THREAD: Friends, ahead of @EiENigeria and partners debate with Osun Guber candidates, let's have a quick review of Osun State Finances.

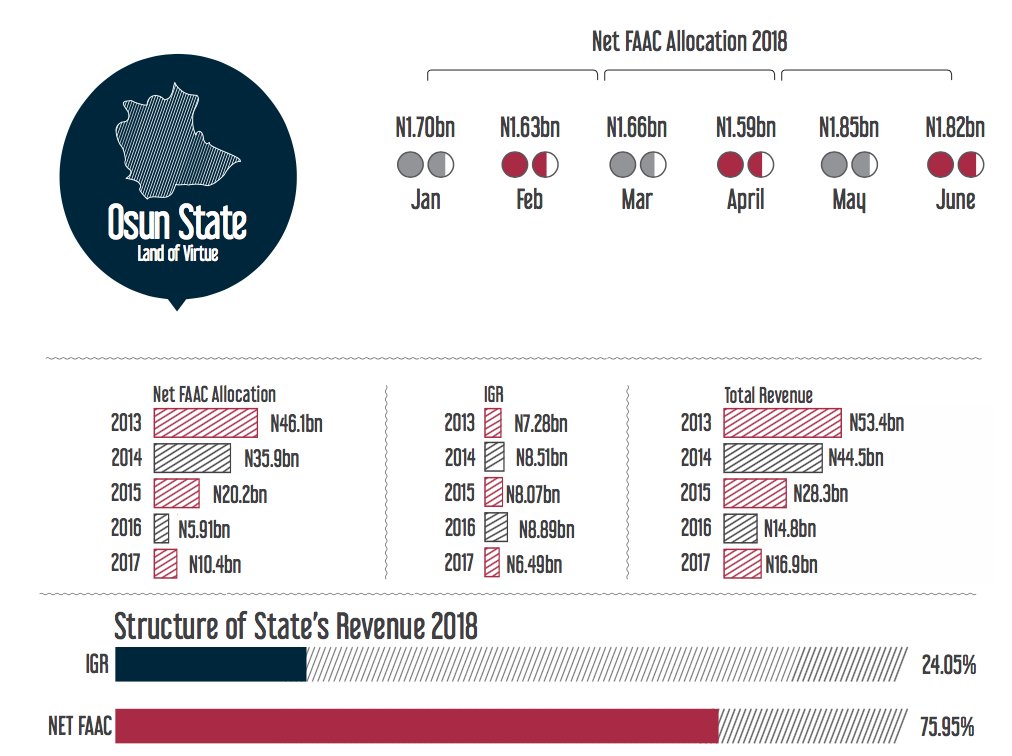

You will notice that Osun State receipts from FAAC has dwindled. From a Net FAAC Allocation of N46bn in 2013 to N10.4bn in 2017. #OsunDecides

You will notice that Osun State receipts from FAAC has dwindled. From a Net FAAC Allocation of N46bn in 2013 to N10.4bn in 2017. #OsunDecides

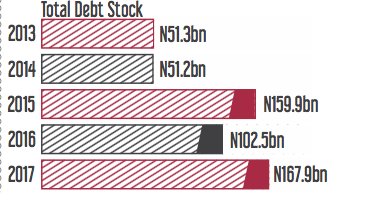

Oil prices started falling in 2014, a big challenge for Osun State has been its accumulation of debt not linked to growth in internal revenues. Total Debt Stock moved from N51bn in 2013 to N167bn as at 2017. #OsunDecides

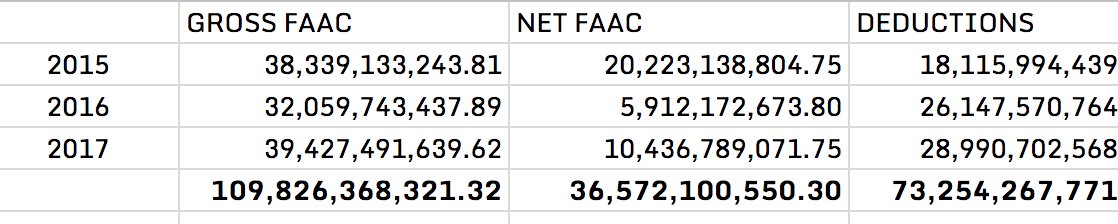

The big challenge for Osun State is the direct DEDUCTIONS by CBN before it earns FAAC allocation.

According to BudgIT Research, Osun gross allocation between 2015 and 2017 is meant to N109bn. However, N73bn was deducted leaving the state to receive on N36.5bn. #OsunDecides

According to BudgIT Research, Osun gross allocation between 2015 and 2017 is meant to N109bn. However, N73bn was deducted leaving the state to receive on N36.5bn. #OsunDecides

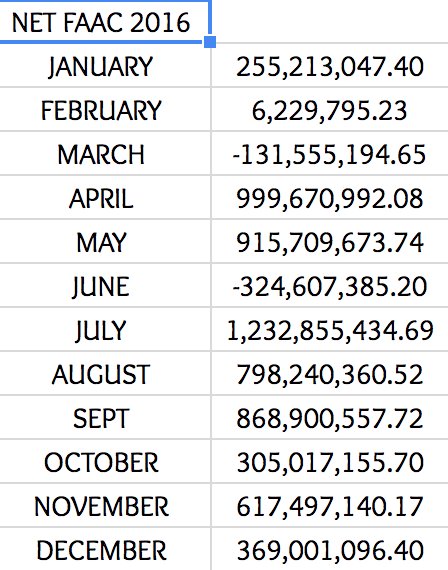

There were months which Osun received nothing from FAAC as its deductions due to the bond repayments were more than the actual amount meant to be received from FAAC. This happened in March and June 2016. Osun's NET FAAC was in negative. #OsunDecides

According to updated NBS report, its annual IGR has grew from N8.89bn in 2016 to N11.7bn in 2017. This is equivalent to the average Lagos State IGR collection in 14 days.

The State Govt claims N13bn in 2017. #OsunDecides

The State Govt claims N13bn in 2017. #OsunDecides

The main support to pay Osun’s salaries has been from the Paris Club Refund. In total Osun State has received N40.96bn, with the following: Tranche 1 (N11.74bn), Tranche 2 (N6.3bn), Tranche 3 (N6.3bn), Tranche 4 (N16.6bn).

There is no other Paris Club Tranche. #Osundecides

There is no other Paris Club Tranche. #Osundecides

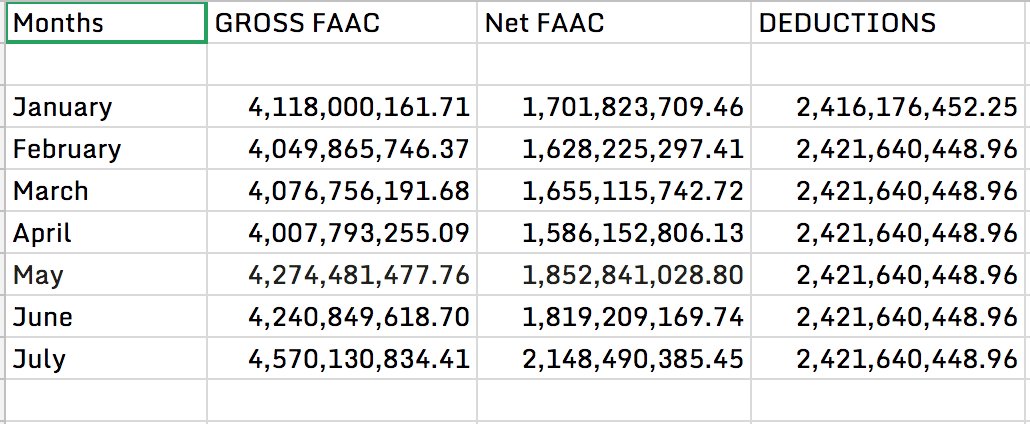

Here is the pattern of Osun State deduction since the start of 2018. N2.4bn is deducted monthly before its final allocation is remitted to the state. When does Osun fiscal challenge end? #OsunDecides

The next State Governor does not have an easy job. As the state govt ended its “modulated/fractional” salaries, which has gone on for 3 years. Osun has also not been able to meet obligations to tertiary institutions. Full salary payments are put at N3.5bn monthly.

#OsunDecides

#OsunDecides

Finally, Out of 36 States, Osun ranks number 35 on our 2018 State Fiscal Sustainability Index. It has come up in 35th or 36th position in our last 3 issues, mainly due to high debt and weak IGR.

The answers aren’t easy. Are the candidates up to the task?

#OsunDecides

The answers aren’t easy. Are the candidates up to the task?

#OsunDecides

If oil prices fall again and there is no further support from FG such as Paris Club Refund, what is the fate of Osun with average IGR around N1bn monthly?

#OsunDecides #AskQuestions

#OsunDecides #AskQuestions

• • •

Missing some Tweet in this thread? You can try to

force a refresh