Queens Park Rangers recently published financial results for the 2016/17 season, when they finished 18th in the Championship, with Ian Holloway returning for a second spell as manager after replacing Jimmy Floyd Hasselbaink. Some thoughts in the following thread #QPR

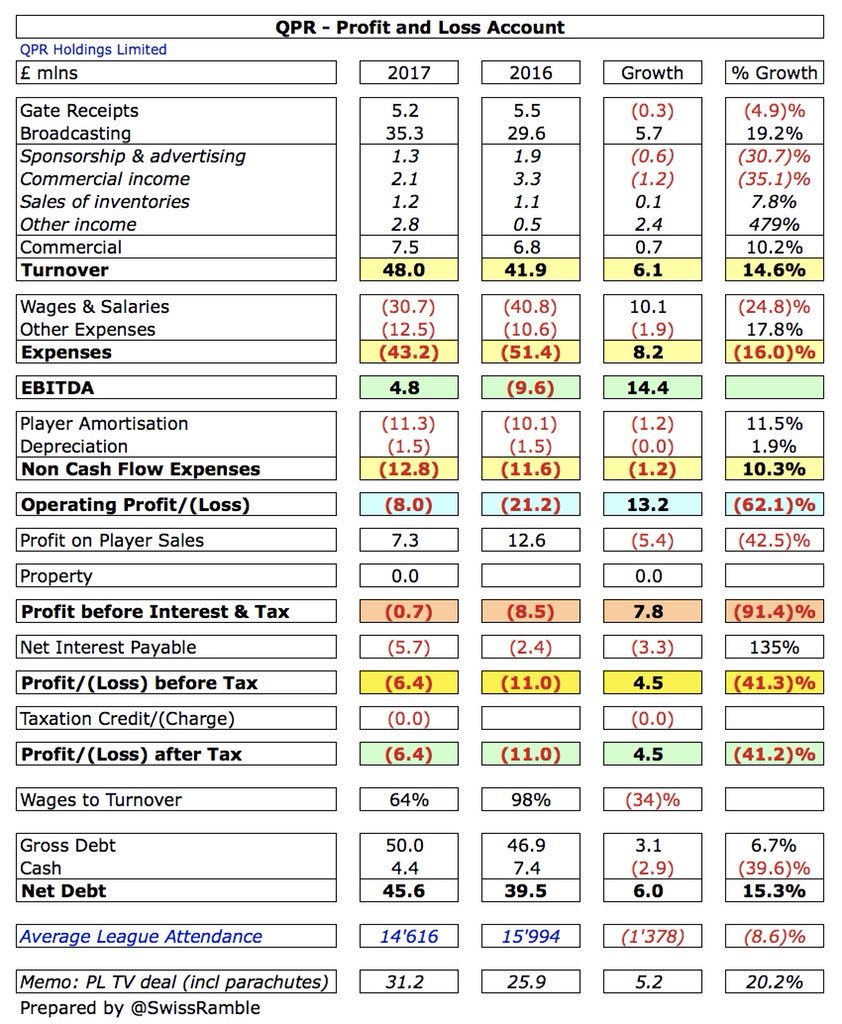

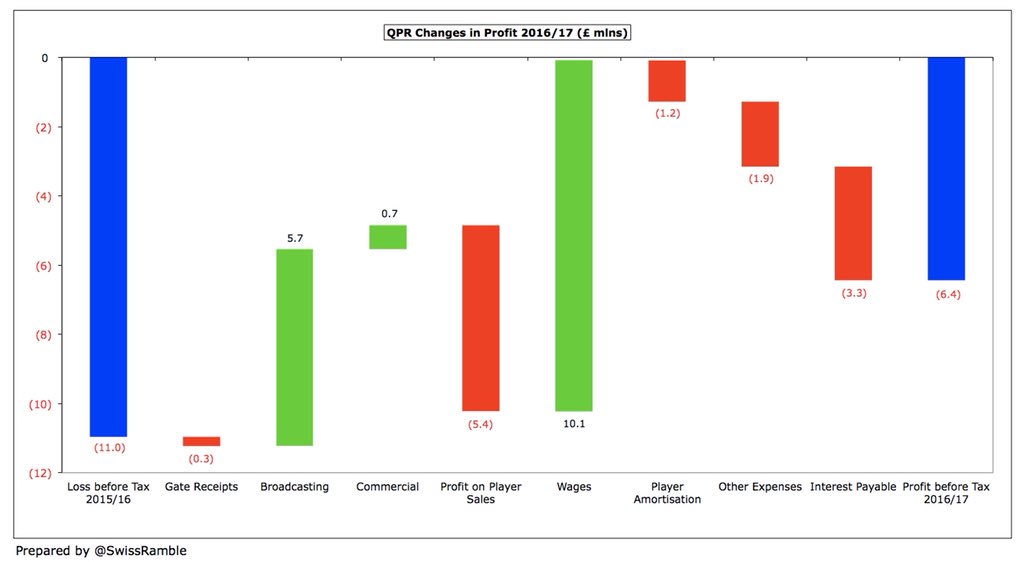

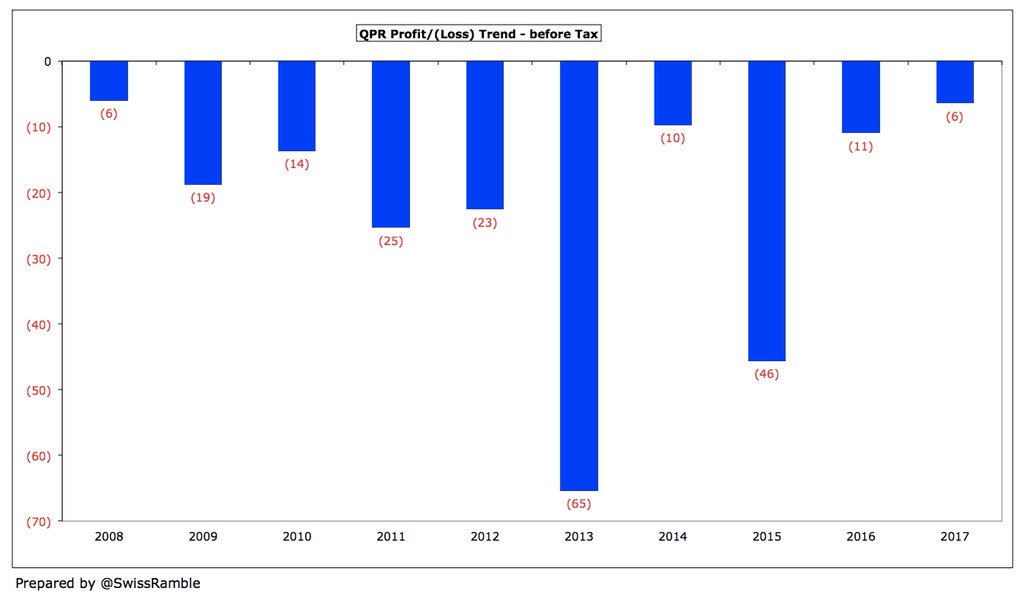

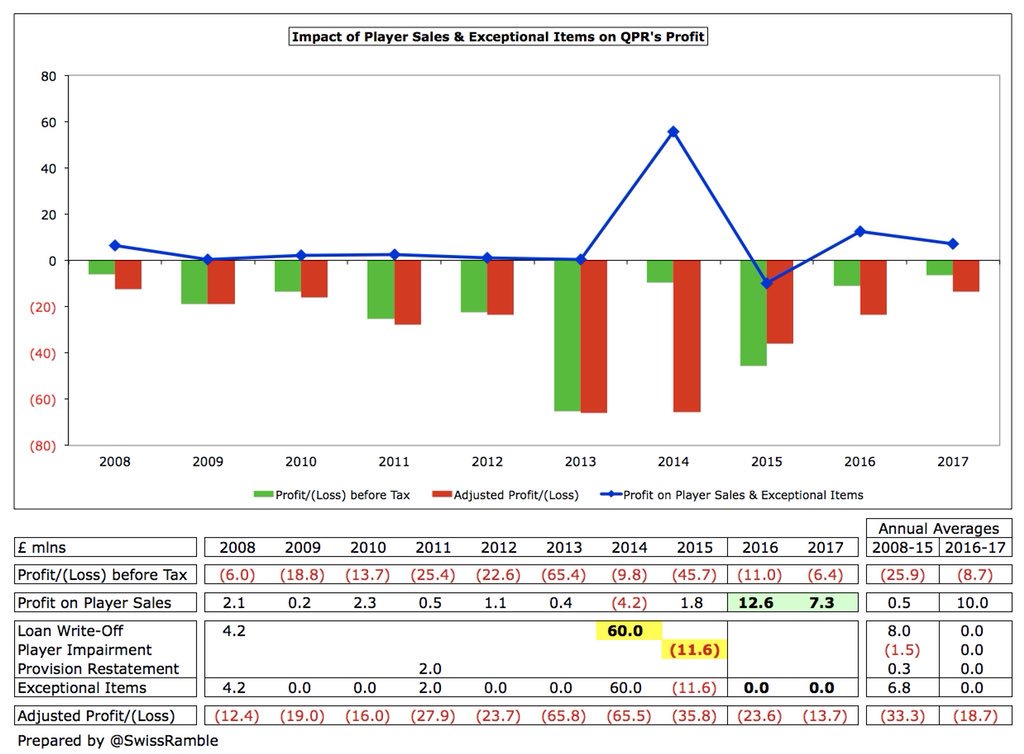

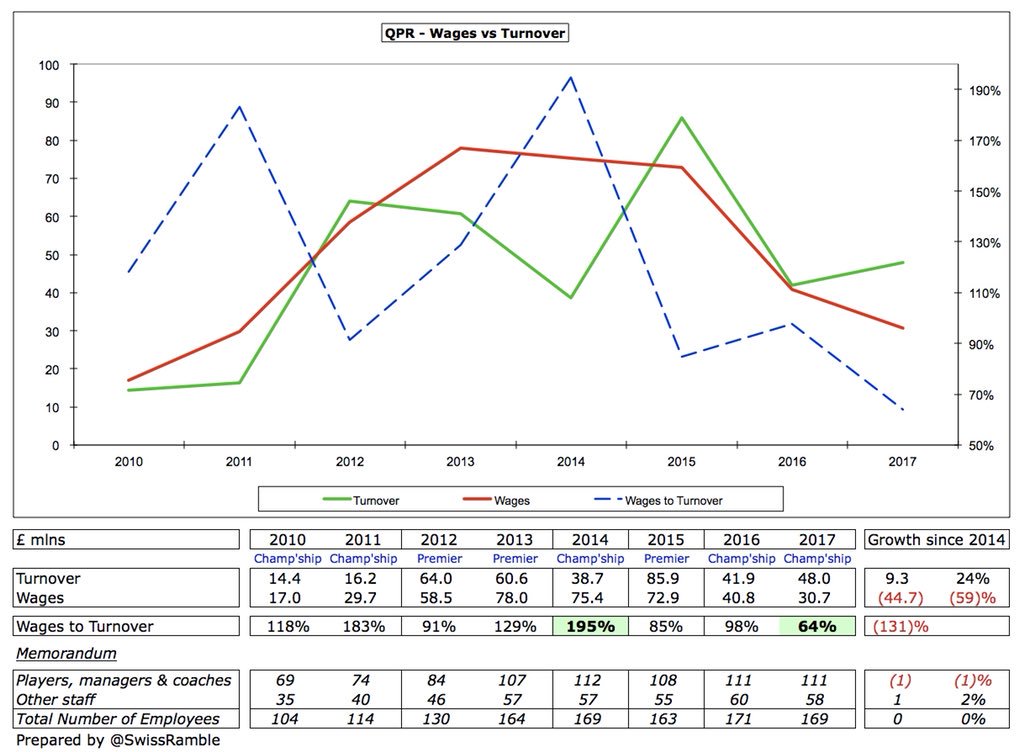

#QPR reduced their loss by £4.6m from £11.0m to £6.4m, their lowest deficit since 2008, as revenue rose £6.1m (15%) to £48.0m and the wage bill was cut by £10.1m (25%) to £30.7m. However, profit on player sales was down £5.4m to £7.3m and interest payable was up £3.3m to £5.7m.

