Discover and read the best of Twitter Threads about #LearnMMT

Most recents (15)

“Then why does the military budget keep going up as social programs keep getting cut?"

Now that’s a good question.

#LearnMMT

[thread – version 2]

Now that’s a good question.

#LearnMMT

[thread – version 2]

You and I require income (a paycheck) before we can spend. We must choose and prioritize what each dollar is spent on. Food or medicine? Can’t afford both this week. Or... gotta chop that pill in half so we can buy food for our kids. Hard choices. One or the other. Either/or.

Before Nixon took the US dollar off the gold standard in 1971, the federal gov't was the same way: they needed income (i.e. taxes) before they could spend. Now that the US dollar is a "fiat" currency, "a budget" to me and you is

**NOTHING**

like "a budget" to the federal gov't.

**NOTHING**

like "a budget" to the federal gov't.

"Then why does the military budget keep going up as social programs keep getting cut?"

Now that’s a good question.

[thread]

#LearnMMT

Now that’s a good question.

[thread]

#LearnMMT

You & I require income (a paycheck) before we can spend. We must choose & prioritize what we spend each $ on. Food or medicine? Can’t afford both this week. Or...gotta chop that pill in half in order to buy bread & eggs to feed our kids. Hard choices. One or the other. Either or.

Before the United States went off the gold standard in August of 1971, the federal government was exactly the same way: they needed income (taxes, borrowing) before they could spend on federal programs.

Macroeconomics never really mattered to me in either grad school program I completed because I truly thought the US Government had to borrow money from private banks & that the economy was dependent on the private sector. Then I was able to #LearnMMT & now I know its on Congress!

It all came together once I learned the very basic foundational truth that there are currency issuers and currency users. #LearnMMT

That the currency issuer could never go broke on debt denominated in it's own currency... unless their was a commodity peg (like gold) with convertibility associated with it. #LearnMMT

Most people think that "printing money" causes inflation while government "borrowing" does not. But they're wrong. They both can cause inflation, and by the same amount. Let's see why. (Thread)

People think this because "printing money" increases the money supply, while "borrowing" does not, it just shifts money around. But that's not really how prices work. Inflation happens when people try to buy more goods/services than the economy can produce. (2/)

If the car-makers can only produce 100 cars, but buyers are trying to purchase 1,000 cars...then they're going to raise the price. It's less about how much money there is, and more about what people are doing with their money. Not buying anything = no inflation. (3/)

The #JobGuarantee is more than a price stabilizing tool, or a "buffer stock of labor" to keep ready for private sector employers. It IS those things, but more importantly it's a life changing policy that will eliminate involuntary unemployment. And for me it's personal.. 1/

My son Jared turns 7 in a few weeks. He was 3 when he was diagnosed with autism. The official diagnosis wasn't a surprise to me, it was almost like diagnosing my daughter with curly hair. We knew. I WAS surprised however when I heard of the unemployment #'s for autistic adults 2/

"There will be 500,000 adults on the autism spectrum aging into adulthood over the next 10 years. Yet a whopping 85% of college grads affected by autism are unemployed, compared to the national unemployment rate of 4.5%" (2017) 3/

moneyish.com/heart/most-col…

moneyish.com/heart/most-col…

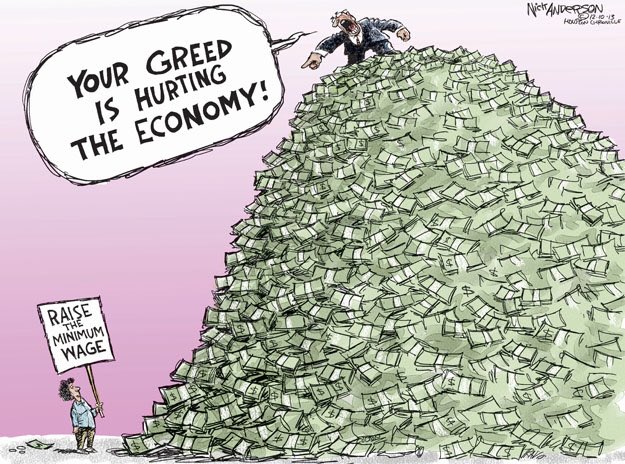

1/ There is so much good in this video by @cenkuygur and @TheYoungTurks: The federal government prioritizes war over programs for the powerless. Like many many times over. But Cenk (and @commondreams) are SO wrong in HOW it’s presented. #LearnMMT

2/ The fed govt is not constrained by💰. The U.S. is a sovereign nation with fiat (non-gold backed) currency. It has infinite💰at its disposal. Whatever it needs, write it in a bill, vote it into law. BAM. New💰. (It SHOULDN’T create infinite💰, but it damn well could.) #LearnMMT

3/ State & municipal govts, and households, ARE constrained by💰, since they can’t create the currency. (Well, at the risk of going federal prison for counterfeiting, they could certainly try.) The fed govt (Congress) are currency ISSUERS. Everyone else are currency USERS.

