Discover and read the best of Twitter Threads about #Gold

Most recents (20)

Gold: Its been a quiet move higher for gold over the past few days, but we are now sitting above the 50 day moving average (cash).

1/3

1/3

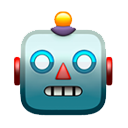

Gold: There has been little change in Comex #gold open interest over the past few weeks, suggesting the large gross shorts are still there (stubborn, aren't they).

2/3

2/3

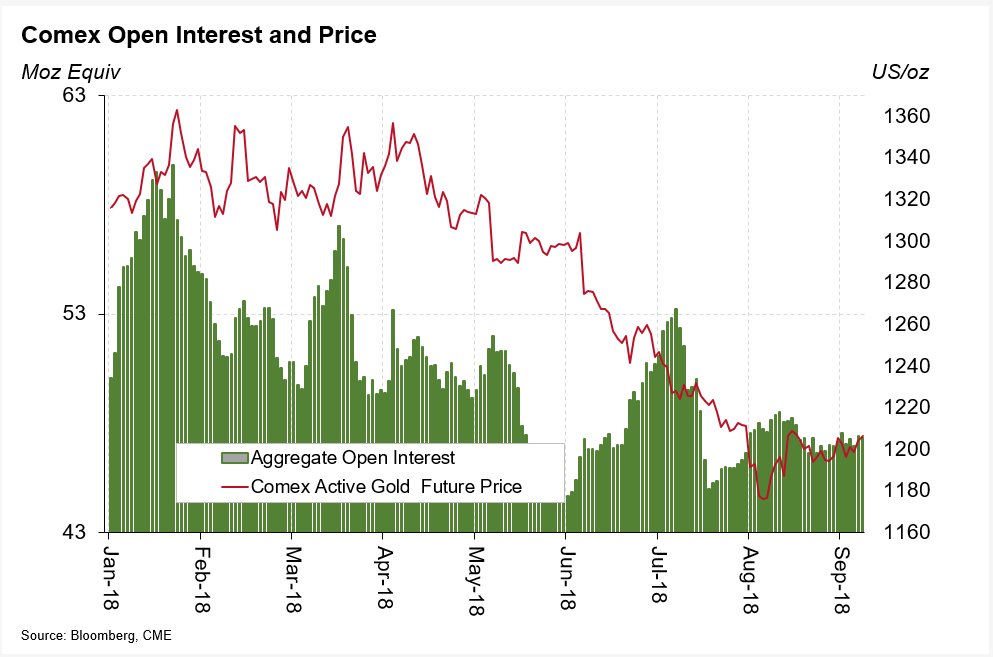

Gold: Comex #gold volumes are unremarkable too.

A close above the 50 day moving average today could be a trigger for some short covering, but further price gains are probably needed to rattle the bulk of the shorts.

3/3

A close above the 50 day moving average today could be a trigger for some short covering, but further price gains are probably needed to rattle the bulk of the shorts.

