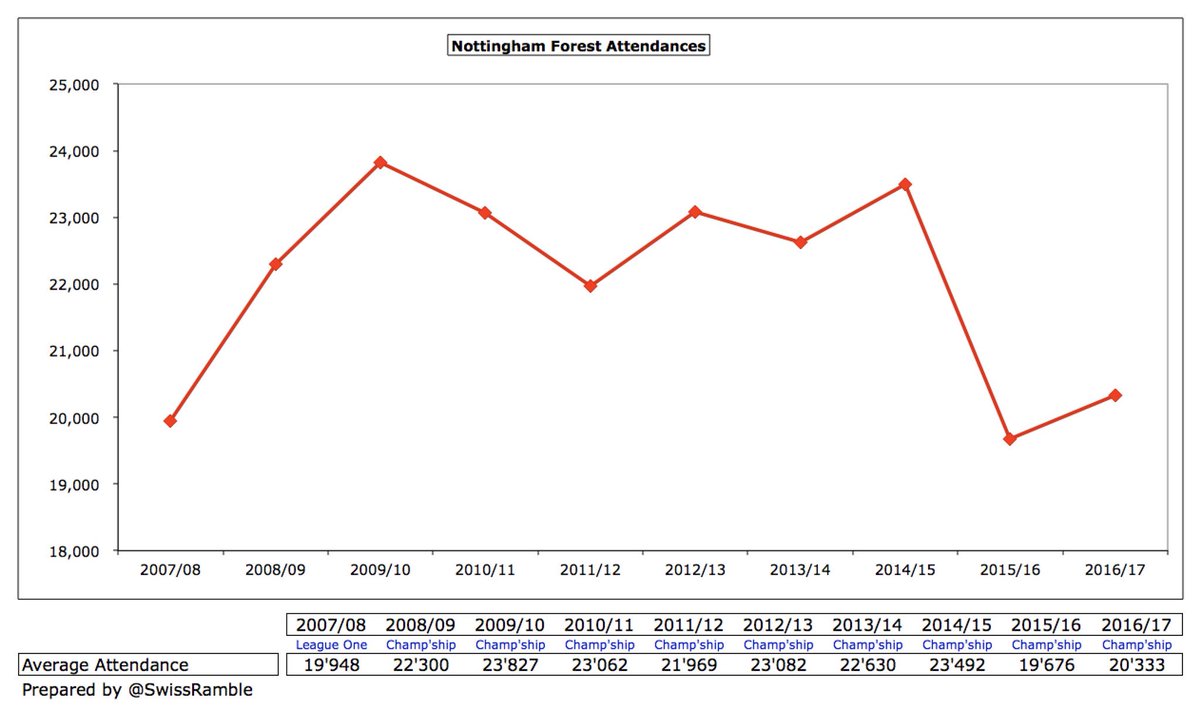

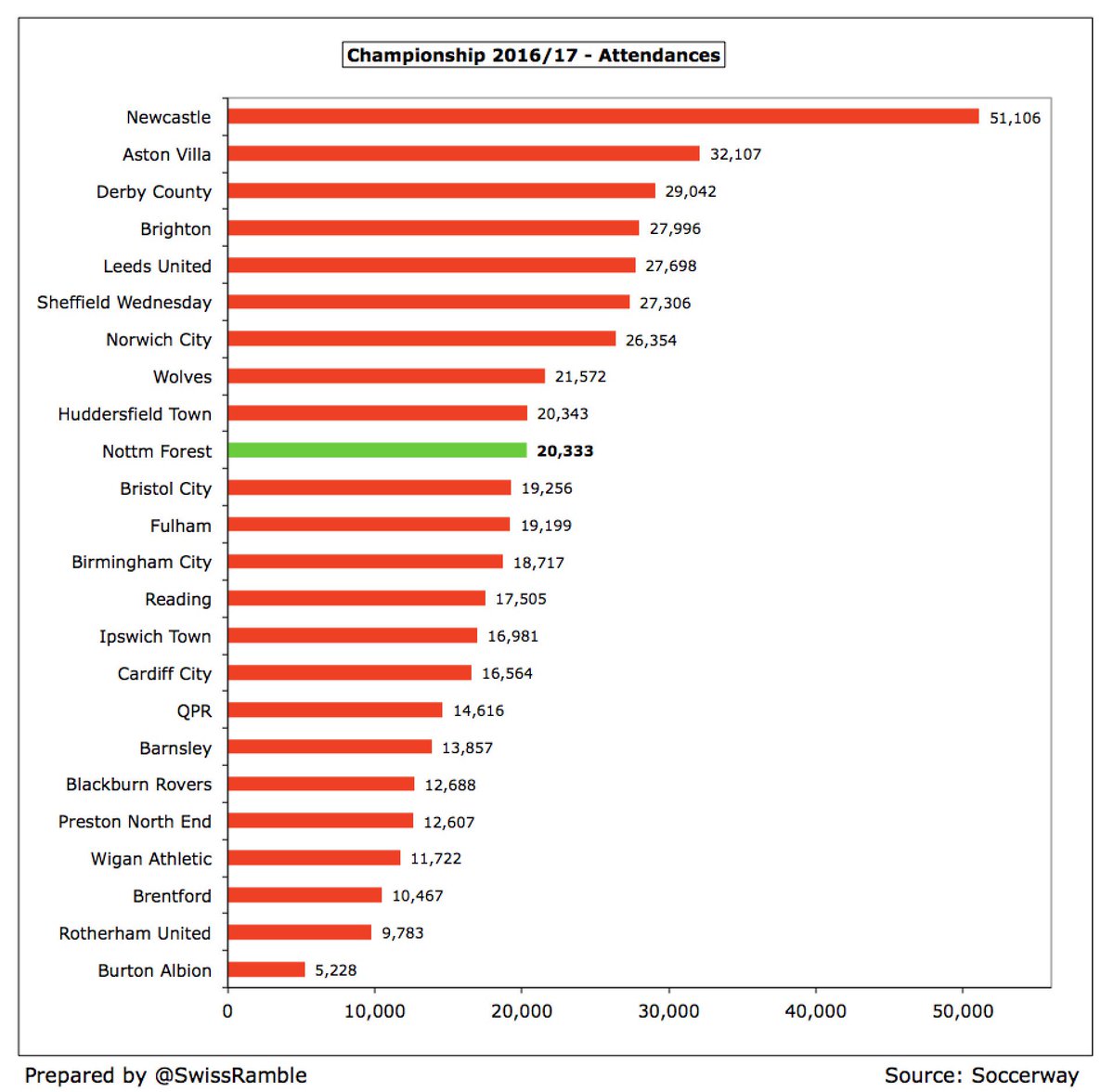

#NFFC match day revenue fell slightly by 2% (£0.1m) to £6.5m, despite increase in average attendance from 19,676 to 20,333, as they hosted 2 fewer games at the City Ground & selected ticket prices were reduced by 5%. The 16/17 figure is 19% (£1.6m) lower than £8.1m peak in 14/15.

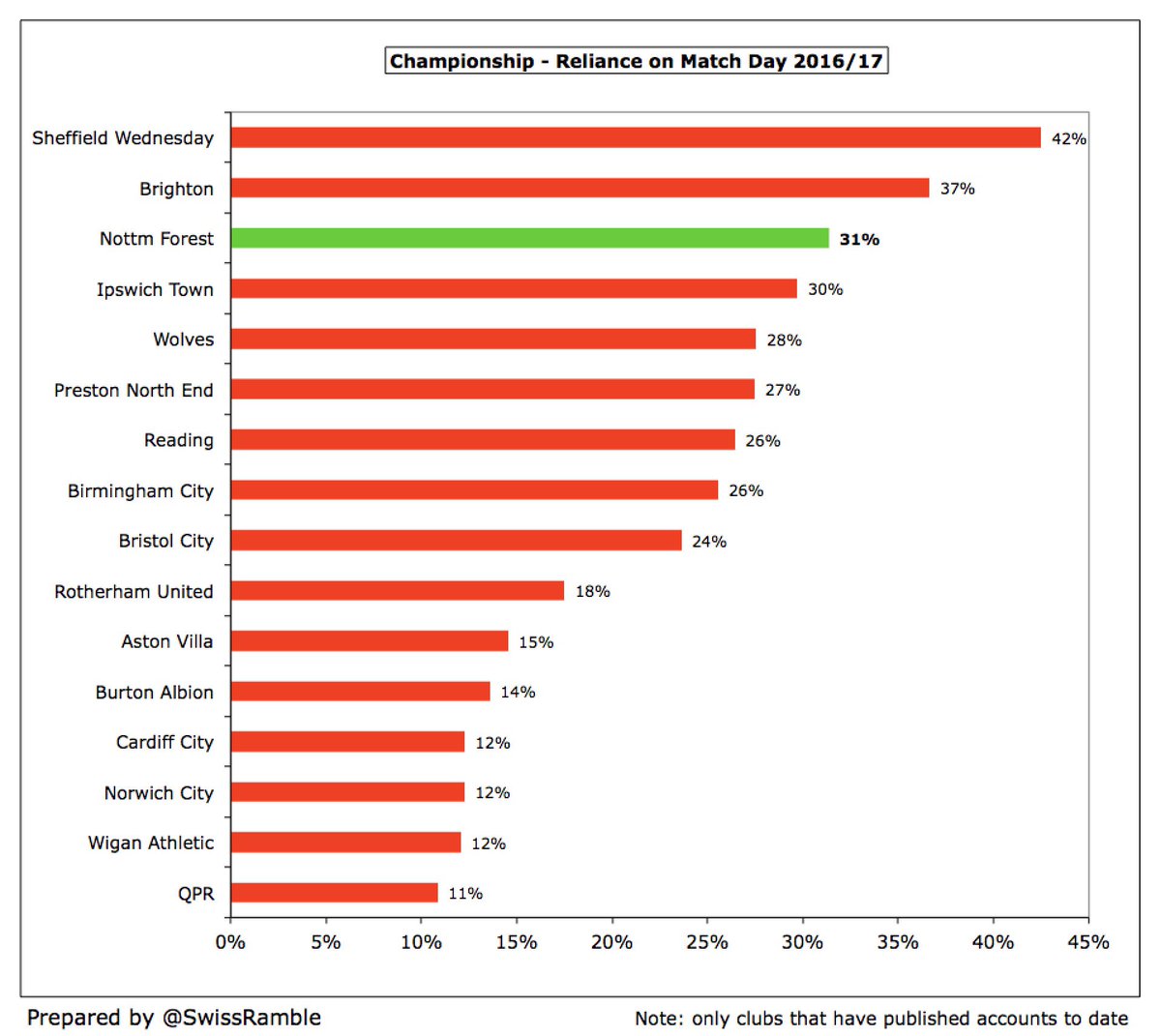

#NFFC only have the 7th highest match day revenue in Championship (of clubs reported to date), a fair way behind the leaders Aston Villa & Brighton £11m. However, they do have the 3rd highest reliance on this revenue stream (31%), only surpassed by Sheffield Wednesday & Brighton.

As might be expected, given the poor results on the pitch and unhappiness with the owner, #NFFC attendances have been declining, losing almost 4,000 in 2015/16 alone. However, crowds bounced back last season to over 20,000 and are averaging around 25,000 this season.

#NFFC 20,333 attendance was 10th largest in the Championship last season, around same level as Huddersfield, but long way behind top two (Newcastle 51,106 & Villa 32,107). Have announced some positive ticket pricing initiatives, e.g. frozen prices, cheap tickets for young fans.

