Given the political dynamics in #Italy, it is time to dust off my analysis from 2016 - 'Eurosceptics in Power' - on how Eurosceptic parties have influenced EU policy making both in the EP and when in nat. government

swp-berlin.org/en/publication…

Four points stand out in particular:

swp-berlin.org/en/publication…

Four points stand out in particular:

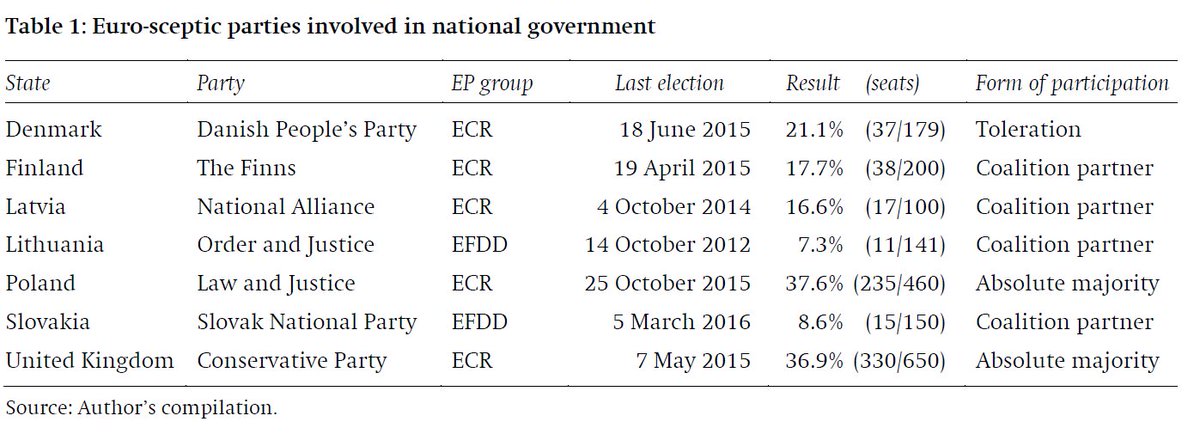

First, Italy is not the first instance of eurosceptic and/or populist parties entering national government.

Elite consensus on EU integration has been waning for a long time - reflecting the more sceptical attitude in many member states.

Elite consensus on EU integration has been waning for a long time - reflecting the more sceptical attitude in many member states.

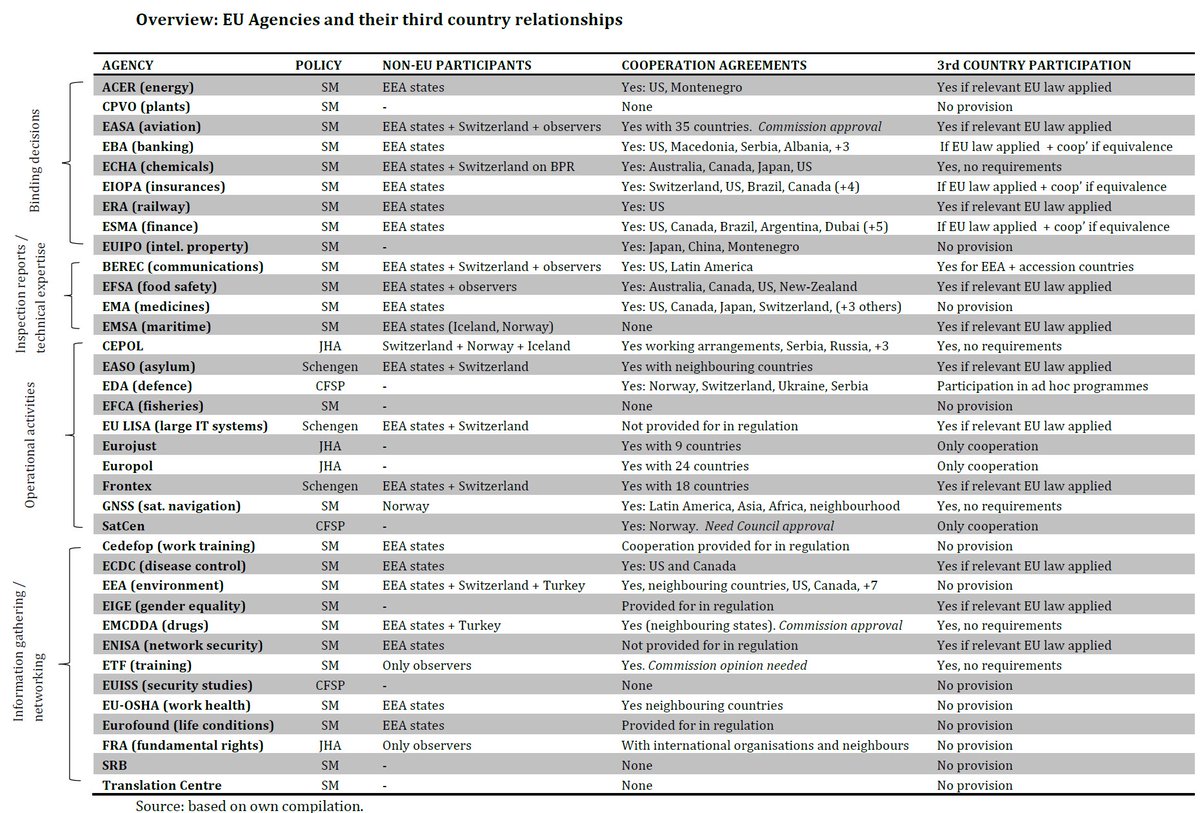

Second, in decision-making at the EU level they acted (largely) constructive. Voting data from the Council revealed no strong increase in vetos or 'no' votes after Eurosceptic parties entered nat. governments.

