1/ It's time to deconstruct this article @cleantechnica republished on #Tesla Energy. I enjoy the site and there is some good reporting there, but I respectfully submit that this article is so materially misleading that it ought to be retracted. $TSLA

cleantechnica.com/2018/03/25/eva…

cleantechnica.com/2018/03/25/eva…

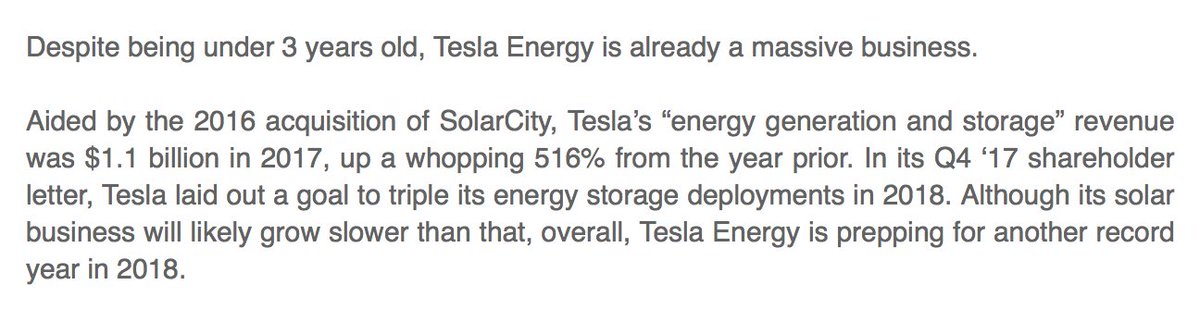

2/ Let's start with this claim. Did you know that Tesla Energy grew by a 'whopping 516%' in 2017? Me neither. Because it didn't. $TSLA

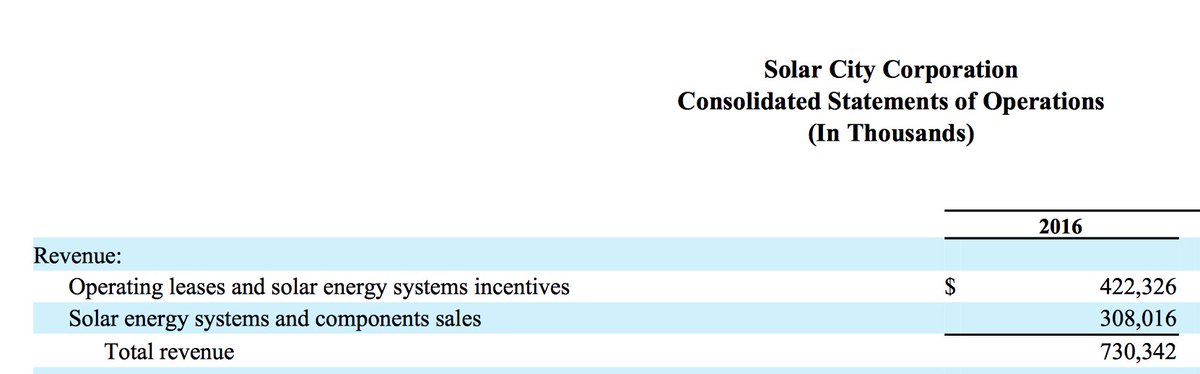

3/ Tesla Energy consists of SolarCity and their battery business. It did $1.116B in combined revenue in 2017. How did these same businesses do in 2016? Go to the last SolarCity 10K. In 2016 SolarCity did $730.3MM in revenue. $TSLA