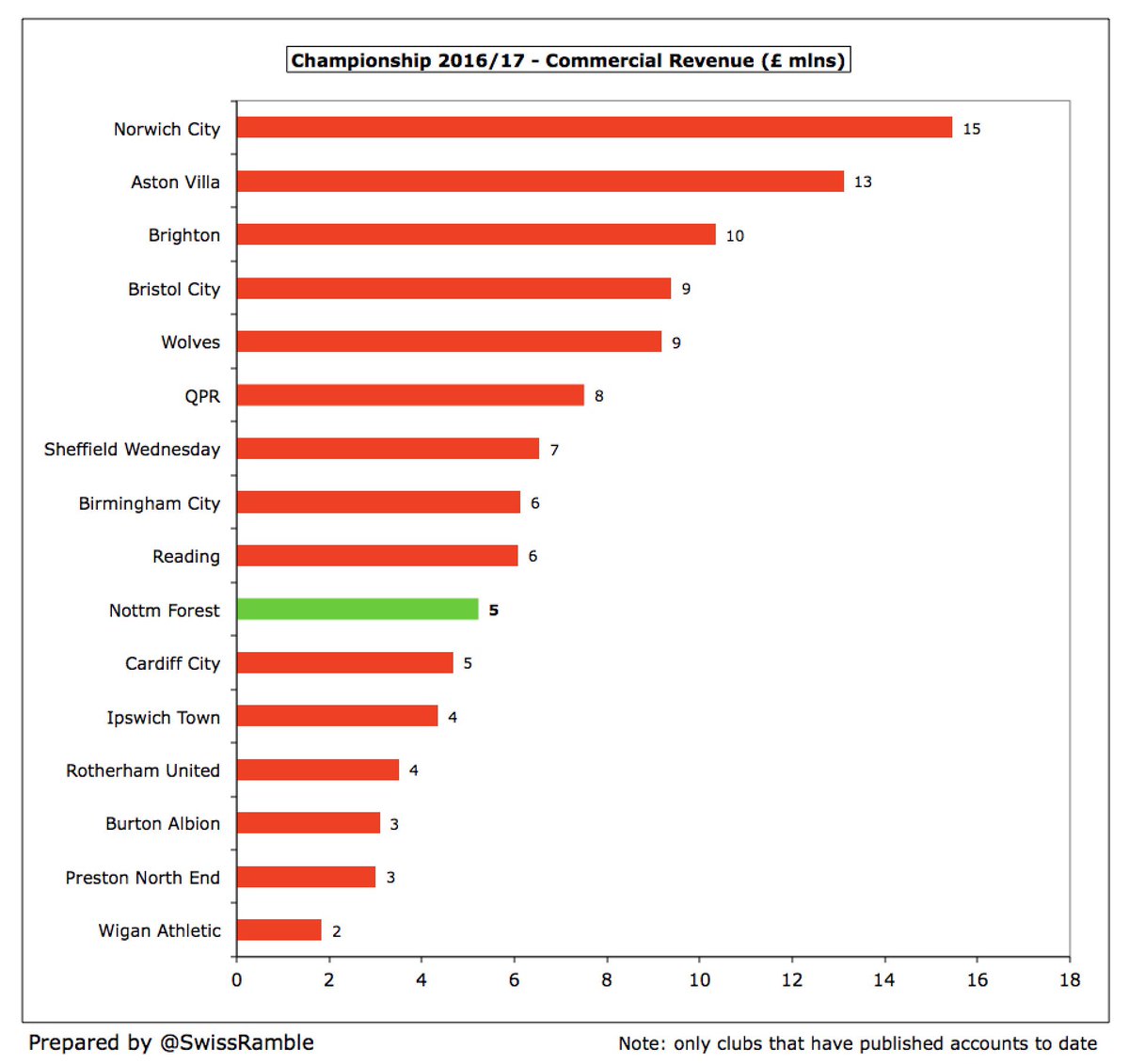

#NFFC commercial income rose 6% (£0.3m) from £4.9m to £5.2m, but this would have reduced without bringing catering back in-house in 2016/17. Shirt sponsor is 888Sport, while Macron will replace the Adidas kit deal from 18/19 with “biggest sponsorship agreement in our history”.

Few Championship clubs earn big money commercially, but it is still disappointing that a club with #NFFC’s great tradition (two European Cups) only earns £5m from this revenue stream, which is at the lower end of the division.