Exceptions to this are migration and institutional questions

Exceptions to this are migration and institutional questions

But even on those issues, there was no indication - so far - of nat governments with Eurosceptic parties forming a group in the EU. Crucially, even all of them together would not have had a blocking minority in the Council.

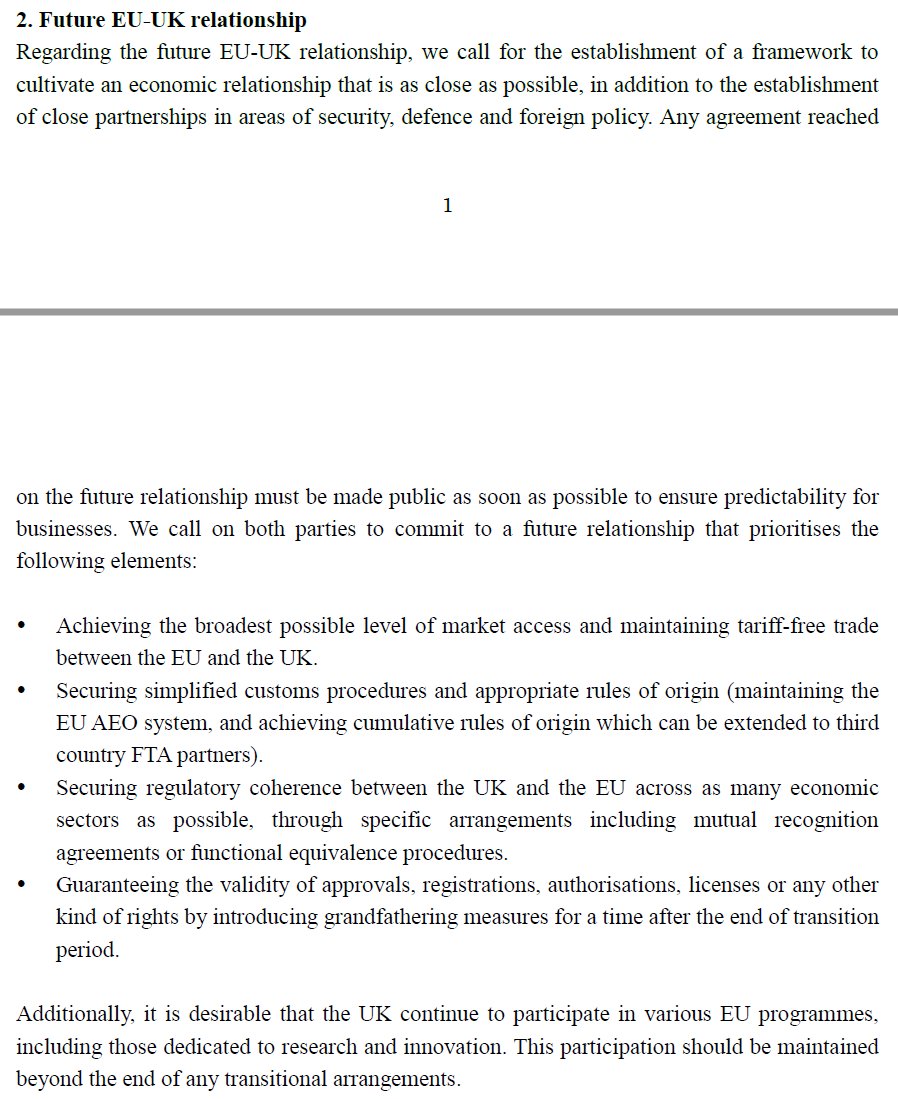

Third, the bigger impact was felt on the national level - in the challenge of EU core values, the rule of law and migration policies.

And the larger the number of EU countries with rule of law issues, the harder it will be to adress this issue by the EU.

And the larger the number of EU countries with rule of law issues, the harder it will be to adress this issue by the EU.

Finally, due its size, an Italy headed by two Eurosceptic parties will be a far bigger challenge to the EU.

4 factors come together:

- High economic relevance to the Eurozone

- High voting share in the Council

- Central role on migration

- Symbolic status as a founding country

4 factors come together:

- High economic relevance to the Eurozone

- High voting share in the Council

- Central role on migration

- Symbolic status as a founding country

In sum: the #M5S #LEGA is not the first Eurosceptic government in the EU - but it is bound to be the most impactful, on the #Eurozone, on migration, on Russia and the future of the EU debate overall.

• • •

Missing some Tweet in this thread? You can try to

force a refresh