Middlesbrough’s 2016/17 financial results covered their first season back in the Premier League since 2008/09, but it ended in disappointment with relegation to the Championship and the dismissal of manager Aitor Karanka in March. Some thoughts in the following thread #Boro

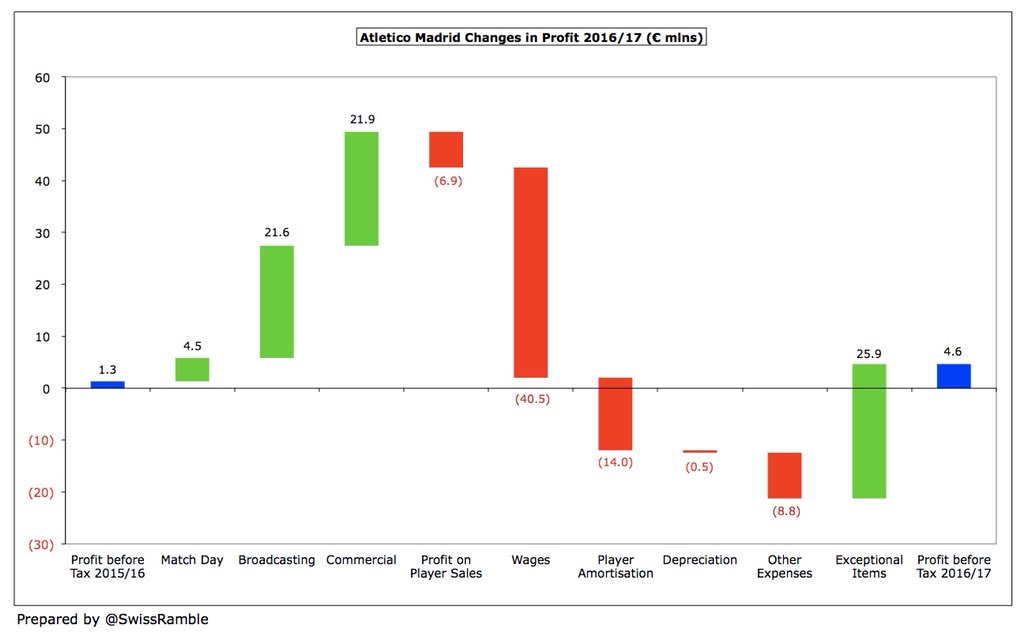

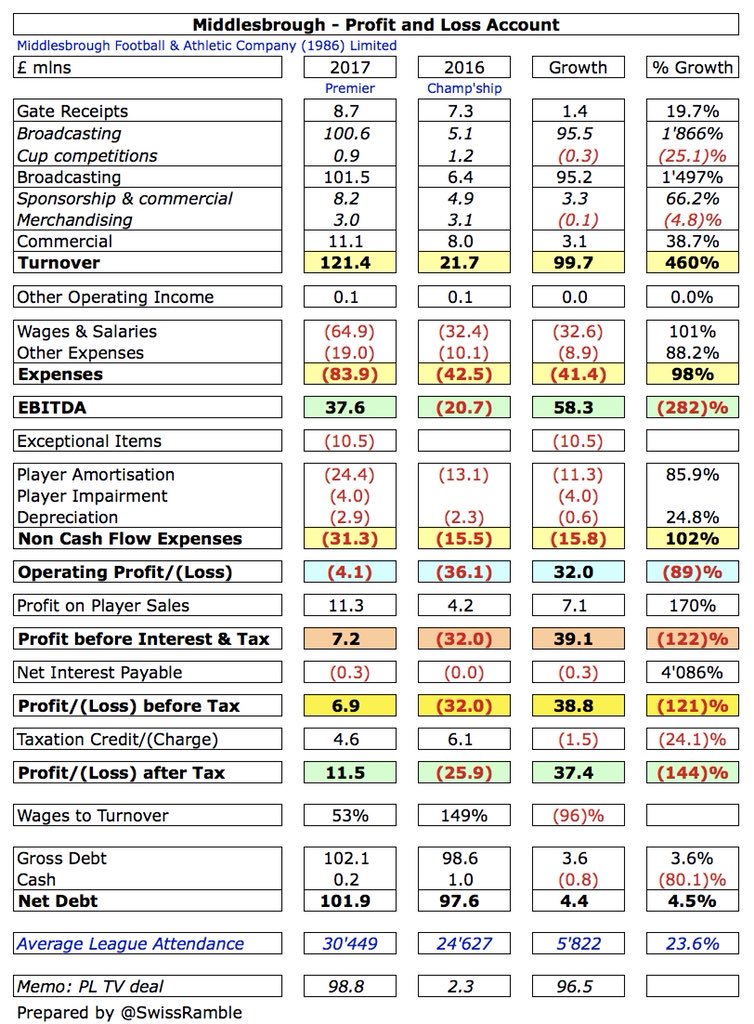

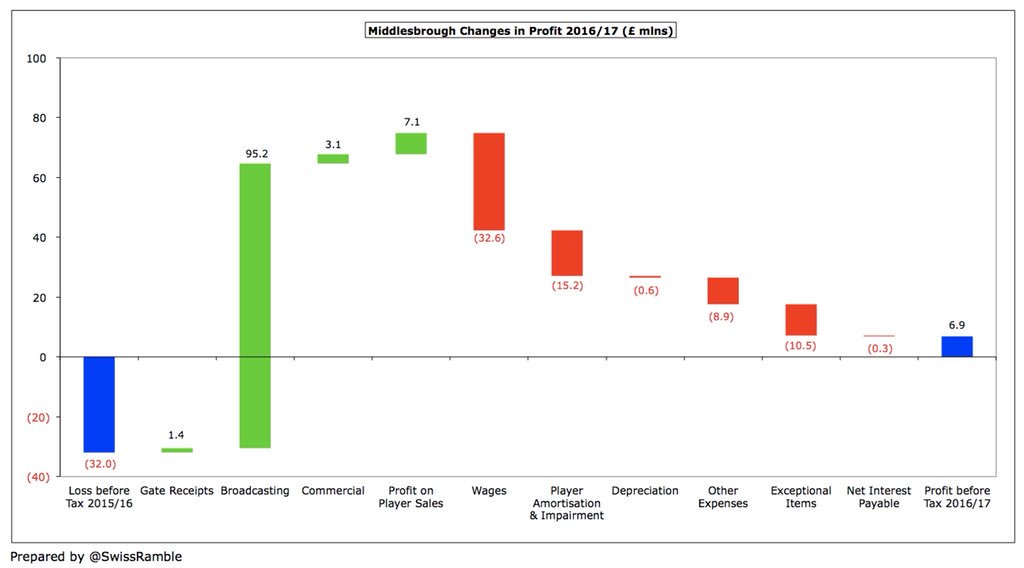

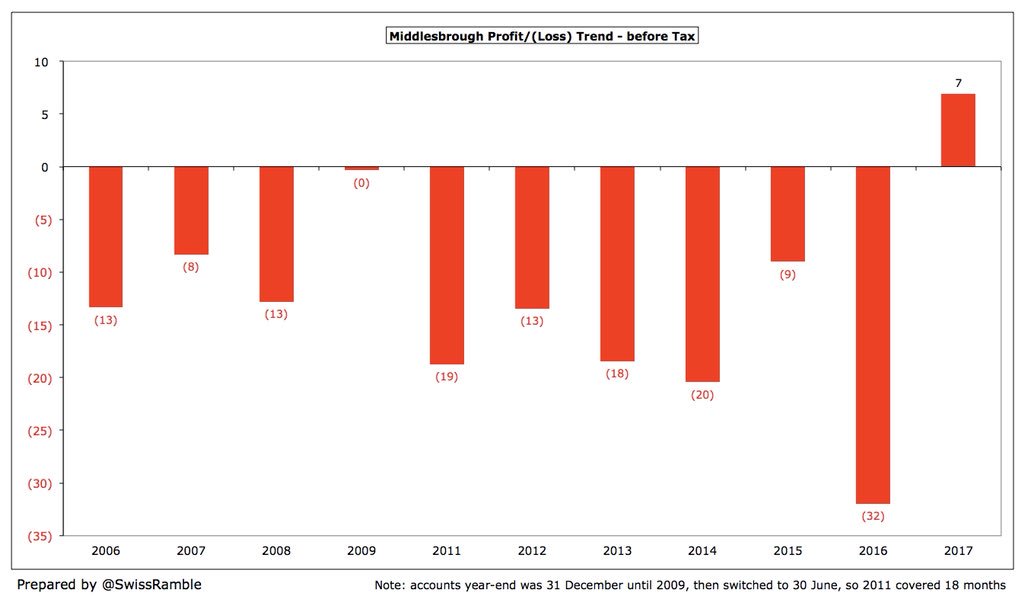

Following promotion to Premier League #Boro converted pre-tax £32.0m loss to £6.9m profit, as revenue increased by £100m to a record £121m and profit on player sales was up £7m to £11m. After tax, profit was £11.5m, compared to £25.9m loss in 15/16, thanks to a £4.6m tax credit.

