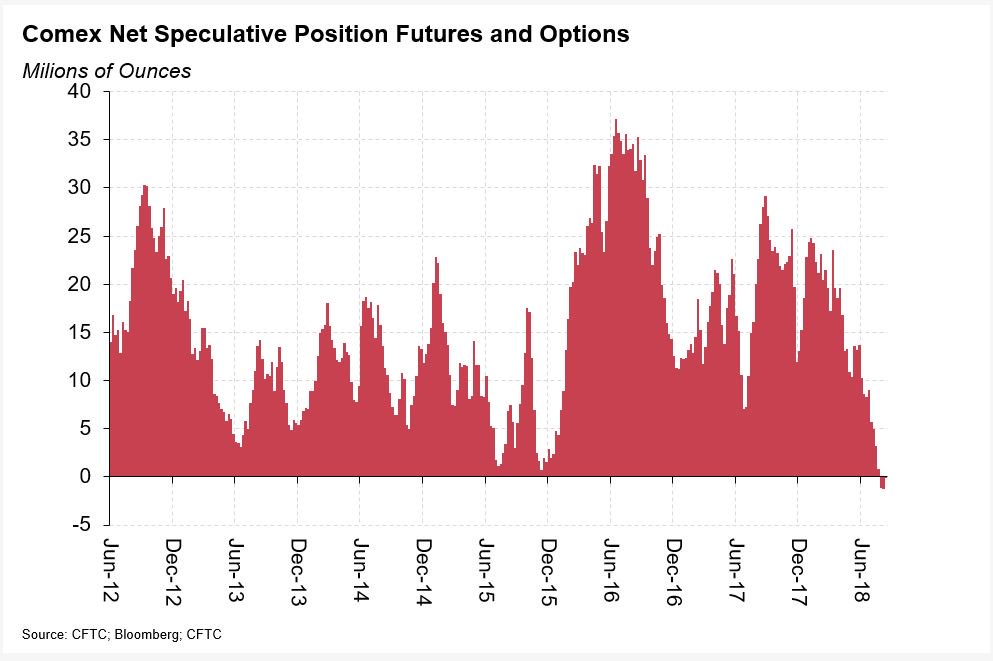

Gold: Stubbornly Short:

