Tottenham Hotspur’s 2016/17 financial results covered the club’s last season at the old White Hart Lane, when they finished 2nd in the Premier League, played in the Champions League and reached the FA Cup semi-finals. Some thoughts in the following thread #THFC

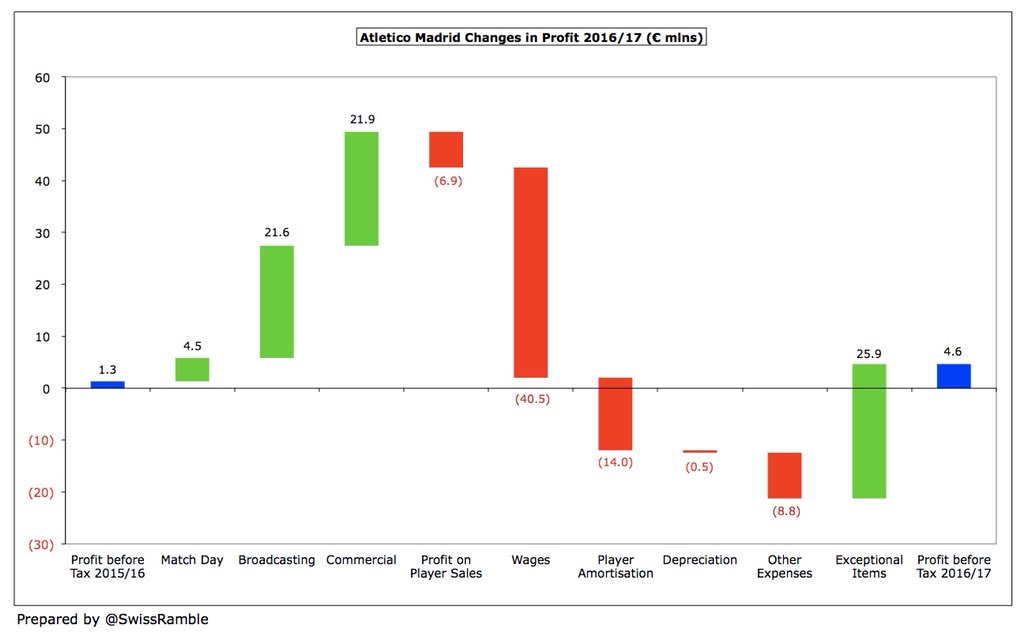

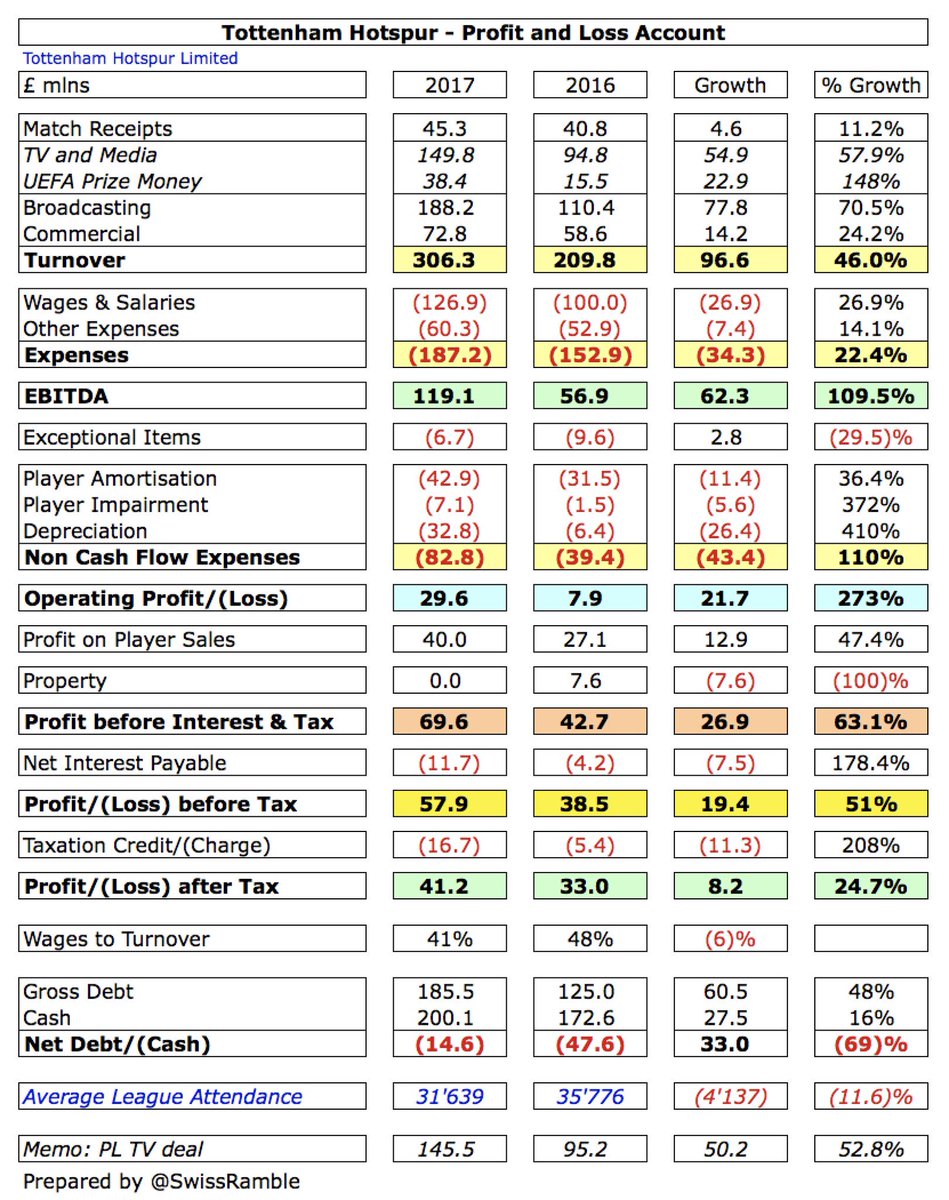

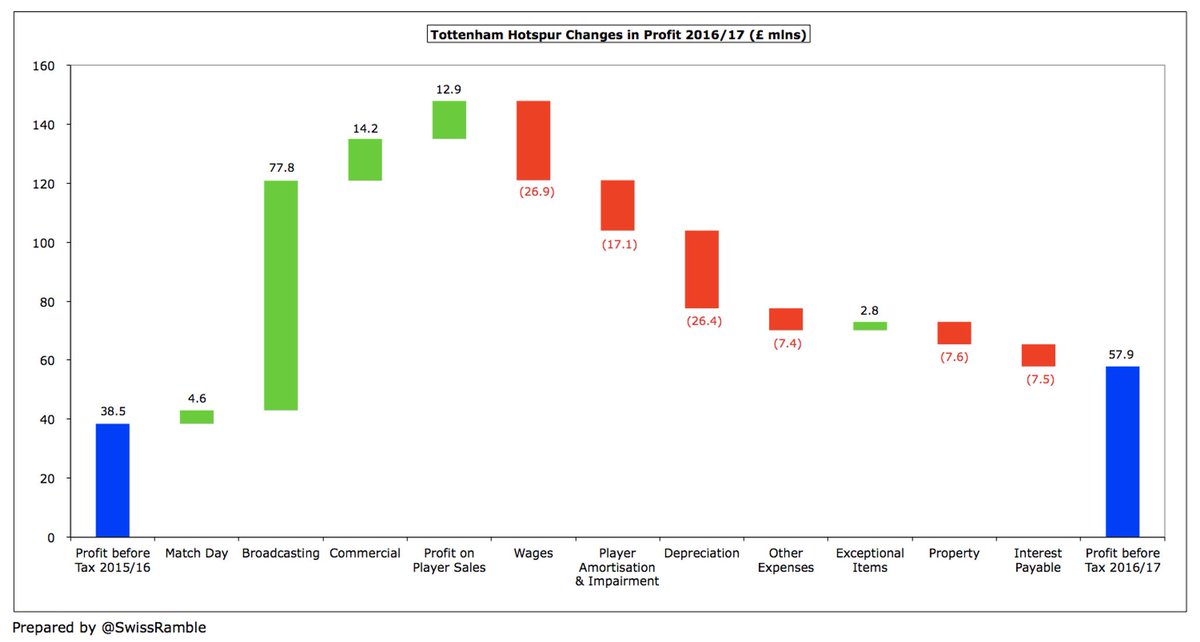

#THFC profit before tax improved by £20m from £38m to £58m with revenue rising by 46% (£97m) to a record £306m and profit on player sales up £13m to £40m. Profit after tax “only” increased by £8m from £33m to £41m, as tax charge was £11m higher at £17m.

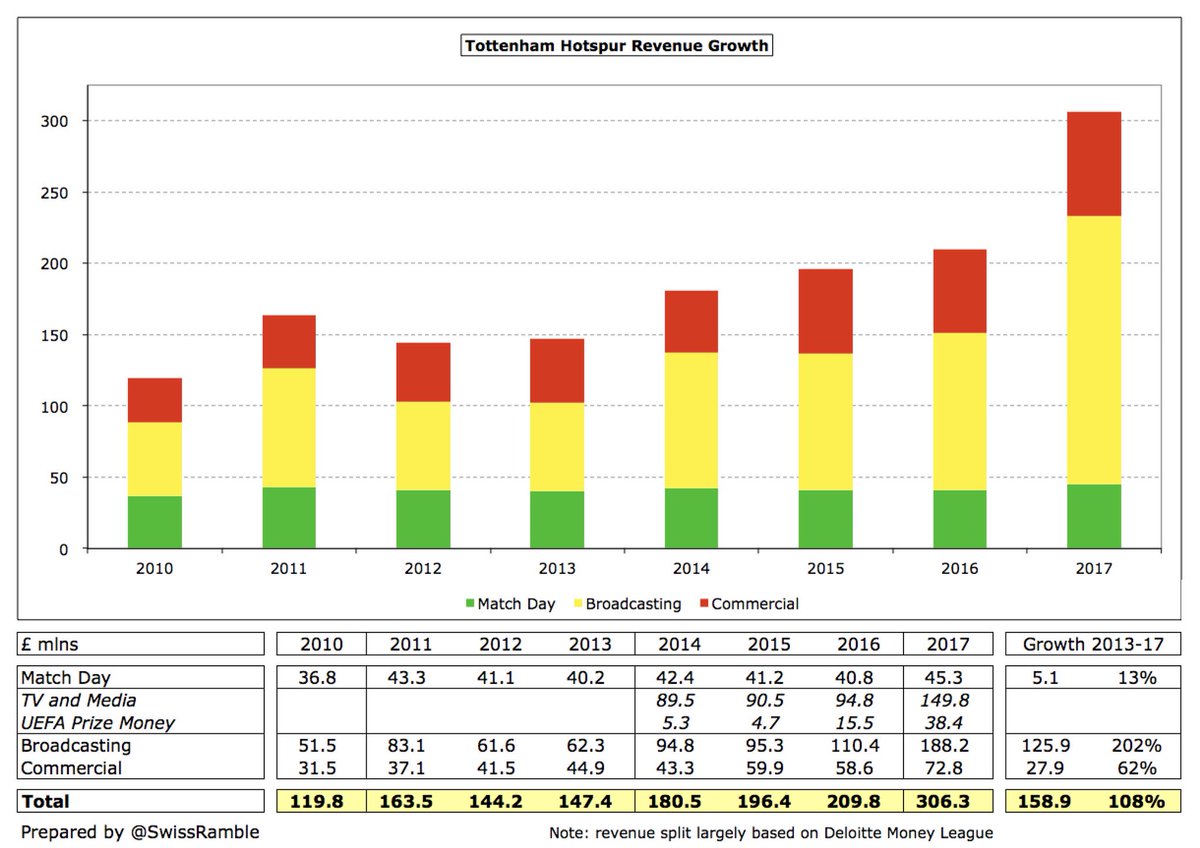

#THFC revenue growth was largely due to broadcasting rising £78m (71%) to £188m, driven by the new Premier League TV deal and Champions League bringing in twice as much as the Europa League. Commercial increased £14m (24%) to £73m, while match day was up £5m (11%) to £45m.