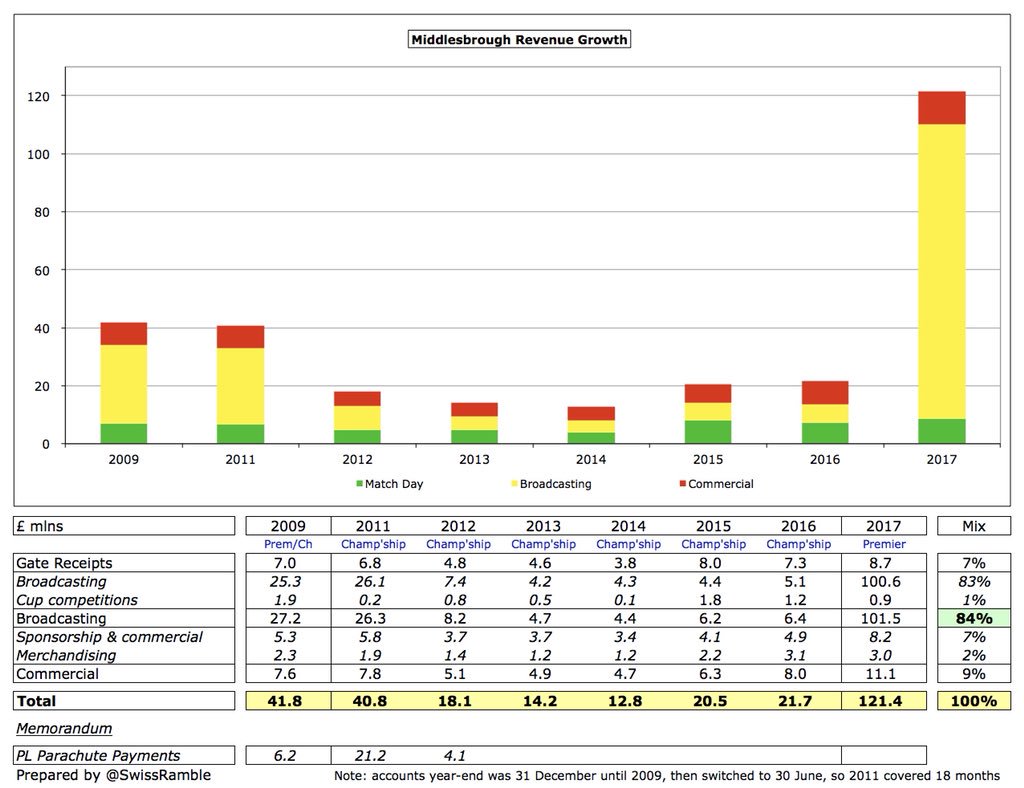

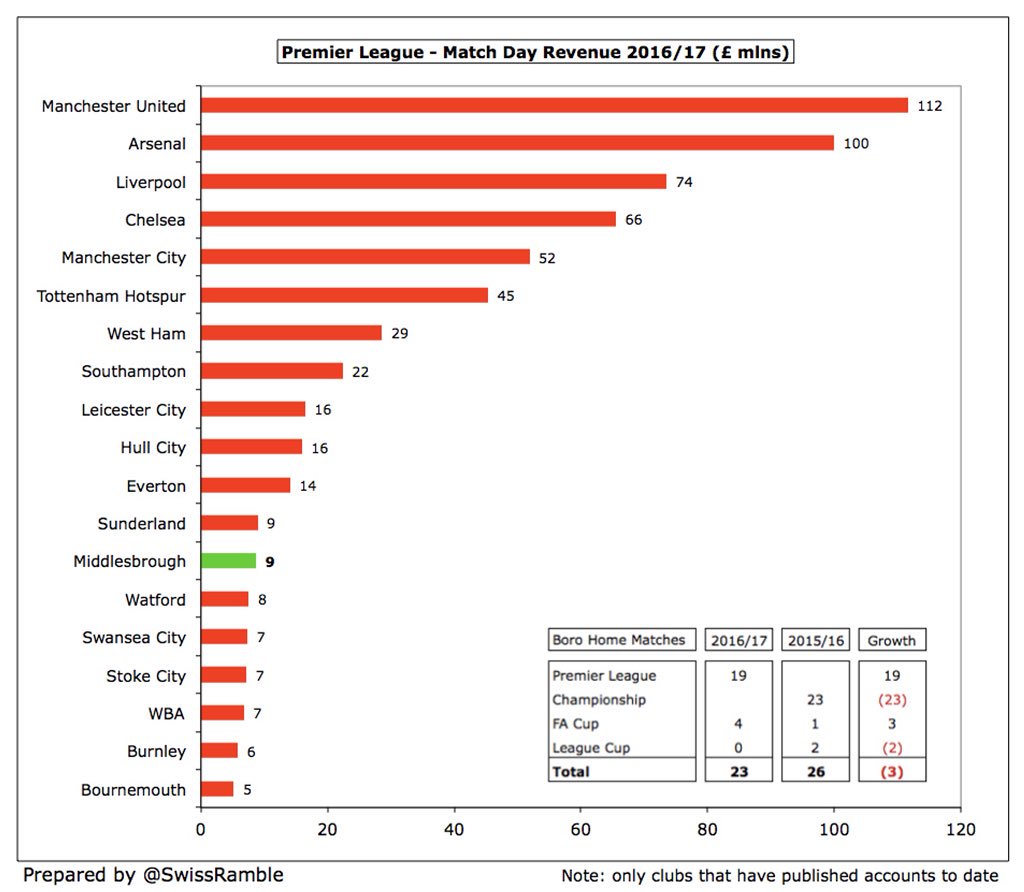

#Boro £100m revenue growth was very largely driven by broadcasting’s £95m increase to £102m, due to the much higher money in the Premier League (plus first year on new deal), while commercial also increased £3.1m (39%) to £11.1 m and gate receipts were £1.4m (20%) up at £8.7m.

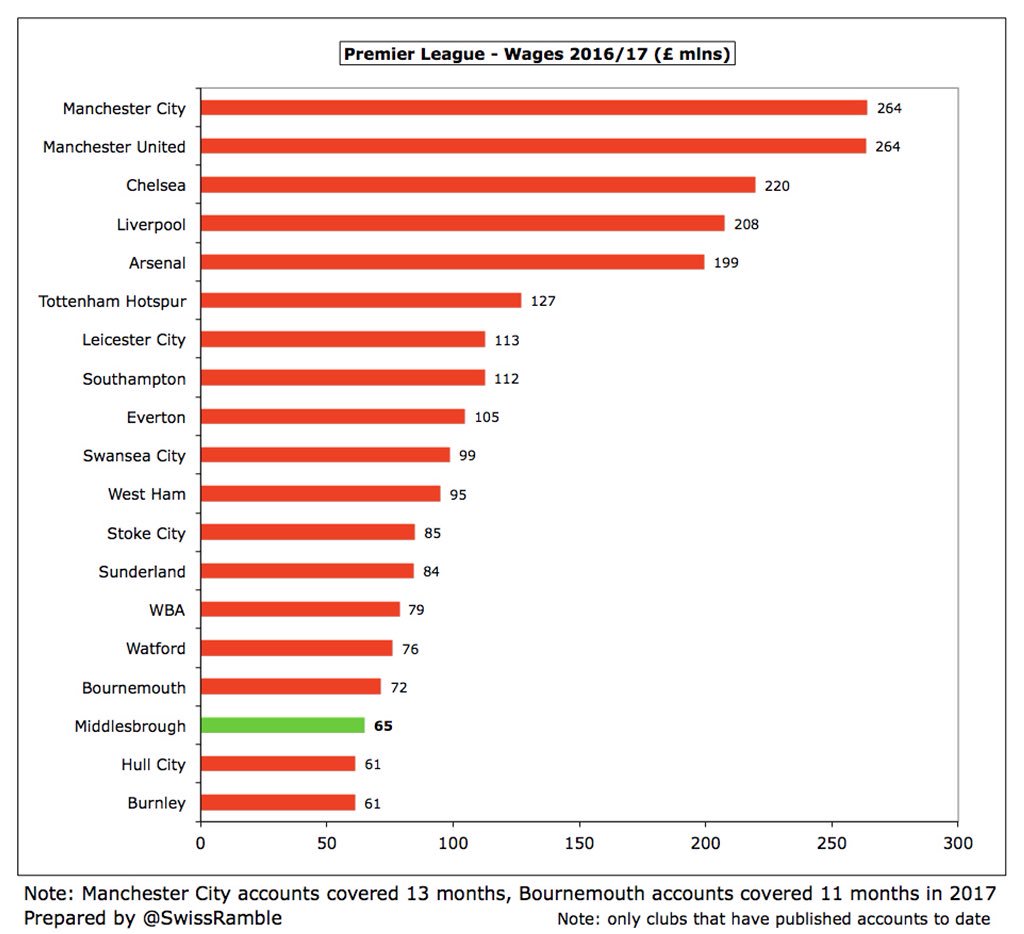

However, #Boro wage bill doubled, rising £33m to £65m, while player amortisation/impairment was up £15m to £28m and other expenses were £9m (88%) higher at £19m. Also £10.5m unexplained “exceptional payroll related charges”, presumably including severance payments to Karanka.

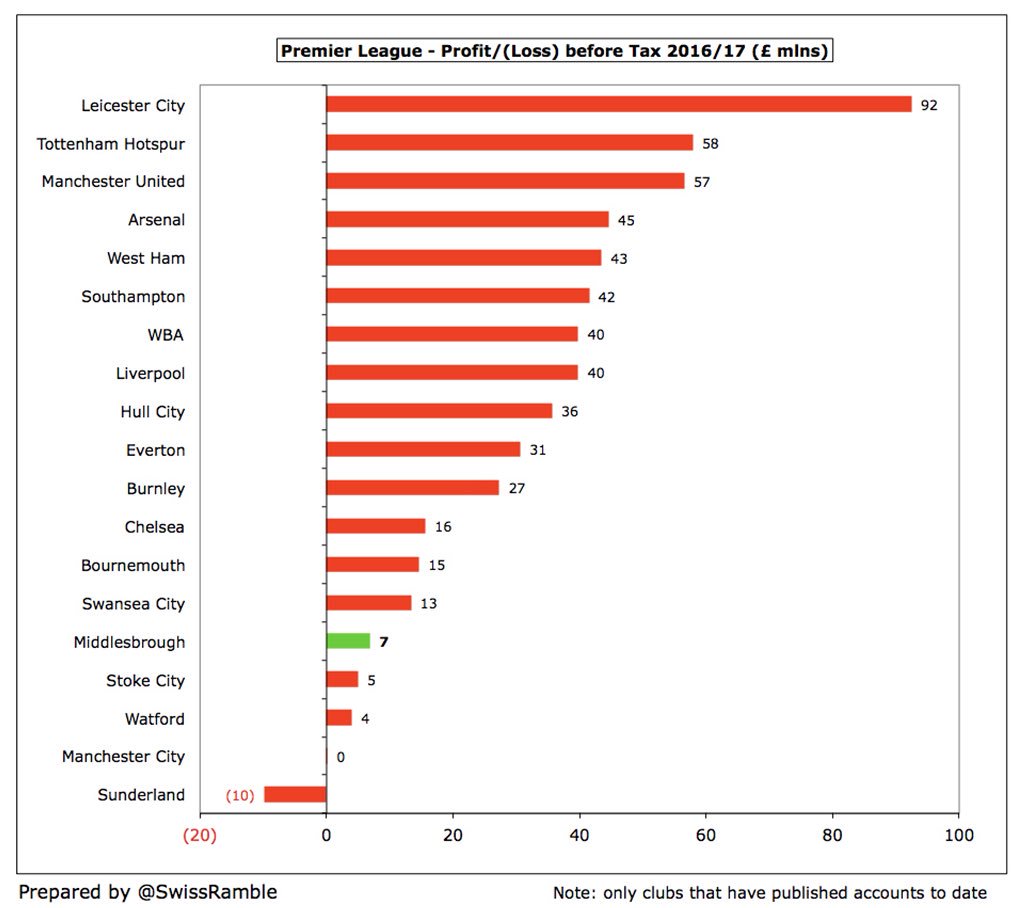

#Boro £7m profit was one of the smallest in the Premier League and lower than the other promoted clubs: Hull £36m, Burnley £27m. All clubs except Sunderland reported profits, thanks to the combination of a spectacular new TV deal plus Short Term Cost Control (FFP) regulations.

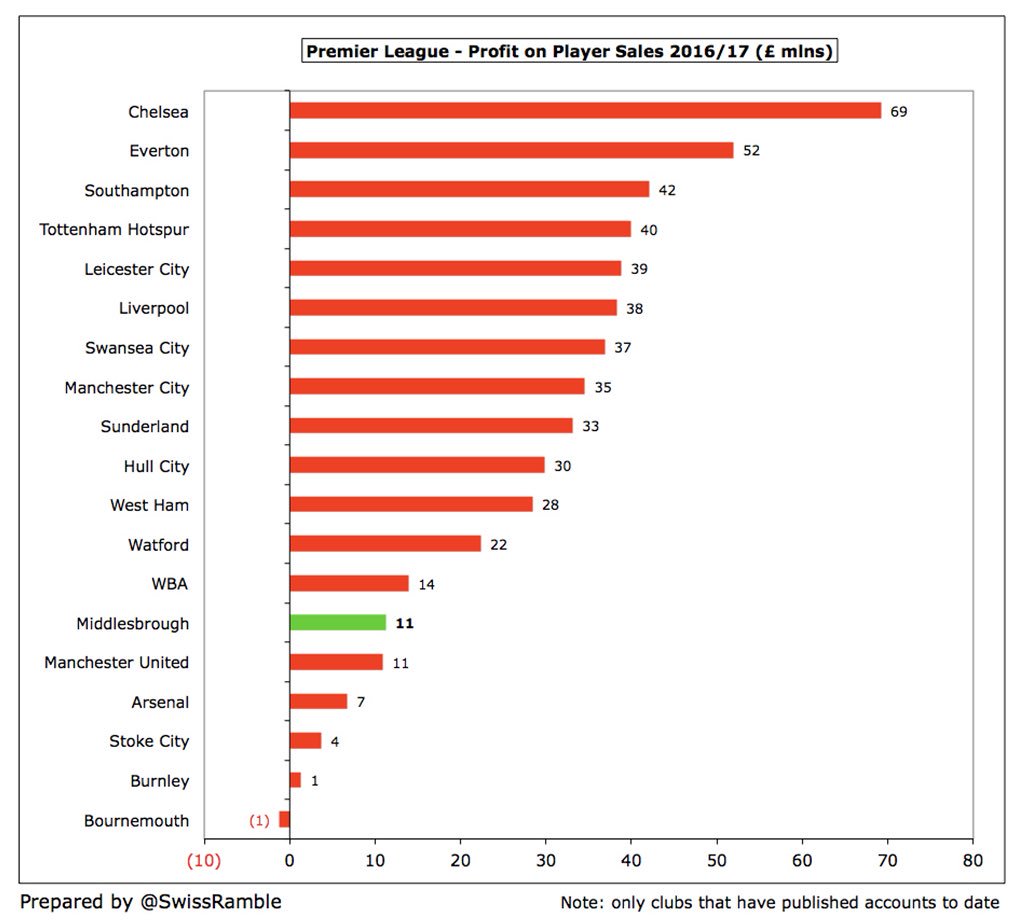

Similarly, #Boro £11m profit on player sales was towards the lower end of the Premier League, despite being £7m higher than previous season. Included transfers of Adam Reach to Sheffield Wednesday, Albert Adomah to Aston Villa, David Nugent to Derby and Emilio Nsue to Birmingham.

2016/17 was first time that #Boro had made a profit since 2005, though very nearly broke-even in 2009. Since then, they accumulated £112m of losses in the Championship. They really “went for it” in 2015/16, resulting in a record £32m loss, though this included promotion bonuses.

#Boro have not made much from player sales (only £14m in 5 years before 16/17). However, should generate big money in 17/18 with sales of de Roon (Atalanta), Rhodes (#SWFC), Ramirez (Sampdoria), Forshaw (Leeds), Espinosa & Stuani (Girona), Christie (Fulham) & Fischer (Mainz).

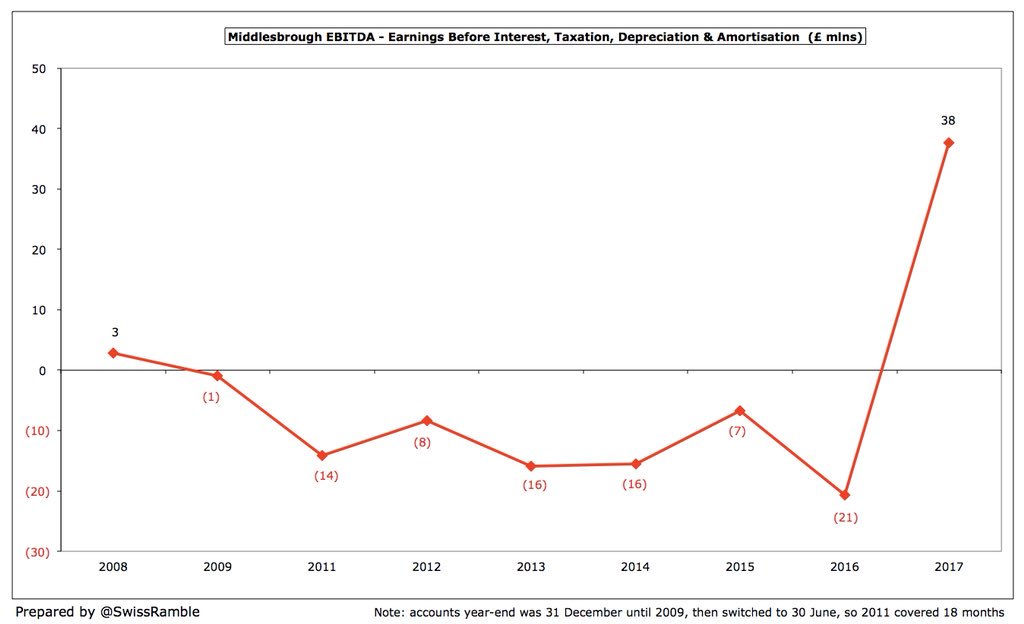

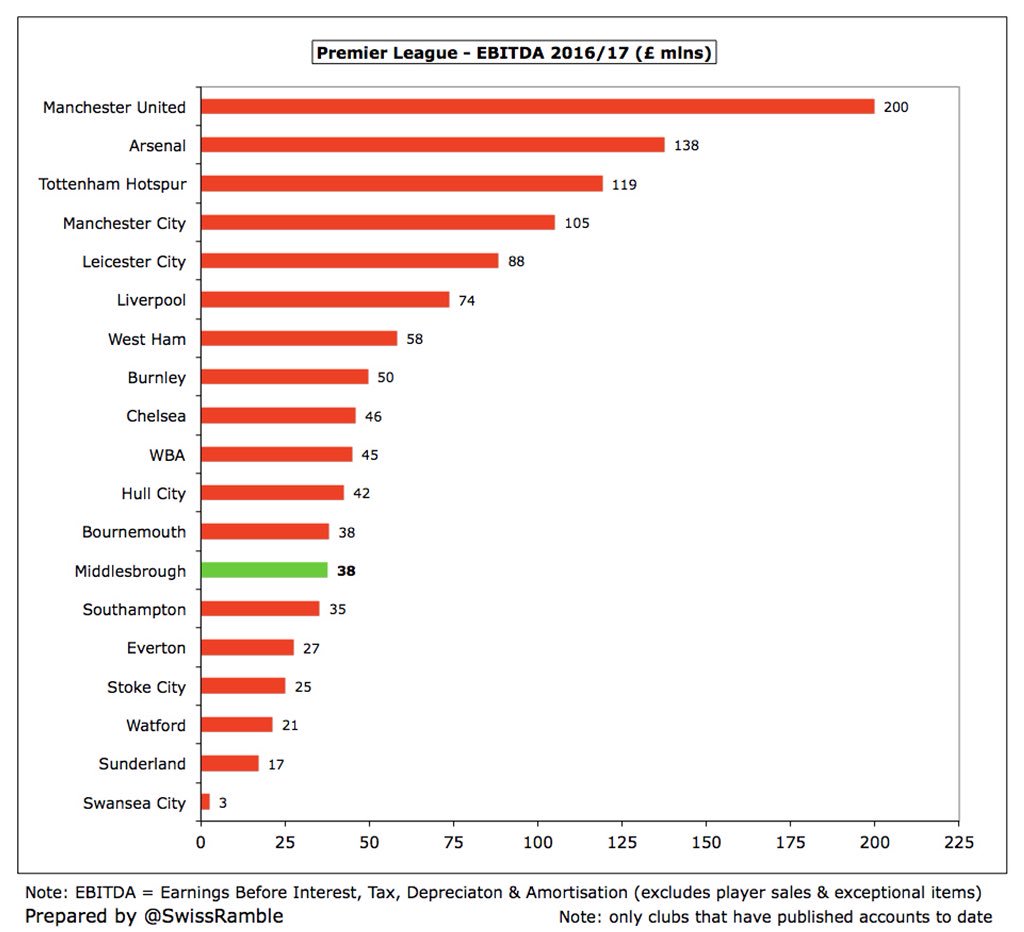

#Boro EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which can be considered a proxy for cash operating profit, as it strips out player sales and once-off items, has been consistently negative in the Championship, but rose £59m to £38m in the Premier League.

Following this growth, #Boro EBITDA of £38m was ahead of Premier League stalwarts like Southampton £35m and Everton £27m, though it was lower than the other promoted clubs: Burnley £50m and Hull City £42m.

#Boro £121m revenue is £80m higher than last time they were in the Premier League. Vast majority of this growth (£75m) has come from TV, which now accounts for 86% of total revenue. Growth in gate receipts and commercial was negligible. I estimate 17/18 revenue will be £60m less.

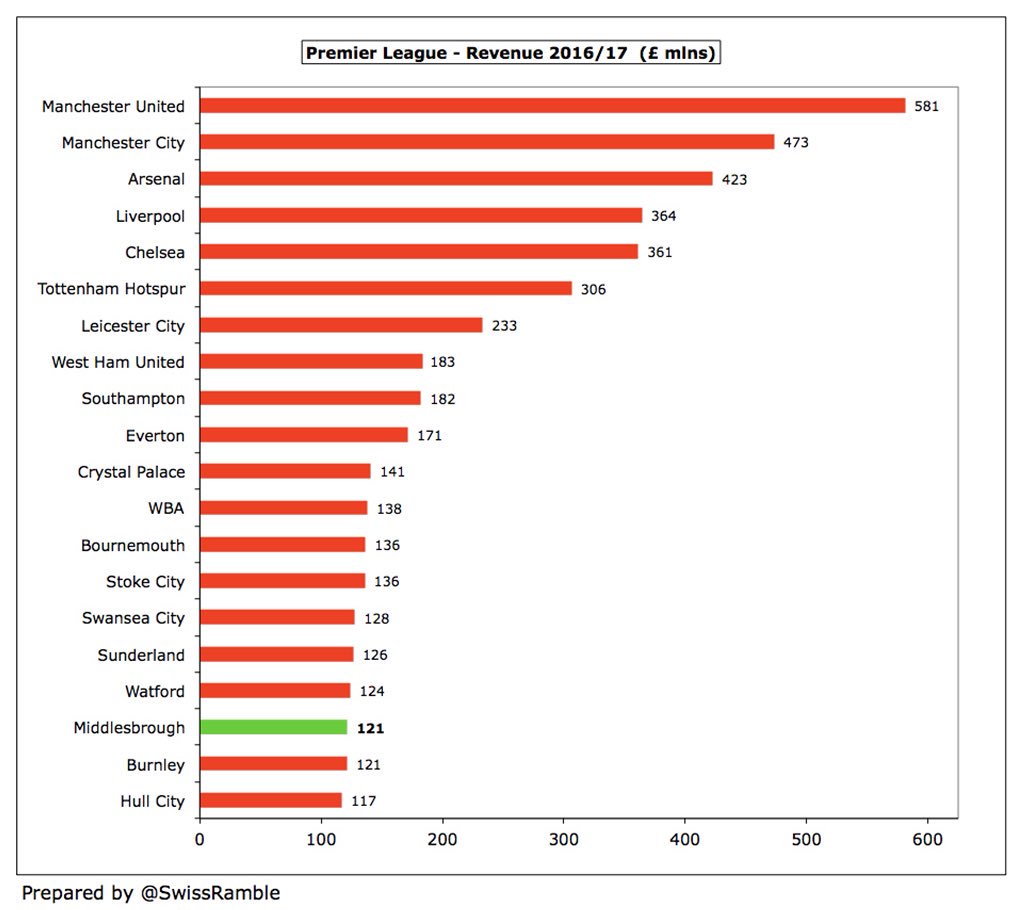

#Boro had the 3rd lowest revenue (£121m) in the Premier League, so from that perspective relegation should not have been a great surprise. They did actually have the highest revenue of the three promoted clubs, ahead of Burnley £121m and Hull City £117m.

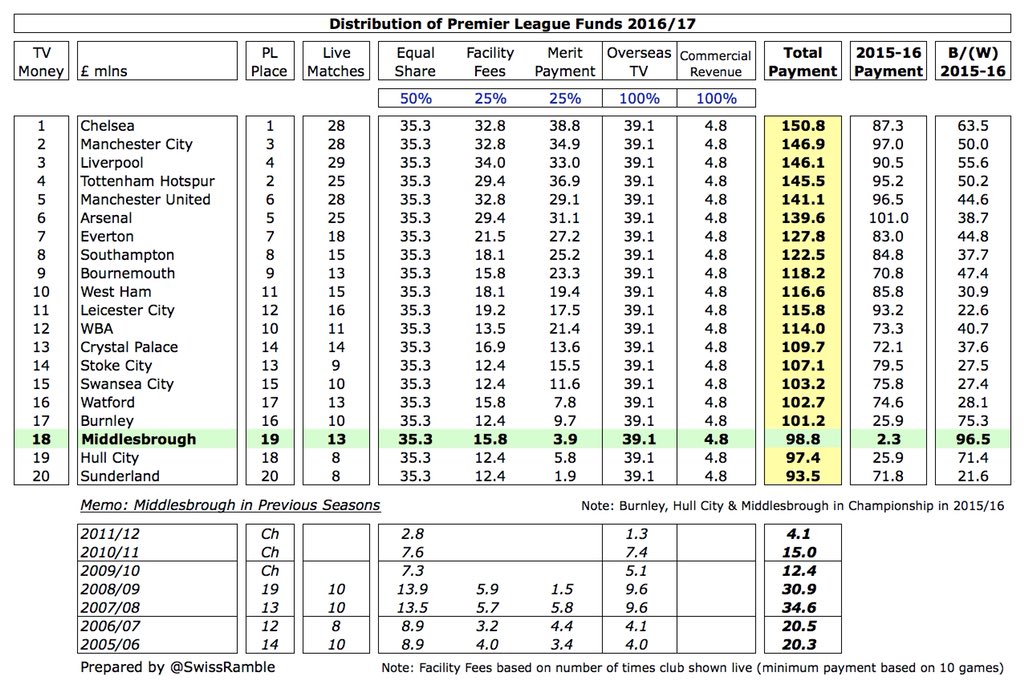

#Boro received £99m TV money from the Premier League, though this was restricted by finishing 19th (lower merit payment). On the other hand, their facility fees were boosted by being shown live 13 times, more than 6 other clubs.

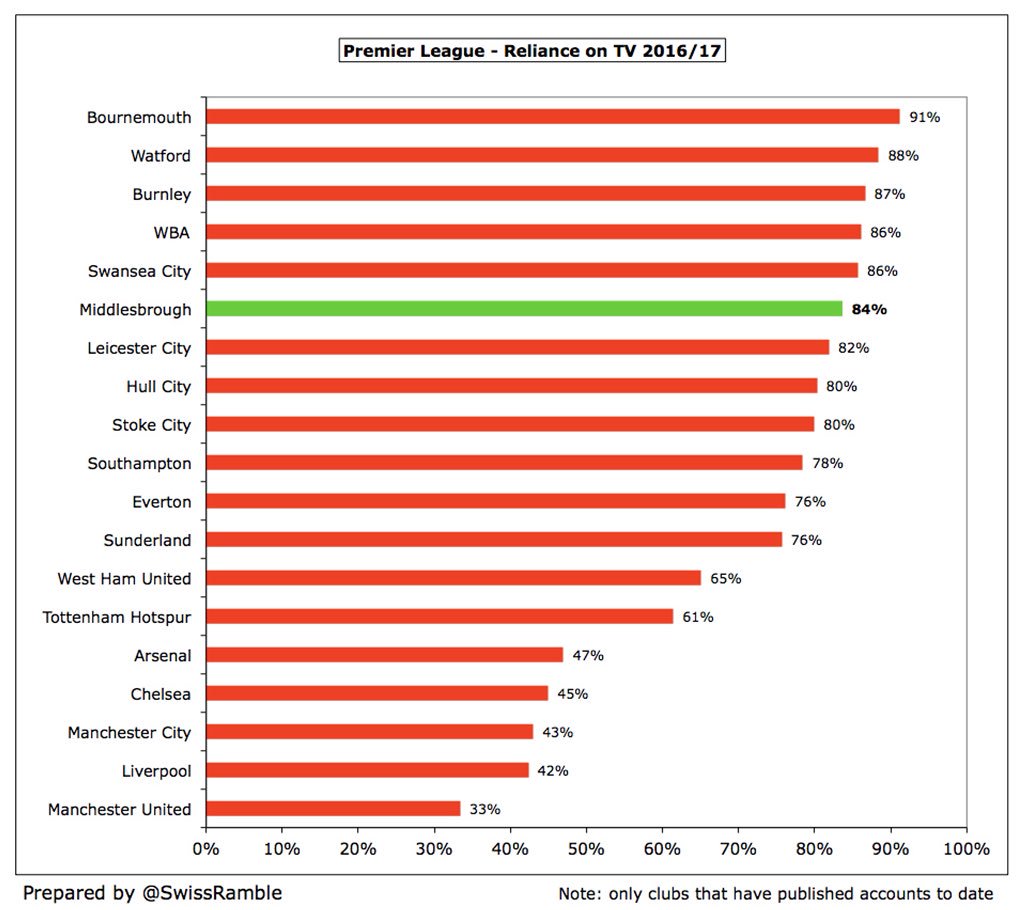

Even though a striking 84% of #Boro revenue came from TV, this level of dependency is far from unusual in the Premier League. No fewer than 5 clubs were more reliant on this revenue stream: Bournemouth, Burnley, Watford, WBA and Swansea City.

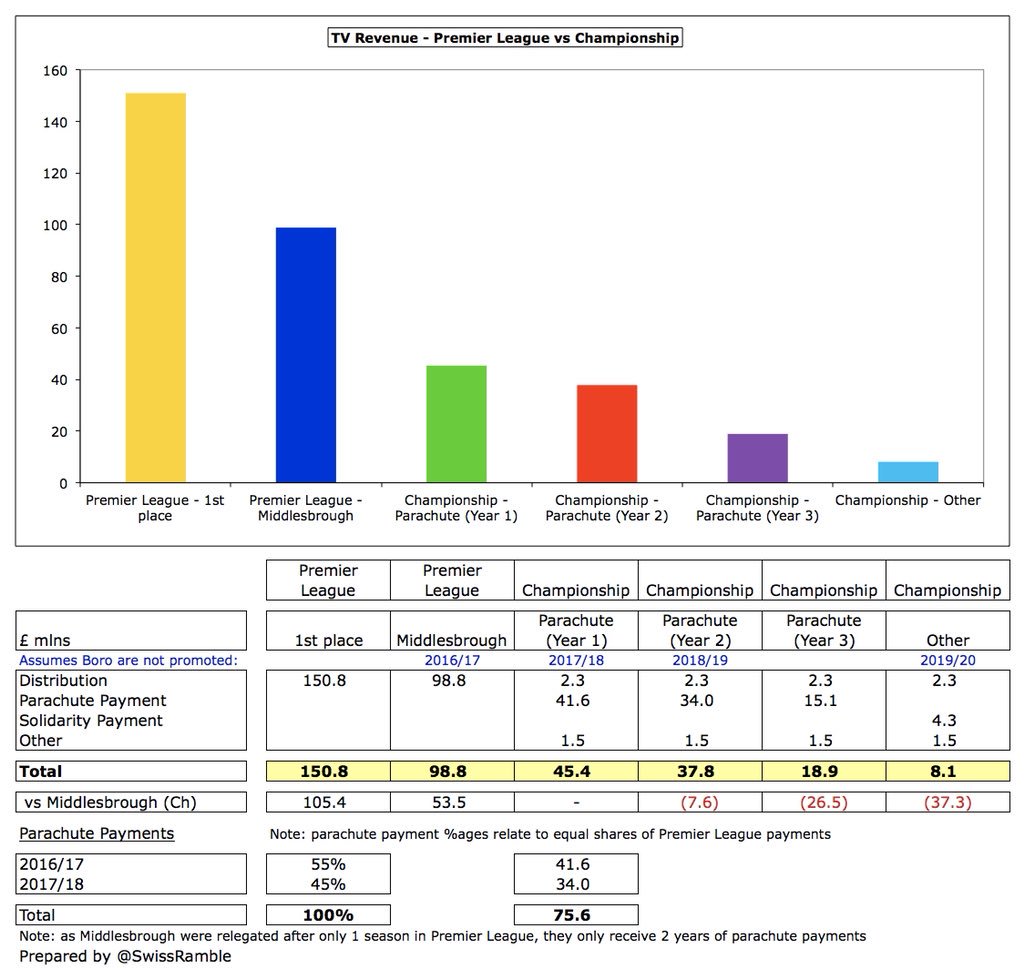

#Boro TV revenue will fall significantly in 17/18 from £99m to an estimated £45m, despite a £41m parachute payment. However, this was significantly higher than the £8m that most Championship clubs averaged. 18/19 will see a further £7m fall to £38m, as parachute lower in year 2.

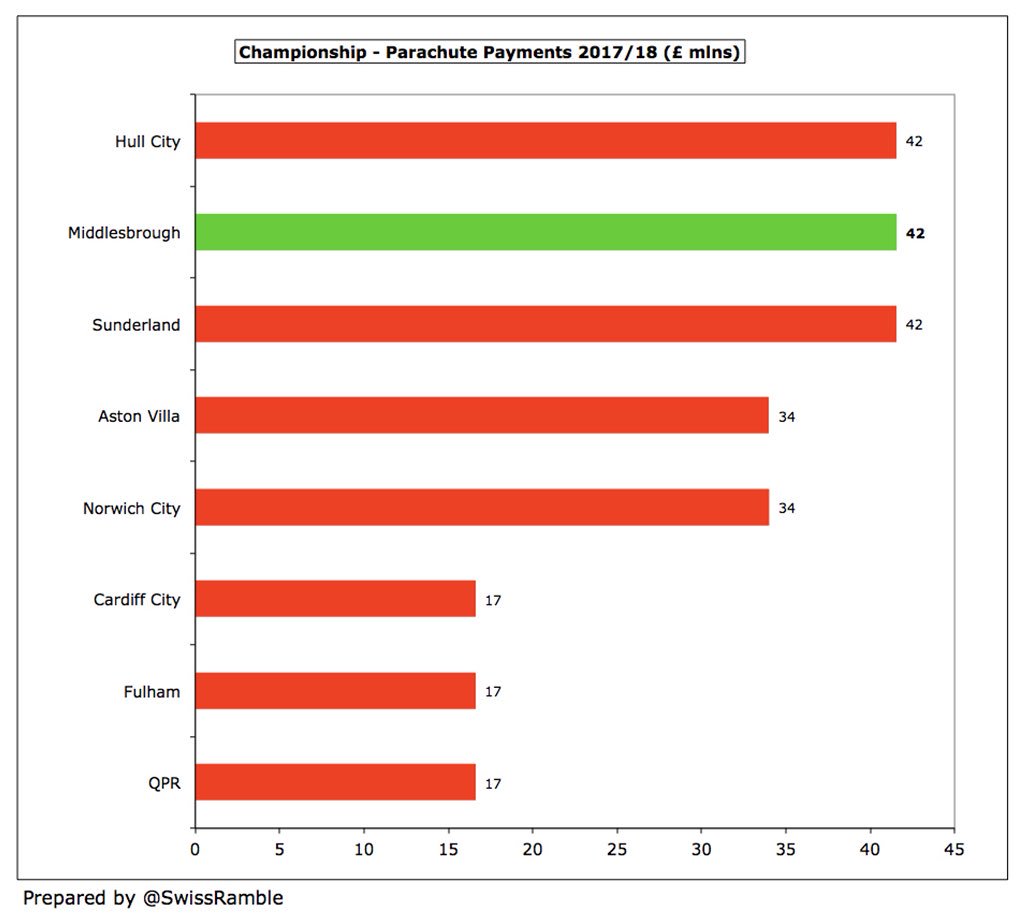

Parachute payments based on PL equal shares (year 1 – 55%, year 2 – 45%, year 3 – 20%), but #Boro only entitled to 2 years, as were relegated after 1 season. Owner Steve Gibson claimed club should have more resources than any other club, but some also have large parachutes.

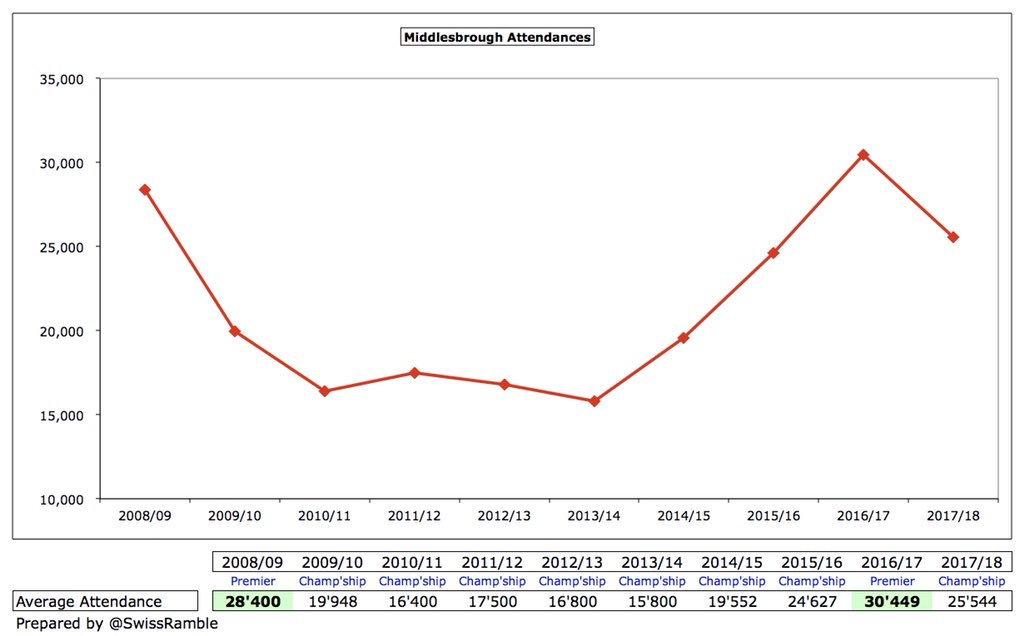

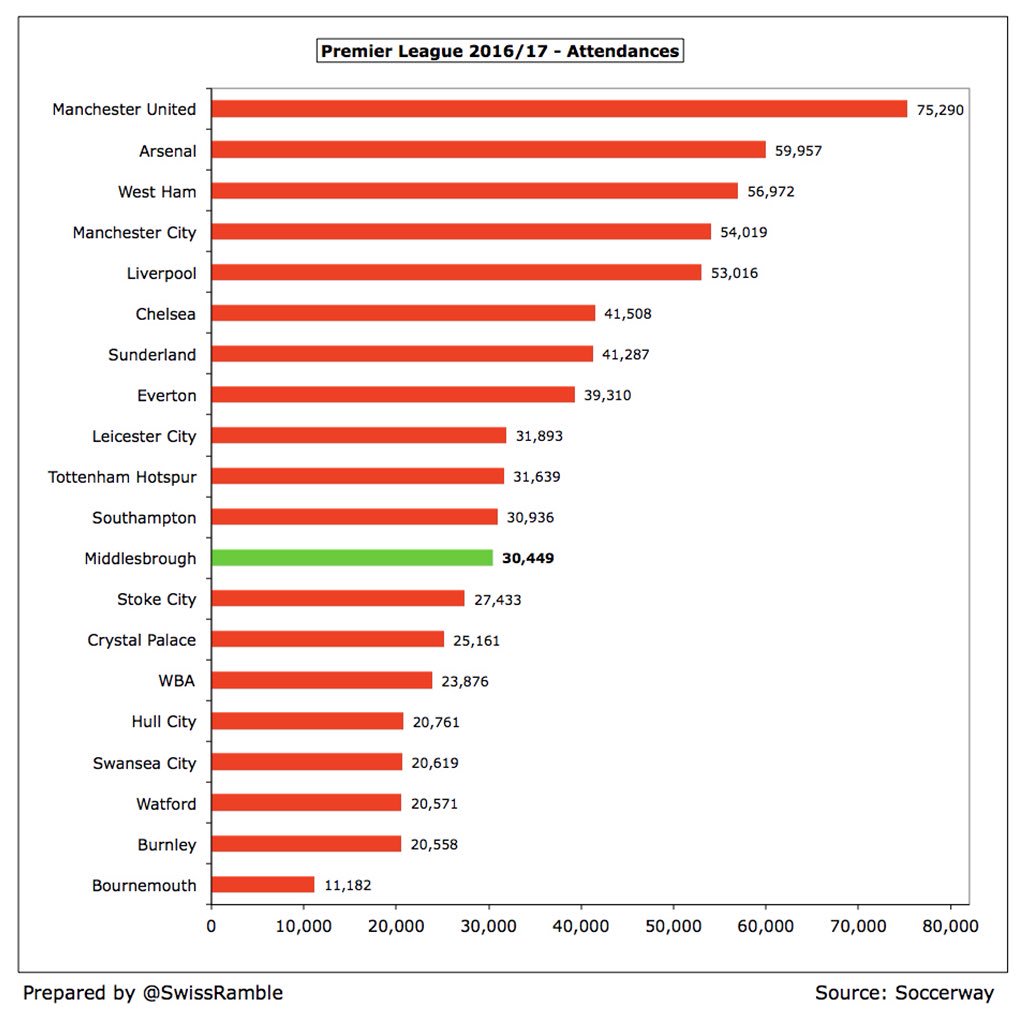

#Boro gate receipts increased £1.4m (20%) from £7.3m to £8.7m, their highest ever, even though season ticket prices were frozen in 2016/17, as attendances rose by almost a quarter from 24,627 to 30,449. Revenue was in the lower half of the Premier League, but higher than 6 clubs.

#Boro crowds are unsurprisingly higher in the Premier League than the Championship, though it is worth noting that their 25,544 attendance in the second tier in 2017/18 is around a 1,000 more than the last time they were in that division.

#Boro attendance of 30,449 was the 12th highest in the Premier League in 16/17, while 17/18 crowds were the 9th largest in the Championship, as some traditional big clubs found themselves in that division. 2017/18 ticket prices were also frozen.

#Boro commercial revenue was up £3.1m (39%) to £11.1m, comprising sponsorship & commercial, up £3.3m to £8.2m, and merchandising, down £0.1m to £3.0m. This was in the lower half of top tier, but above Swansea, Burnley, Hull, Bournemouth and Watford.

Ramsdens, a pawnbroking firm, has been #Boro shirt sponsor since 2010, though the deal is reportedly only worth £1m a season (lowest in Premier League). Recently, kit supplier Adidas was replaced by a five-year deal with Hummel, as worn in the 1986/87 promotion season.

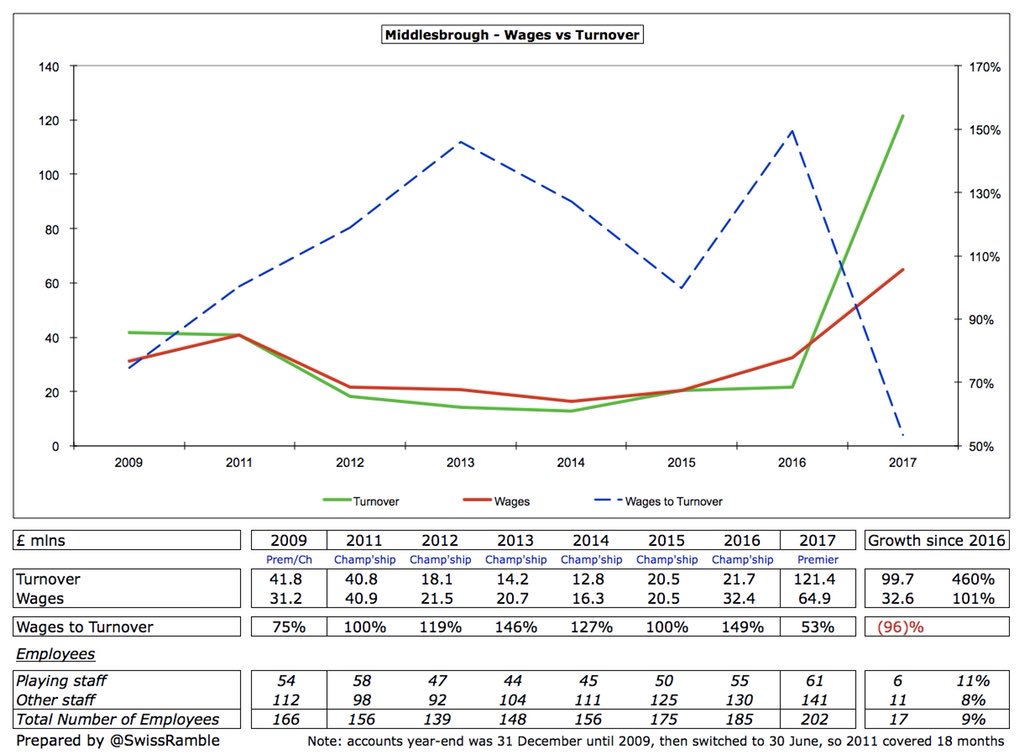

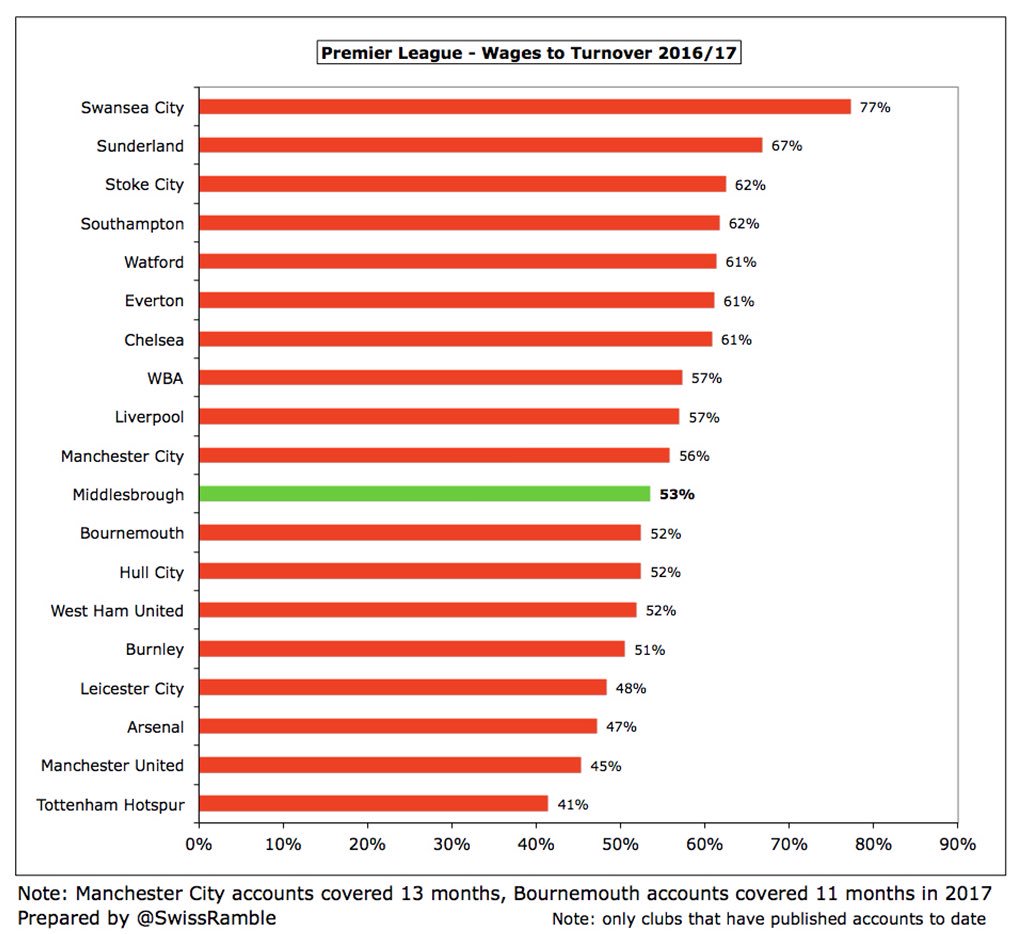

Following promotion #Boro wage bill more than doubled from £32m to £65m, though worth noting that the underlying increase was even higher, as 2015/16 included (estimated) £10m bonus payments. Wages to turnover ratio was cut from 149% to 53%.

Even after the increase in #Boro wage bill to £65m, it was still the 3rd lowest in the Premier League, only ahead of the other promoted clubs (Burnley and Hull City, both £61m). Will reduce in 17/18, due to relegation clauses and departures (player sales and loans ending).

#Boro 53% wages to turnover ratio was mid-table in the Premier League, though 5 clubs were in the 51-53% range. Following the big increase in TV money, all clubs in the top flight now have solid ratios. This will undoubtedly be higher in the Championship, which is very different.

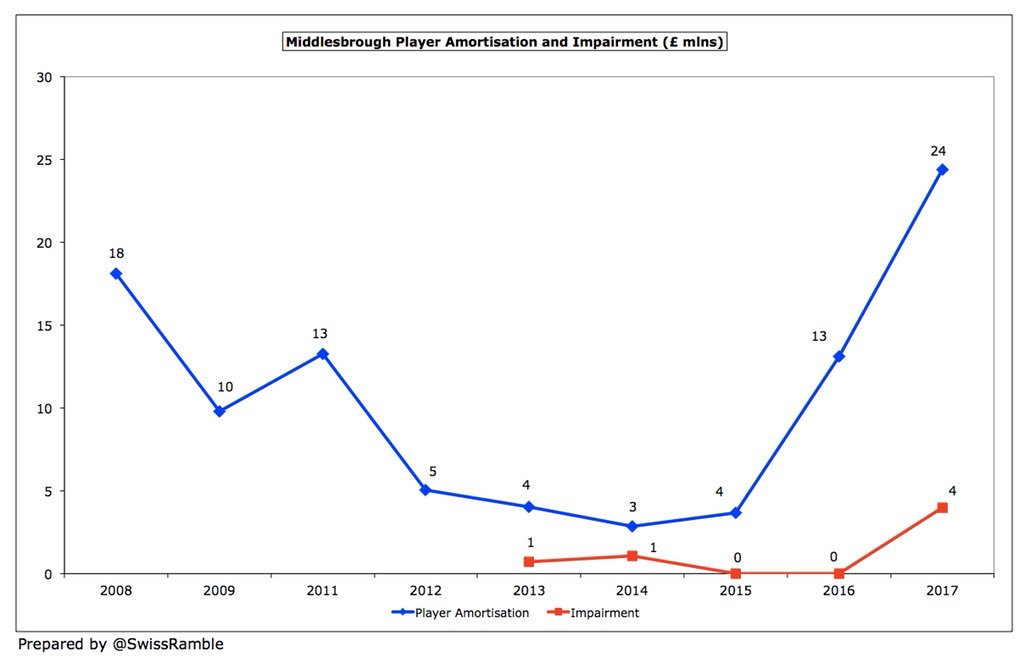

#Boro player amortisation was up £11m (86%) from £13m to £24m, but club also wrote-off £4m of player values (best guess: Rhodes & Fischer), which will improve 2017/18 profit on player sales.

#Boro player amortisation of £24m was 13th highest in the Premier League, just ahead of a pack of clubs: Swansea £24m, Stoke £23m, Hull £23m and Burnley £22m. For some perspective, it is less than a fifth of big-spending #MUFC £124m and #MCFC £122m.

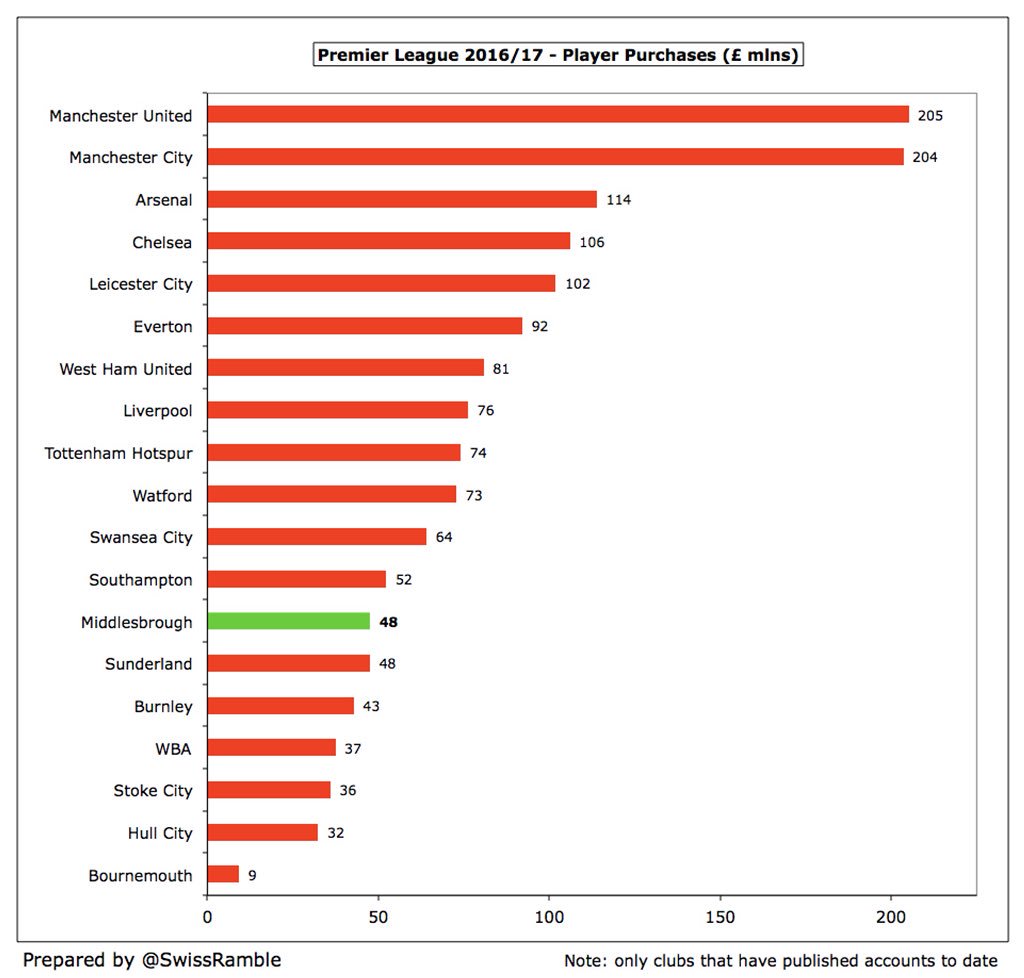

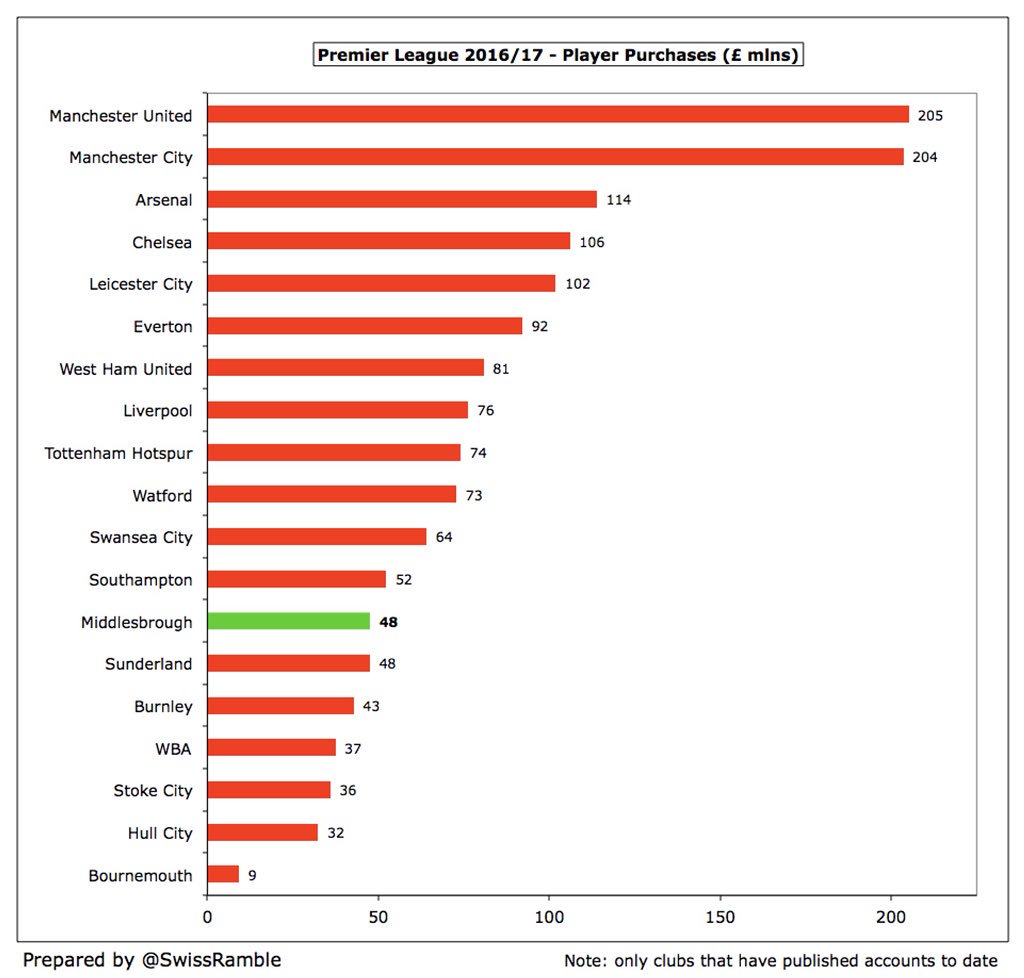

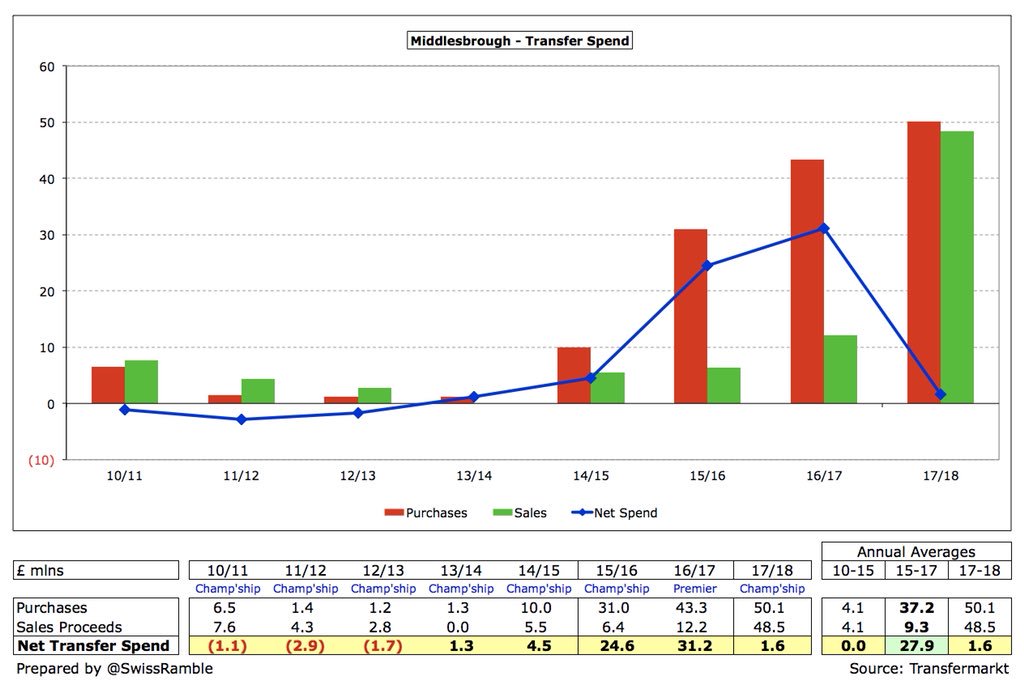

#Boro made £48m player purchases in 16/17 (including de Roon, Traoré, Gestede, Bamford, Guédioura, Barragan & Fabio), which is only £5m more than the previous (big spending) Championship season. Combined £90m in those 2 seasons considerably more than £14m in preceding 2 seasons.

Using Transfermarkt as the source, #Boro net spend really took off in 2015/16 and 2016/17, averaging £28m a year after being break-even over the previous 5 years. Although it fell to £2m following relegation, this was due to high sales, as the gross spend actually rose.

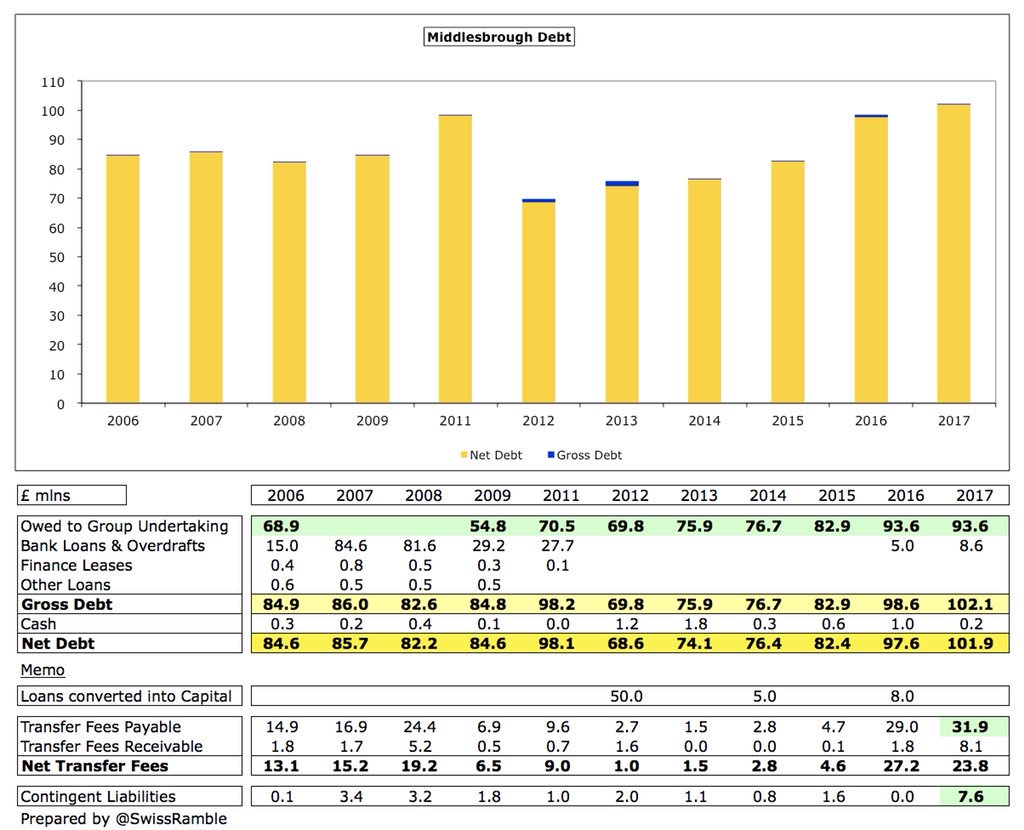

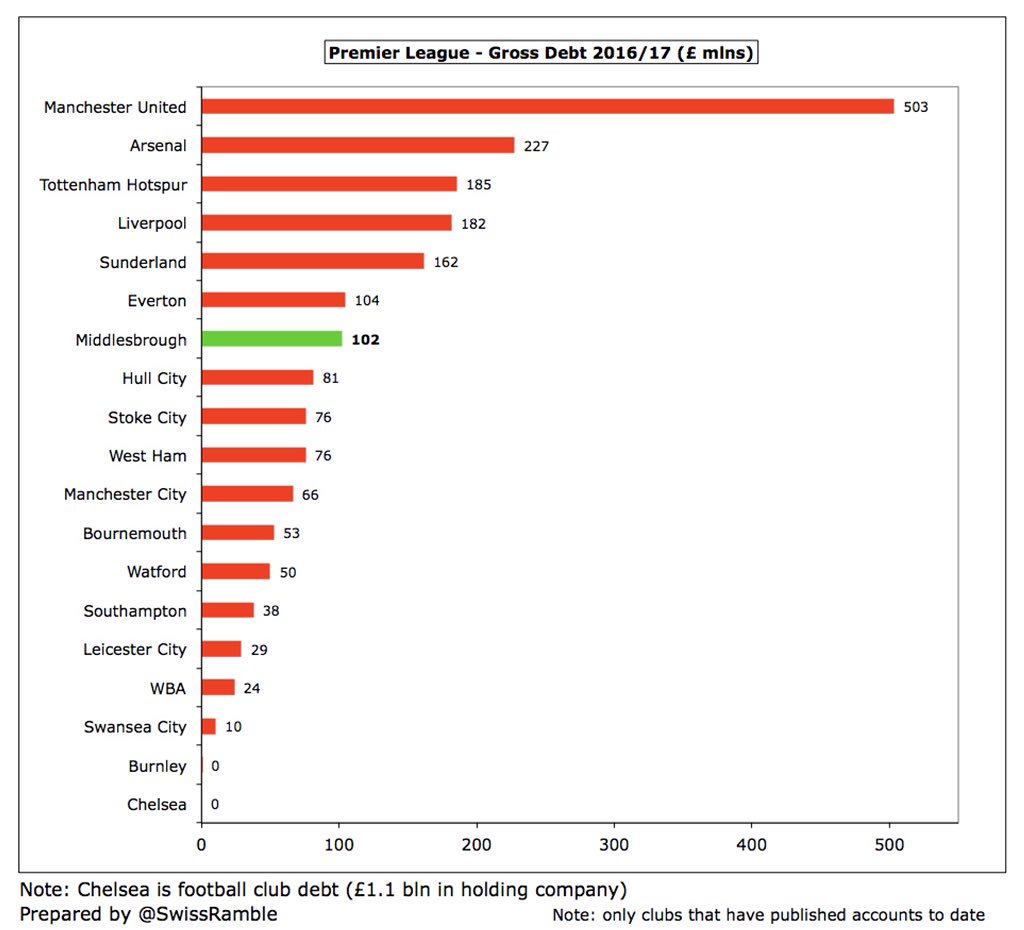

#Boro gross debt rose £3m from £99m to £102m. Almost all of this (£93.6m) is owed to owner Steve Gibson, while there is also a bank loan of £8.6m. Debt would have been even higher if Gibson had not converted £63m into share capital, highlighting the club’s reliance on the owner.

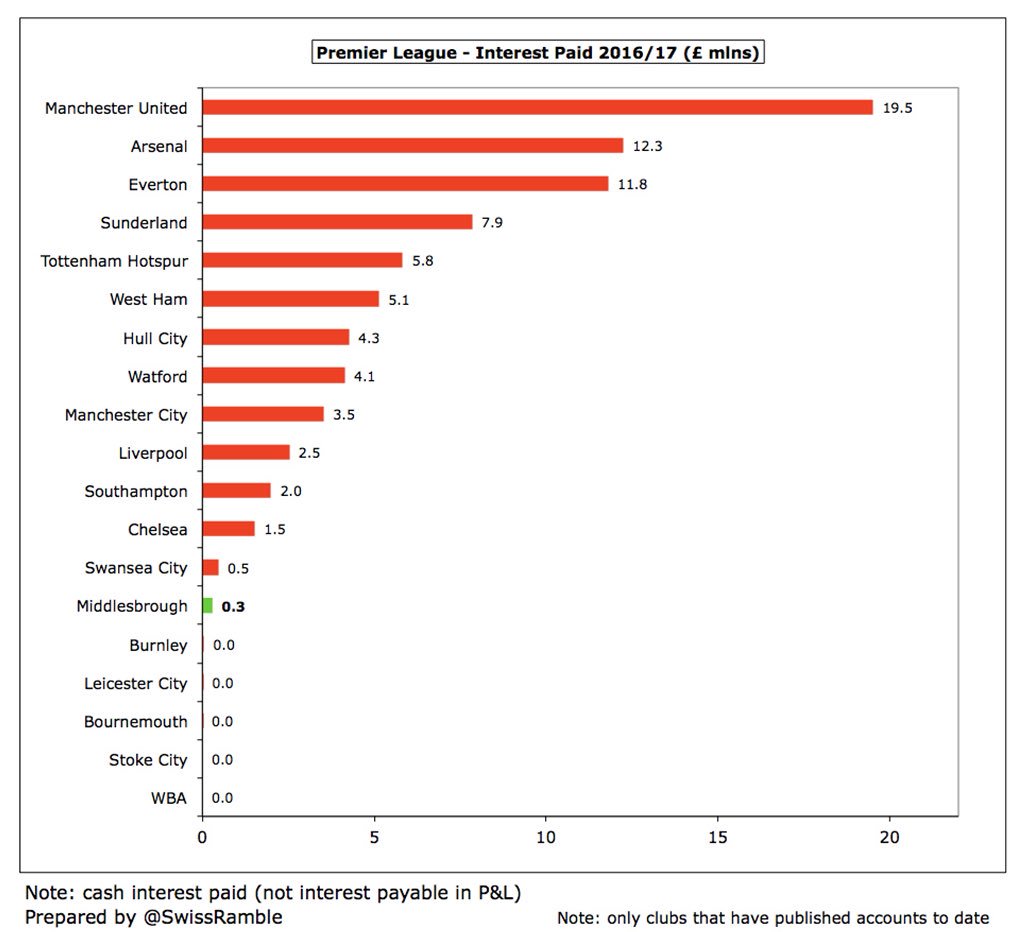

#Boro £102m gross debt was the 7th highest in Premier League, though it is largely of the “soft” variety. On the other hand, the club owed £32m in transfer fees, up from £5m in 2015, suggesting that much of the recent player spend has been on credit.

The loans provided by Gibson are interest-free, but the bank loan carries an interest rate of LIBOR + 2.25%, leading to a £278k interest payment in 2016/17. To place this into perspective, this was much lower than Sunderland’s £7.9m payment.

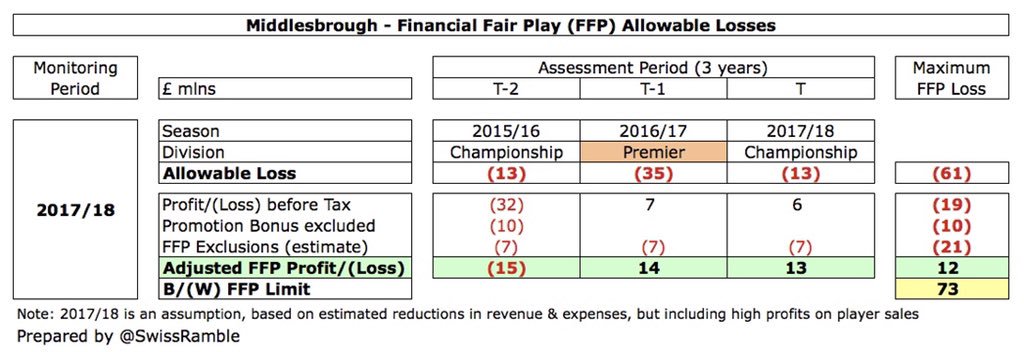

#Boro have no issues with FFP, as they have a total allowable loss of £61m over the 3-year monitoring period (£35m for 1 Premier League season plus 2 Championship seasons at £13m). In any case, I estimate they will make a small profit in 17/18 thanks to hefty player sales.

#Boro did not live up to Gibson’s ambitions for the 17/18 Championship (“We want to smash the league, we want to go up as champions”), but they did reach the play-offs. They are well set financially for another attempt next season, though it will be their last parachute payment.

• • •

Missing some Tweet in this thread? You can try to

force a refresh