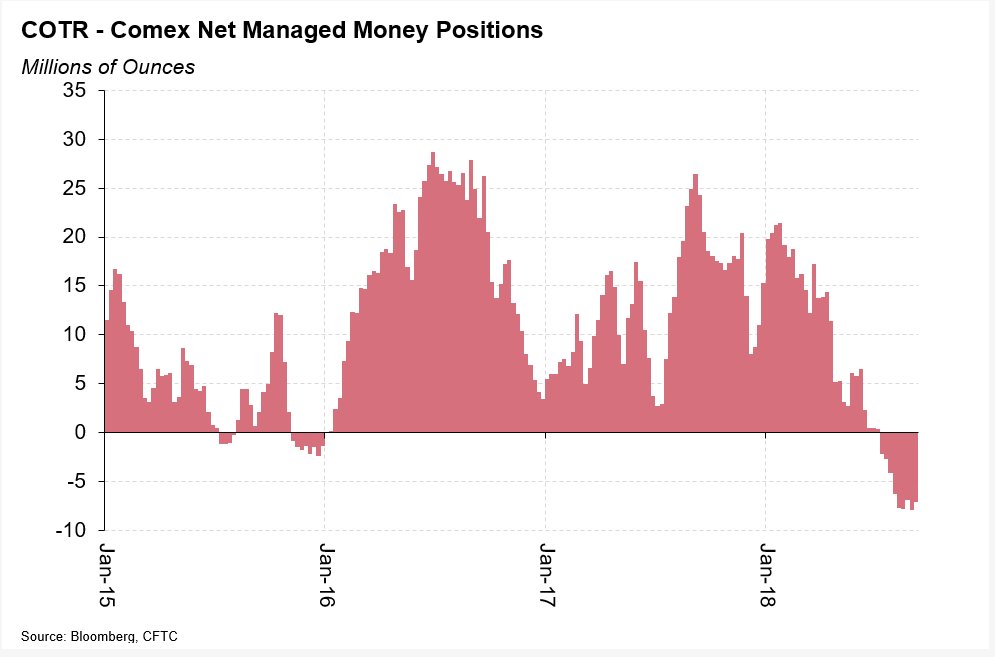

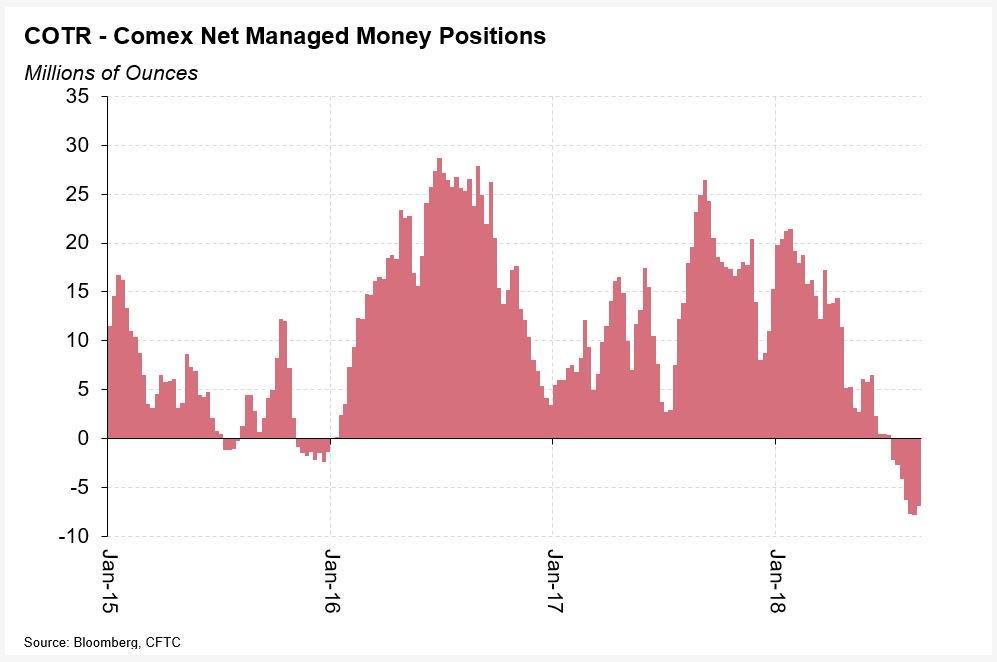

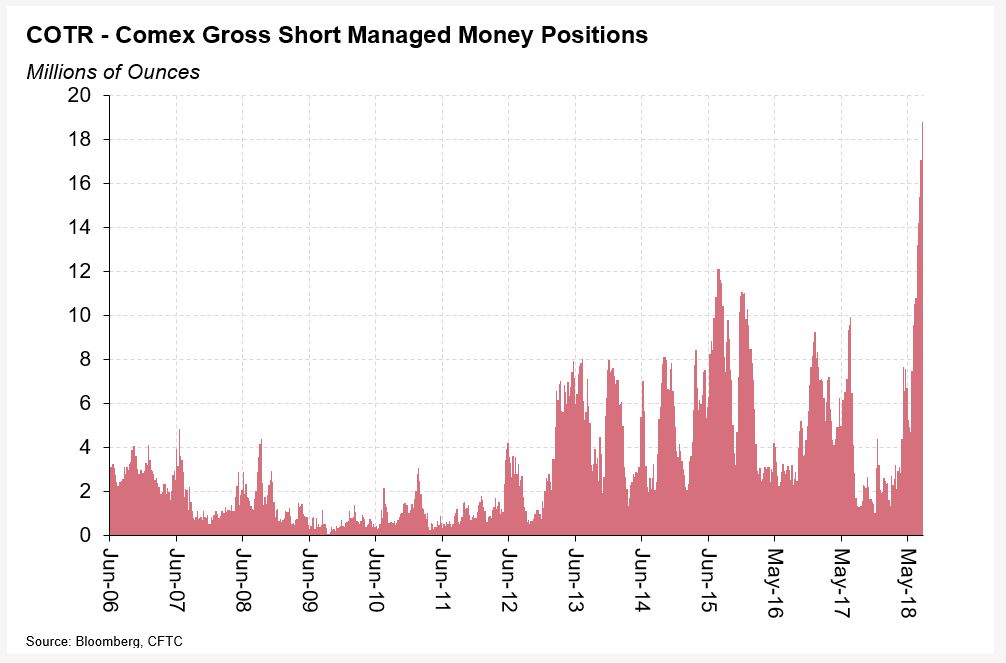

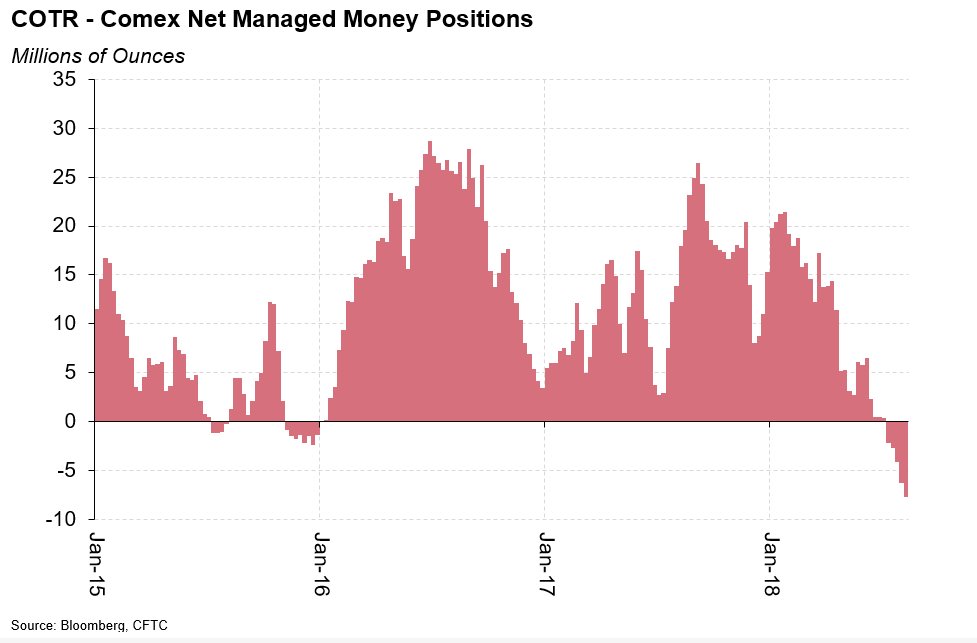

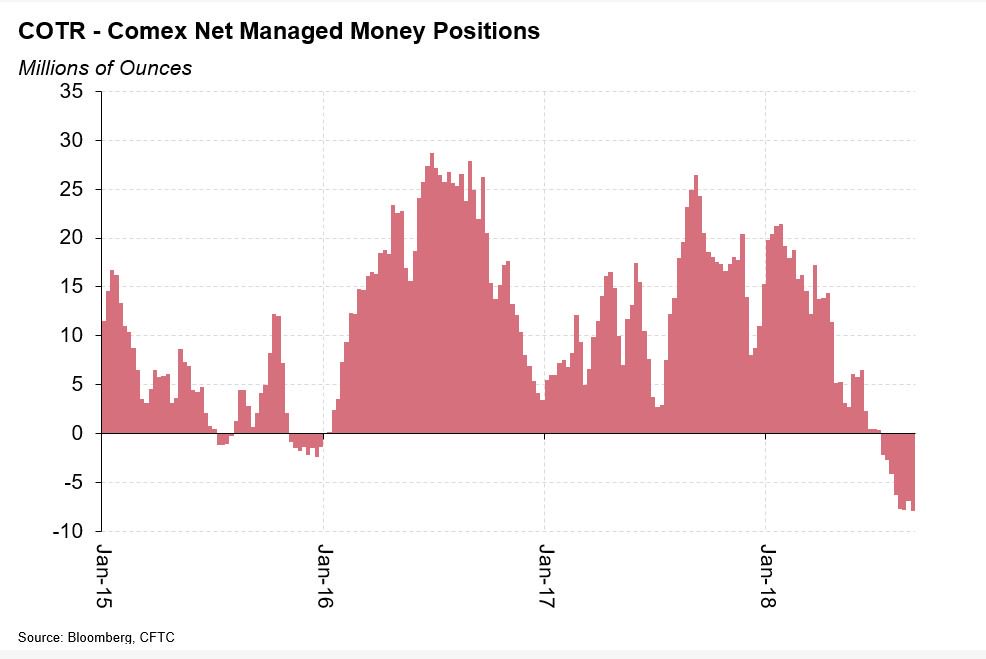

CFTC data, released Friday for positions as of Tuesday 4 September, show that Comex Managed Money remains short #gold.

1/6

CFTC data, released Friday for positions as of Tuesday 4 September, show that Comex Managed Money remains short #gold.