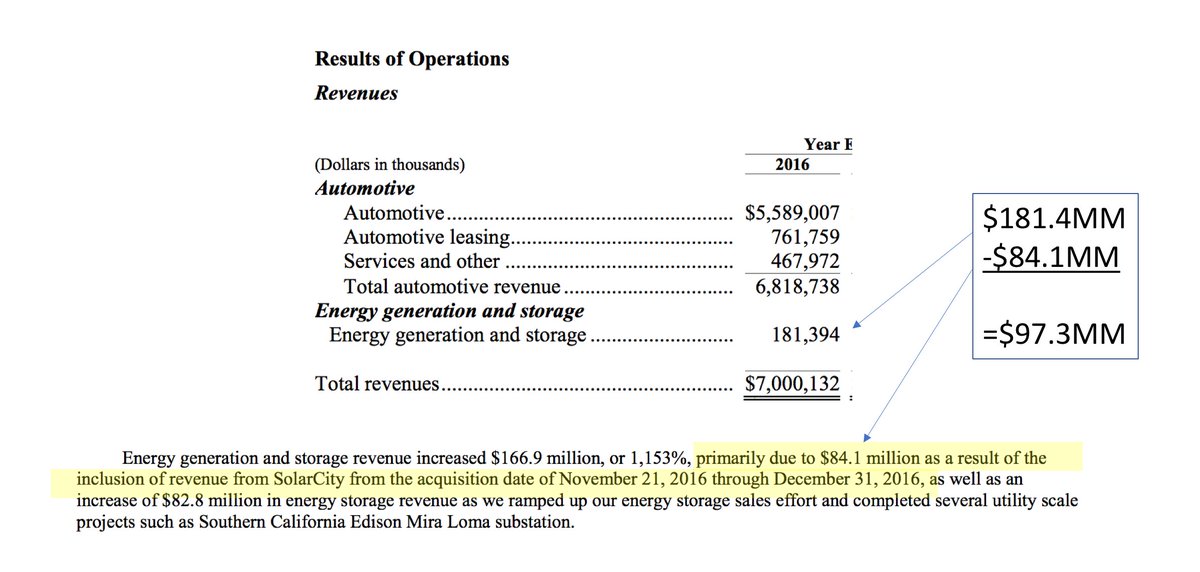

4/ It takes some math, but you can calculate how Tesla's battery business did in 2016 from the 10K Tesla published for that year. It did $97.3MM in revenue. $TSLA

5/ Therefore, in 2016, 'Tesla Energy' had revenues of $730.3MM + $97.3MM = $827.6MM. In 2017 it grew that business to $1.116B. That's 35% growth. 35% is impressive. But it is not 'a whopping 516%'. It's not even close. And extremely misleading. $TSLA