3/3

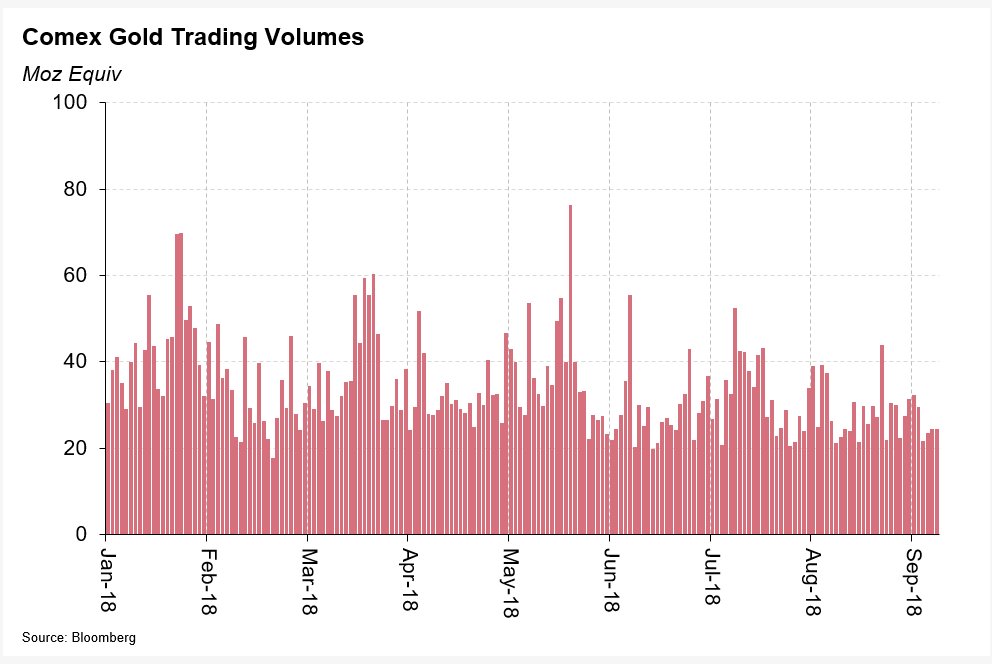

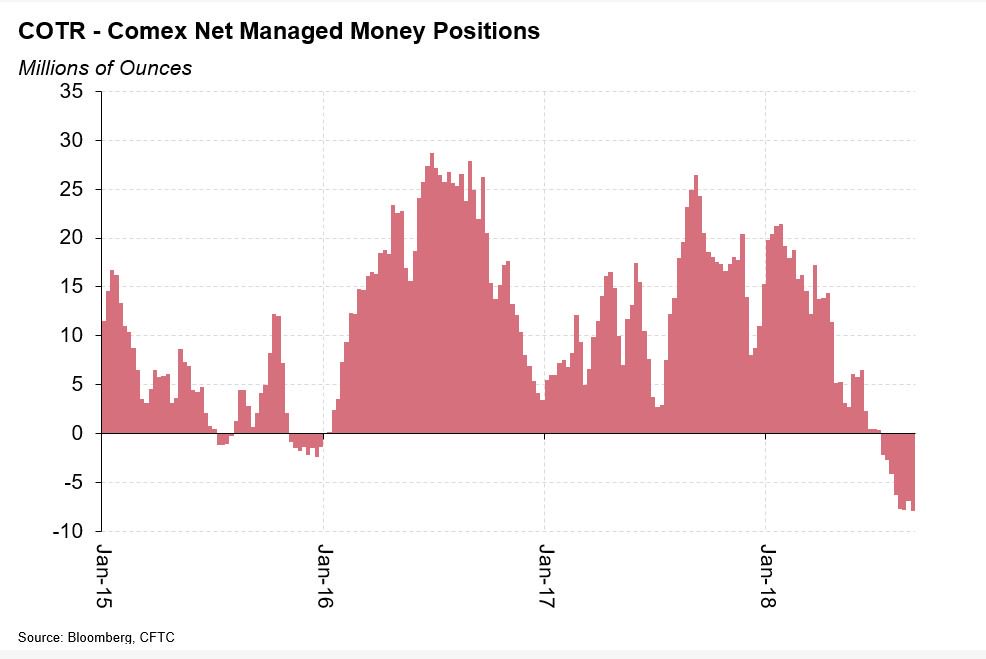

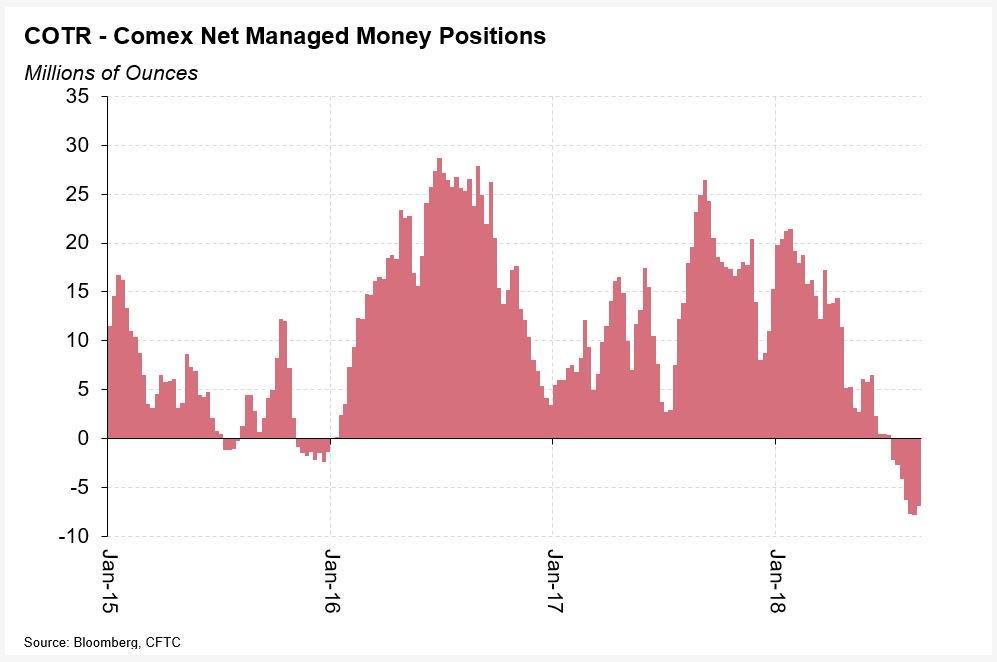

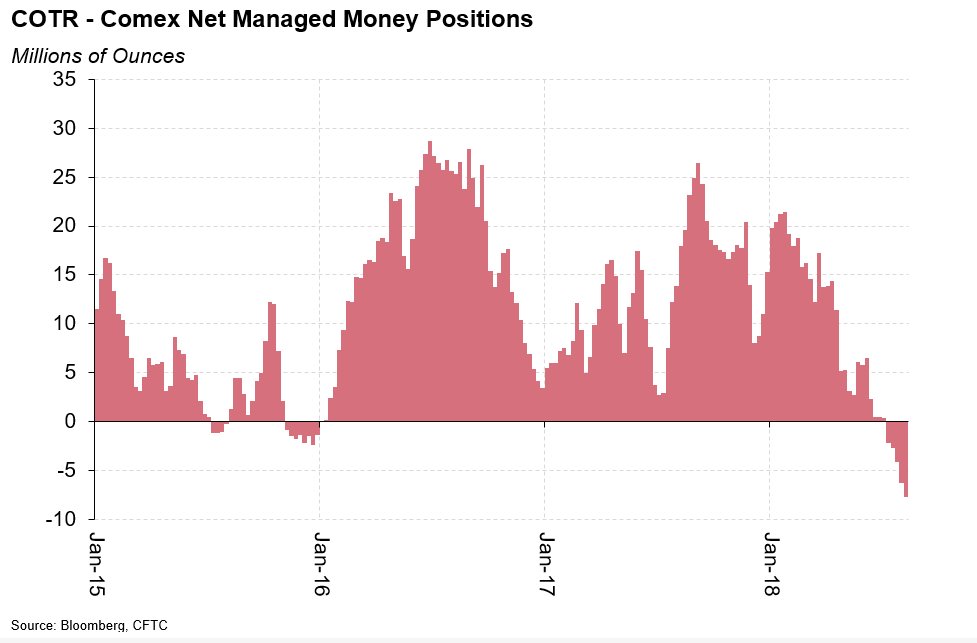

Gold: The COTR for #gold was released Friday, as usual, but I was away from the office yesterday and didn't get a chance to update spreadsheets: I need not have worried as its almost unchanged.

Managed Money remains net short gold, reduced by 0.75moz to 7.1 moz

1/4

Managed Money remains net short gold, reduced by 0.75moz to 7.1 moz

1/4

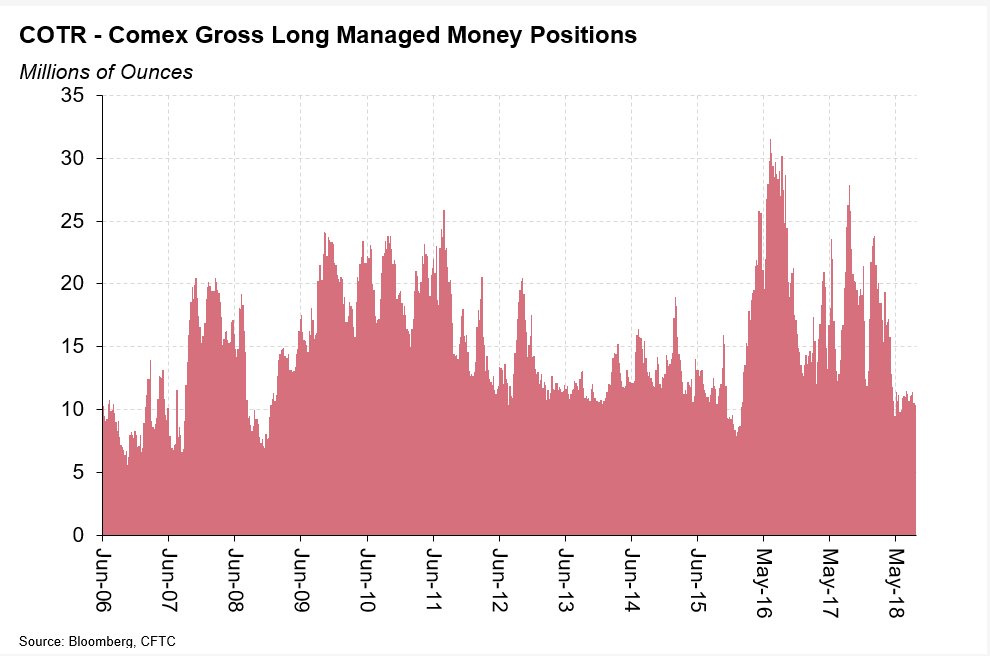

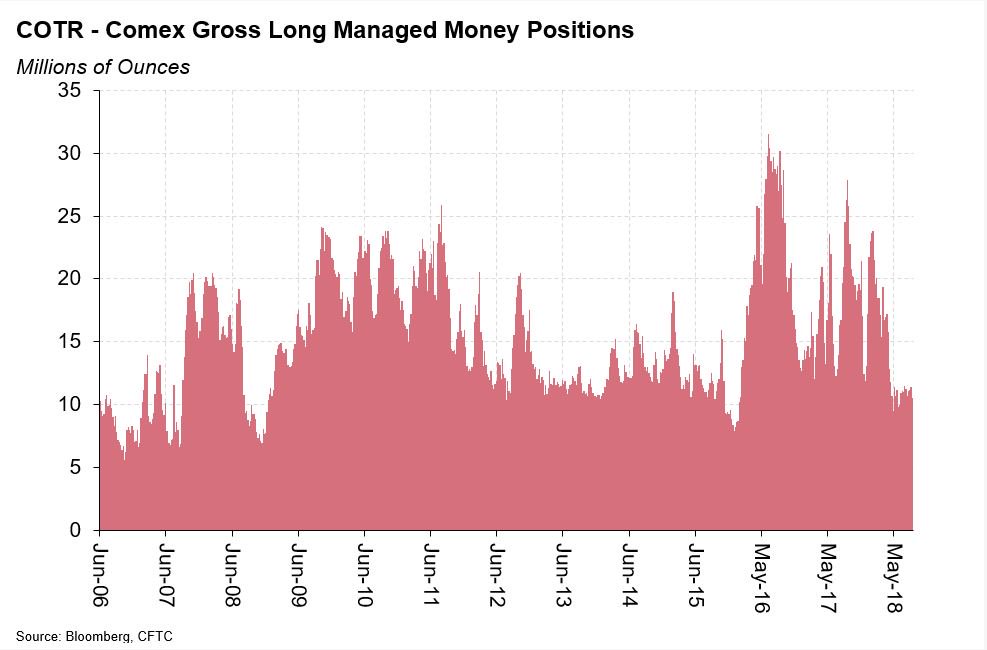

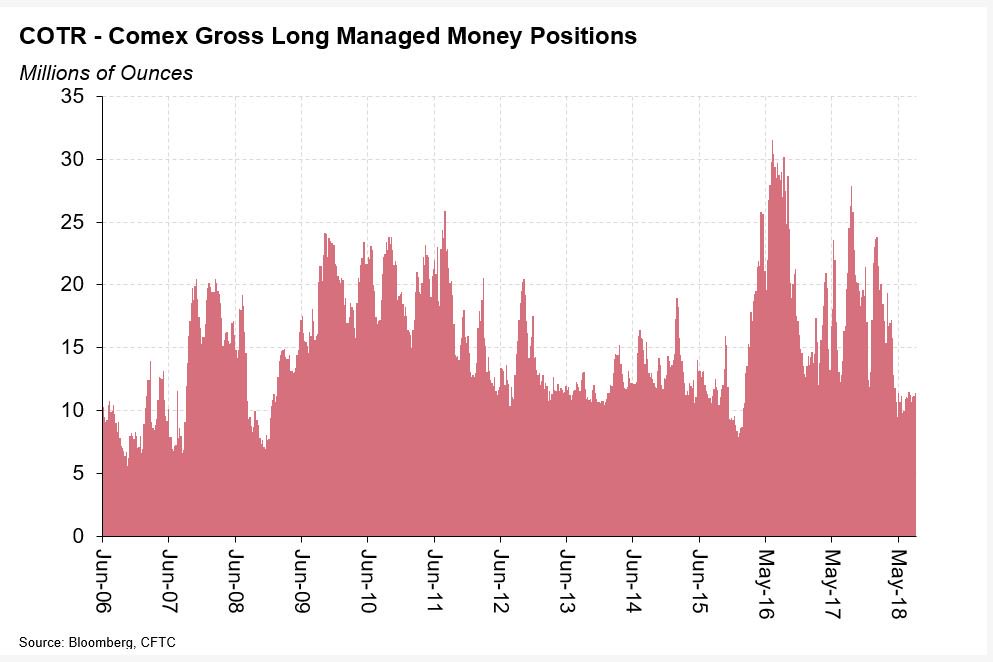

Gold: Gross #gold longs were down 0.16moz to 10.4moz, continuing to bounce roughly around the base level seen over the past six or seven years