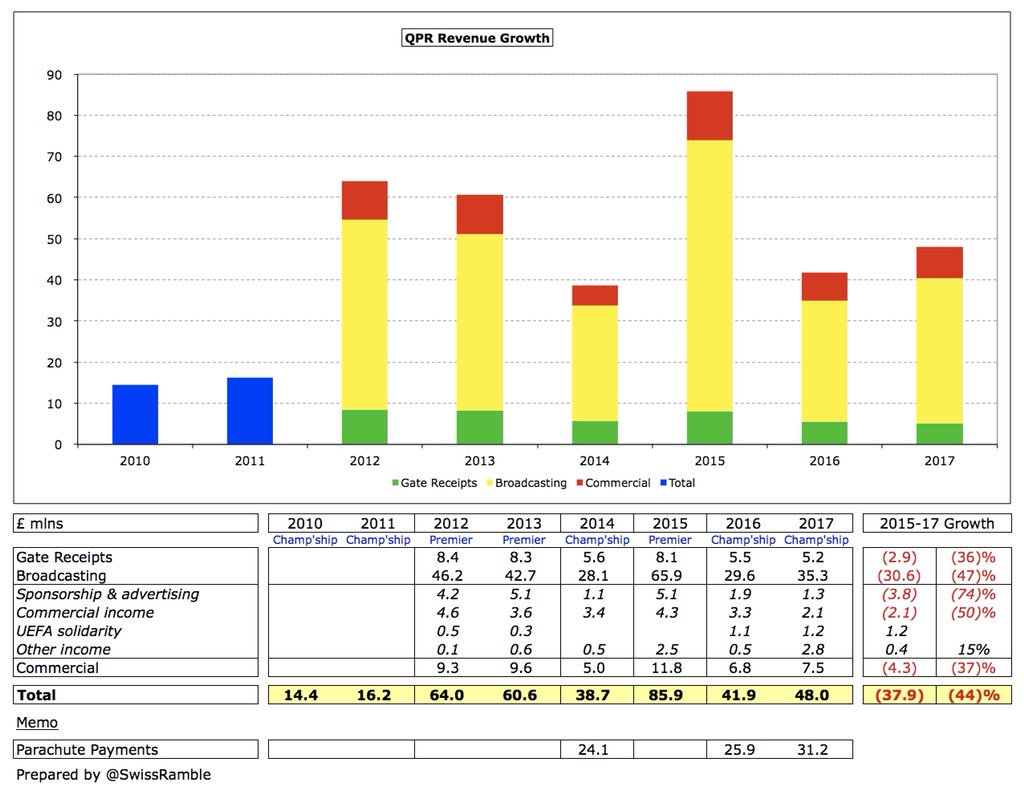

The main reason for the #QPR £6.1m revenue growth was the new Premier League TV deal, which resulted in a higher parachute payment, thus increasing broadcasting income by £5.7m. Commercial income rose £0.7m, but gate receipts were £0.3m lower.

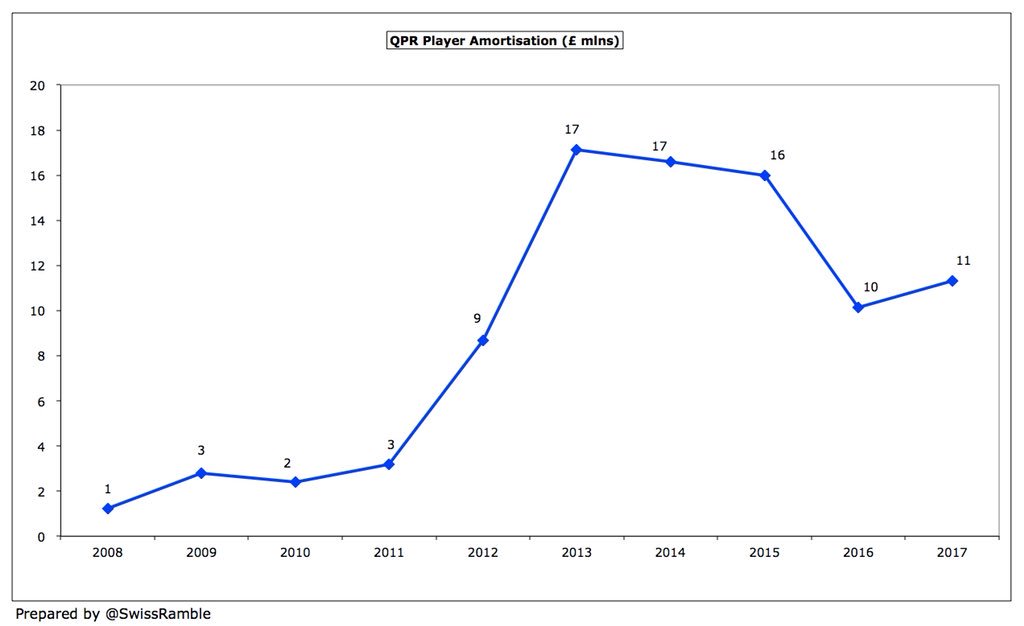

Although #QPR cut the wage bill by £10.1m, they saw cost increases elsewhere with player amortisation rising £1.2m (11%) to £11.3m and other expenses up £1.9m (18%) to £12.5m. The £3.3m interest payable increase to £5.7m is a bit misleading, as hardly anything was actually paid.

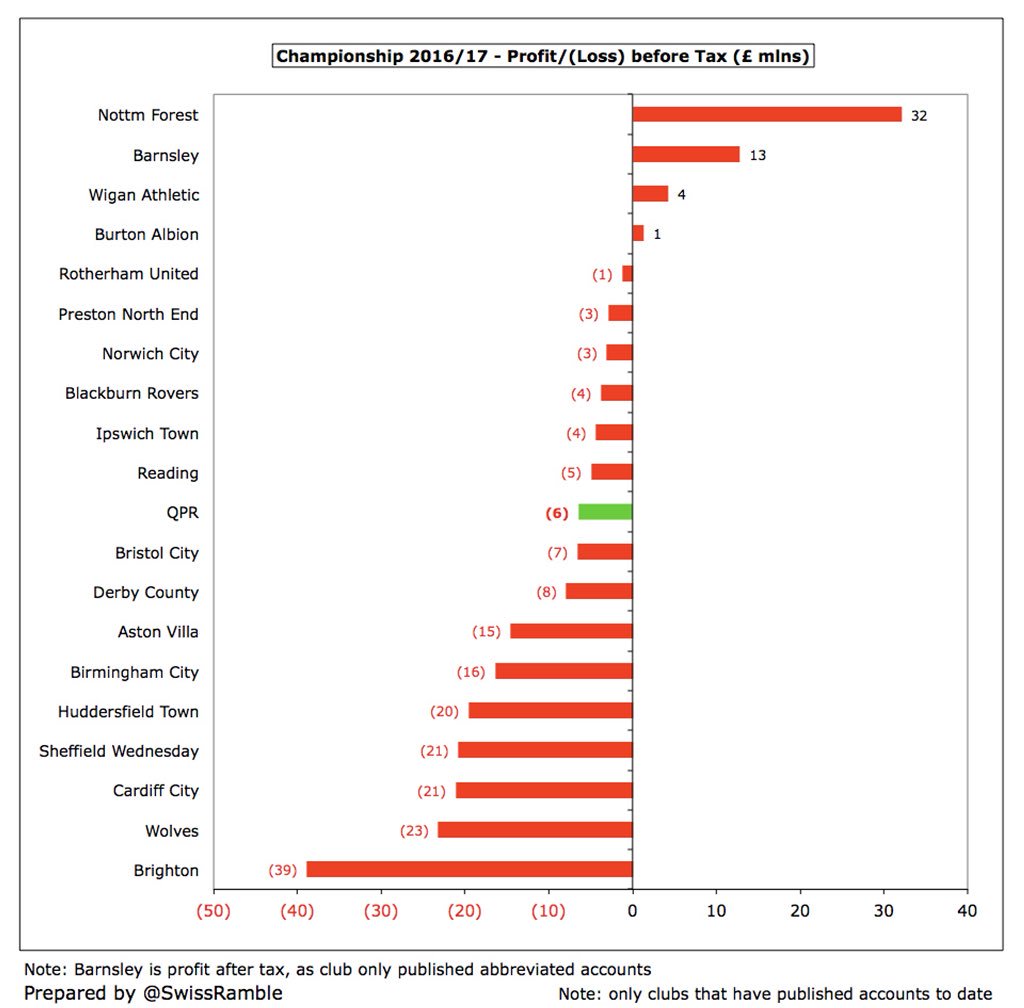

#QPR £6m loss is around mid-table in the Championship in 2016/17. In general, almost all clubs in this division lose money as they often gamble on promotion. Exceptions are normally due to once-off items (high player sales, loan write-offs, etc).

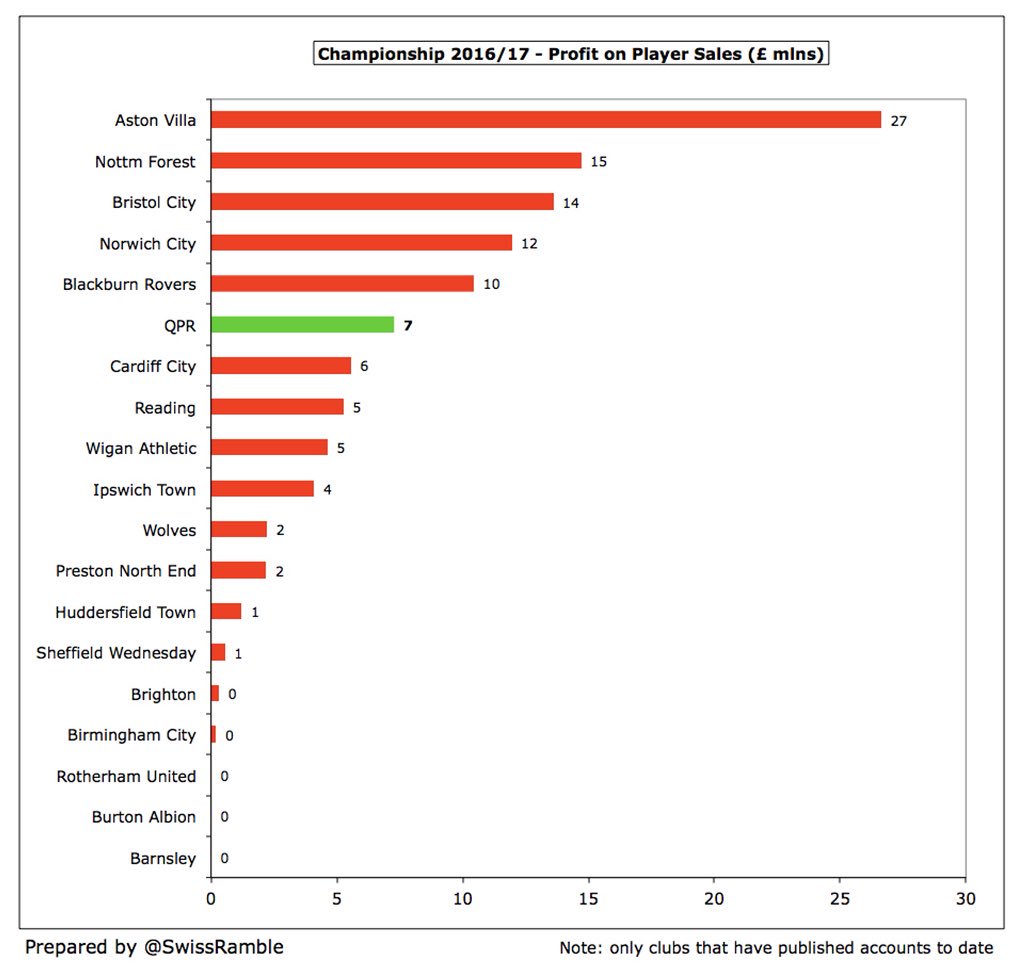

Few Championship clubs earn big money from player trading, so #QPR £7m profit on player sales is actually 6th highest in 16/17, even though £5m less than £13m in 15/16. Mainly due to sales of Matt Phillips to WBA & Leroy Fer to Swansea City.