1/6

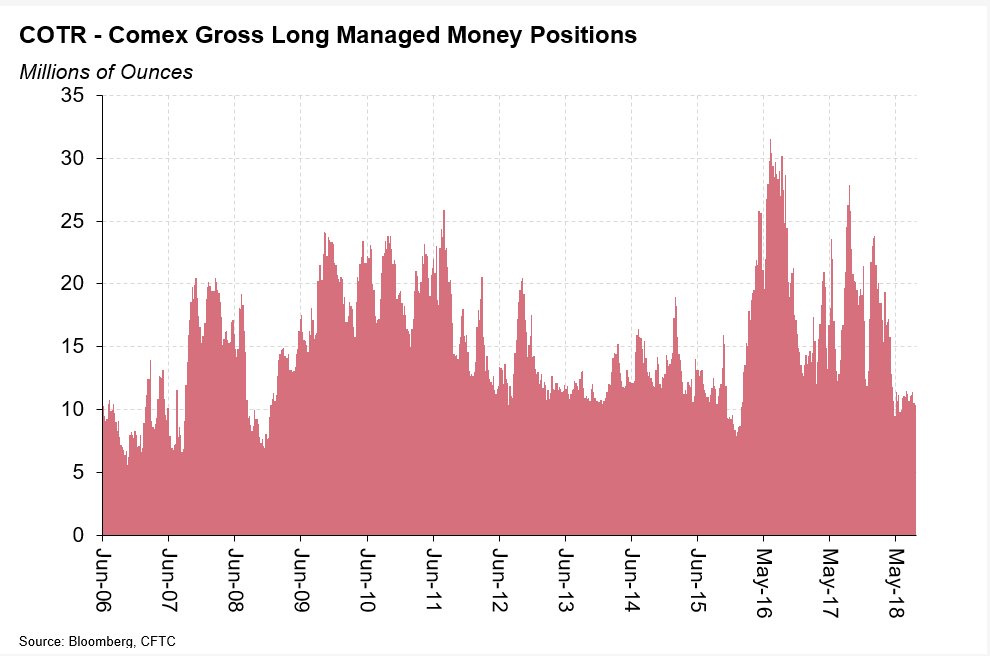

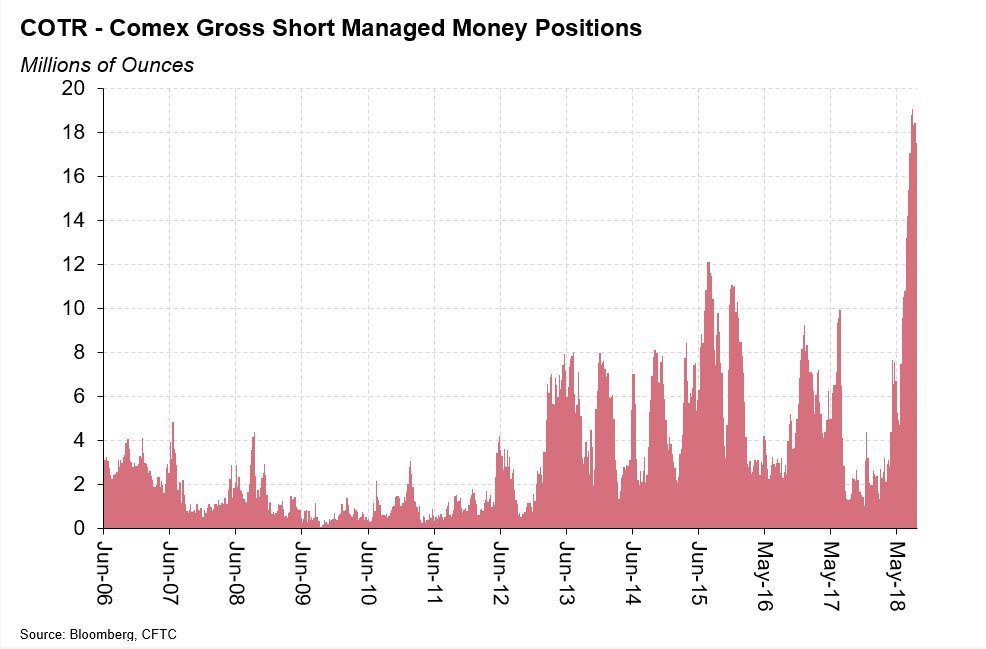

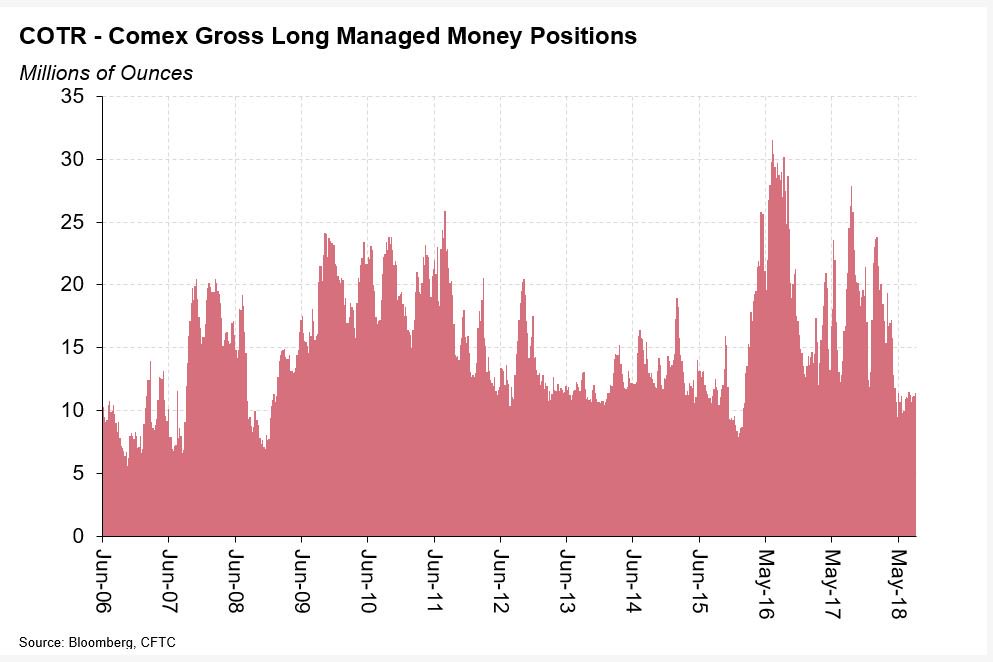