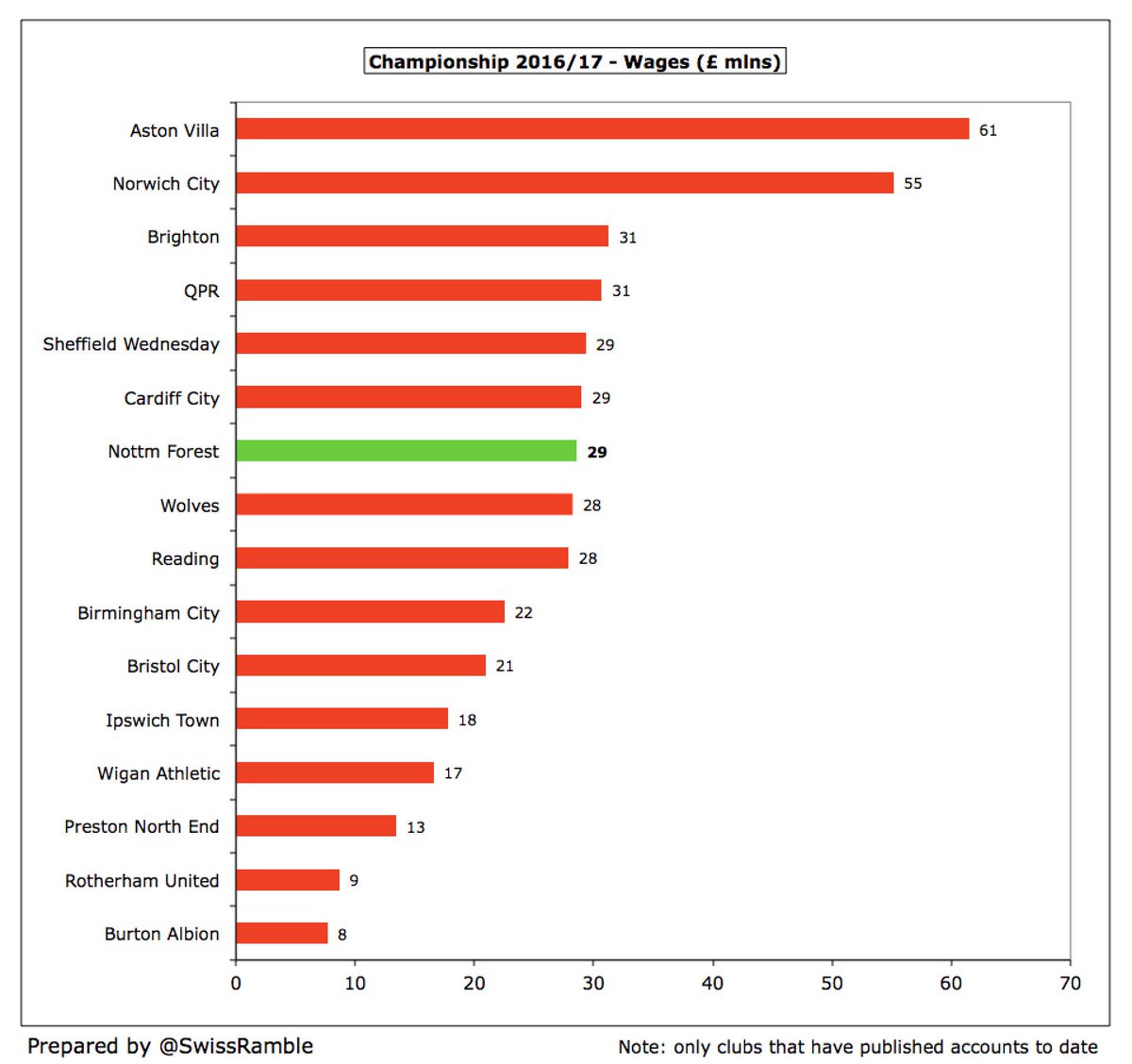

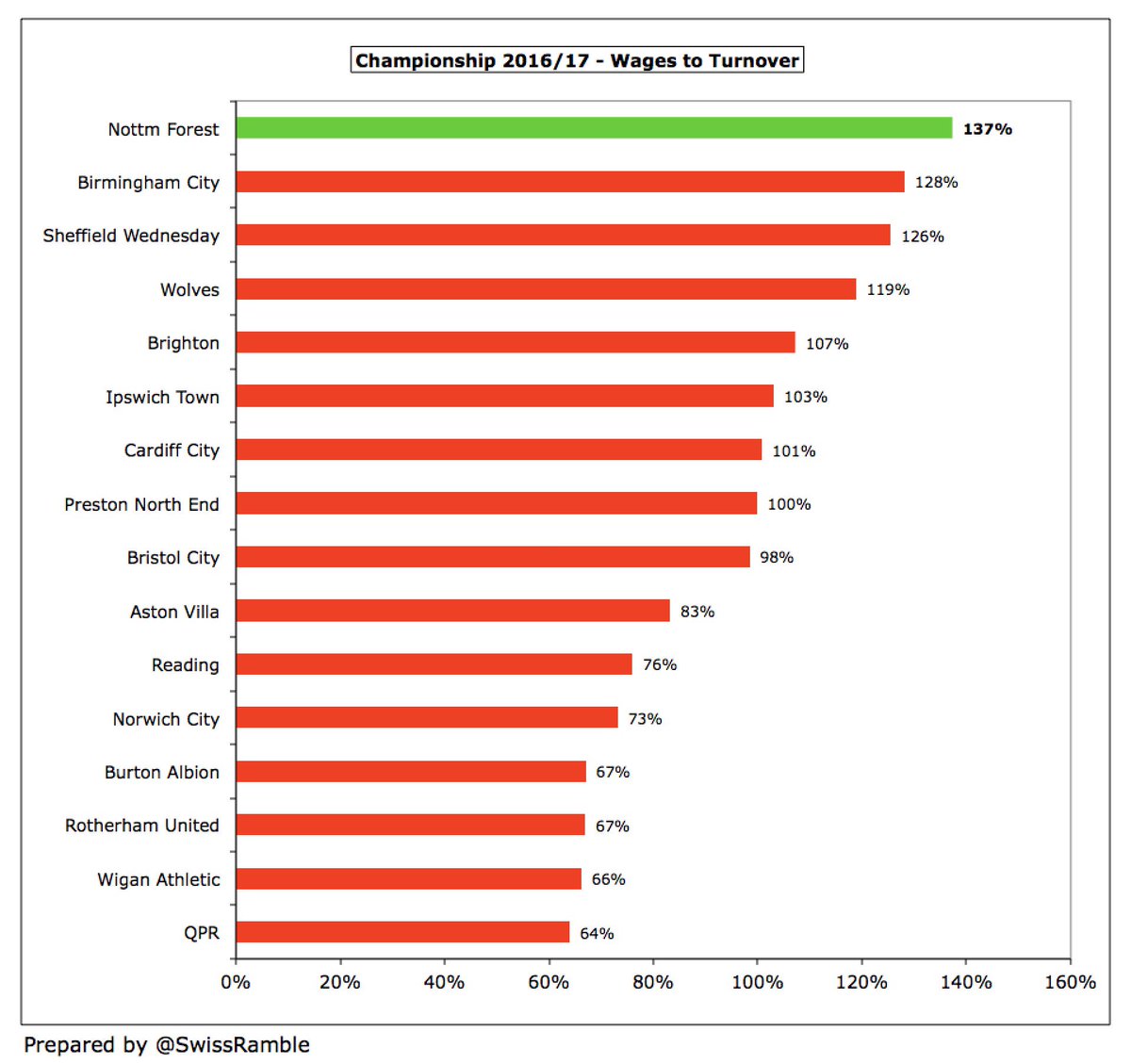

#NFFC wage bill was cut by 7% (£2m) from £30.6m to £28.6m with number of staff falling from 222 to 197 (mainly in non-playing). Allied with the revenue growth, this has reduced the wages to turnover ratio from 166% to 137%.