2/4

2/4

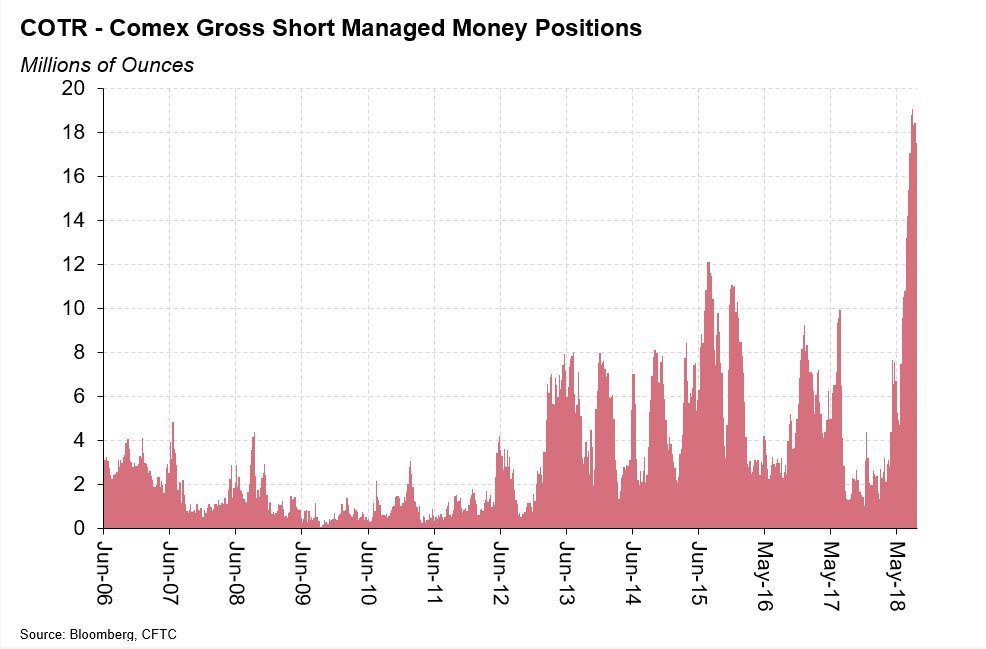

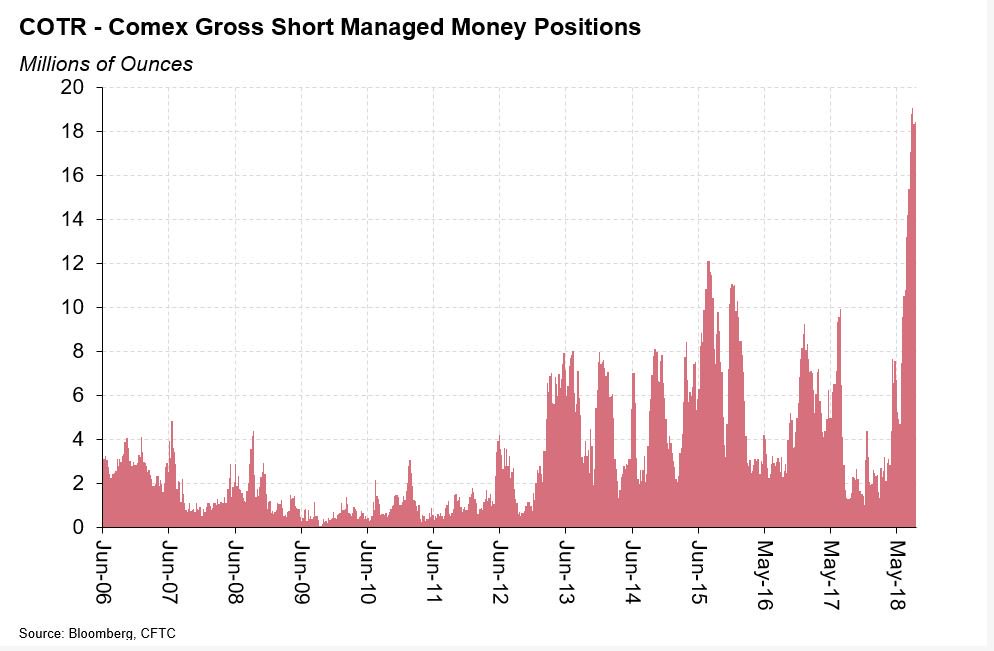

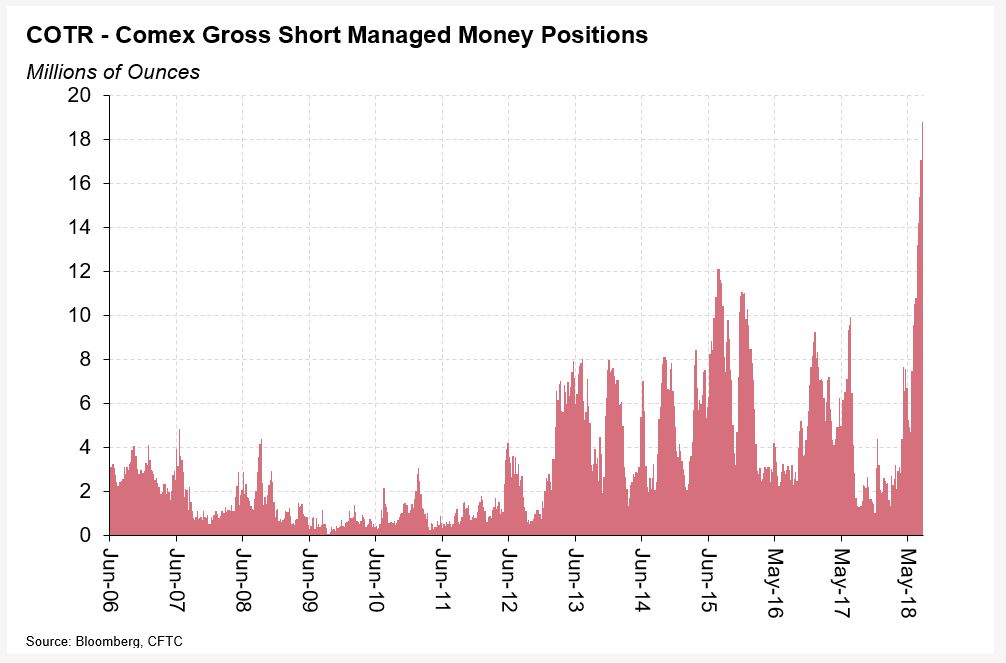

Gold: While Gross #gold shorts fell by 0.91moz to 17.5 million ounces, just shy of the highs seen since this data was available (2006).

3/4

3/4

Oh #Satoshi, I just found a new #RabbitHole! 🤯

tl;dr: #OpenSource #Bitcoin Wallets are like privately minted #gold coins.

[thread]

tl;dr: #OpenSource #Bitcoin Wallets are like privately minted #gold coins.

[thread]

In a free economy with gold as the one sound money, the global consensus are the 79 protons of the gold atom. There are different shapes and forms of collections of atoms, but fundamentally, as long as there are 79 protons, it is the base money.

The raw resource of gold is mixed with lots of dirt, stone and other lesser metals, and extracting gold ore is an entrepreneurial task. Human ingenuity and labor has to be intermingled with these natural resources so to increase the production stage of this good.

Gold: Tomorrow marks the 10-year anniversary of the failure of Lehman Brothers and, consequently, economists, market commentators and journalists have been rolling out their thoughts on both the financial crisis and the subsequent decade.

1/14

1/14

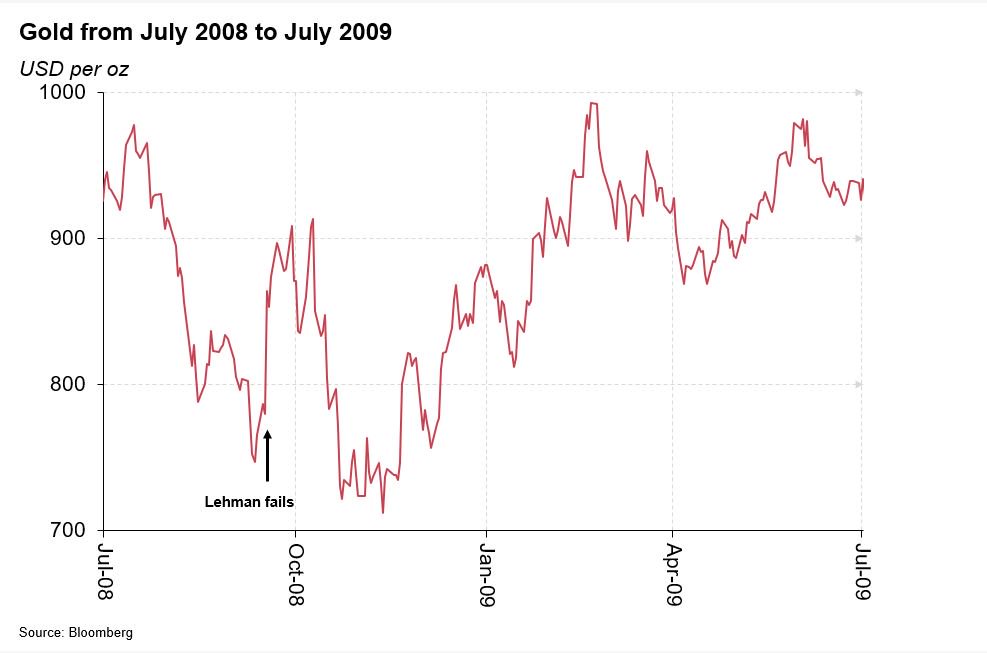

Gold: How did #gold fare through the crisis? This chart, from July 2008 to July 2009, shows no sign of gold moving rapidly higher? In fact, gold fell in the fourth quarter of 2008 as the dollar strengthened and gold was used as a source of liquidity (and sold.)

2/14

2/14

Gold: Although in the first half of 2009 #gold was comfortably above the level it was when Lehman failed…

3/14

3/14

Gold: Stubbornly Short:

CFTC data, released Friday for positions as of Tuesday 4 September, show that Comex Managed Money remains short #gold.

1/6

CFTC data, released Friday for positions as of Tuesday 4 September, show that Comex Managed Money remains short #gold.

1/6

Gold: There was little change to the already-elevated gross Managed Money short #gold position, which increased by only 100Koz; gross longs fell by 900koz to 10.5 million ounces, driving the net short position 1moz higher to 7.9Moz

2/6

2/6

Gold: There has been little change in price or Comex #gold open interest since last Tuesday, indicating little change in positions since then and no obvious technical trigger for a further move.

3/6

3/6

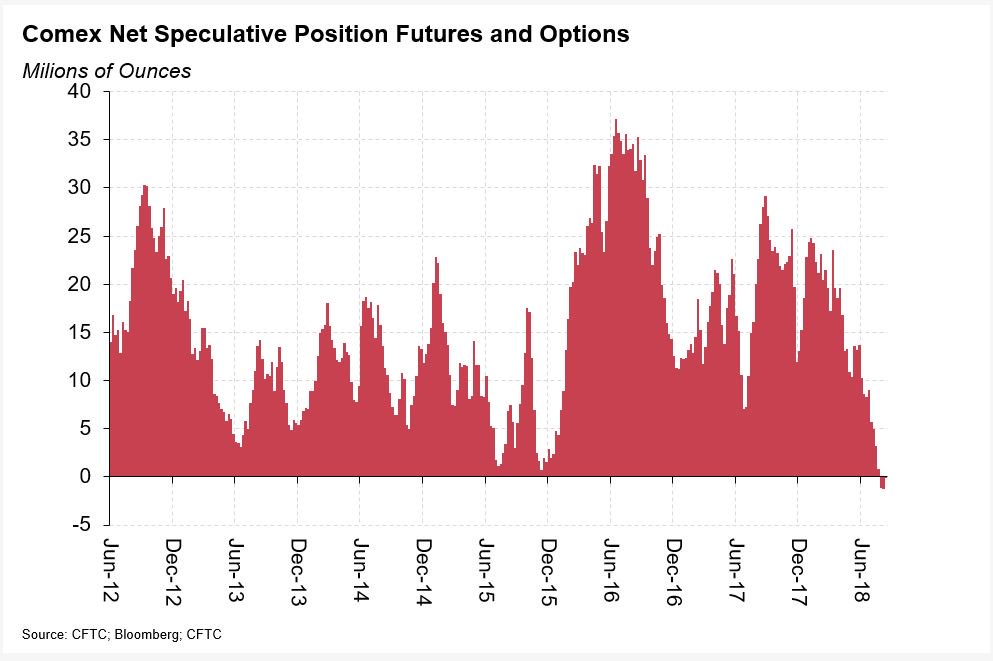

Gold: Its likely to be quiet today, with the US markets closed for the Labor Day public holiday. But the CFTC released its Commitment of Traders Report on Friday, as usual. To summarise, speculators were still (just) net short #gold as of 28 August. 1/6

Gold: The Managed Money category also remains net short #gold, although as in the case of the legacy report net speculative position, the net Managed Money short decreased slightly last week. 2/6

Gold: There was not much change to the Managed Money gross long #gold positions, which were steady around 11.4 million ounces. 3/6

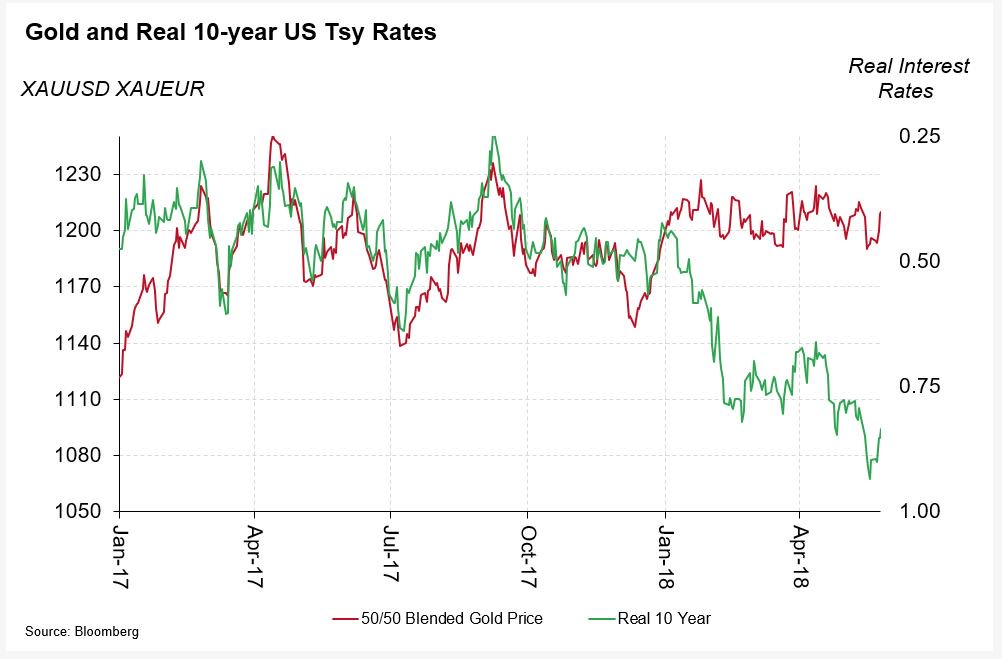

Gold: Early this year I noted the divergence between #gold and real US yields and wondered why this should be. 1/6

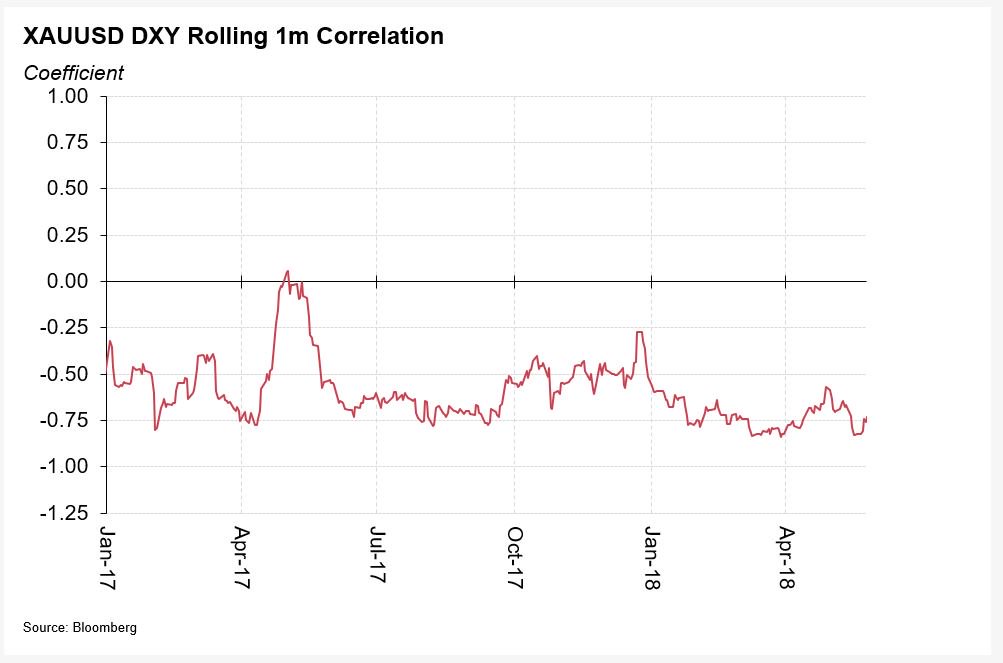

Gold: I noted that #gold's negative relationship with the dollar had become very important. 2/6

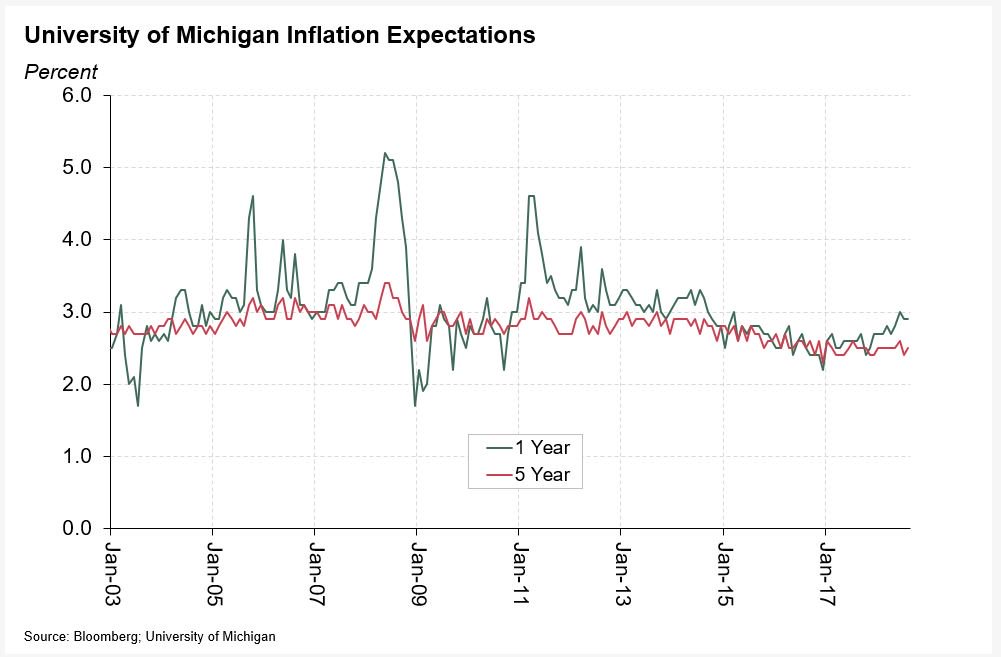

Gold I also suspected rising inflation expectations might be changing the drivers in #gold. 3/6

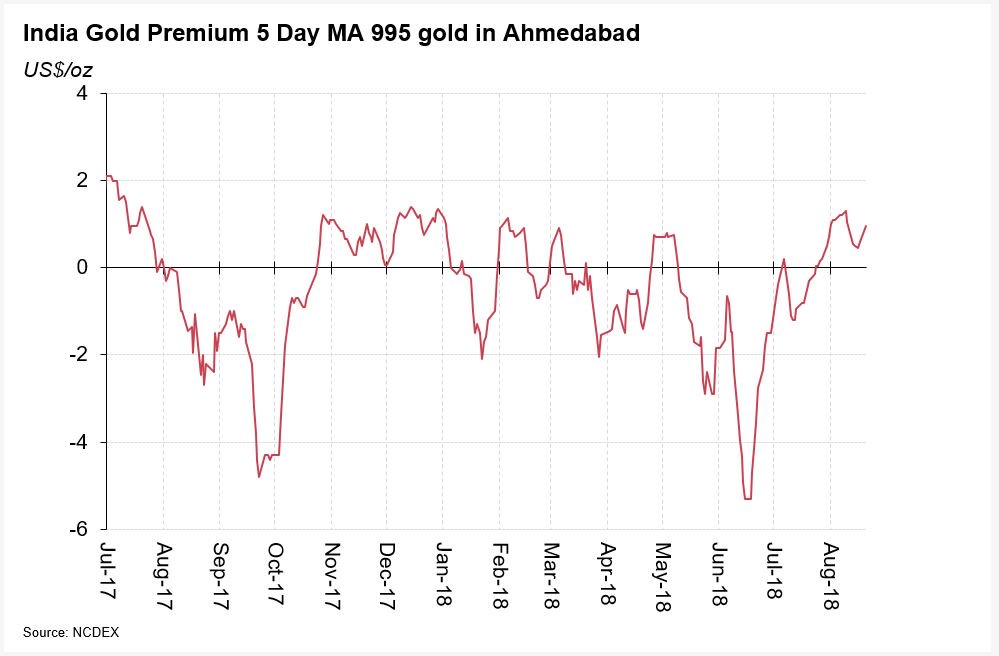

Gold: Mukesh Kumar, manager of research for @GOLDCOUNCIL in India, has spent the past few days talking to contacts across the Indian #gold market. The first thing I would observe is that the NCDEX polled premium is now positive (data to 20 August) 1/6

Gold: Mukesh notes that there will be an impact from the recent devastating Kerala floods and that the Onam festival will see less #gold demand than normal. But almost all the contacts believe the impact of the flooding will be temporary and should be limited to Q3-18. 2/6

Gold: For country as a while, almost all elements of the trade (fabricators, retails, dealers, banks and industry associations) are positive about #gold demand in H2-18. 3/6

Gold: Sitting like a Coiled Spring, #gold remains below $1200/oz on Monday, although it has recovered a little ground from the lows last week. 1/7

Gold: Why did I use the ‘Coiled Spring’ analogy? Because of build-up of Managed Money short #gold positions held on the Comex Futures market. Gross Managed Money short positions increased by a further 1.7 million ounces last week and now stand at a new record 18.8moz. 2/7

Gold: This has driven the net Managed Money #gold position to a larger net short position. 3/7

Holy COW !!

The people of #Turkey need to take action NOW or else this madman #Erdogan will take them to Stone Age era in weeks !

The people of #Turkey need to take action NOW or else this madman #Erdogan will take them to Stone Age era in weeks !

“If they have dollars, we have our Allah,” says #Erdogan to the economic meltdown in #Turkey and the record devaluation of the #Turkish lira against the U.S. dollar.

@aykan_erdemir

@aykan_erdemir

The #TurkishLira has weakened to a record low. Here's what #Turkey's president might say in a speech later today. @markets

Gold: Some reflections on the Indian gold market after speaking to the gold trade in and around the IIGC at Cochin. 1/n

Although the shops seemed busy to me, they were described as quiet by managers and WGC colleagues. That fits with what I’ve always understood, in that this time of thyear year rarely sees strong demand. Should start to pick up at 15 Aug, I’m told. 2/n

Gold: Modern, organised jewellery retailers, part of regional or (inter)national chains, still sell mostly traditional jewellery, but do have more modern lines too. 3/n

Bought a lot of #gold today. Going home now because I think I might throw up.

Gold vs Commercial Short position with Daily Sentiment (DSI) indicated in red. I'm estimating real time commercial shorts are now less than 50k (green box) and maybe even lower.

1/ I have received so many DMs, emails and phone calls regarding the initial tweet about #Gold (above from Thursday) that I’m going to try and explain my thinking here. Hopefully it translates into a coherent answer.

1. Q has told us, in not so many words, that the FEDERAL RESERVE of the UNITED STATES is a tool of immense power which the Cabal uses to consolidate their global influence, enrich their own, fund devastating global wars, and CONTROL THE PEOPLE. #qanon #EndtheFed

2. The Federal Reserve was founded in 1913 to provide a stable currency/economy. What most people don’t realize is that the FedRes is not a gov’t institution per se. It is PRIVATELY administered and controlled, although the President can make appointments to the Board. #qanon

3. Over the years, many people have criticized the Federal Reserves actions, questioning whether the FedRes effectively acts for “the people” or only the interests of the banks and elites. Critics like Ron Paul have lobbied for years to #EndtheFed #qanon

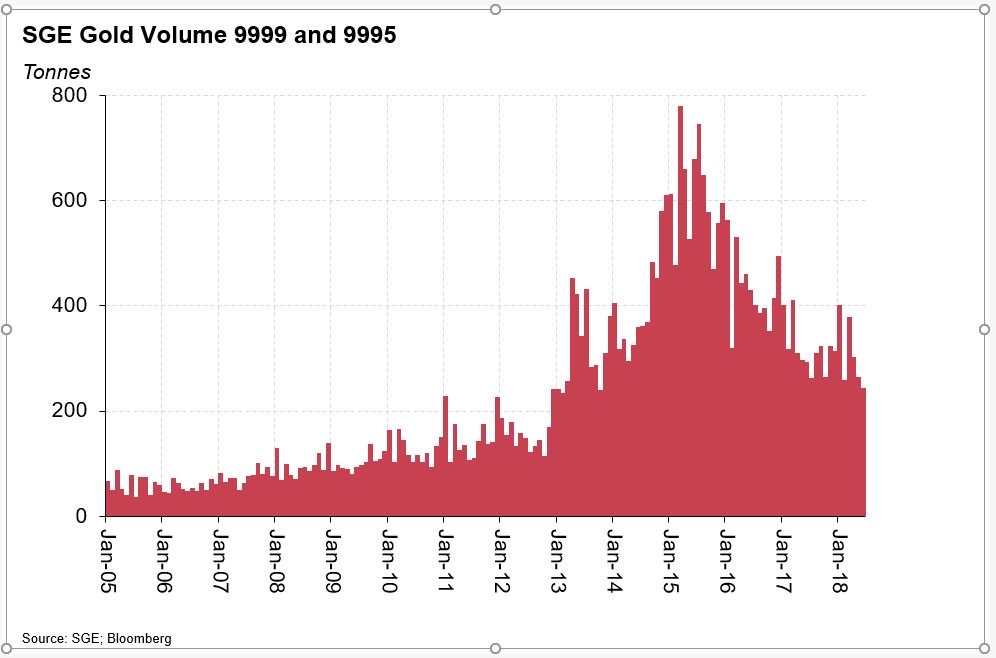

Gold: Physical #gold volumes on the Shanghai Gold Exchange round out a rather slow month, down 17% year on year. 1/3

Gold: Although we continue to hear that underlying demand is doing pretty well in China, efforts to better-control the use of gold in shadow financing may be contributing to a slowing in exchange volumes.

#RobbingGod

The story of how a death at the heart of the Holy Roman Empire set in motion a series of events and a fierce rivalry that engulfed Tirumala Tirupati Temples in such a way the reverberations of which are felt even today.

gginews.in/robbing-god-sm…

The story of how a death at the heart of the Holy Roman Empire set in motion a series of events and a fierce rivalry that engulfed Tirumala Tirupati Temples in such a way the reverberations of which are felt even today.

gginews.in/robbing-god-sm…

#RobbingGod

How East India Company tookover Tirumala Tirupati Temples & established rules for its plunder through the entry of their agent Mahants & establishment of Tirumala Tirupati Devasthanams for successive independent Indian governments to follow.

gginews.in/robbing-god-sm…

How East India Company tookover Tirumala Tirupati Temples & established rules for its plunder through the entry of their agent Mahants & establishment of Tirumala Tirupati Devasthanams for successive independent Indian governments to follow.

gginews.in/robbing-god-sm…

Centuries ago funds from these world’s richest temples of Tirumala Tirupati influenced not just elections of #Commonwealth but financed operations of bankrupt #BritishEmpire & setup numerous modern business houses involved in smuggling antiques even today.

gginews.in/robbing-god-sm…

gginews.in/robbing-god-sm…

1) @Gold_AntiTrust is frustrated James Grant doesn't know central banks manipulate #gold.

Ea day in London, 220M oz of unbacked gold debt instruments are traded primarily between bullion banks.

Est'd 500M oz open int. claims in spot contracts.

#silver gata.org/node/18244

Ea day in London, 220M oz of unbacked gold debt instruments are traded primarily between bullion banks.

Est'd 500M oz open int. claims in spot contracts.

#silver gata.org/node/18244

2) In 1985, Larry Summers' paper identified neg. correlation w/ real interest rates "dominant feature of gold price fluctuations".

In 1987, Bank of England created the LBMA (90% of global gold trade ea day) trading unbacked paper #gold.

safehaven.com/article/42493/… @Gold_AntiTrust

In 1987, Bank of England created the LBMA (90% of global gold trade ea day) trading unbacked paper #gold.

safehaven.com/article/42493/… @Gold_AntiTrust

3) Suppress #gold and interest rates can be suppressed (shut down gold alarm system). Lower int. rates cause speculation / mkt bubbles.

Bullion banks trading paper gold in London benefit fr. low rates w/ $100s billions profits & asset transfer since 1987. safehaven.com/article/34980/…

Bullion banks trading paper gold in London benefit fr. low rates w/ $100s billions profits & asset transfer since 1987. safehaven.com/article/34980/…

Impact of the Petro-Yuan (w/ Gold settlement option) contract still to be seen; first Yuan contract settles in September 2018. As @Ole_S_Hansen notes, trading volume of the Petro-Yuan oil contract continues to build. A developing story. #OOTT #PetroGold

The Yuan/Gold settlement oil contract China has launched will fundamentally impact the Petro Dollar's dominant status. Out comes the mallet.

cnbc.com/2018/05/17/tru… #oott #oil

cnbc.com/2018/05/17/tru… #oott #oil

Russia has been receiving physical gold payment from China for oil for years.

President Trump can see where this is inevitably going globally.

Out comes the mallet.

zerohedge.com/news/2018-05-1…

#oil #oott #gold #petrogold

President Trump can see where this is inevitably going globally.

Out comes the mallet.

zerohedge.com/news/2018-05-1…

#oil #oott #gold #petrogold

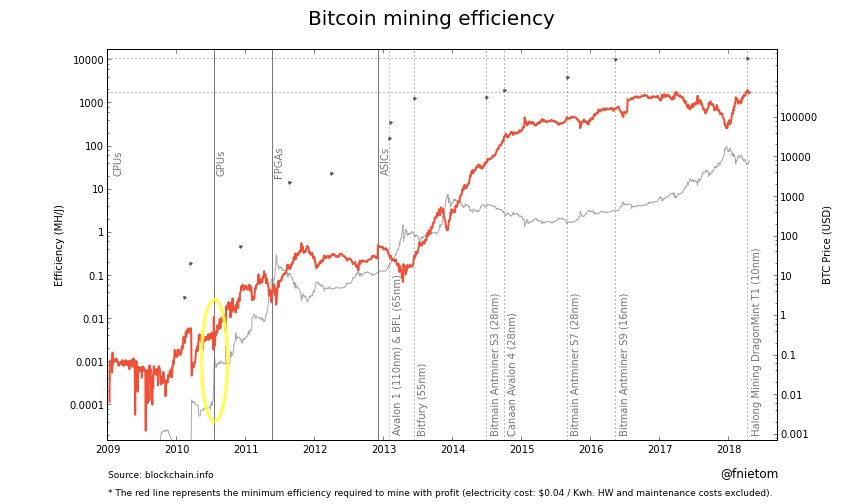

On July 18, 2010 ArtForz started mining bitcoin with GPU, reducing drastically the reward for the rest of the miners. The result was pretty interesting: instead of putting them out of business, the price jumped 10x to fully compensate the new difficulty. ofnumbers.com/2014/04/20/how…

The subjective theory of value states that the value of a good is determined by the importance an acting individual places on it. ArtForz was not selling, so he restricted the offer forcing buyers to reconsider the subjective value of bitcoin and buy at CPU miners price.

Pricing collectibles such as #gold or #bitcoin is very different from pricing other objects. When #offer is depleted #price can quickly jump orders of magnitude. #monetization #hyperbitcoinization

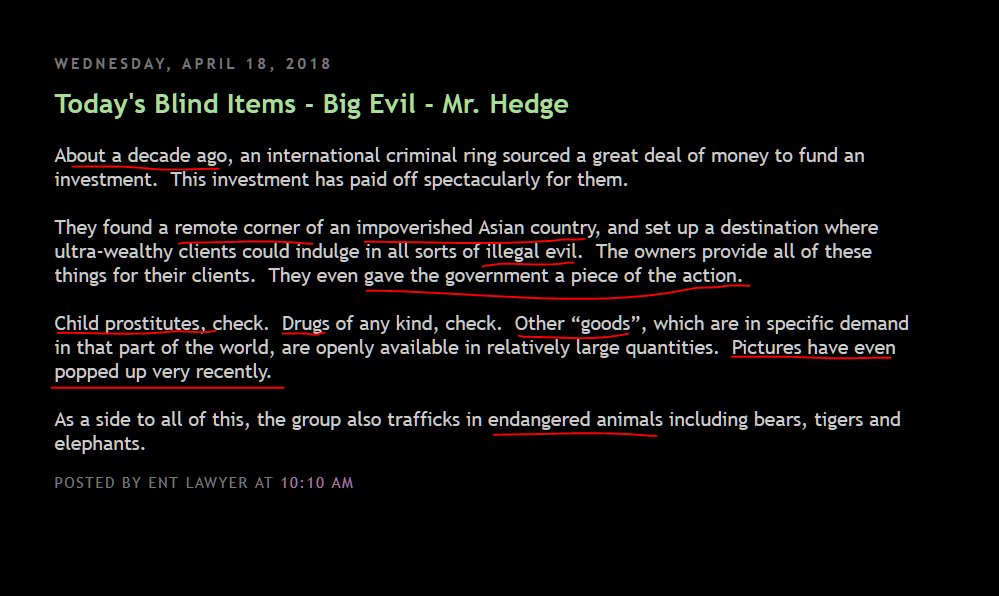

1) This #CDAN blind looks solved & exposes yet another sicko crime network, this time #SoutheastAsia. It connects several interesting items to #QAnon #crumbs. Don't eat while reading.

Lets unravel it.

@entylawyer #GreatAwakenening @potus #WWG1WGA #ThesePeopleAreSick #redpill

Lets unravel it.

@entylawyer #GreatAwakenening @potus #WWG1WGA #ThesePeopleAreSick #redpill

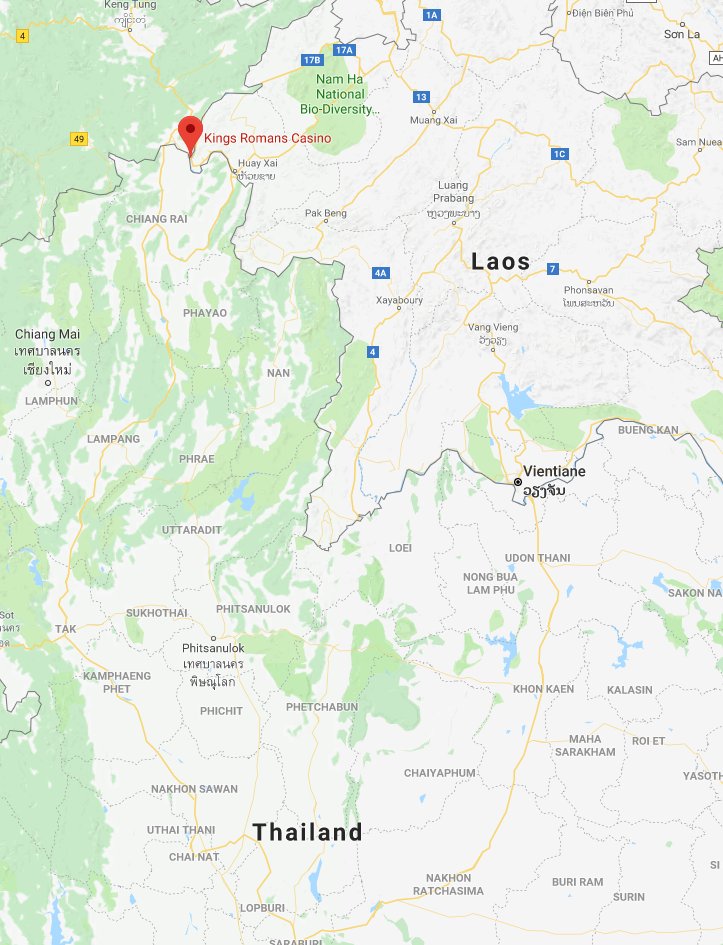

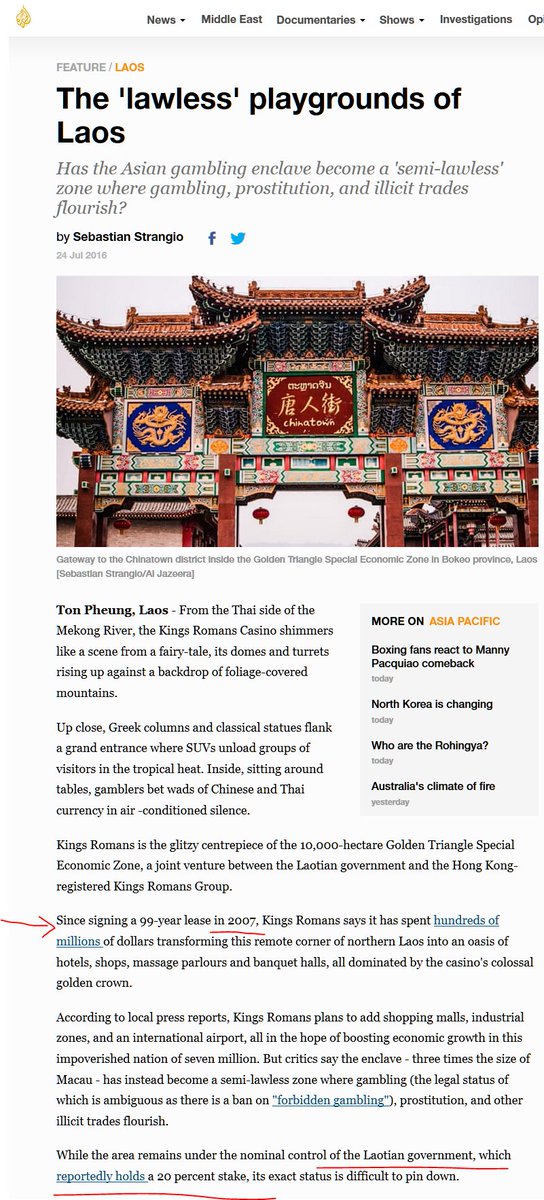

2) Starting with the country in question, it's #Laos. This is the Kings Romans Casino in a remote corner of Laos. Matches the #blind. Poverty? Dead poor. Ranks 9 of 10 in the region, and #135 globally. More about the casino...

#TheStorm #TheStormIsHere #WeThePeople #QArmy

#TheStorm #TheStormIsHere #WeThePeople #QArmy

3) The blind says that "about a decade ago" it was funded. See below, the lease with the government was signed in 2007, that fits. It's a 99 year lease. And the government gets a 20% cut. Ding ding ding.

#QAnon #WWG1WGA @POTUS #MAGA #GreatAwakenening #TheStorm #TheStormIsHere

#QAnon #WWG1WGA @POTUS #MAGA #GreatAwakenening #TheStorm #TheStormIsHere

Strangely, the Dollar has been falling despite the Fed hiking rates. Why? Meanwhile, #Gold has been rising. zerohedge.com/news/2018-01-1…

Currently $btc = $10,116

Google trends is highly correlated with Bitcoin’s price.