#QPR have clearly changed their strategy to operate sustainably, rather than spending big. The club is still making losses, but much smaller than before. That said, total losses since Tony Fernandes took over in August 2011 are £161m (£221m if 2014 £60m loan write-off excluded).

In the past #QPR made very little money from player sales. Indeed, many players were released for nothing, e.g. Barton, Dunne, Ferdinand, Zamora, Wright-Philips. However, that has changed in last 2 seasons with club averaging £10m profit, including Austin and McCarthy in 2015/16.

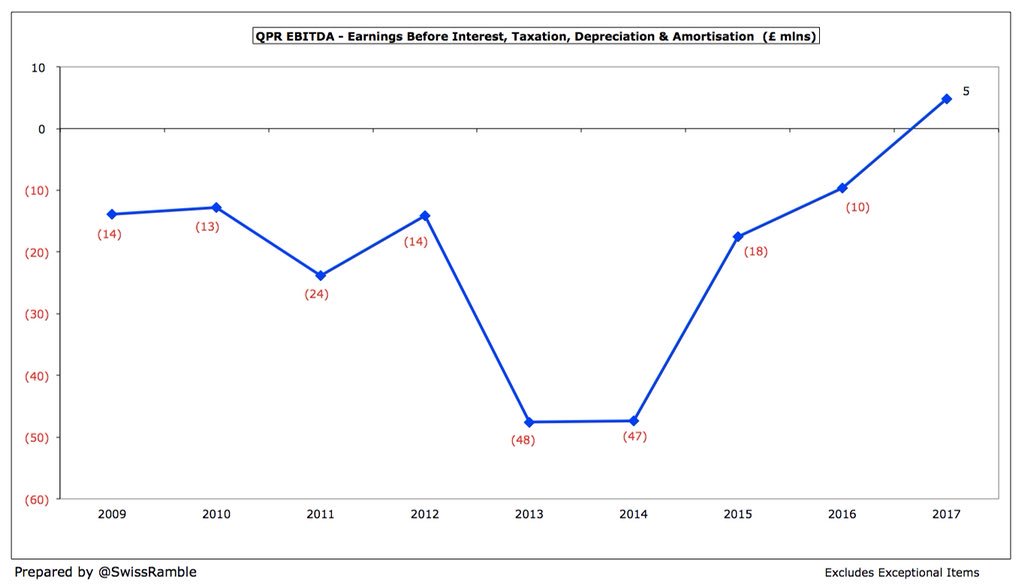

#QPR new sustainable approach is highlighted by their EBITDA (Earnings Before Interest, Depreciation and Amortisation), which strips out profits from player sales and non-cash items. This was a horrific negative £47m in 2013 and 2014, but has steadily improved to £5m in 2016/17.

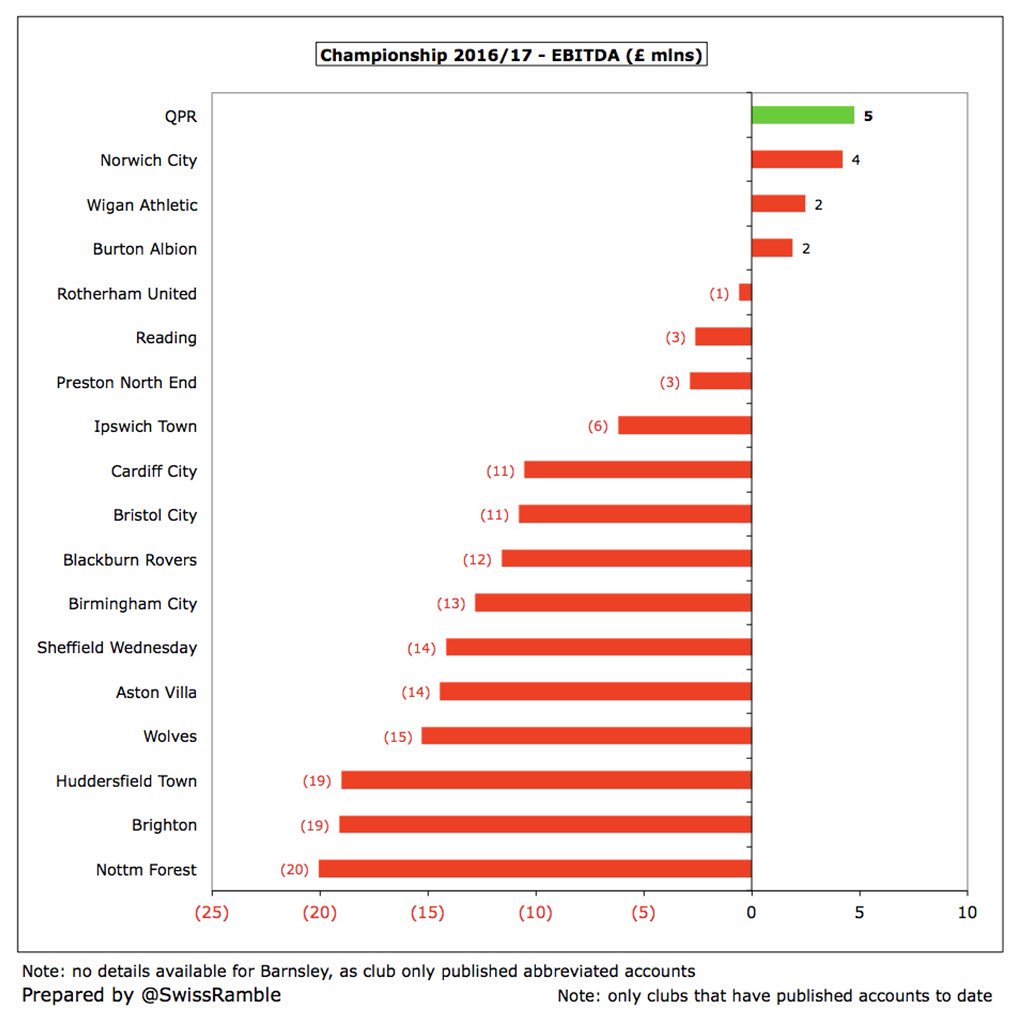

In fact, #QPR are one of just four Championship clubs that managed to generate positive EBITDA in 2016/17, and actually have the highest at £5m, ahead of Norwich City £4m. For some perspective, Nottingham Forest’s EBITDA was minus £20m.

Although #QPR revenue rose £6m (15%) to £48m in 2016/17, this was still £38m lower than the £86m in the last season in the Premier League in 2014/15. Revenue owes a lot to parachute payments (£31m in 16/17), which means that broadcasting accounts for 74% of total.

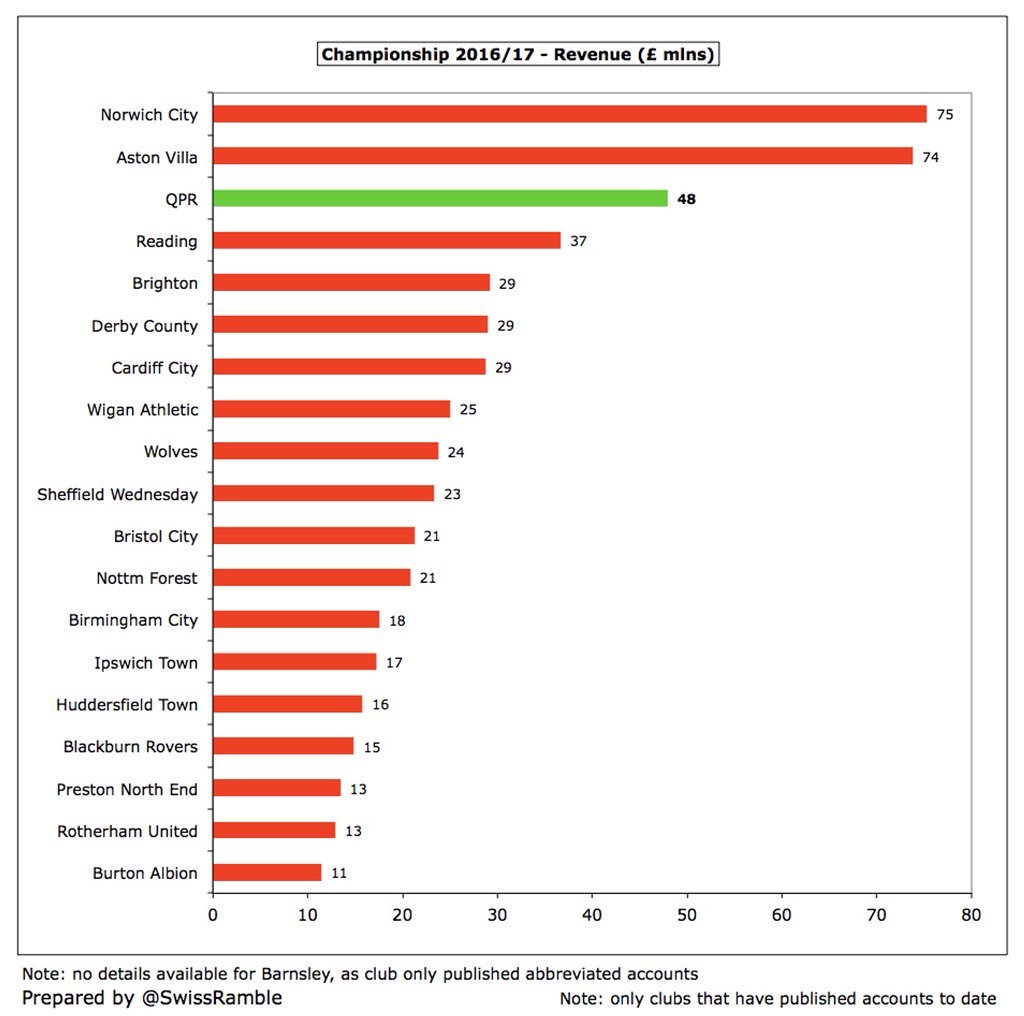

#QPR £48m revenue is the third highest in the Championship in 2016/17, though likely to be overtaken once Newcastle publish their accounts. Still a fair way below Norwich City £75m and Aston Villa £74m. The top club not benefiting from parachute payments was Brighton £29m.

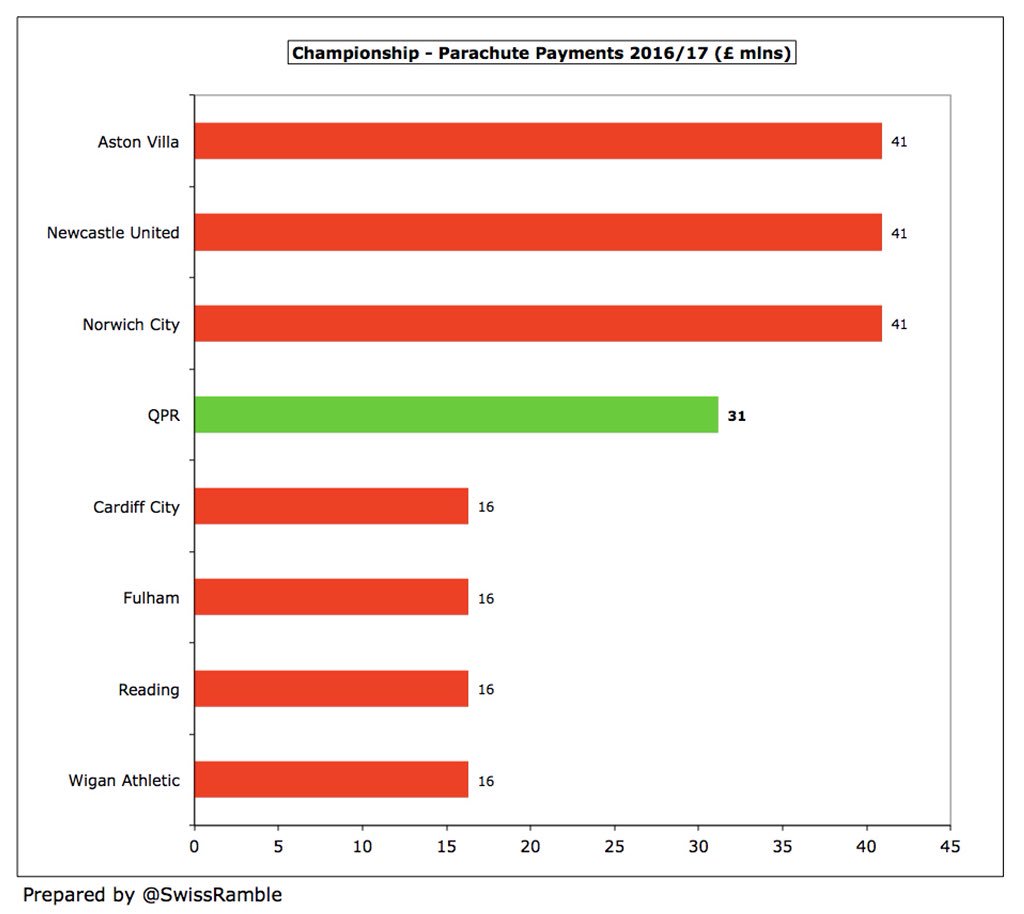

Revenue is greatly influenced by those Premier League parachute payments, e.g. £41m to Villa, Newcastle & Norwich (up from £26m in 15/16 thanks to new PL TV deal). The £31m paid to #QPR gives them an advantage, though they will only have this (lower amounts) for next 2 seasons.