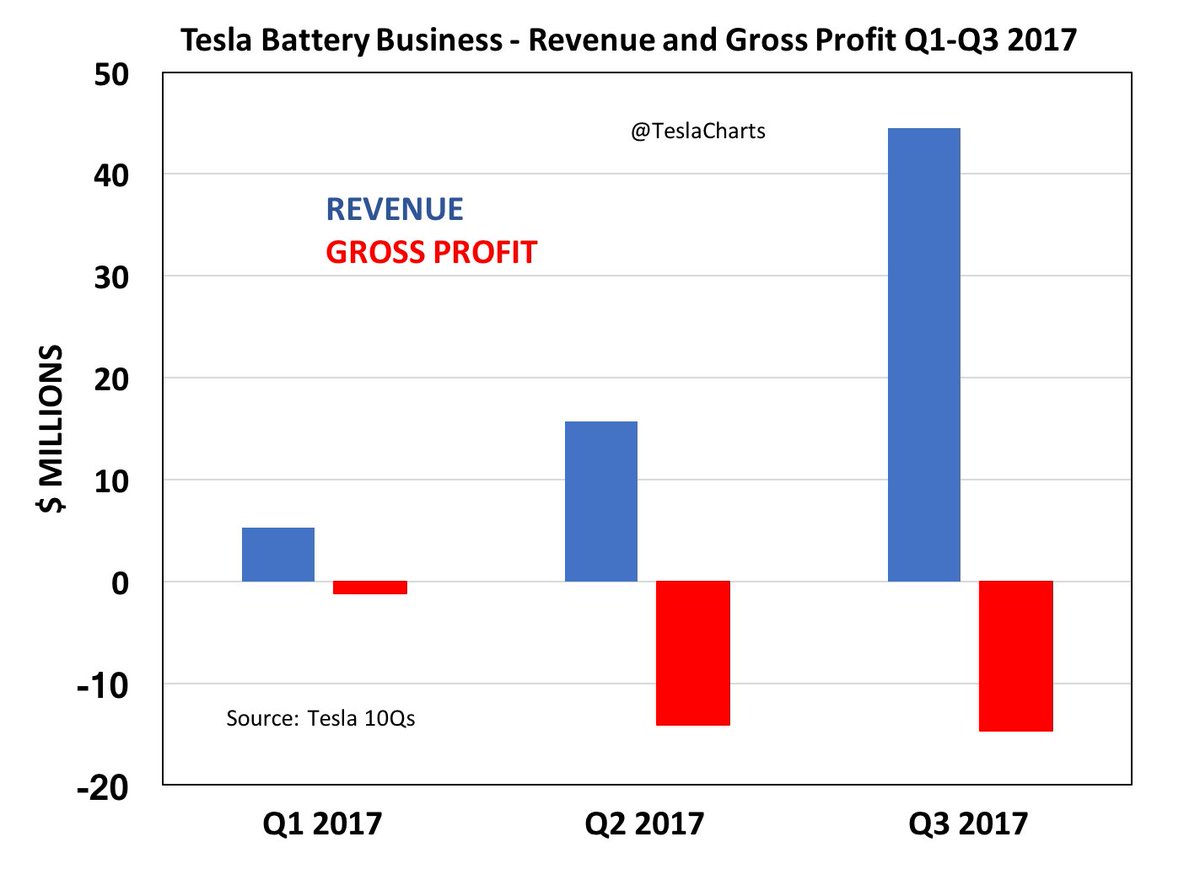

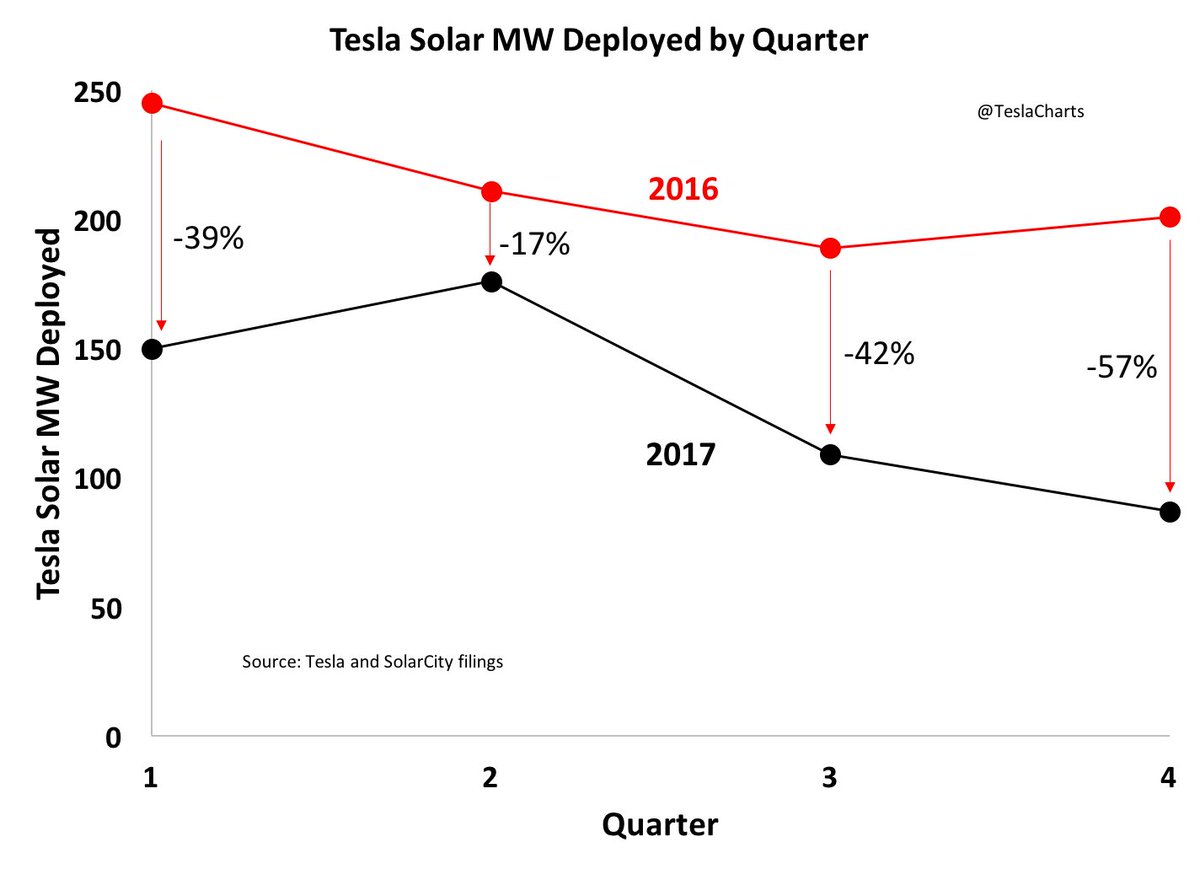

6/ As of Q4 2017, Tesla no longer breaks out the solar and battery businesses separately. But up until Q3 it did, and the results weren't pretty on the battery side. Negative gross profit (imagine on a net basis!) $TSLA

7/ Not to mention that solar installations collapsed in 2017 versus previous year $TSLA

