Discover and read the best of Twitter Threads about #Cryptotwitter

Most recents (7)

#BitcoinTwitter and #CryptoTwitter! Square is hiring 3-4 crypto engineers and 1 designer to work full-time on open source contributions to the bitcoin/crypto ecosystem. Work from anywhere, report directly to me, and we can even pay you in bitcoin! Introducing @sqcrypto. Why?

Last week I was considering my hack week project, and asked @brockm: “what is the most impactful thing we could do for the bitcoin community?” His answer was simple: “pay people to make the broader crypto ecosystem better.” This resonated with me immediately, so we’re doing it.

This will be Square’s first open source initiative independent of our business objectives. These folks will focus entirely on what’s best for the crypto community and individual economic empowerment, not on Square’s commercial interests. All resulting work will be open and free.

0.0/ A lot of #crypto news today from the securities enforcement world:

- DOJ goes to trial on ICO-related securities fraud charges

- SEC charges broker-dealer & hedge fund with securities violations

- FINRA charges broker with fraud & dealing unregistered securities

Thread.

- DOJ goes to trial on ICO-related securities fraud charges

- SEC charges broker-dealer & hedge fund with securities violations

- FINRA charges broker with fraud & dealing unregistered securities

Thread.

1.0/ Let's start with DOJ. Today's news relates to a federal criminal case in the Eastern District of New York: United States v. Maksim Zaslavskiy.

Zaslavskiy was charged in November 2017 on three counts of securities fraud in connection with two ICOs: "REcoin" and "DRC."

Zaslavskiy was charged in November 2017 on three counts of securities fraud in connection with two ICOs: "REcoin" and "DRC."

1.1/ DOJ says Zaslavskiy lied to investors when he sold these ICOs.

According to the indictment, he told investors that both coins were backed by real world assets: he allegedly claimed REcoin was backed by real estate & DRC was backed by diamonds.

According to the indictment, he told investors that both coins were backed by real world assets: he allegedly claimed REcoin was backed by real estate & DRC was backed by diamonds.

0/ The SEC killed *all* of the pending derivative-backed #bitcoin ETFs today. Why did they do it, and what does it mean?

Thread.

Thread.

1/ All eyes were on the SEC this week, as the final deadline to approve or reject the two ProShares bitcoin ETFs was tomorrow, August 23.

Most of us on #cryptotwitter were expecting the ETFs to be rejected.

Most of us on #cryptotwitter were expecting the ETFs to be rejected.

2/ But we weren't expecting the SEC to also reject *seven* other derivative-backed ETFs proposed by GraniteShares & Direxion. Those ETFs weren't due for final decisions until September 15 and 21 respectively.

The only ETF left now is the VanEck/SolidX commodity-backed offering.

The only ETF left now is the VanEck/SolidX commodity-backed offering.

1/ Hey #CryptoTwitter, grab a glass of vino and come sit by the fire so we can discuss your narrow-minded views on FAT PROTOCOL THEORY.

See what I did there -- how I juxtaposed "narrow" with "fat"?

No?

Just shut up and drink your wine. 👇

See what I did there -- how I juxtaposed "narrow" with "fat"?

No?

Just shut up and drink your wine. 👇

2/ First, let's acknowledge it as a "theory" even though it wasn't clearly labelled as such.

A theory is just a plausible principle offered to explain phenomena.

A theory is just a plausible principle offered to explain phenomena.

0/ Ross Ulbricht shouldn't spend the rest of his life in prison.

If you're wondering why his name keeps coming up on #cryptotwitter, please read this. It's long but important.

Thread.

If you're wondering why his name keeps coming up on #cryptotwitter, please read this. It's long but important.

Thread.

1/ In 2011, Ross created Silk Road, a global marketplace to buy & sell goods, whether legal or not.

Silk Road was perhaps the first use case for #bitcoin: censorship-resistant internet money for an online market that governments badly wanted to censor.

Silk Road was perhaps the first use case for #bitcoin: censorship-resistant internet money for an online market that governments badly wanted to censor.

2/ Silk Road hosted many things, including a book club that a lot of us #crypto people would've liked, but the prime attraction for many users was drugs.

By September 2013, Silk Road had thousands of drug listings, including for cocaine, heroin, and LSD.

By September 2013, Silk Road had thousands of drug listings, including for cocaine, heroin, and LSD.

0/ #Cryptotwitter sharpening its knives for @Ripple today. Plenty of good takes already on whether $XRP is a security, so let me tackle a different question: what happens next?