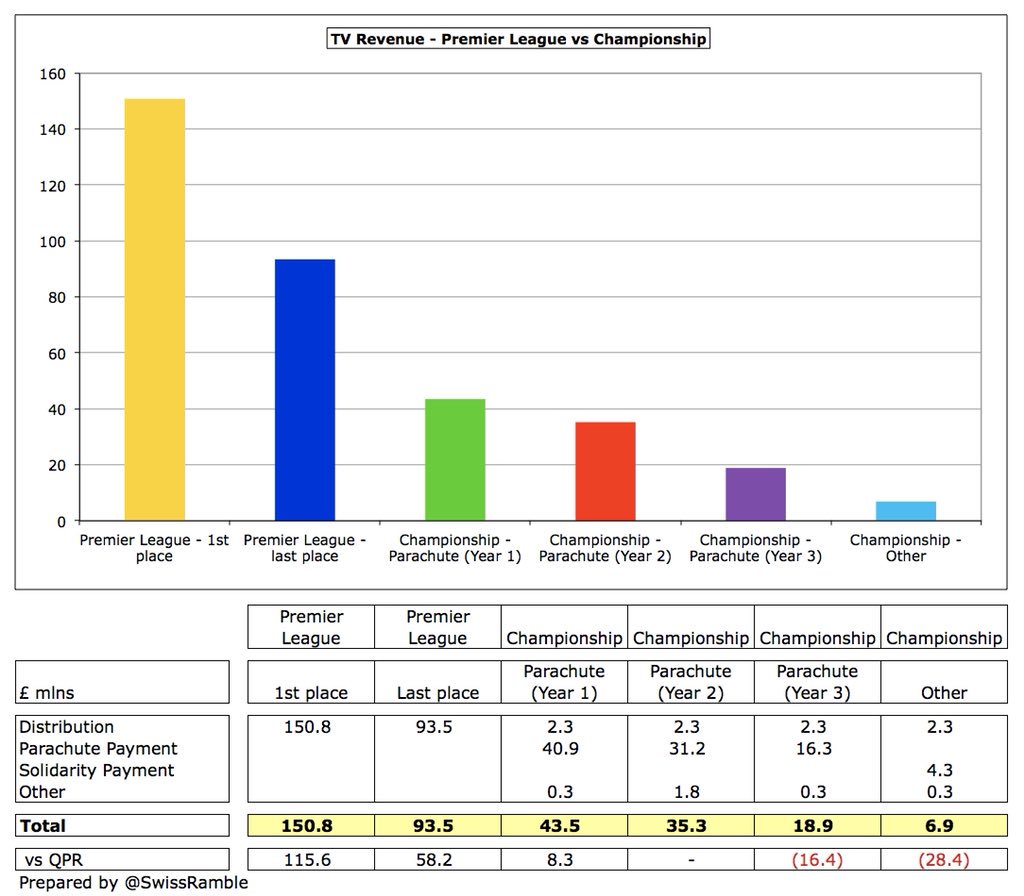

#QPR TV income rose 19% (£5.7m) from £29.6m to £35.3m, due to increase in parachute payment from £25.9m to £31.2m. Most clubs only get £7m, including £4.3m solidarity payment. Amounts in top flight (£151m for 1st, £93m for 20th) explain why many Championship owners spend big.

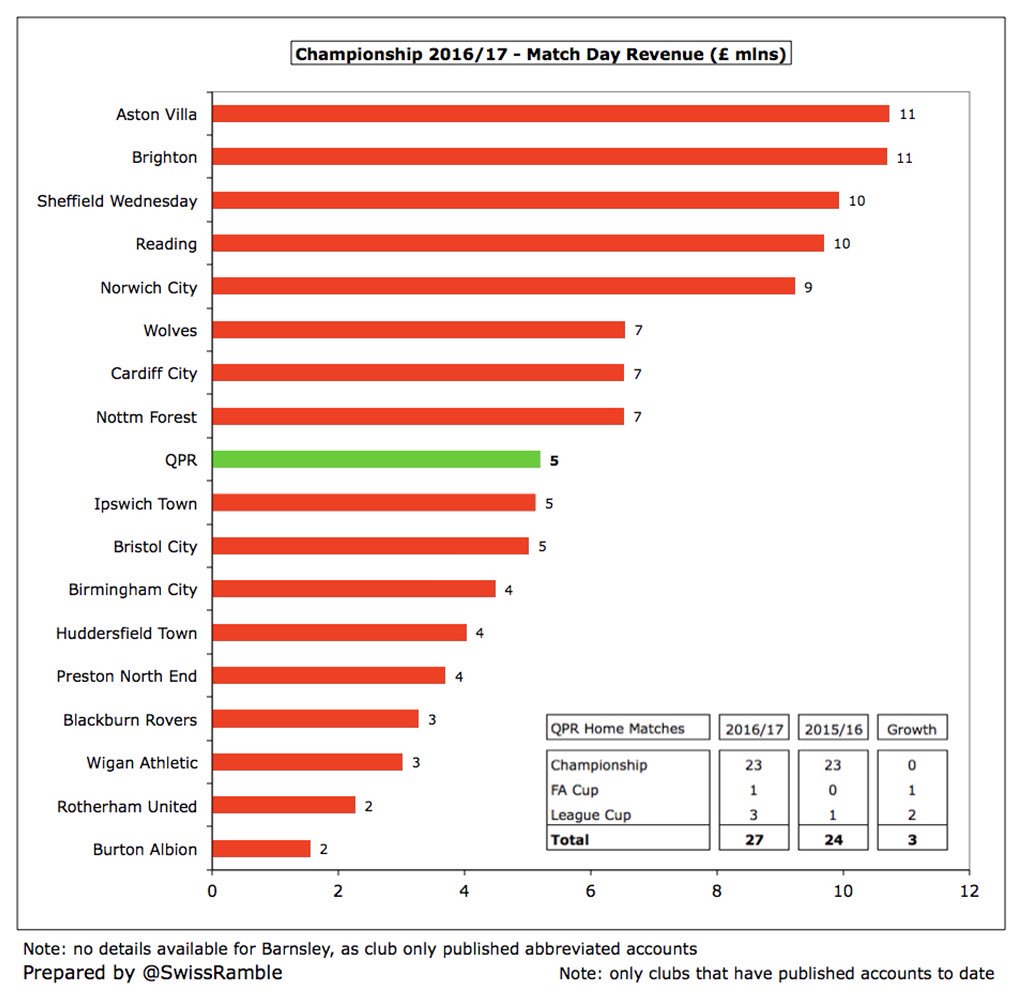

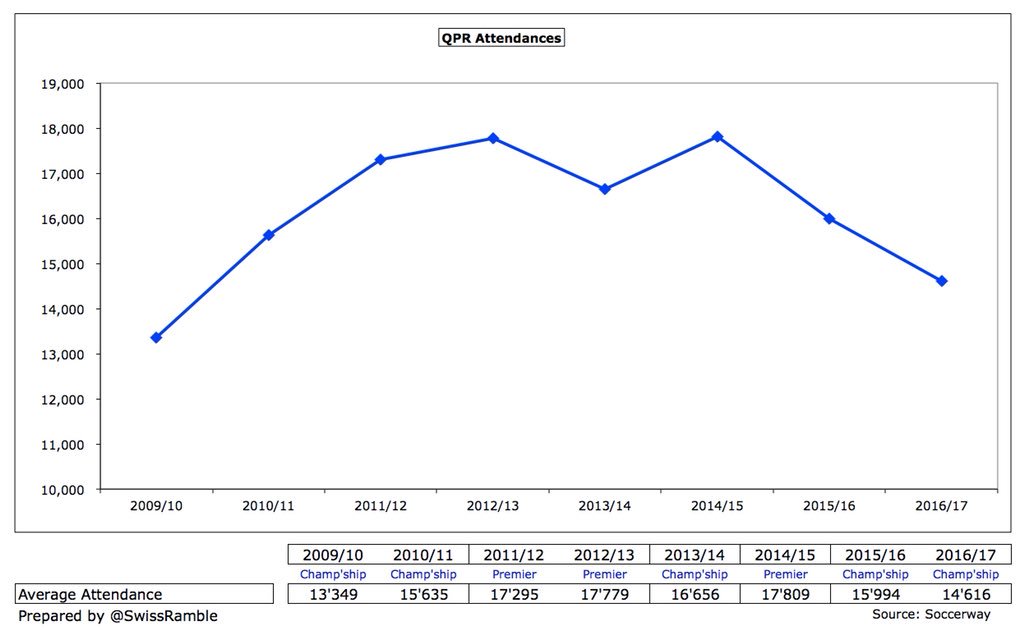

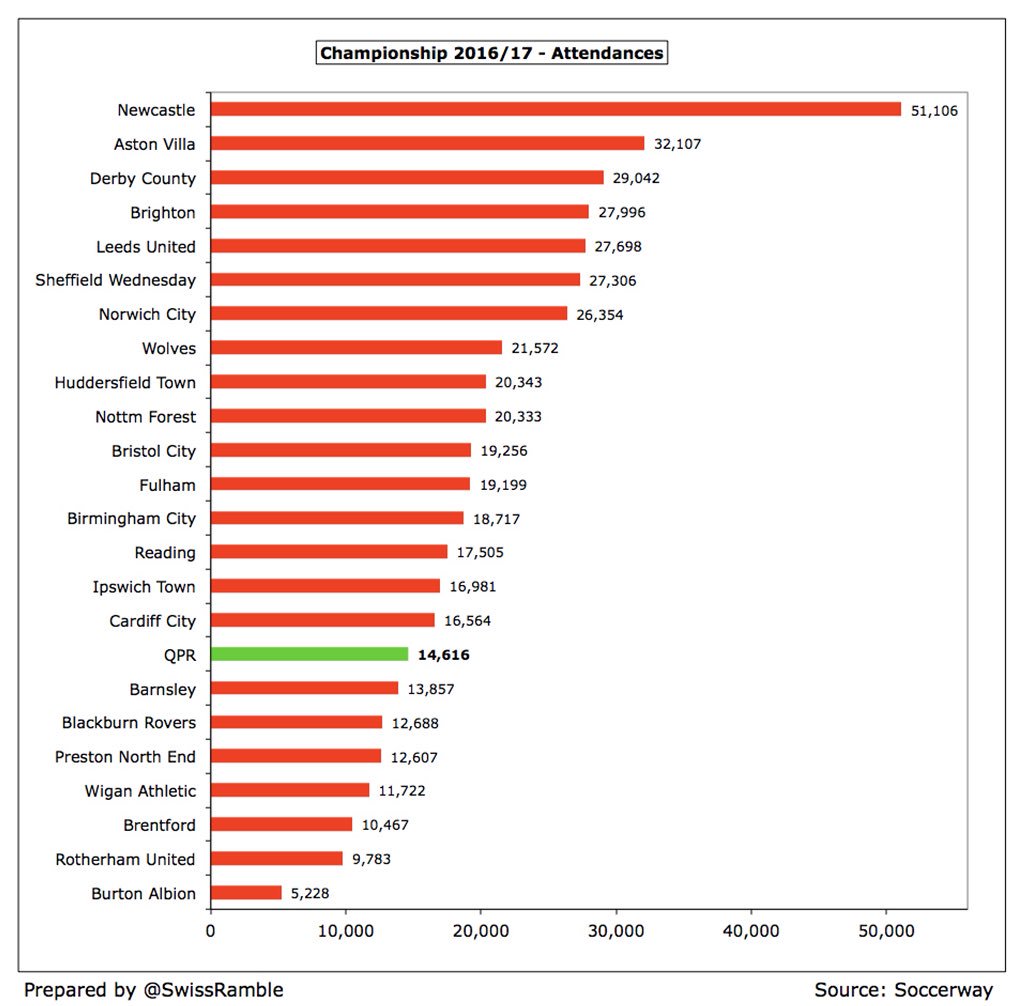

#QPR gate receipts fell by 5% (£0.3m) to £5.2m, despite hosting 3 more games at Loftus Road, as average attendance decreased from 15,994 to 14,616. The 16/17 figure is 38% (£3.2m) lower than the £8.4m peak in 11/12, and less than half of 16/17 top clubs Villa & Brighton £11m.

