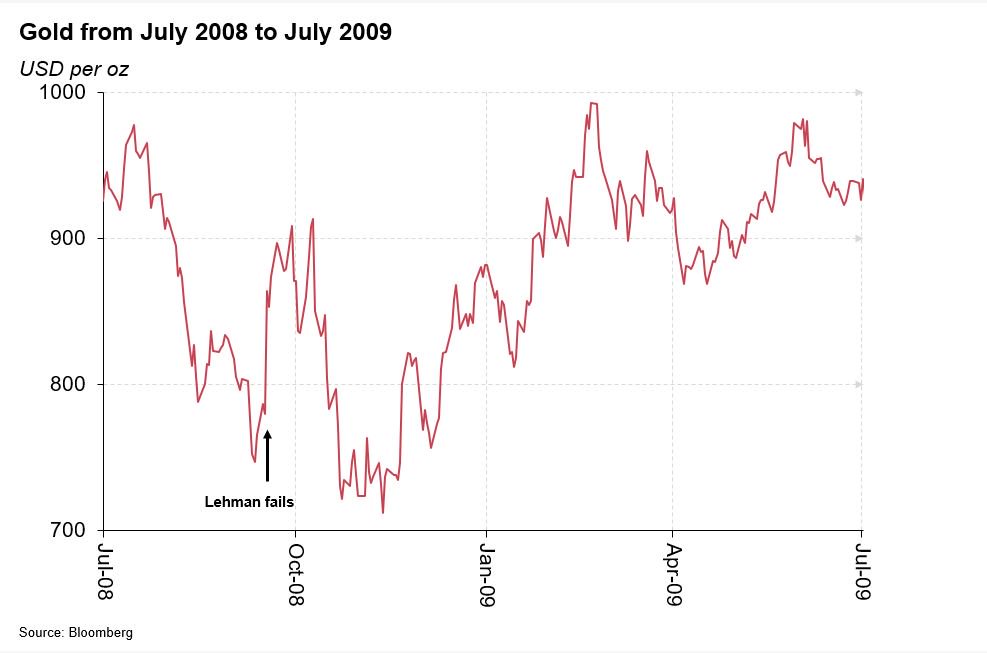

Gold: Tomorrow marks the 10-year anniversary of the failure of Lehman Brothers and, consequently, economists, market commentators and journalists have been rolling out their thoughts on both the financial crisis and the subsequent decade.

1/14

1/14

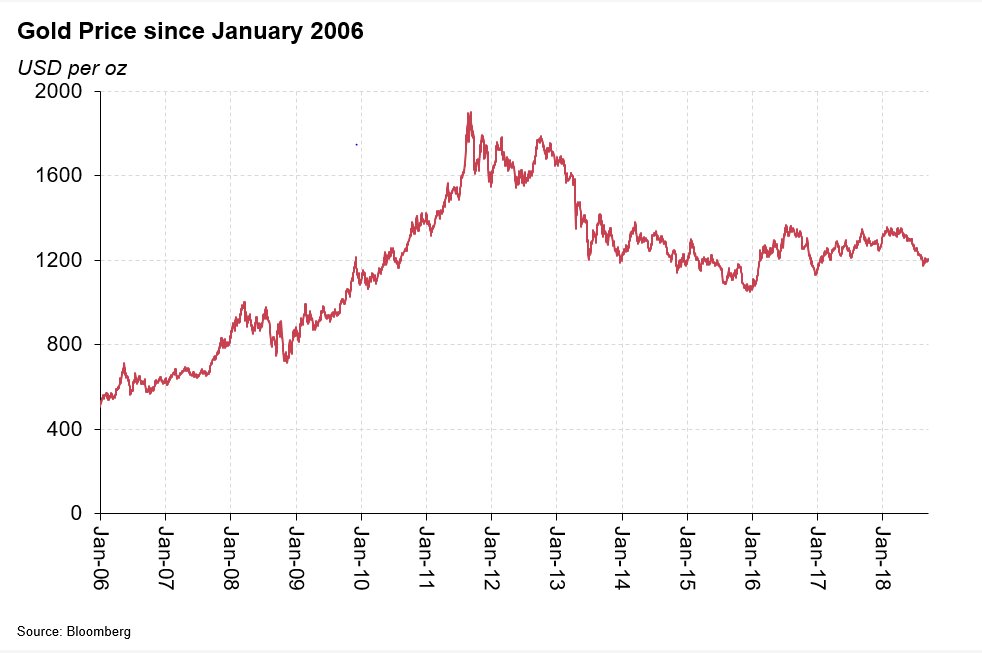

Gold: How did #gold fare through the crisis? This chart, from July 2008 to July 2009, shows no sign of gold moving rapidly higher? In fact, gold fell in the fourth quarter of 2008 as the dollar strengthened and gold was used as a source of liquidity (and sold.)

2/14

2/14

Gold: Although in the first half of 2009 #gold was comfortably above the level it was when Lehman failed…

3/14

3/14

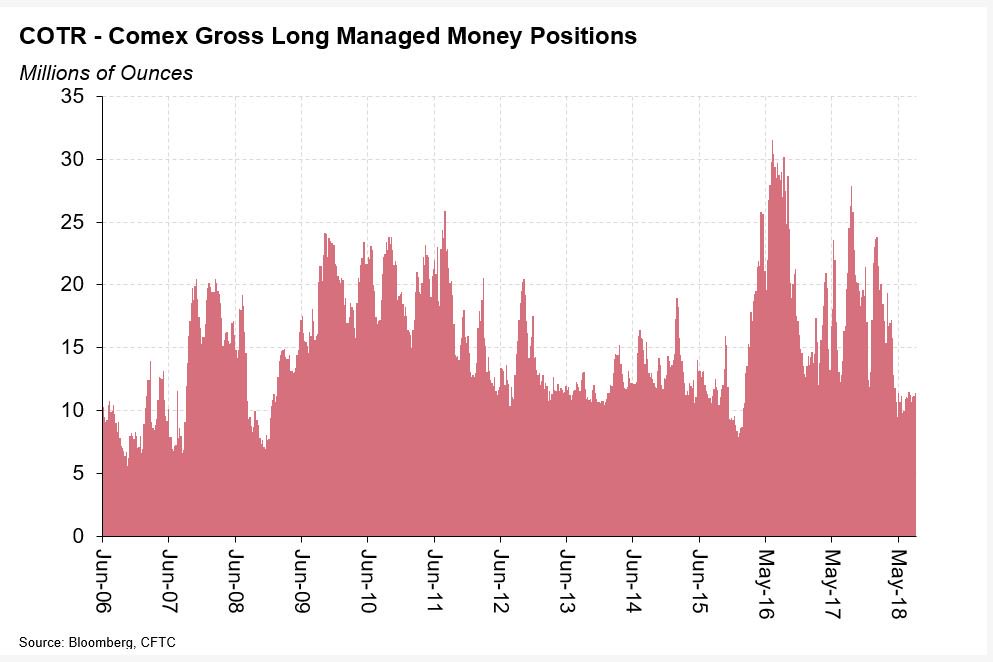

Gold: … and went onto make strong gains through the second half of 2009, 2010 and most of 2011 as investors and speculators bought #gold on fears of the consequences of extraordinary monetary policy.

4/14

4/14

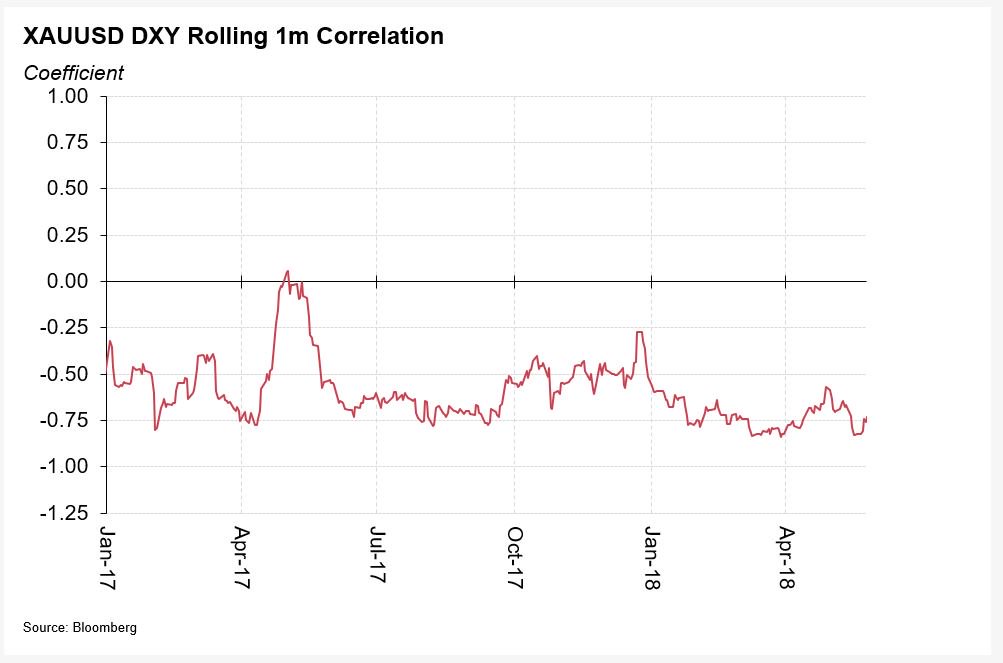

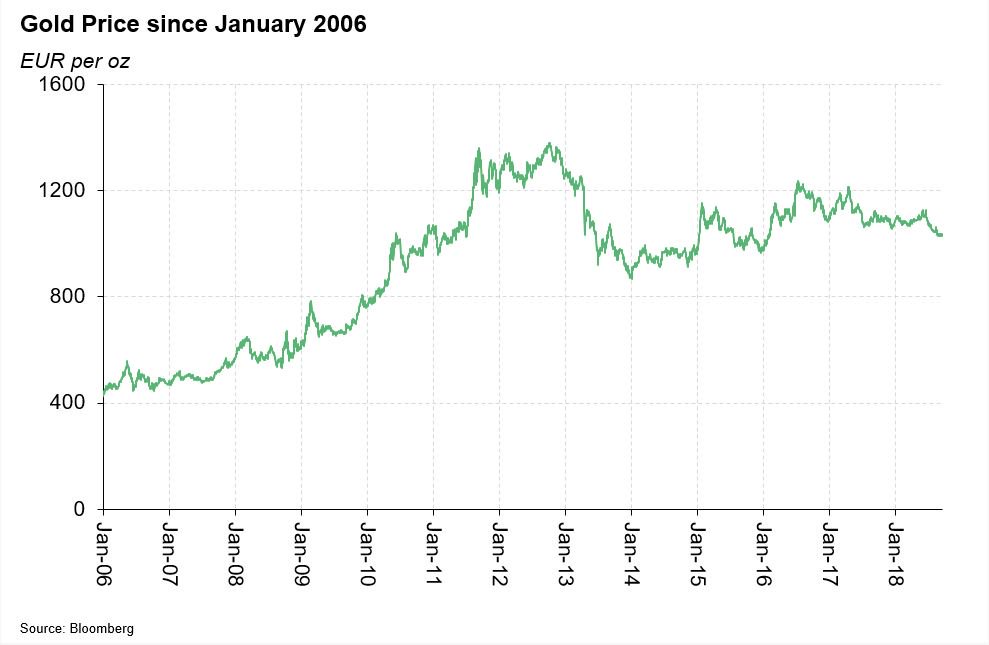

Gold: This was not just a consequence of US dollar weakening – #gold performed well in many currencies, as this chart of gold in euros shows. Interestingly, gold’s strength in euros was more apparent in 2012 than in 2011.

5/14

5/14

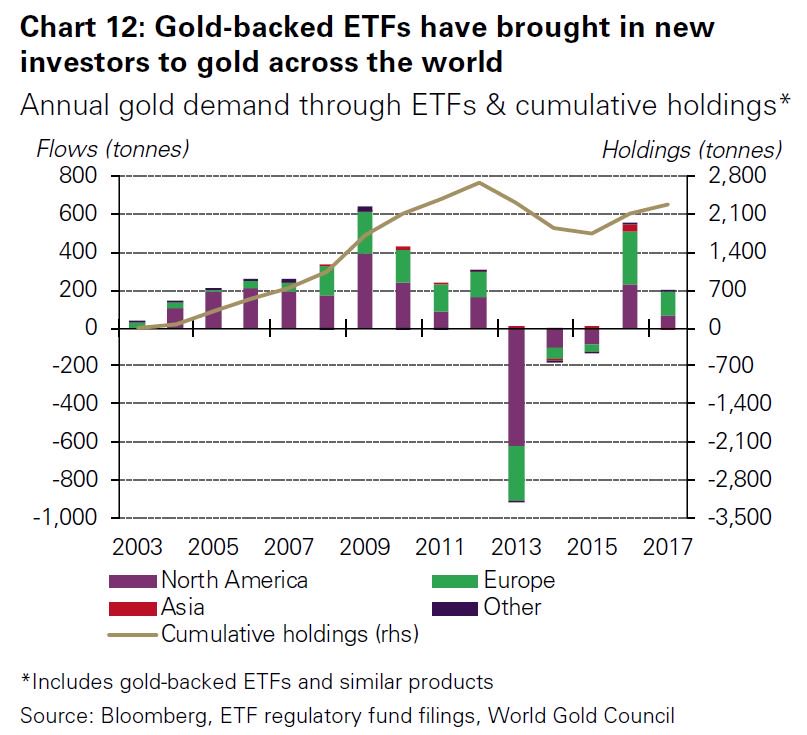

Gold: As the US and some other economies continued to recover and with no sign of an imminent surge in inflation, investors took profits and cut long positions, especially in 2013 as this chart of annual changes in holdings by #gold-backed ETFs shows.

6/14

6/14

Gold: Then fell further in 2014 and 2015, before gold posted a positive return in 2016 and 2017.

7/14

7/14

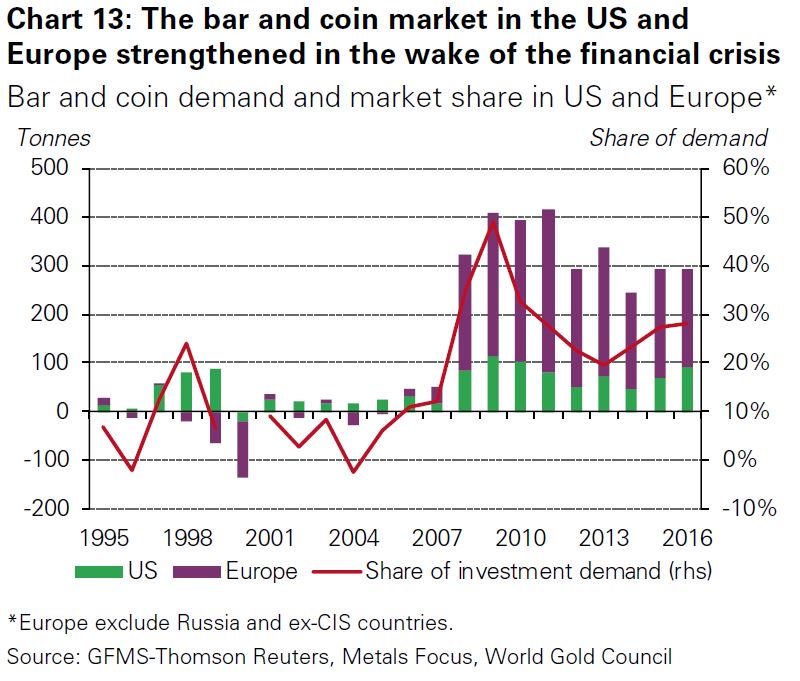

Gold: The gold industry has changed a lot over the past ten years. Aside from the inflows and outflows into #gold ETFs, shown above, the bar and coin market in the US and Europe saw a marked and sustainable change.

8/14

8/14

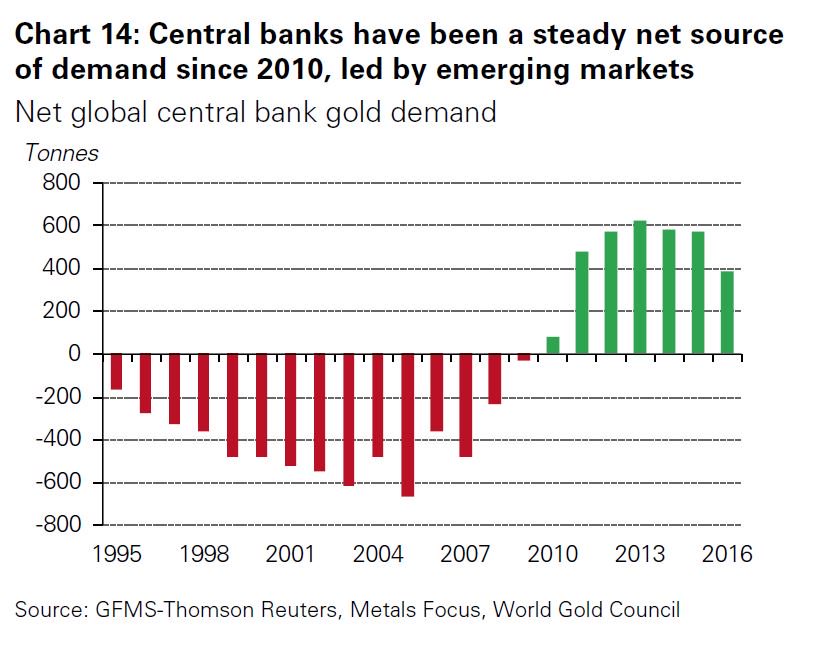

Gold: Central banks actions changed too, reversing a long-standing selling tendency and collectively buying #gold as a source of return, liquidity, diversification and credit risk reduction.

9/14

9/14

Gold: Over the past decade emerging markets have become much more important consumers of #gold, with China and India becoming increasingly important from a global consumption perspective.

10/14

10/14

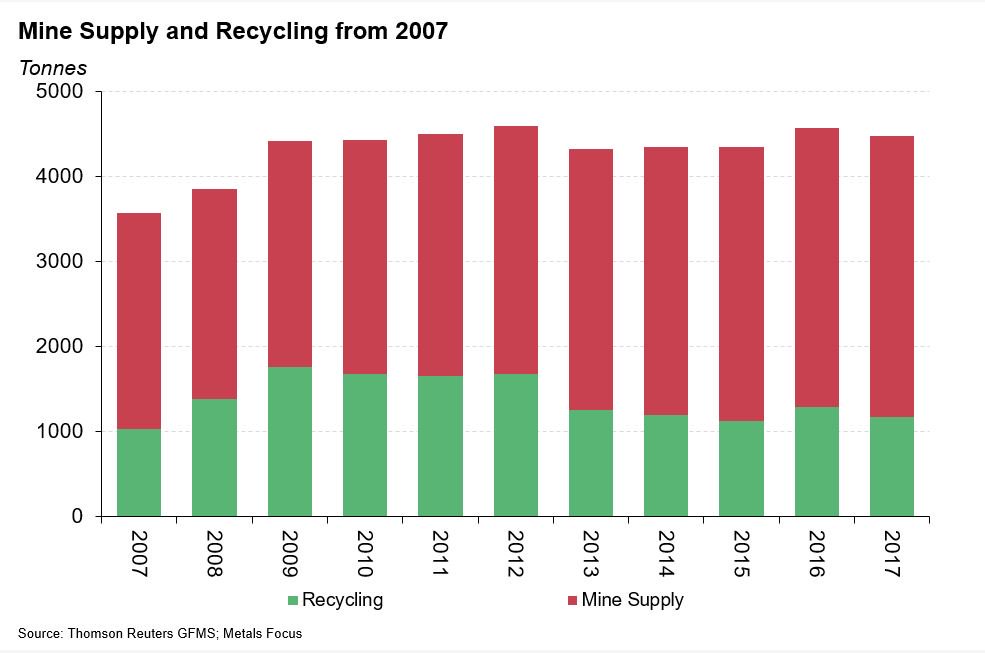

Gold: The industry has grown, initially from increased recycling of #gold and then from growing mine supply.

11/14

11/14

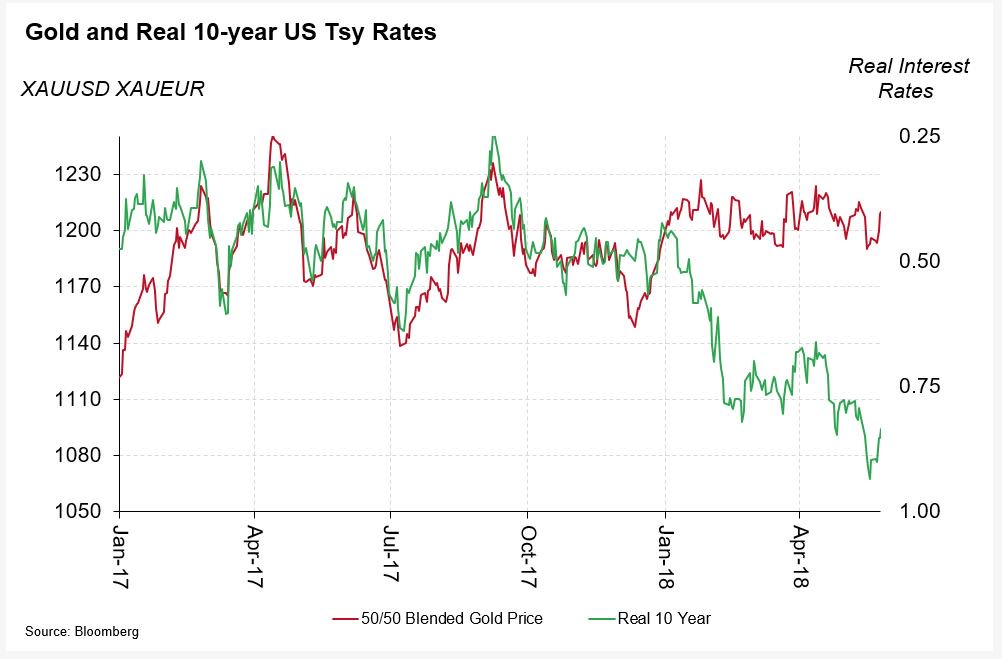

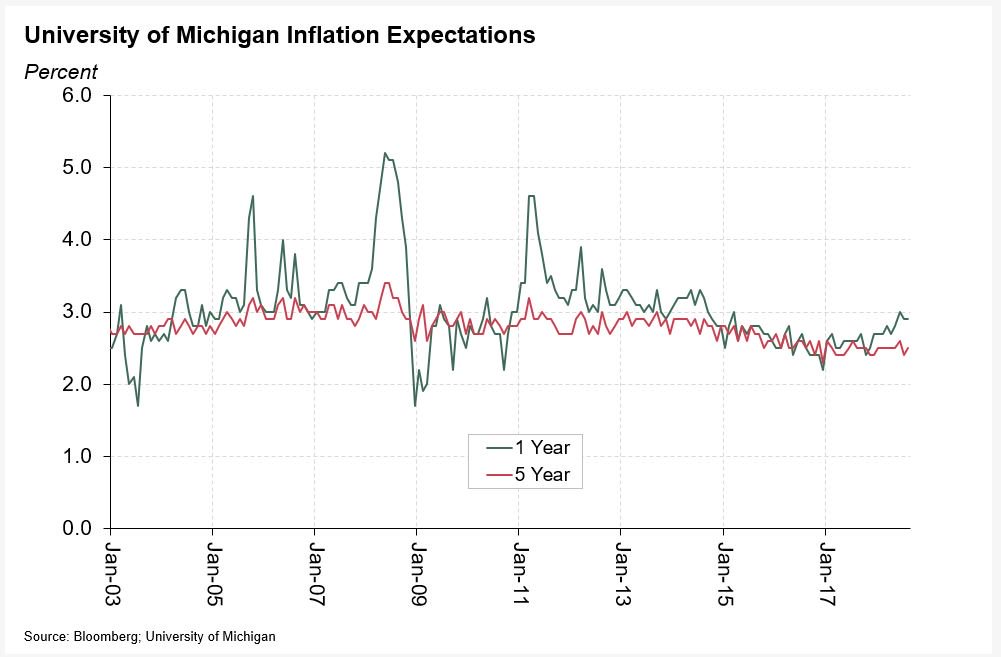

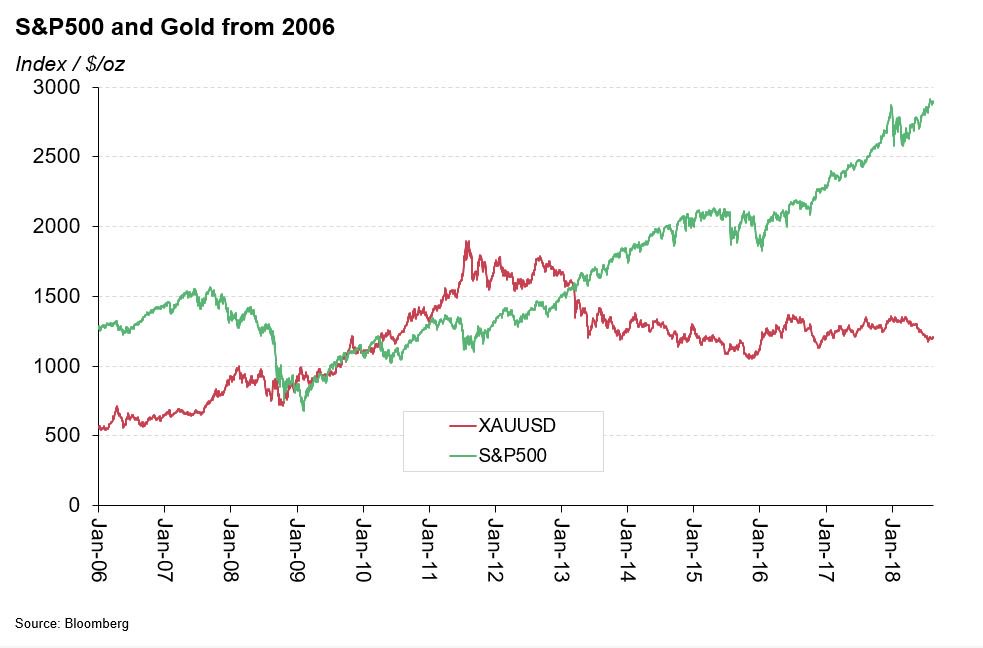

Gold: So where do we stand now, 10 years on? #Gold remains a more mainstream investment asset now than in the ten years before Lehman failed. But it has underperformed other assets in the past few years, especially US equities.

12/14

12/14

Gold: But that’s probably what we should expect after (arguably) the longest US equity bull market in history. And its hardly a cheap US equity market.

13/14

13/14

Gold: So, its probably a great time to think about diversifying some equity holdings into #gold. Even though, as Robert Shiller himself recently said, equities could well head higher from here, a correction looks inevitable at some point.

14/14

14/14

@threadreaderapp Hi, are we sleeping on the job? Please unroll

@threadreaderapp I hope you are up and running again. Please unroll. Thank you

• • •

Missing some Tweet in this thread? You can try to

force a refresh