Discover and read the best of Twitter Threads about #uss

Most recents (24)

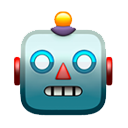

It has been over a month since @Sam_Marsh101 submitted his Addendum to the JEP and #USS. If he's right, the current valuation contains a significant, hidden layer of prudence ABOVE AND BEYOND the following that JEP lists here: 1/

I say more about the significance of Sam's Addendum in this blog post, where I also explain why #USS and @GuyCoughlan owe us an answer to Sam's findings. 2/

medium.com/@mikeotsuka/us…

medium.com/@mikeotsuka/us…

Given importance of HE sector "there may be a case for future governments to consider alternative options" (incl "state-backed guarantee" or "measures enabling more risk-taking"). Powerful piece from @JMariathasan on #USS DB debate post-#JEP ipe.com/analysis/blogs… #USSstrike 1/

Article argues that central problem lies in regulatory changes that transformed management of a DB pension scheme into "a risk management problem, not an investment one" 2/

More info about the @CSFI1 debate over #USS and DB pensions discussed in @JMariathasan's article at @OpenUPP2018

See:

And: 3/

See:

And: 3/

🚨💣😱.@Cambridge_Uni's response to a 2016 consultation re strength of the #USS covenant has recently been released via FOI. Cambridge disputes PWC's finding of a strong covenant over 30 as opposed to merely 20 years! The following statement in their response is a bombshell: 1/

"We would be concerned if the increase in visibility of a strong covenant was used to support a less prudent approach to the 2017 valuation than that adopted in 2014, either in terms of the assumptions adopted or the time horizon for de-risking." 2/

We are all aware that tPR's challenge, in their Sept 2017 letter, to the PWC/#USS assessment of the strength of the covenant, wreaked havoc on our DB pension and helped explain the shift to the more conservative November valuation. 3/

The sentence "#UUK & the #UCU have since agreed to explore risk-sharing alternatives from 2020, w a particular focus on a #CDC arrangement" pensions-expert.com/Law-Regulation… is particularly interesting, given CDC was not in ACAS agreement (simply discussion on 'alternative scheme designs')

A salutary quotation published today emphasising how easy it is to misconstrue #CDC (collective defined contribution) pensions as DB (NB In #CDC, risk is ALL on the employees): pensionsage.com/pa/CDC-will-be…

See also my reflections on #CDC back in July. The more that CDC (currently not possible in UK) is invoked – by various people – as a possible future for #USS, the more that potentiality becomes real. This we must resist. #USSstrike

The #USS dispute exposed a schism between Dons & Bursars of @Cambridge_Uni. We learn from linked FT piece that Cambridge's recently created post of CFO was created in order to provide "a senior leader" to take ownership of their £1 bn housing project. 1/

ftalphaville.ft.com/2018/09/27/153…

ftalphaville.ft.com/2018/09/27/153…

That CFO, Anthony Odgers, formerly a high-flying investment banker at Lehmann Bros & Deutsche Bank, was, we have learned from FOI releases of minutes, a driving force behind the university's push for a 'less risk' response to the Sept valuation... 2/

...in order to make the case for closure of DB to future accrual. In one of these minutes, I get blamed for creating tensions w/in Cambridge Colleges, when I was simply publicising Odgers's views! See embedded tweet: 3/3

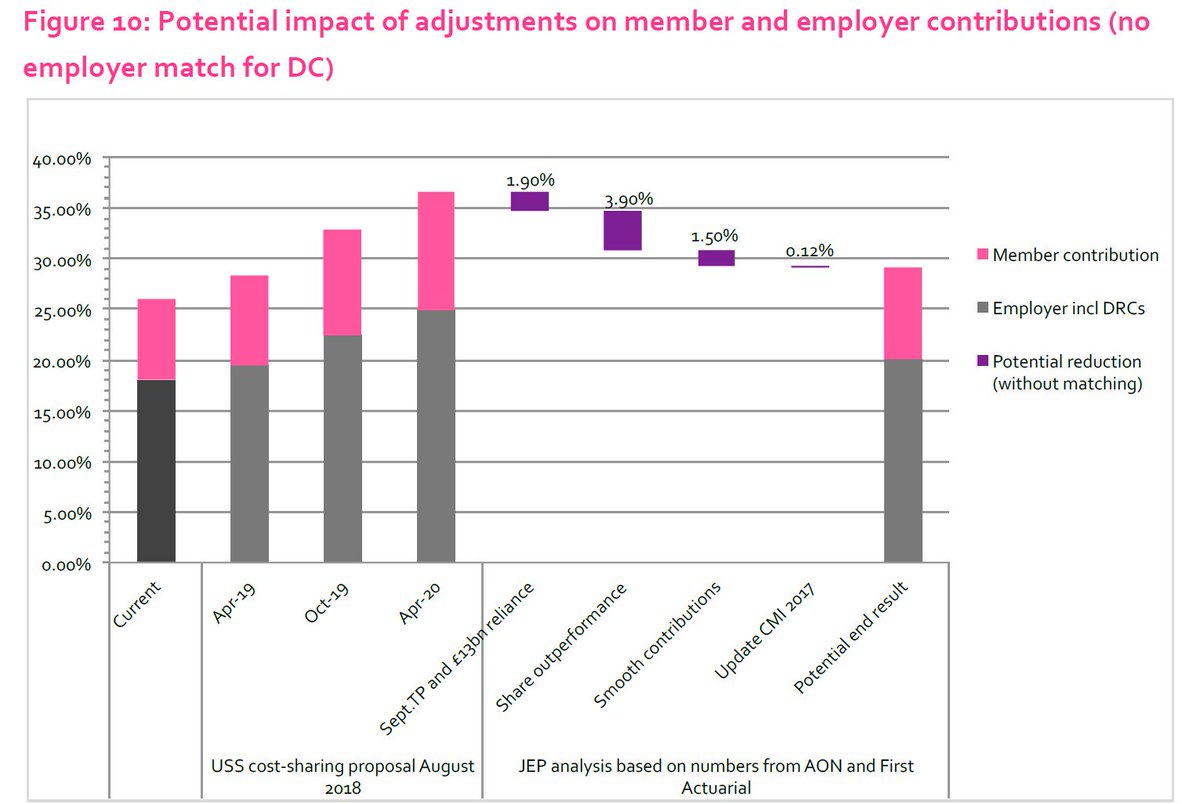

JEP RECOMMENDATION #3: Smooth the cost of future service contributions over at least the next 6 years. As this chart indicates, this would reduce contributions by 1.5%. 1/

#USS's failure to smooth the cost of future service contributions constitutes a significant hidden layer of prudence. See this blog post: 2/

medium.com/@mikeotsuka/us…

medium.com/@mikeotsuka/us…

Now that @AlistairJarvis's @UniversitiesUK has opened the linked consultation, it's important for @ucu & #USS members to make the case to our employers to STRONGLY & PUBLICLY support all 4 JEP recommendations. Links below to arguments in support. 1/

ussemployers.org.uk/news/universit…

ussemployers.org.uk/news/universit…

Embedded thread w/ arguments in support of JEP recommendation #2, re lowering of deficit recovery contributions. 2/

Embedded thread w/ arguments in support of JEP recommendation #3, re smoothing of cost of future service, which draws on @Sam_Marsh101's cashflow data analysis. 3/

JEP RECOMMENDATION #2: Deficit recovery contributions (DRCs) reduced from 6% back down to 2.1%. As this chart indicates, this 3.9% reduction in DRCs makes the biggest difference to contributions of the 4 JEP recommendations. 1/

It is also the JEP recommendation that @AlistairJarvis's @UniversitiesUK supports most strongly👇. 2/

Why did #USS propose such a large increase in DRCs from 2.1% to 6%? Not because the '17 deficit has grown, relative to '14 deficit. The '17 deficit is THE SAME SIZE as the '14 deficit, when properly measured against the value of the assets (=89% of liabilities in '14 & '17). 3/

.@UniversitiesUK has just published the consultation document on the JEP report that they've sent to employers. (Link.) Some 'live-tweeting' of my reactions as I read this document in real time. 1/

I see that the pdf is protected in a manner that makes it impossible to cut and paste. Gratuitous and annoying. I'm now wasting time creating a cut-and-paste-able version. 2/

My efforts have been defeated. So I'm going to need to waste more time making and cropping screenshots. 3/

One of the most interesting things about the #USS dispute is how it has involved shifting adjudications of who has – & crucially hasn't – expertise. @henryhtapper's henrytapper.com/2018/09/22/pen… is an interesting take on this 1/

.@henryhtapper: 'people who are anything but “pension experts”' 'have created the space for the debate to happen.' A primary aim of @USSbriefs & @OpenUPP2018 has been to provide one forum in which the voices of some of those participating in that debate might be amplified 2/

Raised eyebrows over UCL Provost's email re stock market & #USS deficit. In addition to @Will_McDowall 👇see tweets by @vdiazucl @felicitycallard @UCL_UCU @USSbriefs. Thoughts below. 1/

Provost: "With the stock market performing more strongly in the months since the original valuation, the deficit is reduced and the cost of retaining a predominantly defined benefit scheme in the future is feasible". 2/

FACT CHECK: It's true that #USS maintains that the March 2018 deficit is £4 bn, which is £3.5 bn less than the £7.5 bn March 2017 deficit. It's also true that JEP recommendation to lower deficit recovery contributions from 6% to 2.1% appeals to asset outperformance in 2017-18. 3/

A blog in which I argue for the importance of acceptance in full by union and employer of the proposals of the Joint Expert Panel on #USS. Further remarks below on the graphed 65%-35% employer member split of contribution increases. 1/

Link: medium.com/@mikeotsuka/uc…

Link: medium.com/@mikeotsuka/uc…

Some have questioned my claim that the 65%-35% employer-member split of the 3.2% contribution increase graphed above in the righthand column of Figure 10 of the report is among the JEP's proposals. 1/

Whether or not JEP ‘proposes’ this, they are offering a clear steer in the direction of a 65%-35% split. The JEP chair also says the following in the introduction: 2/

There's a bonanza of new FOI responses that give us a much better sense of the range of university responses to #UUK #USS consultations from Oct 2016 and Feb/March 2017. Picking through them it's fascinating to see which universities challenged the direction of travel 1/

e.g. Aberdeen: "Aon ... & UCU have indicated that it may be advantageous to consider other models. We are interested in the Trustees views as to whether there are alternative models that could result in a more considered outcome" whatdotheyknow.com/request/508696… cc @aberdeen_ucu 2/

e.g. LSE: "We note that the latest benefit changes were implemented less than 12 months ago. The School’s view is that it is too soon for further changes to be made." whatdotheyknow.com/request/509128… 3/

A new blog post, in which I argue for the importance of acceptance IN FULL by union and employer of the proposals of the Joint Expert Panel on #USS.

medium.com/@mikeotsuka/uc…

medium.com/@mikeotsuka/uc…

👆Tagging @JoanneSegars @SallyBridgeland @ucu @UniversitiesUK @colette147 @AlistairJarvis @Sam_Marsh101 @Flibitygibity @carlomorelliUCU @Dennis_Leech @DaveGuppy @RedActuary @Derek_Benstead @kevinwesbroom @USSbriefs @OpenUPP2018 @JosephineCumbo @henryhtapper

If you think it might be useful for members to consider this case, I hope you’ll retweet the above link to my blog post.

A new blog post, which elaborates on the significance @Sam_Marsh101's JEP Addendum, while noting that his findings were too late to be incorporated into their report. 1/

medium.com/@mikeotsuka/us…

medium.com/@mikeotsuka/us…

If Sam's findings withstand scrutiny, then Test 1 is in 𝗠𝗨𝗖𝗛 𝗪𝗢𝗥𝗦𝗘 𝗦𝗛𝗔𝗣𝗘 than even the JEP report indicates here!: 2/

See here for a link to an earlier thread on the significance of @Sam_Marsh101's findings for #USS's Test 1: 3/3

2. #JEP has a lot to say about Test 1. Its sentence 'The view of the Panel is that Test 1 is not well understood outside of USS' is ... well ... certainly marvellously diplomatic.

Cf. and 6/

Cf. and 6/

3. #JEP's discussion of #USS's & #UUK's 'differing perspectives' on the shift from Sept to Nov valuation shows just how murky the deliberations that resulted in this shift still are.

This remains a big issue, given #JEP proposal to reassess employers' atttude to risk (p. 45) 7/

This remains a big issue, given #JEP proposal to reassess employers' atttude to risk (p. 45) 7/

4. #JEP agrees w many of us that UUK's 'framing' of questions around risk in their consultations has serious consequences.

How can we be confident that any future assessment of employers' risk appetite by UUK shows an improvement in their use of social scientific methods? 🧐 8/

How can we be confident that any future assessment of employers' risk appetite by UUK shows an improvement in their use of social scientific methods? 🧐 8/

After a few weeks away from Twitter, I'm back to think – alongside many others – about content & rhetoric of the #JEP.

And abt what we at @USSbriefs have been doing all summer w @OpenUPP2018 to encourage deliberations over #USS valuation to take place in public #USSstrike 1/

And abt what we at @USSbriefs have been doing all summer w @OpenUPP2018 to encourage deliberations over #USS valuation to take place in public #USSstrike 1/

Many (incl. @NJSHardy @gailfdavies @DrJoGrady @etymologic @MikeOtsuka) have already provided cogent analyses of the #JEP report & its implications. So here I'll just going to pick out some of what has struck me most forcefully on a first read. #USSstrike 2/

1. There's a judicious use of rhetoric – particularly around 'confidence', '(mis)understanding' & 'communication'. This cleaves closely to that used by #UUK & Bill Galvin – whether that is deliberately so as to increase likelihood of acceptance by those parties, you can decide 3/

So, yesterday the Joint Expert Panel offered its first report on the #USS pension valuation. Here is an attempts at a ‘plain English’ account of what it says.

The history of the dispute up to the point at which the JEP was established is explained in a lengthy but plain English account here: leedsucu.org.uk/a-plain-englis…

The JEP report itself is written in very understandable way, and it is full with helpful appendices and clarifications. Nonetheless, my summary here is intended for those who feel overwhelmed by the detail of the history of the dispute, the various technical terms and so on

Reading fhrough the Joint Expert Panel report and it is quite bruising for the #USS, #UUK and Pensions Regulator.

Key comments from the Executive Summary of the JEP report to follow:

Key comments from the Executive Summary of the JEP report to follow:

Firstly, on the Trustees’ use of 3 tests to help assess contribution affordability. The Panel thought the Trustees gave “too much weight” to “Test 1” which was not being used as a “stop and check” reference point but “constraint” on benefit design and investment strategy. 1/

The Panel said that “insufficient weight” was given to the fact that USS was a large, open scheme that was cash flow positive. The “strength and diversity” of the HE sector appeared not to have been taken into account “in some areas”. 2/

Okay. I'm live-tweeting again. In a very welcome recommendation, JEP recommends that FOR THIS 2017 valuation, USS revert to the Sept proposed 10 year delay in de-risking and increase Test 1 permitted outperformance of low risk self-sufficiency portfolio from £10 bn to £13 bn. 1/

The increase in permitted outperformance (aka 'reliance on the covenant' or 'gap to self-sufficiency') would simply involve an assumption of growth in the payroll by CPI rather than prudent downward adjustment below CPI. 2/

Actually, I see that the move from £10 bn to £13 bn was a joint suggestion of @Aon & @FirstActuarial (i.e., @UniversitiesUK & @ucu actuaries, but who provided *independent* advice to JEP). JEP recommends increase in gap but doesn't specify a figure. 3/

As ever, the excellent @JosephineCumbo has provided a succinct summary of what the recommendations are, & I don't see any need to reproduce that.

I'm v happy to see the disruptive role of Test 1 being acknowledged & criticised. I'm also v happy to see suggestion that employers attitude to risk & the affect this had on the covenant be re-evaluated. Likewise it's good to see assertion that updated data & measures be used.

BREAKING: #USS Joint Expert Panel, reviewing 2017 #USS valuation, has published its report.

Summary of key recommendations to follow:

Summary of key recommendations to follow:

The Panel looked in detail at the methodology, assumptions and tests employed by the Trustee, and particularly at USS’s ‘Test 1’ which underpins the 2017 valuation.

"In the Panel’s view this test has assumed too much weight in determining the valuation."

2/

"In the Panel’s view this test has assumed too much weight in determining the valuation."

2/

The Panel unanimously recommended 4 areas where adjustments to the 2017 valuation should be considered:

1. A re-evaluation of the employers’ attitude to risk, which would result in a re-evaluation of the reliance on the sponsor covenant.

3/

1. A re-evaluation of the employers’ attitude to risk, which would result in a re-evaluation of the reliance on the sponsor covenant.

3/

Consultation on #USS contribution increases opens today. Their website is now live (link). Some differences, on which I comment below, between what's on the website & what's in the hard copy consultation document that we've received in the post. 1/

ussconsultation2018.co.uk/members

ussconsultation2018.co.uk/members

Here's a link to a pdf of the hard copy consultation document we received in the post. 2/

ussconsultation2018.co.uk/uploads/docume…

ussconsultation2018.co.uk/uploads/docume…

In this tweet, I noted my surprise over the following in that document: 3/