As might be expected, #QPR attendances are lower in the Championship with crowds dropping by more than 3,000 (18%) from the 17,800 the last time that Rangers were in the Premier League in 2014/15. The club has struggled to secure a site for a new stadium.

#QPR 14,616 attendance was only 17th largest in the Championship last season, a long way behind the top two (Newcastle 51,106 & Villa 32,107). Season ticket prices were frozen for early bird fans, but then increased after window closed.

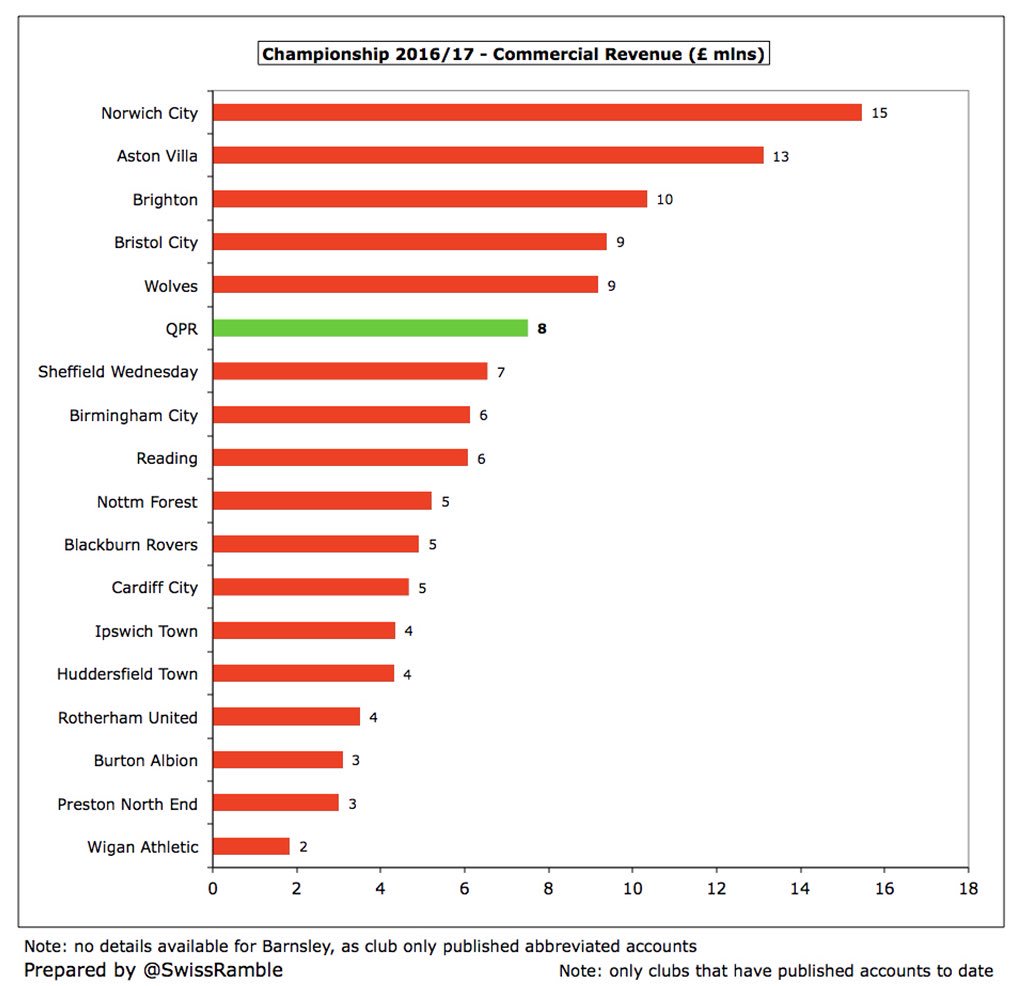

#QPR commercial income rose 10% (£0.7m) from £6.8m to £7.5m. Shirt sponsor was Smarkets, replaced by online casino Royal Panda in 17/18, though Tony Fernandes’ AirAsia also provided sponsorship in 16/17 (per accounts). Errea is kit supplier after Dryworld deal terminated early.

Few Championship clubs earn big money commercially, so #QPR £8m is quite respectable for the division, though still a fair way below Norwich City £15m and Aston Villa £13m.

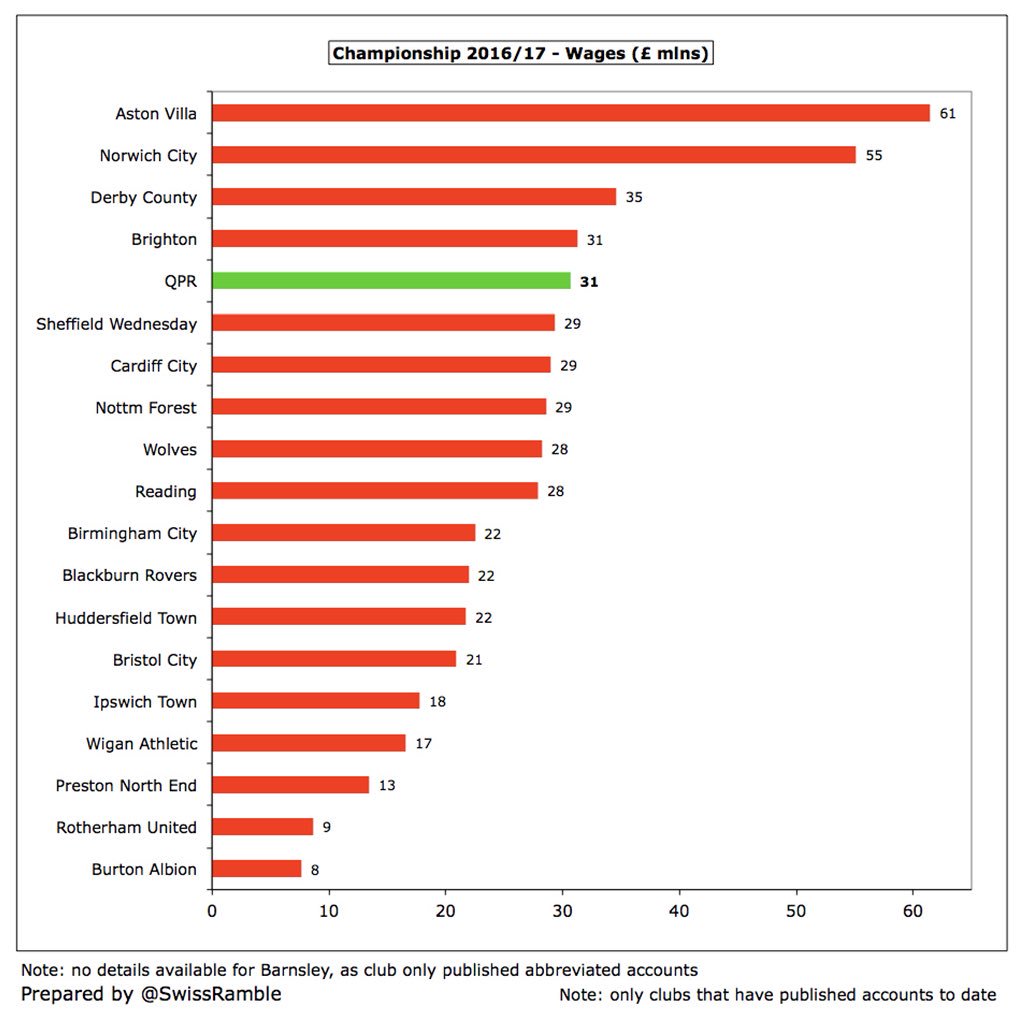

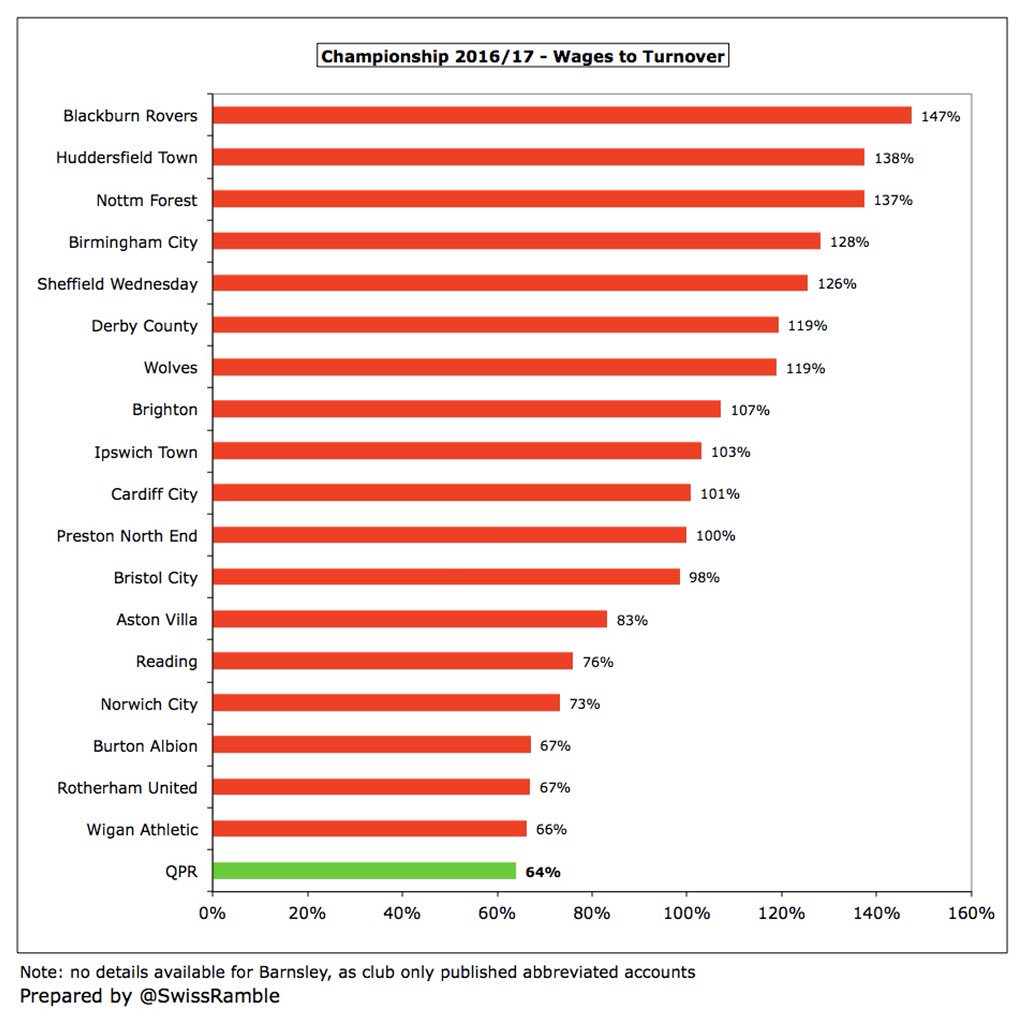

#QPR wage bill was cut by a hefty 25% (£10.1m) from £40.8m to £30.7m, though number of players, managers & coaches remained at 111. This reduced the wages to turnover ratio from 98% to a very respectable 64%, a far cry from the 195% of the Redknapp era.