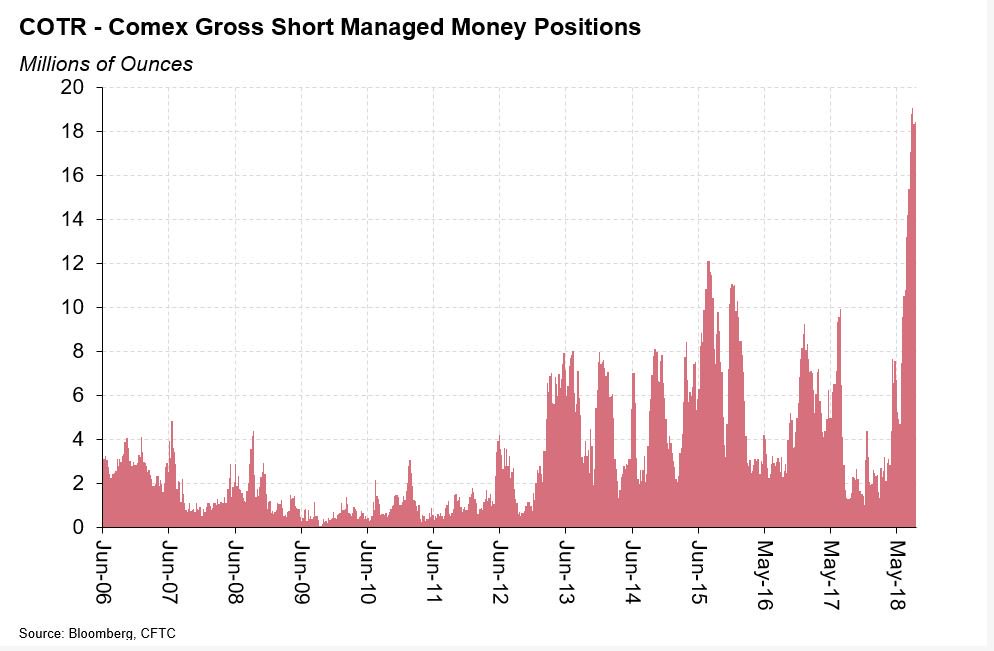

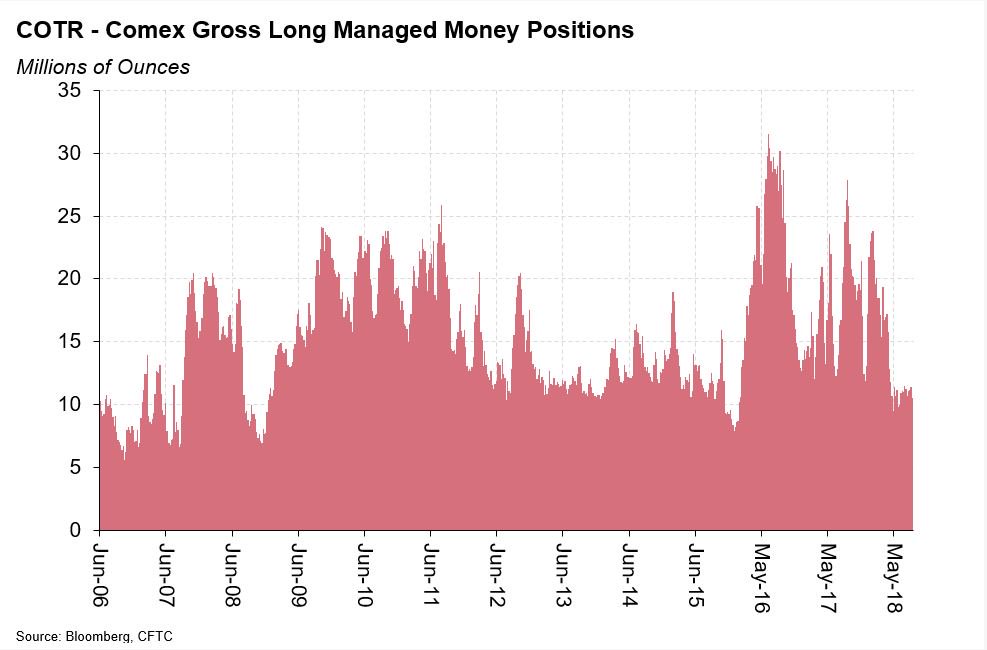

Gold: There was little change to the already-elevated gross Managed Money short #gold position, which increased by only 100Koz; gross longs fell by 900koz to 10.5 million ounces, driving the net short position 1moz higher to 7.9Moz

2/6

2/6

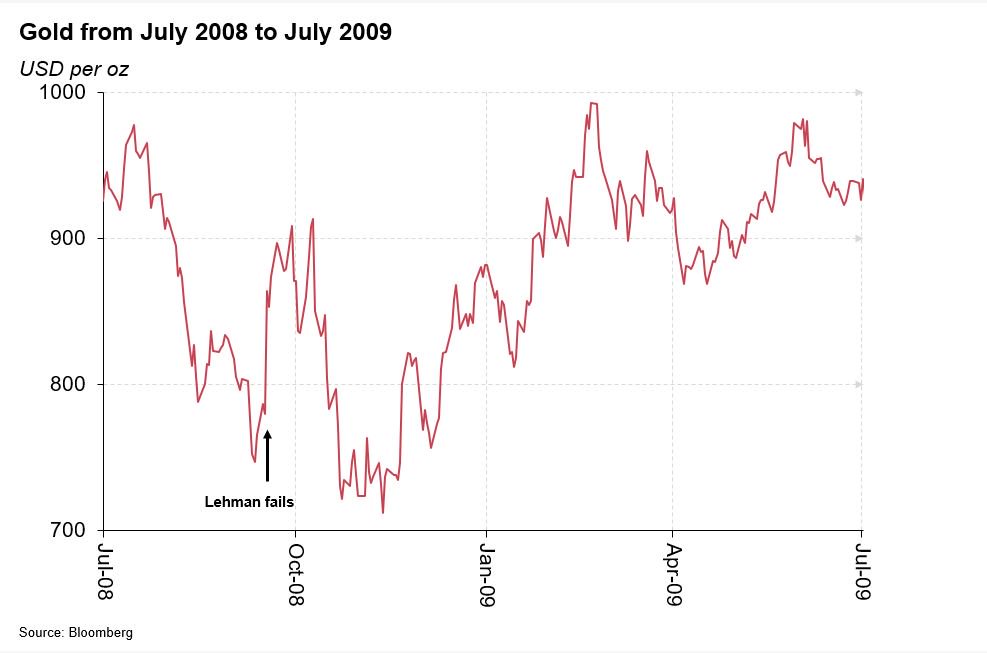

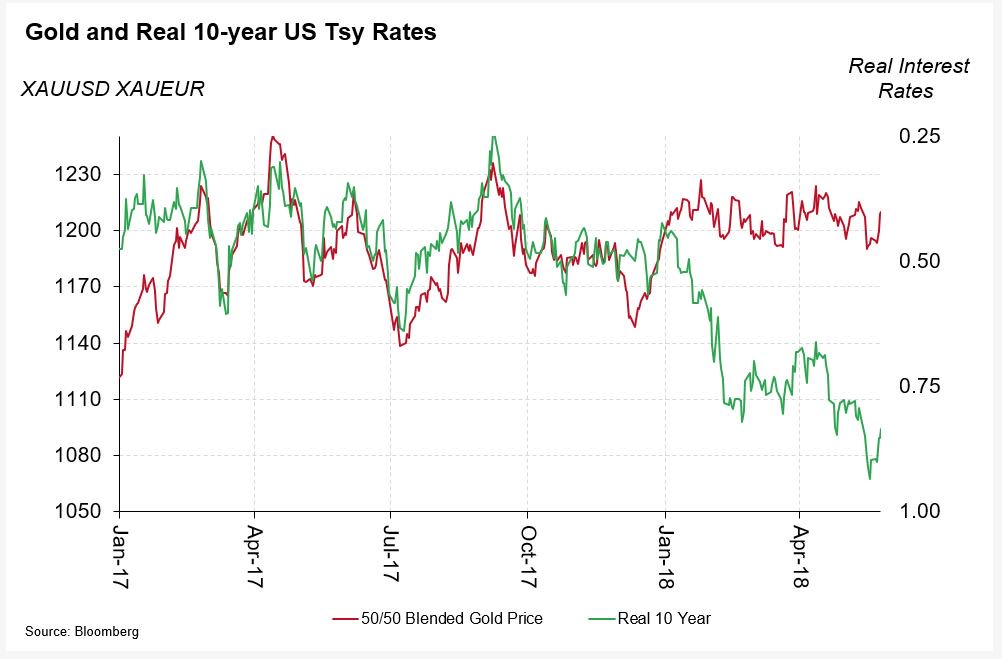

Gold: There has been little change in price or Comex #gold open interest since last Tuesday, indicating little change in positions since then and no obvious technical trigger for a further move.

3/6

3/6

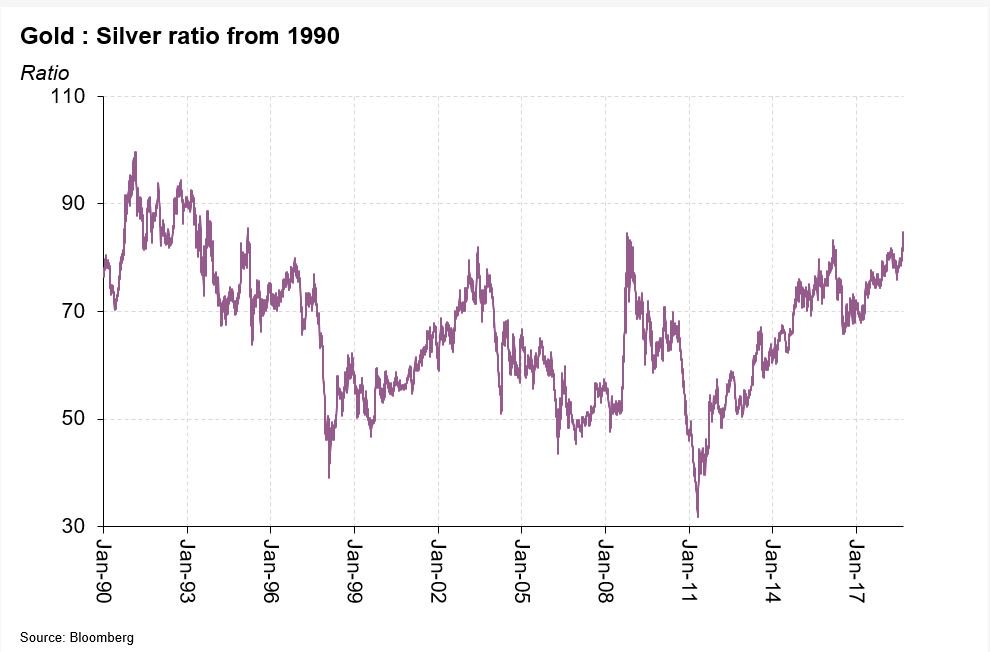

Gold: Precious metals appear out of favour now, at least from the investment and speculative community: one barometer for this is the #Gold: Silver ratio, clearly elevated currently.

5/6

5/6

Gold: The net speculative short position in silver is at an all-time high (using data back to 1993), confirming this negative sentiment.

6/6

6/6

@threadreaderapp Good morning. Please unroll. Thank you.

• • •

Missing some Tweet in this thread? You can try to

force a refresh