Spoiler: if you're wondering "when @bgarlinghouse perp walk," prepare to be disappointed.

Thread.

Spoiler: if you're wondering "when @bgarlinghouse perp walk," prepare to be disappointed.

Thread.

1/ First, keep in mind that the SEC's guidance yesterday is *not* the law. It's only the SEC's current (and non-binding) interpretation of the law -- an explainer for how the SEC will make charging decisions in the #crypto space.

sec.gov/news/speech/sp…

sec.gov/news/speech/sp…

2/ Ultimately, what is or isn't a security will be determined by the courts through litigation, which is how we got the Howey test in the first place. Congress could also pass a clarifying statute and make our lives easier. (please support @coincenter)

coincenter.org/donate

coincenter.org/donate

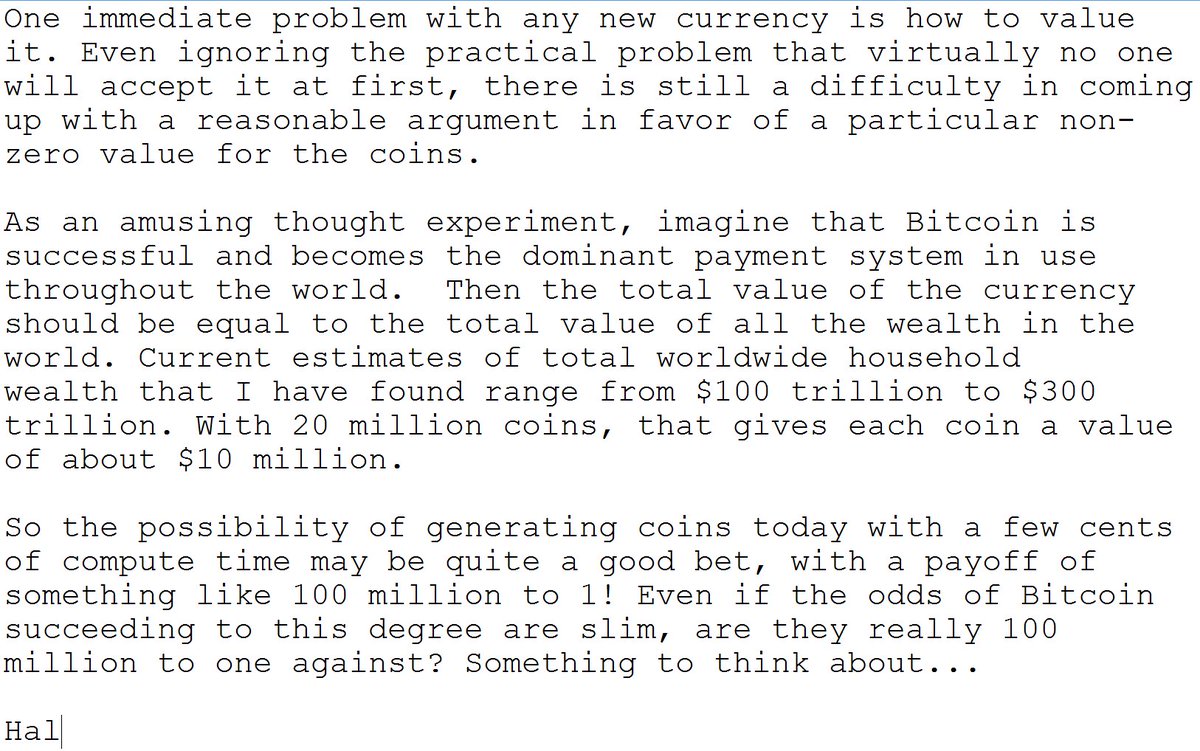

Here's #HalFinney's back-of-the-envelope calculation from January 2009. Let's update that and turn it into a collective decision problem.

I'm starting with a bunch of simplifying assumptions:

1. The "ultimate payoff of world domination" is fixed at $10m per coin.

2. All-or-nothing scenario: world domination or bust. (I actually disagree with that.)

3. No interest rate or NPV accounting.

1. The "ultimate payoff of world domination" is fixed at $10m per coin.

2. All-or-nothing scenario: world domination or bust. (I actually disagree with that.)

3. No interest rate or NPV accounting.

In that case we have a simple lottery. For one lottery ticket, you get a payoff of ε * $10M + (1-p) * 0, or simply $10M times ε. So what's your estimate for the world domination probability ε?