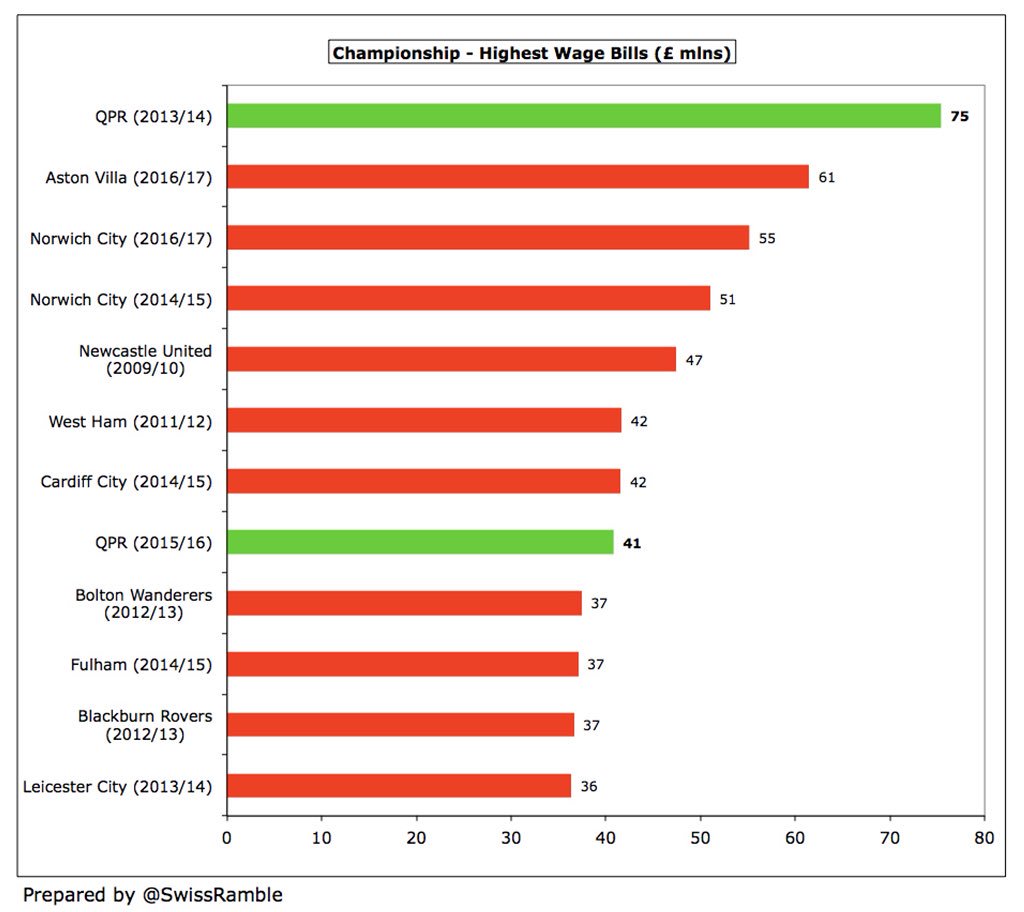

To give some colour to those free spending days, #QPR’s £75m wage bill in 2013/14 is the highest ever in the Championship, a full £14m more than Villa’s £61m in 2016/17. In fact, Rangers also have the 8th largest wage bill ever in the second tier, £41m in 2015/16.

Despite the decrease, #QPR £31m wage bill is still one of the highest in the Championship, though nowhere near those boosted by parachute payments, e.g. Villa £61m, Norwich £55m. However, for some more context, it was the same as promoted Brighton.

#QPR wages to turnover ratio of 64% is actually the lowest reported to date in the Championship, even below relegated Wigan 66% and Rotherham 67%. This is obviously helped by the parachute payment, but is still a notable feat, given that 11 out of 19 clubs are more than 100%.

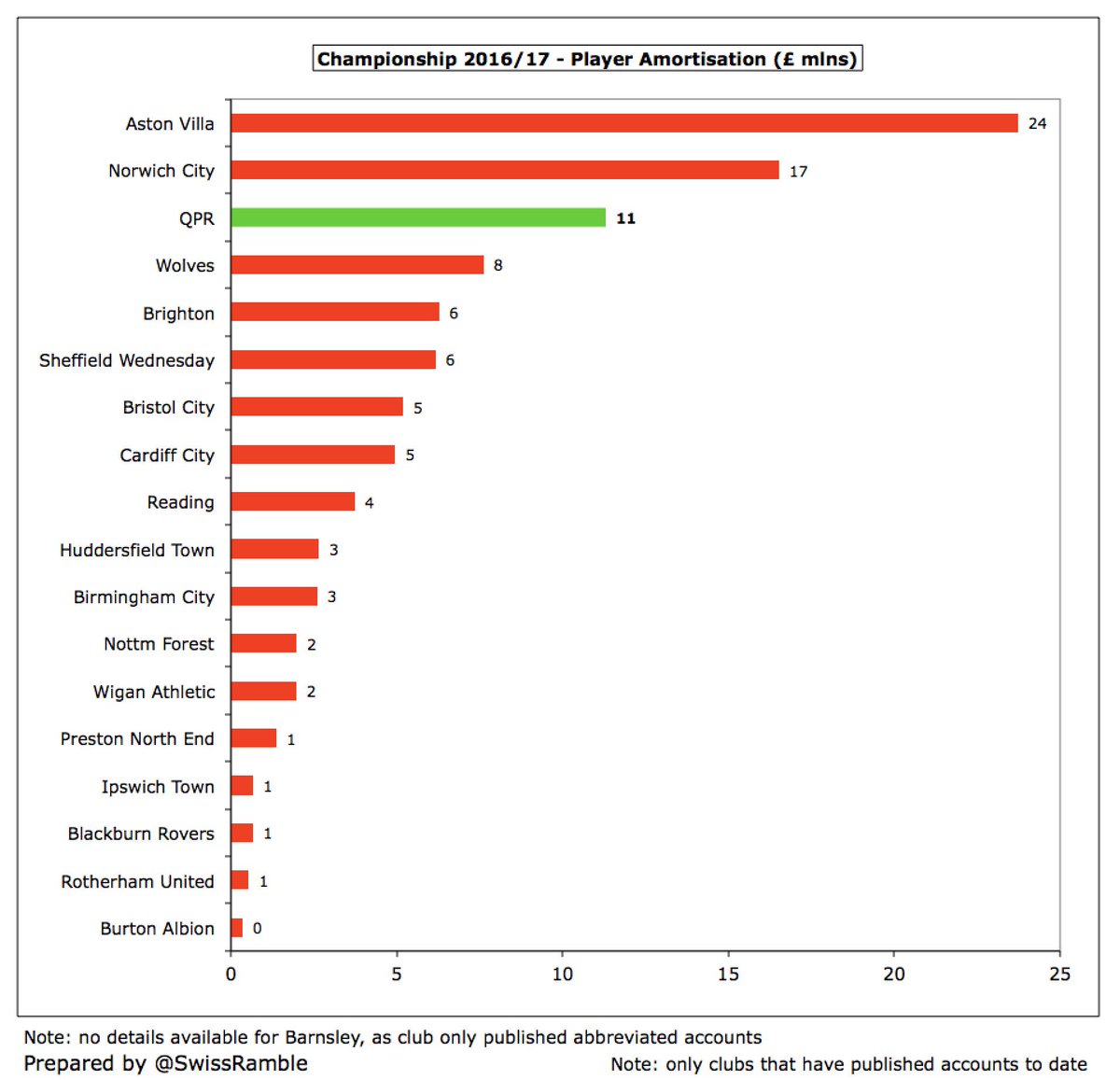

#QPR player amortisation rose £1.2m (11%) to £11.3m, though was still lower than the £17.1m peak in 2012/13. Worth noting that Rangers booked £11.6m of player impairment in 2014/15, the season they were relegated from the Premier League.

After the increase, #QPR player amortisation of £1m is the third highest in the Championship, only behind Aston Villa £24m and Norwich City £17m, though above Wolves £8m.