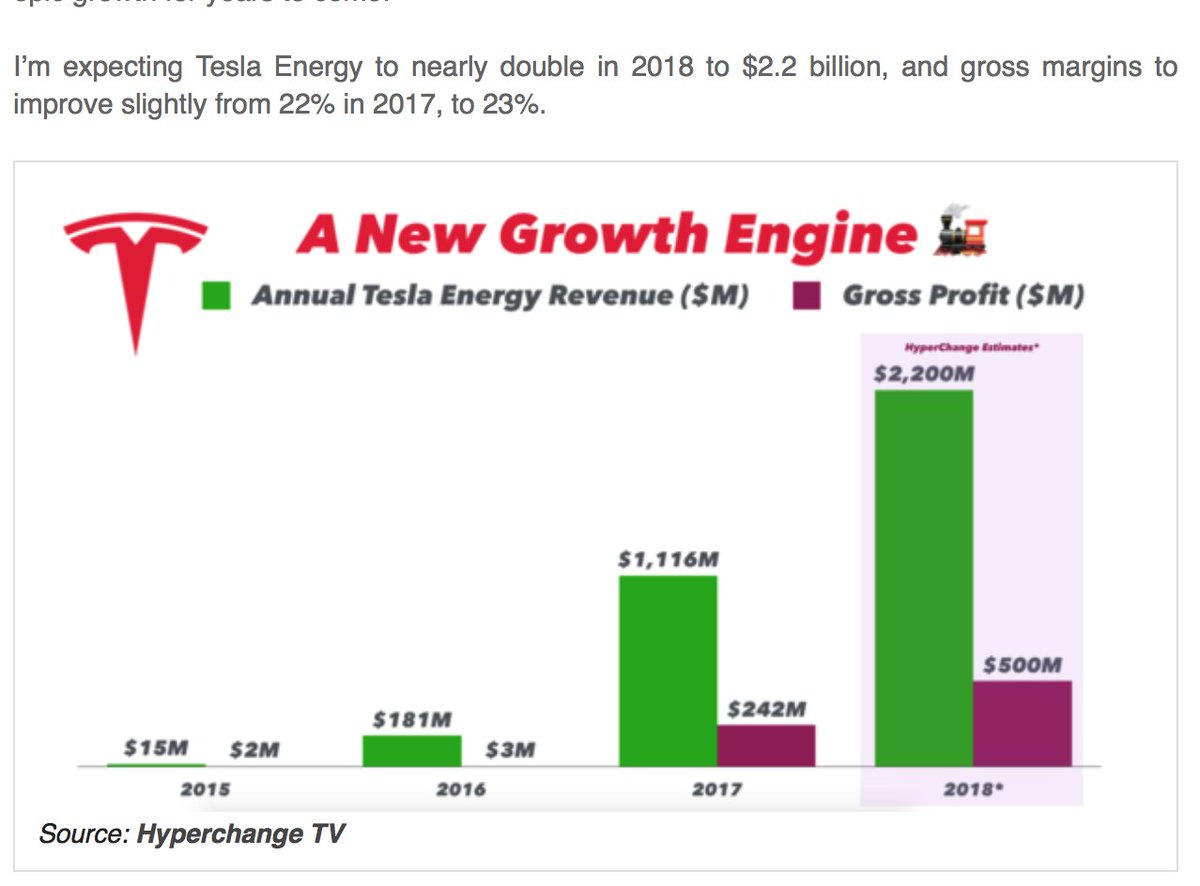

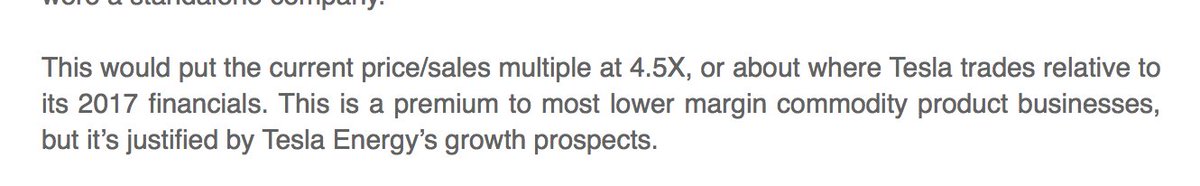

8/ So what is $TSLA Energy worth? The author assumes they will double the business in 2018, assigns a 4.5X revenue multiple to the FORWARD number, and come up with 'over $10B and growing'. The author is implying that Tesla Energy is worth about $60 a share on it's own.

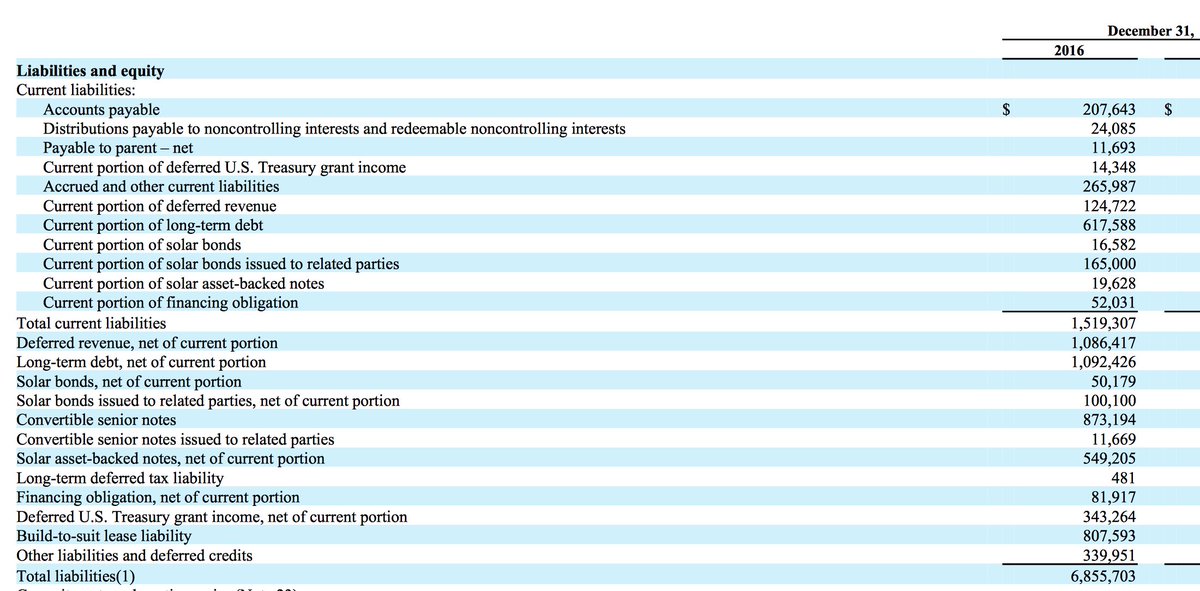

9/ SolarCity brought a mountain of debt to $TSLA. Here again from the last 10K they filed, for the year 2016. I challenge you to figure out the accounting, but it is several billion dollars of debt.

10/ Even in this environment, I doubt the equity value of a negative gross margin battery business + a solar business with a combined trailing 12 month revenue of $1.1B is anywhere near $10B, net of debt. $TSLA

11/ To the folks at @cleantechnica - republishing articles like this do more damage to the movement you support (green energy) than good. They provide fodder to people who claim this is all hype. Please consider retracting it from your site.

• • •

Missing some Tweet in this thread? You can try to

force a refresh