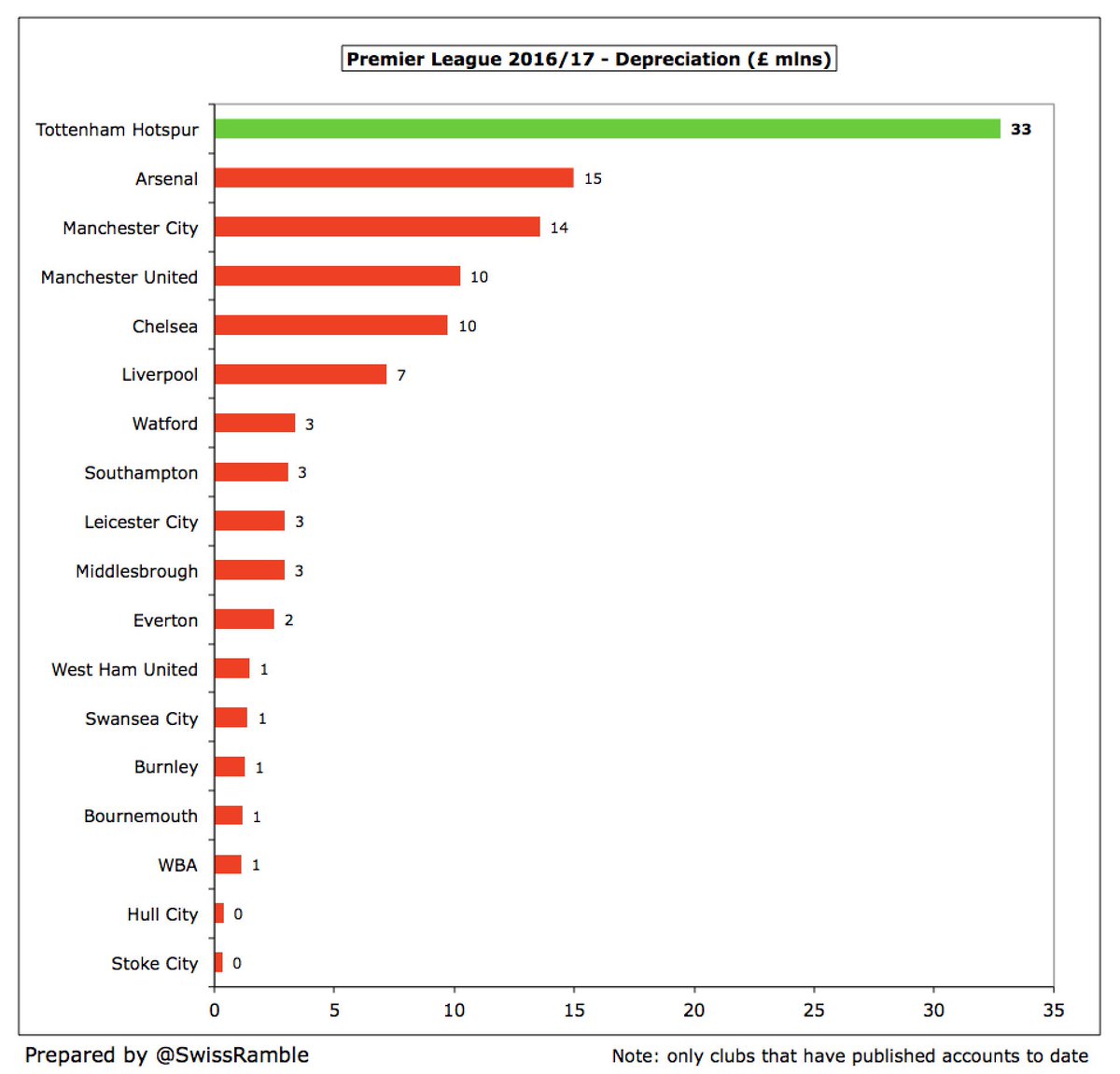

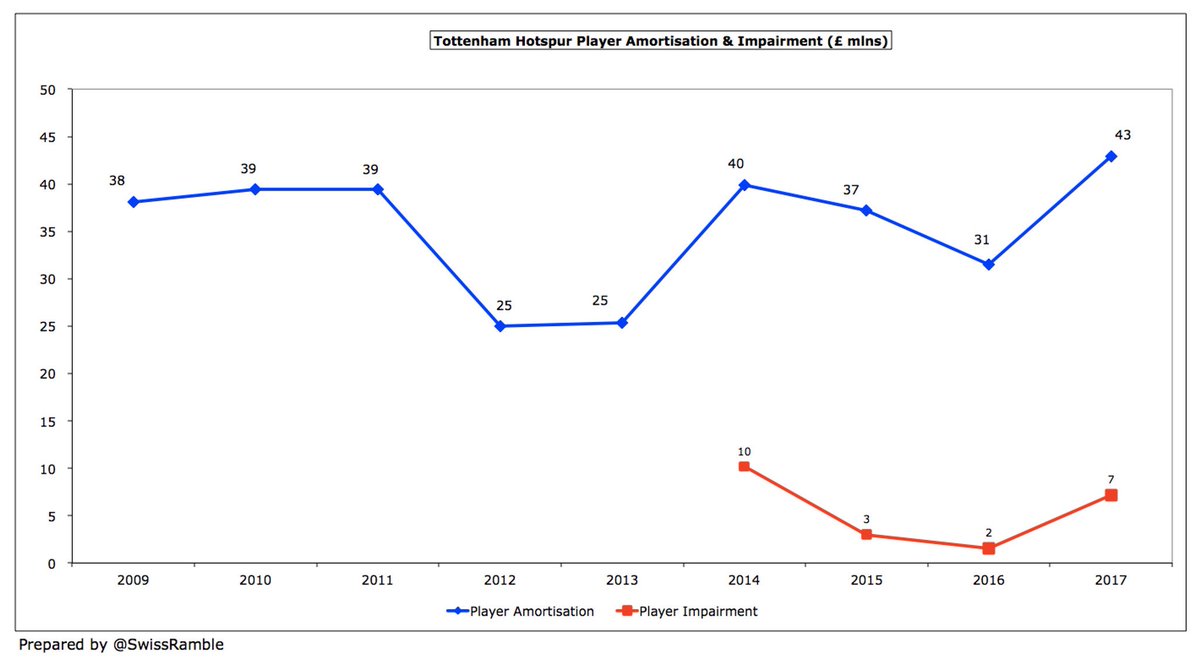

#THFC wage bill rose £27m to £127m, while player amortisation/impairment was £17m higher at £50m. Investment in the new stadium led to large increases in depreciation (up £26m to £33m) and finance costs (up £8m to £12m). Other expenses were up £7m to £60m.

Once-off movements also impacted #THFC figures, as there were £7m of enabling costs related to new stadium construction, though £3m less than 2015/16 commercial and employment contract costs. Previous season benefited from £8 sale of site of Brook House primary school.

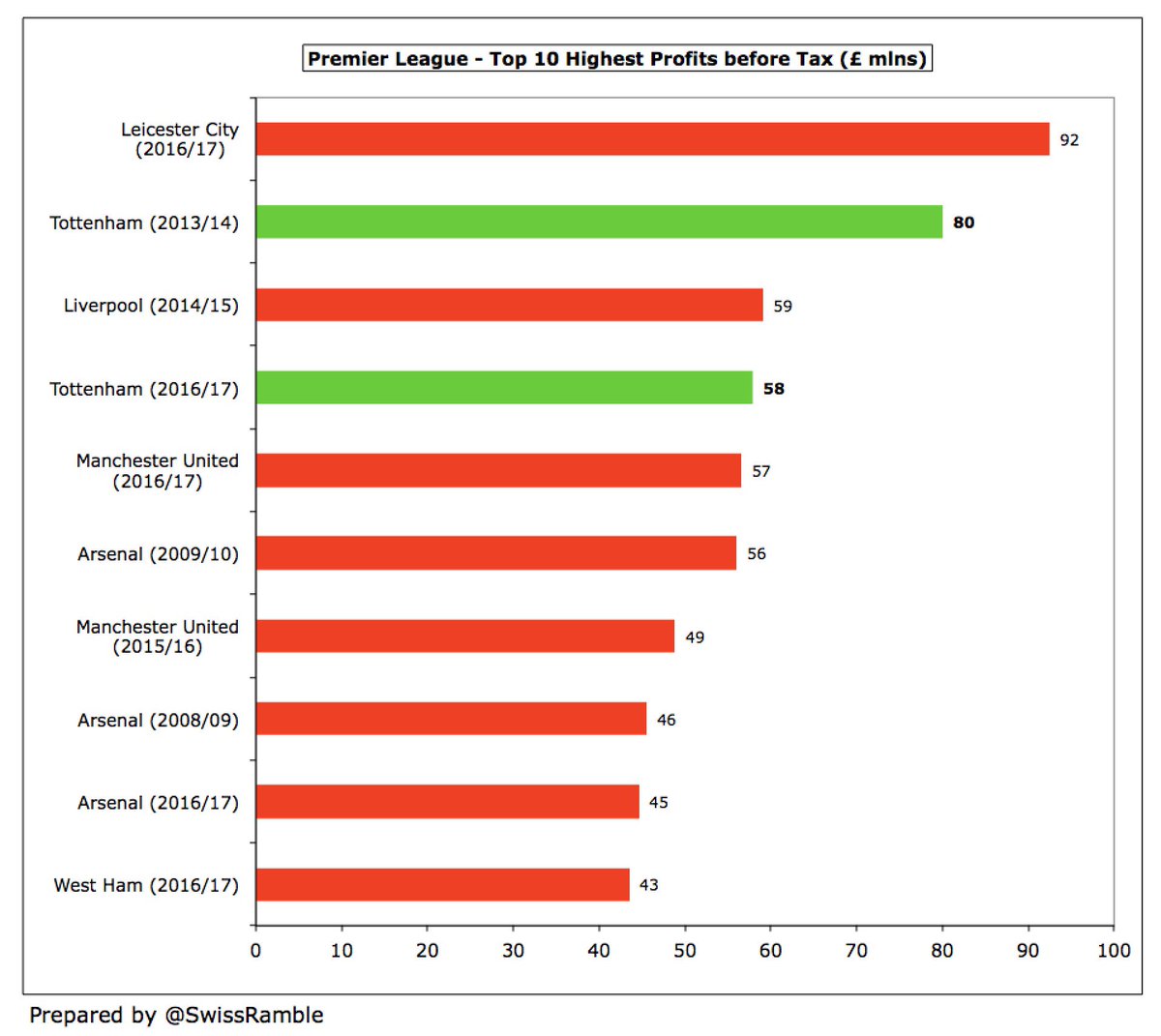

#THFC £58m profit before tax was the 2nd highest in the Premier League, only surpassed by #LCFC £92m, boosted by their Champions League exploits, but ahead of #MUFC £57m, #AFC £45m & #WHUFC £43m. Thanks to TV money, all clubs that have published 2016/17 accounts are profitable.