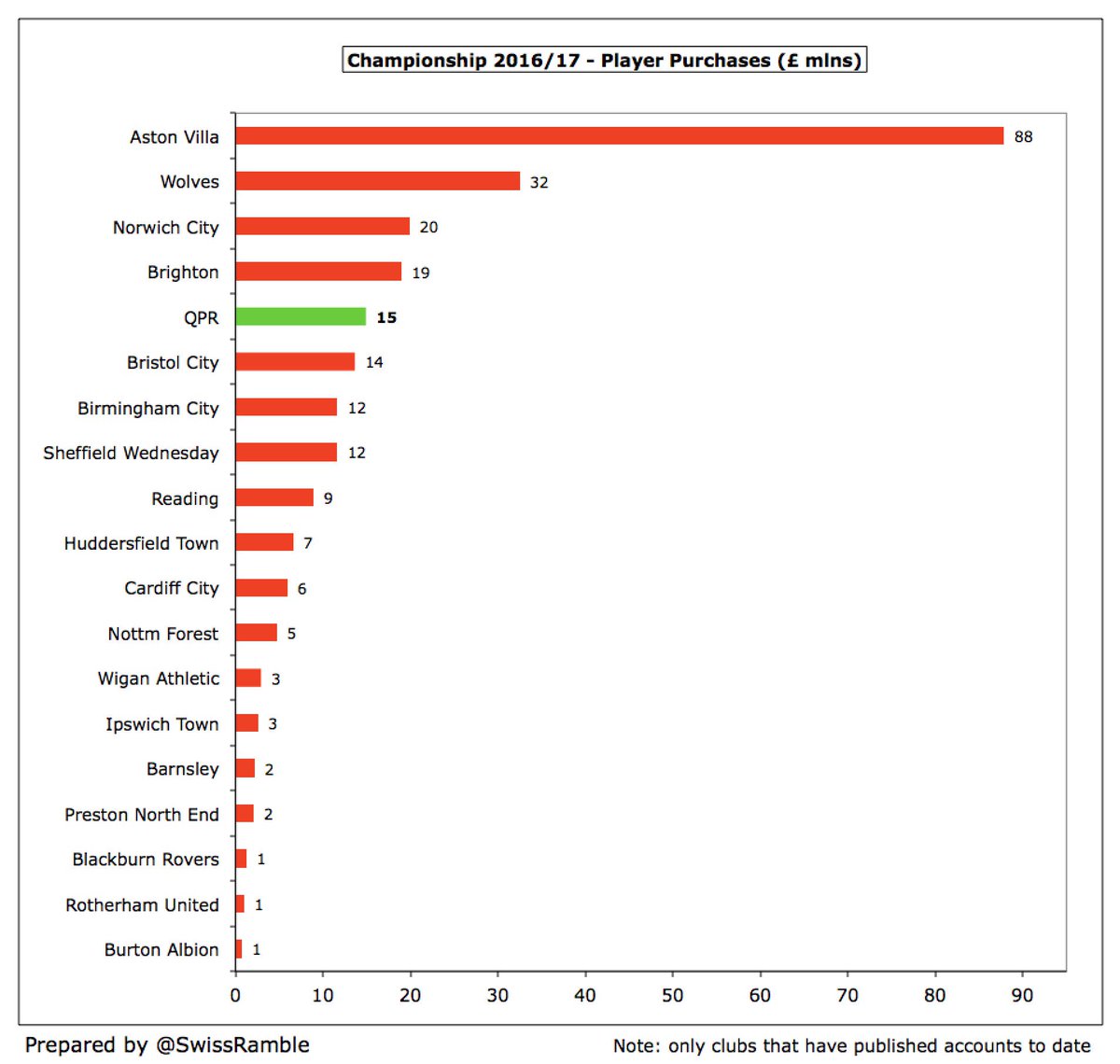

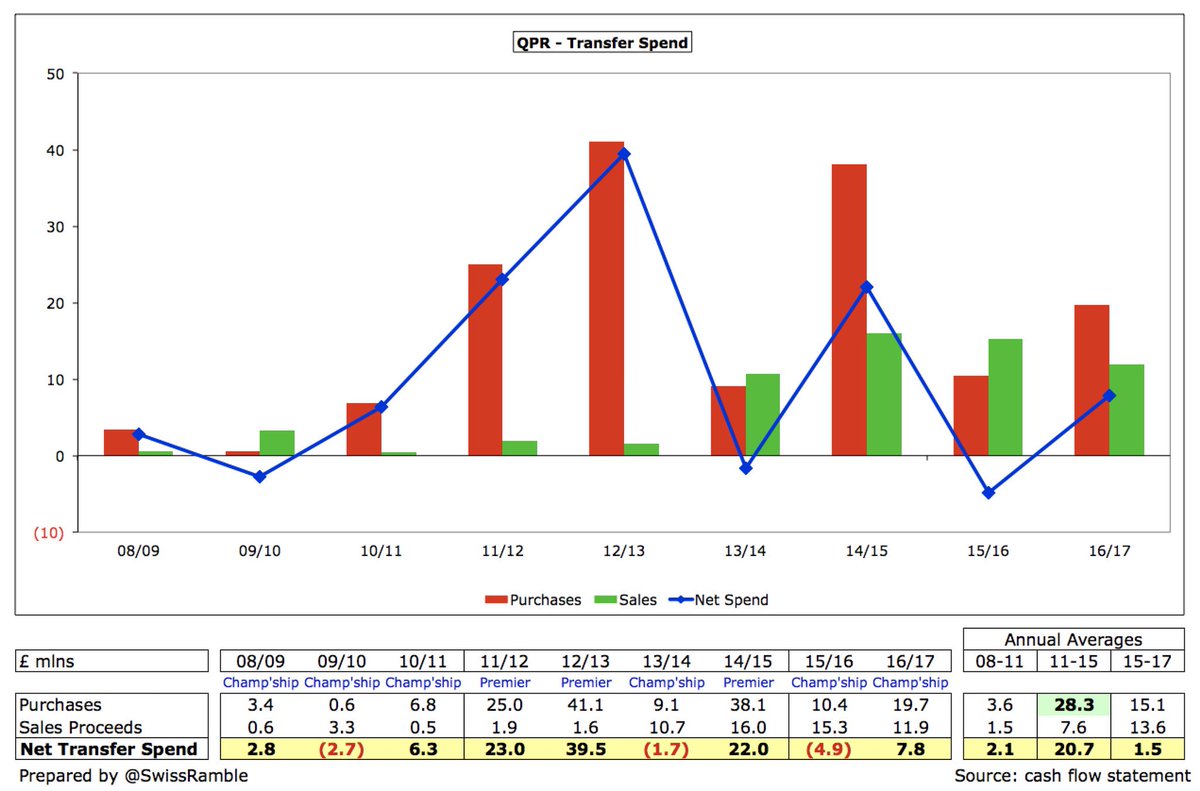

#QPR spent £15m on players in 16/17 (Sylla, Borysiuk, Bidwell, Cousins, Lynch & N’Gbakoto), one of highest in Championship, though significantly outspent by Villa £88m & Wolves £32m. That meant £25m spent by Rangers in last 2 seasons, around half of £48m in preceding 2 seasons.

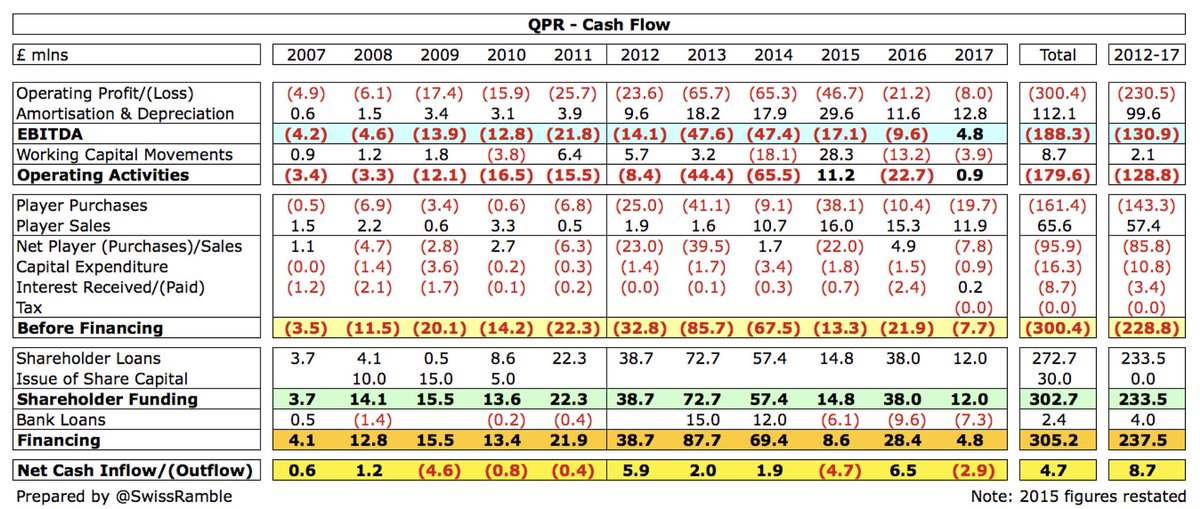

On a cash basis #QPR gross spend on players has obviously diminished in the 2 years since relegation, though the reduction in average annual net spend from £21m between 2011 and 2015 to just £1m in the last 2 seasons is also due to the increase in player sales.

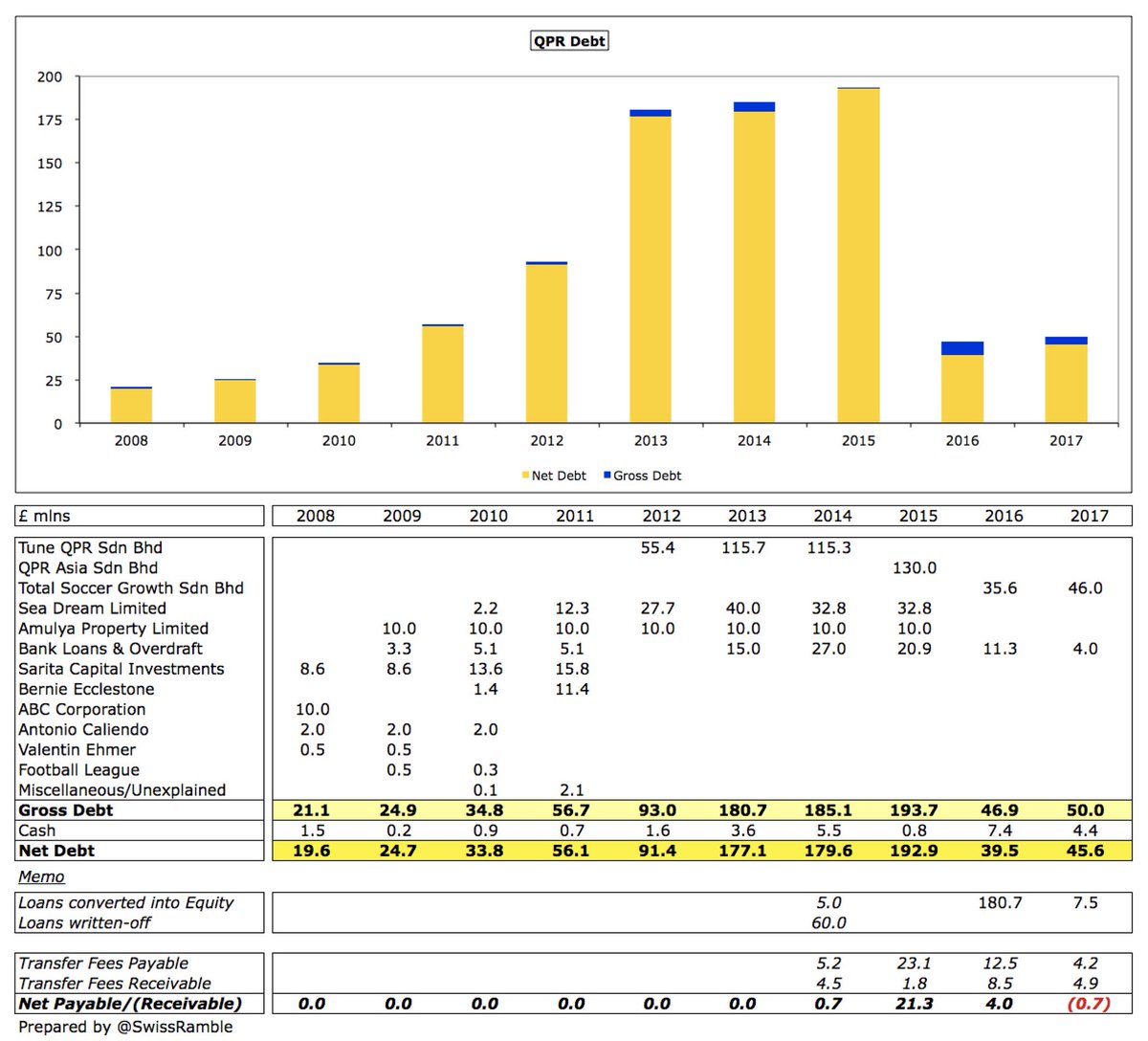

#QPR gross debt rose £3m to £50m, as shareholder loan up £10m to £46m, while bank loan down £7m to £4m. Shareholder loans carry high interest rate (£30m at 1% per month, £16m at 2% per month), though £7.5m charged was capitalised. Bank loan charged at LIBOR + 3.5%.

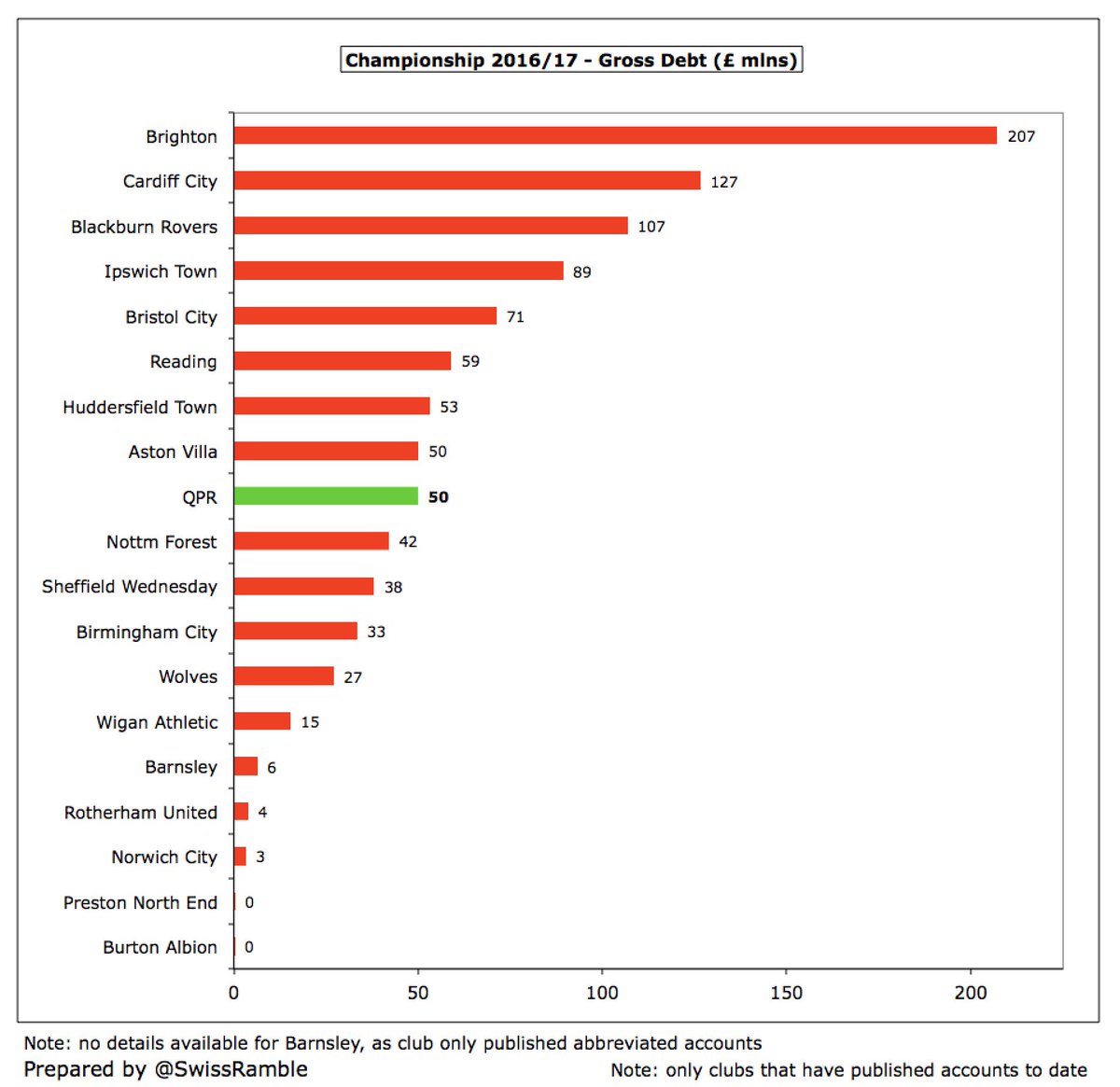

#QPR debt of £50m is by no means the largest in Championship, e.g. Brighton £207m (new stadium & training ground), Cardiff £127m & Ipswich £89m That said, would have been much higher without £193m of debt being capitalised (including £181m in 2016) and £60m write-off in 2014.

