Discover and read the best of Twitter Threads about #Trading

Most recents (13)

Some traders believe news are unimportant, and news/narratives are always spun into prices. That's false. News are only sometimes spun into prices, and can be used effectively for speculative activities. It should be obvious, yet it's not. #trading #investing

This may sound extremely obvious to many, yet I've had many discussions where for example price of oil drops hard on a Saudi statement yet a fellow trader would argue news was irrelevant and price actually dropped because traders sold some 61.8% fibonacci retracement.

Prices are not magical self-contained entities following their own rules.

If in doubt look at the following on Trading View:

$GBPUSD on Jun/23/2016 => Brexit

$ES on Nov/7/2017 => US Election Night

$CL on Nov/27/2014 => OPEC

$BTC on Mar/10/2017 => SEC Bitcoin ETF

If in doubt look at the following on Trading View:

$GBPUSD on Jun/23/2016 => Brexit

$ES on Nov/7/2017 => US Election Night

$CL on Nov/27/2014 => OPEC

$BTC on Mar/10/2017 => SEC Bitcoin ETF

Gorgeous crypto reversal underway, particularly so on $ETH given how undersold it was, although the setup was cleaner on $BTC. Ideal long entries in my book:

- ETH: 1840-1920 EST $264-$270

- BTC: 1500-1930 EST $6100-$6170

#trading

- ETH: 1840-1920 EST $264-$270

- BTC: 1500-1930 EST $6100-$6170

#trading

Setup described as a strong drop that slowly rolls over, upwards. Ideal longs come in the 61.8%-70% reversal, ideally on a 2nd push towards a prior failed attempt to break higher - looking to trade the breakout of the prior failed attempt. Don't want to be dogmatic about the %s.

This may sound like a lot of work, requiring too much chart watching. But it is not so, as these kind of reversals do not happen that often.

Bear markets can end in multiple ways, a V-shaped correction one of them. Whoever states the contrary is not well informed and is thus best ignored. #trading

Can find a great number of examples throughout history. Here's the end of the most significant financial crisis of modern times. You do see a V, yes?

So when you see tweets like this, realize poster clearly lacks financial experience and understanding.

It's not what you don't know that kills you, it's what you know for sure that ain't true - Mark Twain.

It's not what you don't know that kills you, it's what you know for sure that ain't true - Mark Twain.

This is my preferred breakouts system. Breakouts work. And can be identified algorithmically. Bear in mind, if trading a system based on high frequency data, initial stop should be accordingly in line. e.g. shorting at 6300 was great, regardless of price soon reversing. #trading

Yes, system caught the SEC Aug/7 breakout almost immediately. Try trading that with four hour bars and confirmation.

Notice the 8/5 top after a long bar. I distinctly recall traders making fun of whoever FOMOed long into that top. Ironically, that was a great long, and buying did not necessarily mean buying in FOMO. Just because buying that failed doesn't mean it wasn't a good long.

How to trade Support $BTC $XBT #trading small time frames:

#1: don't guess price will bounce off support, buy the bounce off support.

#2: must know how to take a loss and flip direction - or at the bare minimum take a loss. Never EVER get caught on a V-reversal back to support.

#1: don't guess price will bounce off support, buy the bounce off support.

#2: must know how to take a loss and flip direction - or at the bare minimum take a loss. Never EVER get caught on a V-reversal back to support.

That's at least how I execute, and works extremely well. Can use this for scalping or for getting into larger moves/trends with the immediate impulse behind one's back.

This is called Price Action. Same price action concepts are applicable to all time frames => this approach to execution is useful for all short-term scalpers, mid-term swing traders, and long-term investors who want to enter with the trend.

How to trade: if it's going up, you buy.

How most trade: if it's going up, you wait until it's gone up a lot, then sell. Once stopped out, buy in FOMO, and get stopped out again.

¯\_ツ_/¯

#trading

How most trade: if it's going up, you wait until it's gone up a lot, then sell. Once stopped out, buy in FOMO, and get stopped out again.

¯\_ツ_/¯

#trading

Solution: learn to trade with the trend first.

Easier said done than done one may argue!

Solution: enter trades only with stop orders until knowing how to trade with the trend - avoid limit orders temporarily (for as long as trading short time frames).

Easier said done than done one may argue!

Solution: enter trades only with stop orders until knowing how to trade with the trend - avoid limit orders temporarily (for as long as trading short time frames).

1/ It seems every #trader has to do the same mistakes as their predecessors. There are #wisdowms you will only understand, if you have experienced them yourself. In this thread I will give you the #wisdom, which can make the difference between being broke and driving lambos #btc

Whenever I express my market views publicly, I find it even more difficult to change them when the actual market circumstances change. However good I try but my ego gets involved with my views so I think it is better to try to express data than opinion.

#My2Cents

#Trading

#My2Cents

#Trading

In most circumstances consistency is valued and adaptive. Inconsistency is commonly thought to be an undesirable personality trait. The person whose beliefs, words, and deeds don’t match may be seen as indecisive, confused, two-faced, or even mentally ill.

From - Influence

From - Influence

While in other walks of life consistency is desirable and respected, in markets we all know that traders need to adapt quickly according to changing markets. But we often see how traders are trolled for this adaptation i.e. changing their market views.

Ur True Journey as a #Trader starts only after you learn to ignore & stop Trading on so called Analyst Trading Call, Views, Opinions & start trying ur own Trading Strategy, Plan, System;

test them with small size, keep Trading Journal for tracking results to modify accordingly.

test them with small size, keep Trading Journal for tracking results to modify accordingly.

Those who not try to take efforts on his/her own,

sooner or later fall prey to Analysts who runs Slack Rooms (nothing wrong if one have legal authority to run) for Live Trading Calls & post same call on Social Media afterwards mainly if not going Acc. to their SR Call (unethical)

sooner or later fall prey to Analysts who runs Slack Rooms (nothing wrong if one have legal authority to run) for Live Trading Calls & post same call on Social Media afterwards mainly if not going Acc. to their SR Call (unethical)

If not prey to Unethical Analyst then New Traders tends to take blind bets on Stocks without #Riskmanagement & Plan, Strategy.

Emotional Trading is cause of sure failure of #Trading.

Emotional Trading is cause of sure failure of #Trading.

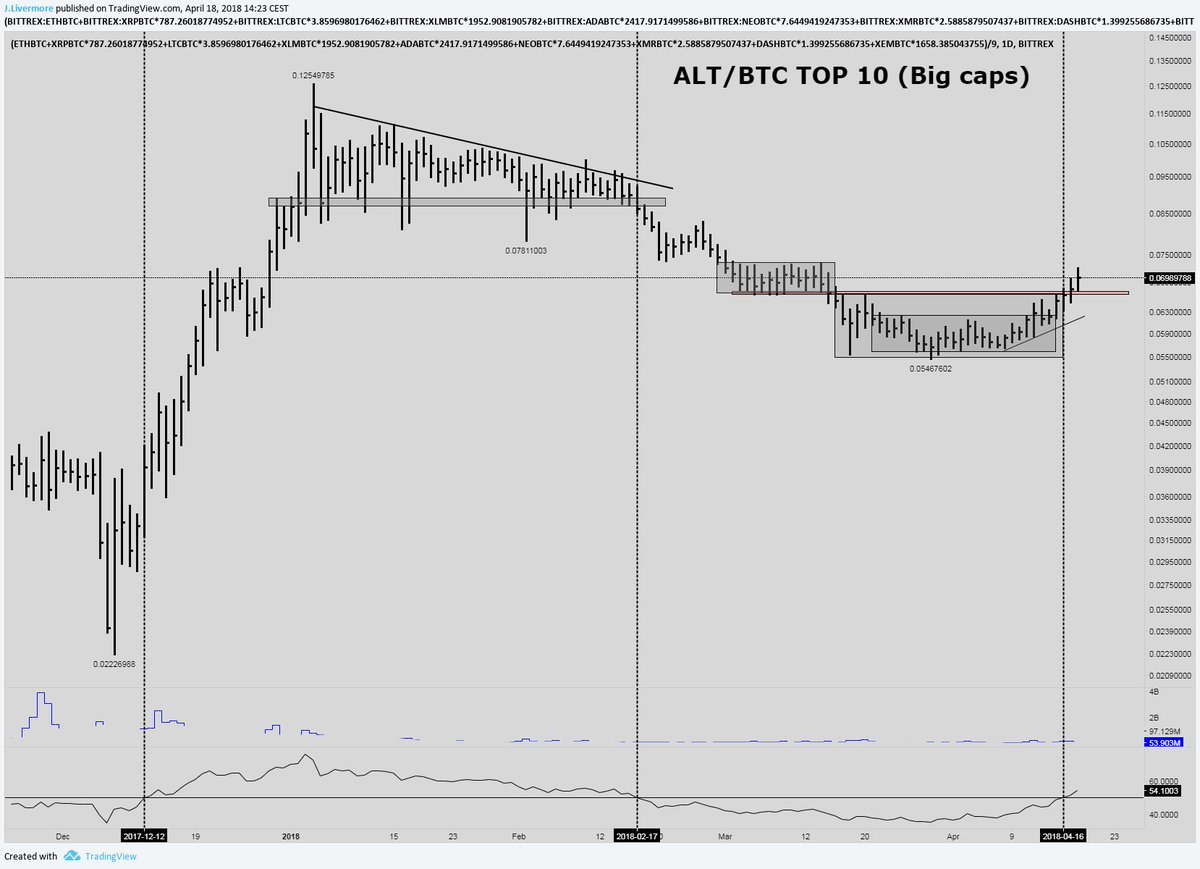

#ALTS $ALTBTC - TOP 10 (Large caps)

"HO PARLATO CON #RENZI IERI, PASSA" il #decreto sulle #popolari #banchepopolari La tessera #pd numero #DeBenedetti usa il suo ultimo burattino #Renzi per guadagni illeciti sulle #banche popolari #insider #trading #InsiderTrading #insiderRenzi

Ovviamente la tessera n1 del #pd #DeBenedetti ha spostato la residenza in #Svizzera e questo #scandalo #InsiderTrading, tale da far crollare un qualunque #governo al mondo, esca tardi, ad orologeria, quando ormai sono sciolte le camere...

Si capiscono sempre meglio i ritardi con cui il #pd e il #governo hanno istituito la #Commissione #banche che per #Gentilono e #Padoan era inutile 😂

Weekly Spam Alert

#WeekendReading The Universal Principles of Successful Trading by Brent Penfold

read good reviews of it many times in past

#WeekendReading The Universal Principles of Successful Trading by Brent Penfold

read good reviews of it many times in past

1 If u function only in an environment of certainty & security, like being in a secure relationship or secure job, then trading is not for u

2If u r n intellectual who rarely admits 2 being wrong, then trading is not 4 u,as markets have regular tendency 2 belittle u & make u wrong

Weekly Spam Alert

This week it will the 'The Art of War' of Sun Tzu

Not directly related to Markets but I guess this classic will be useful.

This week it will the 'The Art of War' of Sun Tzu

Not directly related to Markets but I guess this classic will be useful.

1.Do big institutions let any1 know what they r doing in Markets?

Does dis quote of Art of War reminds u stealth short covering/silent accu

Does dis quote of Art of War reminds u stealth short covering/silent accu

2. Though we have heard of stupid haste in war, cleverness has never been seen associated with long delays.

#timing in trade

The Art of War

#timing in trade

The Art of War