Nevertheless the £29m wage bill is still nowhere near the level of some Championship clubs, especially those boosted by parachute payments, e.g. Villa £61m, Norwich £55m. However, for some more context, it was more than Wolves £28m.

Although high wages to turnover ratios are not uncommon in the Championship (8 out of 17 clubs that have reported to date are more than 100%), #NFFC have the highest (worst) at 137%, even above Birmingham City 128%.

After a transfer embargo affecting three windows, #NFFC player amortisation has fallen from £6.4m in 2014/15 to just £2.0m in 2016/17, as player purchases pretty much dried up.

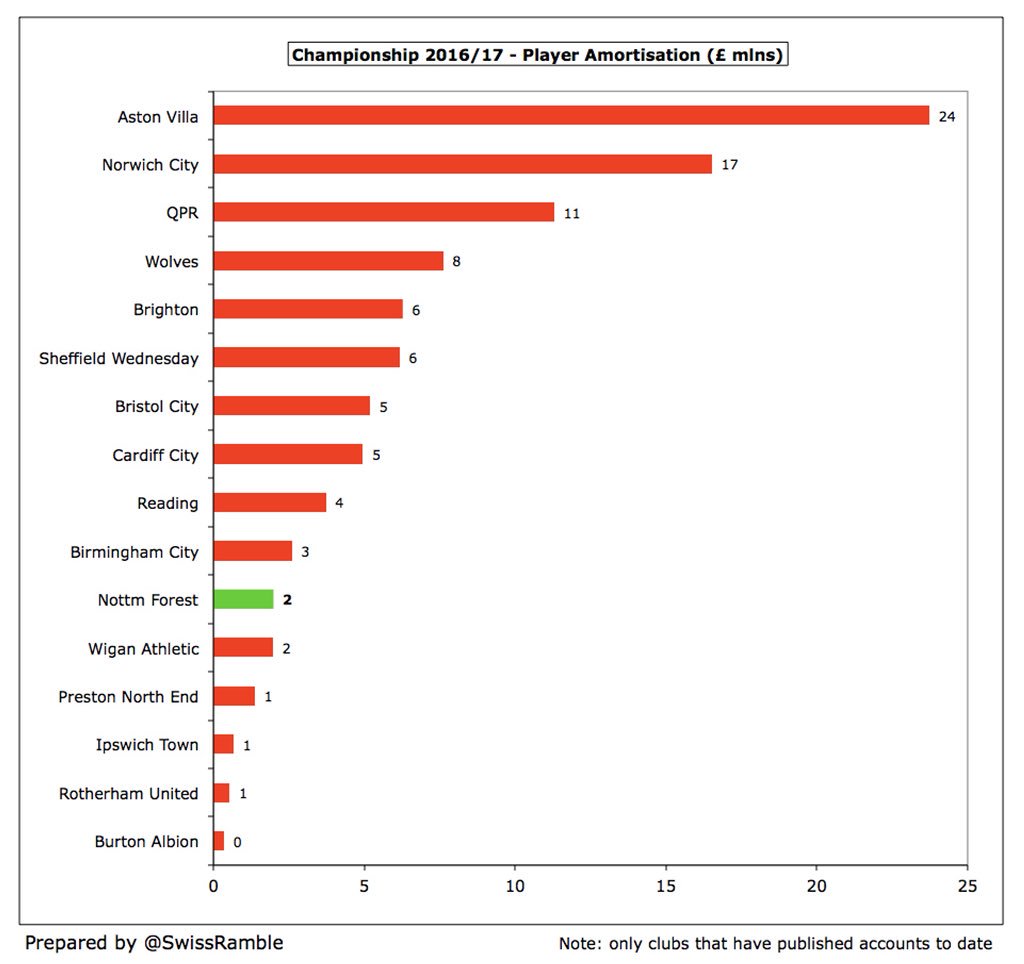

After the big decrease, #NFFC player amortisation of £2m is unsurprisingly one of the lowest in the Championship, only above Wigan Athletic, Preston North End, Ipswich Town , Rotherham United and Burton Albion.