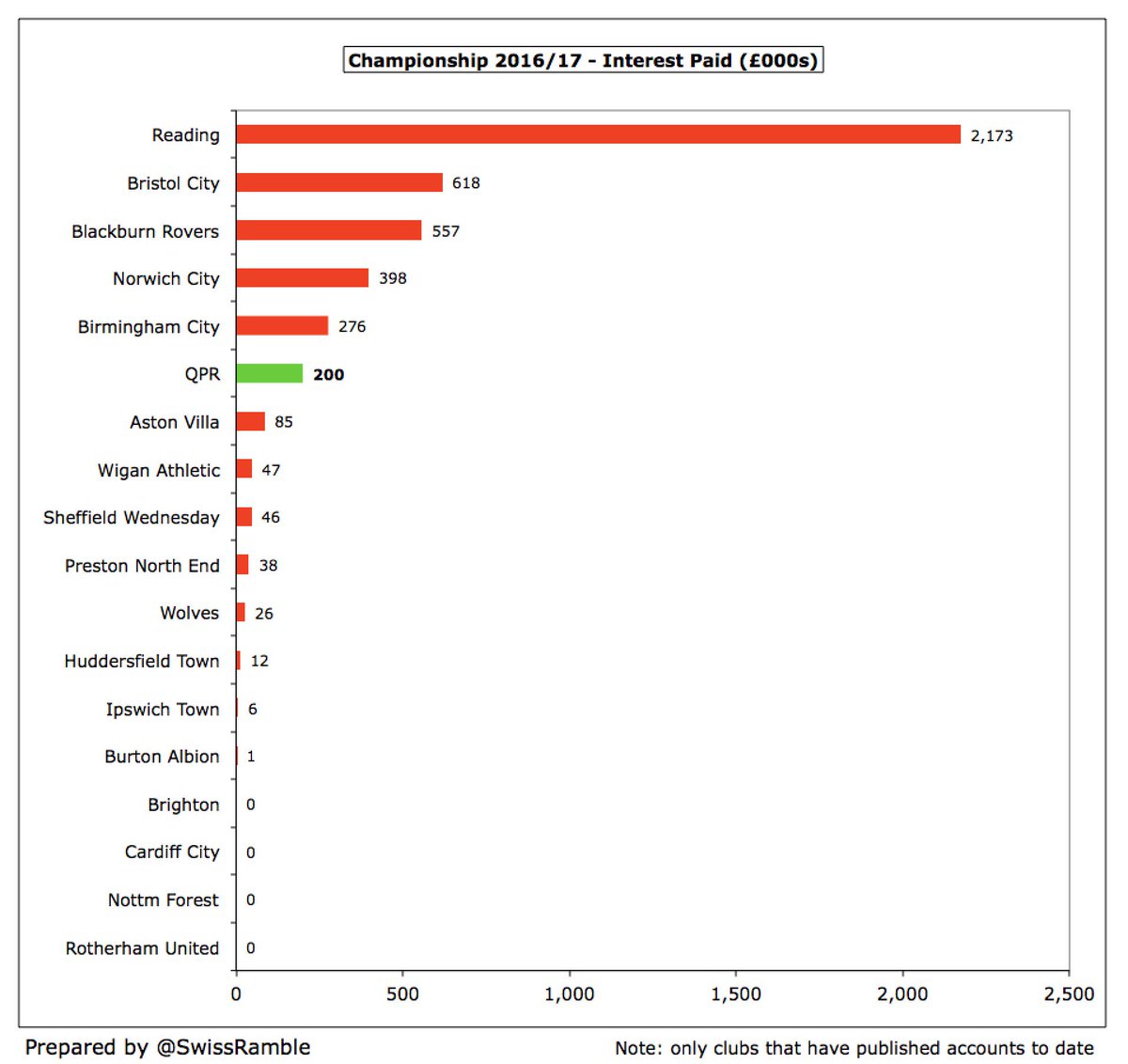

Although debt is high in the Championship, most of it is provided by owners who charge little or no interest. Despite the exorbitant interest rates on #QPR shareholder loans, club only paid £200k in 2016/17, as owners converted the interest payable (£5.7m in 16/17) into equity.

#QPR received £12m in shareholder financing in 2016/17 (all from Ruben Gnanalingam) and repaid £7.5m of the bank loan. They also got £1m from operating activities. There was a £3m decrease in cash balance following £8m net spend on players and £1m on capex.

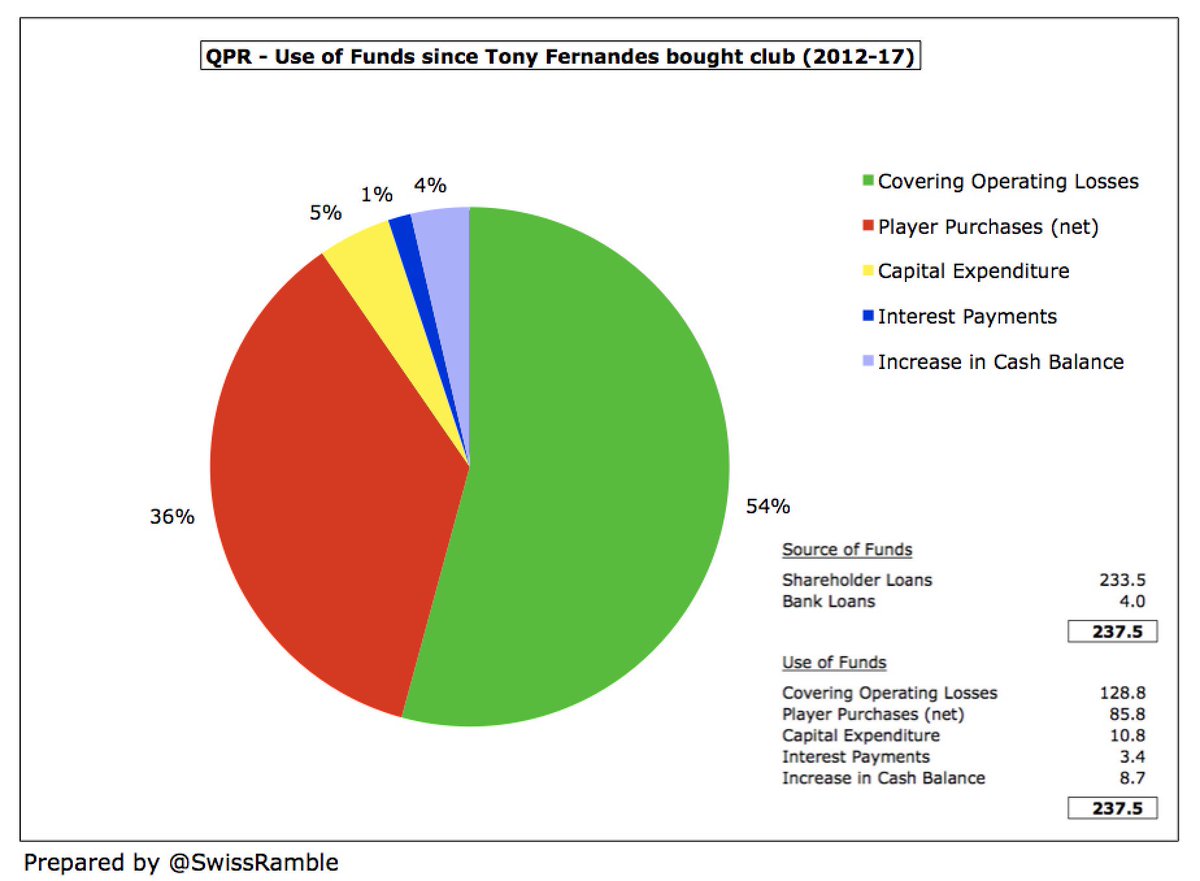

Since Tony Fernandes’ arrival, the owners have pumped £234m into the club. In that period #QPR have spent most of this on covering operating losses (£129m) and net player purchases (£86m). Only £11m has been invested in infrastructure.

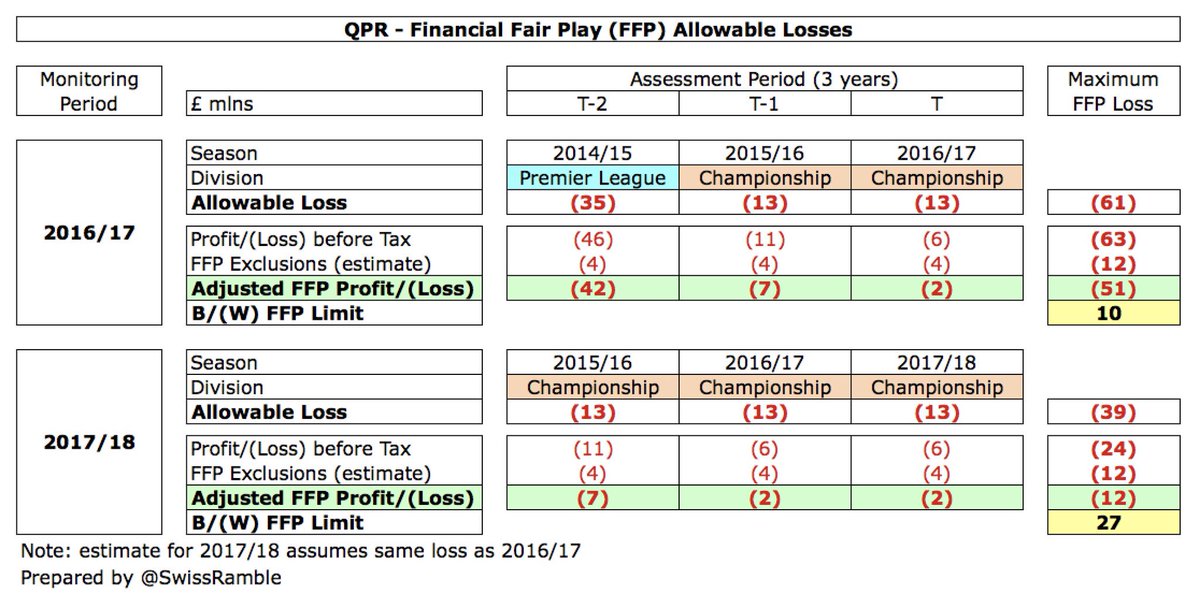

#QPR have not made any provision for the EFL £40m fine for breaching FFP regulations, even though the arbitration panel has dismissed the club’s claim that the rules were unlawful and the fine disproportionate. Rangers have appealed the decision.

In theory, #QPR reduced losses should remove any future FFP problems, especially as can exclude academy, community & infrastructure (which I estimate at £4m a year). FFP is assessed over a three-year period (current season plus previous two seasons).

#QPR should be praised for turning the club around. It is much better managed than the last time they were in the Championship when they spent like crazy. However, they will need to recognise that parachute payments will not go on forever and cut their cloth accordingly.

• • •

Missing some Tweet in this thread? You can try to

force a refresh