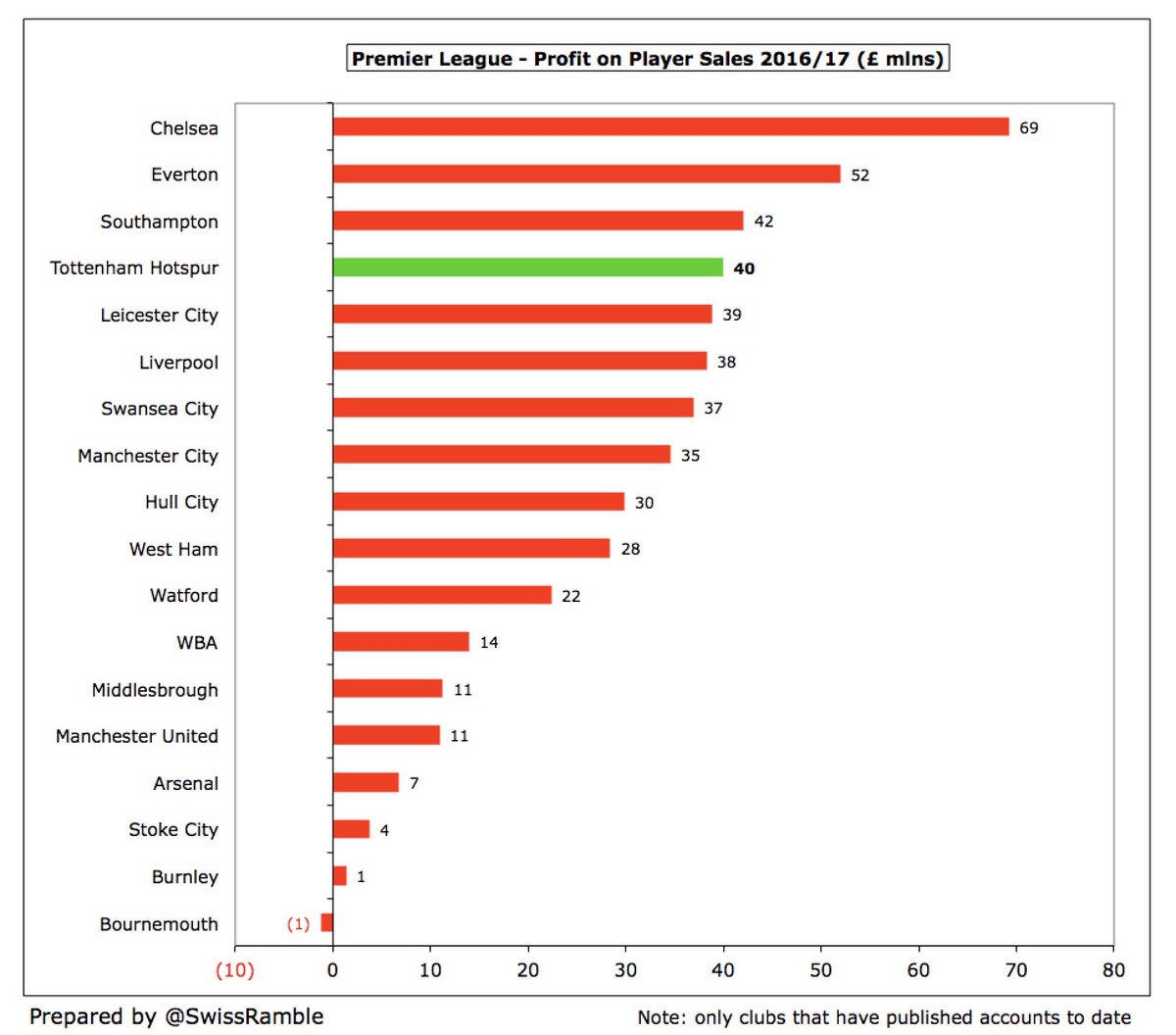

#THFC profit was enhanced by £40m profit on player sales, largely due to sale of Mason to Hull, Chadli to WBA, Pritchard to Norwich, Yedlin to Newcastle and Carroll to Swansea. Only clubs to make more money from player trading were Chelsea £69m, Everton £52m and Southampton £42m.

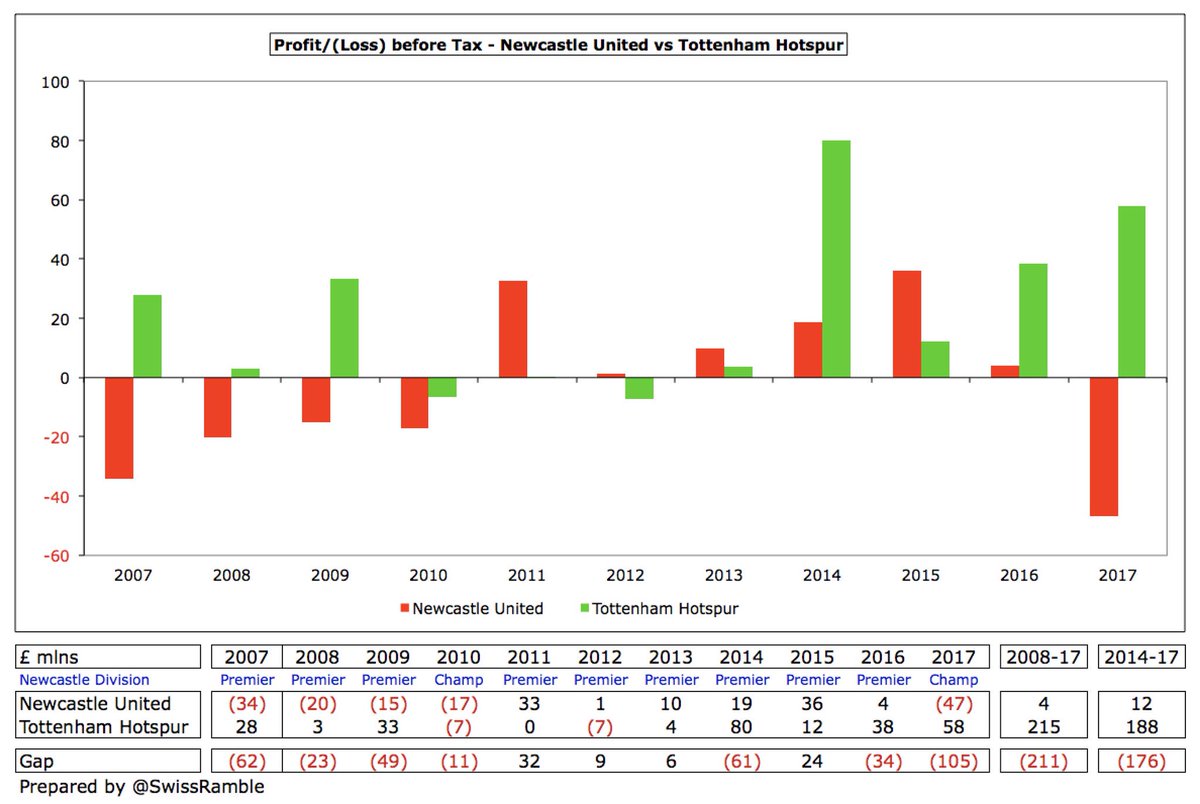

#THFC £58m profit before tax in 2016/17 is actually the 4th highest ever made in the Premier League. However, it is not Spurs’ record profit, which was the £80m made in 2013/14, due to highly lucrative sale of Gareth Bale to Real Madrid.

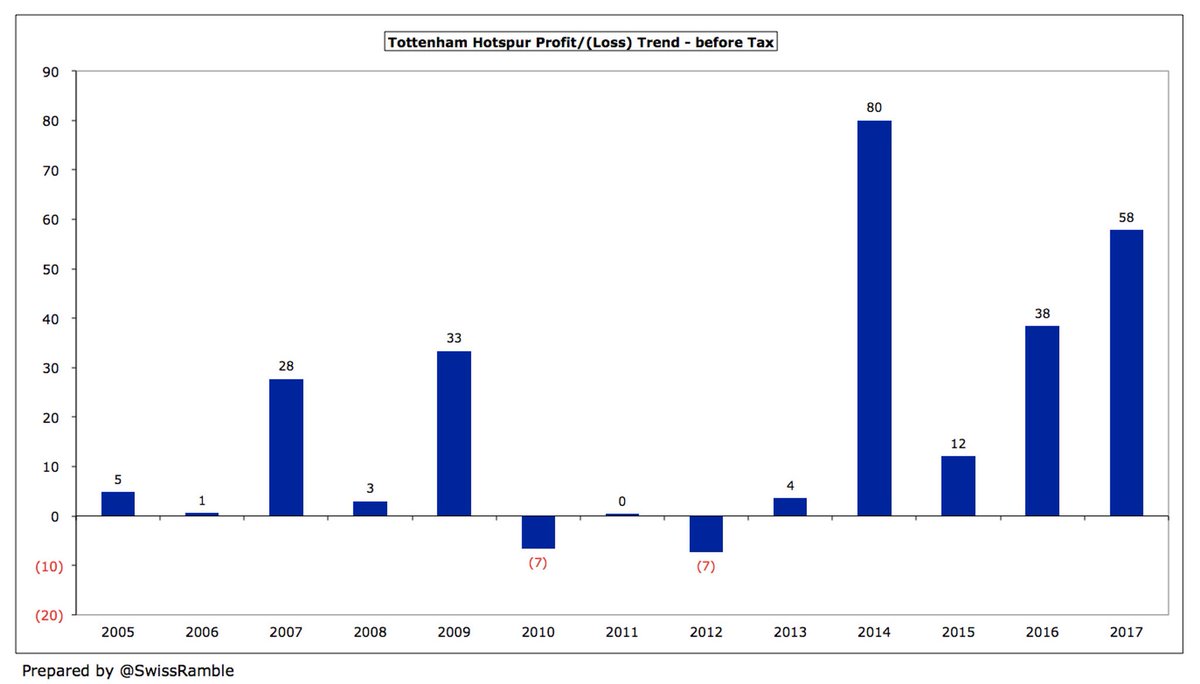

It should be no surprise that #THFC posted a profit, as they have only reported two (small) losses in the last 13 seasons. In the last 4 years they have aggregated a highly impressive £188m of profits.