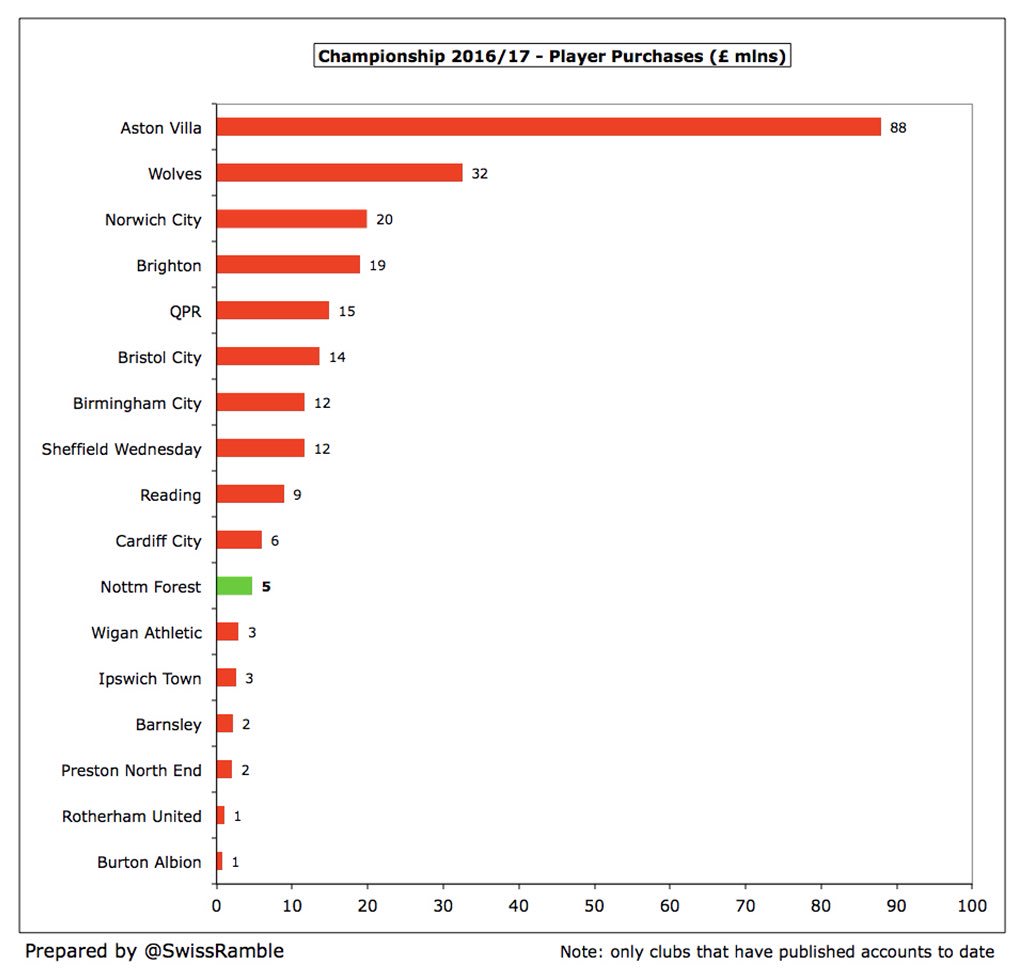

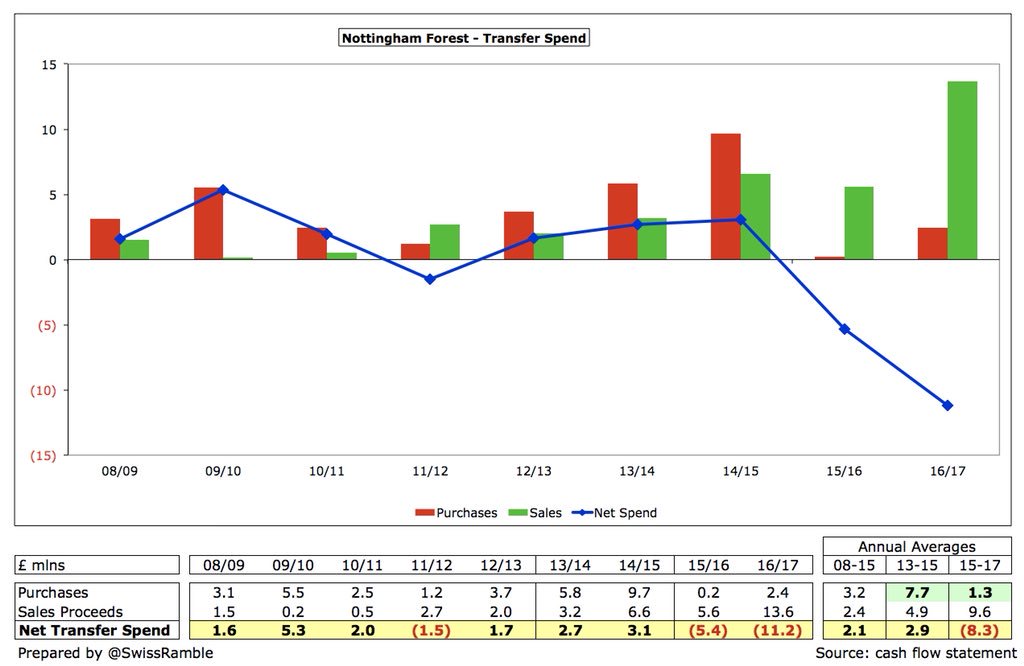

#NFFC only spent £5m on players in 16/17 (Zach Clough, Apostolos Vellios & Lica), following zero in 15/16 (due to transfer embargo from FFP breach). In contrast, outlay in preceding 2 seasons amounted to £18m. Outspent by many clubs, including Villa’s amazing £88m & Wolves £32m.

On a cash basis #NFFC gross spend on players has obviously diminished in the last two years, as they were hit by the FFP transfer embargo for 3 windows (annual average £1.3m). The club had been ramping up its spend in the preceding two years (average £7.7m).