Hello MMT world! This twitter feed is meant to provide opportunities for online MMT activism. We will post articles, YouTube videos, twitter threads, etc., which could benefit from an MMT perspective in the replies, then you can join those discussions. (1/4)

Our purpose: to stamp out myths regarding the monetary and banking system, so that political and economic discussions can truly be informed. (2/4)

Our strategy: get MMT out there to the places these discussions are already being had. Do so in a highly visible and lasting way that maximizes the impact of our time. Engage people in friendly conversation. Win hearts and minds one by one. (3/4)

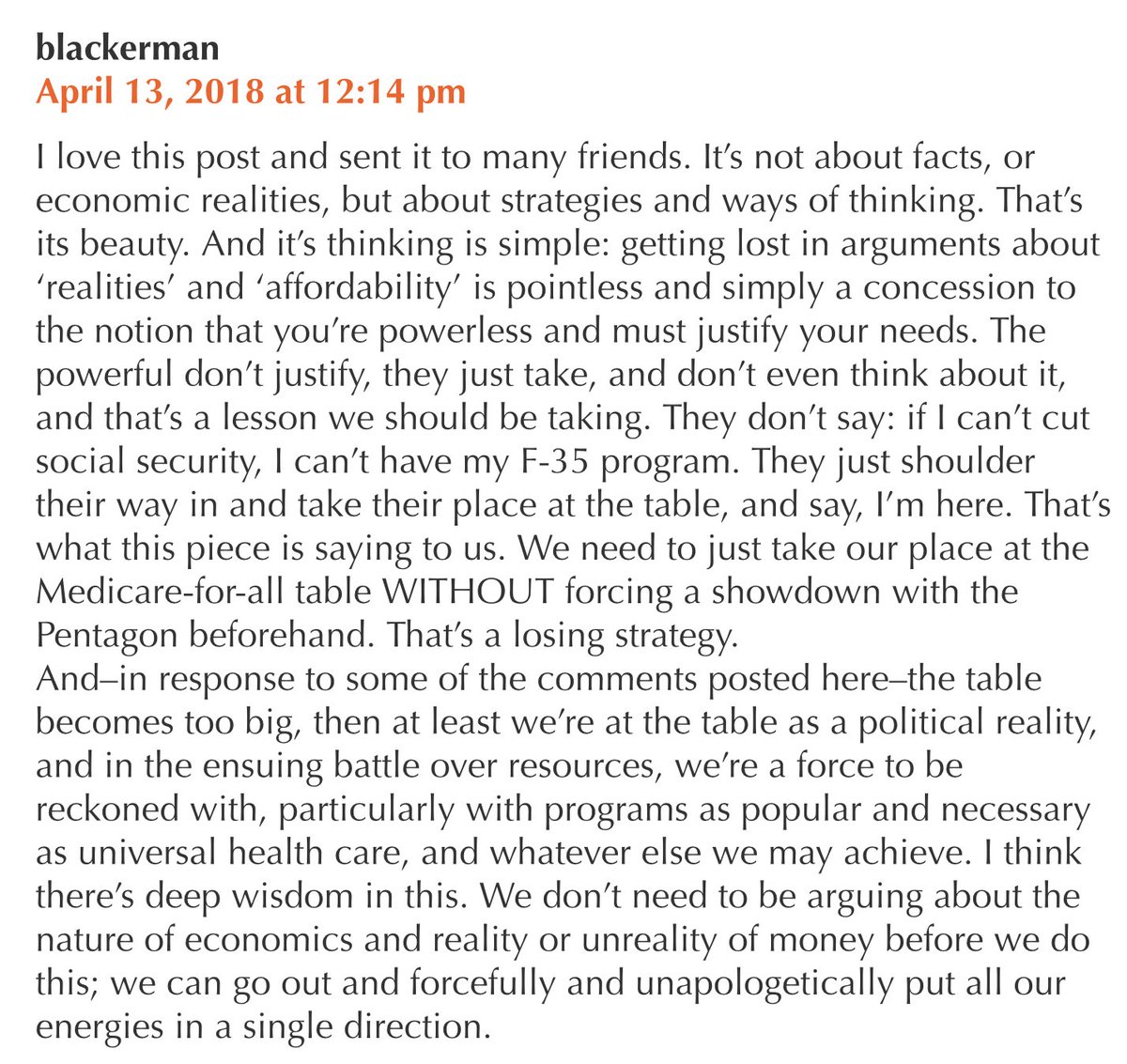

If you REALLY want #MedicareForAll, then stop talking about how we will “pay for“ #MedicareForAll.

#MMT #LearnMMT

citizensmedia.tv/2018/04/12/mmt…

#MMT #LearnMMT

citizensmedia.tv/2018/04/12/mmt…

An insightful response to our article on avoiding the “pay-for” trap.

Article: citizensmedia.tv/2018/04/12/mmt…

Comment: nakedcapitalism.com/2018/04/true-a…

Article: citizensmedia.tv/2018/04/12/mmt…

Comment: nakedcapitalism.com/2018/04/true-a…

And another:

As citizens, we make demands from our reps, it’s their job to deliver on those demands & sort out the details properly.

Me: “I want #MedicareForAll”

Rep: “How RU going to pay for that?”

Me: “Stop making me do your job. You wanna be a leader? LEAD!”

#LearnMMT

As citizens, we make demands from our reps, it’s their job to deliver on those demands & sort out the details properly.

Me: “I want #MedicareForAll”

Rep: “How RU going to pay for that?”

Me: “Stop making me do your job. You wanna be a leader? LEAD!”

#LearnMMT

1/ An extraordinary first article for understanding Modern Monetary Theory #MMT: “Cutting the federal deficit to cure a recession is like applying leeches to cure anemia.” #LearnMMT mythfighter.com/2010/08/13/mon…

2/ Freaking out about the deficit and the debt is to myopically focus on only the federal government’s bank account at the expense of every private citizen. A balanced budget for the federal government takes money directly out of the pockets of every American. #LearnMMT

3/ Freaking out about the deficit & debt is sort of like only caring about the financial condition of the parents while completely ignoring the well-being of all of their children – and the family as a whole. What is best for the FAMILY?! What is best for the COUNTRY?! #LearnMMT

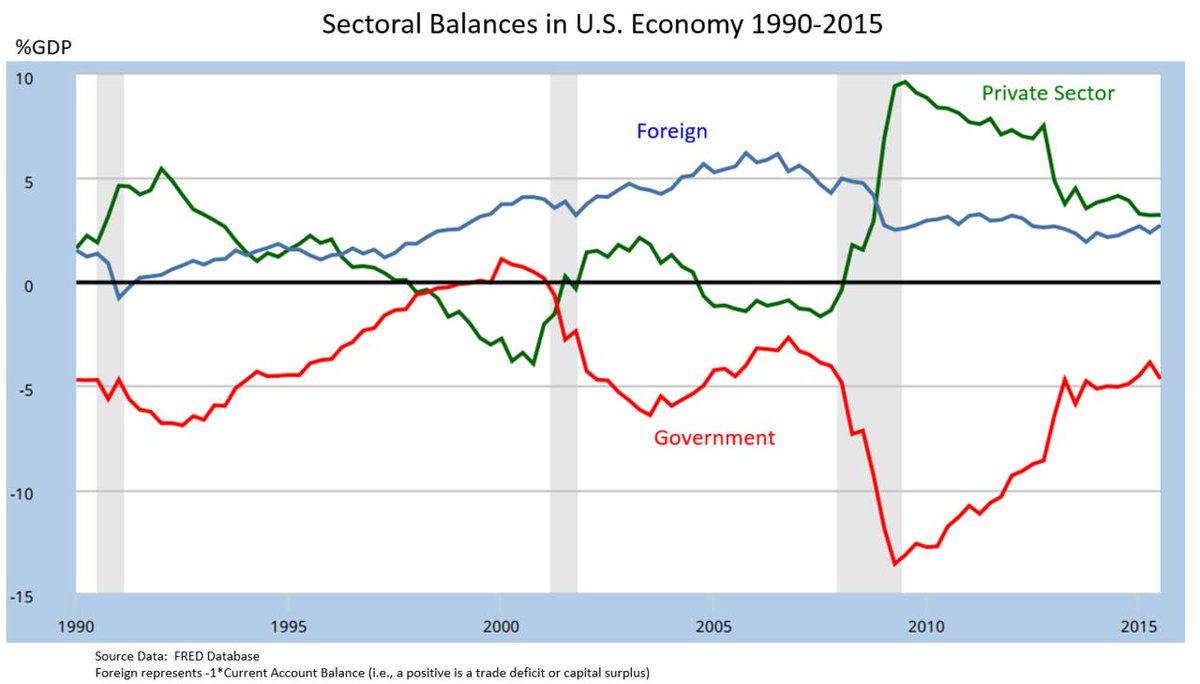

*A Picture's Worth a Thousand Words*

The US had recessions in both the early and late 2000s...when we had government surpluses or drastically reduced government deficits, which (of course) correspond with private sector deficit. And look where things stand as of 2015. 1of 4

The US had recessions in both the early and late 2000s...when we had government surpluses or drastically reduced government deficits, which (of course) correspond with private sector deficit. And look where things stand as of 2015. 1of 4

Federal deficit reduction amounts to decreases in private sector savings as a simple matter of accounting. And you can't sustain an economy that way. The economy will go into a downturn.

2 of 4

2 of 4

Stop listening to these deficit reduction cranks. They don't know what they're talking about and they wreck the economy whenever they get their way, Democrat or Republican. Every. Single. Time.

3 of 4

3 of 4

1/8 Please please please, @WaywardWinifred (& all progressive leaders!), please #LearnMMT. in a country that prints its own money (the United States is a “sovereign” nation with a “fiat” currency) the national debt is meaningless and nonsensical.

2/8 #LearnMMT

- “We can’t ‘afford’ #MedicareForAll!” 👉 The word “afford” is meaningless in a fiat currency. We print our own money!

- “Sure, #M4A is nice, maybe someday, but how will we pay for it?!” 👉 We pay for it by voting the money into existence. How? By passing HR-676.

- “We can’t ‘afford’ #MedicareForAll!” 👉 The word “afford” is meaningless in a fiat currency. We print our own money!

- “Sure, #M4A is nice, maybe someday, but how will we pay for it?!” 👉 We pay for it by voting the money into existence. How? By passing HR-676.

3/8 #LearnMMT

- But r taxes will go up! 👉 Federal taxes, while really important, DO NOT PAY FOR ANYTHING. (If u could print ur own 💰, would u need income?)

- But it will bankrupt the country! Think of the children! 👉 Exactly how do u bankrupt a country that prints its own 💰?

- But r taxes will go up! 👉 Federal taxes, while really important, DO NOT PAY FOR ANYTHING. (If u could print ur own 💰, would u need income?)

- But it will bankrupt the country! Think of the children! 👉 Exactly how do u bankrupt a country that prints its own 💰?

See, this is what happens when you #LearnMMT. @RoKhanna, like every federal government official (whether elected or appointed) has learned #MMT. Federal officials have always known #MMT. ( 👈Remember that, because it will – should! – make you angry after you, too, #LearnMMT.) 1/

Once you #LearnMMT, you will realize that there is one – and only one – reason that we can never seem to "afford" the moderately-expensive nice things for the powerless, even though we can always (and immediately) "afford" the mega-expensive nice things for the powerful. 2/

High-speeed economics lesson. Buckle up:

The US is a "sovereign" nation w a "fiat" currency (which has been the case since 1971, when Nixon took us off the gold standard). That means we can print our own 💰 – WHENEVER we want FOR whatever we want & however MUCH we want. 3/

The US is a "sovereign" nation w a "fiat" currency (which has been the case since 1971, when Nixon took us off the gold standard). That means we can print our own 💰 – WHENEVER we want FOR whatever we want & however MUCH we want. 3/

The key to understanding money, taxes, unemployment, inflation, and national debt is to start with the following question: how does the government get ahold of the real resources (workers, buildings, cars, computers, fuel, etc.) that it needs to do the job of governing? 1/

There are a number of ways you might imagine, each with pros and cons. For instance, the government could ask for volunteers and donations. This tends not to work very well, for obvious reasons. 2/

Another method would be confiscation: if the government needs a car, it could simply take it from you, at gunpoint. Obviously this would work, but has the distinct disadvantage of being massively unpopular. 3/

It would be a shocking scandal if it came to light that the professions of medical science had, for decades, known about an easy to treat, underlying cause of cancer—but conspired to obfuscate and suppress the information to protect their participation in a medical industry

raking in hundreds of billions a year to treat the disease. Professional standings, tenures, licenses would be in tatters. Lawsuits would abound. Outrage would march on every city hospital and medical college in the nation—would it not?

Then you need to read this short article -- A Comfortable Betrayal realprogressivesusa.com/news/economic-…

#LearnMMT #MMT ARE THERE ANY REAL JOURNALIST LEFT??? @SteveCollinsSJ @mikeshepherdME @BillNemitz @chrislhayes #NBC #CBS #abc2020 Will You Take to the streets with us? Poll Below ⬇️⬇️

#LearnMMT #MMT ARE THERE ANY REAL JOURNALIST LEFT??? @SteveCollinsSJ @mikeshepherdME @BillNemitz @chrislhayes #NBC #CBS #abc2020 Will You Take to the streets with us? Poll Below ⬇️⬇️

The U.S. federal government always spends dollars it doesn’t have, simply because, being Monetarily Sovereign, it creates dollars, ad hoc, by spending dollars. Spending, or more specifically, paying bills is the federal government’s money-creation method.

(Anyone who believes the government spends dollars it has, is welcome to tell us how many dollars the U.S. Treasury has. You might be surprised at not being able to find an answer. But why would a government need to have dollars, if it can create dollars, endlessly?)

#LearnMMT

#LearnMMT

What will it take for the American public to understand that the federal debt is nothing more than deposits in T-security accounts?These accounts are quite similar to bank savings accounts, that easily are paid off simply by returning dollars residing in those T-security accounts