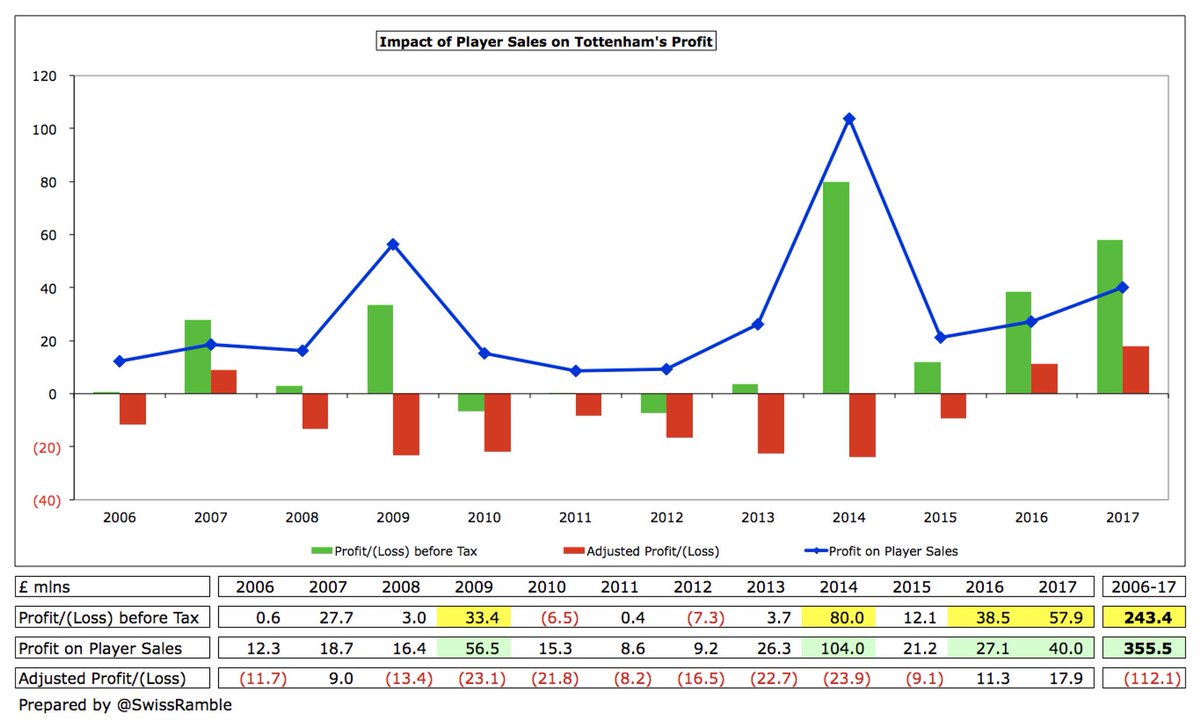

Profit from player sales has had a major impact on #THFC figures, contributing £355m to the last 12 years, turning a £112m loss into £243m profit. Next year will again benefit from big money sales, including Walker to Manchester City, Wimmer to Stoke and Bentaleb to Schalke.

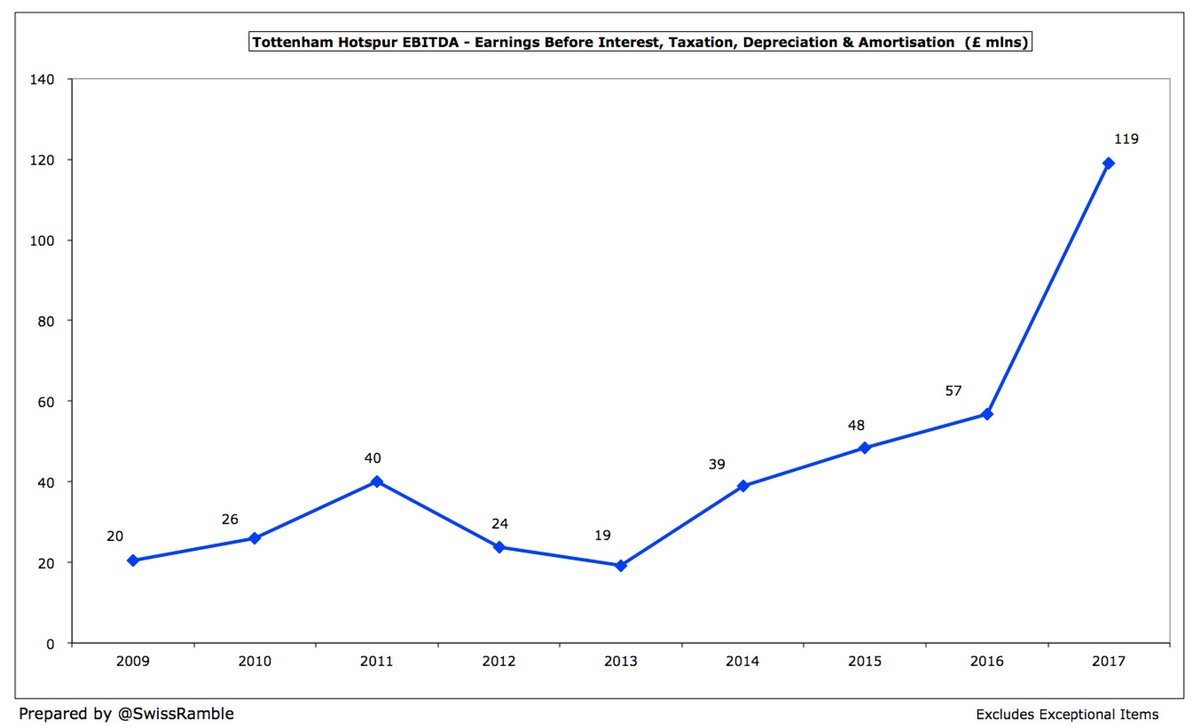

That said, #THFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which can be considered as a proxy for cash operating profit, more than doubled in 2016/17 from £57m to £119m, exactly £100m more than the recent low of £19m in 2012/13.

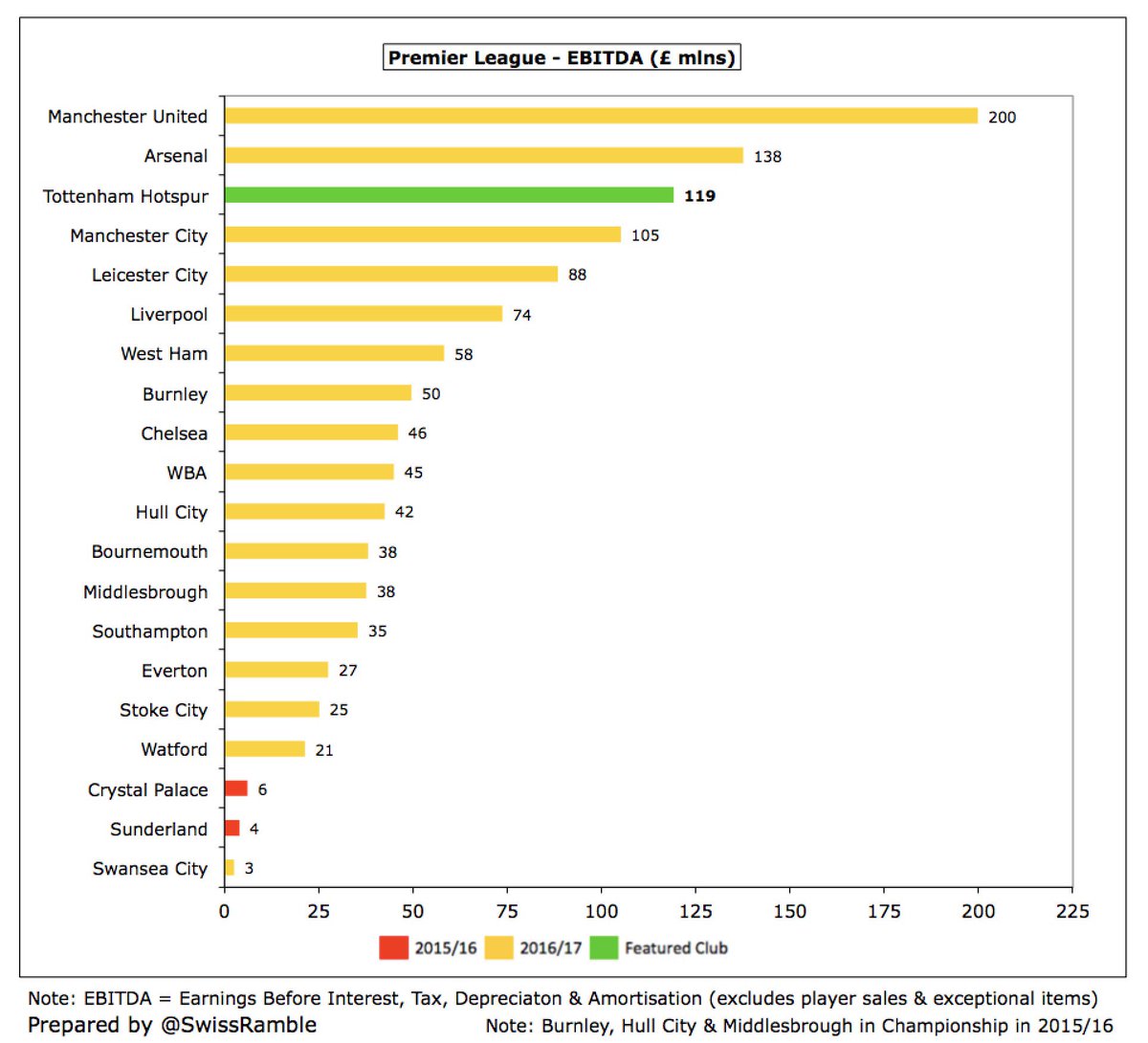

Following this great growth, #THFC EBITDA of £119m is now the 3rd highest in England, though still behind Manchester United £200m, the absolute kings of cash generation, and Arsenal £138m

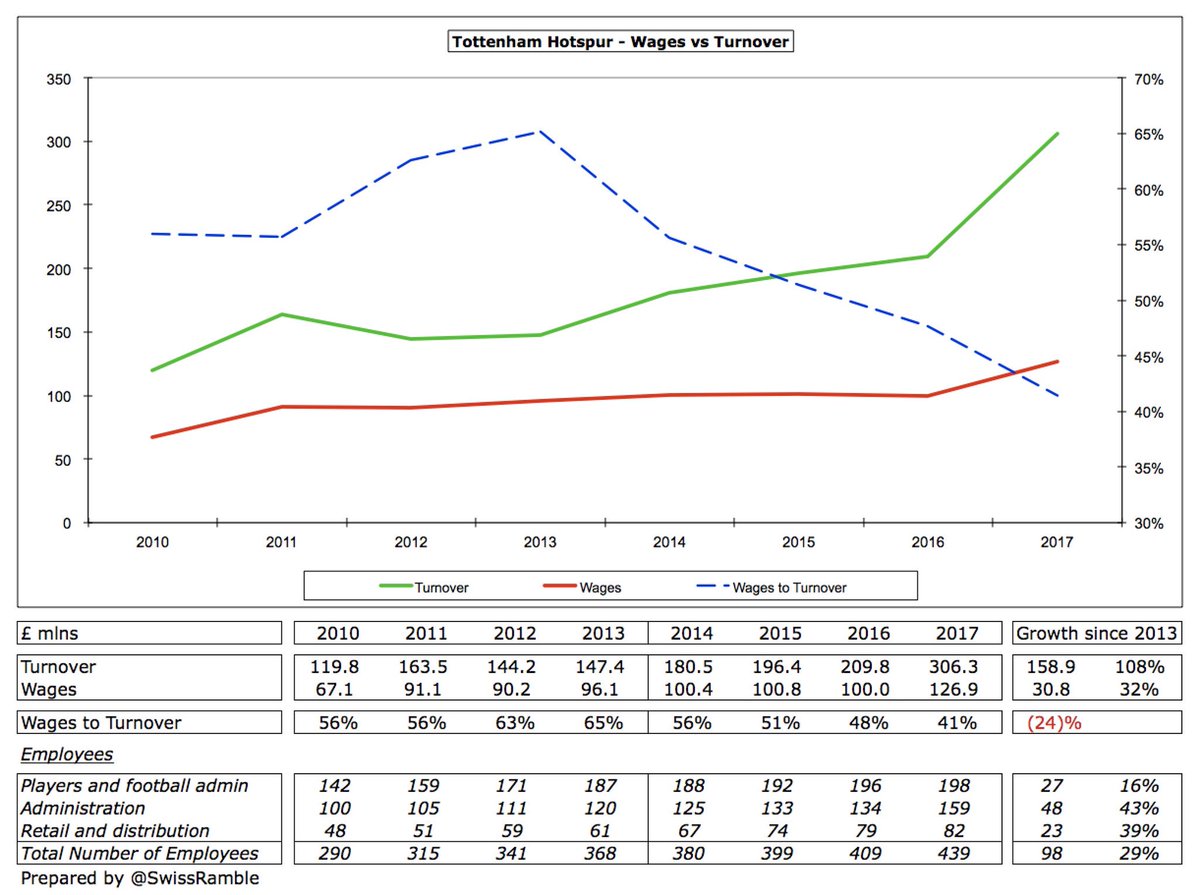

Revenue has increased at #THFC five years in a row, more than doubling from £147m in 2013 to £306m in 2017. Most of the £159m growth in this period was driven by TV money (£126m), but there has been solid commercial growth (£28m), though match day has been relatively flat (£5m).