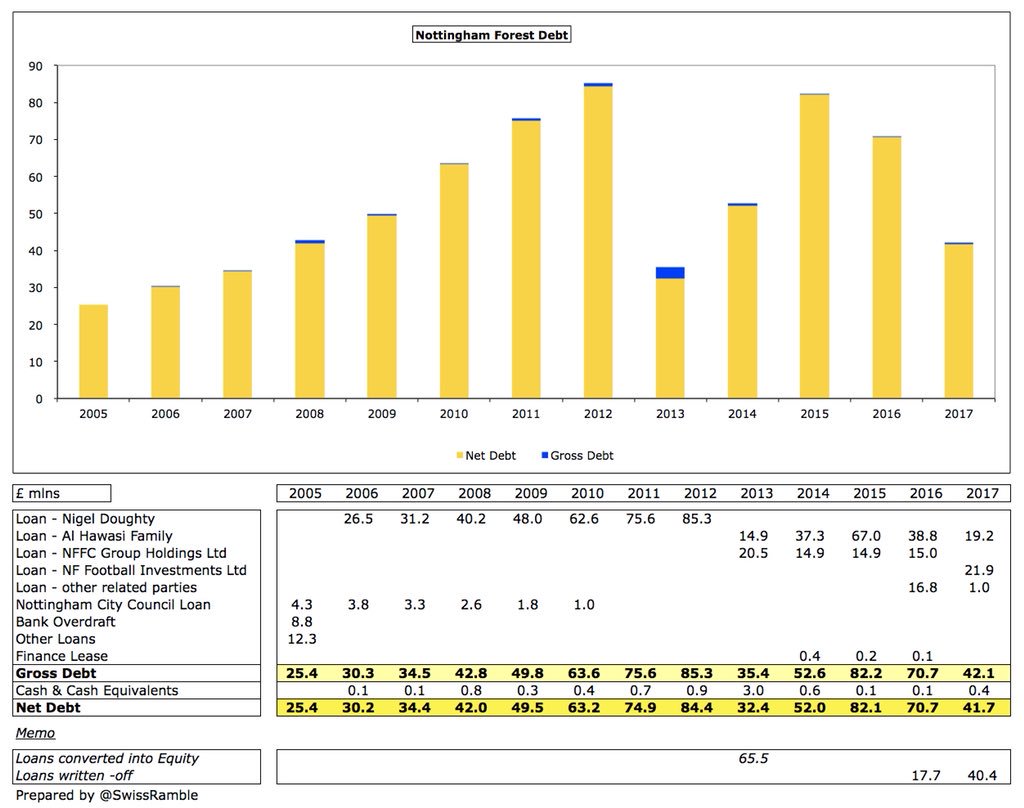

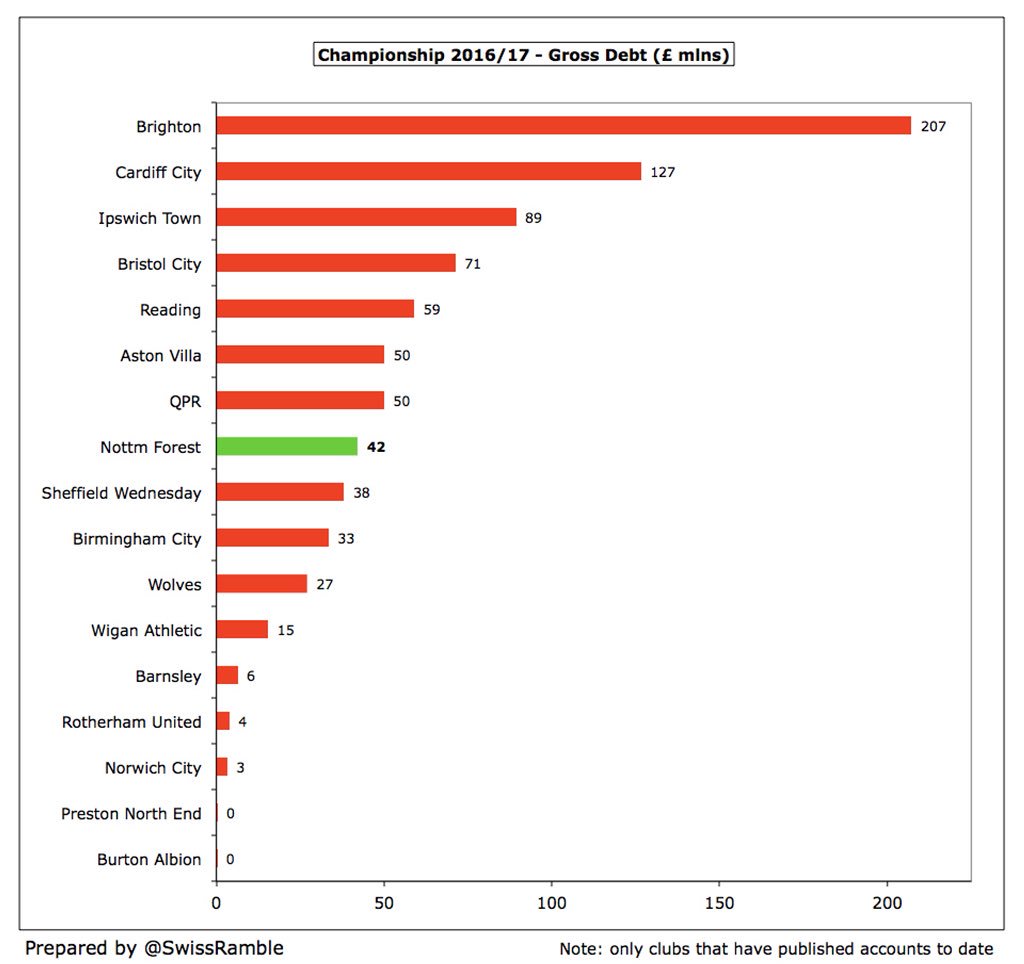

#NFFC gross debt fell £29m from £71m to £42m, comprising £22m from the new Greek owners, £19m to former owner Al Hasawi and £1m to other related parties. Debt would have been considerably higher without capitalising £66m of old Nigel Doughty debt and writing-off £58m of loans.

#NFFC debt of £42m is by no means the largest in the Championship, e.g. Brighton £207m (new stadium and training ground), Cardiff £127m and Ipswich £89m are all much higher. In reality, the debt is not an issue – so long as the club’s owners continue to provide support.

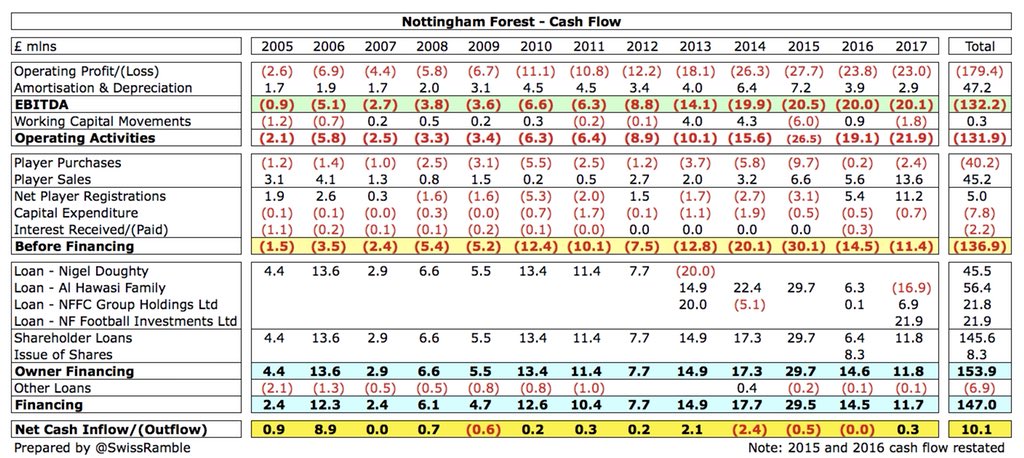

#NFFC maintained their cash balance in 16/17, but only because new owners provided a £22m loan with £11m generated by net player sales. Operational loss was £22m, while £18m repaid some of Al Hasawi’s loan and £1m went on capex. The other £7m came from inter-group loan movements.

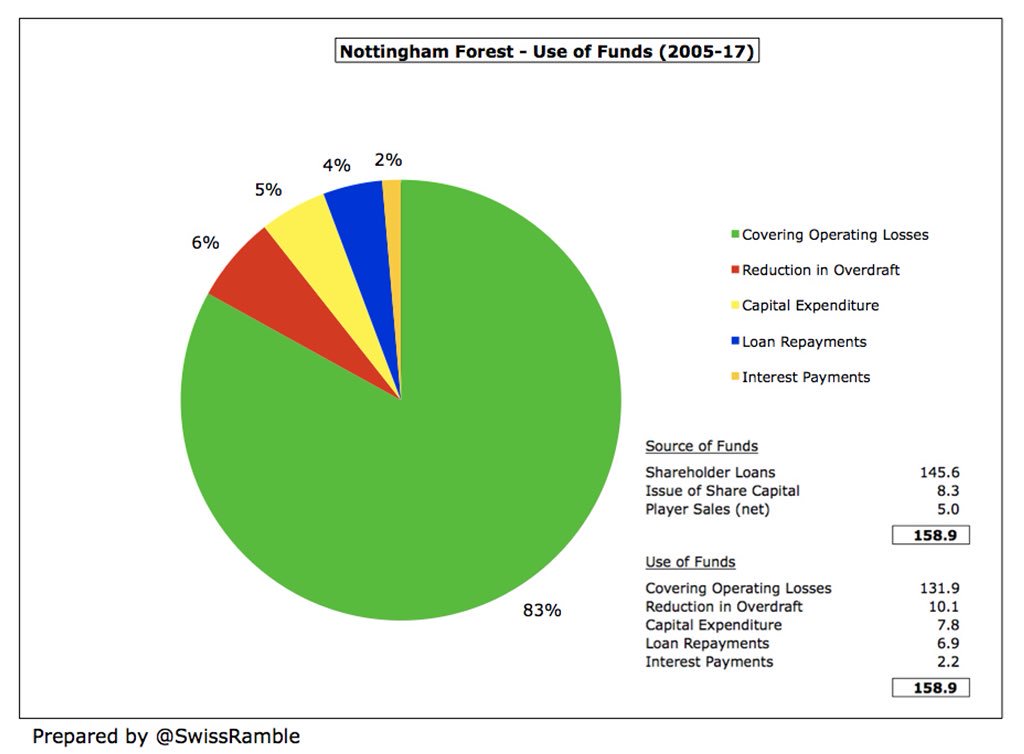

This is nothing new, as all owners since 2005 have had to pump money into the club. In that period #NFFC had £159m of available cash (loans £146m, share capital £8m, player sales £5m), but the vast majority £132m (83%) has been used to cover operating losses.

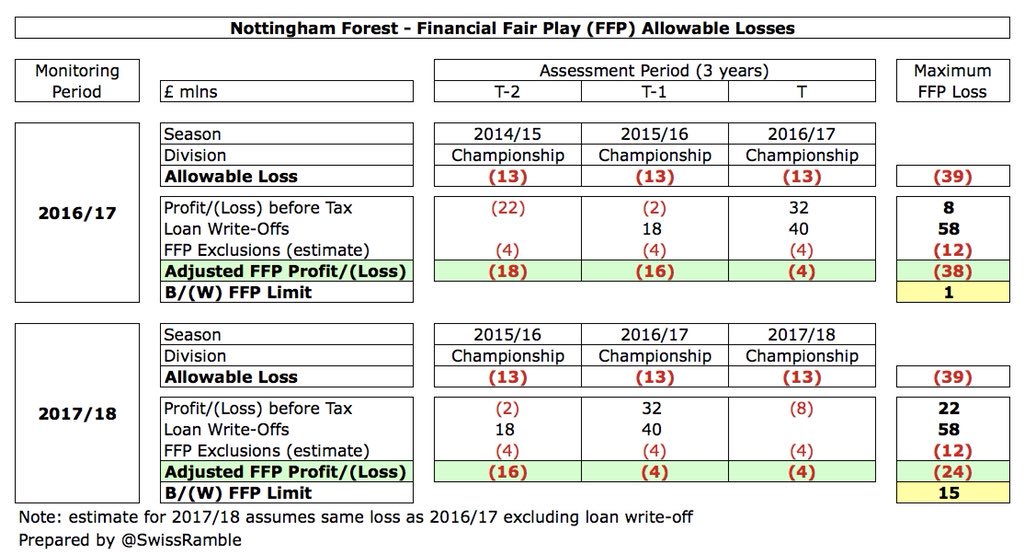

In theory, the improvements in profitability should remove any immediate FFP problems, though it is likely the EFL would deduct the loan write-offs. On the other hand, FFP losses can exclude academy, community & infrastructure (which I estimate at £4m a year).

FFP is assessed over a three-year period (current season plus previous two seasons), so #NFFC have to absorb large £22m loss in 2014/15. However, my calculations indicate they would be fine, assuming the 2017/18 loss is the same as the 2016/17 underlying loss.

#NFFC have been no strangers at the courts (usually over unpaid bills) and it was announced only yesterday that Al Hasawi is suing them for £4.2m unpaid money. This is a counter-claim after the club had sued the former owner in December for money they claim he owes them.

#NFFC fans have suffered recently with the league position worse each year after Al Hasawi arrived (2013 8th, 2014 11th, 2015 14th, 2016 16th, 2017 21st) and numerous financial issues, but the report states, “The takeover has led to increased optimism for the future of the club.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh