Discover and read the best of Twitter Threads about #BitCoin

Most recents (24)

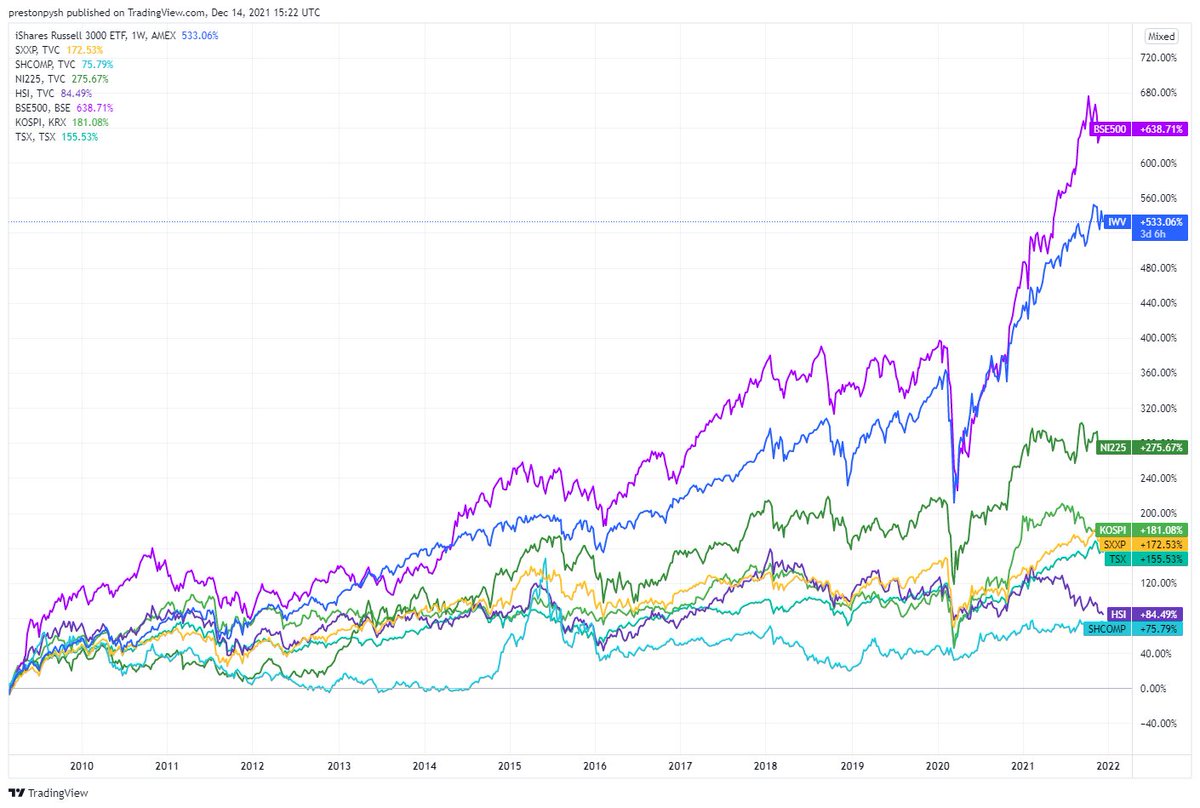

Why does everything feel like the world is falling apart, yet the stock market has looked like this since 2009?

Well, here's a thread w/ some interesting charts that will help you understand: what you see is NOT what you get.

1/

Well, here's a thread w/ some interesting charts that will help you understand: what you see is NOT what you get.

1/

1/ @SatoshiLite recently debated @rogerkver about the merits of using Lightning Network vs BCash for payments. In the debate Roger brought up a point that needs to be addressed; Roger claimed that it is easier to censor payments on LN than on BCash.

2/ Here is the tweet that Roger mentioned in the interview. In it we see a strongly connected network with one isolated node - the node was named Roger Ver.

Roger claims that the ostracization of this node is not funny, but a sign of censorship.

Roger claims that the ostracization of this node is not funny, but a sign of censorship.

3/ Let's consider the economics of his claim. It is important to recognize that with Lightning Network, as with #Bitcoin, or even with free markets in general, you never have guarantees of anything - you have incentives that create long term tendencies.

2/ The whole text reads like a mixture of leftist Latin American dictatorship propaganda ("imperialist," "hegemonic") and and run-of-the-mill ICO marketing scheme ("interconnection," "without third parties").

3/ It claims to feature an original and fully-transparent blockchain backed by Venezuelan commodities as well as a "legal and institutional system

that provides security and judicial guarantees for investing and exchange."

that provides security and judicial guarantees for investing and exchange."

The total size of the Internet, give or take a few MB. This includes IPv4 and IPv6.

sh ip bgp ipv4 uni sum | i total bytes

BGP using 205560814 total bytes of memory

sh ip bgp ipv6 uni sum | i total bytes

BGP using 69169288 total bytes of memory

~275MB.

sh ip bgp ipv4 uni sum | i total bytes

BGP using 205560814 total bytes of memory

sh ip bgp ipv6 uni sum | i total bytes

BGP using 69169288 total bytes of memory

~275MB.

Big blocks are nonsensical. Scaling on-chain is nonsensical. Blockchain (as a communication medium) is nonsensical.

IPv4 prefixes and paths:

712223 network entries using 84042314 bytes of memory

1235329 path entries using 64237108 bytes of memory

IPv6 prefixes and paths:

54780 network entries using 7723980 bytes of memory

54796 path entries using 4164496 bytes of memory

712223 network entries using 84042314 bytes of memory

1235329 path entries using 64237108 bytes of memory

IPv6 prefixes and paths:

54780 network entries using 7723980 bytes of memory

54796 path entries using 4164496 bytes of memory

Central planning eventually breaks down due to unintended consequences. Ever increasing levels of intervention are needed to sustain central planning.

Unintended consequences are inevitable because the market is made up of infinite variables interacting through time.

Even the best models can't hope to include more than a trivial number of those variables.

Even the best models can't hope to include more than a trivial number of those variables.

Central banks are the lowest level, the base layer of all intervention. Their central planning is breaking down. #bitcoin

so #bitcoiner this is a short thread about #secp256k1 (just for my own sake. Warning!!! it might even contains some mistake, still rumping up)

#Bitcoin uses secp256k1 for signing/verifying transaction via ECDSA

#Bitcoin uses secp256k1 for signing/verifying transaction via ECDSA

secp256k1 was originally specified in STANDARDS FOR EFFICIENT CRYPTOGRAPHY by Certicom Research

It is a Koblitz curve (but not a Koblitz binary anomalous curve) defined by the short Weistrass equation y^2=x^3+7.

It is a Koblitz curve (but not a Koblitz binary anomalous curve) defined by the short Weistrass equation y^2=x^3+7.

There is an endomorphism (GLV endomorphism) that can be used to speed up multiplications (different than the Frobenius endomorphism in the binary case) that is turned off by default.

1/ @alexhevans recently dug into the numbers behind forks of #Bitcoin, #Ethereum, #Monero & #Zcash.

Main conclusion: Value can’t be forked away as easily as people like to think. placeholder.vc/blog/2018/9/17…

Main conclusion: Value can’t be forked away as easily as people like to think. placeholder.vc/blog/2018/9/17…

2/ Secondary conclusion: Despite parent #cryptonetworks retaining users, devs & value, the child forks trade at (puzzling) relative valuation premiums.

3/ To follow are graphs and conclusions from @alexhevans that are relevant to specific actors or ratios (if you're not a fan of long form writing 😉)

0.0/ ETF FAQ.

My answers to some common questions about the SEC & the approval process for #bitcoin & #crypto ETFs. If you have a question I didn't address, feel free to ask here & I'll add on.

Thread.

My answers to some common questions about the SEC & the approval process for #bitcoin & #crypto ETFs. If you have a question I didn't address, feel free to ask here & I'll add on.

Thread.

1.0/ Q: "Who decides whether to approve or deny an ETF?"

The initial decision is made by SEC staff in the Division of Trading & Markets. If the staff denies an ETF proposal, the ETF sponsor can file an appeal, which will be decided by all of the SEC Commissioners.

The initial decision is made by SEC staff in the Division of Trading & Markets. If the staff denies an ETF proposal, the ETF sponsor can file an appeal, which will be decided by all of the SEC Commissioners.

2.0/ Q: "What's the process & timeline for the SEC to decide on an ETF?"

When a proposal is filed, the SEC publishes it in the Federal Register (the government's official journal) & solicits comments from the public. It then has 45 days to approve, deny, or delay a decision.

When a proposal is filed, the SEC publishes it in the Federal Register (the government's official journal) & solicits comments from the public. It then has 45 days to approve, deny, or delay a decision.

The #uber / bitcoin story out of Argentina is interesting.

Censorship resistance meets the mainstream.

Censorship resistance meets the mainstream.

People are going to start realizing, having a little #bitcoin, in your own possession, is a good idea.

Plus @wences has come full circle. 👏

#India can't ban #bitcoin. Bitcoin will happily and easily move underground and the resulting premium will draw in more.

Countries will eventually get it, trying to ban bitcoin incentivizes civil disobedience.

It's also interesting that the two gold loving countries of China and India fight bitcoin so much.

Will they be on the wrong side of a monetary shift once again?

Will they be on the wrong side of a monetary shift once again?

Oh #Satoshi, I just found a new #RabbitHole! 🤯

tl;dr: #OpenSource #Bitcoin Wallets are like privately minted #gold coins.

[thread]

tl;dr: #OpenSource #Bitcoin Wallets are like privately minted #gold coins.

[thread]

In a free economy with gold as the one sound money, the global consensus are the 79 protons of the gold atom. There are different shapes and forms of collections of atoms, but fundamentally, as long as there are 79 protons, it is the base money.

The raw resource of gold is mixed with lots of dirt, stone and other lesser metals, and extracting gold ore is an entrepreneurial task. Human ingenuity and labor has to be intermingled with these natural resources so to increase the production stage of this good.

@ericgarland @911CORLEBRA777 @JamesFourM @thespybrief @patribotics @LouiseMensch @ninaandtito @DirkSchwenk @xtrixcyclex @colinkalmbacher @claytonpurdom @emzanotti @RoyBlunt @FBIWFO @NewYorkFBI @FBILosAngeles @INTERPOL_HQ @DHSgov It's hard to overstate how important a cooperating Manafort becomes to unraveling media subversion.

But let's start with Eric's documentation of media-influence operations & go from there.

But let's start with Eric's documentation of media-influence operations & go from there.

@ericgarland @911CORLEBRA777 @JamesFourM @thespybrief @patribotics @LouiseMensch @ninaandtito @DirkSchwenk @xtrixcyclex @colinkalmbacher @claytonpurdom @emzanotti @RoyBlunt @FBIWFO @NewYorkFBI @FBILosAngeles @INTERPOL_HQ @DHSgov First, remember @ericgarland initially just released the public, executive summary of his research into *one* aspect of this - a consistent pattern of harassment in response to his original Game Theory thread.

@ericgarland @911CORLEBRA777 @JamesFourM @thespybrief @patribotics @LouiseMensch @ninaandtito @DirkSchwenk @xtrixcyclex @colinkalmbacher @claytonpurdom @emzanotti @RoyBlunt @FBIWFO @NewYorkFBI @FBILosAngeles @INTERPOL_HQ @DHSgov There are so many critical details to go over here.

One, the patterns were easily detected, & hard evidence could be found in abundance.

Two, Eric *didn't* stop with documenting & researching just that one piece.

One, the patterns were easily detected, & hard evidence could be found in abundance.

Two, Eric *didn't* stop with documenting & researching just that one piece.

@Valustks1 Each one of the techs listed is revolutionary in it's own right. Combining them sets us up to replace *all* financial transactions with #bitcoin. Once the epiphany hits enough people, there will be a MAD rush to get rid of worthless fiat.

@Valustks1 This will be the trigger for the already 'waiting to happen' global hyper inflation.

Imagine the chaos during the *several* year transition period while people/gov/corps *globally* move from fiat to bitcoin.

All your IOUs that are fiat denominated are suddenly worthless.

Imagine the chaos during the *several* year transition period while people/gov/corps *globally* move from fiat to bitcoin.

All your IOUs that are fiat denominated are suddenly worthless.

@Valustks1 It *globally* resets all debt, at every level, personal, local gov, state, federal, and international... ALL goes to zero. What does it matter if you own $20T in debt, if $20T wouldn't buy a stick of gum?

Then, another big part... the globe goes from inflationary

Then, another big part... the globe goes from inflationary

#BTC #Bitcoin + #LightningNetwork + Autopilot + Splicing will cause more earth shattering changes than have happened in the last 500 years.

The invention of the internet and industrial revolution combined are NOTHING compared to whats to come.

The invention of the internet and industrial revolution combined are NOTHING compared to whats to come.

Oh ya, completely forgot AMP... that's an extremely important piece of tech as well.

Oops, posted the additional comments in the wrong place:

A new, great #Bitcoin meme has born today!! #MegalomaniacRoger!!!

This is the first iteration. Please RT and make your own version.

This is the first iteration. Please RT and make your own version.

A few humble suggestions:

"I'm the reason heliocentrism is so popular today. I did it once, I will do it again with Hollow Earth theories!!!"

"I'm the reason antibiotics are so popular today. I did it once, I will do it again with Healing Crystals!!!"

"I'm the reason heliocentrism is so popular today. I did it once, I will do it again with Hollow Earth theories!!!"

"I'm the reason antibiotics are so popular today. I did it once, I will do it again with Healing Crystals!!!"

1/ Most people think #Bitcoin’s PoW is "wasteful." I explore how everything is energy, money is energy, subjective use of energy, and PoW's costs relative to existing governance systems

For a deeper dive, my Medium post: medium.com/@danhedl/pow-i…

TL;DR - check out this thread 👇

For a deeper dive, my Medium post: medium.com/@danhedl/pow-i…

TL;DR - check out this thread 👇

2/ The idea of “work” being energy started when the French Mathematician Gaspard-Gustave de Coriolis introduced the idea of energy being “work done.” A long time ago, the work done in the economy was entirely human. That work was powered by food.

3/ Thousands of years ago, our energy usage increased when we domesticated animals which could labor in our place. Those new laborers also had to be fed. Large amounts of food were required to meet the energy demand, and our prosperity increased alongside.

The altcoin bubble is an externality for #bitcoin.

Satoshi Dice also put its externalities on the network.

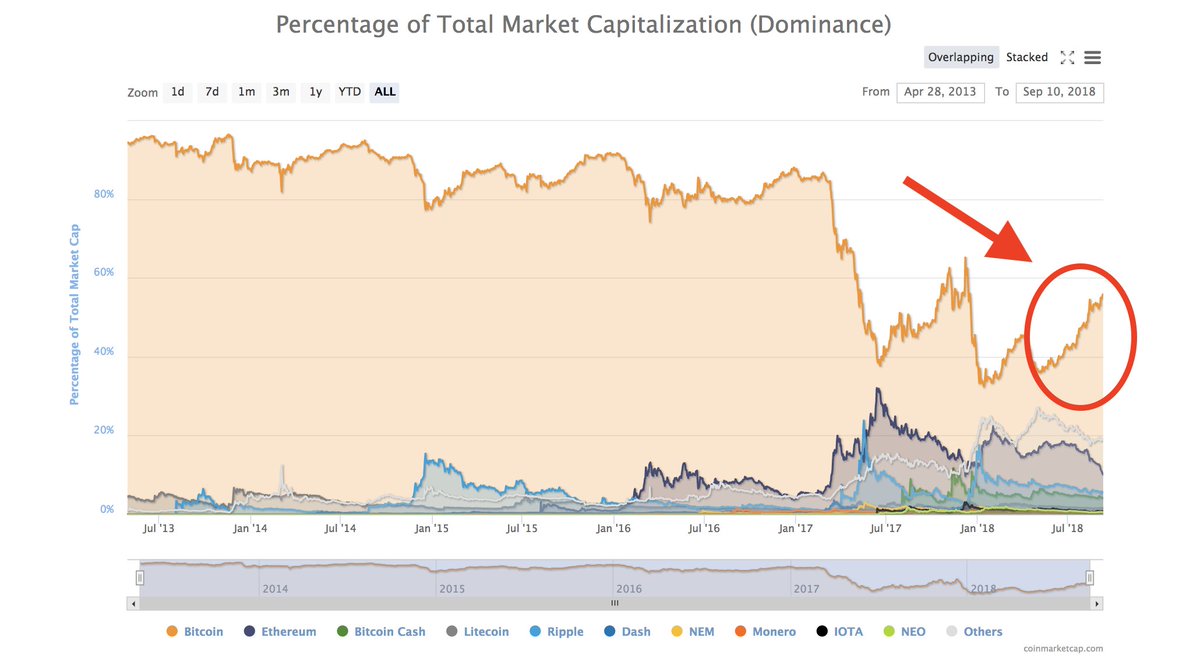

1/ Get ready for a predictable #crypto pattern: in the coming months, we will see an increasing number of #Bitcoin maximalists tormenting “altcoin investors” for straying from the mother ship.

2/ The maximalist drum will get louder as we go deeper into the bear market, with #bitcoin falling less than most other coins, and its dominance index growing. coinmarketcap.com/charts/#domina…

3/ #Bitcoin is the benchmark after all, the market beta of crypto, with most everything oscillating at a higher amplitude than $BTC.

1/ #Ethereum is crashing (not just in USD terms but in BTC terms); has the demand for a decentralized world computer disappeared, or is something else at play? Let's consider the fundamentals from an economic point of view.

2/ The price level of all monetary goods is determined by (and only by) reservation demand. More precisely, the duration that the average unit of the monetary good is held in reserve.

3/ At one extreme you have a good like gold that is stored in vaults in perpetuity because of a widely held belief that it will retain its value long into the future.

Gold has a very high reservation demand which is why it has a market cap of over seven trillion dollars.

Gold has a very high reservation demand which is why it has a market cap of over seven trillion dollars.

1/ in markets, investor psychology is everything. i shared my thoughts on greed, investor psychology, shitcoin, and market cannibalization at @dezentral_io in berlin and wanted to share some of these ideas here...

option b: skip directly to slides here: slideshare.net/DCGCo/how-to-n…

option b: skip directly to slides here: slideshare.net/DCGCo/how-to-n…

1/ Per the analysis below, #bitcoin’s velocity thus far in 2018 has been ~3, about half that of 2016 and 2017.

2/ While a drop in velocity may seem problematic, it’s actually what you’d expect from a *reserve currency.*

3/ With a reserve currency, as confidence falls market wide more people will hold onto the reserve asset (in this case, #bitcoin), dropping its velocity.

1/ a quick thread on protocols focused on location. location data is leveraged by many consumer services (Google Maps, Uber), but also by military and industrial applications. now teams are #blockchain-ing this data to make it tamper-proof (secure), verifiable, and trustless.

2/ furthermore, new applications like self driving vehicles, AI, and increasingly digitized consumer, industrial, and military services will rely on secure location information services to deliver service. example - in 2012, a military drone was hacked and "stolen" by students...

3/ several projects are working on a new form of consensus called "proof of location" to design new mechanisms for collecting, verifying, storing, and sending data about location to the services and applications that consumer this data. let's dig into proof of location.

1)I am seeing an increasing number of people under the impression that #lightning as an overlay bridge network for #blockchains (via atomic swaps) is a great thing for alts.

And they can not be more wrong.

In reality, Lightning is where #altcoins will come in droves only to die

And they can not be more wrong.

In reality, Lightning is where #altcoins will come in droves only to die

2) At the moment, all blockchains are entirely segregated from one another. The only real bridge that exists today are exchanges which are largely inefficient with enormous amounts of friction, ie. registration, KYC/AML, confirmation wait times for deposits/withdrawals, etc.

3) Friction & segregation of networks protects smaller networks from larger ones consuming & engulfing them. Network theory teaches us that we continually gravitate towards the singularity, after all this is the entire premise of a network. This is evident all throughout history.