1/ as you may already know, i love developing new frameworks around various matters in #crypto and drawing analogs to existing concepts in traditional finance (recovering consultant, I know 🙄)

my latest target: the @tezos experiment and token holder activism

my latest target: the @tezos experiment and token holder activism

2/ full disclosure: I'm a #tezos token holder and will be delegating my stake to the baking crew at @tezzigator (what up josh and bo)

Here's why: reddit.com/r/tezos/commen…

now what is "baking" you may ask? a great place to start it turns out.

Here's why: reddit.com/r/tezos/commen…

now what is "baking" you may ask? a great place to start it turns out.

3/ where #bitcoin has Proof of Work and mining, #Tezos has (delegated) Proof of Stake and baking. in tezos, “bakers" participate in consensus and earn the right to create blocks when a tezos "roll" (10,000 $XTZ) that they own or manage is randomly selected to create a new block

new tezzies are generated through these blocks, until 10 billion tezzies have been created (the max allowed by the protocol). the genesis block generated roughly 700M, and the remaining 9.3B will be released over time as inflation (see initial Tezos "wealth" distribution👇🏾)

5/ token holders who participate in consensus by baking or “delegating” to a baker (who participates on their behalf) will take part in this inflation, which is expected to be 5% per year.

the takeaway: participation is key to benefitting from (and protecting against) inflation

the takeaway: participation is key to benefitting from (and protecting against) inflation

6/ so why does this matter?

because it means that if you own less than 10,000 tezzies and / or can't bake, you must hand over your economic power (read: voting rights) to someone else, or risk having your tezzies lose value do to inflation.

because it means that if you own less than 10,000 tezzies and / or can't bake, you must hand over your economic power (read: voting rights) to someone else, or risk having your tezzies lose value do to inflation.

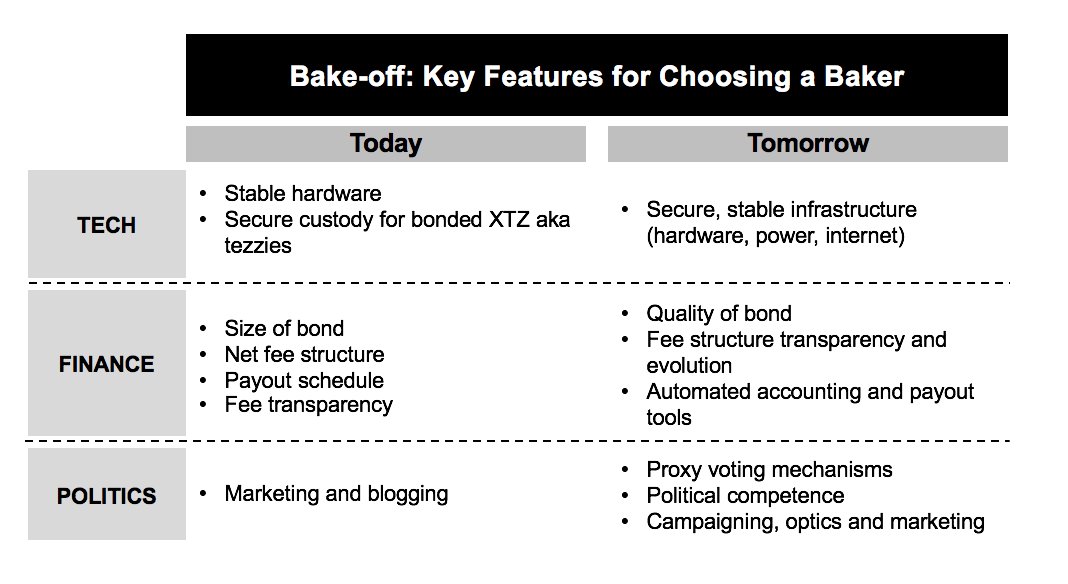

7/ some key features you could look at when choosing a baker today v tomorrow. this is kind of like choosing a political party in a way... and we'll get into that shortly. here's a list of services provided: mytezosbaker.com

8/ so let's rewind a bit...

if we dig deeper into the Tezos genesis block, we can see that nearly 80% of accounts originally distributed to don’t have enough tokens to participate in baking on their own, and thus their only choice is to delegate their stake to a baker.

if we dig deeper into the Tezos genesis block, we can see that nearly 80% of accounts originally distributed to don’t have enough tokens to participate in baking on their own, and thus their only choice is to delegate their stake to a baker.

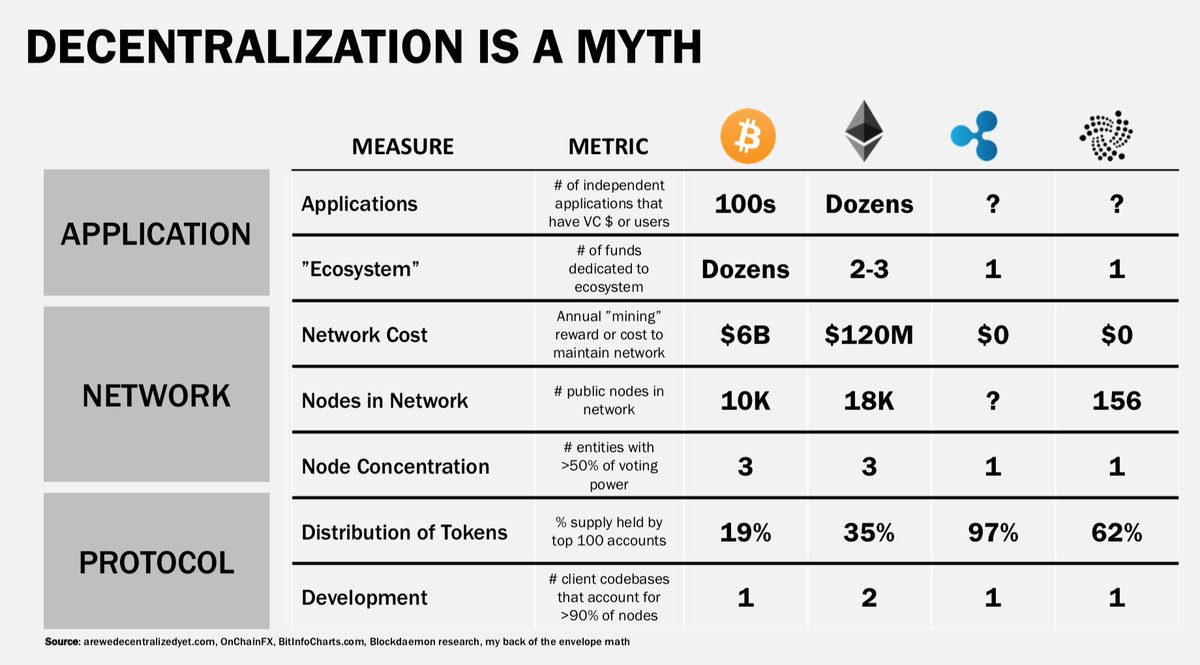

9/ 156 accounts own more than 50% of the XTZ originally distributed. why does this matter? because of two legacy finance concepts - proxy voting and shareholder activism. let's dive right in!

10/ what we see is that larger holders of tokens are more likely to have already delegated their tokens. larger holders of tokens are likely institutions or active investors who are very vested in the outcome of the Tezos experiment.

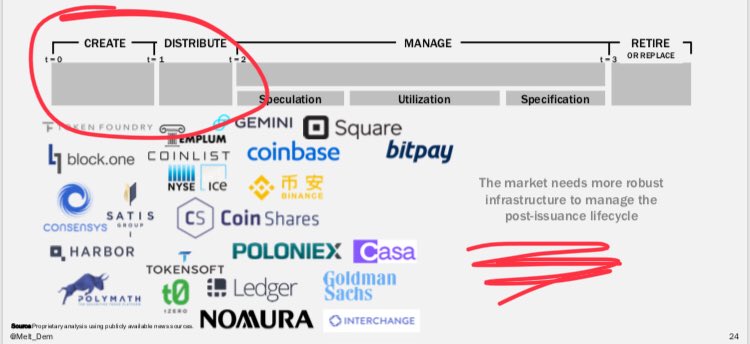

11/ the concept of fiduciary responsibility is nascent as applied to the cryptoasset ecosystem - and it's not just about the investment process, but also what happens *after* investing. people who own shares in a company participate in governance by voting on board resolutions.

12/ if we consider “delegations” in tezos to be a close analog to proxy voting, we start to see interesting parallels emerge. owning Tezzies is certainly not owning shares, but owning XTZ does entitle a holder to participate in governance of the protocol.

13/ effectively, XTZ holders who delegate their stake to a baker *may be* selecting a proxy to “vote” on their behalf. we can't talk about voting in without talking about our favorite corporate raiders, activist shareholders, or people who are unhappy with management.

14/ for most projects, token holders have no right to participating in governance at any level of the project, aside from investors being on the Foundation or on the board of the company. however — Tezos is a perfect protocol to test ideas around token holder activism.

15/ because the Tezos ledger is self-amending, larger holders who have more at stake financially are more incentivized to actively participate in decision making. influencing decision making is an important aspect of investing.

16/ so if i own a lot of Tezos tokens and i'm unhappy with how project is being managed, theoretically I could band together with other token holders, or aggregate a lot of votes via delegation, to force changes I want to see. remember that blockchains don’t change human nature.

17/ a motivated activist token holder can now truly build a decentralized banana republic!

all joking aside, it’s important to examine these projects, to ask questions, analyze information, and form and test new hypotheses about behavioral finance in a world of tokens.

all joking aside, it’s important to examine these projects, to ask questions, analyze information, and form and test new hypotheses about behavioral finance in a world of tokens.

18/ a lot of people in the Tezos community have been angry with me for suggesting this type of "command and control" structure. but ask yourself, do you know how your delegation service will handle proxy voting? if not, start asking. these things matter.

19/ we'll be publishing more this week about different classes of shareholders and what it means for corporate governance, and what different classes of tokenholders may mean for protocols. check out the original Tezos piece here and feel free to comment: medium.com/@Melt_Dem/the-…

20/ lastly, massive shout out to @farchibald_ and @Oliver_W_Stein from my research team @CoinSharesCo for the great data gathering and insightful analysis. we have a lot more content like this planned to break down tokens in the context of behavioral & corporate finance!

• • •

Missing some Tweet in this thread? You can try to

force a refresh