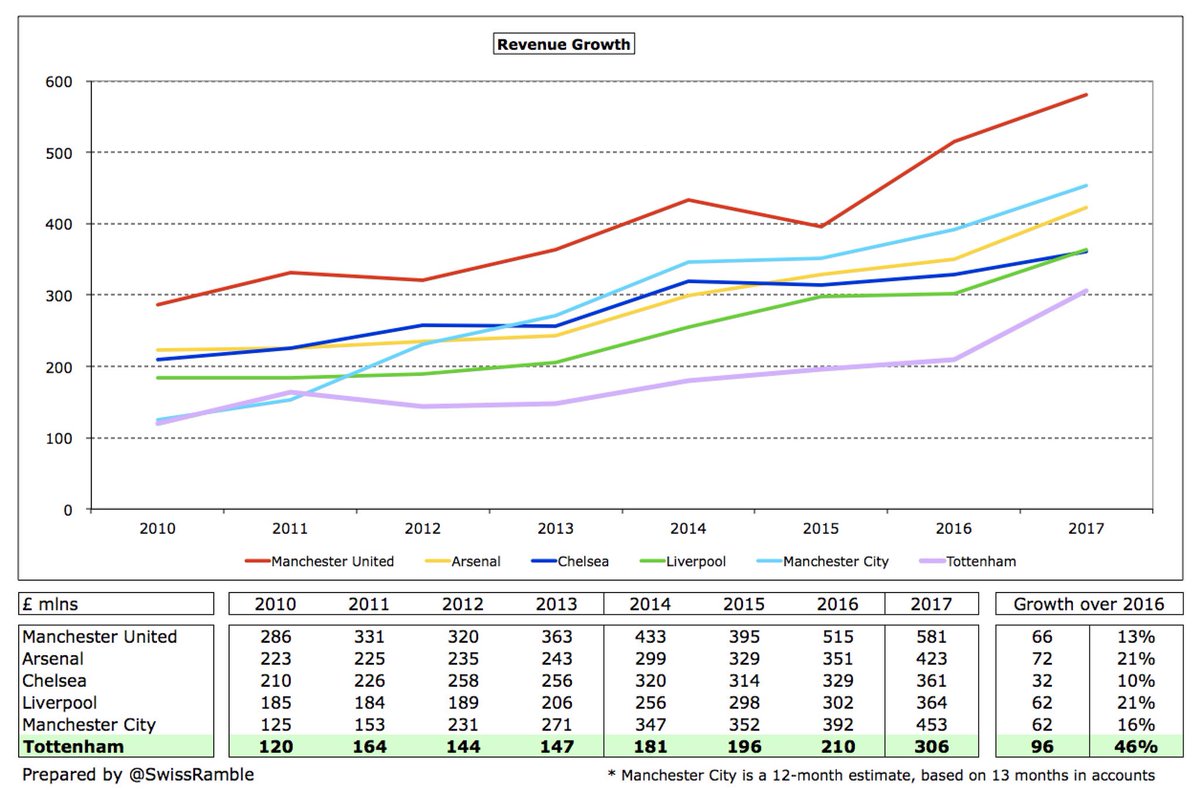

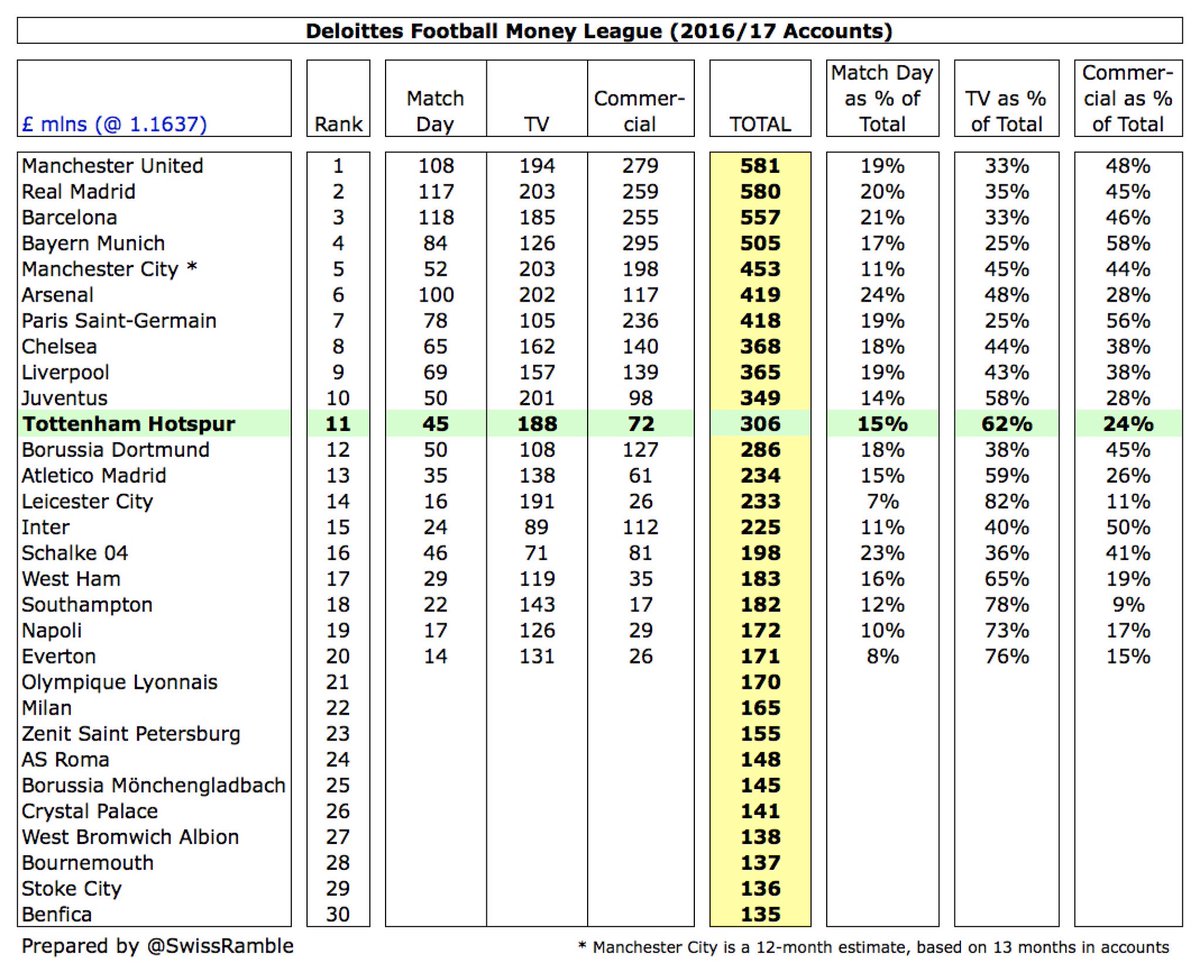

#THFC £306m revenue is still a fair way behind their rivals, e.g. #MUFC £581m are a full £275m higher,) followed by #MCFC £473m and #AFC £423m. That said, the gap to #LFC £364m and #CFC £361m has narrowed.

In fact, #THFC’s £96m (46%) revenue growth last season was much more than the other clubs in the Big Six, both in absolute and percentage terms. The next highest was Arsenal £72m (21%).

#THFC overtook Borussia Dortmund to rise one place in the Deloitte Money League to 11th, just behind Juventus. Given the increased revenue from the new stadium and more lucrative commercial deals, there is every change of them breaking into the top ten.

#THFC TV money from the Premier League increased £50m to £145m, due to the new three-year deal, boosted by finishing 2nd versus 3rd the previous season (merit payment) & being shown live 25 times against 21 in 2015/16 (facility fee). Below #MCFC & #LFC, who were shown live more.

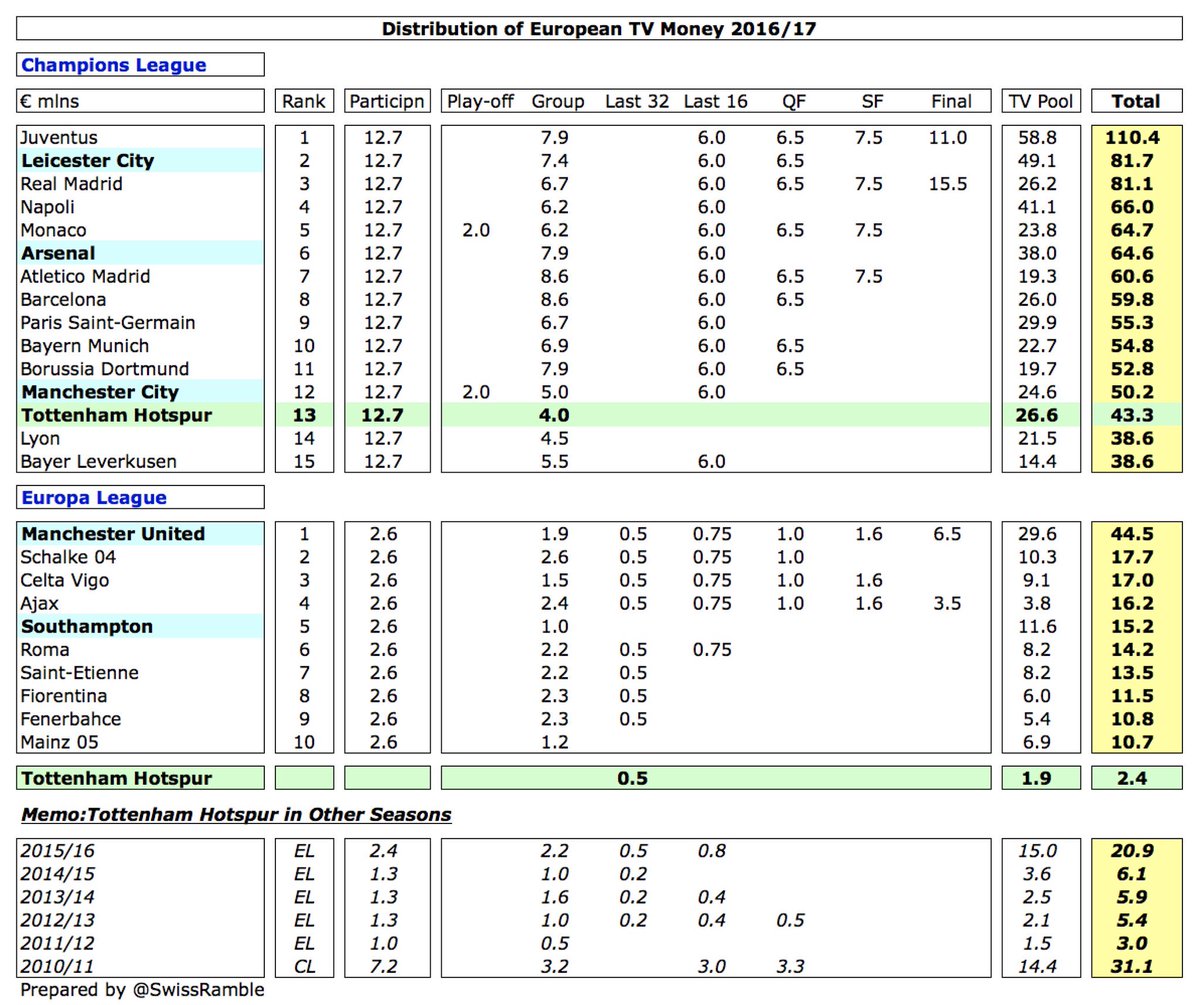

#THFC received €43m (£37m) for reaching Champions League group stage and €2m after dropping down to the Europa League last 32, where they were eliminated by Gent. The €46m total was €25m more than previous season’s €21m from Europa League.

Despite the enormous increases in Premier League distributions, European participation can still make a difference for the leading clubs. #THFC have earned €84m from Europe in the last five years, but this is much less than #MCFC €244m, #AFC €213m, #CFC €193m & #MUFC €167m.

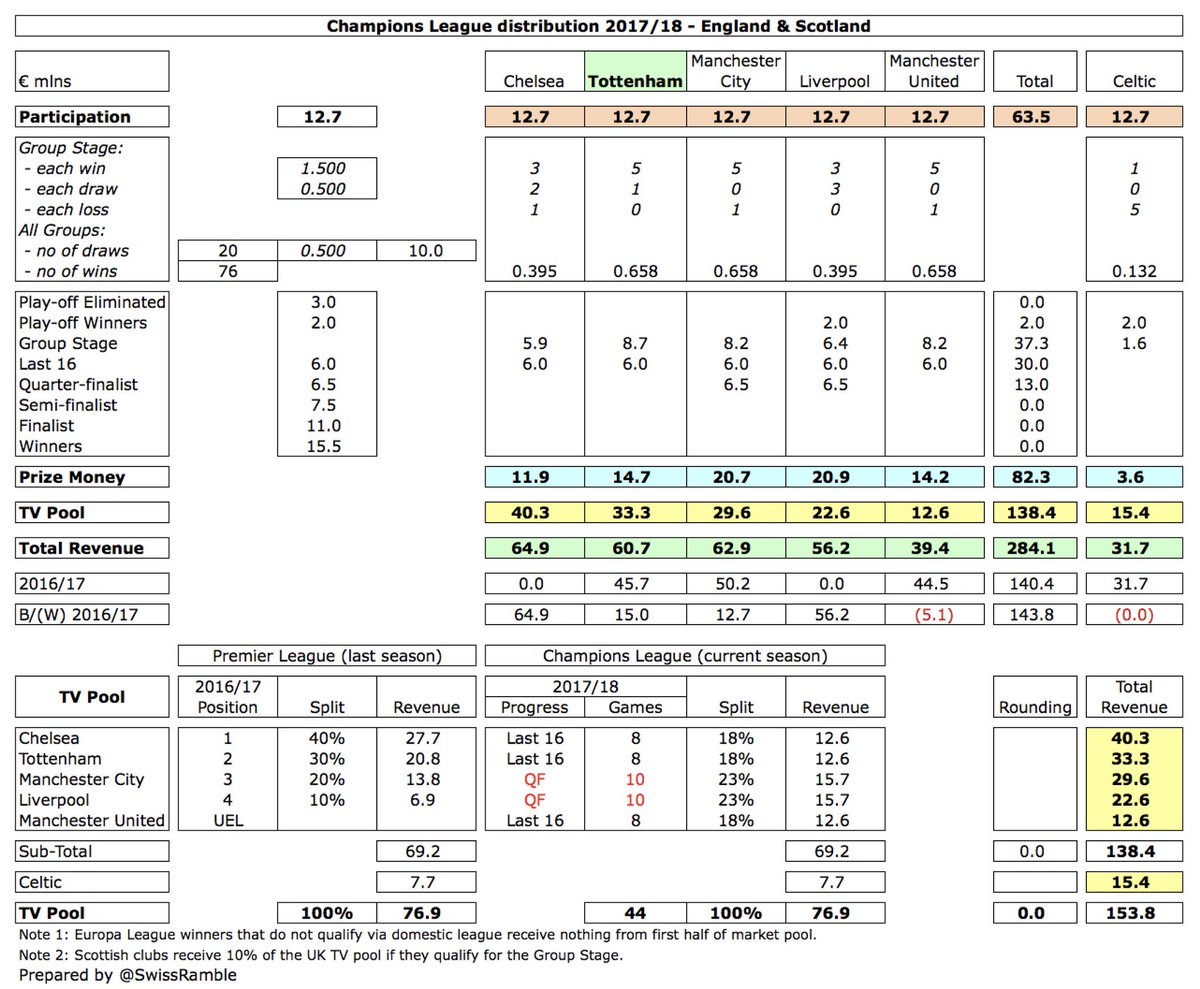

That’s why #THFC good performance in this season’s Champions League is so important. They earned €61m for reaching the last 16, €15m more than 16/17. Mainly due to way TV pool works, i.e. half depends on PL finish previous season (2nd vs. 3rd), plus better performance in group.

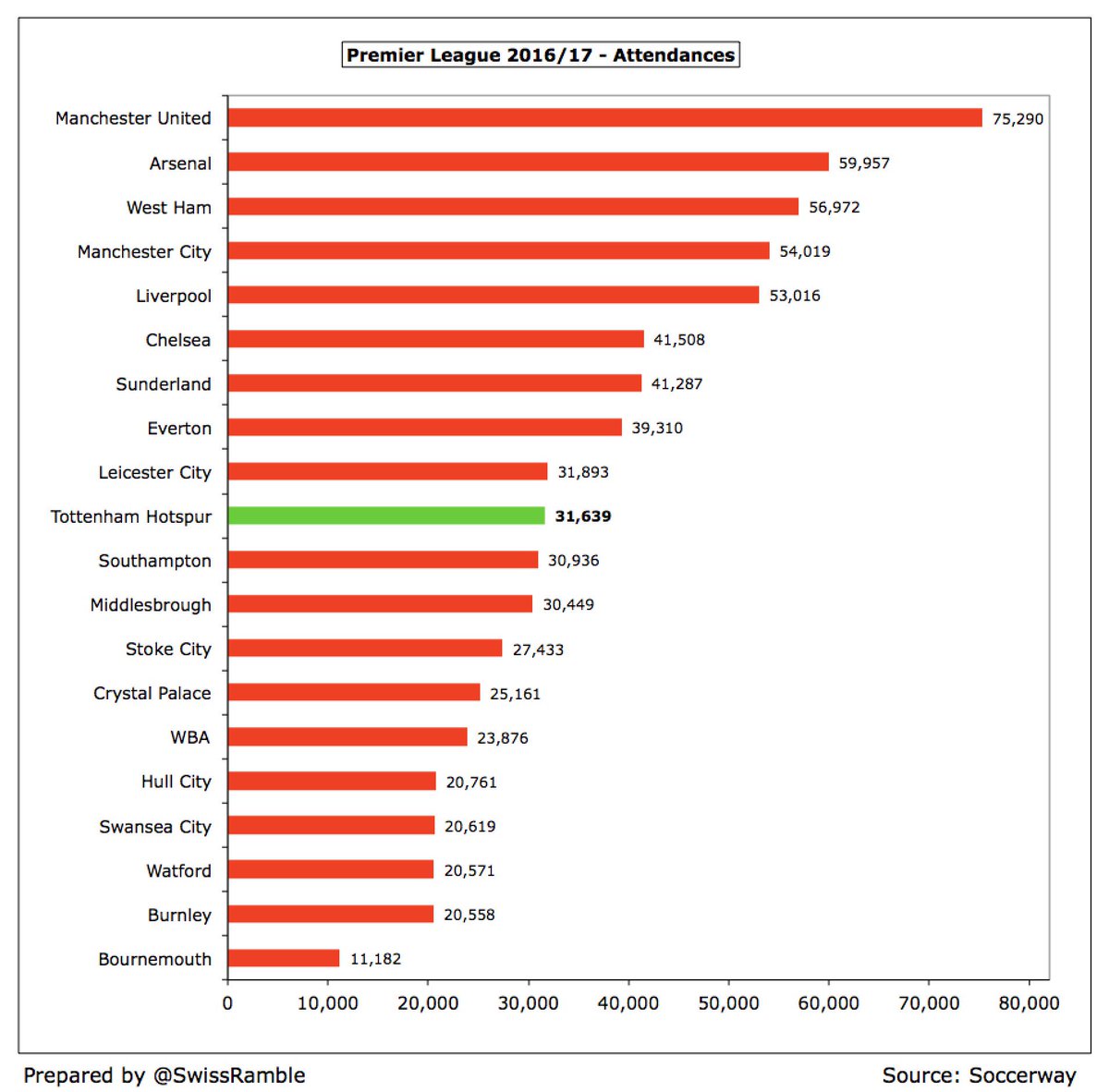

#THFC match day income rose £4m (11%) from £41m to £45m, even though capacity was reduced following demolition of the NE corner of White Hart Lane, partly due to hosting Champions League games at Wembley. However, still less than half of #MUFC and #AFC, both above £100m.

#THFC average attendance fell from 35,776 to 31,639 due to stadium work. Ticket prices were frozen in 2016/17 and are cheaper at Wembley than White Hart Lane, though there is some discontent over the pricing in the new stadium.

#THFC will have a new stadium for 2018/19 season with 62,000 capacity. Revenue should be at least £20m higher plus (probably) also naming rights. Project’s initial cost was £400m, but rose to £750m in planning application & latest reports suggest it might be as much as £1 bln.

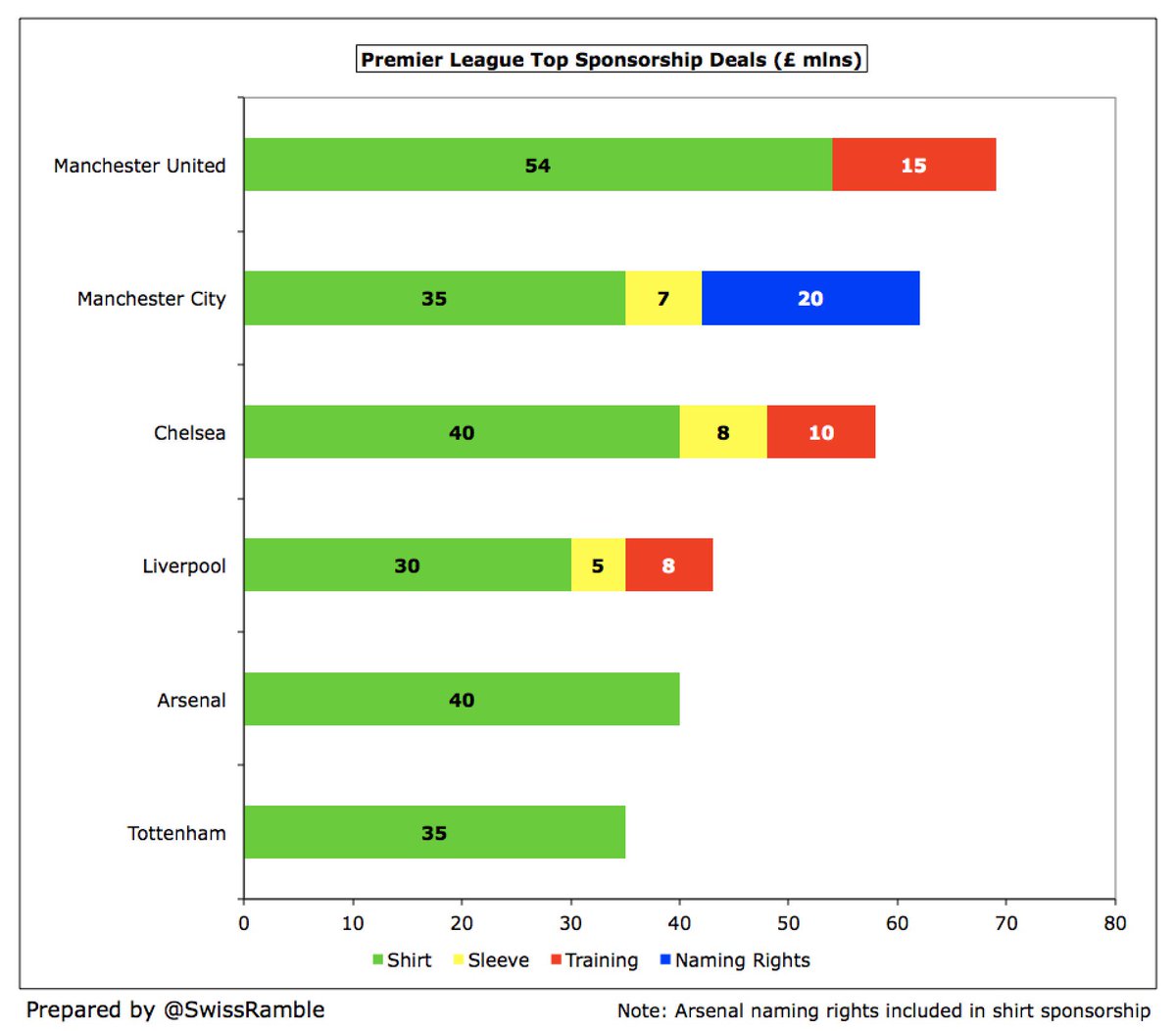

#THFC commercial revenue was up 24% (£14m) from £59m to £73m, the 6th highest in England, though still a long way below rest of Big Six, e.g. #MUFC £276m is almost 4 times as much. The facilities at the new stadium should help close the gap, e.g. NFL games & other major events.

#THFC commercial income will rise significantly in 2017/18, thanks to two major new deals. AIA shirt sponsorship has been extended to 2021/22 season, increasing from £16m to £35m, while Nike have replaced Under Armour, reportedly doubling the payment from £15m to £30m.

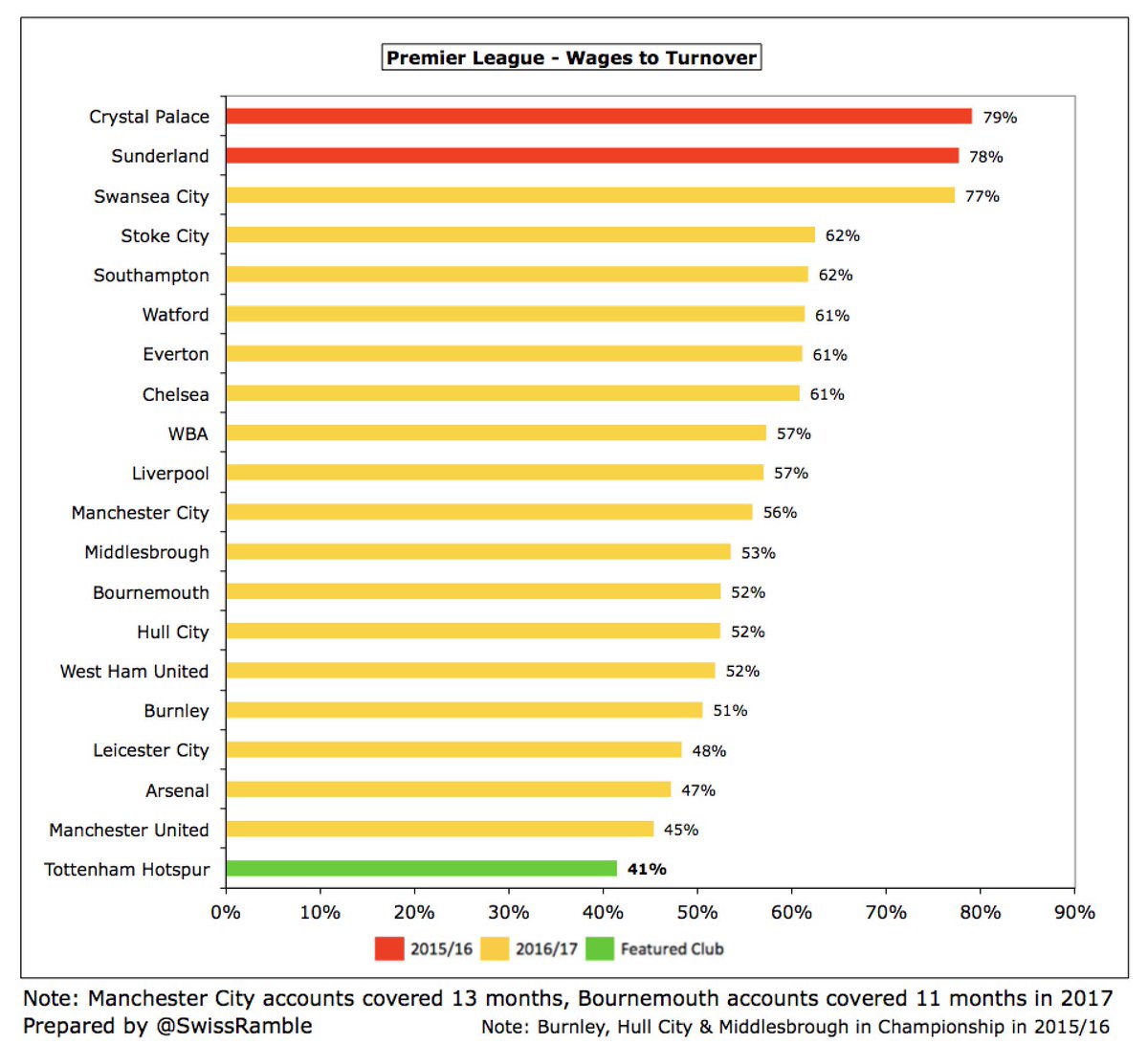

#THFC wage bill rose £27m (27%) from £100m to £127m, reducing wages to turnover ratio from 48% to 41%. Since 2013 revenue has shot up by more than 100%, while wages have only risen 32%. That said, 16/17 represents a major change, as wages had remained at £100m level for 3 years.

In fact, #THFC had the highest % growth in the Big Six in 2016/17, when three clubs saw their wage bill essentially stay flat (#CFC, #AFC & #LFC). However, the two Manchester clubs had higher absolute increases than Spurs: #MCFC £46m & #MUFC £31m.

Even after the growth #THFC £127m wage bill is still miles behind the rest of the Big Six. The closest is Arsenal, £72m higher at £199m, while Manchester United’s £264m is more than twice as much. #MCFC covers a 13 month accounting period, so would be £244m for 12 months.

As a result of higher PL TV money, all clubs have reduced their wages to turnover ratio in 2016/17, but none are lower than #THFC 41%. The next lowest are Manchester United 45% and Arsenal 47%.

One area where #THFC wages “lead the way” is directors’ remuneration, up from £4.8m to £9.0m. Chairman Daniel Levy’s pay surged from £2.8m to £6.0m, far more than Ivan Gazidis (#AFC) & Ed Woodward (#MUFC), both £2.6m. Apparently includes backdated pay rise & bonuses.

Cumulative spend on #THFC new stadium rose from £115m to £315m, while depreciation on land, buildings and equipment increased by £27m from £6m to £33m, which is more than double the next largest in the Premier League, namely Arsenal with £15m.

After two consecutive years of decreases, #THFC player amortisation increased £12m (36%) from £31m to £43m, while the club also booked a £7m player impairment charge.

Despite the increase, #THFC player amortisation of £43m is still only the 7th highest in England, even below West Ham £45m. It is around a third of big-spending #MUFC £124m and #MCFC £122m, though it will again rise in 2017/18 after this season’s purchases.

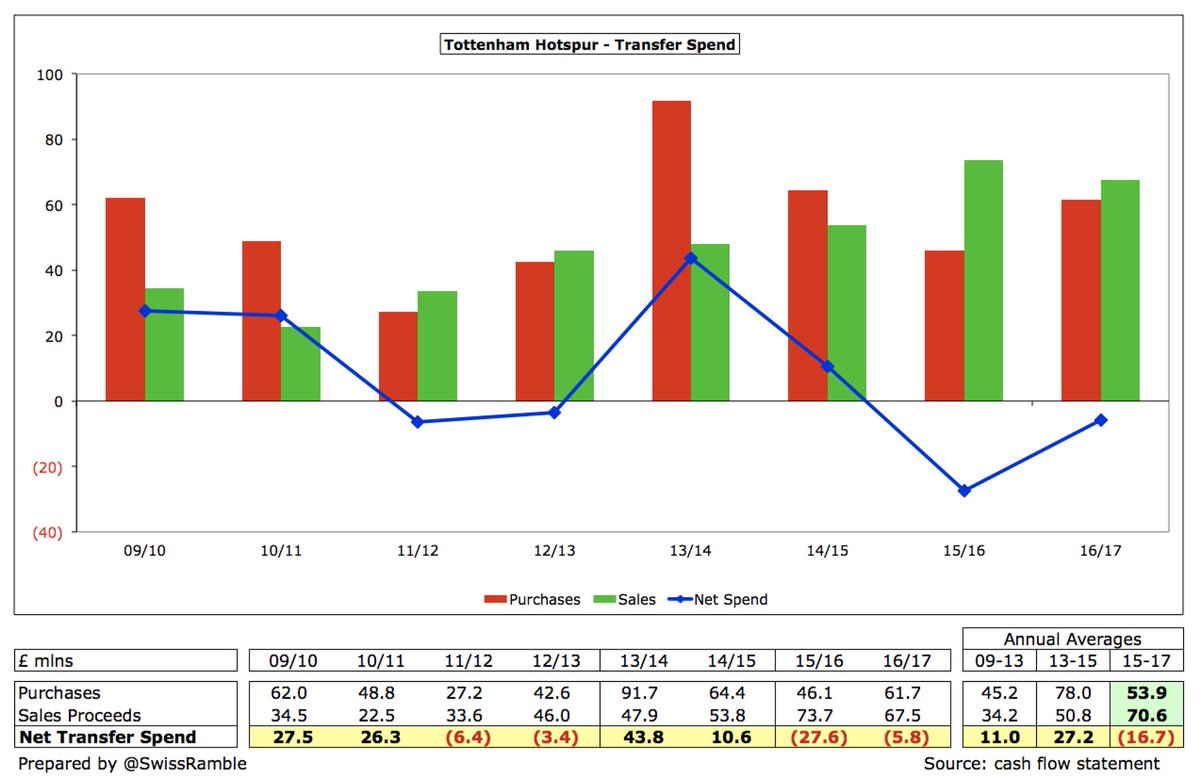

#THFC made player purchases of £74m in 2016/17 (including Sissoko, Janssen, Wanyama and N’Koudou), which might sound impressive, but is actually less than #LCFC £102m, #EFC £92m, #WHUFC £81m, as well as the usual suspects with #MUFC and #MCFC both splashing out more than £200m.

On a cash basis, #THFC averaged £17m net sales in last 2 years, compared to £27m net spend in previous 2 years, though somewhat distorted by Bale stage payments. Since the accounts closed, Spurs have bought Davinson Sanchez, Lucas, Serge Aurier, Fernando Llorente & Juan Foyth.

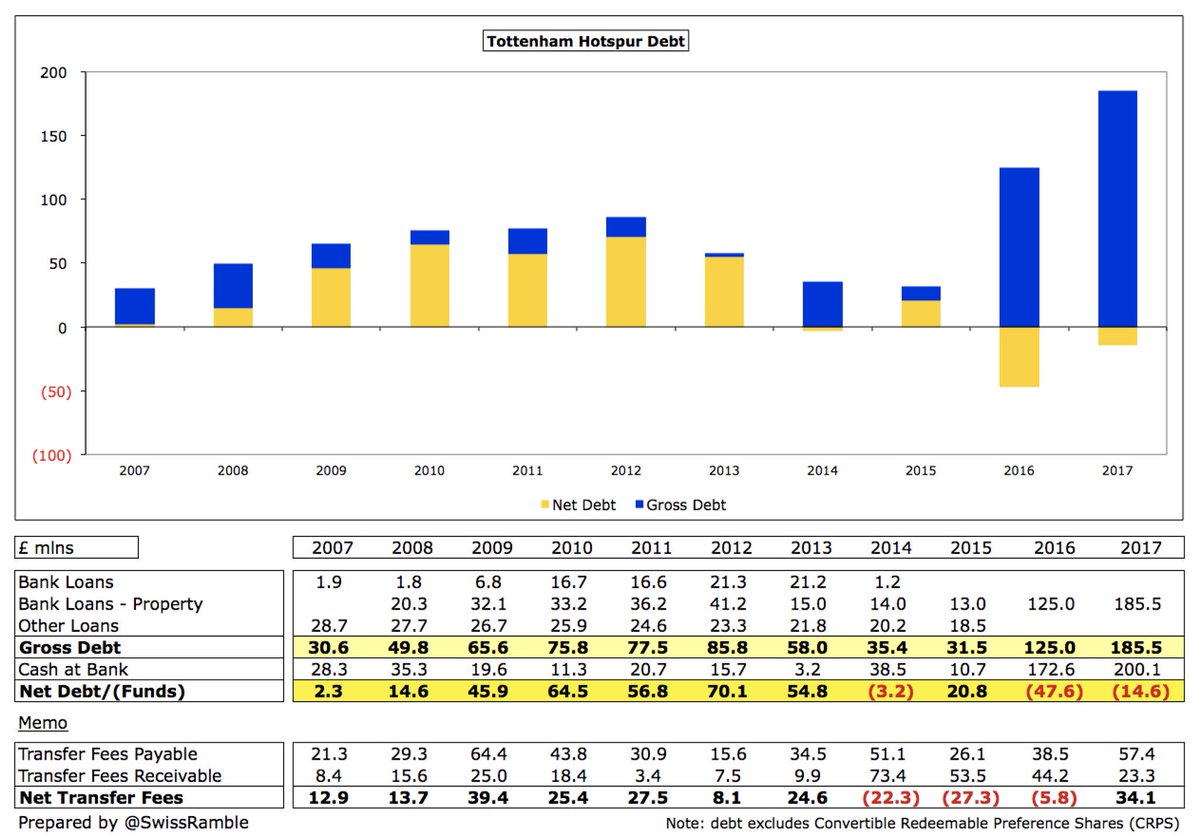

#THFC gross debt rose £60m to £185m, comprising £152m drawn against £400m facility agreed with HSBC, Goldmans & BoA for the new stadium, £23m from Investec for new training ground & £10m short-term loan from HSBC. After considering £200m cash, Spurs have £15m net funds.

#THFC £185m gross debt is 3rd highest debt in the Premier League, only behind #MUFC £503m (Glazers’ leveraged buy-out) & #AFC £227m (Emirates stadium loan) It will surely rise as the investment in the new stadium increases, which will present a major financial challenge.

#THFC paid £6m in interest last year, only really surpassed by #MUFC £20m and #AFC £13m, as #EFC £12m included £7m for early settlement of old loans. As Spurs’ debt increases, interest payments will also rise significantly.

#THFC have a cash balance of £200m, only lower than #MUFC £290m, but ahead of #AFC £180m. This is partly a result of their solid cash generation, but is a little misleading, as also due to loan advances for the new stadium development.

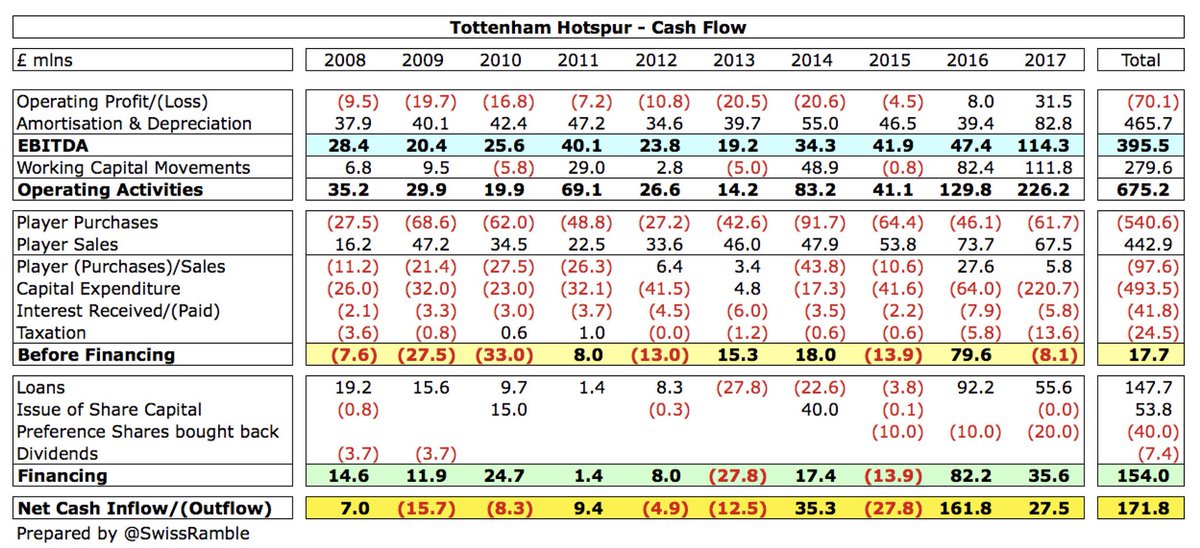

#THFC generated striking £226m cash from operations in 16/17, though half due to increase in deferred income. Cash also sourced from £56m new loans & £5m net player sales. Most spent on capex (new stadium) £221m, but also £20m preference shares buy-back, £14m tax & £6m interest.

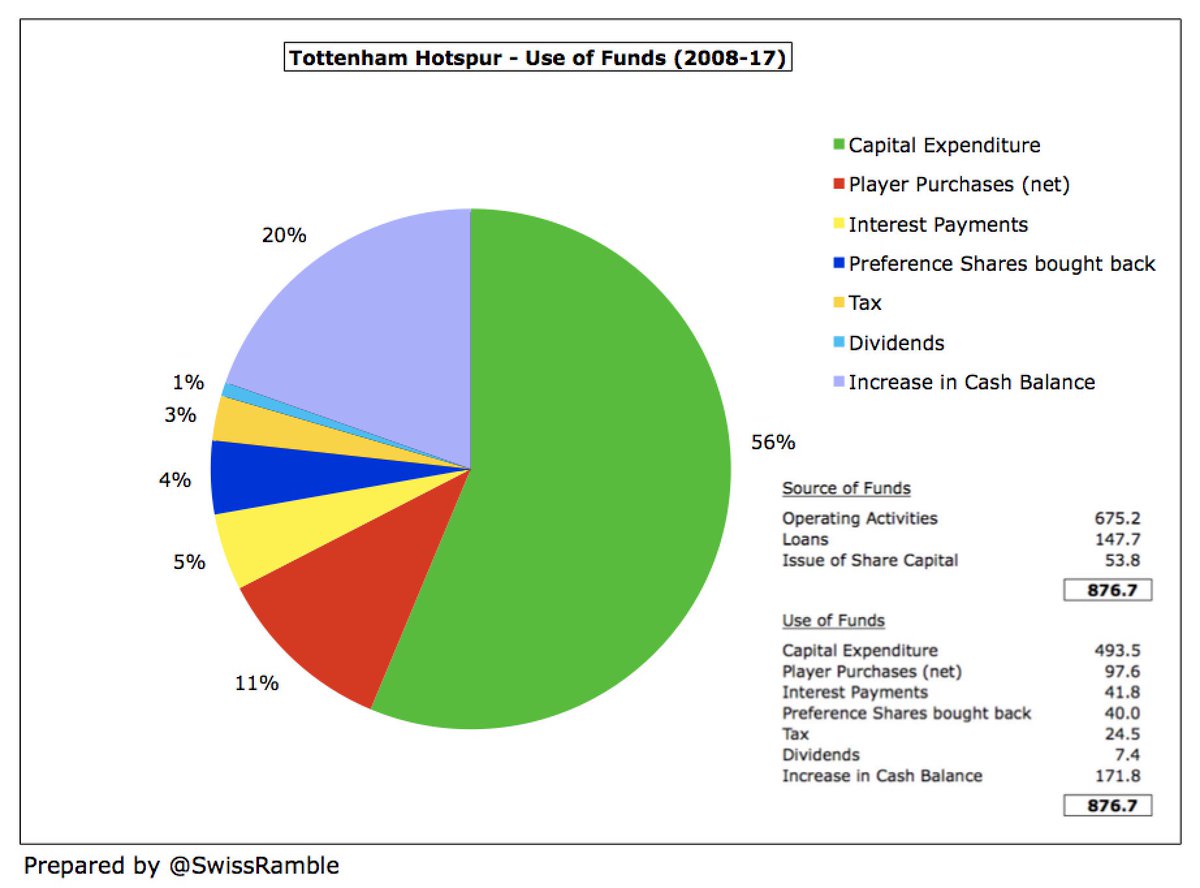

Since 2008 #THFC had £877m available cash, largely generated from own operations £675m, but also loans £148m & share capital £54m. Majority £494m invested in new stadium & training centre, £98m on players, £42m interest, £40m preference shares buyback, £24m tax & £7m dividends.

Levy underlined #THFC delicate balancing act, “We are in an historic period for the club and there is a growing sense of excitement. There will, however, be many challenges in the coming months as we near the latter stages of the construction of the new stadium and its opening.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh