1/ Most neo-gold maximalism is also parroting.

The entire debate of SOV ($BTC) vs. utility ($ETH) #cryptocurrencies relies on the assumption that utility coins can't also be SOV/neo-gold.

But of course--they can!

The entire debate of SOV ($BTC) vs. utility ($ETH) #cryptocurrencies relies on the assumption that utility coins can't also be SOV/neo-gold.

But of course--they can!

External Tweet loading...

If nothing shows, it may have been deleted

by @arjunblj view original on Twitter

2/ Many coins share the same fundamental properties of neo-gold. Let's call these "FPs". The exact FPs are not universally agreed upon but typically include the following:

- Censorship-resistant

- Secure

- Fixed supply/immutable monetary policy

- Decentralized

- Self-sovereign

- Censorship-resistant

- Secure

- Fixed supply/immutable monetary policy

- Decentralized

- Self-sovereign

3/ Many cryptos share these FPs so belief in coin X becoming neo-gold then is a bet that:

A) it scores best among these FPs

B) it will always score best

C) other properties--such as utility and on-chain scaling--either don't matter or worse detract from these FPs

A) it scores best among these FPs

B) it will always score best

C) other properties--such as utility and on-chain scaling--either don't matter or worse detract from these FPs

4/ There are issues with all of these beliefs:

A -- These FPs are not binary so scoring them is complex. E.g., there's no consensus on how to measure decentralization.

A -- These FPs are not binary so scoring them is complex. E.g., there's no consensus on how to measure decentralization.

5/ B -- No coin has completed its roadmap (and updates will continue for many years) so a bet on coin X is a belief that it will continue to score highest across all FPs for the foreseeable future. This is of course unknowable.

6/ C -- Sorry but I believe that utility (and network effects) and scalability increase the value of a neo-gold/SOV. A truly global neo-gold needs more on-chain throughput than 7 tx/s if for example we want it to remain self-sovereign (otherwise custody is forced off-chain).

7/ To sum in laymen terms, this is simply a debate of neo-money vs. neo-programmable-money.

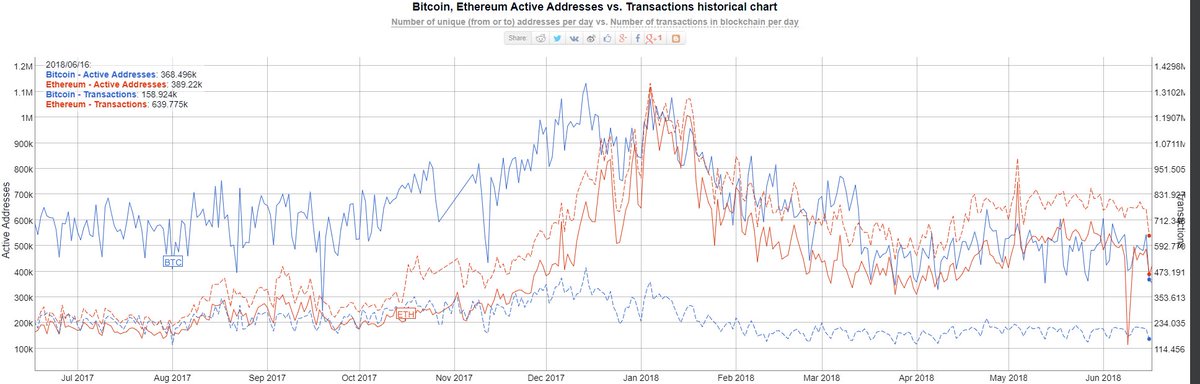

There are many smart people on both sides of the debate. And this is further reflected by the market caps of the top neo-money ($BTC) and neo-programmable-money ($ETH) coins.

There are many smart people on both sides of the debate. And this is further reflected by the market caps of the top neo-money ($BTC) and neo-programmable-money ($ETH) coins.

8/ So to expect that heterogeneous human beings who can't decide between Laurel and Yanny will swiftly converge on a champion given all the uncertainty discussed above is naive. It's simply too early to place a *maximalist* bet IMHO. And the market reflects this.

9/ I plan to write on this in a lot more detail in the coming weeks so stay tuned. This debate is far from settled and fun to be a part of!

Bring on the parroting!

@KyleSamani @TusharJain_

Bring on the parroting!

@KyleSamani @TusharJain_

• • •

Missing some Tweet in this thread? You can try to

force a refresh