How to get URL link on X (Twitter) App

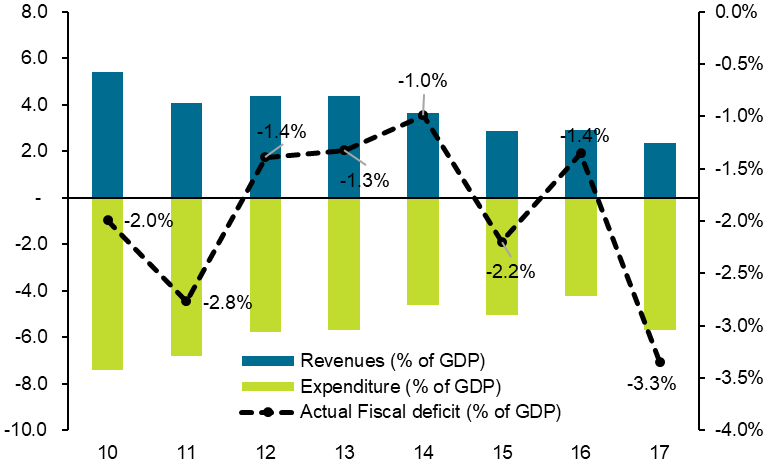

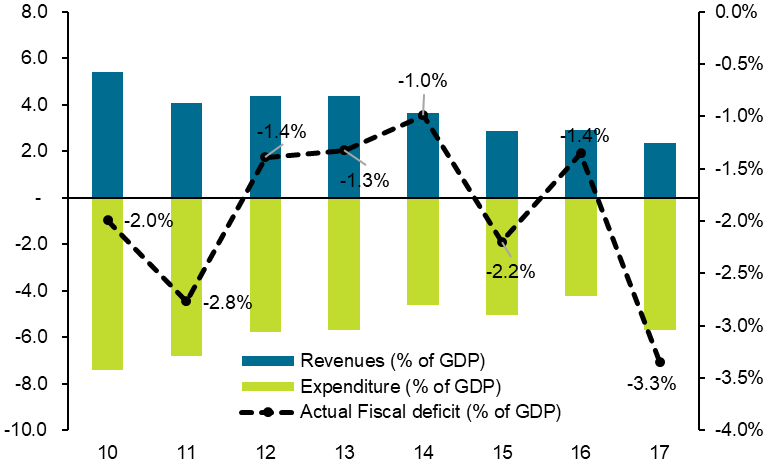

But interestingly, capex spending came in a record NGN1.44tr (1.3% of GDP and around 66% of target) with overall budget execution at 87% suggesting some credibility in implementation despite the costs driven by higher drawdowns by Works, Power and Housing

But interestingly, capex spending came in a record NGN1.44tr (1.3% of GDP and around 66% of target) with overall budget execution at 87% suggesting some credibility in implementation despite the costs driven by higher drawdowns by Works, Power and Housing