Don’t worry about #Malaysia ’s #GST repeal, higher #Oil and sales tax will help. #ge14. The BN lost control of government. Dr. #MahathirMohamad stated that he will repeal the goods and services tax (GST) and replace it with the sales and services tax (SST). Why? @chedetofficial

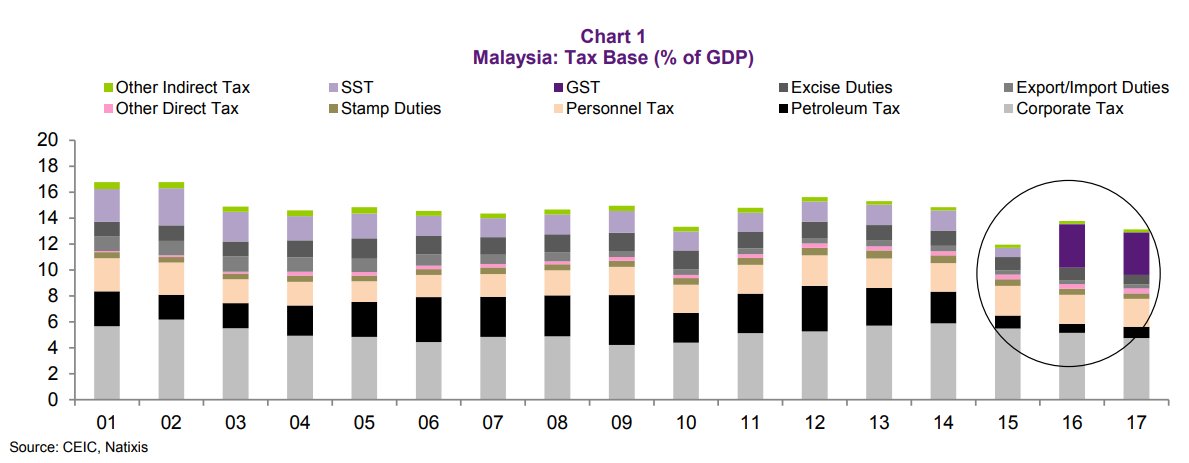

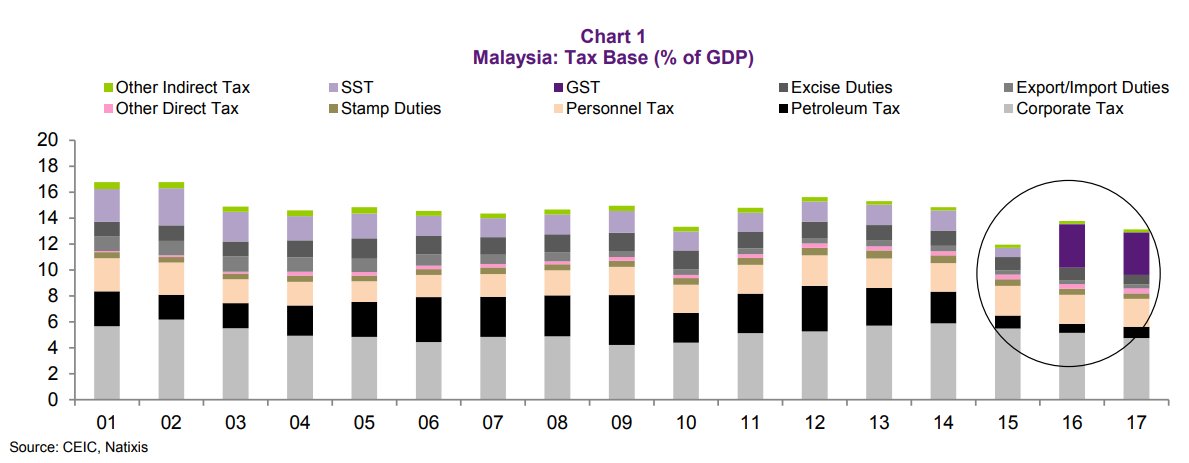

#Najib passed the #GST to offset declining revenue as dependence on #oil backfired when oil prices collapsed. It's a tax on the final consumer & generates more tax revenue than the SST. In 2017, GST was 25% of the total tax revenue and 3.3% of GDP - key reason people are negative

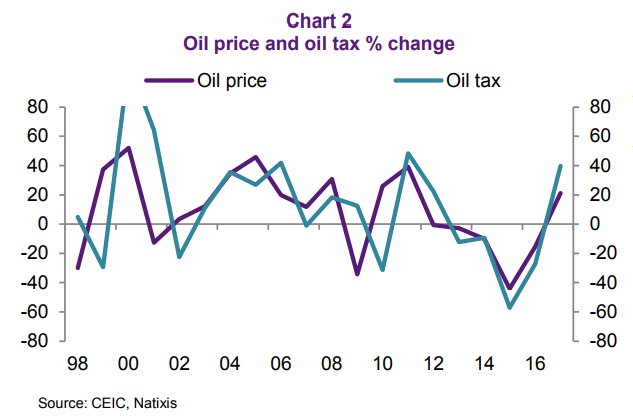

But what's key is the rise of oil, which raises oil tax. So #GST becomes less key! Look at the relationship b/n oil and oil tax. Very strong! We assume oil rises to 73 (basically now) & 10% increase of subsidy, & SST revenue (less than GST). Let's look at what happens to fiscal

U can see in purple that #GST is pretty new & black columns that oil rev declined massive & pink that SST was replaced w/ GST. Assuming SST comes back, oil only contributes little but a bit more, we get the deficit 3.7% of GDP in 2018 from 3.1% in 2017. Not bad. #GE14 #malaysia

#ringgit got sold off (NDF) & #Malaysian equity got sold off (futures) on worries & #uncertainty (btw, uncertainty always exists but b/c this is the first time the #BarisanNasional actually lost a gov). Should u worry about SST killing competitiveness of firms? Nope. Here's why!

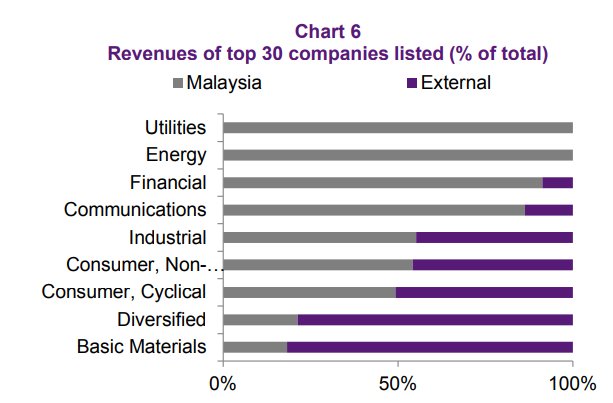

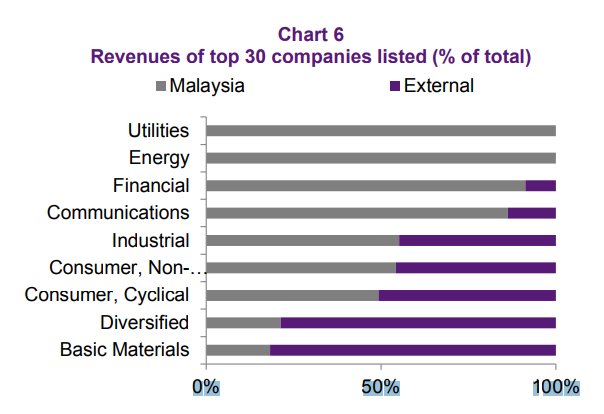

What's the diff b/n #GST & SST? GST is a tax on consumer (hence lost election) & SST is levied on the producers (indirect tax on consumer if prices go up). Some argue that the SST will curb firms’ competitiveness and will hurt #Malaysian exporters. We analyzed the top 30 largest

#Malaysian firms are not externally exposed. External revenue only makes up 31% of earnings. There are three sectors exposed to external revenue, and that is basic materials, diversified and consumer cyclical. Most #Malaysian firms are very domestic oriented. #GE14 So don't worry

We don't expect the SST to materially impact #Malaysian exporters’ competitiveness or the econ. The repeal of #GST only marginally negative for fiscal, & will be a boon for consumers, who have been upset that they bear the burden of poor fiscal management voted against it #GE14

• • •

Missing some Tweet in this thread? You can try to

force a refresh